Key Insights

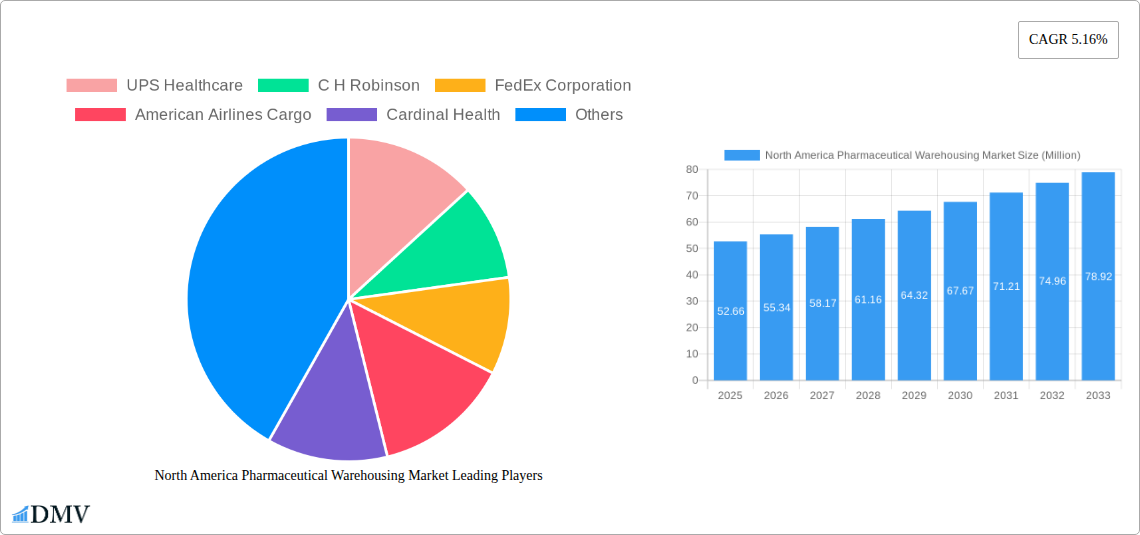

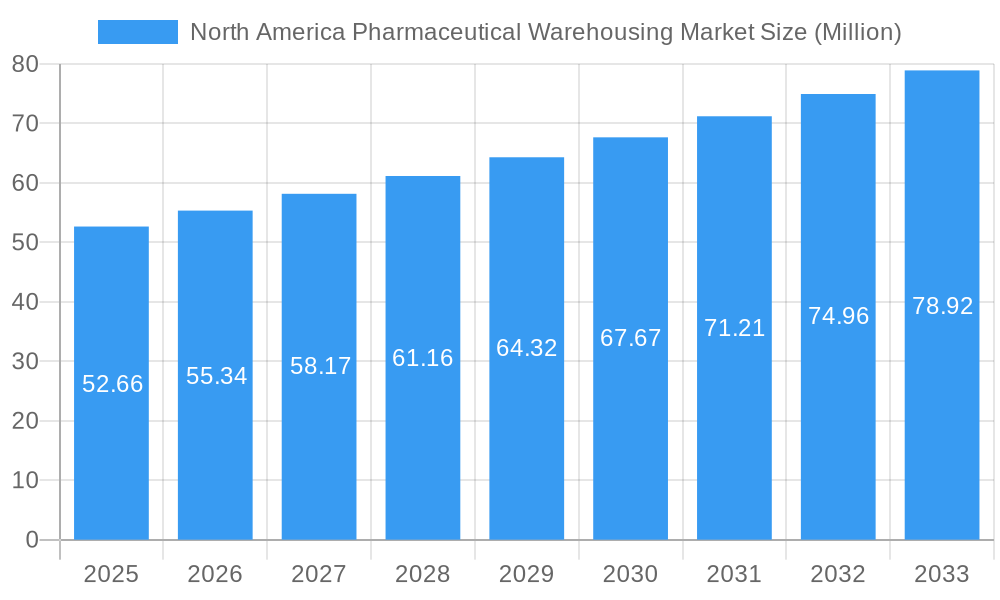

The North America Pharmaceutical Warehousing Market is poised for significant expansion, projected to reach an impressive $52.66 million by 2025. This robust growth is underpinned by a Compound Annual Growth Rate (CAGR) of 5.16%, indicating a steadily increasing demand for specialized storage and logistics solutions within the pharmaceutical sector. Key drivers fueling this upward trajectory include the escalating production of pharmaceuticals, a growing emphasis on maintaining product integrity through stringent cold chain requirements, and the increasing complexity of drug supply chains. The burgeoning biotechnology sector and the continuous innovation in drug development further necessitate advanced warehousing capabilities to ensure the safe and efficient distribution of sensitive medical products. The market is broadly segmented into Cold Chain Warehouses and Non-Cold Chain Warehouses, with critical applications spanning Pharmaceutical Factories, Pharmacies, and Hospitals, alongside "Others" which likely encompasses research facilities and specialized distribution hubs. This dynamic growth highlights the indispensable role of sophisticated warehousing in supporting public health and the advancement of medical treatments across the continent.

North America Pharmaceutical Warehousing Market Market Size (In Million)

The market's expansion is further bolstered by evolving industry trends, such as the increasing adoption of advanced technologies like IoT for real-time temperature monitoring and warehouse automation, enhancing efficiency and compliance. The rise of specialized logistics providers and strategic collaborations between pharmaceutical manufacturers and warehousing companies are also critical trends shaping the market landscape. While the demand is strong, certain restraints, such as the high capital investment required for establishing and maintaining compliant pharmaceutical warehouses, particularly those with advanced cold chain infrastructure, and the increasing regulatory burden and compliance costs, present challenges. Nevertheless, the persistent need for secure, temperature-controlled storage and the expanding pharmaceutical manufacturing base in North America, particularly in the United States, Canada, and Mexico, will continue to drive market growth, ensuring a vital role for pharmaceutical warehousing in the healthcare ecosystem.

North America Pharmaceutical Warehousing Market Company Market Share

This in-depth report provides a definitive analysis of the North America pharmaceutical warehousing market, offering critical insights for stakeholders navigating this dynamic sector. Covering the historical period from 2019-2024, the base and estimated year of 2025, and a robust forecast extending to 2033, this study delves into market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities. With a focus on pharmaceutical logistics, cold chain warehousing, drug storage solutions, and supply chain optimization, this report equips you with the strategic intelligence needed for informed decision-making.

North America Pharmaceutical Warehousing Market Market Composition & Trends

The North America pharmaceutical warehousing market, valued at an estimated $XX Billion in 2025, is characterized by a moderate to high level of concentration, with key players investing significantly in expanding their capabilities to meet the growing demand for specialized pharmaceutical storage. Innovation is largely driven by the increasing need for stringent temperature control, serialization, and real-time tracking to ensure drug integrity and patient safety. Regulatory landscapes, particularly those governed by the FDA in the US and Health Canada, play a pivotal role in shaping operational standards and investment priorities. The threat of substitute products is minimal given the unique requirements for pharmaceutical storage. End-user profiles range from large pharmaceutical manufacturers and biotechnology firms to pharmacies, hospitals, and specialized clinics, each with distinct warehousing needs. Mergers and acquisitions (M&A) are a significant trend, with deal values often in the hundreds of Million as companies seek to consolidate market share, enhance service offerings, and expand geographic reach.

- Market Share Distribution: While a precise breakdown for 2025 is proprietary, leading logistics providers and dedicated pharmaceutical warehousing firms collectively hold a significant portion of the market.

- M&A Deal Values: Recent transactions have seen investments ranging from tens of Million to over XX Million for strategic acquisitions.

- Key Areas of Investment:

- Expansion of cold chain logistics infrastructure.

- Implementation of advanced inventory management systems.

- Development of specialized storage solutions for biologics and temperature-sensitive drugs.

- Enhancement of cybersecurity measures for sensitive data.

North America Pharmaceutical Warehousing Market Industry Evolution

The North America pharmaceutical warehousing market has undergone a remarkable transformation over the study period, evolving from basic storage solutions to highly sophisticated, integrated logistics networks. Historically, from 2019 to 2024, the market witnessed steady growth fueled by an aging population, increasing prevalence of chronic diseases, and a robust pipeline of new drug development. The base year of 2025 positions the market at an estimated $XX Billion, poised for substantial expansion. Technological advancements have been a primary catalyst, with the adoption of IoT sensors for real-time temperature monitoring, advanced Warehouse Management Systems (WMS) for efficient inventory control, and automation technologies like robotic picking and sorting systems significantly improving operational efficiency. The growth trajectory is further supported by the increasing demand for specialized pharmaceutical products, such as biologics and gene therapies, which necessitate stringent cold chain warehousing and ultra-low temperature storage capabilities, contributing to an estimated CAGR of XX% during the forecast period of 2025-2033. Shifting consumer demands, particularly the rise of e-pharmacies and direct-to-patient delivery models, are also reshaping warehousing strategies, emphasizing faster turnaround times and last-mile delivery solutions.

- Growth Rates: Projections indicate a sustained growth rate of XX% annually from 2025 to 2033.

- Technological Adoption Metrics: Over XX% of pharmaceutical warehouses now employ advanced WMS, and the adoption of IoT for temperature monitoring is projected to exceed XX% by 2028.

- Impact of E-commerce: The pharmaceutical e-commerce sector is expected to drive a XX% increase in demand for specialized fulfillment centers by 2030.

Leading Regions, Countries, or Segments in North America Pharmaceutical Warehousing Market

Within the North America pharmaceutical warehousing market, the United States stands out as the dominant region, commanding the largest market share due to its extensive pharmaceutical manufacturing base, a mature healthcare system, and a significant concentration of research and development activities. The segment of Cold Chain Warehouses is experiencing the most rapid growth, driven by the increasing development and distribution of temperature-sensitive biologics, vaccines, and specialty medications.

- Dominant Region: The United States is the primary market, accounting for an estimated XX% of the total North America pharmaceutical warehousing market value in 2025.

- Key Drivers:

- Investment Trends: Significant capital investment in advanced cold chain logistics infrastructure and distribution networks.

- Regulatory Support: A well-established regulatory framework (FDA) that mandates stringent storage and handling protocols, encouraging specialized warehousing.

- Pharmaceutical Hubs: Presence of major pharmaceutical companies and R&D centers in states like New Jersey, California, and Massachusetts.

- Healthcare Expenditure: High per capita healthcare spending translates to higher demand for pharmaceutical products and their efficient storage.

- Key Drivers:

- Dominant Segment (Type): Cold Chain Warehouses.

- In-depth Analysis: The burgeoning market for biologics, immunotherapy drugs, and mRNA vaccines necessitates sophisticated cold chain warehousing solutions, including refrigerated (2-8°C), frozen (-20°C), and ultra-low temperature (ULT) storage. The global shift towards personalized medicine and precision therapeutics further amplifies the demand for precise temperature control throughout the supply chain. Companies are investing heavily in validated cold storage facilities, specialized temperature-controlled transportation, and advanced monitoring systems to ensure product integrity and compliance with Good Distribution Practices (GDP).

- Dominant Segment (Application): Pharmaceutical Factory. Warehousing facilities located at or near pharmaceutical manufacturing plants are critical for efficient staging and dispatch of finished goods, as well as for the storage of raw materials and intermediates.

North America Pharmaceutical Warehousing Market Product Innovations

Innovation in North America pharmaceutical warehousing is sharply focused on enhancing product integrity, ensuring regulatory compliance, and optimizing operational efficiency. Advancements include the deployment of smart sensors for real-time temperature, humidity, and pressure monitoring, integrated with AI-powered analytics to predict and prevent potential temperature excursions. Furthermore, serialization technologies are becoming standard, enabling track-and-trace capabilities from manufacturing to end-user. The development of modular and adaptable warehousing solutions allows for flexible scaling of storage capacity and temperature zones to accommodate a diverse range of pharmaceutical products, from standard room temperature drugs to highly sensitive biologics requiring ultra-low temperatures. The integration of robotics and automation for order picking and packing is significantly reducing human error and accelerating fulfillment times.

Propelling Factors for North America Pharmaceutical Warehousing Market Growth

The North America pharmaceutical warehousing market is propelled by several key factors. Firstly, the burgeoning demand for specialized pharmaceuticals, including biologics, vaccines, and gene therapies, necessitates advanced cold chain warehousing and ultra-low temperature storage capabilities. Secondly, stringent regulatory requirements for drug handling and distribution, such as Good Distribution Practices (GDP), drive investment in compliant and temperature-controlled facilities. Thirdly, the increasing outsourcing of logistics by pharmaceutical manufacturers to third-party logistics (3PL) providers, seeking cost efficiencies and specialized expertise, fuels market expansion. Technological advancements, including IoT, AI, and automation, are enhancing operational efficiency and product integrity, further accelerating growth. Finally, the growing prevalence of chronic diseases and an aging population contribute to an overall increase in pharmaceutical consumption and, consequently, warehousing needs.

Obstacles in the North America Pharmaceutical Warehousing Market Market

Despite robust growth, the North America pharmaceutical warehousing market faces several obstacles. Significant capital investment is required for establishing and maintaining advanced cold chain warehousing facilities, including ultra-low temperature freezers, which can be a substantial barrier for smaller players. Navigating complex and evolving regulatory landscapes across different jurisdictions can lead to compliance challenges and increased operational costs. Supply chain disruptions, such as those experienced during global pandemics or geopolitical events, can impact inventory management and timely delivery. Furthermore, the shortage of skilled labor capable of operating and maintaining sophisticated pharmaceutical warehousing operations presents a persistent challenge. Intense competition among 3PL providers and warehousing companies can also put pressure on pricing and profit margins.

Future Opportunities in North America Pharmaceutical Warehousing Market

Emerging opportunities in the North America pharmaceutical warehousing market are multifaceted. The increasing demand for personalized medicine and cell and gene therapies will drive further investment in ultra-low temperature storage and specialized handling services. The expansion of e-pharmacies and direct-to-patient delivery models creates opportunities for decentralized micro-fulfillment centers and enhanced last-mile logistics solutions. Advancements in blockchain technology offer enhanced supply chain transparency and security, presenting opportunities for integrated track-and-trace systems. The growing focus on sustainability in logistics also opens avenues for eco-friendly warehousing solutions, such as solar-powered facilities and optimized energy consumption. Furthermore, untapped potential exists in providing specialized warehousing for emerging therapeutic areas and emerging markets within North America.

Major Players in the North America Pharmaceutical Warehousing Market Ecosystem

- UPS Healthcare

- C H Robinson

- FedEx Corporation

- American Airlines Cargo

- Cardinal Health

- Langham Logistics

- McKesson Corporation

- MD Logistics

- Deutsche Post DHL

- AmerisourceBergen Corp

Key Developments in North America Pharmaceutical Warehousing Market Industry

- June 2023: McKesson Canada opened its new 233,000 sq ft pharmaceutical distribution facility in Surrey. The facility, up and running since March, provides medical supplies, vaccines, specialty medications, and OTC products to over 1,300 medical facilities, clinics, and pharmacies throughout British Columbia. This expansion bolsters McKesson’s distribution network and enhances its ability to serve the Canadian healthcare market with critical pharmaceutical products.

- February 2023: Langham Logistics, one of the leading third-party logistics and freight management companies, opened its third warehouse in Whiteland, Indiana. This latest warehouse boasts 500,000 sq ft of dedicated space. It is designed to maintain storage environments by temperature zone: controlled room temperature (20-25 degrees Celsius), refrigerated (2-8 degrees Celsius), frozen (-20 degrees Celsius), and an ultra-low temperature freezer farm. The new facility will provide access to ocean, air, freight, truckload, expedited, less than truckload, intermodal, and cGDP transport capabilities. It features an environmentally friendly design, including solar energy capture, HVLS fans, LED lights with motion detection, and battery-operated fork trucks. This development signifies a significant investment in advanced pharmaceutical logistics capabilities and sustainable warehousing practices.

Strategic North America Pharmaceutical Warehousing Market Market Forecast

The strategic forecast for the North America pharmaceutical warehousing market is exceptionally promising, driven by sustained demand for pharmaceuticals, increasing complexity of drug supply chains, and continuous technological integration. The market is projected to witness significant expansion, with investments predominantly focused on enhancing cold chain warehousing infrastructure and specialized storage solutions for biologics and high-value therapeutics. The growing adoption of automation, IoT, and AI will further optimize operations, ensuring greater efficiency and compliance. Strategic partnerships and M&A activities will continue to shape the competitive landscape, leading to market consolidation and the emergence of comprehensive end-to-end logistics providers. The expanding e-pharmacy sector and the need for robust last-mile delivery solutions will also present substantial growth opportunities, solidifying the market's trajectory for robust expansion through 2033.

North America Pharmaceutical Warehousing Market Segmentation

-

1. Type

- 1.1. Cold Chain Warehouses

- 1.2. Non-Cold Chain Warehouses

-

2. Application

- 2.1. Pharmaceutical Factory

- 2.2. Pharmacy

- 2.3. Hospital

- 2.4. Others

North America Pharmaceutical Warehousing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Pharmaceutical Warehousing Market Regional Market Share

Geographic Coverage of North America Pharmaceutical Warehousing Market

North America Pharmaceutical Warehousing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The Rise in Demand for Outsourcing Pharmaceutical Warehousing Services4.; Increasing Need for Pharmaceutical Products

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Efficient Logistics Support4.; Stringent Government Regulations

- 3.4. Market Trends

- 3.4.1. Rise in Aged Population in North America is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cold Chain Warehouses

- 5.1.2. Non-Cold Chain Warehouses

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Pharmaceutical Factory

- 5.2.2. Pharmacy

- 5.2.3. Hospital

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 UPS Healthcare

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 C H Robinson

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FedEx Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 American Airlines Cargo

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cardinal Health

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Langham Logistics**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 McKesson Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MD Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Deutsche Post DHL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AmerisourceBergen Corp

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 UPS Healthcare

List of Figures

- Figure 1: North America Pharmaceutical Warehousing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Pharmaceutical Warehousing Market Share (%) by Company 2025

List of Tables

- Table 1: North America Pharmaceutical Warehousing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: North America Pharmaceutical Warehousing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Pharmaceutical Warehousing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: North America Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: North America Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States North America Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Pharmaceutical Warehousing Market?

The projected CAGR is approximately 5.16%.

2. Which companies are prominent players in the North America Pharmaceutical Warehousing Market?

Key companies in the market include UPS Healthcare, C H Robinson, FedEx Corporation, American Airlines Cargo, Cardinal Health, Langham Logistics**List Not Exhaustive, McKesson Corporation, MD Logistics, Deutsche Post DHL, AmerisourceBergen Corp.

3. What are the main segments of the North America Pharmaceutical Warehousing Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 52.66 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; The Rise in Demand for Outsourcing Pharmaceutical Warehousing Services4.; Increasing Need for Pharmaceutical Products.

6. What are the notable trends driving market growth?

Rise in Aged Population in North America is Driving the Market.

7. Are there any restraints impacting market growth?

4.; Lack of Efficient Logistics Support4.; Stringent Government Regulations.

8. Can you provide examples of recent developments in the market?

June 2023: McKesson Canada opened its new 233,000 sq ft pharmaceutical distribution facility in Surrey. The facility, up and running since March, provides medical supplies, vaccines, specialty medications, and OTC products to over 1,300 medical facilities, clinics, and pharmacies throughout British Columbia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Pharmaceutical Warehousing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Pharmaceutical Warehousing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Pharmaceutical Warehousing Market?

To stay informed about further developments, trends, and reports in the North America Pharmaceutical Warehousing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence