Key Insights

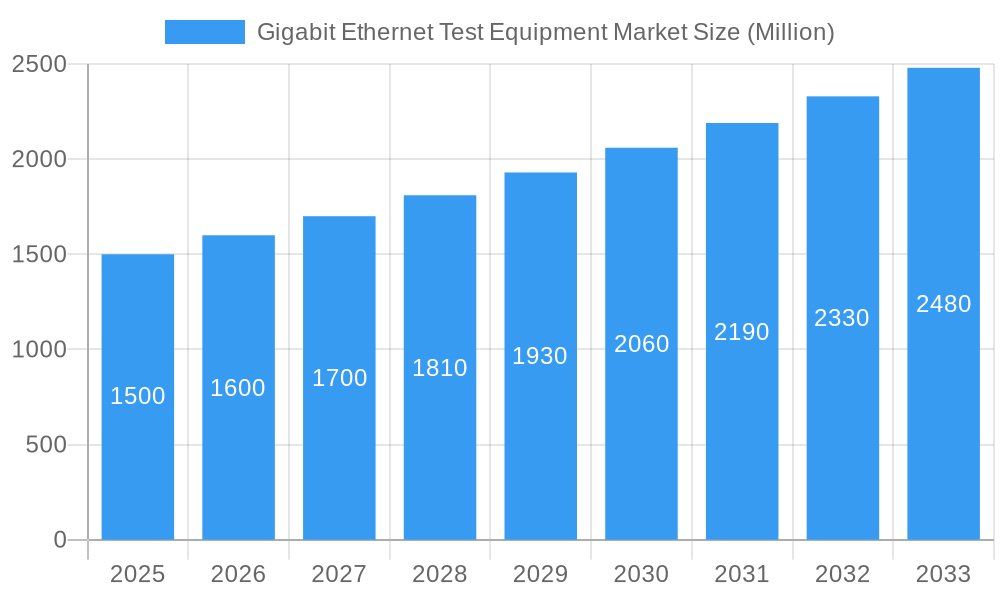

The Gigabit Ethernet Test Equipment market is experiencing robust growth, driven by the increasing adoption of high-speed networking technologies across diverse sectors. The market, valued at approximately $XX million in 2025 (assuming a logical estimation based on the provided CAGR and market size data), is projected to expand at a Compound Annual Growth Rate (CAGR) of 6.45% from 2025 to 2033. This growth is fueled by several key factors. The proliferation of 5G networks and the Internet of Things (IoT) is demanding higher bandwidth capabilities, driving the need for advanced testing equipment to ensure network performance and reliability. Furthermore, the automotive, manufacturing, and telecommunications industries are undergoing significant digital transformations, leading to increased investment in Gigabit Ethernet infrastructure and, consequently, the associated testing solutions. Stringent regulatory compliance standards further contribute to market growth, requiring thorough testing and validation processes.

Gigabit Ethernet Test Equipment Market Market Size (In Billion)

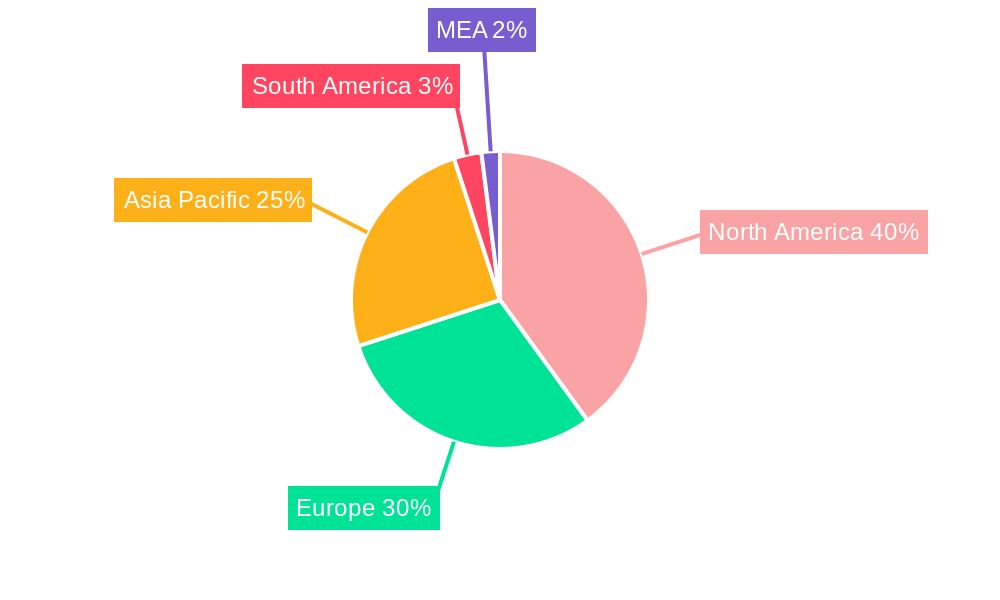

Segmentation analysis reveals that 25/50 GBE equipment is experiencing the fastest growth within the type segment, reflecting the ongoing migration towards higher data speeds. Geographically, North America and Asia Pacific are expected to dominate the market, driven by high technology adoption rates and a substantial presence of key industry players. However, other regions, particularly in Europe and the MEA region are also witnessing substantial growth due to ongoing infrastructure development and digitalization initiatives. While increasing competition and the potential for technological disruptions present certain restraints, the overall outlook for the Gigabit Ethernet Test Equipment market remains positive, propelled by the continuous evolution of network technologies and the expanding demand for robust and reliable network infrastructure across various industry verticals. The market's sustained growth trajectory is underpinned by ongoing technological advancements and the imperative for high-performance, reliable networks.

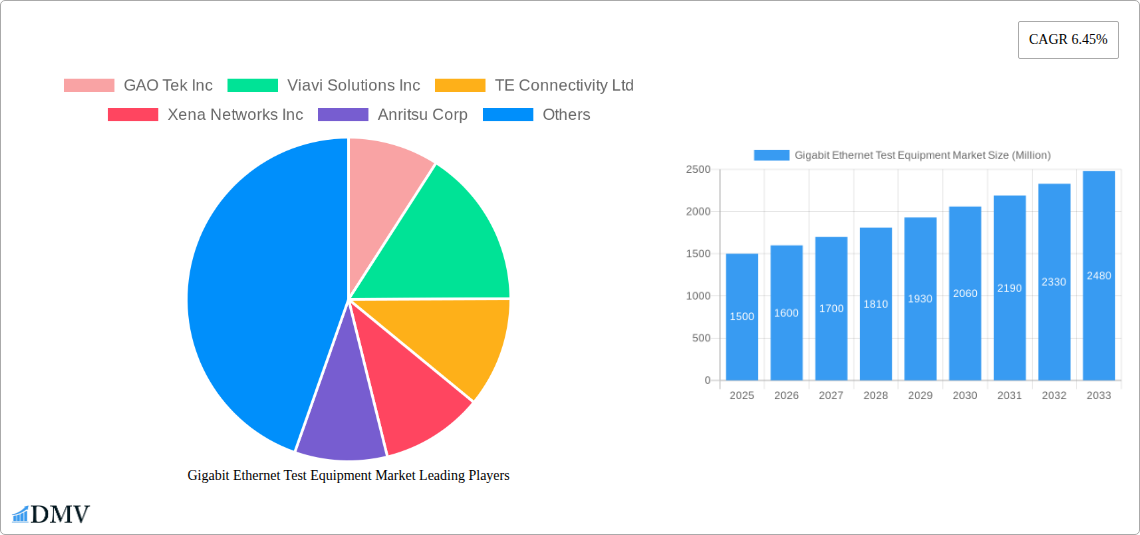

Gigabit Ethernet Test Equipment Market Company Market Share

Gigabit Ethernet Test Equipment Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Gigabit Ethernet Test Equipment market, offering invaluable insights for stakeholders seeking to navigate this dynamic landscape. With a focus on market trends, technological advancements, and competitive dynamics, this report is an essential resource for strategic decision-making. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. The market is projected to reach xx Million by 2033.

Gigabit Ethernet Test Equipment Market Composition & Trends

The Gigabit Ethernet Test Equipment market exhibits a moderately concentrated landscape, with key players like Keysight Technologies Inc, Viavi Solutions Inc, and Spirent Communications PLC holding significant market share. However, the presence of several smaller, specialized companies fosters innovation and competition. Market share distribution currently shows Keysight Technologies Inc leading at approximately xx%, followed by Viavi Solutions Inc at xx% and Spirent Communications PLC at xx%. The remaining market share is distributed amongst other players. Innovation is driven by the increasing demand for higher bandwidth and faster speeds, necessitating more sophisticated testing solutions. Regulatory compliance, particularly concerning data security and network reliability, also plays a significant role. Substitute products are limited, primarily focused on software-based testing solutions, but hardware remains dominant due to its accuracy and comprehensive testing capabilities. End-user profiles vary significantly across sectors, including Automotive, Manufacturing, Telecommunication, Transportation and Logistics, and Other End-user Industries. M&A activity is moderate, with deal values averaging xx Million in recent years, driven by consolidation efforts and the acquisition of specialized technology. Several significant acquisitions have reshaped the market landscape, primarily focusing on expanding product portfolios and geographic reach. For example, the merger of (hypothetical example) Company A and Company B in 2023 resulted in a combined market share of approximately xx%.

- Market Concentration: Moderately Concentrated

- Innovation Catalysts: Demand for higher bandwidth, regulatory compliance.

- Regulatory Landscape: Stringent standards for network performance and security.

- Substitute Products: Limited, primarily software-based solutions.

- M&A Activity: Moderate, with deal values averaging xx Million.

Gigabit Ethernet Test Equipment Market Industry Evolution

The Gigabit Ethernet Test Equipment market has experienced substantial growth, driven primarily by the rapid expansion of high-speed networking applications across various industries. The market witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), and it is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by the increasing adoption of 10GBE, 25/50GBE, and beyond in data centers, telecommunications networks, and industrial automation systems. Technological advancements, particularly in the areas of optical testing and protocol analysis, have significantly enhanced the capabilities and performance of Gigabit Ethernet test equipment. The market is seeing a shift towards more integrated and automated test solutions, enabling faster and more efficient testing processes. Consumer demand focuses on improved accuracy, reduced testing times, and cost-effective solutions. The increasing demand for 5G and edge computing technologies is creating new opportunities for manufacturers of Gigabit Ethernet test equipment. The adoption of 10GBE technology has crossed the xx% mark, while 25/50GBE adoption is rapidly increasing and expected to reach xx% by 2033.

Leading Regions, Countries, or Segments in Gigabit Ethernet Test Equipment Market

The North American region currently holds the leading position in the Gigabit Ethernet Test Equipment market, followed by Europe and Asia-Pacific. This dominance is primarily driven by factors such as substantial investments in advanced networking infrastructure, a high concentration of leading technology companies, and strong regulatory support.

Key Drivers for North America:

- High investments in 5G and data center infrastructure.

- Presence of major equipment manufacturers.

- Stringent regulatory frameworks driving quality control.

Key Drivers for Europe:

- Growing adoption of Gigabit Ethernet in various industries.

- Government initiatives promoting digital transformation.

- Increasing investments in research and development.

Key Drivers for Asia-Pacific:

- Rapid growth of the telecommunications sector.

- Increasing demand for high-speed internet access.

- Rising disposable incomes leading to increased consumer spending.

The Telecommunication end-user industry segment shows the highest demand for Gigabit Ethernet test equipment, followed by the Manufacturing sector. This is attributed to the high dependence on reliable network infrastructure for seamless operations and the rising adoption of Industry 4.0 technologies. Within the types of Gigabit Ethernet, the 10GBE segment currently dominates the market but the 25/50GBE segment is exhibiting the fastest growth rate, driven by the increasing adoption of high-speed data transmission requirements.

Gigabit Ethernet Test Equipment Market Product Innovations

Recent innovations in Gigabit Ethernet test equipment focus on higher throughput, increased channel count, and improved test automation. The integration of artificial intelligence (AI) and machine learning (ML) capabilities is enhancing test accuracy and efficiency. Unique selling propositions emphasize comprehensive testing capabilities, user-friendly interfaces, and compatibility with various network standards and protocols. The evolution of test equipment towards smaller, more portable designs caters to the increasing need for on-site testing and troubleshooting in various environments. Performance metrics such as bit error rate (BER) and jitter measurements are significantly improved in newer equipment models.

Propelling Factors for Gigabit Ethernet Test Equipment Market Growth

The Gigabit Ethernet Test Equipment market is propelled by several factors: the increasing demand for higher bandwidth in data centers and telecommunications networks, the widespread adoption of cloud computing and 5G technology, and the growing need for reliable and high-performance networking solutions in various industries such as manufacturing and automotive. Stringent government regulations mandating higher network speeds and improved security are also boosting market growth. The ongoing technological advancements in testing methodologies further fuel the market. For example, the development of more advanced optical testing techniques enables more comprehensive assessment of network performance and reliability.

Obstacles in the Gigabit Ethernet Test Equipment Market

The Gigabit Ethernet Test Equipment market faces challenges including supply chain disruptions affecting component availability, leading to production delays and price increases. The increasing complexity of network technologies necessitates more specialized and expensive testing equipment, potentially limiting market access for smaller companies. Furthermore, intense competition among established players can put pressure on profit margins.

Future Opportunities in Gigabit Ethernet Test Equipment Market

Future opportunities lie in the expanding adoption of 800 Gigabit Ethernet and beyond, the growth of edge computing, and the increasing demand for automated test solutions, including AI-powered testing systems. New markets in emerging economies present significant growth potential, and the development of more cost-effective and portable testing solutions can increase market accessibility. The integration of virtual and augmented reality into test environments can boost efficiency and user experience.

Major Players in the Gigabit Ethernet Test Equipment Market Ecosystem

- GAO Tek Inc

- Viavi Solutions Inc

- TE Connectivity Ltd

- Xena Networks Inc

- Anritsu Corp

- IDEAL Industries Inc

- Exfo Inc

- Keysight Technologies Inc

- Spirent Communications PLC

- Aquantia Corp

Key Developments in Gigabit Ethernet Test Equipment Market Industry

March 2022: Keysight Technologies demonstrated optical and high-speed digital test solutions at the Optical Fiber Communications (OFC) Conference, showcasing advancements in 800 Gigabit Ethernet testing capabilities. This highlights the industry's focus on high-speed testing solutions.

January 2022: Bharti Airtel and Google's partnership, involving a USD 1 Billion investment, signifies the substantial investment in India's digital infrastructure, indirectly driving demand for Gigabit Ethernet testing equipment to support this expansion.

Strategic Gigabit Ethernet Test Equipment Market Forecast

The Gigabit Ethernet Test Equipment market is poised for continued growth, driven by technological advancements, increasing bandwidth demands, and expanding adoption across diverse industries. The market's future potential is substantial, particularly in emerging regions and with the adoption of next-generation Ethernet technologies. The continued evolution of testing methodologies and the integration of AI will further enhance the capabilities and value of Gigabit Ethernet test equipment, driving sustained market expansion.

Gigabit Ethernet Test Equipment Market Segmentation

-

1. Type

- 1.1. 1 GBE

- 1.2. 10 GBE

- 1.3. 25/50 GBE

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Manufacturing

- 2.3. Telecommunication

- 2.4. Transportation and Logistics

- 2.5. Other End-user Industries

Gigabit Ethernet Test Equipment Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Gigabit Ethernet Test Equipment Market Regional Market Share

Geographic Coverage of Gigabit Ethernet Test Equipment Market

Gigabit Ethernet Test Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need for Ethernet in the Manufacturing Industries; Growth in Mobile Backhaul; Adoption of Cloud Services and Big Data

- 3.3. Market Restrains

- 3.3.1. Operational Challenges and High Levels of Competition Leading to Price Pressures for Manufacturers

- 3.4. Market Trends

- 3.4.1. Telecommunication Segment is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gigabit Ethernet Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. 1 GBE

- 5.1.2. 10 GBE

- 5.1.3. 25/50 GBE

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Manufacturing

- 5.2.3. Telecommunication

- 5.2.4. Transportation and Logistics

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Gigabit Ethernet Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. 1 GBE

- 6.1.2. 10 GBE

- 6.1.3. 25/50 GBE

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive

- 6.2.2. Manufacturing

- 6.2.3. Telecommunication

- 6.2.4. Transportation and Logistics

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Gigabit Ethernet Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. 1 GBE

- 7.1.2. 10 GBE

- 7.1.3. 25/50 GBE

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive

- 7.2.2. Manufacturing

- 7.2.3. Telecommunication

- 7.2.4. Transportation and Logistics

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Gigabit Ethernet Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. 1 GBE

- 8.1.2. 10 GBE

- 8.1.3. 25/50 GBE

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive

- 8.2.2. Manufacturing

- 8.2.3. Telecommunication

- 8.2.4. Transportation and Logistics

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Gigabit Ethernet Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. 1 GBE

- 9.1.2. 10 GBE

- 9.1.3. 25/50 GBE

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive

- 9.2.2. Manufacturing

- 9.2.3. Telecommunication

- 9.2.4. Transportation and Logistics

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 GAO Tek Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Viavi Solutions Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 TE Connectivity Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Xena Networks Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Anritsu Corp

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 IDEAL Industries Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Exfo Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Keysight Technologies Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Spirent Communications PLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Aquantia Corp

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 GAO Tek Inc

List of Figures

- Figure 1: Global Gigabit Ethernet Test Equipment Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Gigabit Ethernet Test Equipment Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Gigabit Ethernet Test Equipment Market Revenue (undefined), by Type 2025 & 2033

- Figure 4: North America Gigabit Ethernet Test Equipment Market Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America Gigabit Ethernet Test Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Gigabit Ethernet Test Equipment Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Gigabit Ethernet Test Equipment Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 8: North America Gigabit Ethernet Test Equipment Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 9: North America Gigabit Ethernet Test Equipment Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: North America Gigabit Ethernet Test Equipment Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 11: North America Gigabit Ethernet Test Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America Gigabit Ethernet Test Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Gigabit Ethernet Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Gigabit Ethernet Test Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Gigabit Ethernet Test Equipment Market Revenue (undefined), by Type 2025 & 2033

- Figure 16: Europe Gigabit Ethernet Test Equipment Market Volume (K Unit), by Type 2025 & 2033

- Figure 17: Europe Gigabit Ethernet Test Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Gigabit Ethernet Test Equipment Market Volume Share (%), by Type 2025 & 2033

- Figure 19: Europe Gigabit Ethernet Test Equipment Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 20: Europe Gigabit Ethernet Test Equipment Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 21: Europe Gigabit Ethernet Test Equipment Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Europe Gigabit Ethernet Test Equipment Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 23: Europe Gigabit Ethernet Test Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 24: Europe Gigabit Ethernet Test Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Gigabit Ethernet Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Gigabit Ethernet Test Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Gigabit Ethernet Test Equipment Market Revenue (undefined), by Type 2025 & 2033

- Figure 28: Asia Pacific Gigabit Ethernet Test Equipment Market Volume (K Unit), by Type 2025 & 2033

- Figure 29: Asia Pacific Gigabit Ethernet Test Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Gigabit Ethernet Test Equipment Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Asia Pacific Gigabit Ethernet Test Equipment Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 32: Asia Pacific Gigabit Ethernet Test Equipment Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 33: Asia Pacific Gigabit Ethernet Test Equipment Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 34: Asia Pacific Gigabit Ethernet Test Equipment Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 35: Asia Pacific Gigabit Ethernet Test Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 36: Asia Pacific Gigabit Ethernet Test Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Gigabit Ethernet Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Gigabit Ethernet Test Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Rest of the World Gigabit Ethernet Test Equipment Market Revenue (undefined), by Type 2025 & 2033

- Figure 40: Rest of the World Gigabit Ethernet Test Equipment Market Volume (K Unit), by Type 2025 & 2033

- Figure 41: Rest of the World Gigabit Ethernet Test Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: Rest of the World Gigabit Ethernet Test Equipment Market Volume Share (%), by Type 2025 & 2033

- Figure 43: Rest of the World Gigabit Ethernet Test Equipment Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 44: Rest of the World Gigabit Ethernet Test Equipment Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 45: Rest of the World Gigabit Ethernet Test Equipment Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Rest of the World Gigabit Ethernet Test Equipment Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Rest of the World Gigabit Ethernet Test Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 48: Rest of the World Gigabit Ethernet Test Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Rest of the World Gigabit Ethernet Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Rest of the World Gigabit Ethernet Test Equipment Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 15: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 17: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 20: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 21: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 22: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 26: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 27: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 29: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gigabit Ethernet Test Equipment Market?

The projected CAGR is approximately 7.8%.

2. Which companies are prominent players in the Gigabit Ethernet Test Equipment Market?

Key companies in the market include GAO Tek Inc, Viavi Solutions Inc, TE Connectivity Ltd, Xena Networks Inc, Anritsu Corp, IDEAL Industries Inc, Exfo Inc, Keysight Technologies Inc, Spirent Communications PLC, Aquantia Corp.

3. What are the main segments of the Gigabit Ethernet Test Equipment Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for Ethernet in the Manufacturing Industries; Growth in Mobile Backhaul; Adoption of Cloud Services and Big Data.

6. What are the notable trends driving market growth?

Telecommunication Segment is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Operational Challenges and High Levels of Competition Leading to Price Pressures for Manufacturers.

8. Can you provide examples of recent developments in the market?

March 2022 - Keysight Demonstrated Optical and High-speed Digital Test Solutions at Optical Fiber Communications (OFC) Conference. IEEE 802.3ck 112 Gigabits/second (112G) PAM4 electrical lanes support full line-rate 800 Gigabit Ethernet (GE) traffic. The G800GE Ethernet test system will demonstrate the performance of Octal Small Form Factor Pluggable (OSFP) 112 and Quad Small Form Factor Pluggable Double Density (QSFP-DD) 800 optical transceivers in terms of bit error rate (BER) and forward error correction (FEC).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gigabit Ethernet Test Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gigabit Ethernet Test Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gigabit Ethernet Test Equipment Market?

To stay informed about further developments, trends, and reports in the Gigabit Ethernet Test Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence