Key Insights

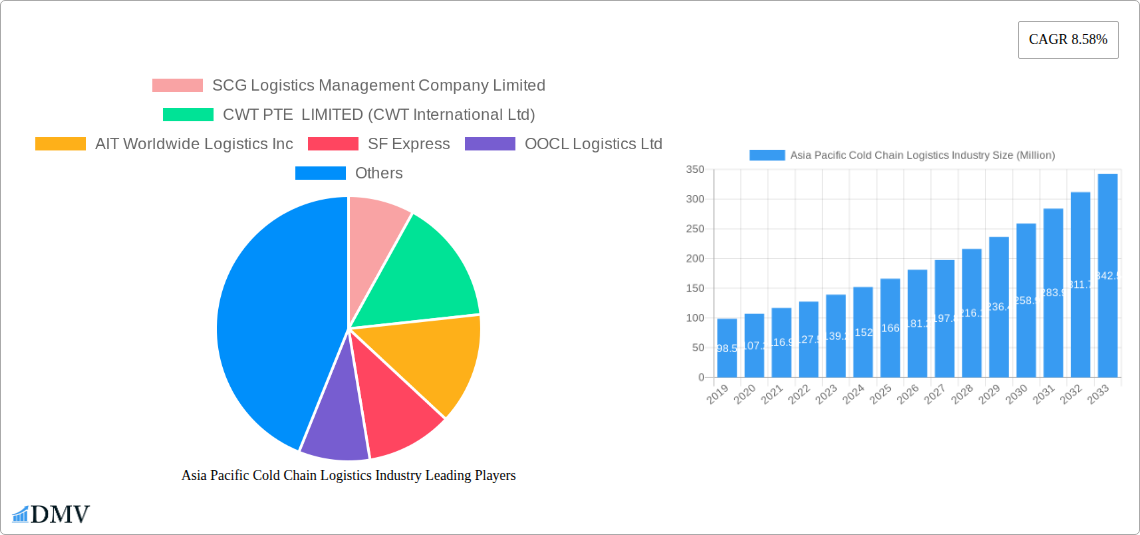

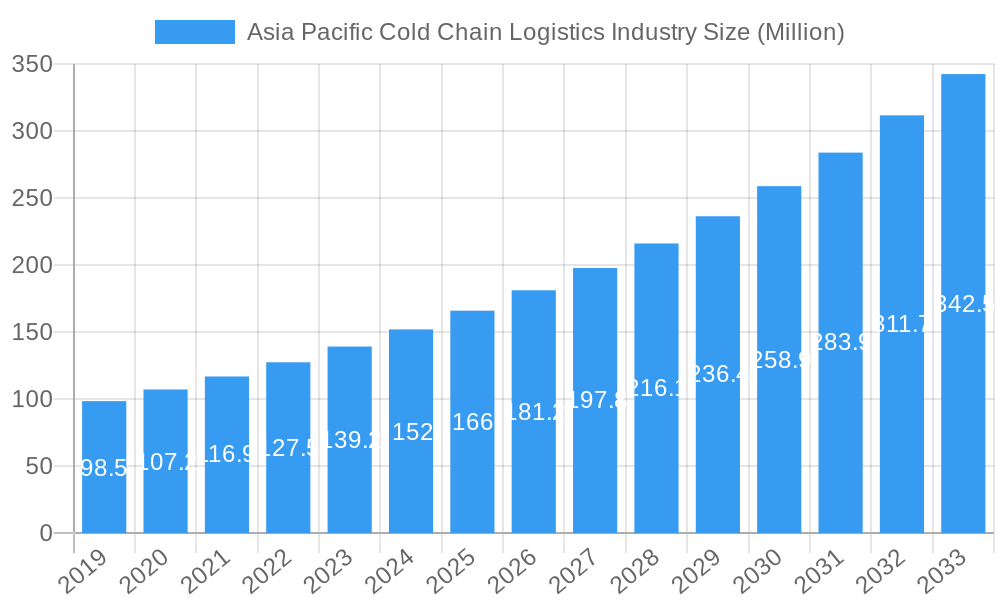

The Asia Pacific Cold Chain Logistics market is poised for robust expansion, projected to reach an estimated USD 154.95 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 8.58% anticipated to persist through 2033. This significant growth is fueled by a confluence of powerful drivers, including the escalating demand for temperature-sensitive goods such as perishables, pharmaceuticals, and dairy products. The region's burgeoning middle class, increasing urbanization, and a growing preference for convenience are further propelling the need for efficient and reliable cold chain solutions. E-commerce penetration, especially for groceries and health products, is also a critical catalyst, necessitating sophisticated temperature-controlled supply chains to maintain product integrity and consumer satisfaction. Advancements in cold chain technology, including more energy-efficient refrigeration systems and real-time monitoring solutions, are also playing a pivotal role in enhancing operational efficiency and reducing spoilage.

Asia Pacific Cold Chain Logistics Industry Market Size (In Million)

Key segments within this dynamic market highlight diverse opportunities. The services sector, encompassing storage, transportation, and value-added services, is expected to witness substantial growth, with storage solutions and refrigerated transportation being particularly crucial. The demand spans a broad spectrum of temperature requirements, from chilled to frozen products, catering to a wide array of applications. Horticulture, including fresh fruits and vegetables, along with dairy products, meats, fish, poultry, and processed food items, represent significant end-use industries. Furthermore, the pharmaceutical and life sciences sectors, with their stringent temperature control requirements for vaccines, biologics, and other sensitive medications, are increasingly relying on specialized cold chain logistics. Prominent players like SCG Logistics Management Company Limited, CWT PTE LIMITED, and AIT Worldwide Logistics Inc. are actively investing in expanding their cold chain capabilities across the Asia Pacific region, demonstrating strong confidence in its future potential.

Asia Pacific Cold Chain Logistics Industry Company Market Share

Asia Pacific Cold Chain Logistics Industry Market Composition & Trends

The Asia Pacific cold chain logistics market is characterized by its dynamic evolution and increasing complexity, driven by burgeoning demand for temperature-sensitive goods and strategic investments in infrastructure. Market concentration is moderately fragmented, with key players vying for dominance through service expansion and technological integration. Innovation is a significant catalyst, spurred by the need for enhanced efficiency, reduced spoilage, and compliance with stringent food and pharmaceutical safety regulations. The regulatory landscape, while evolving, presents both opportunities and challenges, with governments actively promoting advancements in food safety and pharmaceutical distribution networks. Substitute products are minimal within the core cold chain, though advancements in packaging technology can offer temporary solutions. End-user profiles are increasingly diverse, encompassing a broad spectrum from horticulture and dairy to vital pharmaceutical and life sciences applications. Mergers and acquisitions (M&A) are a crucial aspect of market consolidation and strategic expansion, with estimated deal values in the billions of USD as companies seek to broaden their geographic reach and service portfolios. The market share distribution is projected to see significant shifts as specialized providers gain traction.

Asia Pacific Cold Chain Logistics Industry Industry Evolution

The Asia Pacific cold chain logistics industry is experiencing a remarkable growth trajectory, fueled by a confluence of evolving consumer demands, rapid technological advancements, and strategic infrastructure development. This evolution, spanning the historical period of 2019–2024 and projected through the forecast period of 2025–2033, with 2025 serving as the base and estimated year, showcases a sustained upward trend. Market growth rates are robust, with an anticipated Compound Annual Growth Rate (CAGR) of approximately 9.5% during the forecast period, indicating substantial expansion of the overall market size, which is expected to reach over $150 billion by 2033. This growth is intrinsically linked to the escalating consumption of perishable goods, including fresh produce, dairy products, and frozen foods, driven by rising disposable incomes and a growing middle class across the region. Furthermore, the expanding pharmaceutical and life sciences sectors, with their critical need for uninterrupted temperature control throughout the supply chain, are significant contributors to this upward trajectory. Technological advancements are at the forefront of this industry's evolution. The adoption of Internet of Things (IoT) sensors for real-time temperature monitoring, advanced analytics for predictive maintenance and route optimization, and the increasing use of automation in warehousing operations are revolutionizing efficiency and reliability. Blockchain technology is also gaining traction, enhancing traceability and transparency across the cold chain. Shifting consumer demands, particularly a preference for fresh and organic products, coupled with the imperative for reliable pharmaceutical distribution for vaccines and temperature-sensitive medications, are compelling logistics providers to invest heavily in specialized infrastructure and sophisticated technological solutions. This dynamic interplay between market forces and technological innovation is shaping a more resilient, efficient, and customer-centric cold chain ecosystem across Asia Pacific.

Leading Regions, Countries, or Segments in Asia Pacific Cold Chain Logistics Industry

The dominance within the Asia Pacific cold chain logistics industry is multifaceted, with specific regions, countries, and service segments exhibiting significant leadership. From a regional perspective, Southeast Asia is emerging as a pivotal growth hub, propelled by its burgeoning economies, increasing urbanization, and a rising middle class with a higher propensity to consume chilled and frozen goods. Countries like Thailand and Singapore are particularly prominent due to their strategic geographical locations, well-developed port infrastructure, and proactive government initiatives aimed at enhancing food safety and pharmaceutical distribution networks.

Within the Services segment, Transportation is currently leading, driven by the immense demand for moving perishable goods across vast distances and the continuous expansion of e-commerce for groceries and pharmaceuticals. The Storage segment is also experiencing substantial growth, with an increasing need for state-of-the-art cold storage facilities to maintain product integrity. Value-added services, such as inventory management, order fulfillment, and specialized packaging, are gaining traction as companies seek end-to-end solutions.

In terms of Temperature Type, the Chilled segment holds a slight lead, owing to the widespread consumption of fresh produce, dairy, and ready-to-eat meals. However, the Frozen segment is rapidly catching up, fueled by the demand for frozen foods and the growing prevalence of frozen pharmaceuticals.

The Application landscape is dominated by Horticulture (Fresh Fruits and Vegetables) and Dairy Products, which constitute a significant portion of the cold chain's volume due to daily consumption patterns. However, the Pharma and Life Sciences segment is the fastest-growing application, driven by the stringent requirements for vaccine distribution, biologics, and specialty drugs, projected to grow at a CAGR of over 12% during the forecast period. This critical application demands the highest levels of precision and compliance, often commanding premium service levels. The increasing focus on food safety and the expanding healthcare needs across the region are key drivers for the sustained growth across these dominant segments.

Asia Pacific Cold Chain Logistics Industry Product Innovations

Recent product innovations in the Asia Pacific cold chain logistics industry are revolutionizing operational efficiency and product integrity. Advancements in IoT-enabled temperature monitoring systems provide real-time data streams, enabling proactive intervention against temperature deviations, thus reducing spoilage rates for horticulture and dairy products. Advanced insulation materials for reefer trucks and containers are improving energy efficiency and maintaining consistent temperatures, benefiting the transportation of meats, fish, and poultry. Furthermore, specialized packaging solutions, such as insulated boxes with advanced coolants, are enabling reliable last-mile delivery for temperature-sensitive pharmaceuticals and life sciences products, even in challenging climates. These innovations are crucial for meeting the stringent quality demands across diverse applications.

Propelling Factors for Asia Pacific Cold Chain Logistics Industry Growth

Several key factors are propelling the Asia Pacific cold chain logistics industry forward. Economic growth and rising disposable incomes in emerging economies are significantly increasing consumer demand for fresh, frozen, and pharmaceutical products. Technological advancements, including the adoption of IoT for real-time tracking and monitoring, AI for predictive analytics, and automation in warehouses, are enhancing efficiency and reliability. Supportive government initiatives, focused on improving food safety standards, developing cold chain infrastructure, and promoting the pharmaceutical supply chain, are creating a favorable regulatory environment. The increasing penetration of e-commerce for grocery and pharmaceutical delivery also necessitates robust cold chain capabilities.

Obstacles in the Asia Pacific Cold Chain Logistics Industry Market

Despite its growth, the Asia Pacific cold chain logistics industry faces several obstacles. Infrastructure limitations in certain developing nations, including insufficient cold storage capacity and inadequate transportation networks, can hinder efficient operations. High operational costs associated with maintaining temperature-controlled environments, energy consumption, and specialized equipment pose a financial challenge. Regulatory complexities and varying standards across different countries can create compliance hurdles. Furthermore, supply chain disruptions due to natural disasters or geopolitical events can severely impact the integrity of temperature-sensitive goods. The shortage of skilled labor capable of operating and maintaining advanced cold chain technologies is another significant restraint.

Future Opportunities in Asia Pacific Cold Chain Logistics Industry

The Asia Pacific cold chain logistics industry is ripe with emerging opportunities. The continued growth of the pharmaceutical and life sciences sector, particularly in biopharmaceuticals and vaccines, presents a significant avenue for specialized cold chain providers. The expanding e-commerce landscape for perishable goods, including fresh produce and ready-to-eat meals, will drive demand for efficient last-mile delivery solutions. Investment in sustainable cold chain technologies, such as renewable energy-powered refrigeration and eco-friendly refrigerants, offers both environmental and cost-saving benefits. Furthermore, the development of integrated cold chain networks in less developed regions of the Asia Pacific offers substantial market potential for expansion.

Major Players in the Asia Pacific Cold Chain Logistics Industry Ecosystem

- SCG Logistics Management Company Limited

- CWT PTE LIMITED (CWT International Ltd)

- AIT Worldwide Logistics Inc

- SF Express

- OOCL Logistics Ltd

- CJ Rokin Logistics

- Nichirei Logistics Group Inc

- United Parcel Service of America

- X2 Logistics Network (X2 GROUP)

- JWD Infologistics Public Company Ltd

Key Developments in Asia Pacific Cold Chain Logistics Industry Industry

- October 2022: Express giant UPS expanded its Premier service for time and temperature-sensitive shipments to Thailand and Singapore. The service offers to track and prioritize loads and has three tiers, with Premier Gold service available in two locations.

- September 2022: SCG Logistics, DENSO Sales (Thailand), and Toyota Tsusho Thailand have signed a partnership agreement to raise the bar in Thailand's refrigeration ecosystem and promote food safety that meets international standards.

Strategic Asia Pacific Cold Chain Logistics Industry Market Forecast

The strategic outlook for the Asia Pacific cold chain logistics industry remains exceptionally strong, driven by the convergence of robust economic growth, evolving consumer preferences for perishable goods, and the critical demands of the pharmaceutical sector. The forecast period of 2025–2033 anticipates sustained high growth, fueled by ongoing investments in advanced technology, infrastructure development, and an increasing emphasis on sustainable logistics solutions. Opportunities abound in expanding specialized services for biologics and vaccines, optimizing last-mile delivery networks for e-commerce, and leveraging data analytics for enhanced supply chain visibility and efficiency, positioning the region as a global leader in cold chain logistics.

Asia Pacific Cold Chain Logistics Industry Segmentation

-

1. Services

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature Type

- 2.1. Chilled

- 2.2. Frozen

-

3. Application

- 3.1. Horticulture (Fresh Fruits and Vegetables)

- 3.2. Dairy Products (Milk, Ice-cream, Butter, Etc.)

- 3.3. Meats, Fish, Poultry

- 3.4. Processed Food Products

- 3.5. Pharma, Life Sciences, and Chemicals

- 3.6. Other Applications

Asia Pacific Cold Chain Logistics Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Cold Chain Logistics Industry Regional Market Share

Geographic Coverage of Asia Pacific Cold Chain Logistics Industry

Asia Pacific Cold Chain Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.58% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing international trade; Advancements in technology

- 3.3. Market Restrains

- 3.3.1. Geopolitical uncertainities; Changing trade policies

- 3.4. Market Trends

- 3.4.1. Decreasing Volume of Domestic Water Freight Transport in Japan

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Cold Chain Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature Type

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Horticulture (Fresh Fruits and Vegetables)

- 5.3.2. Dairy Products (Milk, Ice-cream, Butter, Etc.)

- 5.3.3. Meats, Fish, Poultry

- 5.3.4. Processed Food Products

- 5.3.5. Pharma, Life Sciences, and Chemicals

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SCG Logistics Management Company Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CWT PTE LIMITED (CWT International Ltd)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AIT Worldwide Logistics Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SF Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 OOCL Logistics Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CJ Rokin Logistics**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nichirei Logistics Group Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 United Parcel Service of America

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 X2 Logistics Network (X2 GROUP)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 JWD Infologistics Public Company Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 SCG Logistics Management Company Limited

List of Figures

- Figure 1: Asia Pacific Cold Chain Logistics Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Cold Chain Logistics Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Cold Chain Logistics Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Asia Pacific Cold Chain Logistics Industry Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 3: Asia Pacific Cold Chain Logistics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Asia Pacific Cold Chain Logistics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Asia Pacific Cold Chain Logistics Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 6: Asia Pacific Cold Chain Logistics Industry Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 7: Asia Pacific Cold Chain Logistics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Asia Pacific Cold Chain Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Asia Pacific Cold Chain Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia Pacific Cold Chain Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia Pacific Cold Chain Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: India Asia Pacific Cold Chain Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia Pacific Cold Chain Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia Pacific Cold Chain Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia Pacific Cold Chain Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia Pacific Cold Chain Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia Pacific Cold Chain Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia Pacific Cold Chain Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia Pacific Cold Chain Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia Pacific Cold Chain Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Cold Chain Logistics Industry?

The projected CAGR is approximately 8.58%.

2. Which companies are prominent players in the Asia Pacific Cold Chain Logistics Industry?

Key companies in the market include SCG Logistics Management Company Limited, CWT PTE LIMITED (CWT International Ltd), AIT Worldwide Logistics Inc, SF Express, OOCL Logistics Ltd, CJ Rokin Logistics**List Not Exhaustive, Nichirei Logistics Group Inc, United Parcel Service of America, X2 Logistics Network (X2 GROUP), JWD Infologistics Public Company Ltd.

3. What are the main segments of the Asia Pacific Cold Chain Logistics Industry?

The market segments include Services, Temperature Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 154.95 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing international trade; Advancements in technology.

6. What are the notable trends driving market growth?

Decreasing Volume of Domestic Water Freight Transport in Japan.

7. Are there any restraints impacting market growth?

Geopolitical uncertainities; Changing trade policies.

8. Can you provide examples of recent developments in the market?

October 2022: Express giant UPS expanded its Premier service for time and temperature-sensitive shipments to Thailand and Singapore. The service offers to track and prioritize loads and has three tiers, with Premier Gold service available in two locations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Cold Chain Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Cold Chain Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Cold Chain Logistics Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Cold Chain Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence