Key Insights

The Mexico last-mile delivery market is poised for significant expansion, propelled by the rapid growth of e-commerce and escalating consumer demand for expedited and convenient delivery services. The market, valued at an estimated $200.95 billion in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 12% from 2025 to 2033. Key growth drivers include the surge in online shopping across the consumer & retail and food & beverage sectors, alongside the increasing adoption of same-day delivery, aligning with modern consumer expectations. The proliferation of B2C business models within Mexico further intensifies the need for robust and scalable last-mile delivery networks. Despite potential challenges such as infrastructure constraints and fuel price volatility, the market outlook remains highly positive. Continuous investment in technological advancements, including route optimization software and enhanced logistics infrastructure, is expected to effectively mitigate these challenges and sustain market expansion. Leading global players like DHL, FedEx, and UPS, alongside prominent local providers such as Estafeta and Grupo AMPM, are strategically investing in technology and expanding their delivery capabilities to capitalize on this burgeoning market. Market segmentation by service type (same-day, regular, express) and business model (B2B, B2C, C2C) offers insights into specific market niches and opportunities for tailored strategies.

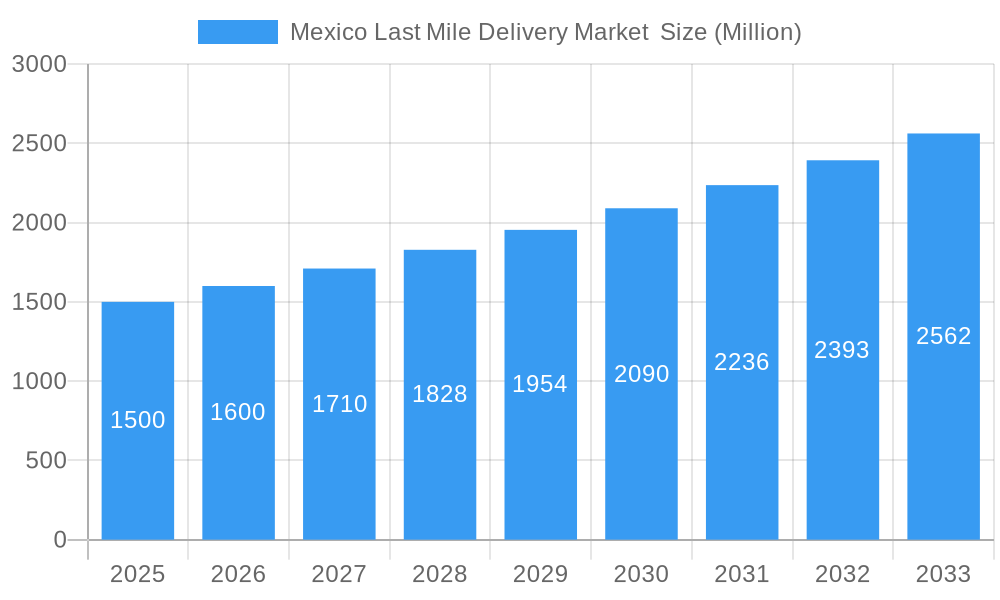

Mexico Last Mile Delivery Market Market Size (In Billion)

The competitive arena features a dynamic interplay between established international logistics providers and strong domestic operators. Global companies bring extensive networks and cutting-edge technology, while local players leverage their in-depth understanding of the Mexican market and established local relationships, fostering innovation and optimized service delivery. The pharmaceutical and healthcare sector is emerging as a notable growth catalyst, driven by the escalating demand for punctual delivery of medications and medical supplies. The forecast period (2025-2033) indicates sustained market growth, fueled by ongoing e-commerce expansion, heightened consumer expectations, and consistent investment in technological solutions designed to improve delivery efficiency and elevate customer satisfaction, presenting ample opportunities for both incumbent and emerging market participants.

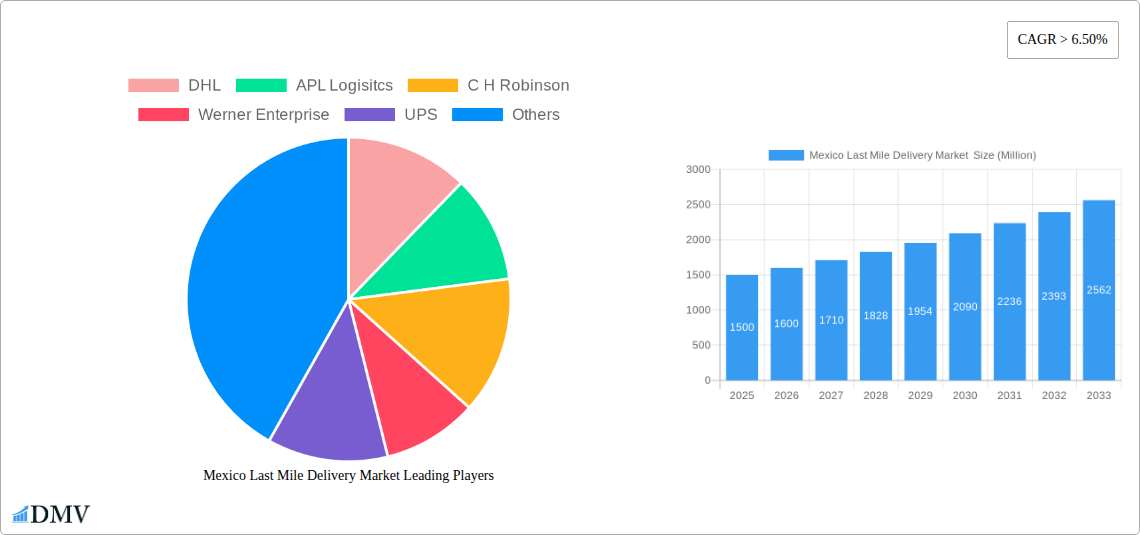

Mexico Last Mile Delivery Market Company Market Share

Mexico Last Mile Delivery Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the burgeoning Mexico last mile delivery market, offering invaluable insights for stakeholders seeking to navigate this dynamic landscape. Spanning the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this study meticulously examines market trends, competitive dynamics, and future growth prospects. The report delves deep into key segments, including B2B, B2C, and C2C deliveries, across various end-user industries like Consumer & Retail, Food & Beverages, and Pharmaceuticals & Healthcare. Discover the impact of technological advancements on same-day delivery, regular delivery, and other express delivery services, and understand the challenges and opportunities shaping this crucial sector. The report features detailed profiles of key players, including DHL, UPS, FedEx, Grupo AMPM, Estafeta, and more, providing crucial data for informed decision-making. This report is essential for investors, businesses, and industry analysts seeking a complete understanding of the Mexico last mile delivery market.

Mexico Last Mile Delivery Market Market Composition & Trends

The Mexico last mile delivery market is experiencing significant growth, driven by e-commerce expansion and rising consumer expectations. Market concentration is moderate, with a few major players holding significant shares, while numerous smaller companies compete in niche segments. Innovation is fueled by technological advancements in logistics technology, such as route optimization software and autonomous delivery vehicles. The regulatory landscape is evolving, with ongoing efforts to improve infrastructure and streamline delivery processes. Substitute products, such as in-store pickup and curbside delivery, are gaining traction, posing a challenge to traditional last-mile delivery providers. M&A activity has been moderate, with deal values ranging from xx Million to xx Million in recent years. Key end-users include:

- Consumer & Retail: This segment holds the largest market share, estimated at xx% in 2025, driven by the booming e-commerce sector.

- Food & Beverages: Experiencing rapid growth with the rise of online grocery delivery platforms. Market share estimated at xx% in 2025.

- Pharmaceuticals & Healthcare: This segment requires specialized handling and stringent regulations, presenting both challenges and opportunities. Market share estimated at xx% in 2025.

- Others: This segment includes various industries leveraging last-mile delivery services, estimated at xx% market share in 2025.

Market share distribution among major players is as follows (2025 estimates): DHL (xx%), UPS (xx%), FedEx (xx%), Grupo AMPM (xx%), Estafeta (xx%), Others (xx%).

Mexico Last Mile Delivery Market Industry Evolution

The Mexico last mile delivery market has witnessed substantial growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth trajectory is projected to continue during the forecast period (2025-2033), with a projected CAGR of xx%, driven by several key factors. Technological advancements, such as the adoption of delivery management systems (DMS) and the increased utilization of mobile tracking apps, have significantly enhanced efficiency and transparency. Simultaneously, shifting consumer demands, particularly a preference for faster and more convenient delivery options, including same-day delivery and flexible delivery windows, are reshaping the market landscape. The penetration rate of e-commerce in Mexico continues to rise, further stimulating demand for last-mile delivery services. Growth in specific segments like food and beverage delivery has accelerated, showing CAGR of xx% during the historical period and projected to reach xx% during the forecast period. The adoption rate of innovative technologies, such as drones and autonomous vehicles, while still nascent, is expected to grow steadily, contributing to future market expansion.

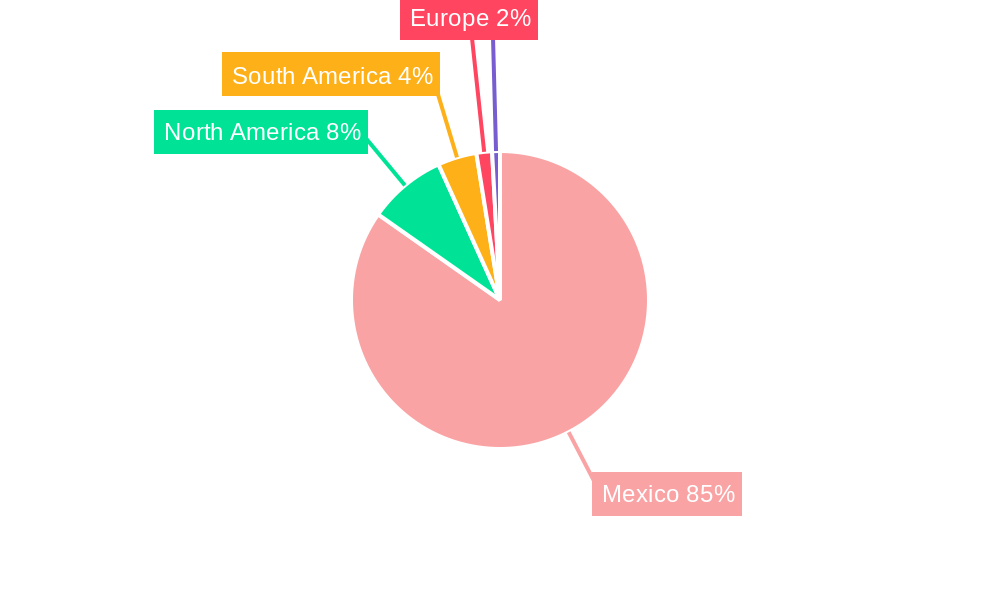

Leading Regions, Countries, or Segments in Mexico Last Mile Delivery Market

The Mexico last mile delivery market is geographically diverse, with significant activity across major metropolitan areas. However, the Mexico City metropolitan area currently holds the dominant position, contributing the largest share of the market due to high population density and robust e-commerce activity.

By End User:

- Consumer & Retail: Remains the leading segment due to strong e-commerce growth.

- Food & Beverages: Shows the highest growth rate due to increasing online grocery orders.

- Pharmaceuticals & Healthcare: Experiences steady growth driven by demand for timely medication delivery.

By Service:

- Same-Day Delivery: Demonstrates strong growth, fueled by consumer preference for speed and convenience.

- Regular Delivery: Continues to be a significant segment due to its cost-effectiveness for less time-sensitive goods.

By Business:

- B2C: This segment dominates the market due to the high volume of online consumer purchases.

Key Drivers for Dominance:

- Investment Trends: Significant investments in logistics infrastructure and technology are supporting market expansion in major metropolitan areas.

- Regulatory Support: Government initiatives to improve logistics infrastructure and ease regulatory hurdles further contribute to growth.

The dominance of these segments and regions is primarily driven by higher e-commerce penetration, denser populations, and better infrastructure, fostering rapid growth and intense competition.

Mexico Last Mile Delivery Market Product Innovations

Recent product innovations within the Mexico last mile delivery market focus on enhancing efficiency, tracking, and convenience. This includes the development of sophisticated route optimization software that minimizes delivery times and fuel consumption, along with advanced tracking systems providing real-time updates to both businesses and consumers. Furthermore, the introduction of contactless delivery options and flexible delivery windows caters to evolving consumer preferences and safety concerns. The integration of mobile apps allows for seamless order placement, tracking, and communication, enhancing overall customer experience. The introduction of specialized vehicles for temperature-sensitive goods, such as refrigerated vans and insulated containers, caters to the growing demand for food and pharmaceutical deliveries. These innovations contribute to improved delivery speed, reduced costs, and enhanced customer satisfaction, bolstering the sector's growth.

Propelling Factors for Mexico Last Mile Delivery Market Growth

The growth of the Mexico last mile delivery market is propelled by several key factors. Technological advancements, such as the widespread adoption of GPS tracking, route optimization software, and delivery management systems, have substantially improved efficiency and delivery speeds. The burgeoning e-commerce sector continues to fuel demand, with a growing number of consumers opting for online shopping. Government initiatives to improve infrastructure, such as investing in better roads and logistics hubs, are creating a more favorable environment for last-mile delivery operations. Economic growth and rising disposable incomes are further increasing consumer spending, leading to a surge in online purchases and the subsequent demand for faster and more reliable deliveries.

Obstacles in the Mexico Last Mile Delivery Market

The Mexico last mile delivery market faces several challenges. Regulatory hurdles, such as complex permitting processes and inconsistent enforcement of regulations, can hinder efficient operations. Supply chain disruptions, especially those related to fuel prices and the availability of vehicles, can impact delivery costs and reliability. The intense competition among numerous players, including both established logistics companies and smaller, emerging businesses, creates price pressures and makes it difficult for some businesses to achieve profitability. Traffic congestion in major metropolitan areas adds significant time and cost to deliveries, hindering timely delivery performance and increasing operational expenses. These challenges necessitate strategic adjustments and innovative solutions to ensure sustained growth.

Future Opportunities in Mexico Last Mile Delivery Market

Future opportunities in the Mexico last mile delivery market abound. The expansion into underserved rural areas presents significant potential for growth, especially with the increasing penetration of e-commerce in these regions. The adoption of new technologies, such as drone delivery and autonomous vehicles, holds the promise of revolutionizing last-mile logistics, enhancing efficiency, and reducing costs. The increasing demand for specialized delivery services, such as temperature-controlled transportation and same-day delivery for specific industries, creates niche market opportunities. Catering to the changing consumer preferences for flexibility and transparency through personalized delivery options and enhanced tracking capabilities will also provide avenues for growth and differentiation.

Major Players in the Mexico Last Mile Delivery Market Ecosystem

- DHL

- APL Logistics

- C.H. Robinson

- Werner Enterprises

- UPS

- FedEx

- Grupo AMPM

- Estafeta

- Paquet Express

- Seabay Logistics

- DSV

Key Developments in Mexico Last Mile Delivery Market Industry

- 2023-Q3: Grupo AMPM announced a major expansion of its delivery network in Southern Mexico.

- 2022-Q4: Estafeta launched a new same-day delivery service targeting the e-commerce sector.

- 2021-Q2: DHL invested in a new sorting facility in Mexico City to improve delivery efficiency.

- 2020-Q1: UPS partnered with a local technology company to implement a new route optimization system.

(Note: This list is not exhaustive and represents a selection of significant developments. The full report will provide a more comprehensive overview.)

Strategic Mexico Last Mile Delivery Market Forecast

The Mexico last mile delivery market is poised for continued robust growth over the forecast period (2025-2033). Driven by ongoing e-commerce expansion, technological advancements, and supportive government initiatives, the market will experience significant expansion, with substantial growth potential in underserved regions and the adoption of innovative delivery solutions. Opportunities exist in the development and deployment of next-generation technologies like drone delivery, autonomous vehicles, and advanced route optimization software. The continued growth of e-commerce, particularly in food and beverage delivery, and the rise of personalized delivery options will also fuel market expansion. The market's strong trajectory, coupled with an evolving regulatory landscape, points towards a positive outlook for the years to come.

Mexico Last Mile Delivery Market Segmentation

-

1. Service

- 1.1. Same-Day Delivery

- 1.2. Regular Delivery

- 1.3. Other Express Delivery

-

2. Business

- 2.1. B2B (Business-to-Business)

- 2.2. B2C (Business-to-Consumer)

- 2.3. C2C (Customer-to-Customer)

-

3. End User

- 3.1. Consumer & Retail

- 3.2. Food & Beverages

- 3.3. Pharmaceuticals & Healthcare

- 3.4. Others

Mexico Last Mile Delivery Market Segmentation By Geography

- 1. Mexico

Mexico Last Mile Delivery Market Regional Market Share

Geographic Coverage of Mexico Last Mile Delivery Market

Mexico Last Mile Delivery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Humanitarian and disaster relief operations driving the market; Efforts of Mordernization enhancing the market

- 3.3. Market Restrains

- 3.3.1. Changes in the government policies might affect the market; Insufficient transportation networks affecting the market

- 3.4. Market Trends

- 3.4.1. Mexican online grocers are rapidly expanding their presence in other Latin American countries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Last Mile Delivery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Same-Day Delivery

- 5.1.2. Regular Delivery

- 5.1.3. Other Express Delivery

- 5.2. Market Analysis, Insights and Forecast - by Business

- 5.2.1. B2B (Business-to-Business)

- 5.2.2. B2C (Business-to-Consumer)

- 5.2.3. C2C (Customer-to-Customer)

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Consumer & Retail

- 5.3.2. Food & Beverages

- 5.3.3. Pharmaceuticals & Healthcare

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DHL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 APL Logisitcs

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 C H Robinson

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Werner Enterprise

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 UPS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FedEx

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Grupo AMPM

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Estafeta

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Paquet Express

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Seabay Logistics**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 DSV

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 DHL

List of Figures

- Figure 1: Mexico Last Mile Delivery Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Mexico Last Mile Delivery Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Last Mile Delivery Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Mexico Last Mile Delivery Market Revenue billion Forecast, by Business 2020 & 2033

- Table 3: Mexico Last Mile Delivery Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Mexico Last Mile Delivery Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Mexico Last Mile Delivery Market Revenue billion Forecast, by Service 2020 & 2033

- Table 6: Mexico Last Mile Delivery Market Revenue billion Forecast, by Business 2020 & 2033

- Table 7: Mexico Last Mile Delivery Market Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Mexico Last Mile Delivery Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Last Mile Delivery Market ?

The projected CAGR is approximately 12%.

2. Which companies are prominent players in the Mexico Last Mile Delivery Market ?

Key companies in the market include DHL, APL Logisitcs, C H Robinson, Werner Enterprise, UPS, FedEx, Grupo AMPM, Estafeta, Paquet Express, Seabay Logistics**List Not Exhaustive, DSV.

3. What are the main segments of the Mexico Last Mile Delivery Market ?

The market segments include Service, Business, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 200.95 billion as of 2022.

5. What are some drivers contributing to market growth?

Humanitarian and disaster relief operations driving the market; Efforts of Mordernization enhancing the market.

6. What are the notable trends driving market growth?

Mexican online grocers are rapidly expanding their presence in other Latin American countries.

7. Are there any restraints impacting market growth?

Changes in the government policies might affect the market; Insufficient transportation networks affecting the market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Last Mile Delivery Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Last Mile Delivery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Last Mile Delivery Market ?

To stay informed about further developments, trends, and reports in the Mexico Last Mile Delivery Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence