Key Insights

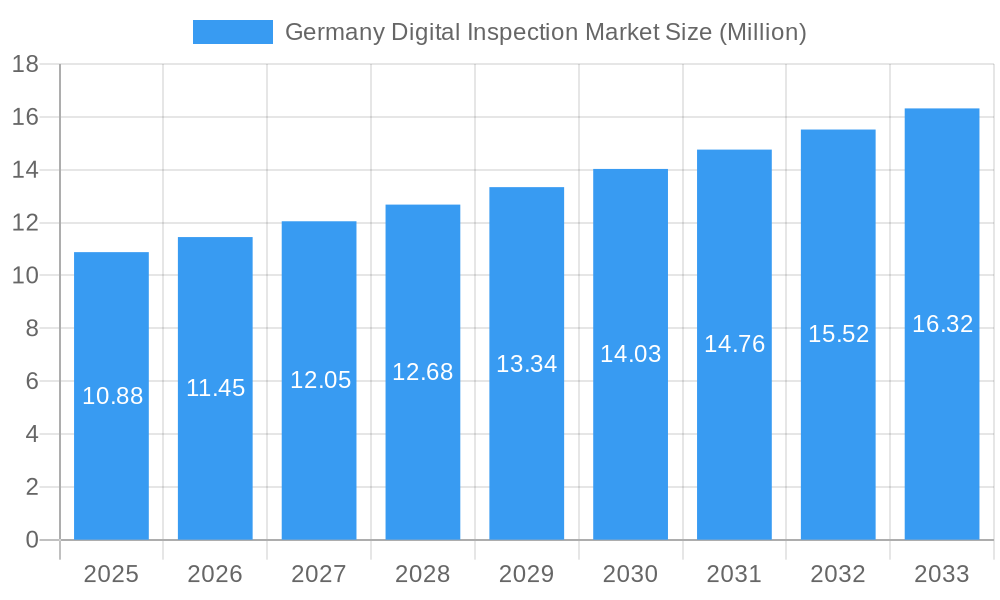

The German digital inspection market, valued at €10.88 million in 2025, is poised for robust growth, exhibiting a compound annual growth rate (CAGR) of 5.20% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing adoption of Industry 4.0 technologies across various sectors, including automotive, manufacturing, and food & agriculture, is fueling demand for efficient and automated inspection processes. Digital inspection solutions offer significant advantages over traditional methods, including enhanced accuracy, reduced inspection times, and improved data analysis capabilities for better quality control and risk management. Furthermore, stringent regulatory compliance requirements across industries are pushing businesses to adopt more sophisticated inspection technologies to ensure product safety and meet environmental standards. The growth is also propelled by the rising need for remote inspections, particularly beneficial in geographically dispersed operations and hazardous environments. Finally, the German government's initiatives to promote digitalization and technological advancements in various sectors are indirectly boosting the market’s growth trajectory.

Germany Digital Inspection Market Market Size (In Million)

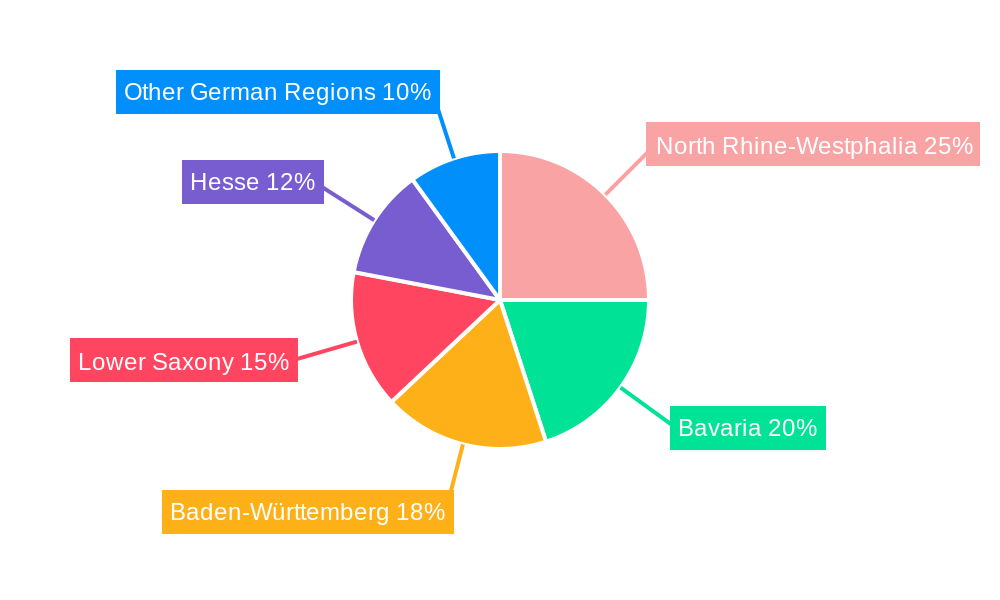

The market is segmented by sourcing type (outsourced vs. in-house/government), service type (testing & inspection, certification), and end-user vertical (automotive, food & agriculture, manufacturing, etc.). The outsourced segment is expected to dominate due to the specialized expertise and cost-effectiveness offered by specialized inspection service providers. Within service types, testing and inspection services currently hold the largest share, reflecting the high volume of routine inspections needed across industries. However, the certification segment is projected to witness accelerated growth driven by increased demand for internationally recognized certifications and compliance standards. Geographically, regions like North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse are key contributors to the market's growth, mirroring the concentration of manufacturing and industrial activities in these areas. Major players like Intertek, SGS, TÜV SÜD, and others are actively shaping the market landscape through technological innovations and strategic partnerships.

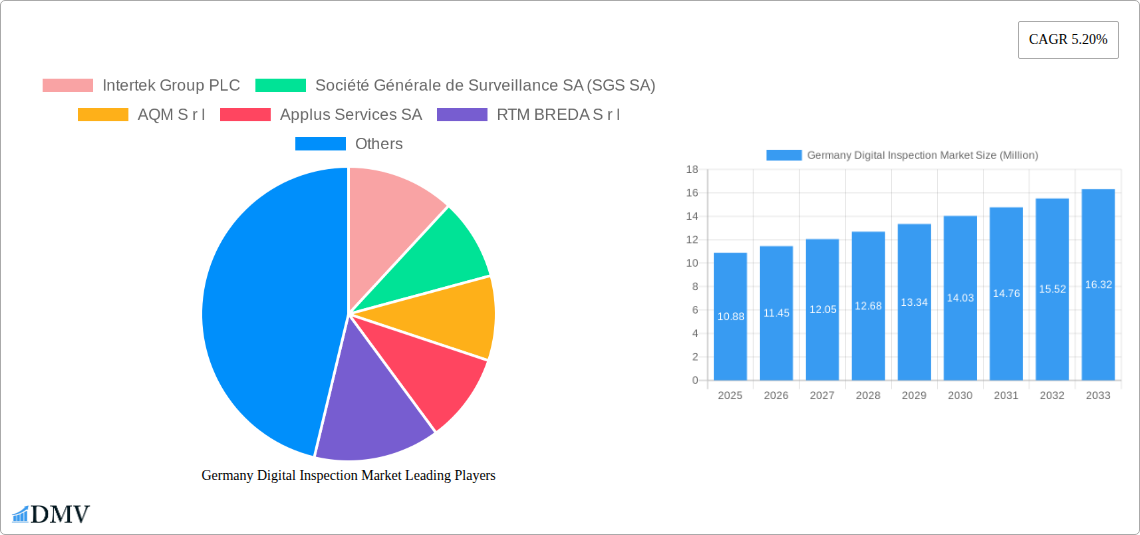

Germany Digital Inspection Market Company Market Share

Germany Digital Inspection Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Germany digital inspection market, encompassing market size, trends, key players, and future projections. The study period covers 2019-2033, with 2025 as the base and estimated year. The report offers crucial insights for stakeholders seeking to navigate this dynamic market, valued at xx Million in 2025 and projected to reach xx Million by 2033.

Germany Digital Inspection Market Composition & Trends

The German digital inspection market is characterized by a moderately concentrated landscape, with several major players holding significant market share. Intertek Group PLC, SGS SA, TÜV SÜD Limited, and DEKRA SE are among the leading companies, although the exact market share distribution remains dynamic due to ongoing M&A activity and technological advancements. The market value is estimated at xx Million in 2025.

- Market Concentration: A moderate level of concentration, with the top 5 players accounting for approximately xx% of the market share in 2025.

- Innovation Catalysts: Increasing adoption of AI, IoT, and advanced data analytics is driving innovation in digital inspection technologies.

- Regulatory Landscape: Stringent quality and safety regulations across various industries (automotive, food, etc.) are a key driver for the market.

- Substitute Products: Traditional inspection methods still hold a segment of the market, but their share is steadily declining due to the efficiency and accuracy of digital solutions.

- End-User Profiles: The market caters to a diverse range of end-user verticals, including automotive, manufacturing, food and agriculture, and more.

- M&A Activities: The past five years have witnessed several M&A deals, with deal values ranging from xx Million to xx Million, reflecting consolidation and expansion strategies within the market. This activity is expected to continue in the forecast period.

Germany Digital Inspection Market Industry Evolution

The German digital inspection market exhibits a robust growth trajectory, driven by several factors. Technological advancements, such as AI-powered image recognition and advanced sensor technologies, are significantly improving inspection accuracy and efficiency. Furthermore, increasing demand for quality control and regulatory compliance across industries, coupled with a growing preference for digital solutions over traditional methods, is fueling market expansion. The market registered a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is fuelled by the rising adoption of digital inspection solutions, which show a xx% adoption rate in 2025. Increased automation in the manufacturing and industrial sectors are driving this growth. Consumer demand for higher quality products and greater transparency in supply chains also contribute to this trend.

Leading Regions, Countries, or Segments in Germany Digital Inspection Market

The German digital inspection market is broadly segmented by sourcing type (outsourced vs. in-house/government), type of service (testing and inspection, certification), and end-user vertical.

- By Sourcing Type: The outsourced segment dominates, driven by the cost-effectiveness and specialized expertise offered by external providers.

- By Type of Service: Testing and inspection services constitute the largest segment, followed by certification.

- By End-user Vertical: The automotive, manufacturing and industrial goods, and food and agriculture sectors are major drivers of market growth due to their stringent quality and safety requirements.

Key Drivers:

- Significant investments in technological advancements within the German digital inspection sector are driving growth.

- Stringent government regulations regarding safety and quality control incentivize the adoption of digital solutions.

The dominance of these segments is primarily due to the higher prevalence of digital inspection needs in these sectors, which necessitates outsourced services and testing/inspection capabilities.

Germany Digital Inspection Market Product Innovations

Recent innovations include the integration of AI and machine learning into inspection systems, enabling faster, more accurate, and automated defect detection. Advanced sensor technologies, such as hyperspectral imaging and 3D scanning, are enhancing the capabilities of digital inspection systems. These innovations offer enhanced accuracy, real-time analysis, and reduced operational costs, setting new benchmarks in performance metrics. The unique selling proposition (USP) of many new digital inspection products focuses on improved efficiency and reduced human error.

Propelling Factors for Germany Digital Inspection Market Growth

Technological advancements, such as AI-powered image recognition and drone-based inspections, are significantly improving efficiency and accuracy. Stringent regulatory requirements across sectors are driving demand for robust inspection procedures. Furthermore, growing consumer awareness of product quality and safety is also contributing to market growth. The economic expansion in Germany provides a further boost to this market.

Obstacles in the Germany Digital Inspection Market

High initial investment costs associated with implementing digital inspection technologies can be a barrier for smaller companies. Supply chain disruptions can impact the availability of essential components and skilled labor. Intense competition among established players and new entrants can also pose challenges. These challenges may lead to xx% market stagnation for smaller players.

Future Opportunities in Germany Digital Inspection Market

The integration of blockchain technology for enhancing transparency and traceability in supply chains presents a significant opportunity. The increasing demand for digital twins for predictive maintenance and asset management opens up new market avenues. Expansion into emerging industries, such as renewable energy and smart infrastructure, will further propel market growth.

Major Players in the Germany Digital Inspection Market Ecosystem

- Intertek Group PLC

- Société Générale de Surveillance SA (SGS SA)

- AQM S r l

- Applus Services SA

- RTM BREDA S r l

- A/S Baltic Control Group Ltd

- TÜV SÜD Limited

- Mistras GMA - Holding GmbH

- TUV Nord

- CIS Commodity Inspection Services BV

- VIC Inspection Services Holding Ltd

- Element Materials Technology Group Limited

- DEKRA SE

- UL LLC

- Kiwa NV

- ALS Limited

- Bureau Veritas SA

- Eurofins Scientific SE

- ATG Technology Group

Key Developments in Germany Digital Inspection Market Industry

- June 2023: TÜV SÜD developed a new directional photometer offering precise 3D light distribution measurements, benefiting lighting designers and manufacturers.

- June 2023: DAkkS accredited a biobank at Heidelberg University Hospital, according to DIN EN ISO 20387, setting a benchmark for biobank accreditation in Europe.

Strategic Germany Digital Inspection Market Forecast

The German digital inspection market is poised for sustained growth, driven by ongoing technological advancements, stringent regulations, and increasing industry demands for efficient and accurate inspection solutions. The market's potential is further amplified by the expansion into new sectors and applications, promising substantial growth opportunities for market players in the coming years. The projected CAGR of xx% over the forecast period reflects this optimistic outlook.

Germany Digital Inspection Market Segmentation

-

1. Sourcing Type

-

1.1. Outsourced

-

1.1.1. Type of Service

- 1.1.1.1. Testing and Inspection

- 1.1.1.2. Certification

-

1.1.1. Type of Service

- 1.2. In-house/Government

-

1.1. Outsourced

-

2. End-user Vertical

- 2.1. Consumer Goods and Retail

- 2.2. Automotive

- 2.3. Food and Agriculture

- 2.4. Manufacturing and Industrial Goods

- 2.5. Minerals and Metals

- 2.6. Oil & Gas and Chemicals

- 2.7. Construction

- 2.8. Transport, Aerospace and Rail

- 2.9. Other End-user Verticals

Germany Digital Inspection Market Segmentation By Geography

- 1. Germany

Germany Digital Inspection Market Regional Market Share

Geographic Coverage of Germany Digital Inspection Market

Germany Digital Inspection Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Regulations and Mandates to Ensure Product Safety and Environmental Protection

- 3.3. Market Restrains

- 3.3.1. Increase in Lead Times For Assessment Programs Due to the Growing Complexity of the Supply Chain

- 3.4. Market Trends

- 3.4.1. Certification to be the Fastest Growing Type of Service

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Digital Inspection Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 5.1.1. Outsourced

- 5.1.1.1. Type of Service

- 5.1.1.1.1. Testing and Inspection

- 5.1.1.1.2. Certification

- 5.1.1.1. Type of Service

- 5.1.2. In-house/Government

- 5.1.1. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Consumer Goods and Retail

- 5.2.2. Automotive

- 5.2.3. Food and Agriculture

- 5.2.4. Manufacturing and Industrial Goods

- 5.2.5. Minerals and Metals

- 5.2.6. Oil & Gas and Chemicals

- 5.2.7. Construction

- 5.2.8. Transport, Aerospace and Rail

- 5.2.9. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Intertek Group PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Société Générale de Surveillance SA (SGS SA)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AQM S r l

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Applus Services SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 RTM BREDA S r l

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 A/S Baltic Control Group Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TÜV SÜD Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mistras GMA - Holding GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TUV Nord*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CIS Commodity Inspection Services BV

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 VIC Inspection Services Holding Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Element Materials Technology Group Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 DEKRA SE

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 UL LLC

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Kiwa NV

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 ALS Limited

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Bureau Veritas SA

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Eurofins Scientific SE

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 ATG Technology Group

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.1 Intertek Group PLC

List of Figures

- Figure 1: Germany Digital Inspection Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Digital Inspection Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Digital Inspection Market Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 2: Germany Digital Inspection Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 3: Germany Digital Inspection Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Germany Digital Inspection Market Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 5: Germany Digital Inspection Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: Germany Digital Inspection Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Digital Inspection Market?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the Germany Digital Inspection Market?

Key companies in the market include Intertek Group PLC, Société Générale de Surveillance SA (SGS SA), AQM S r l, Applus Services SA, RTM BREDA S r l, A/S Baltic Control Group Ltd, TÜV SÜD Limited, Mistras GMA - Holding GmbH, TUV Nord*List Not Exhaustive, CIS Commodity Inspection Services BV, VIC Inspection Services Holding Ltd, Element Materials Technology Group Limited, DEKRA SE, UL LLC, Kiwa NV, ALS Limited, Bureau Veritas SA, Eurofins Scientific SE, ATG Technology Group.

3. What are the main segments of the Germany Digital Inspection Market?

The market segments include Sourcing Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Regulations and Mandates to Ensure Product Safety and Environmental Protection.

6. What are the notable trends driving market growth?

Certification to be the Fastest Growing Type of Service.

7. Are there any restraints impacting market growth?

Increase in Lead Times For Assessment Programs Due to the Growing Complexity of the Supply Chain.

8. Can you provide examples of recent developments in the market?

June 2023: The TUV SUD created and tested a new directional photometer for use in lighting system planning. The tool is the first to offer extremely precise three-dimensional measuring information on how light is spread over things in a place. Lighting designers and manufacturers can greatly benefit from this information, which will help them examine and evaluate lighting circumstances more precisely in order to create particular moods or conditions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Digital Inspection Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Digital Inspection Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Digital Inspection Market?

To stay informed about further developments, trends, and reports in the Germany Digital Inspection Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence