Key Insights

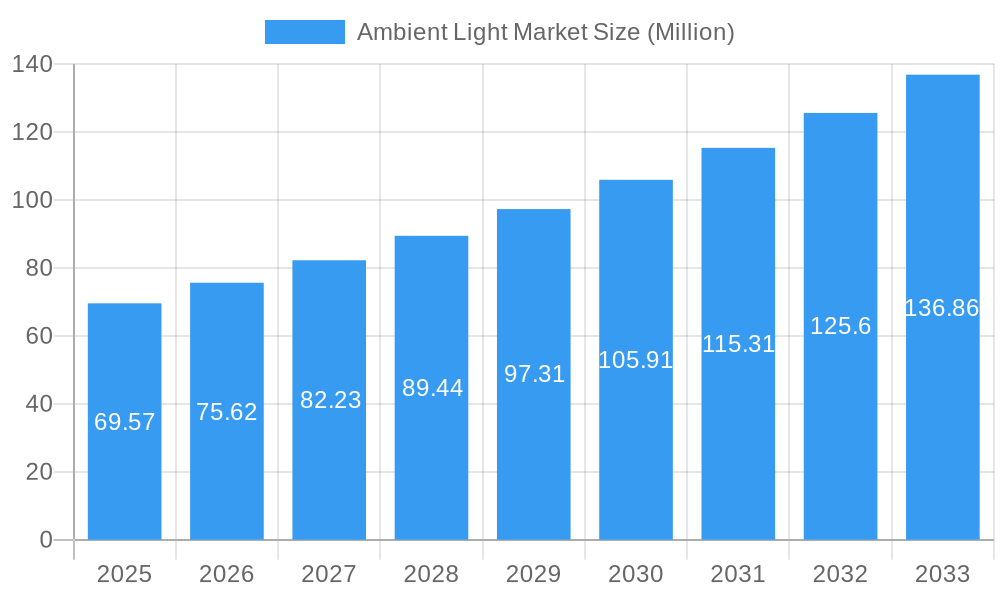

The global Ambient Light Market is poised for significant expansion, projected to reach $69.57 million by 2025 and demonstrating a robust Compound Annual Growth Rate (CAGR) of 8.90% throughout the forecast period of 2025-2033. This substantial growth is fueled by an increasing consumer demand for aesthetically pleasing and energy-efficient lighting solutions across diverse applications. The rising adoption of smart home technologies and the growing awareness of the impact of lighting on well-being and productivity are key drivers propelling the market forward. Furthermore, advancements in LED technology, offering superior energy efficiency, longer lifespans, and enhanced design flexibility, continue to shape product innovation and market penetration. The market is segmented into various offerings, including Lamps and Luminaires and sophisticated Lighting Controls, catering to a wide array of user needs.

Ambient Light Market Market Size (In Million)

The market's dynamism is further underscored by the diverse range of light types available, such as Surface-mounted Lights, Track Lights, Strip Lights, Suspended Lights, and Recessed Lights, each offering unique design and functional advantages. The end-user landscape is equally varied, encompassing Residential, Automotive, Hospitality and Retail, Healthcare, and other industrial sectors. The expansion of smart city initiatives and the burgeoning demand for intelligent lighting systems that adapt to environmental conditions and user preferences are expected to further accelerate market growth. While the market is characterized by strong growth, potential challenges may arise from the initial investment costs of advanced lighting systems and the need for continuous technological upgrades to maintain a competitive edge. However, the overwhelming trend towards sustainable and human-centric lighting solutions positions the Ambient Light Market for sustained and profitable growth.

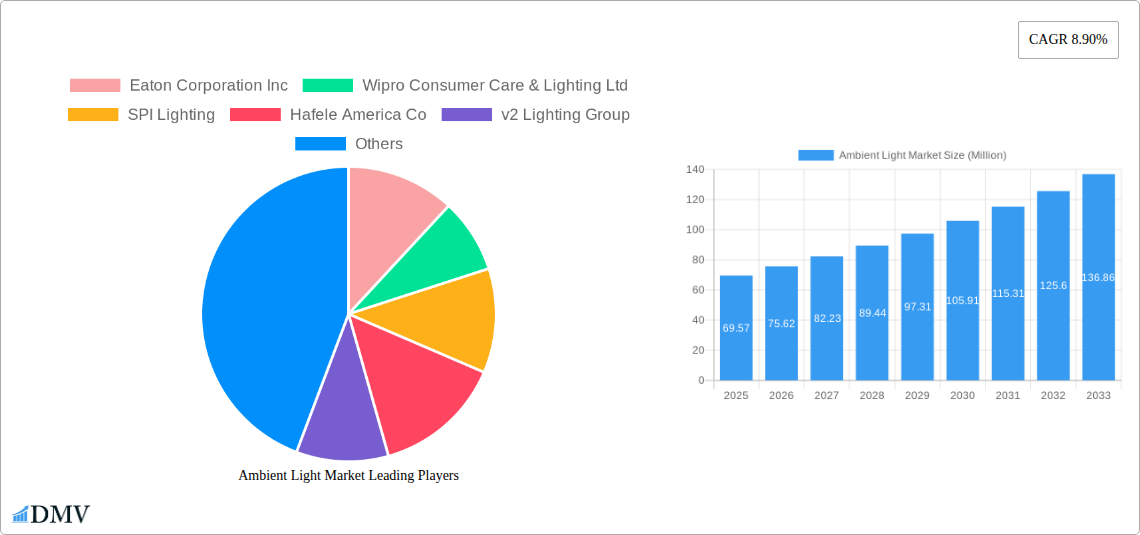

Ambient Light Market Company Market Share

Ambient Light Market: Illuminating the Future of Experience-Driven Lighting

This comprehensive report delves into the dynamic ambient light market, a rapidly expanding sector driven by a confluence of technological innovation, evolving consumer preferences, and the increasing demand for personalized and immersive lighting experiences. Covering the study period 2019–2033, with base year 2025 and forecast period 2025–2033, this analysis provides deep insights into market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, future opportunities, key players, and strategic forecasts.

Ambient Light Market Market Composition & Trends

The ambient light market exhibits a moderately concentrated structure, with key players like Koninklijke Philips NV, Acuity Brands Inc., and OSRAM Licht AG holding significant market share. Innovation is primarily fueled by advancements in LED technology, smart controls, and the integration of AI and IoT for responsive lighting solutions. The regulatory landscape, though evolving, generally supports energy efficiency and safety standards, influencing product development and market entry. Substitute products, such as traditional lighting solutions, are gradually losing ground to the superior performance and versatility of ambient lighting. End-user profiles are diverse, ranging from the aesthetic demands of the residential and hospitality sectors to the functional requirements of healthcare and automotive applications. Mergers and acquisitions are strategically shaping the market, with recent deals valued in the tens of millions of dollars, consolidating expertise and expanding product portfolios.

- Market Share Distribution: Dominated by a few large players, with a growing number of niche manufacturers contributing to market dynamism.

- M&A Deal Values: Significant investment in strategic acquisitions to enhance technological capabilities and market reach, with average deal values ranging from $50 Million to $200 Million.

- Innovation Catalysts: Rapid advancements in LED efficiency, color-tunable technologies, and sophisticated lighting control systems.

Ambient Light Market Industry Evolution

The ambient light market has witnessed remarkable evolution, transforming from basic illumination to sophisticated experiential tools. Driven by a projected Compound Annual Growth Rate (CAGR) of approximately 8% from 2019 to 2033, the industry is experiencing sustained growth. Technological advancements have been paramount, with the transition from incandescent and fluorescent lighting to energy-efficient LED technologies enabling greater control over color, intensity, and dynamic effects. Smart lighting integration, facilitated by the proliferation of IoT devices and the development of user-friendly mobile applications, has empowered consumers and businesses alike to create personalized lighting environments. Shifting consumer demands, influenced by wellness trends and the desire for enhanced comfort and productivity, are pushing the adoption of human-centric lighting solutions. The residential sector is increasingly embracing ambient lighting for creating mood and enhancing home aesthetics, while commercial spaces, particularly hospitality and retail, are leveraging it to improve customer experience and brand perception. The automotive industry is integrating dynamic ambient lighting for passenger comfort and safety, and the healthcare sector is exploring its therapeutic benefits. This continuous innovation and adaptation to market needs position the ambient light market for continued robust expansion.

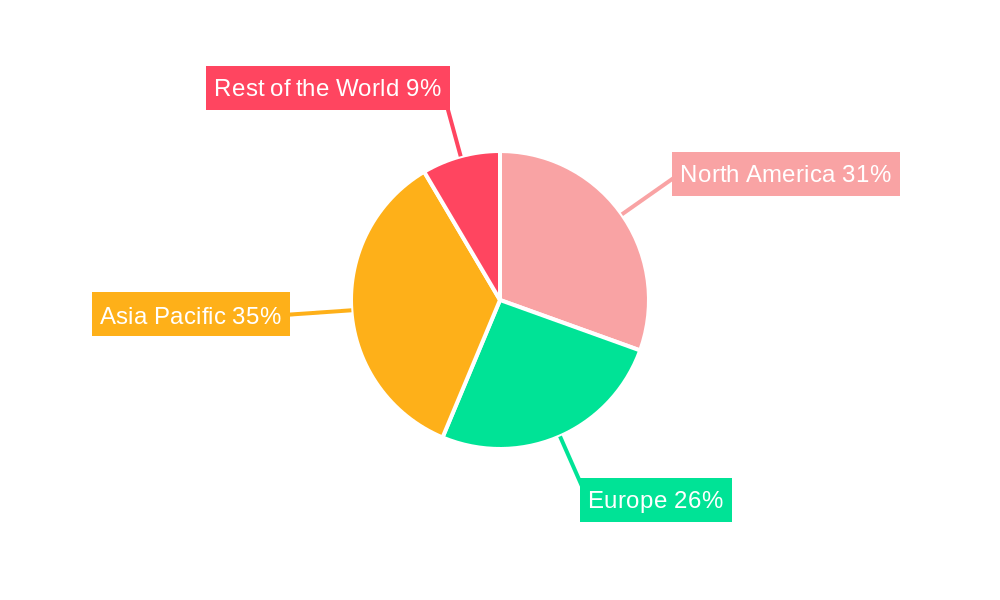

Leading Regions, Countries, or Segments in Ambient Light Market

North America currently leads the ambient light market, propelled by substantial investments in smart home technologies, robust infrastructure development, and a high consumer propensity for adopting advanced lighting solutions. The region's dominance is further bolstered by strong regulatory support for energy efficiency and the presence of major industry players.

Key Drivers for Dominance in North America:

- High Disposable Income: Enabling consumers to invest in premium ambient lighting solutions for residential and commercial applications.

- Technological Adoption: Rapid uptake of smart home devices and integrated lighting systems, creating a fertile ground for ambient lighting.

- Government Initiatives: Policies promoting energy efficiency and the adoption of LED technologies, driving demand for advanced lighting.

- Commercial Sector Growth: Significant investments in hospitality, retail, and healthcare infrastructure, all key adopters of ambient lighting for enhanced user experience.

Within North America, the Lamps and Luminaires segment, particularly Strip Lights and Suspended Lights, command the largest market share. These offerings are versatile and easily integrated into various applications, from accent lighting in homes to dynamic displays in retail environments. The Residential and Hospitality and Retail end-user segments are the primary drivers for this segment's growth, seeking to create inviting atmospheres and enhance customer engagement. The Lighting Controls segment is also experiencing exponential growth, as users demand more sophisticated and personalized control over their ambient lighting environments.

Dominance Factors:

- Offering: Lamps and Luminaires:

- Strip Lights: Highly adaptable for accent, cove, and decorative lighting in residential and commercial spaces. Market share estimated at 25%.

- Suspended Lights: Offer aesthetic appeal and functional illumination for dining areas, lobbies, and modern office spaces. Market share estimated at 20%.

- End User: Residential: Driven by the desire for personalized comfort, mood setting, and smart home integration. Accounts for approximately 30% of market demand.

- End User: Hospitality and Retail: Crucial for creating brand ambiance, enhancing product display, and improving customer experience. Accounts for approximately 25% of market demand.

- Type: Surface-mounted Light and Recessed Light: Significant adoption in commercial and residential retrofits and new constructions due to ease of installation and aesthetic integration. Estimated market share of 15% each.

Ambient Light Market Product Innovations

Recent product innovations in the ambient light market focus on enhancing user experience through advanced control, color rendering, and integration capabilities. Companies are developing tunable white and full-spectrum LED solutions that mimic natural daylight cycles, promoting well-being and productivity. Smart lighting systems, leveraging AI and machine learning, are enabling dynamic adjustments based on occupancy, time of day, and even user mood. Applications are expanding beyond mere illumination to include therapeutic lighting in healthcare settings and immersive entertainment experiences in homes and commercial venues. Performance metrics are continually improving, with LEDs offering higher lumens per watt, extended lifespans exceeding 50,000 hours, and superior color rendering indices (CRIs) of 90+, ensuring true-to-life color reproduction.

Propelling Factors for Ambient Light Market Growth

The ambient light market's growth is propelled by several key factors. Technologically, the continuous evolution of LED technology offers greater efficiency, versatility, and cost-effectiveness. The widespread adoption of smart home ecosystems and IoT integration allows for seamless control and personalization. Economically, the increasing disposable income globally and the rising awareness of the link between lighting and well-being are driving demand. Regulatory support for energy-efficient lighting solutions also plays a crucial role. Furthermore, the growing trend of experiential retail and hospitality, where ambiance is paramount, fuels the adoption of sophisticated ambient lighting.

- Technological Advancements: Energy-efficient LEDs, advanced color-tuning capabilities, and intelligent control systems.

- Consumer Demand: Growing preference for personalized lighting, mood enhancement, and wellness-focused environments.

- Smart Home Integration: Seamless connectivity with other smart devices, enabling intuitive control.

- Energy Efficiency Regulations: Government mandates promoting sustainable lighting solutions.

Obstacles in the Ambient Light Market Market

Despite its strong growth, the ambient light market faces certain obstacles. High initial installation costs for sophisticated systems can be a deterrent for some consumers and smaller businesses. Interoperability issues between different smart lighting ecosystems can also present challenges for users. Supply chain disruptions, as witnessed in recent global events, can impact the availability and pricing of components. Furthermore, the lack of standardized protocols for smart lighting can lead to consumer confusion and hinder mass adoption. Intense competition from established players and emerging startups also puts pressure on profit margins, requiring continuous innovation and cost optimization.

- High Upfront Investment: Initial cost of advanced systems can be a barrier.

- Interoperability Challenges: Ensuring seamless integration across different platforms.

- Supply Chain Volatility: Potential for disruptions and price fluctuations of key components.

- Lack of Standardization: Consumer confusion due to varied protocols and user interfaces.

Future Opportunities in Ambient Light Market

The future of the ambient light market is replete with opportunities. The burgeoning demand for human-centric lighting solutions that positively impact health and well-being presents a significant avenue for growth. The expansion of smart city initiatives, incorporating intelligent street lighting and public space illumination, offers substantial potential. Furthermore, the integration of ambient lighting with augmented reality (AR) and virtual reality (VR) technologies can create unprecedented immersive experiences. The increasing adoption of energy-harvesting technologies within lighting systems could also reduce operational costs and environmental impact.

- Human-Centric Lighting: Focus on circadian rhythm management and well-being.

- Smart City Integration: Intelligent lighting for public spaces and infrastructure.

- AR/VR Integration: Creating hyper-realistic and interactive environments.

- Sustainable Technologies: Development of energy-harvesting and self-powered lighting solutions.

Major Players in the Ambient Light Market Ecosystem

- Eaton Corporation Inc

- Wipro Consumer Care & Lighting Ltd

- SPI Lighting

- Hafele America Co

- v2 Lighting Group

- Samsung Electronics Co Ltd

- Cree Inc

- Hubbell Incorporated

- GE Lighting

- Amerlux

- Bridgelux Inc

- Nulite Lighting

- Louis Poulsen

- Koninklijke Philips NV

- Acuity Brands Inc

- OSRAM Licht AG

- The Zumtobel Group

- Decon Lighting Pvt Ltd

Key Developments in Ambient Light Market Industry

- March 2022: Koninklijke Philips NV rolled out an ambient experience and flexvision display with the Azurion system. The ambient experience with the flexvision display can reduce patient anxiety during interventional treatments, improve patient-staff expertise, and enhance workflows and productivity. According to the Samsung company, the new system enables staff members to adjust the ambient lighting and sound in the room during the patient arrival and preparation phases to maintain an overall calm sensation. The solution aims to distract, inform, educate, and empower patients to minimize their anxiety, particularly before therapy.

- February 2022: Samsung Electronics Co., Ltd. unveiled the newest micro LED. As Samsung's state-of-the-art display, micro LED offers a best-in-class picture quality. This goal has been achieved by 25 million micrometer-sized light-emitting diodes that individually produce color and light, creating an immersive experience through incredibly vibrant colors, impressive depth, and a heightened level of contrast and clarity. At CES 2022, the company will unveil the micro LED in three different sizes: 89',101', and 110'. Micro LED delivers extreme performance with an immersive design made possible by its 99.99% screen-to-body ratio.

Strategic Ambient Light Market Market Forecast

The strategic outlook for the ambient light market remains exceptionally positive, driven by a sustained demand for personalized, dynamic, and energy-efficient lighting solutions. The ongoing convergence of technology, including AI, IoT, and advanced LED innovations, will continue to unlock new applications and enhance user experiences. Investments in human-centric lighting for health and wellness, coupled with the expansion of smart city infrastructure, are expected to be significant growth catalysts. While challenges related to cost and standardization persist, strategic partnerships, ongoing research and development, and supportive regulatory environments will pave the way for market expansion, with an estimated market valuation projected to reach over $15 Billion by 2033. The market's trajectory is firmly set towards becoming an integral component of modern living and working environments.

Ambient Light Market Segmentation

-

1. Offering

- 1.1. Lamps and Luminaires

- 1.2. Lighting Controls

-

2. Type

- 2.1. Surface-mounted Light

- 2.2. Track Light

- 2.3. Strip Light

- 2.4. Suspended Light

- 2.5. Recessed Light

- 2.6. Other Types

-

3. End User

- 3.1. Residential

- 3.2. Automotive

- 3.3. Hospitality and Retail

- 3.4. Healthcare

- 3.5. Other End Users (Industrial)

Ambient Light Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Latin America

- 4.2. Middle East and Africa

Ambient Light Market Regional Market Share

Geographic Coverage of Ambient Light Market

Ambient Light Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need for Energy-efficient Lighting Solutions; Increasing Adoption of Smart Lighting; Modernization of Infrastructure

- 3.3. Market Restrains

- 3.3.1. Challenges Associated With LED Driver Failure and High Cost Associated With Installation

- 3.4. Market Trends

- 3.4.1. LEDs to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ambient Light Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Lamps and Luminaires

- 5.1.2. Lighting Controls

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Surface-mounted Light

- 5.2.2. Track Light

- 5.2.3. Strip Light

- 5.2.4. Suspended Light

- 5.2.5. Recessed Light

- 5.2.6. Other Types

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Residential

- 5.3.2. Automotive

- 5.3.3. Hospitality and Retail

- 5.3.4. Healthcare

- 5.3.5. Other End Users (Industrial)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. North America Ambient Light Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 6.1.1. Lamps and Luminaires

- 6.1.2. Lighting Controls

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Surface-mounted Light

- 6.2.2. Track Light

- 6.2.3. Strip Light

- 6.2.4. Suspended Light

- 6.2.5. Recessed Light

- 6.2.6. Other Types

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Residential

- 6.3.2. Automotive

- 6.3.3. Hospitality and Retail

- 6.3.4. Healthcare

- 6.3.5. Other End Users (Industrial)

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 7. Europe Ambient Light Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 7.1.1. Lamps and Luminaires

- 7.1.2. Lighting Controls

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Surface-mounted Light

- 7.2.2. Track Light

- 7.2.3. Strip Light

- 7.2.4. Suspended Light

- 7.2.5. Recessed Light

- 7.2.6. Other Types

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Residential

- 7.3.2. Automotive

- 7.3.3. Hospitality and Retail

- 7.3.4. Healthcare

- 7.3.5. Other End Users (Industrial)

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 8. Asia Pacific Ambient Light Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 8.1.1. Lamps and Luminaires

- 8.1.2. Lighting Controls

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Surface-mounted Light

- 8.2.2. Track Light

- 8.2.3. Strip Light

- 8.2.4. Suspended Light

- 8.2.5. Recessed Light

- 8.2.6. Other Types

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Residential

- 8.3.2. Automotive

- 8.3.3. Hospitality and Retail

- 8.3.4. Healthcare

- 8.3.5. Other End Users (Industrial)

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 9. Rest of the World Ambient Light Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 9.1.1. Lamps and Luminaires

- 9.1.2. Lighting Controls

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Surface-mounted Light

- 9.2.2. Track Light

- 9.2.3. Strip Light

- 9.2.4. Suspended Light

- 9.2.5. Recessed Light

- 9.2.6. Other Types

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Residential

- 9.3.2. Automotive

- 9.3.3. Hospitality and Retail

- 9.3.4. Healthcare

- 9.3.5. Other End Users (Industrial)

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Eaton Corporation Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Wipro Consumer Care & Lighting Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 SPI Lighting

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Hafele America Co

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 v2 Lighting Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Samsung Electronics Co Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Cree Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Hubbell Incorporated

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 GE Lighting

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Amerlux

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Bridgelux Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Nulite Lighting

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Louis Poulsen

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Koninklijke Philips NV

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Acuity Brands Inc

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 OSRAM Licht AG

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 The Zumtobel Group

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 Decon Lighting Pvt Ltd

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.1 Eaton Corporation Inc

List of Figures

- Figure 1: Global Ambient Light Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Ambient Light Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Ambient Light Market Revenue (Million), by Offering 2025 & 2033

- Figure 4: North America Ambient Light Market Volume (K Unit), by Offering 2025 & 2033

- Figure 5: North America Ambient Light Market Revenue Share (%), by Offering 2025 & 2033

- Figure 6: North America Ambient Light Market Volume Share (%), by Offering 2025 & 2033

- Figure 7: North America Ambient Light Market Revenue (Million), by Type 2025 & 2033

- Figure 8: North America Ambient Light Market Volume (K Unit), by Type 2025 & 2033

- Figure 9: North America Ambient Light Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Ambient Light Market Volume Share (%), by Type 2025 & 2033

- Figure 11: North America Ambient Light Market Revenue (Million), by End User 2025 & 2033

- Figure 12: North America Ambient Light Market Volume (K Unit), by End User 2025 & 2033

- Figure 13: North America Ambient Light Market Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Ambient Light Market Volume Share (%), by End User 2025 & 2033

- Figure 15: North America Ambient Light Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Ambient Light Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Ambient Light Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Ambient Light Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Ambient Light Market Revenue (Million), by Offering 2025 & 2033

- Figure 20: Europe Ambient Light Market Volume (K Unit), by Offering 2025 & 2033

- Figure 21: Europe Ambient Light Market Revenue Share (%), by Offering 2025 & 2033

- Figure 22: Europe Ambient Light Market Volume Share (%), by Offering 2025 & 2033

- Figure 23: Europe Ambient Light Market Revenue (Million), by Type 2025 & 2033

- Figure 24: Europe Ambient Light Market Volume (K Unit), by Type 2025 & 2033

- Figure 25: Europe Ambient Light Market Revenue Share (%), by Type 2025 & 2033

- Figure 26: Europe Ambient Light Market Volume Share (%), by Type 2025 & 2033

- Figure 27: Europe Ambient Light Market Revenue (Million), by End User 2025 & 2033

- Figure 28: Europe Ambient Light Market Volume (K Unit), by End User 2025 & 2033

- Figure 29: Europe Ambient Light Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Ambient Light Market Volume Share (%), by End User 2025 & 2033

- Figure 31: Europe Ambient Light Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Ambient Light Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Ambient Light Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Ambient Light Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Ambient Light Market Revenue (Million), by Offering 2025 & 2033

- Figure 36: Asia Pacific Ambient Light Market Volume (K Unit), by Offering 2025 & 2033

- Figure 37: Asia Pacific Ambient Light Market Revenue Share (%), by Offering 2025 & 2033

- Figure 38: Asia Pacific Ambient Light Market Volume Share (%), by Offering 2025 & 2033

- Figure 39: Asia Pacific Ambient Light Market Revenue (Million), by Type 2025 & 2033

- Figure 40: Asia Pacific Ambient Light Market Volume (K Unit), by Type 2025 & 2033

- Figure 41: Asia Pacific Ambient Light Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: Asia Pacific Ambient Light Market Volume Share (%), by Type 2025 & 2033

- Figure 43: Asia Pacific Ambient Light Market Revenue (Million), by End User 2025 & 2033

- Figure 44: Asia Pacific Ambient Light Market Volume (K Unit), by End User 2025 & 2033

- Figure 45: Asia Pacific Ambient Light Market Revenue Share (%), by End User 2025 & 2033

- Figure 46: Asia Pacific Ambient Light Market Volume Share (%), by End User 2025 & 2033

- Figure 47: Asia Pacific Ambient Light Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Ambient Light Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Ambient Light Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Ambient Light Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Rest of the World Ambient Light Market Revenue (Million), by Offering 2025 & 2033

- Figure 52: Rest of the World Ambient Light Market Volume (K Unit), by Offering 2025 & 2033

- Figure 53: Rest of the World Ambient Light Market Revenue Share (%), by Offering 2025 & 2033

- Figure 54: Rest of the World Ambient Light Market Volume Share (%), by Offering 2025 & 2033

- Figure 55: Rest of the World Ambient Light Market Revenue (Million), by Type 2025 & 2033

- Figure 56: Rest of the World Ambient Light Market Volume (K Unit), by Type 2025 & 2033

- Figure 57: Rest of the World Ambient Light Market Revenue Share (%), by Type 2025 & 2033

- Figure 58: Rest of the World Ambient Light Market Volume Share (%), by Type 2025 & 2033

- Figure 59: Rest of the World Ambient Light Market Revenue (Million), by End User 2025 & 2033

- Figure 60: Rest of the World Ambient Light Market Volume (K Unit), by End User 2025 & 2033

- Figure 61: Rest of the World Ambient Light Market Revenue Share (%), by End User 2025 & 2033

- Figure 62: Rest of the World Ambient Light Market Volume Share (%), by End User 2025 & 2033

- Figure 63: Rest of the World Ambient Light Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Rest of the World Ambient Light Market Volume (K Unit), by Country 2025 & 2033

- Figure 65: Rest of the World Ambient Light Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Rest of the World Ambient Light Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Ambient Light Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 2: Global Ambient Light Market Volume K Unit Forecast, by Offering 2020 & 2033

- Table 3: Global Ambient Light Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Ambient Light Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 5: Global Ambient Light Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Ambient Light Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Global Ambient Light Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Ambient Light Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Ambient Light Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 10: Global Ambient Light Market Volume K Unit Forecast, by Offering 2020 & 2033

- Table 11: Global Ambient Light Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Ambient Light Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 13: Global Ambient Light Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global Ambient Light Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: Global Ambient Light Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Ambient Light Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Ambient Light Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Ambient Light Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Ambient Light Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Ambient Light Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Global Ambient Light Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 22: Global Ambient Light Market Volume K Unit Forecast, by Offering 2020 & 2033

- Table 23: Global Ambient Light Market Revenue Million Forecast, by Type 2020 & 2033

- Table 24: Global Ambient Light Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 25: Global Ambient Light Market Revenue Million Forecast, by End User 2020 & 2033

- Table 26: Global Ambient Light Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 27: Global Ambient Light Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Ambient Light Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 29: United Kingdom Ambient Light Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Ambient Light Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Germany Ambient Light Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Ambient Light Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: France Ambient Light Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: France Ambient Light Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Ambient Light Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Ambient Light Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Ambient Light Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 38: Global Ambient Light Market Volume K Unit Forecast, by Offering 2020 & 2033

- Table 39: Global Ambient Light Market Revenue Million Forecast, by Type 2020 & 2033

- Table 40: Global Ambient Light Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 41: Global Ambient Light Market Revenue Million Forecast, by End User 2020 & 2033

- Table 42: Global Ambient Light Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 43: Global Ambient Light Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global Ambient Light Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 45: China Ambient Light Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: China Ambient Light Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Japan Ambient Light Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Ambient Light Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: India Ambient Light Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: India Ambient Light Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Rest of Asia Pacific Ambient Light Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Ambient Light Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Global Ambient Light Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 54: Global Ambient Light Market Volume K Unit Forecast, by Offering 2020 & 2033

- Table 55: Global Ambient Light Market Revenue Million Forecast, by Type 2020 & 2033

- Table 56: Global Ambient Light Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 57: Global Ambient Light Market Revenue Million Forecast, by End User 2020 & 2033

- Table 58: Global Ambient Light Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 59: Global Ambient Light Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Ambient Light Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: Latin America Ambient Light Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Latin America Ambient Light Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Middle East and Africa Ambient Light Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Middle East and Africa Ambient Light Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ambient Light Market?

The projected CAGR is approximately 8.90%.

2. Which companies are prominent players in the Ambient Light Market?

Key companies in the market include Eaton Corporation Inc, Wipro Consumer Care & Lighting Ltd, SPI Lighting, Hafele America Co, v2 Lighting Group, Samsung Electronics Co Ltd, Cree Inc, Hubbell Incorporated, GE Lighting, Amerlux, Bridgelux Inc, Nulite Lighting, Louis Poulsen, Koninklijke Philips NV, Acuity Brands Inc, OSRAM Licht AG, The Zumtobel Group, Decon Lighting Pvt Ltd.

3. What are the main segments of the Ambient Light Market?

The market segments include Offering, Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 69.57 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for Energy-efficient Lighting Solutions; Increasing Adoption of Smart Lighting; Modernization of Infrastructure.

6. What are the notable trends driving market growth?

LEDs to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Challenges Associated With LED Driver Failure and High Cost Associated With Installation.

8. Can you provide examples of recent developments in the market?

March 2022: Koninklijke Philips NV rolled out an ambient experience and flexvision display with the Azurion system. The ambient experience with the flexvision display can reduce patient anxiety during interventional treatments, improve patient-staff expertise, and enhance workflows and productivity. According to the Samsung company, the new system enables staff members to adjust the ambient lighting and sound in the room during the patient arrival and preparation phases to maintain an overall calm sensation. The solution aims to distract, inform, educate, and empower patients to minimize their anxiety, particularly before therapy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ambient Light Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ambient Light Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ambient Light Market?

To stay informed about further developments, trends, and reports in the Ambient Light Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence