Key Insights

The European water meter market is projected to reach $2.51 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 11.7% through 2033. This growth is propelled by escalating urbanization and population increases across Europe, intensifying the demand for efficient water infrastructure and management. Stringent governmental mandates focused on minimizing water wastage and optimizing resource utilization are compelling utilities to embrace smart metering technology. The adoption of smart water meters delivers significant advantages, including real-time data insights, enhanced leak detection, and precise billing, all contributing to sustained market expansion. Key industry leaders such as Badger Meter, Siemens, and Landis+Gyr, alongside numerous regional and niche manufacturers, define the competitive environment. Ongoing advancements in meter technology, such as sophisticated communication protocols and data analytics, are further stimulating market growth.

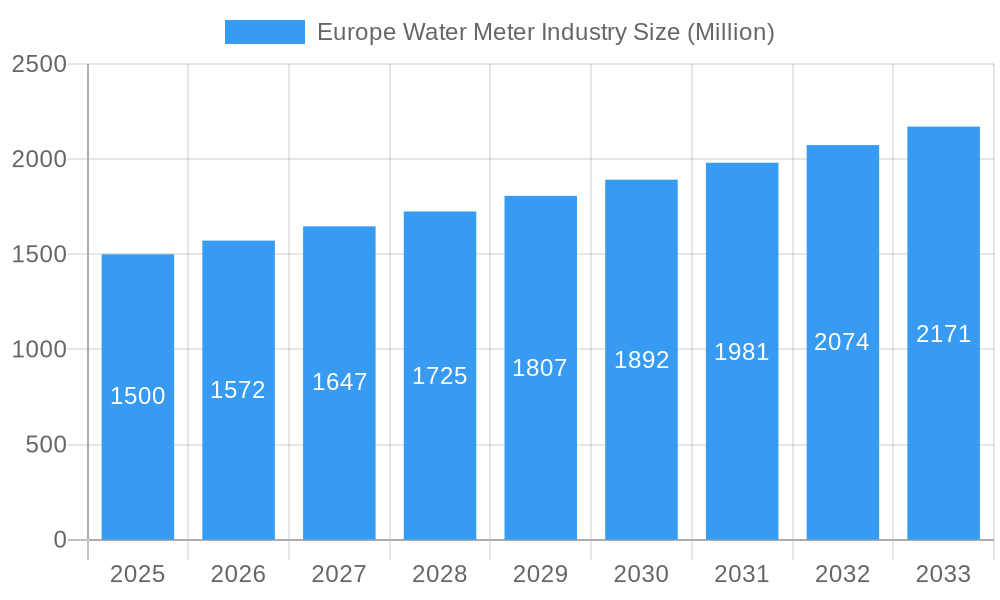

Europe Water Meter Industry Market Size (In Billion)

Despite the promising outlook, the market faces certain hurdles. Substantial upfront capital expenditure for smart meter implementation can present an adoption challenge, particularly for smaller water utilities. Moreover, critical concerns surrounding data security and privacy in the handling of water consumption information necessitate robust security frameworks and diligent oversight. Market segmentation includes basic meters and advanced communicating smart meters, serving key European nations like the United Kingdom, Germany, and France, thereby offering varied opportunities. The penetration of meter types differs according to regional technological adoption levels and regulatory structures. In summation, the European water meter market offers a significant strategic avenue for businesses prepared to expertly manage technological evolution, regulatory complexities, and dynamic market forces to deliver superior, dependable solutions.

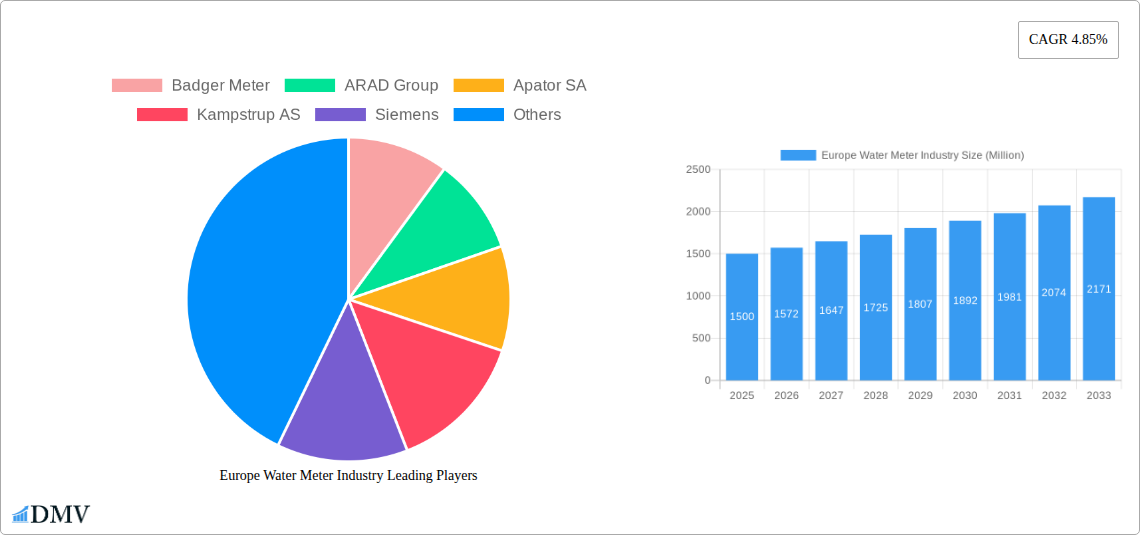

Europe Water Meter Industry Company Market Share

Europe Water Meter Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the European water meter industry, offering a comprehensive overview of market trends, leading players, technological advancements, and future growth prospects. Covering the period from 2019 to 2033, with a focus on 2025, this report is an indispensable resource for stakeholders seeking to navigate this dynamic market. The total market size is projected to reach xx Million by 2033.

Europe Water Meter Industry Market Composition & Trends

This section delves into the competitive landscape of the European water meter market, analyzing market concentration, innovation drivers, regulatory frameworks, and prevalent M&A activities. The market is characterized by a moderate level of concentration, with key players like Badger Meter, ARAD Group, Apator SA, and Kampstrup AS holding significant market share. However, the presence of numerous regional players and smaller niche companies ensures a dynamic competitive environment.

- Market Share Distribution (2025): Badger Meter (15%), ARAD Group (12%), Apator SA (10%), Kampstrup AS (8%), Others (55%). (Note: These figures are estimates based on available market intelligence.)

- Innovation Catalysts: Stringent water conservation regulations, increasing demand for smart water management solutions, and advancements in IoT technology are key drivers of innovation.

- Regulatory Landscape: Differing regulations across European countries influence product specifications and market access. Harmonization efforts across the EU are gradually shaping a more unified regulatory environment.

- Substitute Products: While traditional mechanical meters still hold a market segment, the growing adoption of smart meters is gradually replacing basic meters.

- End-User Profiles: Municipal water utilities, industrial water users, and residential consumers constitute the primary end-user segments.

- M&A Activities: The past five years have witnessed xx Million in M&A deals within the European water meter industry, primarily focused on consolidating market share and acquiring technological expertise. Notable examples include (insert examples if available or state “data not publicly available”).

Europe Water Meter Industry Industry Evolution

The European water meter market has experienced significant evolution since 2019. Driven by increasing urbanization, stricter environmental regulations, and the need for improved water resource management, the market has witnessed robust growth. The shift from basic mechanical meters to advanced smart meters is a major transformation, impacting market dynamics. This transition is fueled by the need for accurate real-time data, enhanced leak detection capabilities, and reduced water loss. Technological advancements, such as the integration of IoT and AI, are further accelerating the adoption of smart metering solutions. Consumer demand is shifting towards solutions that offer greater transparency, efficiency, and sustainability. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). Adoption of smart meters is anticipated to increase from xx% in 2025 to xx% in 2033.

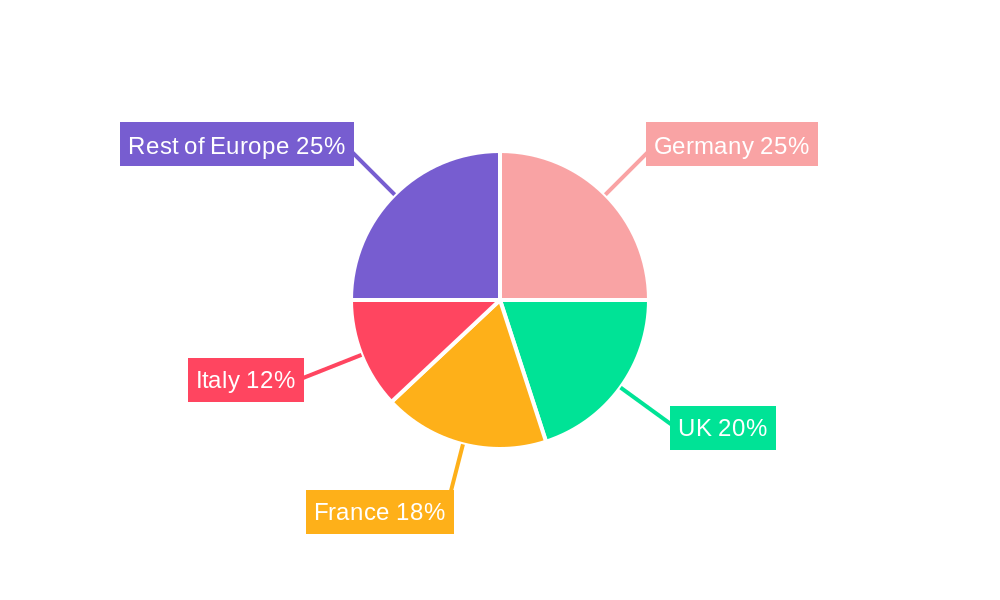

Leading Regions, Countries, or Segments in Europe Water Meter Industry

The United Kingdom, Germany, and France represent the leading markets in Europe for water meters, driven by factors such as high population density, aging infrastructure, and robust regulatory support for smart water management initiatives. The "Rest of Europe" segment also presents significant growth potential.

- By Type of Meter: Communicating smart meters are experiencing the fastest growth, driven by technological advancements and the need for real-time data analysis. Basic meters still maintain a considerable share, primarily in regions with less stringent regulations or lower budgets.

- By Country:

- United Kingdom: Strong government initiatives promoting smart city development and water efficiency are driving market growth.

- Germany: A robust industrial base and focus on technological innovation contribute to high demand for advanced water metering solutions.

- France: Significant investments in water infrastructure modernization are fueling growth within the water meter market.

- Rest of Europe: This segment offers growth potential driven by varying levels of regulatory support and infrastructure development across different European countries.

The dominance of these regions and segments stems from several key drivers:

- Increased Investment: Significant investments in water infrastructure upgrades and modernization are fueling demand for advanced water meters.

- Regulatory Support: Government regulations mandating water efficiency and leak detection are pushing the adoption of smart metering solutions.

- Technological Advancements: The continuous development and refinement of smart meter technologies are improving their performance and affordability.

Europe Water Meter Industry Product Innovations

Recent innovations include the development of advanced communication protocols (e.g., NB-IoT, LoRaWAN) for improved data transmission, enhanced data analytics capabilities for proactive leak detection and predictive maintenance, and the integration of smart sensors for real-time monitoring of water quality. These innovations offer significant value propositions such as reduced water loss, optimized resource management, and improved customer service.

Propelling Factors for Europe Water Meter Industry Growth

The growth of the European water meter industry is propelled by several key factors:

- Stringent Water Regulations: European Union directives and national regulations are driving the adoption of water-efficient technologies, including smart meters.

- Aging Water Infrastructure: The need to replace outdated infrastructure in many European countries creates significant demand for new water meters.

- Technological Advancements: The continuous innovation in smart meter technology, including IoT and AI integration, is enhancing their capabilities and driving adoption.

- Growing Environmental Awareness: Increasing awareness of water scarcity and the need for sustainable water management is driving demand for accurate and efficient water metering solutions.

Obstacles in the Europe Water Meter Industry Market

The European water meter industry faces challenges such as:

- High Initial Investment Costs: The upfront cost of deploying smart meter systems can be a barrier for some utilities, particularly in smaller communities.

- Cybersecurity Concerns: The increasing connectivity of smart meters raises concerns about data security and potential cyberattacks.

- Interoperability Issues: Lack of standardization in communication protocols can hinder seamless integration of different smart metering systems.

- Supply Chain Disruptions: Global supply chain disruptions can impact the availability and cost of components, leading to project delays and increased prices.

Future Opportunities in Europe Water Meter Industry

Future opportunities lie in:

- Expansion into Smart Water Management Solutions: Integrating water meters into broader smart city initiatives creates new market opportunities.

- Advancements in Data Analytics: Developing advanced analytics tools for extracting valuable insights from water meter data can improve resource management.

- Development of Advanced Metering Infrastructure (AMI): Building robust AMI networks to support large-scale smart meter deployments offers significant growth potential.

- Focus on Sustainability: Developing more sustainable and environmentally friendly water meter solutions, including those manufactured using recycled materials, will be critical.

Major Players in the Europe Water Meter Industry Ecosystem

- Badger Meter

- ARAD Group

- Apator SA

- Kampstrup AS

- Siemens

- Zenner International

- B Meters Metering Solutions

- Elster Group GmbH (Honeywell International Inc)

- Sensus

- DH Metering Europe SA

- Sontex SA

- Ningbo Water Meter Co

- Diehl Metering

- Landis+Gyr

Key Developments in Europe Water Meter Industry Industry

- 2022 Q4: Badger Meter launched a new smart water meter with advanced communication capabilities.

- 2023 Q1: ARAD Group acquired a smaller competitor in the French market, expanding its market share.

- 2023 Q2: New EU regulations regarding water metering standards came into effect. (Insert other specific developments with dates if available).

Strategic Europe Water Meter Industry Market Forecast

The European water meter market is poised for continued growth, driven by ongoing investments in water infrastructure, technological advancements, and supportive regulatory frameworks. The increasing adoption of smart meters and the integration of advanced data analytics capabilities will create significant opportunities for market players. The market's strong growth trajectory is expected to continue throughout the forecast period, driven by factors such as urbanization, increased focus on water conservation, and continuous technological innovations in smart water management. The market is expected to see substantial growth in the smart meter segment, with further consolidation among key players and increasing innovation in data analytics and connected solutions.

Europe Water Meter Industry Segmentation

-

1. Type of Meter

- 1.1. Basic Meters

- 1.2. Communicating Smart Meters

Europe Water Meter Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Water Meter Industry Regional Market Share

Geographic Coverage of Europe Water Meter Industry

Europe Water Meter Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Need for improvement in utility usage and efficiency; Supportive state regulations and growing awareness on the wastage of water due to lack of accountability

- 3.3. Market Restrains

- 3.3.1. Costs & integration challenges

- 3.4. Market Trends

- 3.4.1. Communicating Smart Water Meters to have a significant growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Water Meter Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Meter

- 5.1.1. Basic Meters

- 5.1.2. Communicating Smart Meters

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type of Meter

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Badger Meter

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ARAD Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Apator SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kampstrup AS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zenner International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 B Meters Metering Solutions

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Elster Group GmbH (Honeywell International Inc )

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sensus

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DH Metering Europe SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sontex SA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Ningbo Water Meter Co

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Diehl Metering

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Landis+Gyr

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Badger Meter

List of Figures

- Figure 1: Europe Water Meter Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Water Meter Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Water Meter Industry Revenue billion Forecast, by Type of Meter 2020 & 2033

- Table 2: Europe Water Meter Industry Volume K Unit Forecast, by Type of Meter 2020 & 2033

- Table 3: Europe Water Meter Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Water Meter Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Europe Water Meter Industry Revenue billion Forecast, by Type of Meter 2020 & 2033

- Table 6: Europe Water Meter Industry Volume K Unit Forecast, by Type of Meter 2020 & 2033

- Table 7: Europe Water Meter Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Europe Water Meter Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Water Meter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Europe Water Meter Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 11: Germany Europe Water Meter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Water Meter Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 13: France Europe Water Meter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Europe Water Meter Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Italy Europe Water Meter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Water Meter Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Water Meter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Spain Europe Water Meter Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Netherlands Europe Water Meter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Netherlands Europe Water Meter Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Belgium Europe Water Meter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Belgium Europe Water Meter Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Sweden Europe Water Meter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Sweden Europe Water Meter Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Norway Europe Water Meter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Norway Europe Water Meter Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Poland Europe Water Meter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Poland Europe Water Meter Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Denmark Europe Water Meter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Denmark Europe Water Meter Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Water Meter Industry?

The projected CAGR is approximately 11.7%.

2. Which companies are prominent players in the Europe Water Meter Industry?

Key companies in the market include Badger Meter, ARAD Group, Apator SA, Kampstrup AS, Siemens, Zenner International, B Meters Metering Solutions, Elster Group GmbH (Honeywell International Inc ), Sensus, DH Metering Europe SA, Sontex SA, Ningbo Water Meter Co, Diehl Metering, Landis+Gyr.

3. What are the main segments of the Europe Water Meter Industry?

The market segments include Type of Meter.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.51 billion as of 2022.

5. What are some drivers contributing to market growth?

Need for improvement in utility usage and efficiency; Supportive state regulations and growing awareness on the wastage of water due to lack of accountability.

6. What are the notable trends driving market growth?

Communicating Smart Water Meters to have a significant growth.

7. Are there any restraints impacting market growth?

Costs & integration challenges.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Water Meter Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Water Meter Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Water Meter Industry?

To stay informed about further developments, trends, and reports in the Europe Water Meter Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence