Key Insights

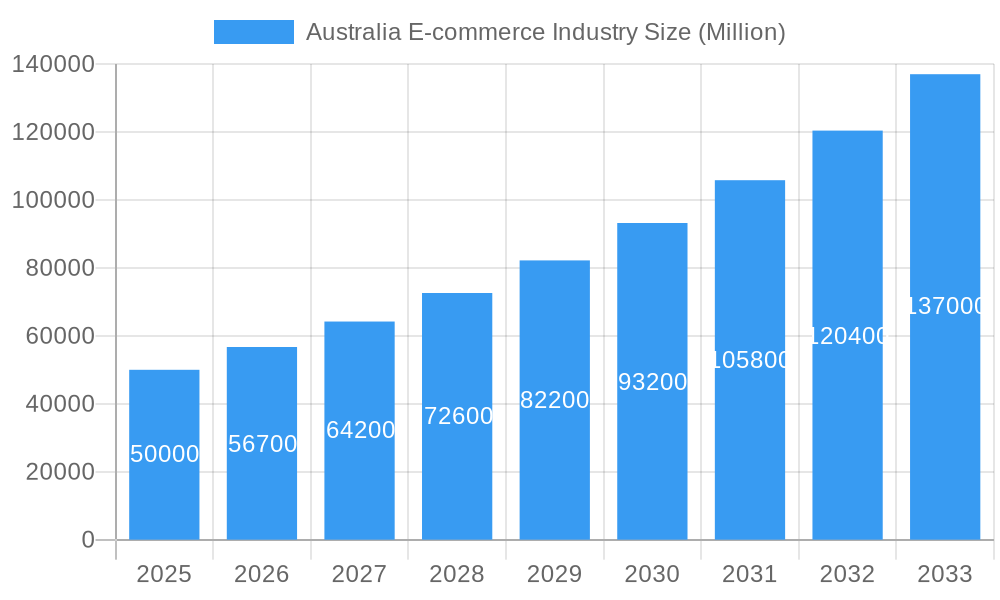

The Australian e-commerce market, currently experiencing robust growth, is projected to maintain a significant upward trajectory throughout the forecast period (2025-2033). A Compound Annual Growth Rate (CAGR) of 13.70% indicates a consistently expanding market, driven by increasing internet and smartphone penetration, a burgeoning preference for online shopping convenience, and the expanding range of goods and services available digitally. Key players like eBay Australia, Amazon, Kmart, JB Hi-Fi, Woolworths, and Kogan.com are fiercely competitive, constantly innovating to enhance customer experience and expand their market share. While factors like economic uncertainty and potential supply chain disruptions could pose challenges, the overall market outlook remains positive. The growth is further fueled by advancements in mobile commerce, improved logistics and delivery infrastructure, and a growing acceptance of digital payment methods within the Australian consumer base. The market segmentation by application will likely see continued growth in diverse sectors including fashion, electronics, groceries, and home goods, reflecting evolving consumer preferences and digital transformation across various retail segments.

Australia E-commerce Industry Market Size (In Billion)

The strong presence of established international and domestic players underscores the competitive landscape. However, opportunities exist for smaller businesses and startups to leverage niche markets and innovative e-commerce strategies. The continued expansion of high-speed internet access across Australia, particularly in regional areas, will further stimulate market growth by enhancing online shopping accessibility for a wider population. Government initiatives promoting digital adoption and supporting small and medium-sized enterprises (SMEs) in their e-commerce ventures will also play a role in shaping the future trajectory of the Australian e-commerce sector. Predicting specific market size figures requires comprehensive market research data, which is not fully provided here; however, the given CAGR and existing major players strongly suggest a substantial market expansion in the coming years.

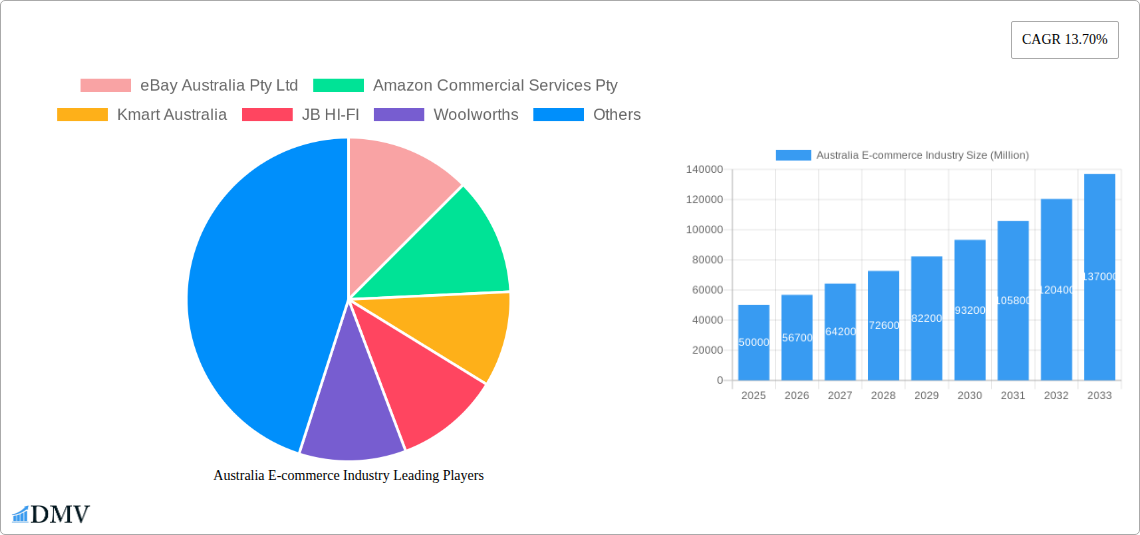

Australia E-commerce Industry Company Market Share

Australia E-commerce Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Australian e-commerce industry, covering market trends, leading players, and future growth prospects from 2019 to 2033. The study period spans 2019-2024 (Historical Period), with 2025 as the base and estimated year, and a forecast period of 2025-2033. This report is essential for stakeholders seeking to understand the dynamic Australian e-commerce landscape and make informed strategic decisions. The total market value in 2025 is estimated at $XX Million.

Australia E-commerce Industry Market Composition & Trends

This section evaluates the competitive intensity, innovation drivers, regulatory environment, substitute products, user demographics, and merger & acquisition (M&A) activity within the Australian e-commerce sector. The market is characterized by a mix of large multinational players and smaller, specialized businesses. Market share is highly concentrated among the top players, with eBay Australia Pty Ltd, Amazon Commercial Services Pty Ltd, and Woolworths holding significant portions. However, smaller players like Kogan.com and MyDeal are gaining market share through niche offerings and agile strategies.

- Market Concentration: High concentration among top players, with the top 5 controlling approximately XX% of the market in 2024.

- Innovation Catalysts: Rapid technological advancements in mobile commerce, AI-powered personalization, and omnichannel strategies are driving innovation.

- Regulatory Landscape: Australian e-commerce is subject to regulations concerning consumer protection, data privacy (e.g., GDPR compliance), and fair trading practices.

- Substitute Products: Traditional brick-and-mortar retail remains a significant substitute, although its share is declining steadily.

- End-User Profiles: The market caters to a diverse range of consumers, from young tech-savvy individuals to older generations increasingly adopting online shopping.

- M&A Activity: The Australian e-commerce landscape has witnessed several significant M&A deals in recent years, totaling an estimated $XX Million in value from 2019-2024. These transactions reflect the consolidation trend and the pursuit of market dominance.

Australia E-commerce Industry Industry Evolution

The Australian e-commerce industry has experienced significant growth since 2019, driven by increased internet penetration, smartphone adoption, and changing consumer preferences. The industry growth trajectory shows a steady upward trend, with a compound annual growth rate (CAGR) of approximately XX% during the historical period (2019-2024). This growth is projected to continue during the forecast period (2025-2033), though at a potentially moderated rate due to market maturity. Technological advancements such as AI-driven recommendations, improved logistics, and the rise of mobile payments have played a key role in this growth. Consumer demand has shifted towards convenience, personalized experiences, and seamless omnichannel integration, prompting businesses to adapt their strategies accordingly. The adoption of Buy Now Pay Later (BNPL) services has also significantly impacted purchase decisions and overall growth. The increasing preference for contactless transactions accelerated by the COVID-19 pandemic has solidified the industry's trajectory towards digital dominance.

Leading Regions, Countries, or Segments in Australia E-commerce Industry

The Australian e-commerce market is geographically diverse, with significant activity across major metropolitan areas and regional centers. However, major cities like Sydney, Melbourne, and Brisbane tend to dominate due to higher population density and greater internet accessibility. Market segmentation by application reveals strong growth in several areas.

Key Drivers:

- High Investment: Significant venture capital investments in e-commerce startups.

- Government Support: Government initiatives aimed at fostering digital economy growth.

- Consumer Adoption: Rising consumer confidence and online shopping familiarity.

Dominance Factors: Urban centers demonstrate higher internet penetration and digital literacy rates compared to rural areas. E-commerce penetration is particularly strong in the fashion, electronics, and grocery segments, which all experienced exceptional growth in recent years. The rapid adoption of mobile commerce further fuels this dominance in these areas.

Australia E-commerce Industry Product Innovations

Recent innovations include personalized recommendations, augmented reality (AR) shopping experiences, subscription services, and the integration of social commerce platforms. These enhancements aim to improve the overall customer experience and drive sales conversion. Companies leverage AI and machine learning for dynamic pricing, inventory management, and fraud prevention. The adoption of headless commerce architecture facilitates more efficient and adaptable e-commerce systems, which allow for integration across various platforms and channels.

Propelling Factors for Australia E-commerce Industry Growth

Several factors are propelling the growth of the Australian e-commerce industry. Technological advancements, such as improved logistics and mobile payment systems, enhance efficiency and convenience. A robust digital infrastructure and rising smartphone penetration support greater online engagement. Government initiatives supporting digital transformation create a favorable environment for e-commerce expansion. Finally, shifting consumer preferences towards convenience and online purchasing power continue to drive market growth.

Obstacles in the Australia E-commerce Industry Market

Challenges include high shipping costs, particularly to regional areas, and managing the complexities of international trade. Supply chain disruptions caused by global events impact delivery times and costs, negatively influencing profitability. Intense competition from both established players and new entrants, particularly in crowded segments, impacts profit margins. Furthermore, concerns around cybersecurity and data privacy are increasingly critical challenges.

Future Opportunities in Australia E-commerce Industry

Future growth opportunities lie in expanding into underserved regional markets, leveraging emerging technologies like AR/VR and blockchain for enhanced shopping experiences, and catering to evolving consumer needs through personalized offerings. The adoption of sustainable and ethical practices within the e-commerce supply chain can attract environmentally conscious customers. Furthermore, targeting specific niche markets can lead to substantial growth for smaller players.

Major Players in the Australia E-commerce Industry Ecosystem

- eBay Australia Pty Ltd

- Amazon Commercial Services Pty Ltd

- Kmart Australia

- JB HI-FI

- Woolworths

- Kogan.com

- Big W

- MyDeal

- Gumtree Australia

- BigCommerce

- Coles

Key Developments in Australia E-commerce Industry Industry

- April 2022: Pinterest partnered with WooCommerce, enabling 3.6 Million merchants to create Shoppable Pins. This integration significantly expands Pinterest's reach within the e-commerce ecosystem.

- May 2022: Marketplacer launched a holistic online marketplace for True Woo, focusing on wellbeing products and services. This demonstrates the industry's expansion into specialized niches.

Strategic Australia E-commerce Industry Market Forecast

The Australian e-commerce market is poised for continued growth, driven by technological innovation, evolving consumer behavior, and supportive government policies. Emerging technologies and expanding market segments present significant opportunities for both established players and new entrants. The focus on omnichannel strategies, personalization, and sustainable practices will shape the industry's future landscape. The market is expected to reach $XX Million by 2033, signifying significant growth potential in the coming years.

Australia E-commerce Industry Segmentation

-

1. Application

- 1.1. Beauty and Personal Care

- 1.2. Consumer Electronics

- 1.3. Fashion and Apparel

- 1.4. Food and Beverages

- 1.5. Furniture and Home

- 1.6. Others (Toys, DIY, Media, etc.)

Australia E-commerce Industry Segmentation By Geography

- 1. Australia

Australia E-commerce Industry Regional Market Share

Geographic Coverage of Australia E-commerce Industry

Australia E-commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Purchase Frequency and Online Spending; Rising Adoption of Click and Collect Services

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Equipment than Conventional Radiography is Discouraging the Market Growth

- 3.4. Market Trends

- 3.4.1. Rise in Purchase Frequency and Online Spending

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia E-commerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Beauty and Personal Care

- 5.1.2. Consumer Electronics

- 5.1.3. Fashion and Apparel

- 5.1.4. Food and Beverages

- 5.1.5. Furniture and Home

- 5.1.6. Others (Toys, DIY, Media, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 eBay Australia Pty Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amazon Commercial Services Pty

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kmart Australia

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 JB HI-FI

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Woolworths

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kogan com

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Big W

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MyDeal

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Gumutree Australia

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BigCommerce

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Coles

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 eBay Australia Pty Ltd

List of Figures

- Figure 1: Australia E-commerce Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia E-commerce Industry Share (%) by Company 2025

List of Tables

- Table 1: Australia E-commerce Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Australia E-commerce Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Australia E-commerce Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Australia E-commerce Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia E-commerce Industry?

The projected CAGR is approximately 13.70%.

2. Which companies are prominent players in the Australia E-commerce Industry?

Key companies in the market include eBay Australia Pty Ltd, Amazon Commercial Services Pty, Kmart Australia, JB HI-FI, Woolworths, Kogan com, Big W, MyDeal, Gumutree Australia, BigCommerce, Coles.

3. What are the main segments of the Australia E-commerce Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Purchase Frequency and Online Spending; Rising Adoption of Click and Collect Services.

6. What are the notable trends driving market growth?

Rise in Purchase Frequency and Online Spending.

7. Are there any restraints impacting market growth?

; High Cost of Equipment than Conventional Radiography is Discouraging the Market Growth.

8. Can you provide examples of recent developments in the market?

April 2022 - Pinterest announced a strategic partnership with the E-commerce platform WooCommerce, which will enable WooCommerce's 3.6 million merchants the convert their product catalogs into Shoppable Pins on Pinterest. with this partnership, a new Pinterest app within WooCommerce would be launched, which will include various Pinterest shopping features such as tag deployment and catalog ingestion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia E-commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia E-commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia E-commerce Industry?

To stay informed about further developments, trends, and reports in the Australia E-commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence