Key Insights

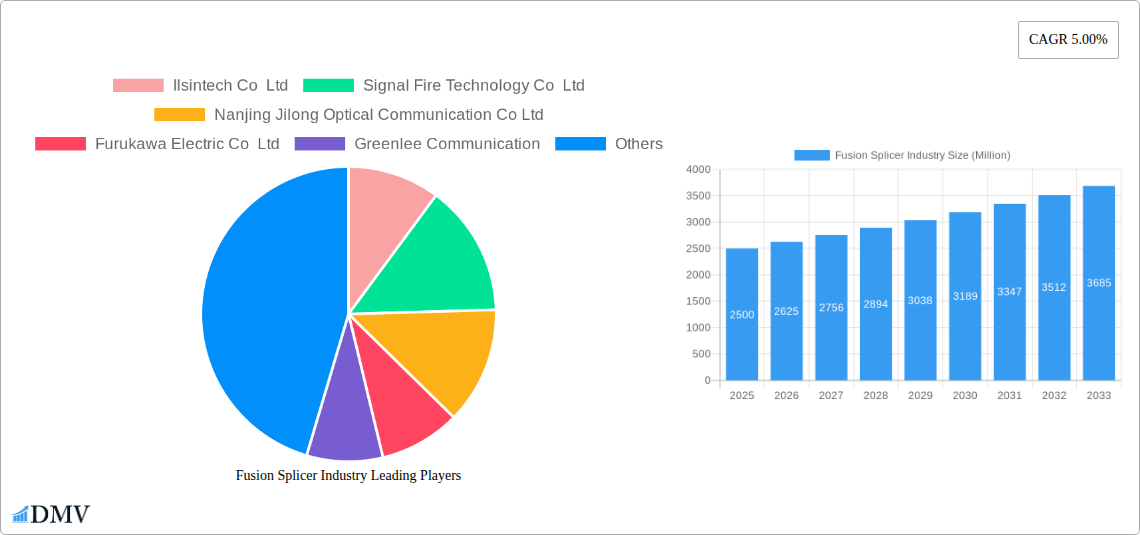

The global fusion splicer market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.00% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning telecommunications sector, driven by increasing demand for high-speed internet and 5G network deployments, is a primary catalyst. Furthermore, the growth of the aerospace and defense industries, requiring advanced fiber optic technologies for communication and navigation systems, significantly contributes to market demand. Expansion of data centers and enterprise networks are also fueling the demand for efficient and reliable fiber optic splicing solutions. Technological advancements, such as the development of smaller, more portable, and user-friendly fusion splicers with improved splicing speed and precision, are further enhancing market attractiveness. However, the market faces certain restraints, including the high initial investment costs associated with fusion splicer acquisition and the potential for skilled labor shortages in certain regions hindering efficient deployment. Market segmentation reveals significant contributions from core alignment and cladding alignment splicer types, catering to diverse application needs within telecommunications, aerospace & defense, premises & enterprise, cable TV, and other industries. Geographical analysis indicates strong market presence in North America and Asia-Pacific, with emerging opportunities in other regions as infrastructure development progresses. Competitive landscape analysis reveals a mix of established players and emerging companies, indicating a dynamic market with ongoing innovation and competitive pricing.

Fusion Splicer Industry Market Size (In Billion)

The forecast period (2025-2033) promises continued growth, driven by sustained investments in fiber optic infrastructure globally. The increasing adoption of fiber to the home (FTTH) initiatives and the expansion of smart city projects are expected to further stimulate market demand. Continued technological advancements, including the integration of automation and artificial intelligence in fusion splicing processes, will improve efficiency and accuracy, leading to greater market penetration. Strategic partnerships and mergers & acquisitions among market players are anticipated, shaping the competitive landscape and driving further innovation. While challenges related to fluctuating raw material prices and economic uncertainties exist, the overall outlook for the fusion splicer market remains positive, promising significant growth opportunities for businesses operating within this dynamic sector.

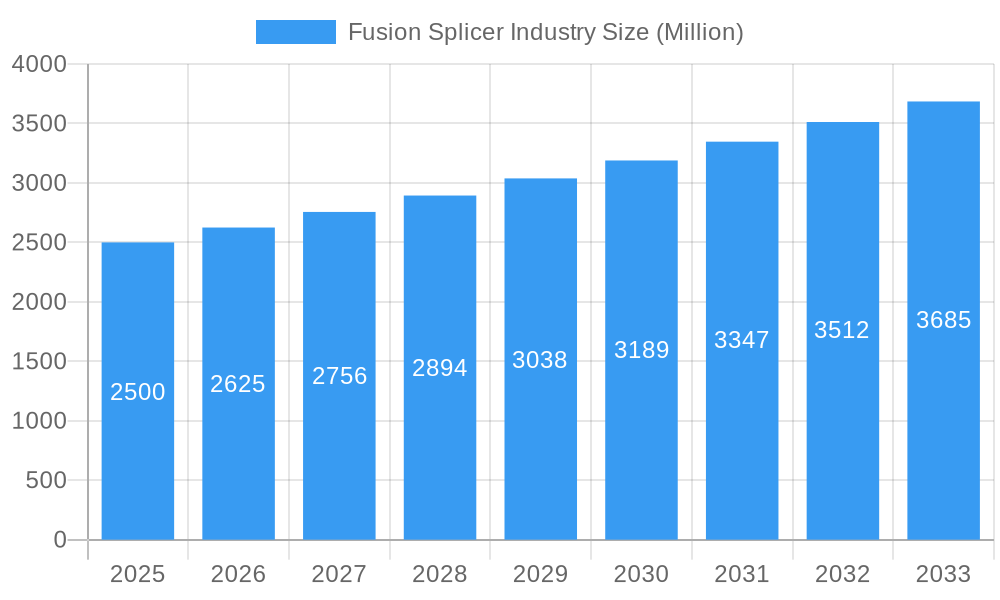

Fusion Splicer Industry Company Market Share

Fusion Splicer Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the global Fusion Splicer industry, projecting a market value exceeding $XX Million by 2033. We delve into market dynamics, technological advancements, competitive landscapes, and future growth opportunities, offering crucial insights for stakeholders across the value chain. The study period covers 2019-2033, with 2025 serving as both the base and estimated year. This report is essential for businesses seeking to navigate the complexities of this dynamic market and capitalize on emerging trends.

Fusion Splicer Industry Market Composition & Trends

The global fusion splicer market, valued at $XX Million in 2025, exhibits a moderately consolidated structure. Key players like Furukawa Electric Co Ltd, Fujikura Ltd, and Sumitomo Electric Industries Ltd hold significant market share, while several smaller, specialized companies cater to niche segments. Market concentration is influenced by factors such as technological advancements, economies of scale, and strategic acquisitions.

Innovation is a key driver, with continuous improvements in splicing speed, precision, and automation. Stringent regulatory frameworks governing fiber optic network deployment in various regions play a crucial role. Substitute technologies, while present (e.g., mechanical splicing), are limited in their performance and application range, especially for high-bandwidth networks.

End-users span diverse sectors including telecommunications (the dominant segment), aerospace & defense, premises & enterprise networks, cable TV, and other emerging applications. The report details end-user segmentation and their respective growth trajectories.

M&A activity has been moderate, with deal values totaling approximately $XX Million over the past five years. Consolidation is expected to continue, driven by companies seeking to expand their product portfolios and geographical reach.

- Market Share Distribution (2025): Furukawa Electric: XX%; Fujikura Ltd: XX%; Sumitomo Electric Industries: XX%; Others: XX%.

- M&A Deal Value (2019-2024): $XX Million

- Key Market Drivers: Technological innovation, increasing fiber optic network deployments, rising demand for high-bandwidth connectivity.

- Key Challenges: Intense competition, price pressure from low-cost manufacturers, technological obsolescence.

Fusion Splicer Industry Evolution

The fusion splicer market has witnessed significant growth since 2019, driven primarily by the global expansion of fiber optic networks. The historical period (2019-2024) saw a Compound Annual Growth Rate (CAGR) of XX%, primarily fueled by increased investments in 5G infrastructure and the burgeoning demand for high-speed internet access across both developed and developing nations. This growth trajectory is expected to continue into the forecast period (2025-2033), albeit at a slightly moderated pace, with a projected CAGR of XX%.

Technological advancements, such as the incorporation of automated alignment systems, improved fiber handling, and enhanced user interfaces, are streamlining the splicing process, improving efficiency, and reducing operational costs. Simultaneously, increasing consumer demand for seamless connectivity across various devices is driving significant investments in fiber optic network upgrades and expansions.

The market is also witnessing a shift towards more compact and portable fusion splicers, catering to the needs of field technicians and mobile deployment scenarios. This trend is further bolstered by the growing adoption of smart features, such as integrated fiber testing capabilities and remote diagnostics. This evolution is reflected in the increasing adoption rates of advanced fusion splicers in major telecommunication networks globally.

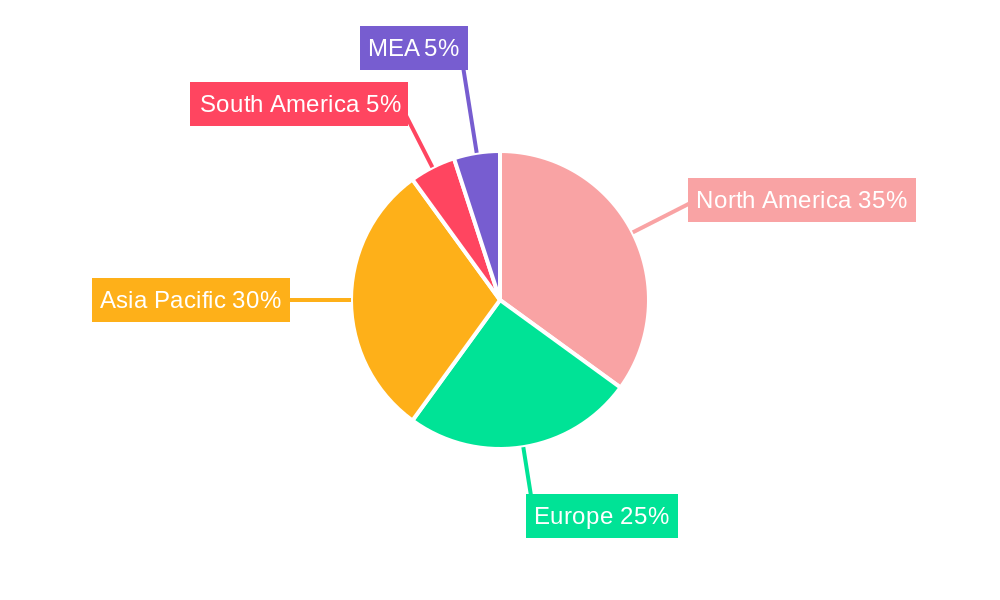

Leading Regions, Countries, or Segments in Fusion Splicer Industry

The telecommunications segment dominates the fusion splicer market, accounting for over XX% of total revenue in 2025. This is due to the extensive deployment of fiber optic cables in 5G networks and broadband infrastructure upgrades. The Asia-Pacific region is currently the leading market, driven by robust economic growth and substantial investments in telecommunications infrastructure.

- Dominant Segment: Telecommunications

- Leading Region: Asia-Pacific

- Key Drivers (Asia-Pacific): High infrastructure spending, rapid urbanization, rising mobile data consumption.

- Core Alignment vs. Cladding Alignment: Core alignment splicers currently hold a larger market share due to their higher precision, although cladding alignment technologies are gaining traction in specific applications.

The North American market also presents substantial opportunities, spurred by ongoing network modernization initiatives. Europe demonstrates consistent growth, although at a slower pace compared to Asia-Pacific. Other regions, including Latin America and the Middle East and Africa, are experiencing a surge in demand, largely driven by government initiatives to bridge the digital divide.

Fusion Splicer Industry Product Innovations

Recent innovations include advancements in core alignment techniques leading to improved splice loss and increased splicing speed. The integration of automated fiber cleavers and advanced optical power meters into the fusion splicer units has further enhanced efficiency and reduced the need for separate instruments. Some models now incorporate advanced diagnostic capabilities, including visual inspection and fault detection, enhancing network reliability and reducing maintenance costs. Miniaturization of the devices has made them more portable and user-friendly for field deployments.

Propelling Factors for Fusion Splicer Industry Growth

The industry's growth is propelled by several key factors. Technological advancements are at the forefront, with continuous improvements in splicing speed, precision, and automation driving demand. The expanding global fiber optic network infrastructure, fueled by the increasing demand for higher bandwidth and faster internet speeds, particularly for 5G and broadband deployment, is a major catalyst. Government initiatives aimed at improving digital connectivity, along with favorable regulatory frameworks supporting fiber optic deployment, also contribute significantly.

Obstacles in the Fusion Splicer Industry Market

Several challenges hinder market growth. Intense competition from numerous established and emerging players exerts significant price pressure, impacting profit margins. Supply chain disruptions, particularly those related to critical components, can lead to production delays and impact market availability. Stringent regulatory requirements regarding safety and performance standards can increase production costs and compliance burdens.

Future Opportunities in Fusion Splicer Industry

Emerging opportunities include the expansion into new applications such as underwater fiber optic cables and the deployment of fiber optic sensors in various sectors. Advancements in technologies like all-fiber splicing and the integration of artificial intelligence (AI) for automated splice quality assessment hold immense potential. The increasing demand for high-speed data transmission in sectors like data centers and cloud computing will also drive continued market expansion.

Major Players in the Fusion Splicer Industry Ecosystem

- Ilsintech Co Ltd

- Signal Fire Technology Co Ltd

- Nanjing Jilong Optical Communication Co Ltd

- Furukawa Electric Co Ltd

- Greenlee Communication

- INNO Instruments Inc

- China Electronics Technology Group Corporation

- Nanjing Jilong Optical Communication Co Ltd

- Fujikura Ltd

- Fiberfox Inc

- Shenzhen Ruiyan Communication Equipment Co Ltd

- Skycome Express LLC

- Shanghai Xianghe Optical Fiber Communication Co Ltd

- GAO Tek & GAO Group Inc

- Darkhorsechina (Beijing) Telecom Tech Co Ltd

- Sumitomo Electric Industries Ltd

- Eloik Communication Equipment Technology Co Ltd

Key Developments in Fusion Splicer Industry Industry

- 2022 Q3: Fujikura Ltd launches a new generation of fusion splicer with integrated fiber testing capabilities.

- 2023 Q1: Sumitomo Electric Industries Ltd announces a strategic partnership to expand its global distribution network.

- 2024 Q4: Ilsintech Co Ltd acquires a smaller competitor, strengthening its market position. (Further key developments will be detailed within the full report)

Strategic Fusion Splicer Industry Market Forecast

The fusion splicer market is poised for robust growth over the forecast period (2025-2033), driven by ongoing investments in fiber optic infrastructure and technological advancements. The increasing adoption of 5G networks and the growing demand for high-bandwidth connectivity across various sectors will fuel this expansion. New market applications, such as fiber optic sensors and underwater cable deployments, will further contribute to market growth. The report concludes with detailed regional and segment-specific forecasts, providing valuable insights into future market dynamics and opportunities.

Fusion Splicer Industry Segmentation

-

1. Alignment Type

- 1.1. Core Alignment

- 1.2. Cladding Alignment

-

2. Application

- 2.1. Telecommunications

- 2.2. Aerospace & Defense

- 2.3. Premises & Enterprise

- 2.4. Cable TV

- 2.5. Other Applications

Fusion Splicer Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Fusion Splicer Industry Regional Market Share

Geographic Coverage of Fusion Splicer Industry

Fusion Splicer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Augmented Demand for Increased Network Bandwidth; Growth in Government Funding for Fiber Optic Networks

- 3.3. Market Restrains

- 3.3.1. ; Huge Cost of Equipment; Lack of Technical Knowledge

- 3.4. Market Trends

- 3.4.1. Telecom and Enterprise Application to Continue Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fusion Splicer Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Alignment Type

- 5.1.1. Core Alignment

- 5.1.2. Cladding Alignment

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Telecommunications

- 5.2.2. Aerospace & Defense

- 5.2.3. Premises & Enterprise

- 5.2.4. Cable TV

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Alignment Type

- 6. North America Fusion Splicer Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Alignment Type

- 6.1.1. Core Alignment

- 6.1.2. Cladding Alignment

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Telecommunications

- 6.2.2. Aerospace & Defense

- 6.2.3. Premises & Enterprise

- 6.2.4. Cable TV

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Alignment Type

- 7. Europe Fusion Splicer Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Alignment Type

- 7.1.1. Core Alignment

- 7.1.2. Cladding Alignment

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Telecommunications

- 7.2.2. Aerospace & Defense

- 7.2.3. Premises & Enterprise

- 7.2.4. Cable TV

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Alignment Type

- 8. Asia Pacific Fusion Splicer Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Alignment Type

- 8.1.1. Core Alignment

- 8.1.2. Cladding Alignment

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Telecommunications

- 8.2.2. Aerospace & Defense

- 8.2.3. Premises & Enterprise

- 8.2.4. Cable TV

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Alignment Type

- 9. Rest of the World Fusion Splicer Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Alignment Type

- 9.1.1. Core Alignment

- 9.1.2. Cladding Alignment

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Telecommunications

- 9.2.2. Aerospace & Defense

- 9.2.3. Premises & Enterprise

- 9.2.4. Cable TV

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Alignment Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Ilsintech Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Signal Fire Technology Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Nanjing Jilong Optical Communication Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Furukawa Electric Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Greenlee Communication

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 INNO Instruments Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 China Electronics Technology Group Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Nanjing Jilong Optical Communication Co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Fujikura Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Fiberfox Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Shenzhen Ruiyan Communication Equipment Co Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Skycome Express LLC

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Shanghai Xianghe Optical Fiber Communication Co Ltd

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 GAO Tek & GAO Group Inc

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Darkhorsechina (Beijing) Telecom Tech Co Ltd

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Sumitomo Electric Industries Ltd

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Eloik Communication Equipment Technology Co Ltd

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.1 Ilsintech Co Ltd

List of Figures

- Figure 1: Global Fusion Splicer Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Fusion Splicer Industry Revenue (undefined), by Alignment Type 2025 & 2033

- Figure 3: North America Fusion Splicer Industry Revenue Share (%), by Alignment Type 2025 & 2033

- Figure 4: North America Fusion Splicer Industry Revenue (undefined), by Application 2025 & 2033

- Figure 5: North America Fusion Splicer Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Fusion Splicer Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Fusion Splicer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Fusion Splicer Industry Revenue (undefined), by Alignment Type 2025 & 2033

- Figure 9: Europe Fusion Splicer Industry Revenue Share (%), by Alignment Type 2025 & 2033

- Figure 10: Europe Fusion Splicer Industry Revenue (undefined), by Application 2025 & 2033

- Figure 11: Europe Fusion Splicer Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Fusion Splicer Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Fusion Splicer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Fusion Splicer Industry Revenue (undefined), by Alignment Type 2025 & 2033

- Figure 15: Asia Pacific Fusion Splicer Industry Revenue Share (%), by Alignment Type 2025 & 2033

- Figure 16: Asia Pacific Fusion Splicer Industry Revenue (undefined), by Application 2025 & 2033

- Figure 17: Asia Pacific Fusion Splicer Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Fusion Splicer Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Fusion Splicer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Fusion Splicer Industry Revenue (undefined), by Alignment Type 2025 & 2033

- Figure 21: Rest of the World Fusion Splicer Industry Revenue Share (%), by Alignment Type 2025 & 2033

- Figure 22: Rest of the World Fusion Splicer Industry Revenue (undefined), by Application 2025 & 2033

- Figure 23: Rest of the World Fusion Splicer Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of the World Fusion Splicer Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Fusion Splicer Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fusion Splicer Industry Revenue undefined Forecast, by Alignment Type 2020 & 2033

- Table 2: Global Fusion Splicer Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Fusion Splicer Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Fusion Splicer Industry Revenue undefined Forecast, by Alignment Type 2020 & 2033

- Table 5: Global Fusion Splicer Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Fusion Splicer Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Fusion Splicer Industry Revenue undefined Forecast, by Alignment Type 2020 & 2033

- Table 8: Global Fusion Splicer Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 9: Global Fusion Splicer Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Fusion Splicer Industry Revenue undefined Forecast, by Alignment Type 2020 & 2033

- Table 11: Global Fusion Splicer Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global Fusion Splicer Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Fusion Splicer Industry Revenue undefined Forecast, by Alignment Type 2020 & 2033

- Table 14: Global Fusion Splicer Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Global Fusion Splicer Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fusion Splicer Industry?

The projected CAGR is approximately 5.98%.

2. Which companies are prominent players in the Fusion Splicer Industry?

Key companies in the market include Ilsintech Co Ltd, Signal Fire Technology Co Ltd, Nanjing Jilong Optical Communication Co Ltd, Furukawa Electric Co Ltd, Greenlee Communication, INNO Instruments Inc, China Electronics Technology Group Corporation, Nanjing Jilong Optical Communication Co Ltd, Fujikura Ltd, Fiberfox Inc, Shenzhen Ruiyan Communication Equipment Co Ltd, Skycome Express LLC, Shanghai Xianghe Optical Fiber Communication Co Ltd, GAO Tek & GAO Group Inc, Darkhorsechina (Beijing) Telecom Tech Co Ltd, Sumitomo Electric Industries Ltd, Eloik Communication Equipment Technology Co Ltd.

3. What are the main segments of the Fusion Splicer Industry?

The market segments include Alignment Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Augmented Demand for Increased Network Bandwidth; Growth in Government Funding for Fiber Optic Networks.

6. What are the notable trends driving market growth?

Telecom and Enterprise Application to Continue Dominating the Market.

7. Are there any restraints impacting market growth?

; Huge Cost of Equipment; Lack of Technical Knowledge.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fusion Splicer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fusion Splicer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fusion Splicer Industry?

To stay informed about further developments, trends, and reports in the Fusion Splicer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence