Key Insights

The global Battery Testing and Inspection Equipment Market is projected to reach $634.31 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 5.4% from 2025 to 2033. This expansion is driven by the accelerating adoption of electric vehicles (EVs), demanding rigorous testing of battery cells, modules, and packs. The burgeoning consumer electronics sector and the critical need for reliable energy storage in utilities also contribute significantly. Increasing battery system complexity and evolving safety regulations necessitate advanced testing solutions, compelling manufacturers to invest in high-performance equipment.

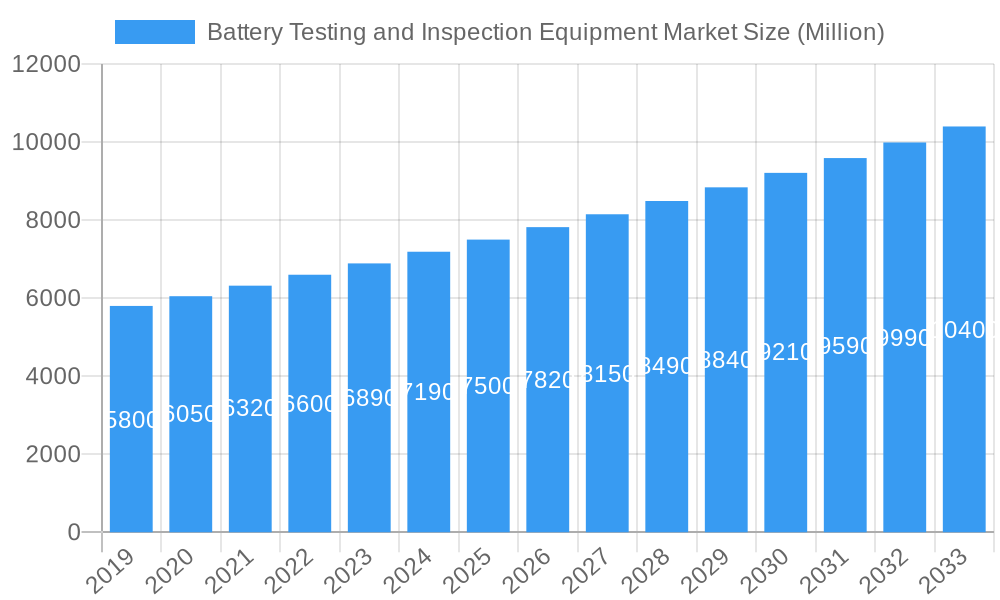

Battery Testing and Inspection Equipment Market Market Size (In Million)

The market encompasses portable and stationary testing equipment, serving battery cell, module, and pack testing throughout the lifecycle. Key end-user industries include automotive, consumer electronics, energy & utilities, and telecommunications, with emerging applications in healthcare and aerospace. While high equipment costs and technical expertise requirements pose challenges, continuous technological advancements and a focus on battery safety and longevity are expected to propel market growth.

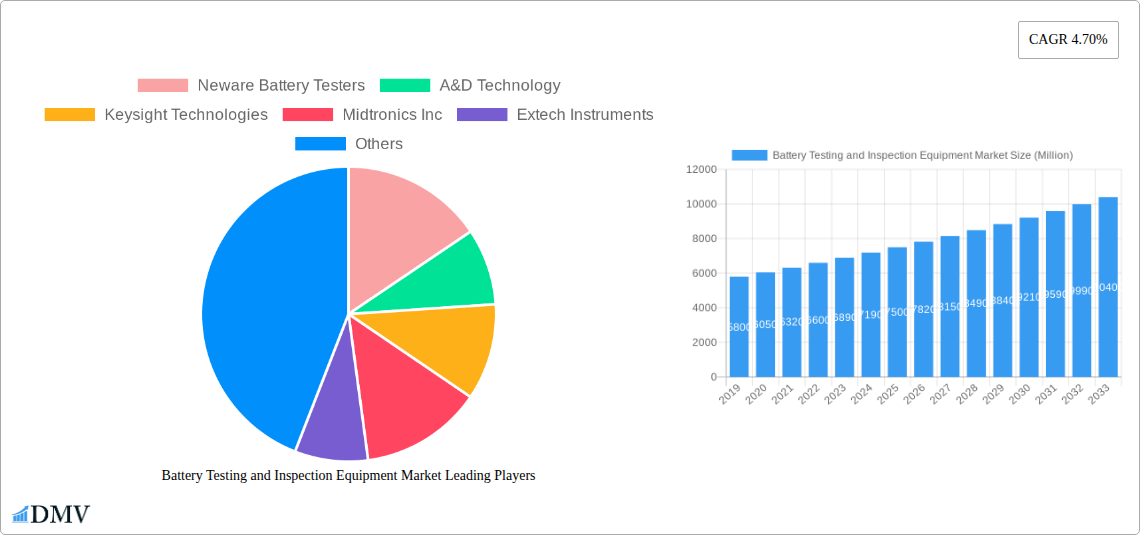

Battery Testing and Inspection Equipment Market Company Market Share

This comprehensive report analyzes the global Battery Testing and Inspection Equipment Market, offering insights into market dynamics, industry trends, regional performance, product innovations, growth drivers, challenges, and future opportunities. Covering the historical period (2019-2024), base year (2025), and forecast period (to 2033), the study leverages high-ranking keywords such as "battery test equipment," "battery inspection systems," "lithium-ion battery testing," "automotive battery testing," and "energy storage testing" to enhance search visibility for industry professionals, investors, and researchers.

Battery Testing and Inspection Equipment Market Market Composition & Trends

The Battery Testing and Inspection Equipment Market is characterized by a moderate level of concentration, with key players like Neware Battery Testers, A&D Technology, Keysight Technologies, Midtronics Inc, Extech Instruments, Arbin Instruments, MTI Corporation, Chroma Systems Solutions Inc, Kikusui Electronics Corp, Heinzinger Electronic GmbH, Megger, and Hioko USA holding significant market share. Innovation is a primary catalyst, driven by the escalating demand for advanced battery technologies and stringent safety regulations. The regulatory landscape, particularly concerning battery safety and performance standards, plays a crucial role in shaping market trends, pushing manufacturers towards sophisticated testing and inspection solutions. Substitute products, while present in the form of simpler diagnostic tools, often fall short of the comprehensive capabilities offered by specialized battery testing equipment. End-user profiles are diverse, encompassing automotive manufacturers investing heavily in electric vehicle battery development, consumer electronics giants, and the rapidly expanding energy and utility sector focused on grid-scale battery storage. Mergers and acquisitions (M&A) activities, while not extensively documented with specific deal values in the public domain, are anticipated to increase as companies seek to expand their product portfolios and market reach. Market share distribution is closely tied to technological expertise and the ability to cater to evolving end-user needs, with estimates suggesting the top 5 players collectively command over 60% of the market.

Battery Testing and Inspection Equipment Market Industry Evolution

The global Battery Testing and Inspection Equipment Market has witnessed a significant evolutionary trajectory, marked by consistent growth and technological advancements, particularly during the study period of 2019–2033. The foundation of this evolution lies in the burgeoning demand for reliable and safe energy storage solutions across multiple industries, propelling the need for sophisticated testing and inspection equipment. The historical period (2019–2024) saw a steady increase in adoption, driven by the growing awareness of battery performance, longevity, and safety concerns. As of the base year 2025, the market is projected to reach a valuation of approximately $3,500 Million, reflecting a robust compound annual growth rate (CAGR) from its historical figures. This growth is intrinsically linked to the exponential rise in electric vehicle (EV) adoption, where battery performance and safety are paramount. Furthermore, the expansion of renewable energy sources like solar and wind power necessitates efficient grid-scale battery storage, further fueling the demand for high-capacity and reliable battery testing systems. Technological advancements have been a cornerstone of this industry's evolution. Early iterations of battery testing equipment focused on basic charge/discharge cycles and voltage/current measurements. However, the market has since evolved to incorporate advanced techniques such as impedance spectroscopy, thermal imaging, accelerated life testing, and comprehensive safety testing protocols. This sophistication is crucial for identifying subtle defects, predicting battery lifespan, and ensuring compliance with increasingly stringent international safety standards. Shifting consumer demands also play a pivotal role. Consumers are increasingly expecting longer battery life, faster charging capabilities, and enhanced safety in their portable electronic devices and EVs. This pressure on manufacturers trickles down to the testing equipment sector, demanding more precise, efficient, and automated testing solutions that can deliver data crucial for product improvement and innovation. The estimated market size for 2025 stands at approximately $3,500 Million, with projections indicating a sustained CAGR of over 7% through the forecast period of 2025–2033. This consistent growth underscores the indispensable nature of battery testing and inspection equipment in the modern technological landscape.

Leading Regions, Countries, or Segments in Battery Testing and Inspection Equipment Market

The Automotive end-user industry stands out as the dominant force within the Battery Testing and Inspection Equipment Market, driven by the unprecedented global push towards electrification. This dominance is further amplified by the burgeoning demand for Battery Pack Testing Equipment, crucial for ensuring the safety, performance, and longevity of EV batteries. The forecast period of 2025–2033 is expected to see this segment continue its ascendance, with projections indicating its share of the market to exceed 40%.

Dominant End-User Industry: Automotive

- Key Drivers:

- Electric Vehicle (EV) Revolution: The global transition to EVs necessitates rigorous testing of battery packs to meet performance, safety, and lifespan expectations. Governments worldwide are implementing supportive policies and incentives for EV adoption, further accelerating this trend.

- Battery Safety Regulations: Increasingly stringent safety standards for automotive batteries are compelling manufacturers to invest in advanced testing equipment to ensure compliance and prevent potential hazards.

- Battery Management System (BMS) Development: Sophisticated BMS require extensive testing to optimize battery performance and prevent overcharging, overheating, and deep discharge.

- Long-Term Battery Health Monitoring: The need to ensure the reliability of EV batteries over their lifespan drives demand for equipment capable of performing long-term health diagnostics and predictive maintenance.

- Key Drivers:

Dominant Application Type: Battery Pack Testing Equipment

- Key Drivers:

- Scale and Complexity of EV Battery Packs: Modern EV battery packs are complex assemblies, requiring specialized equipment for comprehensive testing of individual cells, modules, and the entire pack.

- Safety Criticality: The sheer power and potential hazards associated with EV battery packs make thorough pack-level testing a non-negotiable aspect of production.

- Performance Optimization: Testing at the pack level allows for the optimization of power output, energy density, and charging efficiency for vehicles.

- Quality Assurance: Robust pack testing ensures that batteries meet OEM specifications and consumer expectations for performance and durability.

- Key Drivers:

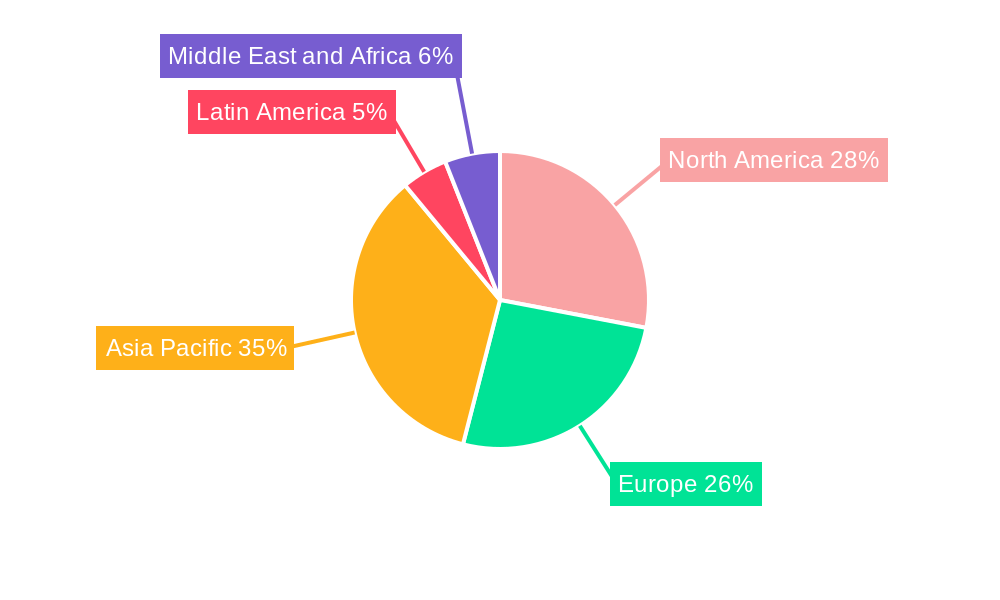

Regional Dominance: While North America and Europe are significant contributors due to their advanced automotive industries and strong regulatory frameworks, Asia Pacific is emerging as the largest and fastest-growing regional market for battery testing and inspection equipment.

- Key Drivers in Asia Pacific:

- Manufacturing Hub: Asia Pacific, particularly China, is the global manufacturing hub for batteries, EVs, and consumer electronics, creating substantial demand for testing solutions across the entire production chain.

- Government Initiatives: Numerous governments in the region are actively promoting battery technology development and EV adoption through favorable policies and investments.

- Growing EV Market: The rapid expansion of the EV market in countries like China, Japan, and South Korea directly translates to increased demand for automotive battery testing equipment.

- Energy Storage Deployment: Investments in grid-scale energy storage solutions in the region are also contributing to the demand for sophisticated battery testing systems.

Within the Product Type segment, while Stationary equipment is crucial for R&D and large-scale manufacturing, the demand for Portable testing equipment is also on the rise, driven by field service, maintenance, and quality control applications across various industries. The Consumer Electronics segment, though a significant user, is experiencing slower growth compared to the automotive sector due to market saturation and evolving device lifecycles. The Energy and Utility sector, however, presents substantial future growth potential, fueled by the global transition towards renewable energy and the need for reliable grid-scale energy storage.

Battery Testing and Inspection Equipment Market Product Innovations

Product innovations in the Battery Testing and Inspection Equipment Market are largely focused on enhancing accuracy, speed, and automation. Advanced battery testers now incorporate AI-driven algorithms for predictive analytics, enabling early detection of potential failures and optimizing battery lifespan. High-resolution impedance spectroscopy and sophisticated thermal imaging are becoming standard features, providing deeper insights into internal battery health. Furthermore, the development of integrated solutions that combine multiple testing functions into a single, user-friendly platform is a key trend, streamlining workflows for manufacturers and researchers. For instance, the recent launch of three battery quality testers by Hioki exemplifies this innovation, specifically designed to detect latent defects on production lines, directly addressing the critical need for enhanced safety in lithium-ion batteries.

Propelling Factors for Battery Testing and Inspection Equipment Market Growth

The Battery Testing and Inspection Equipment Market is propelled by several key factors. The relentless growth of the electric vehicle (EV) market is a primary driver, demanding high-performance and safe battery solutions. Furthermore, the expanding adoption of renewable energy sources necessitates robust battery storage systems, creating a significant demand for specialized testing equipment. Stricter government regulations regarding battery safety and performance also compel manufacturers to invest in advanced testing capabilities to ensure compliance. Technological advancements, leading to more sophisticated and accurate testing methodologies, are crucial for identifying and mitigating battery defects, thereby fostering market growth. Finally, the increasing focus on battery recycling and second-life applications also creates a demand for equipment capable of assessing battery health and degradation.

Obstacles in the Battery Testing and Inspection Equipment Market Market

Despite its robust growth, the Battery Testing and Inspection Equipment Market faces several obstacles. The high initial cost of advanced testing equipment can be a significant barrier for smaller manufacturers and research institutions. Rapid technological evolution can lead to faster obsolescence of existing equipment, requiring continuous investment in upgrades. Supply chain disruptions, particularly for specialized components, can impact production timelines and lead to increased costs. Furthermore, the complexity of battery chemistries and architectures requires constant adaptation of testing methodologies, posing a challenge for equipment manufacturers. Intense competition among players can also lead to price pressures, impacting profit margins.

Future Opportunities in Battery Testing and Inspection Equipment Market

Emerging opportunities in the Battery Testing and Inspection Equipment Market are abundant. The growing demand for battery testing solutions in emerging markets, coupled with the development of new battery technologies such as solid-state batteries, presents significant growth avenues. The increasing focus on battery recycling and repurposing creates a niche market for specialized testing equipment to assess the health of used batteries. The integration of advanced data analytics and artificial intelligence into testing platforms offers opportunities for predictive maintenance and enhanced battery management. Furthermore, the expansion of battery applications into sectors like aerospace, defense, and medical devices will create new demand for tailored testing solutions.

Major Players in the Battery Testing and Inspection Equipment Market Ecosystem

- Neware Battery Testers

- A&D Technology

- Keysight Technologies

- Midtronics Inc

- Extech Instruments

- Arbin Instruments

- MTI Corporation

- Chroma Systems Solutions Inc

- Kikusui Electronics Corp

- Heinzinger Electronic GmbH

- Megger

- Hioko USA

Key Developments in Battery Testing and Inspection Equipment Market Industry

- February 2022 - Hioki testing solutions contribute to battery production, development, and maintenance. Hioki announced launching three battery quality testers in the drive to eliminate battery fires. These three new measuring instruments can detect latent defects in quality inspections on battery production lines. The company aims to increase the safety of lithium-ion batteries, for which demand is growing globally.

- January 2022 - Arbin Instruments announced expanding into the future with the battery industry. Broader accessibility of battery research will significantly support sustainability efforts and other battery applications with a society-wide reach. The company provides a turn-key test solution that can get expanded with additional auxiliary capabilities. Arbin's MITS Pro software also provides a universal software interface for all the battery testing applications so clients can transition effortlessly from lab-scale research and development to commercial scale and production testing.

Strategic Battery Testing and Inspection Equipment Market Market Forecast

The strategic forecast for the Battery Testing and Inspection Equipment Market is overwhelmingly positive, driven by a confluence of powerful growth catalysts. The relentless electrification of transportation continues to be a dominant force, ensuring sustained demand for advanced automotive battery testing solutions. The parallel expansion of renewable energy infrastructure and the associated need for grid-scale energy storage further solidify this positive outlook. Government mandates for battery safety and performance will continue to act as a significant impetus for investment in sophisticated testing and inspection equipment. Emerging technologies, such as solid-state batteries and novel battery chemistries, will unlock new frontiers for innovation and market expansion. The increasing emphasis on battery lifecycle management, including recycling and second-life applications, presents a substantial and growing opportunity. Collectively, these factors paint a picture of a robust and expanding market, with significant potential for technological advancement and increased adoption across diverse industries.

Battery Testing and Inspection Equipment Market Segmentation

-

1. Product Type

- 1.1. Portable

- 1.2. Stationary

-

2. Application Type

- 2.1. Battery Cell Testing Equipment

- 2.2. Battery Module Testing Equipment

- 2.3. Battery Pack Testing Equipment

-

3. End-user Industry

- 3.1. Automotive

- 3.2. Consumer Electronics

- 3.3. Energy and Utility

- 3.4. Telecom and Data Communication

- 3.5. Healthcare

- 3.6. Aerospace and defense

- 3.7. Oil and Gas

- 3.8. Others (

Battery Testing and Inspection Equipment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Battery Testing and Inspection Equipment Market Regional Market Share

Geographic Coverage of Battery Testing and Inspection Equipment Market

Battery Testing and Inspection Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Regulations Related to Safety; Increasing Adoption of Battery Testing Equipment for Evs

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled and Trained Personnel

- 3.4. Market Trends

- 3.4.1. Automotive Industry to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Battery Testing and Inspection Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Portable

- 5.1.2. Stationary

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Battery Cell Testing Equipment

- 5.2.2. Battery Module Testing Equipment

- 5.2.3. Battery Pack Testing Equipment

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive

- 5.3.2. Consumer Electronics

- 5.3.3. Energy and Utility

- 5.3.4. Telecom and Data Communication

- 5.3.5. Healthcare

- 5.3.6. Aerospace and defense

- 5.3.7. Oil and Gas

- 5.3.8. Others (

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Battery Testing and Inspection Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Portable

- 6.1.2. Stationary

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Battery Cell Testing Equipment

- 6.2.2. Battery Module Testing Equipment

- 6.2.3. Battery Pack Testing Equipment

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Automotive

- 6.3.2. Consumer Electronics

- 6.3.3. Energy and Utility

- 6.3.4. Telecom and Data Communication

- 6.3.5. Healthcare

- 6.3.6. Aerospace and defense

- 6.3.7. Oil and Gas

- 6.3.8. Others (

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Battery Testing and Inspection Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Portable

- 7.1.2. Stationary

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Battery Cell Testing Equipment

- 7.2.2. Battery Module Testing Equipment

- 7.2.3. Battery Pack Testing Equipment

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Automotive

- 7.3.2. Consumer Electronics

- 7.3.3. Energy and Utility

- 7.3.4. Telecom and Data Communication

- 7.3.5. Healthcare

- 7.3.6. Aerospace and defense

- 7.3.7. Oil and Gas

- 7.3.8. Others (

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Battery Testing and Inspection Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Portable

- 8.1.2. Stationary

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Battery Cell Testing Equipment

- 8.2.2. Battery Module Testing Equipment

- 8.2.3. Battery Pack Testing Equipment

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Automotive

- 8.3.2. Consumer Electronics

- 8.3.3. Energy and Utility

- 8.3.4. Telecom and Data Communication

- 8.3.5. Healthcare

- 8.3.6. Aerospace and defense

- 8.3.7. Oil and Gas

- 8.3.8. Others (

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Latin America Battery Testing and Inspection Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Portable

- 9.1.2. Stationary

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Battery Cell Testing Equipment

- 9.2.2. Battery Module Testing Equipment

- 9.2.3. Battery Pack Testing Equipment

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Automotive

- 9.3.2. Consumer Electronics

- 9.3.3. Energy and Utility

- 9.3.4. Telecom and Data Communication

- 9.3.5. Healthcare

- 9.3.6. Aerospace and defense

- 9.3.7. Oil and Gas

- 9.3.8. Others (

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Battery Testing and Inspection Equipment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Portable

- 10.1.2. Stationary

- 10.2. Market Analysis, Insights and Forecast - by Application Type

- 10.2.1. Battery Cell Testing Equipment

- 10.2.2. Battery Module Testing Equipment

- 10.2.3. Battery Pack Testing Equipment

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Automotive

- 10.3.2. Consumer Electronics

- 10.3.3. Energy and Utility

- 10.3.4. Telecom and Data Communication

- 10.3.5. Healthcare

- 10.3.6. Aerospace and defense

- 10.3.7. Oil and Gas

- 10.3.8. Others (

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Neware Battery Testers

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 A&D Technology

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Keysight Technologies

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Midtronics Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Extech Instruments

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Arbin Instruments

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MTI Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Chroma Systems Solutions Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kikusui Electronics Corp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Heinzinger Electronic GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Megger

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Hioko USA

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Neware Battery Testers

List of Figures

- Figure 1: Global Battery Testing and Inspection Equipment Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Global Battery Testing and Inspection Equipment Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Battery Testing and Inspection Equipment Market Revenue (million), by Product Type 2025 & 2033

- Figure 4: North America Battery Testing and Inspection Equipment Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 5: North America Battery Testing and Inspection Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Battery Testing and Inspection Equipment Market Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Battery Testing and Inspection Equipment Market Revenue (million), by Application Type 2025 & 2033

- Figure 8: North America Battery Testing and Inspection Equipment Market Volume (K Unit), by Application Type 2025 & 2033

- Figure 9: North America Battery Testing and Inspection Equipment Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 10: North America Battery Testing and Inspection Equipment Market Volume Share (%), by Application Type 2025 & 2033

- Figure 11: North America Battery Testing and Inspection Equipment Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 12: North America Battery Testing and Inspection Equipment Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 13: North America Battery Testing and Inspection Equipment Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: North America Battery Testing and Inspection Equipment Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 15: North America Battery Testing and Inspection Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 16: North America Battery Testing and Inspection Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Battery Testing and Inspection Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Battery Testing and Inspection Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Battery Testing and Inspection Equipment Market Revenue (million), by Product Type 2025 & 2033

- Figure 20: Europe Battery Testing and Inspection Equipment Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 21: Europe Battery Testing and Inspection Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Europe Battery Testing and Inspection Equipment Market Volume Share (%), by Product Type 2025 & 2033

- Figure 23: Europe Battery Testing and Inspection Equipment Market Revenue (million), by Application Type 2025 & 2033

- Figure 24: Europe Battery Testing and Inspection Equipment Market Volume (K Unit), by Application Type 2025 & 2033

- Figure 25: Europe Battery Testing and Inspection Equipment Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 26: Europe Battery Testing and Inspection Equipment Market Volume Share (%), by Application Type 2025 & 2033

- Figure 27: Europe Battery Testing and Inspection Equipment Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 28: Europe Battery Testing and Inspection Equipment Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 29: Europe Battery Testing and Inspection Equipment Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Europe Battery Testing and Inspection Equipment Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 31: Europe Battery Testing and Inspection Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 32: Europe Battery Testing and Inspection Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Battery Testing and Inspection Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Battery Testing and Inspection Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Battery Testing and Inspection Equipment Market Revenue (million), by Product Type 2025 & 2033

- Figure 36: Asia Pacific Battery Testing and Inspection Equipment Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 37: Asia Pacific Battery Testing and Inspection Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Asia Pacific Battery Testing and Inspection Equipment Market Volume Share (%), by Product Type 2025 & 2033

- Figure 39: Asia Pacific Battery Testing and Inspection Equipment Market Revenue (million), by Application Type 2025 & 2033

- Figure 40: Asia Pacific Battery Testing and Inspection Equipment Market Volume (K Unit), by Application Type 2025 & 2033

- Figure 41: Asia Pacific Battery Testing and Inspection Equipment Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 42: Asia Pacific Battery Testing and Inspection Equipment Market Volume Share (%), by Application Type 2025 & 2033

- Figure 43: Asia Pacific Battery Testing and Inspection Equipment Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 44: Asia Pacific Battery Testing and Inspection Equipment Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 45: Asia Pacific Battery Testing and Inspection Equipment Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Asia Pacific Battery Testing and Inspection Equipment Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Asia Pacific Battery Testing and Inspection Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 48: Asia Pacific Battery Testing and Inspection Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Battery Testing and Inspection Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Battery Testing and Inspection Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Battery Testing and Inspection Equipment Market Revenue (million), by Product Type 2025 & 2033

- Figure 52: Latin America Battery Testing and Inspection Equipment Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 53: Latin America Battery Testing and Inspection Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Latin America Battery Testing and Inspection Equipment Market Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Latin America Battery Testing and Inspection Equipment Market Revenue (million), by Application Type 2025 & 2033

- Figure 56: Latin America Battery Testing and Inspection Equipment Market Volume (K Unit), by Application Type 2025 & 2033

- Figure 57: Latin America Battery Testing and Inspection Equipment Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 58: Latin America Battery Testing and Inspection Equipment Market Volume Share (%), by Application Type 2025 & 2033

- Figure 59: Latin America Battery Testing and Inspection Equipment Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 60: Latin America Battery Testing and Inspection Equipment Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 61: Latin America Battery Testing and Inspection Equipment Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 62: Latin America Battery Testing and Inspection Equipment Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 63: Latin America Battery Testing and Inspection Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 64: Latin America Battery Testing and Inspection Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 65: Latin America Battery Testing and Inspection Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Latin America Battery Testing and Inspection Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East and Africa Battery Testing and Inspection Equipment Market Revenue (million), by Product Type 2025 & 2033

- Figure 68: Middle East and Africa Battery Testing and Inspection Equipment Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 69: Middle East and Africa Battery Testing and Inspection Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 70: Middle East and Africa Battery Testing and Inspection Equipment Market Volume Share (%), by Product Type 2025 & 2033

- Figure 71: Middle East and Africa Battery Testing and Inspection Equipment Market Revenue (million), by Application Type 2025 & 2033

- Figure 72: Middle East and Africa Battery Testing and Inspection Equipment Market Volume (K Unit), by Application Type 2025 & 2033

- Figure 73: Middle East and Africa Battery Testing and Inspection Equipment Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 74: Middle East and Africa Battery Testing and Inspection Equipment Market Volume Share (%), by Application Type 2025 & 2033

- Figure 75: Middle East and Africa Battery Testing and Inspection Equipment Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 76: Middle East and Africa Battery Testing and Inspection Equipment Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 77: Middle East and Africa Battery Testing and Inspection Equipment Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 78: Middle East and Africa Battery Testing and Inspection Equipment Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 79: Middle East and Africa Battery Testing and Inspection Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 80: Middle East and Africa Battery Testing and Inspection Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 81: Middle East and Africa Battery Testing and Inspection Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Battery Testing and Inspection Equipment Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Battery Testing and Inspection Equipment Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Global Battery Testing and Inspection Equipment Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Global Battery Testing and Inspection Equipment Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 4: Global Battery Testing and Inspection Equipment Market Volume K Unit Forecast, by Application Type 2020 & 2033

- Table 5: Global Battery Testing and Inspection Equipment Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Battery Testing and Inspection Equipment Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Battery Testing and Inspection Equipment Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: Global Battery Testing and Inspection Equipment Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Battery Testing and Inspection Equipment Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 10: Global Battery Testing and Inspection Equipment Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: Global Battery Testing and Inspection Equipment Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 12: Global Battery Testing and Inspection Equipment Market Volume K Unit Forecast, by Application Type 2020 & 2033

- Table 13: Global Battery Testing and Inspection Equipment Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Battery Testing and Inspection Equipment Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Battery Testing and Inspection Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Global Battery Testing and Inspection Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Battery Testing and Inspection Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: United States Battery Testing and Inspection Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Battery Testing and Inspection Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Canada Battery Testing and Inspection Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Global Battery Testing and Inspection Equipment Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 22: Global Battery Testing and Inspection Equipment Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 23: Global Battery Testing and Inspection Equipment Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 24: Global Battery Testing and Inspection Equipment Market Volume K Unit Forecast, by Application Type 2020 & 2033

- Table 25: Global Battery Testing and Inspection Equipment Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 26: Global Battery Testing and Inspection Equipment Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 27: Global Battery Testing and Inspection Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 28: Global Battery Testing and Inspection Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 29: United Kingdom Battery Testing and Inspection Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Battery Testing and Inspection Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Germany Battery Testing and Inspection Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Germany Battery Testing and Inspection Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: France Battery Testing and Inspection Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: France Battery Testing and Inspection Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Battery Testing and Inspection Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Battery Testing and Inspection Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Battery Testing and Inspection Equipment Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 38: Global Battery Testing and Inspection Equipment Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 39: Global Battery Testing and Inspection Equipment Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 40: Global Battery Testing and Inspection Equipment Market Volume K Unit Forecast, by Application Type 2020 & 2033

- Table 41: Global Battery Testing and Inspection Equipment Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 42: Global Battery Testing and Inspection Equipment Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 43: Global Battery Testing and Inspection Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 44: Global Battery Testing and Inspection Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 45: China Battery Testing and Inspection Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: China Battery Testing and Inspection Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Japan Battery Testing and Inspection Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: Japan Battery Testing and Inspection Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: India Battery Testing and Inspection Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: India Battery Testing and Inspection Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Rest of Asia Pacific Battery Testing and Inspection Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Battery Testing and Inspection Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Global Battery Testing and Inspection Equipment Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 54: Global Battery Testing and Inspection Equipment Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 55: Global Battery Testing and Inspection Equipment Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 56: Global Battery Testing and Inspection Equipment Market Volume K Unit Forecast, by Application Type 2020 & 2033

- Table 57: Global Battery Testing and Inspection Equipment Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 58: Global Battery Testing and Inspection Equipment Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 59: Global Battery Testing and Inspection Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 60: Global Battery Testing and Inspection Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: Global Battery Testing and Inspection Equipment Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 62: Global Battery Testing and Inspection Equipment Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 63: Global Battery Testing and Inspection Equipment Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 64: Global Battery Testing and Inspection Equipment Market Volume K Unit Forecast, by Application Type 2020 & 2033

- Table 65: Global Battery Testing and Inspection Equipment Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 66: Global Battery Testing and Inspection Equipment Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 67: Global Battery Testing and Inspection Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 68: Global Battery Testing and Inspection Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Battery Testing and Inspection Equipment Market?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the Battery Testing and Inspection Equipment Market?

Key companies in the market include Neware Battery Testers, A&D Technology, Keysight Technologies, Midtronics Inc, Extech Instruments, Arbin Instruments, MTI Corporation, Chroma Systems Solutions Inc, Kikusui Electronics Corp, Heinzinger Electronic GmbH, Megger, Hioko USA.

3. What are the main segments of the Battery Testing and Inspection Equipment Market?

The market segments include Product Type, Application Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 634.31 million as of 2022.

5. What are some drivers contributing to market growth?

Government Regulations Related to Safety; Increasing Adoption of Battery Testing Equipment for Evs.

6. What are the notable trends driving market growth?

Automotive Industry to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of Skilled and Trained Personnel.

8. Can you provide examples of recent developments in the market?

February 2022 - Hioki testing solutions contribute to battery production, development, and maintenance. Hioki announced launching three battery quality testers in the drive to eliminate battery fires. These three new measuring instruments can detect latent defects in quality inspections on battery production lines. The company aims to increase the safety of lithium-ion batteries, for which demand is growing globally.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Battery Testing and Inspection Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Battery Testing and Inspection Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Battery Testing and Inspection Equipment Market?

To stay informed about further developments, trends, and reports in the Battery Testing and Inspection Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence