Key Insights

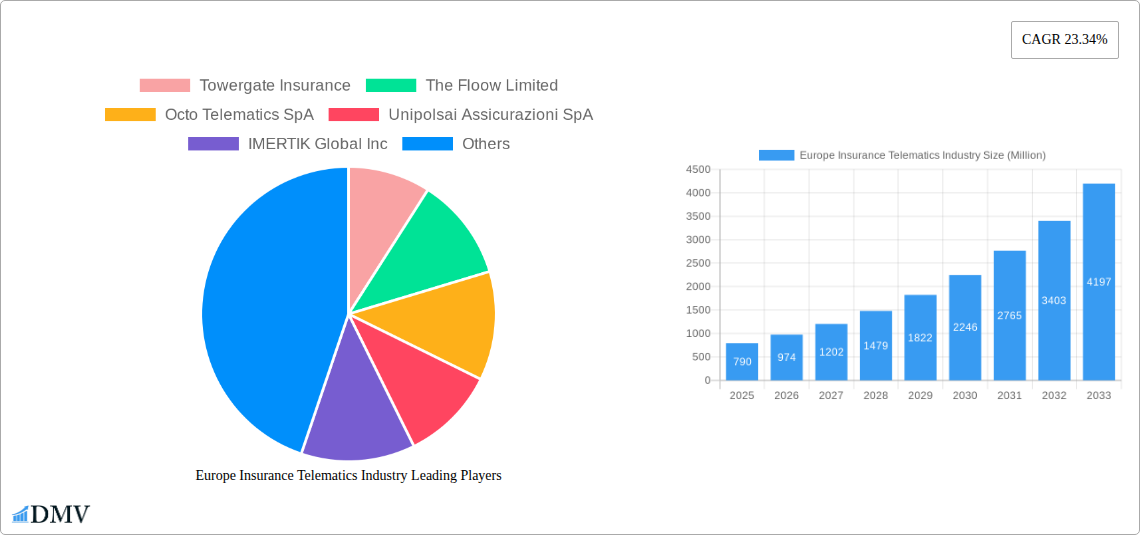

The European insurance telematics market, valued at €0.79 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 23.34% from 2025 to 2033. This expansion is fueled by several key factors. Increasing adoption of connected car technology provides a wealth of driving data for insurers to assess risk more accurately, leading to personalized premiums and improved safety initiatives. Furthermore, stringent government regulations promoting road safety and the rising demand for usage-based insurance (UBI) are significantly accelerating market penetration. The shift towards telematics-based insurance offers benefits to both insurers and consumers, resulting in a win-win situation. Insurers can benefit from reduced claims costs due to better risk assessment and proactive safety measures, while consumers can enjoy lower premiums based on their driving behavior. The market's segmentation by type (Pay-As-You-Drive, Pay-How-You-Drive, Manage-How-You-Drive) reflects the varied approaches to leveraging telematics data, catering to different customer preferences and insurance needs. The leading European countries, including Germany, the United Kingdom, and Italy, are key contributors to this growth, with Germany likely holding the largest market share due to its advanced automotive industry and technological infrastructure. The competitive landscape is dynamic, with established insurance companies and specialized telematics providers vying for market dominance. The ongoing innovations in data analytics and the integration of artificial intelligence are expected to further propel the market's growth trajectory in the coming years.

Europe Insurance Telematics Industry Market Size (In Million)

The competitive intensity within the European insurance telematics market is expected to remain high, with both established players and new entrants continuously seeking to enhance their offerings. The success of companies will hinge on their ability to develop advanced analytics capabilities, integrate seamlessly with various vehicle systems, and provide compelling value propositions for both insurers and consumers. Data security and privacy concerns are also expected to influence the market’s trajectory, requiring companies to invest in robust security measures and transparent data handling practices. The future of the European insurance telematics market is bright, with potential for significant expansion across various regions and customer segments, particularly as the adoption of electric vehicles and autonomous driving technologies accelerates. The market will continue to see consolidation as larger companies acquire smaller players and innovative technologies are integrated to enhance risk assessment and personalize insurance products even further.

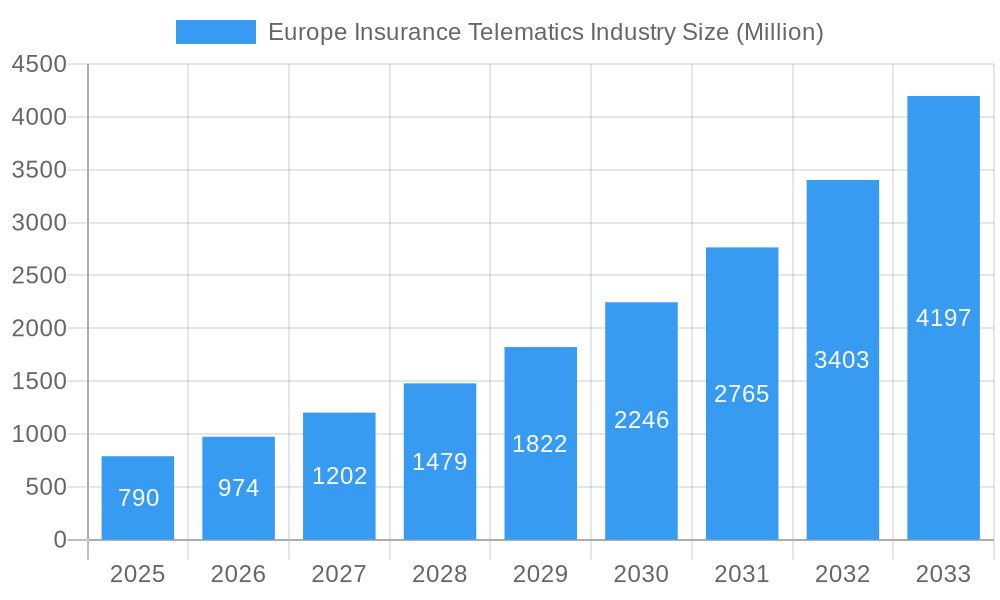

Europe Insurance Telematics Industry Company Market Share

Europe Insurance Telematics Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the European insurance telematics market, offering invaluable insights for stakeholders across the industry. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to predict future trends and opportunities. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting significant growth potential. Key segments analyzed include Pay-As-You-Drive, Pay-How-You-Drive, and Manage-How-You-Drive, across major European countries like Italy, the United Kingdom, Germany, and the Rest of Europe. Leading players such as Octo Telematics, AXA, and Vodafone Automotive are profiled, providing a comprehensive understanding of the competitive landscape.

Europe Insurance Telematics Industry Market Composition & Trends

The European insurance telematics market is characterized by moderate concentration, with a few major players holding significant market share. However, the market is dynamic, with ongoing innovation driving significant changes. The regulatory landscape, though evolving, is generally supportive of telematics adoption, fostering competition and market growth. Substitute products, such as traditional insurance models, still pose some challenges, but the increasing adoption of telematics is steadily reducing their relevance. End-users, primarily insurance companies and fleet operators, are increasingly demanding sophisticated data analytics and risk management solutions. Mergers and acquisitions (M&A) activities have been relatively frequent, with deal values reaching xx Million in recent years. This signifies consolidation and an increase in market competitiveness.

- Market Share Distribution: Octo Telematics holds approximately xx% market share, followed by AXA with xx%, and Vodafone Automotive with xx%. The remaining market share is distributed among numerous smaller players.

- M&A Activity: Significant M&A activity has been witnessed, with deals valued at an aggregate of xx Million over the past five years. These activities involve strategic acquisitions of smaller technology firms and consolidation among larger players.

- Innovation Catalysts: Advanced analytics, IoT integration, and the development of sophisticated algorithms are driving innovation in the market.

- Regulatory Landscape: Data privacy regulations (GDPR) and insurance regulations influence market dynamics and technology adoption.

Europe Insurance Telematics Industry Industry Evolution

The European insurance telematics market has experienced substantial growth over the past five years, driven by technological advancements, increasing consumer demand for personalized insurance solutions, and a favorable regulatory environment. The market’s growth trajectory is expected to continue, fueled by factors such as the proliferation of connected cars, the growing adoption of telematics-based insurance products, and improvements in data analytics capabilities. The adoption rate of telematics in the insurance sector has increased significantly from xx% in 2019 to xx% in 2024, signifying a remarkable shift in consumer and industry preferences. Technological advancements, such as the development of advanced driver-assistance systems (ADAS) and improvements in data processing capabilities, have enabled the development of more accurate and sophisticated risk assessment models, making telematics-based insurance more efficient and cost-effective. Consumer demands for personalized pricing and incentives have further propelled the adoption of telematics-based insurance products. We project a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033.

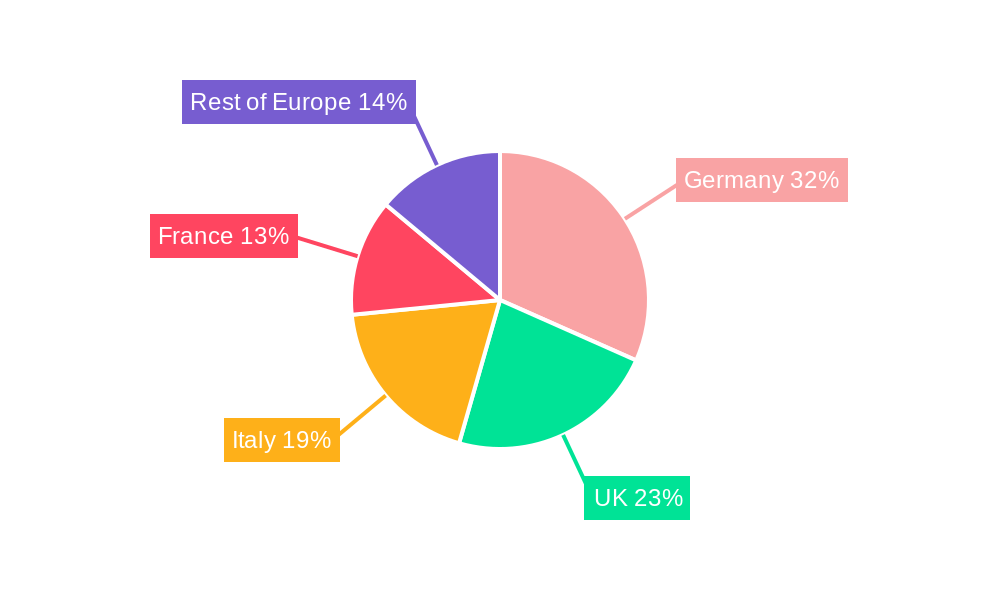

Leading Regions, Countries, or Segments in Europe Insurance Telematics Industry

The United Kingdom currently leads the European insurance telematics market, followed by Germany and Italy. This dominance is attributed to several factors:

- United Kingdom: High vehicle ownership rates, advanced technological infrastructure, and a relatively mature insurance market contribute to the UK's leading position. Strong regulatory support and consumer acceptance of telematics-based insurance solutions further solidify its dominance.

- Germany: A strong automotive industry and a focus on technological advancements are driving growth in the German market.

- Italy: Growing adoption of telematics-based insurance products and a robust insurance sector contribute to Italy's significant market share.

- Pay-As-You-Drive (PAYD): This segment currently dominates the market due to its simplicity and consumer appeal. The transparent pricing model and potential for cost savings are major drivers of its popularity.

- Key Drivers: Increased investment in telematics technology, supportive regulatory frameworks, and consumer preference for personalized insurance pricing are key factors driving growth across all segments and countries.

Europe Insurance Telematics Industry Product Innovations

Recent innovations in the European insurance telematics market include the development of advanced driver-assistance systems (ADAS) integration, improved data analytics capabilities enabling more personalized risk assessments, and the integration of wearable devices to collect broader behavioral data. These improvements offer unique selling propositions such as reduced premiums based on safer driving habits and personalized feedback for driver improvement. The technological advancements are enhancing the accuracy and effectiveness of risk assessment, enabling more equitable pricing and better fraud detection.

Propelling Factors for Europe Insurance Telematics Industry Growth

Technological advancements, such as AI-powered risk assessment and enhanced data analytics, are significantly driving growth. Economic factors, like the increasing affordability of telematics devices, further boost adoption. Supportive regulatory environments in several European countries are also promoting market expansion. For example, the GDPR, while demanding data privacy, also spurred the creation of innovative data management practices.

Obstacles in the Europe Insurance Telematics Industry Market

Data privacy concerns, particularly under GDPR, pose a significant challenge, requiring robust data security measures. Supply chain disruptions, particularly impacting the availability of electronic components, can also hinder growth. Finally, intense competition among established players and the emergence of new entrants creates market pressure. The overall impact of these factors is projected to reduce the market growth by approximately xx% in the forecast period.

Future Opportunities in Europe Insurance Telematics Industry

Expansion into new markets within Europe, particularly in Eastern European countries with growing insurance sectors, presents a significant opportunity. Integration of advanced technologies like AI and machine learning for predictive analytics and personalized risk profiles will unlock further growth. Furthermore, the increasing demand for connected car services provides a fertile ground for expansion.

Major Players in the Europe Insurance Telematics Industry Ecosystem

- Towergate Insurance

- The Floow Limited

- Octo Telematics SpA

- Unipolsai Assicurazioni SpA

- IMERTIK Global Inc

- AXA S A

- Drive Quant

- Viasat Group

- LexisNexis Risk Solutions

- Vodafone Automotive SpA

- List Not Exhaustive

Key Developments in Europe Insurance Telematics Industry Industry

- February 2023: OCTO Telematics partners with Ford Motor Company to expand its data streaming partnership into Europe, signifying a major step towards enhanced data collection and analytics capabilities within the automotive and insurance sectors. This partnership positions OCTO Telematics as a leading provider of fleet telematics and smart mobility solutions.

Strategic Europe Insurance Telematics Industry Market Forecast

The European insurance telematics market is poised for continued robust growth, driven by technological innovation, favorable regulatory environments, and increasing consumer demand for personalized insurance products. Future opportunities lie in expanding into underserved markets, integrating advanced technologies, and capitalizing on the burgeoning connected car ecosystem. The market is projected to maintain a healthy growth trajectory, exceeding xx Million by 2033, creating significant opportunities for established players and new entrants alike.

Europe Insurance Telematics Industry Segmentation

-

1. Type

- 1.1. Pay-As-You-Drive

- 1.2. Pay-How-You-Drive

- 1.3. Manage-How-You-Drive

-

2. BY COUNTRY

- 2.1. Italy

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. Rest of the Europe

Europe Insurance Telematics Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Insurance Telematics Industry Regional Market Share

Geographic Coverage of Europe Insurance Telematics Industry

Europe Insurance Telematics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Usage-based Insurance by Insurance Companies

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Workforce and Low Capital Investment

- 3.4. Market Trends

- 3.4.1. Adoption of Usage-based Insurance by Insurance Companies will Drive The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Insurance Telematics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Pay-As-You-Drive

- 5.1.2. Pay-How-You-Drive

- 5.1.3. Manage-How-You-Drive

- 5.2. Market Analysis, Insights and Forecast - by BY COUNTRY

- 5.2.1. Italy

- 5.2.2. United Kingdom

- 5.2.3. Germany

- 5.2.4. Rest of the Europe

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Towergate Insurance

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Floow Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Octo Telematics SpA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Unipolsai Assicurazioni SpA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IMERTIK Global Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 *List Not Exhaustive*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AXA S A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Drive Quant

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Viasat Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LexisNexis Risks Solutions

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Vodafone Automotive SpA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Towergate Insurance

List of Figures

- Figure 1: Europe Insurance Telematics Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Insurance Telematics Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Insurance Telematics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Insurance Telematics Industry Revenue Million Forecast, by BY COUNTRY 2020 & 2033

- Table 3: Europe Insurance Telematics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Insurance Telematics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Europe Insurance Telematics Industry Revenue Million Forecast, by BY COUNTRY 2020 & 2033

- Table 6: Europe Insurance Telematics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Insurance Telematics Industry?

The projected CAGR is approximately 23.34%.

2. Which companies are prominent players in the Europe Insurance Telematics Industry?

Key companies in the market include Towergate Insurance, The Floow Limited, Octo Telematics SpA, Unipolsai Assicurazioni SpA, IMERTIK Global Inc, *List Not Exhaustive*List Not Exhaustive, AXA S A, Drive Quant, Viasat Group, LexisNexis Risks Solutions, Vodafone Automotive SpA.

3. What are the main segments of the Europe Insurance Telematics Industry?

The market segments include Type, BY COUNTRY.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Usage-based Insurance by Insurance Companies.

6. What are the notable trends driving market growth?

Adoption of Usage-based Insurance by Insurance Companies will Drive The Market.

7. Are there any restraints impacting market growth?

Shortage of Skilled Workforce and Low Capital Investment.

8. Can you provide examples of recent developments in the market?

February 2023 -OCTO Telematics, a provider of telematics and data analytics for the insurance sector, has partnered with Ford Motor Company to extend its data streaming partnership into Europe. The company has positioned itself as one of the leading companies offering Fleet Telematics and Smart Mobility solutions. The company is on a mission to leverage its advanced analytics and set of IoT Big Data to generate actionable analytics, giving life to a new era of Smart Telematics.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Insurance Telematics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Insurance Telematics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Insurance Telematics Industry?

To stay informed about further developments, trends, and reports in the Europe Insurance Telematics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence