Key Insights

The global borescope market is projected to reach approximately $0.85 billion in 2025, with a projected compound annual growth rate (CAGR) of 5.53% from 2025 to 2033. This expansion is propelled by escalating demand across key industrial sectors. Technological advancements in borescopes, including enhanced imaging resolution and flexibility, are significantly improving inspection capabilities and driving adoption. The imperative for non-destructive testing (NDT) in critical industries such as aerospace, automotive, and oil & gas, where equipment integrity is paramount for safety and economic stability, serves as a primary market catalyst. Moreover, stringent regulatory compliance and the growing emphasis on proactive maintenance are compelling enterprises to invest in advanced inspection solutions like borescopes, thus fostering market growth.

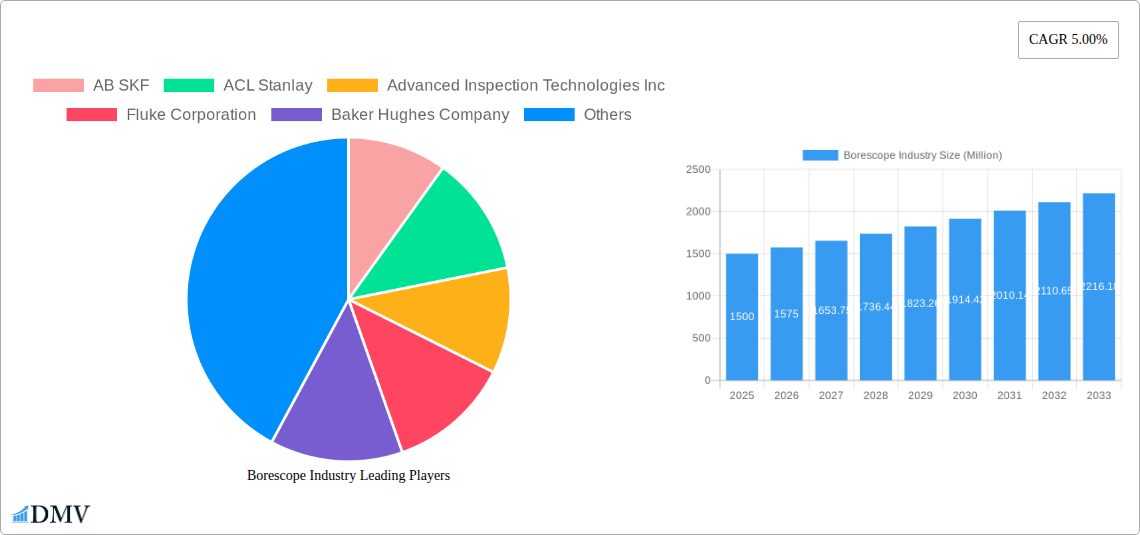

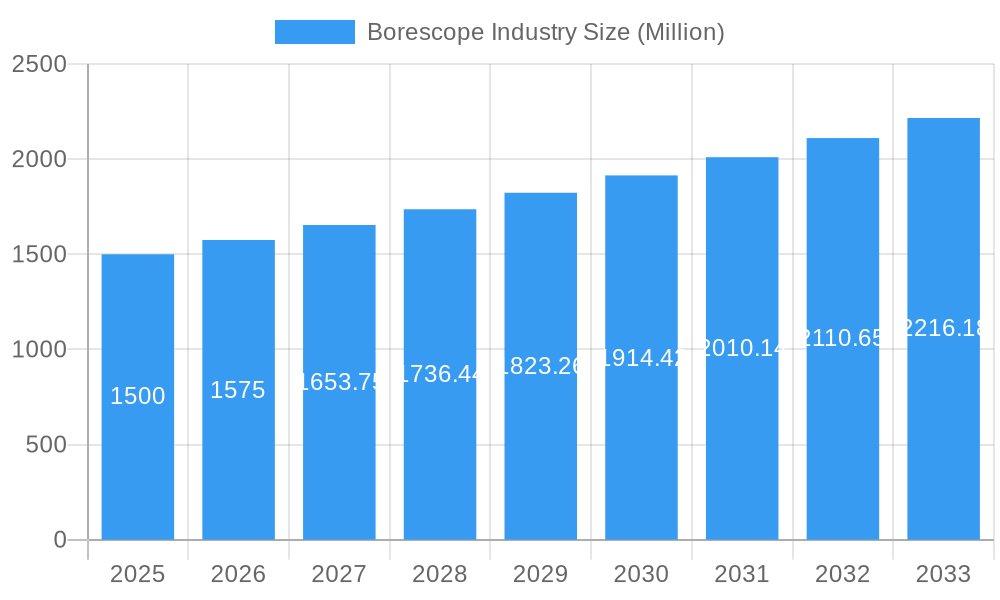

Borescope Industry Market Size (In Million)

The video borescope segment commands a dominant market share, attributed to its superior image clarity and user-friendly interface. Within diameter classifications, the 3mm to 6mm range is a significant contributor, accommodating a wide array of applications. The automotive, aviation, and oil & gas industries represent major end-user segments, underscoring the vital role borescopes play in ensuring operational safety and efficiency. Potential market restraints include the substantial initial investment for sophisticated borescopes and the existence of alternative inspection technologies. Despite these challenges, the market outlook remains optimistic, supported by continuous innovation and sustained demand. Geographic expansion is anticipated to be most pronounced in the Asia-Pacific region, fueled by robust industrial activity and infrastructure development in its emerging economies.

Borescope Industry Company Market Share

Borescope Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global borescope industry, offering invaluable insights for stakeholders seeking to understand market dynamics, future trends, and investment opportunities. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The market is expected to reach xx Million by 2033, driven by technological advancements and increasing demand across diverse end-user industries.

Borescope Industry Market Composition & Trends

This section delves into the competitive landscape of the borescope market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. The global borescope market is moderately fragmented, with several key players holding significant market share.

- Market Share Distribution: AB SKF, Olympus Corporation, and FLIR Systems collectively hold an estimated xx% market share in 2025, while other significant players include Baker Hughes Company, ViZaar Industrial Imaging AG, and JME Technologies Inc. The remaining market share is distributed among numerous smaller players.

- Innovation Catalysts: Continuous advancements in imaging technology, such as the integration of AI and improved resolution capabilities, are driving market growth. Miniaturization and improved flexibility are also key innovation trends.

- Regulatory Landscape: Stringent safety and quality regulations in various end-user industries, particularly aerospace and healthcare, influence product development and market entry.

- Substitute Products: While borescopes remain the primary solution for visual inspection in many applications, alternative technologies such as industrial computed tomography (CT) and ultrasound are emerging as substitutes in specific niches.

- End-User Profiles: Key end-users are spread across diverse sectors including automotive, aviation, oil & gas, manufacturing, and healthcare. The automotive sector is anticipated to witness significant growth in borescope adoption due to increasing demand for efficient vehicle maintenance and repair.

- M&A Activities: The last five years have witnessed several M&A activities in the borescope industry, with deal values averaging xx Million USD per transaction. These activities reflect the consolidation trend in the industry and efforts to expand market reach and product portfolios.

Borescope Industry Evolution

This section analyzes the historical and projected growth trajectories of the borescope market, technological advancements, and evolving consumer demands. The market has experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by rising demand for non-destructive testing (NDT) in various sectors. Technological progress, encompassing higher resolution imaging, improved flexibility, and integration of AI, is a key driver of adoption. The increasing complexity of industrial equipment necessitates sophisticated inspection tools, contributing significantly to market growth. Furthermore, the rising awareness of safety regulations within industries like Oil and Gas is also propelling the demand for borescopes. Technological advancements like AI-powered image analysis and remote operation are transforming the industry, allowing for more efficient and accurate inspections. The adoption rate of advanced borescopes with features like AI and enhanced visualization is increasing steadily; currently at xx% and is predicted to reach xx% by 2033.

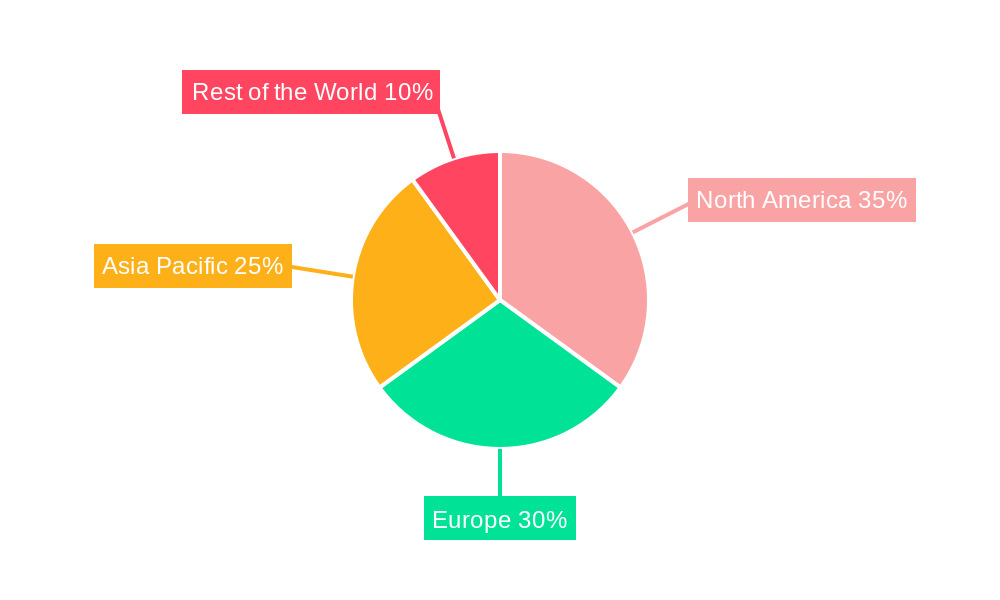

Leading Regions, Countries, or Segments in Borescope Industry

This section identifies the dominant regions, countries, and market segments within the borescope industry.

- By Type: The video borescope segment dominates the market, followed by flexible borescopes, driven by their superior image quality and ease of use.

- By Diameter: The 3 mm to 6 mm diameter segment holds the largest market share due to its versatility across a wide range of applications.

- By Angle: The 0° to 90° angle segment is the most prevalent, reflecting the demand for straightforward visual inspections.

- By End-user Industry: The oil and gas industry is a major driver, followed by the automotive and aviation sectors, owing to stringent safety regulations and the need for regular maintenance. Growth in the manufacturing and healthcare sectors is also significant.

Key Drivers:

- North America: Strong regulatory support for NDT and a high concentration of key players in the region.

- Europe: Growing focus on industrial automation and increasing adoption of advanced inspection techniques.

- Asia-Pacific: Rapid industrialization and expanding infrastructure development, leading to high demand for inspection tools.

Borescope Industry Product Innovations

Recent innovations include the integration of artificial intelligence (AI) for automated defect detection, improved image clarity with higher resolution cameras, and the development of more flexible and maneuverable borescopes for difficult-to-reach areas. These advancements enhance inspection efficiency and accuracy, catering to the growing demand for reliable and efficient visual inspection solutions across various industries. The unique selling propositions often include miniaturization for access to smaller spaces, higher resolution for clearer images, and the integration of AI for automated analysis.

Propelling Factors for Borescope Industry Growth

Technological advancements, particularly in imaging technology and miniaturization, are primary growth drivers. The increasing demand for non-destructive testing (NDT) across industries like aviation and oil & gas, coupled with stringent safety regulations, further propels market growth. Economic factors, such as the rising cost of downtime due to equipment failure, also incentivize investment in advanced inspection technologies like borescopes.

Obstacles in the Borescope Industry Market

High initial investment costs for advanced borescopes can be a barrier to entry for some businesses. Supply chain disruptions, particularly the availability of specialized components, can also impact market growth. Intense competition among established players and the emergence of new technologies like industrial CT scanning pose challenges. Furthermore, the fluctuation in raw material prices and the impact of global economic conditions can affect the industry's overall growth.

Future Opportunities in Borescope Industry

Emerging opportunities exist in the development of more compact and portable borescopes for use in remote locations. The integration of augmented reality (AR) and virtual reality (VR) technologies offers further opportunities for enhancing inspection capabilities. Expanding applications in areas like infrastructure inspection, robotics, and healthcare present significant growth potential. The increasing need for efficient and cost-effective inspection methods in developing countries represents a lucrative untapped market.

Major Players in the Borescope Industry Ecosystem

- AB SKF

- ACL Stanlay

- Advanced Inspection Technologies Inc

- Fluke Corporation

- Baker Hughes Company

- ViZaar Industrial Imaging AG

- Gradient Lens Corporation

- Olympus Corporation

- JME Technologies Inc

- FLIR Systems

Key Developments in Borescope Industry Industry

- February 2022: Waygate Technologies launched an upgraded Everest Mentor Visual iQ (MViQ) VideoProbe with integrated AI for remote visual inspection, targeting aerospace, energy, and petrochemical industries. This development significantly improves inspection efficiency and accuracy.

- February 2021: Olympus Corporation introduced the SIF-H190 single balloon enteroscope, enhancing small intestine diagnostics and treatment capabilities. This expansion into the medical field broadens the applications of borescope technology.

Strategic Borescope Industry Market Forecast

The global borescope market is poised for substantial growth driven by technological advancements, increasing demand from diverse end-user industries, and stringent safety regulations. The integration of AI, improved imaging capabilities, and miniaturization will drive future adoption. Expansion into new applications and emerging markets will further fuel market growth, leading to a significant increase in market size and value in the coming years. The market is expected to witness a positive outlook driven by a combination of technological and industrial factors.

Borescope Industry Segmentation

-

1. Type

- 1.1. Video

- 1.2. Flexible

- 1.3. Endoscopes

- 1.4. Semi-rigid

- 1.5. Rigid

-

2. Diameter

- 2.1. 0 mm to 3 mm

- 2.2. 3 mm to 6 mm

- 2.3. 6 mm to 10 mm

- 2.4. Above 10 mm

-

3. Angle

- 3.1. 0° to 90°

- 3.2. 90° to 180°

- 3.3. 180° to 360°

-

4. End-user Industry

- 4.1. Automotive

- 4.2. Aviation

- 4.3. Power Generation

- 4.4. Oil and Gas

- 4.5. Manufacturing

- 4.6. Chemicals

- 4.7. Food and Beverages

- 4.8. Pharmaceuticals

- 4.9. Mining and Construction

- 4.10. Other End-user Industries

Borescope Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Borescope Industry Regional Market Share

Geographic Coverage of Borescope Industry

Borescope Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Requirement for High Operational Productivity

- 3.3. Market Restrains

- 3.3.1. Lack of Good Lighting Conditions

- 3.4. Market Trends

- 3.4.1. Automotive Industry to Exhibit High Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Borescope Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Video

- 5.1.2. Flexible

- 5.1.3. Endoscopes

- 5.1.4. Semi-rigid

- 5.1.5. Rigid

- 5.2. Market Analysis, Insights and Forecast - by Diameter

- 5.2.1. 0 mm to 3 mm

- 5.2.2. 3 mm to 6 mm

- 5.2.3. 6 mm to 10 mm

- 5.2.4. Above 10 mm

- 5.3. Market Analysis, Insights and Forecast - by Angle

- 5.3.1. 0° to 90°

- 5.3.2. 90° to 180°

- 5.3.3. 180° to 360°

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. Automotive

- 5.4.2. Aviation

- 5.4.3. Power Generation

- 5.4.4. Oil and Gas

- 5.4.5. Manufacturing

- 5.4.6. Chemicals

- 5.4.7. Food and Beverages

- 5.4.8. Pharmaceuticals

- 5.4.9. Mining and Construction

- 5.4.10. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Borescope Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Video

- 6.1.2. Flexible

- 6.1.3. Endoscopes

- 6.1.4. Semi-rigid

- 6.1.5. Rigid

- 6.2. Market Analysis, Insights and Forecast - by Diameter

- 6.2.1. 0 mm to 3 mm

- 6.2.2. 3 mm to 6 mm

- 6.2.3. 6 mm to 10 mm

- 6.2.4. Above 10 mm

- 6.3. Market Analysis, Insights and Forecast - by Angle

- 6.3.1. 0° to 90°

- 6.3.2. 90° to 180°

- 6.3.3. 180° to 360°

- 6.4. Market Analysis, Insights and Forecast - by End-user Industry

- 6.4.1. Automotive

- 6.4.2. Aviation

- 6.4.3. Power Generation

- 6.4.4. Oil and Gas

- 6.4.5. Manufacturing

- 6.4.6. Chemicals

- 6.4.7. Food and Beverages

- 6.4.8. Pharmaceuticals

- 6.4.9. Mining and Construction

- 6.4.10. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Borescope Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Video

- 7.1.2. Flexible

- 7.1.3. Endoscopes

- 7.1.4. Semi-rigid

- 7.1.5. Rigid

- 7.2. Market Analysis, Insights and Forecast - by Diameter

- 7.2.1. 0 mm to 3 mm

- 7.2.2. 3 mm to 6 mm

- 7.2.3. 6 mm to 10 mm

- 7.2.4. Above 10 mm

- 7.3. Market Analysis, Insights and Forecast - by Angle

- 7.3.1. 0° to 90°

- 7.3.2. 90° to 180°

- 7.3.3. 180° to 360°

- 7.4. Market Analysis, Insights and Forecast - by End-user Industry

- 7.4.1. Automotive

- 7.4.2. Aviation

- 7.4.3. Power Generation

- 7.4.4. Oil and Gas

- 7.4.5. Manufacturing

- 7.4.6. Chemicals

- 7.4.7. Food and Beverages

- 7.4.8. Pharmaceuticals

- 7.4.9. Mining and Construction

- 7.4.10. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Borescope Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Video

- 8.1.2. Flexible

- 8.1.3. Endoscopes

- 8.1.4. Semi-rigid

- 8.1.5. Rigid

- 8.2. Market Analysis, Insights and Forecast - by Diameter

- 8.2.1. 0 mm to 3 mm

- 8.2.2. 3 mm to 6 mm

- 8.2.3. 6 mm to 10 mm

- 8.2.4. Above 10 mm

- 8.3. Market Analysis, Insights and Forecast - by Angle

- 8.3.1. 0° to 90°

- 8.3.2. 90° to 180°

- 8.3.3. 180° to 360°

- 8.4. Market Analysis, Insights and Forecast - by End-user Industry

- 8.4.1. Automotive

- 8.4.2. Aviation

- 8.4.3. Power Generation

- 8.4.4. Oil and Gas

- 8.4.5. Manufacturing

- 8.4.6. Chemicals

- 8.4.7. Food and Beverages

- 8.4.8. Pharmaceuticals

- 8.4.9. Mining and Construction

- 8.4.10. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Borescope Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Video

- 9.1.2. Flexible

- 9.1.3. Endoscopes

- 9.1.4. Semi-rigid

- 9.1.5. Rigid

- 9.2. Market Analysis, Insights and Forecast - by Diameter

- 9.2.1. 0 mm to 3 mm

- 9.2.2. 3 mm to 6 mm

- 9.2.3. 6 mm to 10 mm

- 9.2.4. Above 10 mm

- 9.3. Market Analysis, Insights and Forecast - by Angle

- 9.3.1. 0° to 90°

- 9.3.2. 90° to 180°

- 9.3.3. 180° to 360°

- 9.4. Market Analysis, Insights and Forecast - by End-user Industry

- 9.4.1. Automotive

- 9.4.2. Aviation

- 9.4.3. Power Generation

- 9.4.4. Oil and Gas

- 9.4.5. Manufacturing

- 9.4.6. Chemicals

- 9.4.7. Food and Beverages

- 9.4.8. Pharmaceuticals

- 9.4.9. Mining and Construction

- 9.4.10. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 AB SKF

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 ACL Stanlay

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Advanced Inspection Technologies Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Fluke Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Baker Hughes Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 ViZaar Industrial Imaging AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Gradient Lens Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Olympus Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 JME Technologies Inc *List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 FLIR Systems

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 AB SKF

List of Figures

- Figure 1: Global Borescope Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Borescope Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Borescope Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Borescope Industry Revenue (billion), by Diameter 2025 & 2033

- Figure 5: North America Borescope Industry Revenue Share (%), by Diameter 2025 & 2033

- Figure 6: North America Borescope Industry Revenue (billion), by Angle 2025 & 2033

- Figure 7: North America Borescope Industry Revenue Share (%), by Angle 2025 & 2033

- Figure 8: North America Borescope Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 9: North America Borescope Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: North America Borescope Industry Revenue (billion), by Country 2025 & 2033

- Figure 11: North America Borescope Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Borescope Industry Revenue (billion), by Type 2025 & 2033

- Figure 13: Europe Borescope Industry Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Borescope Industry Revenue (billion), by Diameter 2025 & 2033

- Figure 15: Europe Borescope Industry Revenue Share (%), by Diameter 2025 & 2033

- Figure 16: Europe Borescope Industry Revenue (billion), by Angle 2025 & 2033

- Figure 17: Europe Borescope Industry Revenue Share (%), by Angle 2025 & 2033

- Figure 18: Europe Borescope Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 19: Europe Borescope Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: Europe Borescope Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Europe Borescope Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Borescope Industry Revenue (billion), by Type 2025 & 2033

- Figure 23: Asia Pacific Borescope Industry Revenue Share (%), by Type 2025 & 2033

- Figure 24: Asia Pacific Borescope Industry Revenue (billion), by Diameter 2025 & 2033

- Figure 25: Asia Pacific Borescope Industry Revenue Share (%), by Diameter 2025 & 2033

- Figure 26: Asia Pacific Borescope Industry Revenue (billion), by Angle 2025 & 2033

- Figure 27: Asia Pacific Borescope Industry Revenue Share (%), by Angle 2025 & 2033

- Figure 28: Asia Pacific Borescope Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Asia Pacific Borescope Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Asia Pacific Borescope Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Borescope Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of the World Borescope Industry Revenue (billion), by Type 2025 & 2033

- Figure 33: Rest of the World Borescope Industry Revenue Share (%), by Type 2025 & 2033

- Figure 34: Rest of the World Borescope Industry Revenue (billion), by Diameter 2025 & 2033

- Figure 35: Rest of the World Borescope Industry Revenue Share (%), by Diameter 2025 & 2033

- Figure 36: Rest of the World Borescope Industry Revenue (billion), by Angle 2025 & 2033

- Figure 37: Rest of the World Borescope Industry Revenue Share (%), by Angle 2025 & 2033

- Figure 38: Rest of the World Borescope Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 39: Rest of the World Borescope Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Rest of the World Borescope Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Rest of the World Borescope Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Borescope Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Borescope Industry Revenue billion Forecast, by Diameter 2020 & 2033

- Table 3: Global Borescope Industry Revenue billion Forecast, by Angle 2020 & 2033

- Table 4: Global Borescope Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Borescope Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Borescope Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Global Borescope Industry Revenue billion Forecast, by Diameter 2020 & 2033

- Table 8: Global Borescope Industry Revenue billion Forecast, by Angle 2020 & 2033

- Table 9: Global Borescope Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Borescope Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Borescope Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Global Borescope Industry Revenue billion Forecast, by Diameter 2020 & 2033

- Table 13: Global Borescope Industry Revenue billion Forecast, by Angle 2020 & 2033

- Table 14: Global Borescope Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Borescope Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Borescope Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Borescope Industry Revenue billion Forecast, by Diameter 2020 & 2033

- Table 18: Global Borescope Industry Revenue billion Forecast, by Angle 2020 & 2033

- Table 19: Global Borescope Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Borescope Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Borescope Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Global Borescope Industry Revenue billion Forecast, by Diameter 2020 & 2033

- Table 23: Global Borescope Industry Revenue billion Forecast, by Angle 2020 & 2033

- Table 24: Global Borescope Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 25: Global Borescope Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Borescope Industry?

The projected CAGR is approximately 5.53%.

2. Which companies are prominent players in the Borescope Industry?

Key companies in the market include AB SKF, ACL Stanlay, Advanced Inspection Technologies Inc, Fluke Corporation, Baker Hughes Company, ViZaar Industrial Imaging AG, Gradient Lens Corporation, Olympus Corporation, JME Technologies Inc *List Not Exhaustive, FLIR Systems.

3. What are the main segments of the Borescope Industry?

The market segments include Type, Diameter, Angle, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.85 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Requirement for High Operational Productivity.

6. What are the notable trends driving market growth?

Automotive Industry to Exhibit High Growth.

7. Are there any restraints impacting market growth?

Lack of Good Lighting Conditions.

8. Can you provide examples of recent developments in the market?

February 2022: Waygate Technologies announced the upgrade of its high-end Everest Mentor Visual iQ (MViQ) VideoProbe for remote visual inspection. The software upgrade enables Waygate Technologies to provide the most advanced video borescopes with built-in artificial intelligence (AI) to aerospace, energy, and petrochemical industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Borescope Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Borescope Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Borescope Industry?

To stay informed about further developments, trends, and reports in the Borescope Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence