Key Insights

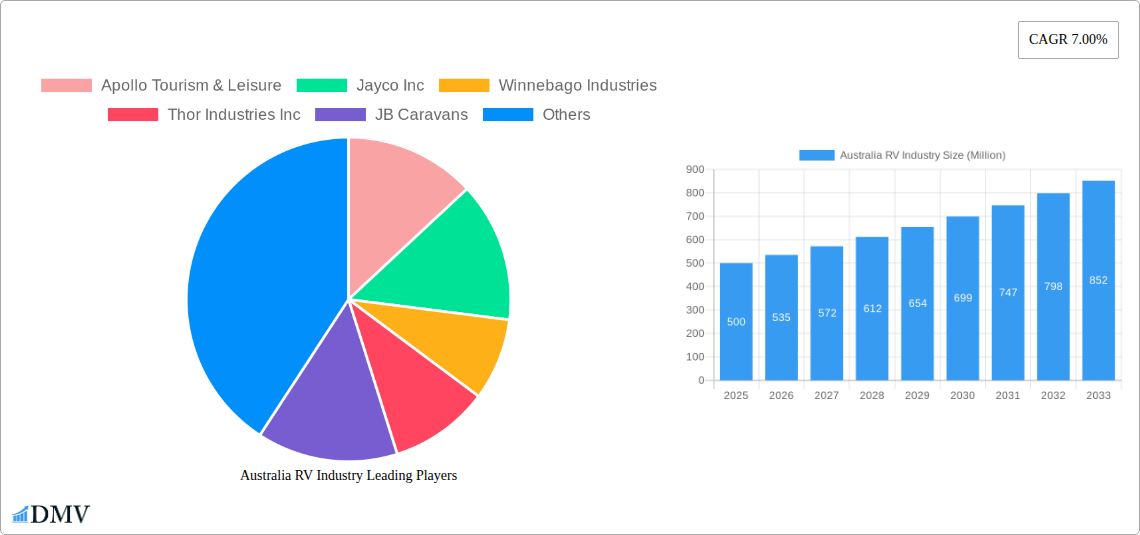

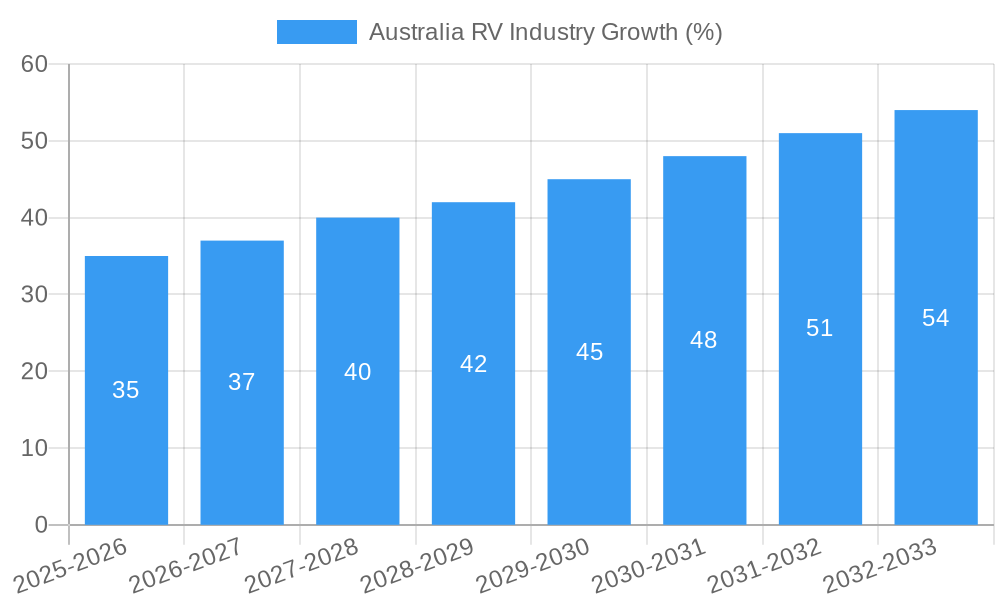

The Australian RV industry, currently valued at approximately $X million (estimated based on available data and industry trends), is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of 7% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, a growing preference for outdoor recreation and adventure tourism among Australians is boosting demand for RVs. Secondly, improved infrastructure supporting RV travel, including designated campsites and improved road networks, is enhancing the overall RV experience. Finally, an increasing disposable income among a significant segment of the Australian population is contributing to greater affordability and accessibility of RV ownership and rentals. The market is segmented by type (truck campers, motorhomes, towable RVs), application (private and commercial use), and various manufacturers cater to different segments' needs and preferences. Competitive rivalry amongst established players like Apollo Tourism & Leisure, Jayco Inc, and Winnebago Industries, alongside emerging smaller brands, keeps innovation and pricing competitive.

Despite the positive outlook, certain restraints could potentially impact the market's trajectory. These include fluctuations in fuel prices, which directly affect operational costs for RV owners. Furthermore, environmental concerns related to increased tourism and potential impacts on natural environments could lead to stricter regulations or limitations on RV usage in certain areas. Moreover, the economic climate, particularly fluctuations in the Australian dollar and interest rates, can influence consumer spending on discretionary items like RVs. However, the industry's strong fundamentals, coupled with innovative product development and strategic marketing initiatives, position the Australian RV market for continued expansion throughout the forecast period. Further analysis focusing on individual segments and regional variations within Australia could reveal more nuanced insights into the market’s future growth potential.

Australia RV Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Australian RV industry, covering market size, trends, key players, and future forecasts. The study period spans 2019-2033, with 2025 as the base and estimated year. This report is essential for stakeholders seeking to understand the dynamics of this growing market and make informed strategic decisions. The Australian RV market, valued at approximately $XX Million in 2024, is projected to reach $XX Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of XX%.

Australia RV Industry Market Composition & Trends

The Australian RV market is characterized by a moderately concentrated landscape, with key players like Apollo Tourism & Leisure, Jayco Inc, Winnebago Industries, Thor Industries Inc, JB Caravans, Avida RV, Road Star Caravans, Maverick Camper, Sunliner Recreational Vehicles, and Forest River Inc dominating market share. Market share distribution is currently estimated at approximately XX% for the top 5 players. Innovation is driven by increasing consumer demand for technologically advanced and comfortable RVs, particularly in the motorhome segment. Regulatory landscapes, including safety standards and environmental regulations, are influencing product design and manufacturing processes. Substitute products, such as hotel stays and other forms of travel accommodation, pose a competitive threat. The primary end-users are private individuals, followed by commercial operators. Recent M&A activities have been relatively limited, with the total deal value estimated at $XX Million over the past five years.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately XX% of market share.

- Innovation Catalysts: Growing demand for technologically advanced and comfortable RVs.

- Regulatory Landscape: Safety standards and environmental regulations influence product design.

- Substitute Products: Hotel stays and alternative travel options present competition.

- End-User Profiles: Primarily private individuals and commercial operators.

- M&A Activity: Relatively low, with total deal value estimated at $XX Million (2019-2024).

Australia RV Industry Industry Evolution

The Australian RV industry has witnessed significant growth over the historical period (2019-2024), fueled by increased disposable incomes, a growing interest in outdoor recreational activities, and the appeal of flexible travel options. Technological advancements, such as the integration of smart home technology and improved fuel efficiency in motorhomes, have further propelled market expansion. Consumer demands are shifting towards larger, more luxurious, and technologically advanced RVs, with a growing preference for environmentally friendly options. The market experienced a CAGR of XX% during the historical period, with particular growth in the motorhome segment. Adoption of new technologies, like improved navigation systems and solar power integration, is increasing steadily. The forecast period (2025-2033) anticipates continued growth, driven by factors like population growth and increased tourism.

Leading Regions, Countries, or Segments in Australia RV Industry

The motorhome segment within the Truck Campers category dominates the Australian RV market. The private application segment constitutes the largest share of the market. Towable RVs also hold a significant market share.

- Key Drivers for Motorhome Segment Dominance:

- High demand for flexible and comfortable travel options.

- Growing popularity of extended road trips and outdoor recreational activities.

- Technological advancements leading to improved fuel efficiency and features.

- Key Drivers for Private Application Segment Dominance:

- Increased disposable income and leisure time among Australian households.

- Growing interest in independent and personalized travel experiences.

- Key Drivers for Towable RVs:

- Affordability compared to motorhomes.

- Suitability for various types of terrains and camping sites.

- Wide range of models and sizes to cater to diverse needs.

The dominance of these segments is primarily attributed to a rising preference for recreational travel, growing affluence among Australians, and increasing technological advancements within the RV industry itself. Specific regional variations exist, with higher concentrations of RV ownership in areas with significant natural beauty and tourism attractions.

Australia RV Industry Product Innovations

Recent innovations focus on enhancing comfort, technology integration, and sustainability. Features like advanced navigation systems, solar power integration, and smart home technology are becoming increasingly common. Manufacturers are also focusing on lighter materials and improved fuel efficiency to address environmental concerns. Unique selling propositions emphasize luxury, convenience, and technological advancements to attract discerning consumers.

Propelling Factors for Australia RV Industry Growth

The growth of the Australian RV industry is fueled by several key factors: rising disposable incomes enabling more Australians to afford RVs, increased popularity of outdoor recreation and adventure tourism, and government initiatives promoting domestic tourism. Technological advancements like improved fuel efficiency and integrated smart technologies also contribute significantly. Favorable regulatory environments further support the industry's expansion.

Obstacles in the Australia RV Industry Market

The Australian RV industry faces challenges such as fluctuations in raw material prices impacting production costs, supply chain disruptions leading to delays in manufacturing and delivery, and intense competition from established players and new entrants. Stringent environmental regulations also present a hurdle, requiring manufacturers to adopt sustainable practices.

Future Opportunities in Australia RV Industry

Future opportunities lie in expanding into niche markets, such as eco-friendly RVs and luxury RV rentals, along with the development of innovative technologies to improve fuel efficiency and integrate smart features. Leveraging the growing trend of sustainable and responsible tourism also presents significant potential for expansion. Exploring new markets and partnerships could significantly enhance industry growth in the long term.

Major Players in the Australia RV Industry Ecosystem

- Apollo Tourism & Leisure

- Jayco Inc

- Winnebago Industries

- Thor Industries Inc

- JB Caravans

- Avida RV

- Road Star Caravans

- Maverick Camper

- Sunliner Recreational Vehicles

- Forest River Inc

Key Developments in Australia RV Industry Industry

Sept 2022: Jayco expands its South Dandenong manufacturing facility to meet growing demand for motorhomes and campervans, implementing upgrades for new product development. This reflects the strong growth in the market and signals an investment in future capacity.

Apr 2021: Jayco Inc. launches a new Customer Experience Software tool using Qualtric Software, improving customer feedback and data analysis across all its divisions. This indicates a focus on improving customer satisfaction and operational efficiency.

Strategic Australia RV Industry Market Forecast

The Australian RV industry is poised for sustained growth over the forecast period (2025-2033), driven by continuous innovation, increasing consumer demand, and favorable economic conditions. The focus on sustainable practices and technological advancements will further shape the market's trajectory. Expanding into new market segments and strategic partnerships will unlock significant growth opportunities. The market’s positive outlook anticipates a strong return on investment for businesses within the RV industry.

Australia RV Industry Segmentation

-

1. Type

-

1.1. Towable RVs

- 1.1.1. Travel Trailers

- 1.1.2. Fifth-wheel Trailers

- 1.1.3. Folding Camp Trailers

- 1.1.4. Truck Campers

-

1.2. Motorhomes

- 1.2.1. Type A

- 1.2.2. Type B

- 1.2.3. Type C

-

1.1. Towable RVs

-

2. Application

- 2.1. Private

- 2.2. Commercial

Australia RV Industry Segmentation By Geography

- 1. Australia

Australia RV Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Tourism Activity Drive Demand in the Market

- 3.3. Market Restrains

- 3.3.1. Lack of Government Framework for the Usage of RVs

- 3.4. Market Trends

- 3.4.1. The Increase in Self-Contained RVs Creates a Tourism Opportunity for Small Towns

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia RV Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Towable RVs

- 5.1.1.1. Travel Trailers

- 5.1.1.2. Fifth-wheel Trailers

- 5.1.1.3. Folding Camp Trailers

- 5.1.1.4. Truck Campers

- 5.1.2. Motorhomes

- 5.1.2.1. Type A

- 5.1.2.2. Type B

- 5.1.2.3. Type C

- 5.1.1. Towable RVs

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Private

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Apollo Tourism & Leisure

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jayco Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Winnebago Industries

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Thor Industries Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 JB Caravans

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Avida RV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Road Star Caravans

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Maverick Camper

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sunliner Recreational Vehicles

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Forest River Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Apollo Tourism & Leisure

List of Figures

- Figure 1: Australia RV Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia RV Industry Share (%) by Company 2024

List of Tables

- Table 1: Australia RV Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia RV Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Australia RV Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Australia RV Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Australia RV Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Australia RV Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Australia RV Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Australia RV Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia RV Industry?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Australia RV Industry?

Key companies in the market include Apollo Tourism & Leisure, Jayco Inc, Winnebago Industries, Thor Industries Inc, JB Caravans, Avida RV, Road Star Caravans, Maverick Camper, Sunliner Recreational Vehicles, Forest River Inc.

3. What are the main segments of the Australia RV Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Tourism Activity Drive Demand in the Market.

6. What are the notable trends driving market growth?

The Increase in Self-Contained RVs Creates a Tourism Opportunity for Small Towns.

7. Are there any restraints impacting market growth?

Lack of Government Framework for the Usage of RVs.

8. Can you provide examples of recent developments in the market?

Sept 2022: Jayco, a leading caravan manufacturer, expanded its South Dandenong manufacturing facility in response to recent growth in the motorhome and campervan market in Australia, as well as implementing a number of upgrades to support new product development.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia RV Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia RV Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia RV Industry?

To stay informed about further developments, trends, and reports in the Australia RV Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence