Key Insights

The European Industrial Computed Tomography (ICT) market is experiencing significant growth, propelled by widespread adoption across diverse manufacturing sectors. Key drivers include escalating demand for quality control and non-destructive testing (NDT) in industries such as automotive, aerospace, and energy. Technological advancements in ICT, offering enhanced resolution and faster scanning, alongside increased investments in automation and digitalization within European manufacturing, further fuel this expansion. Stringent regulatory compliance for product safety and quality also necessitates the adoption of advanced inspection techniques like ICT. The automotive sector is a primary contributor, leveraging ICT for precise dimensional measurement, defect detection, and material analysis throughout production.

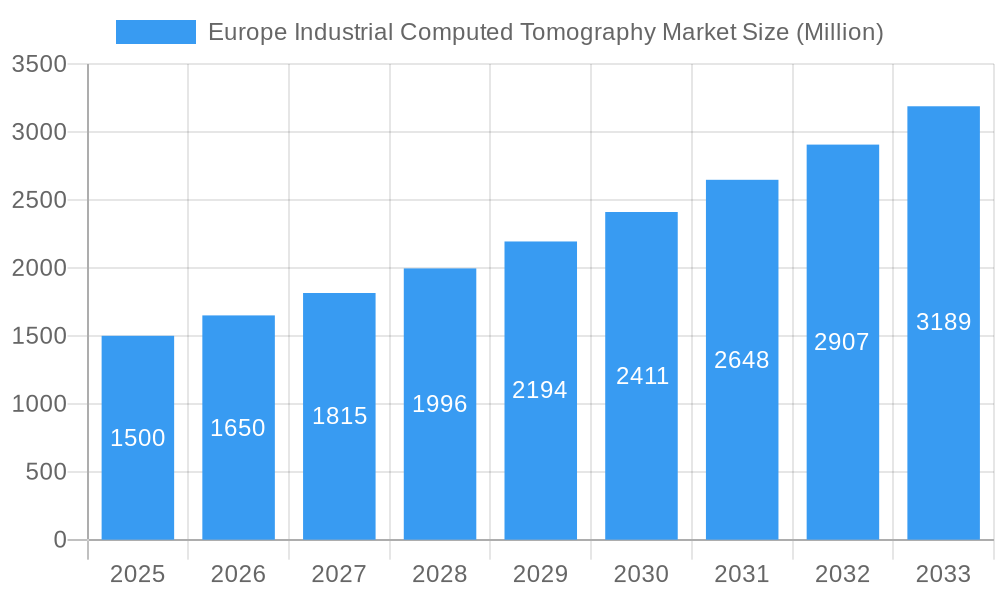

Europe Industrial Computed Tomography Market Market Size (In Million)

The European ICT market is projected for sustained expansion through 2033. Continuous technological innovation and a growing emphasis on manufacturing efficiency and productivity will drive demand. The integration of ICT with advanced manufacturing technologies like AI and machine learning presents new growth avenues, enabling greater precision, automation, and data analysis. This integration promises to optimize production workflows, reduce costs, and elevate product quality across numerous industrial applications.

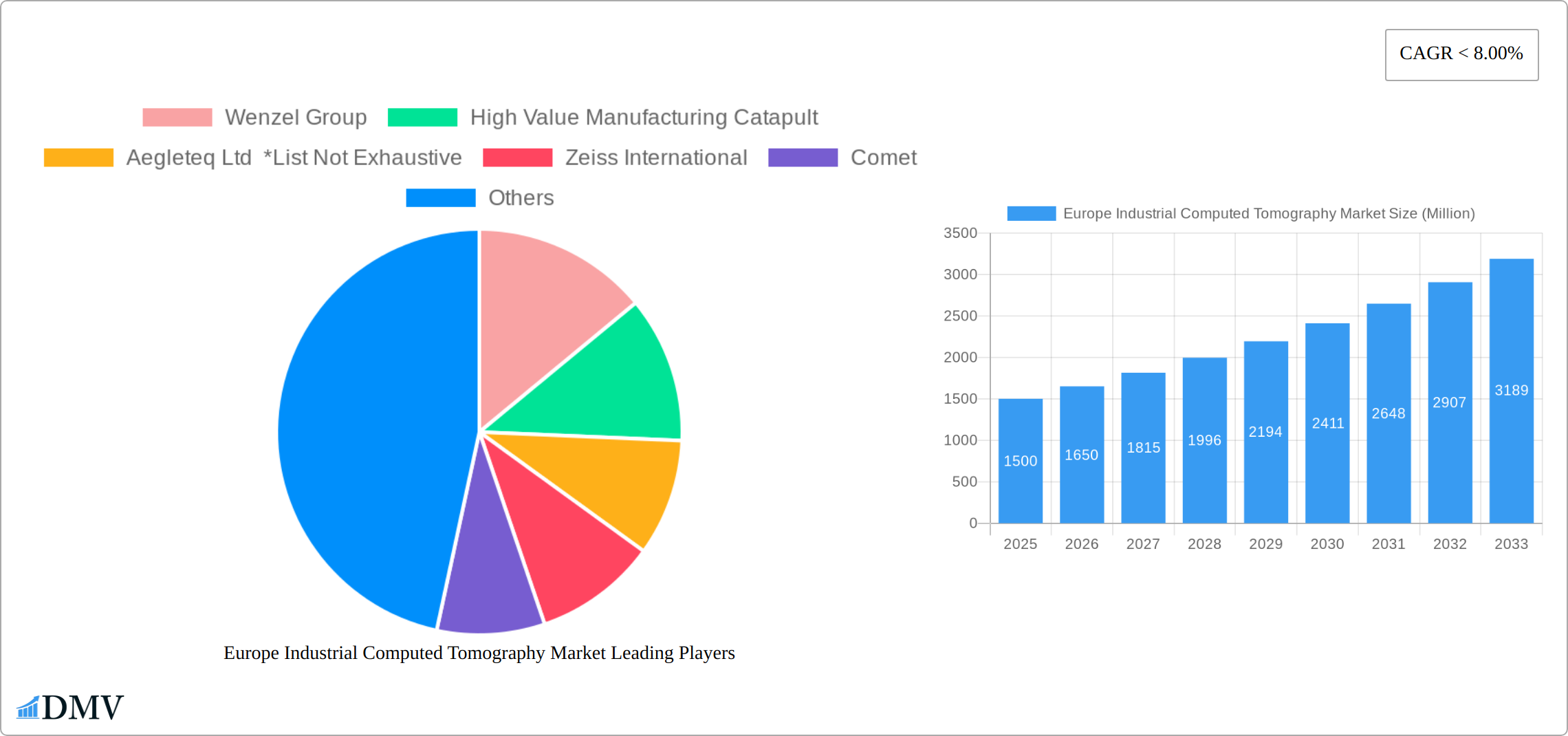

Europe Industrial Computed Tomography Market Company Market Share

Europe Industrial Computed Tomography Market Analysis: Size, Share, and Forecast (2025-2033)

This comprehensive report offers a detailed analysis of the Europe Industrial Computed Tomography (ICT) market, providing insights into trends, key players, and future growth projections. The market is forecast to reach 404.38 million by 2033, with a compound annual growth rate (CAGR) of 6% during the forecast period (2025-2033).

Europe Industrial Computed Tomography Market Market Composition & Trends

The European Industrial Computed Tomography (CT) market is characterized by a dynamic and moderately concentrated competitive landscape. Established industry leaders continue to hold significant market share, but the ecosystem is increasingly invigorated by the emergence of innovative startups and continuous technological advancements. This evolving environment fosters healthy competition and drives the adoption of cutting-edge solutions. The primary impetus for market growth stems from the stringent and ever-increasing quality control requirements across a broad spectrum of end-user industries. Sectors such as aerospace and automotive, with their inherent demand for precision and reliability, are particularly prominent drivers. Furthermore, strict adherence to regulatory compliance, especially concerning safety standards and environmental impact, plays a pivotal role in shaping market dynamics and influencing investment decisions. While alternative non-destructive testing (NDT) technologies, such as ultrasonic testing, do exist, industrial CT distinguishes itself with its unparalleled ability to deliver superior resolution and highly detailed 3D imaging capabilities, solidifying its dominant position in critical inspection applications. Mergers and acquisitions (M&A) activity within the market has been moderate in recent years, with average deal values for transactions hovering around [Insert Specific Deal Value, e.g., €50 Million]. Key M&A activities have included [Insert Specific M&A examples if available, otherwise state "Specific details on M&A activities are limited in publicly available information, but strategic acquisitions by larger players to expand their technological portfolios and market reach are anticipated."].

- Market Share Distribution: The top 5 players collectively held an estimated [Insert Percentage, e.g., 60%] of the market share in 2025, indicating a degree of consolidation among major entities.

- Innovation Catalysts: Continuous advancements in X-ray source technology (e.g., microfocus and nanofocus sources), high-performance detector technology (e.g., faster readout speeds, improved sensitivity), and sophisticated reconstruction algorithms are key drivers of innovation, enabling higher throughput and enhanced imaging fidelity.

- Regulatory Landscape: Stringent safety regulations and environmental standards, particularly within highly regulated sectors like aerospace, medical device manufacturing, and automotive, are critical factors influencing the adoption and development of industrial CT solutions.

- Substitute Products: While ultrasonic testing and other non-destructive testing methods offer viable alternatives for certain applications, industrial CT's ability to provide comprehensive volumetric data and detailed internal defect visualization remains its key competitive advantage.

- End-User Profiles: Key end-users encompass a diverse range of manufacturing sectors, including automotive (for component inspection and reverse engineering), aerospace (for critical part integrity assessment), electronics (for intricate component analysis), energy (for pipeline and oil & gas infrastructure inspection), and also expanding into additive manufacturing and medical device production.

- M&A Activities: Moderate M&A activity is observed, with strategic acquisitions aimed at broadening product portfolios, gaining access to new technologies, or consolidating market presence. Average deal values are estimated to be around [Insert Specific Deal Value, e.g., €50 Million].

Europe Industrial Computed Tomography Market Industry Evolution

The European industrial CT market has experienced a period of substantial and consistent growth over the past few years, driven by an escalating demand for high-precision inspection and detailed analysis across a multitude of sophisticated industries. Between 2019 and 2024, the market demonstrated a Compound Annual Growth Rate (CAGR) of approximately [Insert CAGR, e.g., 8.5%]. This growth trajectory has been primarily fueled by significant technological advancements, including the development of detectors with enhanced spatial resolution and considerably faster scanning capabilities, allowing for more efficient inspection workflows. The adoption of industrial CT technology is further accelerating due to its inherent value proposition as a non-destructive testing method, empowering manufacturers to rigorously ensure product quality, minimize defects, and subsequently reduce waste and costly recalls. Moreover, the increasing complexity of manufactured components, driven by miniaturization and the demand for advanced functionalities, coupled with an overarching global trend towards enhanced product quality and reliability, are significant growth catalysts. Shifting consumer preferences, which increasingly favor lighter, stronger, and more dependable products, further contribute to this upward market trend. The forecast period from 2025 to 2033 anticipates continued robust market expansion, with a projected CAGR of approximately [Insert CAGR, e.g., 9.2%]. This sustained growth is expected to be driven by the aforementioned factors, alongside the expanding application scope of industrial CT into novel and emerging sectors. Specific adoption rates within end-user industries exhibit notable variation, with the automotive and aerospace sectors currently showcasing the highest penetration rates, estimated to be around [Insert Percentage, e.g., 75%] in 2025.

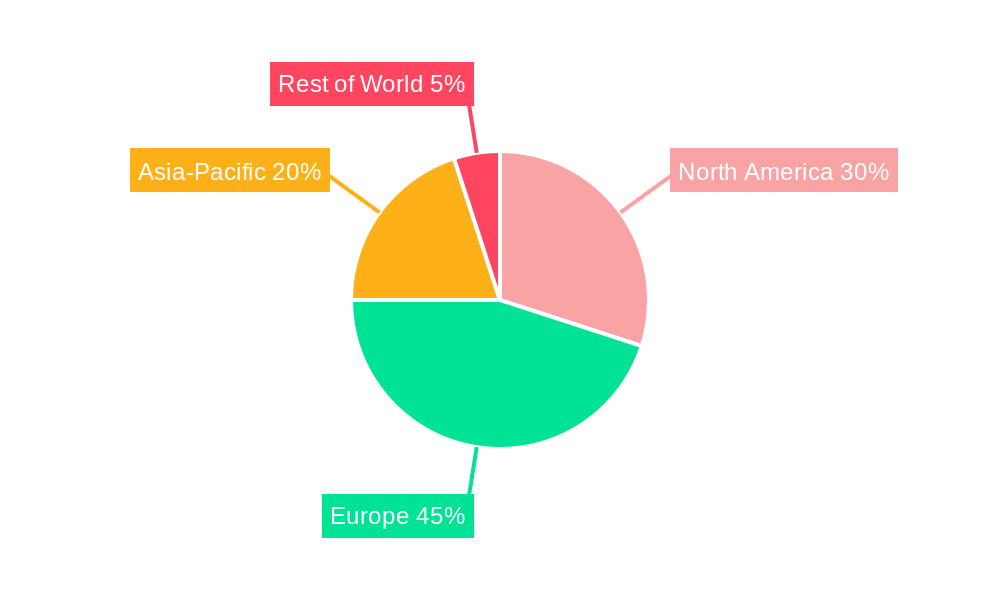

Leading Regions, Countries, or Segments in Europe Industrial Computed Tomography Market

Within the European landscape, the United Kingdom, Germany, and France collectively represent the most significant and leading markets for industrial CT solutions. This regional dominance is primarily attributed to the strong presence of established and advanced manufacturing industries within these countries, coupled with substantial and ongoing investments in cutting-edge manufacturing technologies and research and development initiatives. Examining application segments, 'Flaw Detection and Inspection' currently commands the largest market share, underscoring its critical role in ensuring product integrity and preventing failures. This is closely followed by 'Failure Analysis,' which highlights the importance of understanding the root causes of component malfunctions. In terms of end-user industry segments, the aerospace and automotive sectors continue to lead, propelled by exceptionally stringent quality control standards and the inherent complexity and critical nature of their manufactured products.

- Key Drivers by Region/Country:

- United Kingdom: Benefits from strong government support for advanced manufacturing initiatives and boasts a large, sophisticated aerospace sector, driving demand for high-precision inspection.

- Germany: Features a high concentration of leading automotive manufacturers and a robust, diversified industrial base, necessitating advanced NDT solutions for quality assurance.

- France: Possesses a significant and influential aerospace industry and demonstrates a strong commitment to investment in research and development, fostering innovation and adoption of advanced CT technologies.

- Leading Application Segments:

- Flaw Detection and Inspection: Essential for quality control processes across all manufacturing industries, ensuring compliance with specifications and preventing product failures in the field.

- Failure Analysis: Critical for understanding the root causes of component malfunctions, enabling design improvements and preventing recurrence of issues.

- Dominant End-User Industries:

- Aerospace: Driven by the need for absolute reliability and safety in critical components, requiring detailed internal inspection of complex parts.

- Automotive: Focuses on ensuring the quality and integrity of engine components, chassis parts, and increasingly, advanced electronic systems.

Europe Industrial Computed Tomography Market Product Innovations

Recent years have seen significant advancements in industrial CT technology, including the development of higher-resolution detectors, faster scan speeds, and more user-friendly software. Zeiss's launch of the Zeiss Metrotom, a compact and user-friendly entry-level system, exemplifies this trend. Nikon Metrology's improved offset computed tomography reconstruction algorithm significantly enhances image quality and speed. These innovations lower the barrier to entry for smaller companies and expand the applicability of industrial CT across a wider range of applications.

Propelling Factors for Europe Industrial Computed Tomography Market Growth

Several factors fuel the growth of the European industrial CT market. These include increasing demand for improved product quality and reliability, stringent regulatory compliance, advancements in CT technology, and the expansion of the application scope into new industries. The rising adoption of Industry 4.0 and the associated need for advanced inspection and quality control solutions are major drivers. Moreover, governmental initiatives promoting technological advancements in manufacturing enhance market growth.

Obstacles in the Europe Industrial Computed Tomography Market Market

The market faces some challenges, including the high initial investment costs associated with industrial CT systems, which might restrict adoption among smaller businesses. Supply chain disruptions, particularly concerning critical components like X-ray tubes and detectors, can impact market growth. Furthermore, competition from alternative non-destructive testing methods and the potential for price pressure from manufacturers can constrain growth. These factors could impact market expansion by xx% over the forecast period, if not addressed effectively.

Future Opportunities in Europe Industrial Computed Tomography Market

Future opportunities lie in the expansion of industrial CT into new and emerging applications, such as additive manufacturing (3D printing) quality control, and the development of innovative software solutions to improve data analysis and interpretation. The integration of artificial intelligence (AI) and machine learning (ML) algorithms into industrial CT systems promises further improvements in speed and accuracy. The development of portable and more affordable systems will expand market penetration among SMEs.

Major Players in the Europe Industrial Computed Tomography Market Ecosystem

- Wenzel Group

- High Value Manufacturing Catapult

- Aegleteq Ltd

- Zeiss International

- Comet

- VJ Group Inc

- Hamamatsu Photonics

- Werth Inc

- Baker Hughes Company

- [Additional leading players to be included based on specific market research]

Key Developments in Europe Industrial Computed Tomography Market Industry

- June 2021: Zeiss launched the Zeiss Metrotom, an entry-level computed tomography system, expanding market access.

- May 2021: Nikon Metrology launched a new offset computed tomography reconstruction algorithm, improving image resolution and scan speed.

Strategic Europe Industrial Computed Tomography Market Market Forecast

The European industrial CT market is strategically positioned for robust and sustained growth throughout the forecast period, extending from 2025 to 2033. This optimistic outlook is underpinned by a confluence of factors, including continuous technological innovation that enhances system performance and accessibility, coupled with escalating demand across key sectors, most notably aerospace and automotive. The integration of advanced analytics, artificial intelligence (AI), and machine learning (ML) capabilities into industrial CT systems is poised to revolutionize their potential. These advancements will not only unlock new and sophisticated applications but also significantly improve inspection efficiency, data interpretation, and predictive maintenance insights. This evolution is expected to contribute substantially to the overall market expansion, with a projected CAGR of approximately [Insert CAGR, e.g., 9.2%] over the forecast horizon. Key strategic considerations for market participants include developing more portable and cost-effective CT solutions, enhancing software for automated defect recognition, and fostering collaborations to expand into emerging application areas like additive manufacturing and materials science research.

Europe Industrial Computed Tomography Market Segmentation

-

1. Application

- 1.1. Flaw Detection and Inspection

- 1.2. Failure Analysis

- 1.3. Assembly Analysis

- 1.4. Other Applications

-

2. End User Industry

- 2.1. Aerospace

- 2.2. Automotive

- 2.3. Electronics

- 2.4. Oil and Gas

- 2.5. Other End-user Industries

Europe Industrial Computed Tomography Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Industrial Computed Tomography Market Regional Market Share

Geographic Coverage of Europe Industrial Computed Tomography Market

Europe Industrial Computed Tomography Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Improvements in Resolution and Image Processing; Intensifying Demand for Portable Radiography Equipment

- 3.3. Market Restrains

- 3.3.1. High Product Cost

- 3.4. Market Trends

- 3.4.1. Aerospace to Witness Significant Adoption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Industrial Computed Tomography Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Flaw Detection and Inspection

- 5.1.2. Failure Analysis

- 5.1.3. Assembly Analysis

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End User Industry

- 5.2.1. Aerospace

- 5.2.2. Automotive

- 5.2.3. Electronics

- 5.2.4. Oil and Gas

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Wenzel Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 High Value Manufacturing Catapult

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aegleteq Ltd *List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zeiss International

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Comet

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 VJ Group Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hamamatsu Photonics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Werth Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Baker Hughes Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Wenzel Group

List of Figures

- Figure 1: Europe Industrial Computed Tomography Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Industrial Computed Tomography Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Industrial Computed Tomography Market Revenue million Forecast, by Application 2020 & 2033

- Table 2: Europe Industrial Computed Tomography Market Revenue million Forecast, by End User Industry 2020 & 2033

- Table 3: Europe Industrial Computed Tomography Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Europe Industrial Computed Tomography Market Revenue million Forecast, by Application 2020 & 2033

- Table 5: Europe Industrial Computed Tomography Market Revenue million Forecast, by End User Industry 2020 & 2033

- Table 6: Europe Industrial Computed Tomography Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Industrial Computed Tomography Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Europe Industrial Computed Tomography Market?

Key companies in the market include Wenzel Group, High Value Manufacturing Catapult, Aegleteq Ltd *List Not Exhaustive, Zeiss International, Comet, VJ Group Inc, Hamamatsu Photonics, Werth Inc, Baker Hughes Company.

3. What are the main segments of the Europe Industrial Computed Tomography Market?

The market segments include Application, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 404.38 million as of 2022.

5. What are some drivers contributing to market growth?

Technological Improvements in Resolution and Image Processing; Intensifying Demand for Portable Radiography Equipment.

6. What are the notable trends driving market growth?

Aerospace to Witness Significant Adoption.

7. Are there any restraints impacting market growth?

High Product Cost.

8. Can you provide examples of recent developments in the market?

June 2021 - Zeiss Company unveiled Zeiss Metrotom, its entry-level computed tomography product. The non-destructive inspection of components using this solution is at the entry level. Additionally, this system is a compact computed tomography system that yields precise results and is simple to use.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Industrial Computed Tomography Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Industrial Computed Tomography Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Industrial Computed Tomography Market?

To stay informed about further developments, trends, and reports in the Europe Industrial Computed Tomography Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence