Key Insights

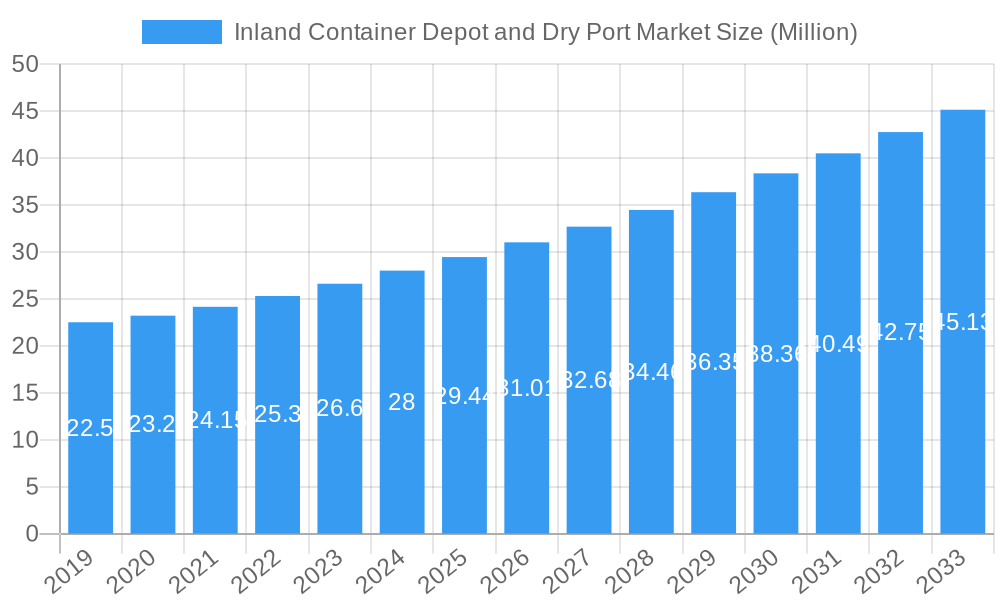

The Inland Container Depot (ICD) and Dry Port Market is poised for robust growth, projected to reach a significant market size of $29.44 million and expand at a Compound Annual Growth Rate (CAGR) exceeding 5.45% from 2025 to 2033. This expansion is primarily fueled by the escalating volume of international trade and the increasing need for efficient and integrated logistics solutions to manage container traffic beyond traditional port boundaries. Key drivers include the growing emphasis on supply chain optimization, the expansion of e-commerce, and government initiatives aimed at improving multimodal transportation infrastructure. As global trade networks become more complex, the demand for sophisticated storage, handling, and maintenance services within these inland hubs is intensifying. Furthermore, the evolving landscape of container types, with a notable rise in the use of refrigerated (reefer) containers to support the global food and pharmaceutical industries, presents a significant opportunity for specialized service providers.

Inland Container Depot and Dry Port Market Market Size (In Million)

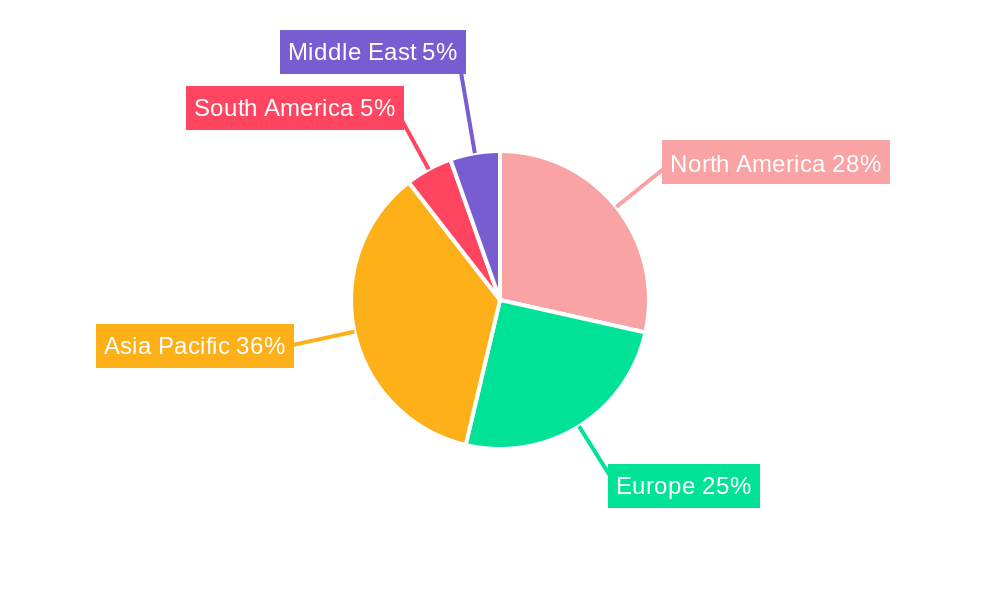

The market is segmented by both service offerings and container types, reflecting the diverse needs of the logistics ecosystem. Services such as storage, handling, and maintenance and repair are critical components of the ICD and dry port value chain. Simultaneously, the distinction between general-purpose containers and specialized refrigerated containers highlights the growing demand for temperature-controlled logistics. Geographically, the market is witnessing substantial activity across North America, Europe, and Asia Pacific, with burgeoning potential in South America and the Middle East. Leading players like Maersk, DP World, and Hapag-Lloyd are actively investing in expanding their infrastructure and service capabilities to cater to this expanding market. While the growth trajectory is strong, potential restraints such as high initial infrastructure investment costs and regulatory hurdles in certain regions may influence the pace of development. However, the overall outlook remains highly positive, driven by the imperative for streamlined and cost-effective container logistics solutions.

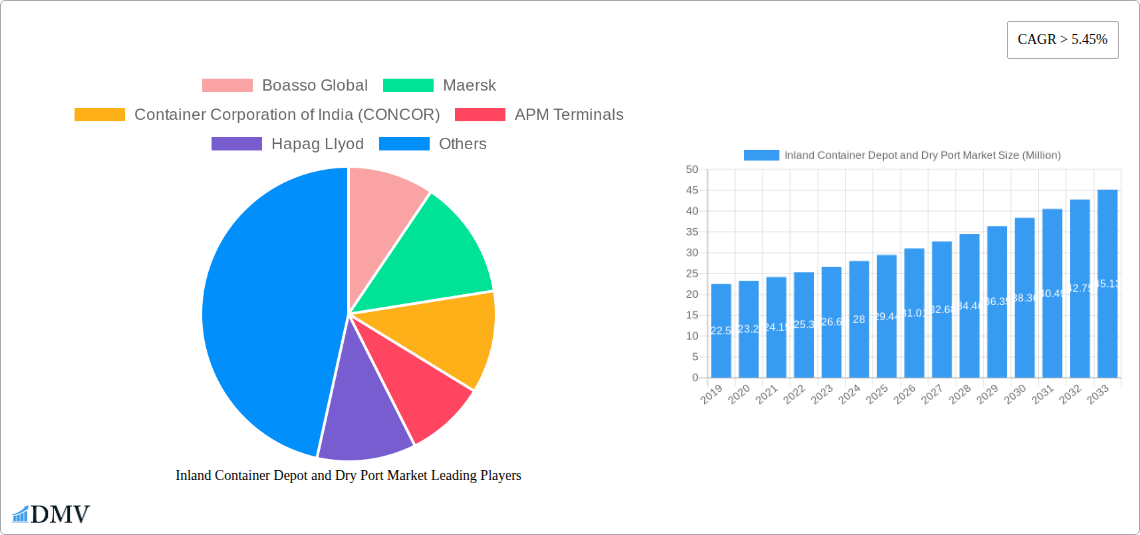

Inland Container Depot and Dry Port Market Company Market Share

Unlocking the Potential: Inland Container Depot and Dry Port Market Report 2024-2033

SEO Optimized Title: Inland Container Depot & Dry Port Market: Growth Drivers, Forecasts, Key Players (Maersk, CONCOR, DP World), and Industry Trends 2024-2033

Report Description:

This comprehensive report, "Inland Container Depot and Dry Port Market Analysis: Strategic Insights & Forecasts 2024-2033," delves deep into the dynamic global market for inland container depots and dry ports. Providing an in-depth understanding of market composition, industry evolution, and future opportunities, this report is an essential resource for logistics providers, terminal operators, investors, and policymakers. Analyzing the market from 2019 to 2033, with a base and estimated year of 2025, we dissect crucial trends, competitive landscapes, and technological advancements shaping this vital sector.

This in-depth market research report offers a detailed examination of the Inland Container Depot and Dry Port Market, providing strategic insights and robust forecasts from 2024 to 2033. The study period spans from 2019 to 2033, with a specific focus on the base year of 2025 and a forecast period from 2025 to 2033. We meticulously analyze historical trends from 2019-2024, uncovering the foundational growth drivers and market shifts. The report covers essential segments including storage, handling, maintenance and repair services for general and refrigerated (reefer) containers. Key industry developments from February 2024 and January 2024 are thoroughly examined, alongside an exhaustive list of major players and their strategic moves. Whether you are a logistics company seeking to optimize operations, an investor identifying high-growth opportunities, or a stakeholder looking for comprehensive market intelligence, this report equips you with the actionable insights needed to navigate and capitalize on the burgeoning inland container depot and dry port sector.

Inland Container Depot and Dry Port Market Composition & Trends

The Inland Container Depot and Dry Port Market is characterized by a moderate to high degree of market concentration, with several large global players alongside numerous regional and specialized operators. Innovation is largely driven by the need for enhanced efficiency, digitalization, and sustainability in logistics operations. Regulatory landscapes vary significantly by region, with governments increasingly focused on infrastructure development, trade facilitation, and environmental standards. Substitute products are limited, with the core function of these facilities being essential for intermodal transport. End-user profiles are diverse, encompassing shipping lines, freight forwarders, manufacturers, and retailers, all reliant on these hubs for efficient cargo movement. Merger and acquisition (M&A) activities are a significant trend, as companies seek to expand their geographic footprint, enhance service offerings, and achieve economies of scale. For instance, recent acquisitions highlight the consolidation trend, with deal values often running into the tens of millions.

- Market Concentration: Dominated by a mix of global logistics giants and specialized regional providers.

- Innovation Catalysts: Focus on automation, digital twin technology, AI-powered optimization, and green logistics solutions.

- Regulatory Landscapes: Evolving policies related to customs procedures, environmental compliance (e.g., emissions standards), and freeport incentives.

- Substitute Products: Limited, with the primary alternative being direct port-to-destination trucking, which is often less efficient and cost-effective for long distances.

- End-User Profiles: Primarily consists of B2B entities involved in international and domestic trade, requiring efficient multimodal connectivity.

- M&A Activities: Strategic acquisitions aimed at market expansion, service diversification, and vertical integration are prevalent. M&A deal values can reach tens of millions of dollars.

Inland Container Depot and Dry Port Market Industry Evolution

The evolution of the Inland Container Depot and Dry Port Market is a compelling narrative of adaptation and growth, directly mirroring the expansion of global trade and the increasing sophistication of supply chain management. Historically, these facilities emerged as necessary extensions of congested seaports, offering space for container storage, customs clearance, and consolidation away from prime coastal real estate. The period from 2019-2024 has witnessed significant acceleration in this evolution. The market has moved beyond mere storage and handling to encompass a broader spectrum of value-added services. Technological advancements have been a pivotal force, with the adoption of sophisticated Warehouse Management Systems (WMS), Transportation Management Systems (TMS), and automation technologies like automated guided vehicles (AGVs) and robotic stacking systems becoming more prevalent. These innovations have not only boosted operational efficiency but also enhanced cargo visibility and reduced turnaround times, crucial for today's fast-paced logistics environment.

Shifting consumer demands, driven by the rise of e-commerce and the expectation of faster delivery times, have also profoundly influenced the industry. This has led to a greater emphasis on last-mile connectivity and the integration of dry ports and inland depots into broader distribution networks. Furthermore, the increasing complexity of global supply chains, punctuated by events like the COVID-19 pandemic, has highlighted the resilience and strategic importance of these inland hubs in mitigating disruptions and ensuring cargo flow. The market has responded by expanding service offerings to include container maintenance and repair, specialized handling for reefer cargo, and the integration of intermodal rail and road connectivity. Growth rates for key infrastructure projects have seen double-digit percentage increases in regions investing heavily in trade facilitation. For instance, the adoption of digital platforms for cargo tracking and booking has seen over 60% of transactions moving online in leading markets, signifying a substantial shift in operational paradigms and a commitment to enhanced customer experience. The strategic placement of these depots, often within or near freeports, further amplifies their economic contribution by offering fiscal incentives and streamlined customs procedures. The continuous investment in infrastructure upgrades, such as expanding yard capacity and improving rail links, underscores the industry's commitment to meeting future trade demands and fostering a more efficient global logistics ecosystem.

Leading Regions, Countries, or Segments in Inland Container Depot and Dry Port Market

The dominance within the Inland Container Depot and Dry Port Market is a multifaceted phenomenon, driven by a confluence of economic activity, strategic investment, and supportive government policies. While numerous regions exhibit robust growth, certain areas have emerged as clear leaders, particularly in the Storage and Handling services for General Containers, due to their pivotal role in global trade routes and manufacturing hubs.

Dominant Segments and Regions:

- Service: Storage & Handling: These services form the bedrock of the inland container depot and dry port industry. Their dominance is directly linked to the sheer volume of containerized cargo flowing through major economic arteries. Regions with extensive manufacturing bases and significant import/export volumes naturally lead in the demand for these core services.

- Type of Container: General: While specialized containers like reefers are critical, general-purpose containers constitute the vast majority of global containerized trade. Consequently, the infrastructure and services catering to general containers in dry ports and depots naturally command a larger market share.

Key Drivers of Dominance:

- Investment Trends: Major economic powerhouses and emerging trade nations are channeling substantial investment into developing state-of-the-art dry ports and inland terminals. For example, countries in Asia, particularly China, India, and Southeast Asian nations, have seen massive investments exceeding several billion dollars in expanding their logistics infrastructure, including inland ports. This investment is crucial for accommodating growing trade volumes and improving connectivity to hinterlands.

- Regulatory Support: Governments play a critical role in fostering the growth of these facilities. Policies aimed at trade facilitation, such as simplified customs procedures, tax incentives for businesses operating within freeports or special economic zones, and streamlined land acquisition processes, are significant catalysts. The establishment of freeport initiatives, like the one mentioned for the East Midlands Gateway campus in the UK, is a prime example of regulatory support designed to boost economic activity and enhance logistics efficiency. This often translates into reduced operational costs and faster cargo throughput, making these regions highly attractive.

- Connectivity and Infrastructure: Proximity to major seaports, coupled with excellent rail and road connectivity, is paramount. Regions with well-developed intermodal networks can efficiently transfer containers from ports to inland locations and vice versa. The strategic location of facilities near major UK ports like Felixstowe, Liverpool, and Southampton, combined with access to the nation's rail, road, and air networks, exemplifies this advantage. Such connectivity dramatically reduces transit times and logistics costs, thereby increasing the attractiveness and operational capacity of inland depots.

- Economic Hubs and Manufacturing Centers: The presence of large industrial zones and manufacturing clusters drives the demand for efficient container handling and storage solutions. Companies based in these hubs rely heavily on dry ports to manage their inbound raw materials and outbound finished goods, making these regions inherently dominant in the market. The concentration of manufacturing in countries like China and its extensive network of inland ports directly reflects this correlation.

Inland Container Depot and Dry Port Market Product Innovations

Product innovation in the Inland Container Depot and Dry Port Market is largely centered on digital transformation and operational efficiency. Companies are increasingly integrating advanced IoT sensors for real-time tracking of container conditions, temperature monitoring for reefers, and predictive maintenance for equipment. The development of AI-powered yard management systems optimizes container placement and retrieval, significantly reducing dwell times and improving space utilization. Furthermore, sustainable practices are driving innovation in areas like electric-powered yard equipment and the adoption of renewable energy sources for depot operations. The unique selling proposition of these innovations lies in their ability to enhance supply chain visibility, reduce operational costs, and improve the overall reliability and speed of cargo movement, thereby providing a competitive edge in the global logistics arena.

Propelling Factors for Inland Container Depot and Dry Port Market Growth

The Inland Container Depot and Dry Port Market is experiencing robust growth, propelled by several interconnected factors. Firstly, the relentless expansion of global e-commerce necessitates more efficient and geographically dispersed logistics hubs to facilitate faster last-mile delivery and manage increasing volumes of smaller shipments. Secondly, ongoing investments in infrastructure development by governments worldwide, particularly in emerging economies, are creating new opportunities for dry ports and inland depots. For instance, initiatives aimed at decongesting major seaports and improving hinterland connectivity directly benefit this sector. Thirdly, technological advancements, including automation, digitalization, and the adoption of AI-driven management systems, are enhancing operational efficiency, reducing costs, and improving cargo visibility, making these facilities indispensable. Finally, the increasing trend towards supply chain resilience and diversification, driven by geopolitical events and trade uncertainties, is encouraging businesses to establish more distributed logistics networks, further fueling the demand for strategically located inland container facilities.

Obstacles in the Inland Container Depot and Dry Port Market Market

Despite its significant growth potential, the Inland Container Depot and Dry Port Market faces several considerable obstacles. Regulatory hurdles and complex customs procedures in certain regions can lead to delays and increased administrative burdens, hindering efficient cargo movement. Supply chain disruptions, such as port congestion, labor shortages, and unpredictable demand fluctuations, can significantly impact the operational capacity and cost-effectiveness of these facilities. Intense competitive pressure from existing players and the emergence of new entrants can lead to price wars and reduced profit margins. Furthermore, the high capital investment required for establishing and upgrading these facilities, coupled with land acquisition challenges in prime locations, presents a significant barrier to entry and expansion. Finally, the lack of standardized technological integration across different operators can create inefficiencies in data sharing and intermodal coordination.

Future Opportunities in Inland Container Depot and Dry Port Market

The future of the Inland Container Depot and Dry Port Market is brimming with opportunities. The burgeoning demand for specialized logistics services, such as temperature-controlled storage for pharmaceuticals and perishables, presents a significant growth avenue for Refrigerated (Reefer) Container handling. The continued expansion of e-commerce and the ongoing development of smart cities will drive the need for more sophisticated, digitally integrated, and strategically located inland hubs closer to consumption centers. Emerging technologies like blockchain for enhanced supply chain transparency and autonomous vehicles for internal yard operations offer further avenues for innovation and efficiency gains. Furthermore, the increasing focus on sustainable logistics practices creates opportunities for depots that adopt green technologies and renewable energy sources, attracting environmentally conscious clients and aligning with global sustainability goals. The development of advanced cargo consolidation and deconsolidation services tailored for specific industries will also create niche market opportunities.

Major Players in the Inland Container Depot and Dry Port Market Ecosystem

- Boasso Global

- Maersk

- Container Corporation of India (CONCOR)

- APM Terminals

- Hapag Llyod

- Hutchison Ports

- GAC

- DP World

- Abu Dhabi Terminals

- Freightliner Group Ltd

- 7 3 Other Companies

Key Developments in Inland Container Depot and Dry Port Market Industry

- February 2024: Quala and Boasso Global, key players in the tank trailer and ISO tank container industry specializing in cleaning, maintenance, storage, and transportation services, completed the acquisition of Mainport Tank Cleaning BV, Mainport Tank Container Services Botlek BV, and Mainport Tank Container Services Moerdijk BV – collectively referred to as "MTC" – from Matrans Holding BV, headquartered in Rotterdam, Netherlands. MTC is renowned for its excellence in tank cleaning and ISO tank container depot services.

- January 2024: Maersk established a 'center of excellence' at the East Midlands Gateway campus. The campus, featuring a 695,000 sq ft warehouse, a rail terminal managed by Maritime, and a 14-acre container depot, all situated within a freeport, is well-positioned to champion this streamlined approach. Moreover, its strategic location, near major UK ports like Felixstowe, Liverpool, and Southampton, alongside easy access to the nation's rail, road network, and key airports, enhances its allure.

Strategic Inland Container Depot and Dry Port Market Market Forecast

The Inland Container Depot and Dry Port Market is poised for significant and sustained growth over the forecast period of 2025–2033. Key growth catalysts include the continuing expansion of global trade, driven by e-commerce and the increasing interconnectedness of economies. Strategic investments in multimodal logistics infrastructure, particularly in developing regions, will create new hubs and expand existing capacities. The adoption of advanced digital technologies, such as AI and IoT, will revolutionize operational efficiency and cargo visibility, making inland depots more attractive. Furthermore, the growing emphasis on supply chain resilience and sustainability will encourage businesses to diversify their logistics networks and opt for greener, more efficient inland solutions. The market potential is substantial, driven by the essential role these facilities play in the modern global supply chain, ensuring the smooth and cost-effective movement of goods from origin to destination.

Inland Container Depot and Dry Port Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Handling

- 1.3. Maintenance and Repair

-

2. Type of Container

- 2.1. General

- 2.2. Refrigerated (Reefer)

Inland Container Depot and Dry Port Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Chile

-

5. Middle East

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East

Inland Container Depot and Dry Port Market Regional Market Share

Geographic Coverage of Inland Container Depot and Dry Port Market

Inland Container Depot and Dry Port Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Multimodal Connectivity Boosts Demand for Inland Container Depots

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Inland Container Depot and Dry Port Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Handling

- 5.1.3. Maintenance and Repair

- 5.2. Market Analysis, Insights and Forecast - by Type of Container

- 5.2.1. General

- 5.2.2. Refrigerated (Reefer)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America Inland Container Depot and Dry Port Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Storage

- 6.1.2. Handling

- 6.1.3. Maintenance and Repair

- 6.2. Market Analysis, Insights and Forecast - by Type of Container

- 6.2.1. General

- 6.2.2. Refrigerated (Reefer)

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Europe Inland Container Depot and Dry Port Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Storage

- 7.1.2. Handling

- 7.1.3. Maintenance and Repair

- 7.2. Market Analysis, Insights and Forecast - by Type of Container

- 7.2.1. General

- 7.2.2. Refrigerated (Reefer)

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Asia Pacific Inland Container Depot and Dry Port Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Storage

- 8.1.2. Handling

- 8.1.3. Maintenance and Repair

- 8.2. Market Analysis, Insights and Forecast - by Type of Container

- 8.2.1. General

- 8.2.2. Refrigerated (Reefer)

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. South America Inland Container Depot and Dry Port Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Storage

- 9.1.2. Handling

- 9.1.3. Maintenance and Repair

- 9.2. Market Analysis, Insights and Forecast - by Type of Container

- 9.2.1. General

- 9.2.2. Refrigerated (Reefer)

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Middle East Inland Container Depot and Dry Port Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Storage

- 10.1.2. Handling

- 10.1.3. Maintenance and Repair

- 10.2. Market Analysis, Insights and Forecast - by Type of Container

- 10.2.1. General

- 10.2.2. Refrigerated (Reefer)

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Boasso Global

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Maersk

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Container Corporation of India (CONCOR)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 APM Terminals

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hapag Llyod

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hutchison Ports

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GAC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DP World

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Abu Dhabi Terminals

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Freightliner Group Ltd**List Not Exhaustive 7 3 Other Companie

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Boasso Global

List of Figures

- Figure 1: Global Inland Container Depot and Dry Port Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Inland Container Depot and Dry Port Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Inland Container Depot and Dry Port Market Revenue (Million), by Service 2025 & 2033

- Figure 4: North America Inland Container Depot and Dry Port Market Volume (Billion), by Service 2025 & 2033

- Figure 5: North America Inland Container Depot and Dry Port Market Revenue Share (%), by Service 2025 & 2033

- Figure 6: North America Inland Container Depot and Dry Port Market Volume Share (%), by Service 2025 & 2033

- Figure 7: North America Inland Container Depot and Dry Port Market Revenue (Million), by Type of Container 2025 & 2033

- Figure 8: North America Inland Container Depot and Dry Port Market Volume (Billion), by Type of Container 2025 & 2033

- Figure 9: North America Inland Container Depot and Dry Port Market Revenue Share (%), by Type of Container 2025 & 2033

- Figure 10: North America Inland Container Depot and Dry Port Market Volume Share (%), by Type of Container 2025 & 2033

- Figure 11: North America Inland Container Depot and Dry Port Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Inland Container Depot and Dry Port Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North America Inland Container Depot and Dry Port Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Inland Container Depot and Dry Port Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Inland Container Depot and Dry Port Market Revenue (Million), by Service 2025 & 2033

- Figure 16: Europe Inland Container Depot and Dry Port Market Volume (Billion), by Service 2025 & 2033

- Figure 17: Europe Inland Container Depot and Dry Port Market Revenue Share (%), by Service 2025 & 2033

- Figure 18: Europe Inland Container Depot and Dry Port Market Volume Share (%), by Service 2025 & 2033

- Figure 19: Europe Inland Container Depot and Dry Port Market Revenue (Million), by Type of Container 2025 & 2033

- Figure 20: Europe Inland Container Depot and Dry Port Market Volume (Billion), by Type of Container 2025 & 2033

- Figure 21: Europe Inland Container Depot and Dry Port Market Revenue Share (%), by Type of Container 2025 & 2033

- Figure 22: Europe Inland Container Depot and Dry Port Market Volume Share (%), by Type of Container 2025 & 2033

- Figure 23: Europe Inland Container Depot and Dry Port Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Inland Container Depot and Dry Port Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Europe Inland Container Depot and Dry Port Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Inland Container Depot and Dry Port Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Inland Container Depot and Dry Port Market Revenue (Million), by Service 2025 & 2033

- Figure 28: Asia Pacific Inland Container Depot and Dry Port Market Volume (Billion), by Service 2025 & 2033

- Figure 29: Asia Pacific Inland Container Depot and Dry Port Market Revenue Share (%), by Service 2025 & 2033

- Figure 30: Asia Pacific Inland Container Depot and Dry Port Market Volume Share (%), by Service 2025 & 2033

- Figure 31: Asia Pacific Inland Container Depot and Dry Port Market Revenue (Million), by Type of Container 2025 & 2033

- Figure 32: Asia Pacific Inland Container Depot and Dry Port Market Volume (Billion), by Type of Container 2025 & 2033

- Figure 33: Asia Pacific Inland Container Depot and Dry Port Market Revenue Share (%), by Type of Container 2025 & 2033

- Figure 34: Asia Pacific Inland Container Depot and Dry Port Market Volume Share (%), by Type of Container 2025 & 2033

- Figure 35: Asia Pacific Inland Container Depot and Dry Port Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Inland Container Depot and Dry Port Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Asia Pacific Inland Container Depot and Dry Port Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Inland Container Depot and Dry Port Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Inland Container Depot and Dry Port Market Revenue (Million), by Service 2025 & 2033

- Figure 40: South America Inland Container Depot and Dry Port Market Volume (Billion), by Service 2025 & 2033

- Figure 41: South America Inland Container Depot and Dry Port Market Revenue Share (%), by Service 2025 & 2033

- Figure 42: South America Inland Container Depot and Dry Port Market Volume Share (%), by Service 2025 & 2033

- Figure 43: South America Inland Container Depot and Dry Port Market Revenue (Million), by Type of Container 2025 & 2033

- Figure 44: South America Inland Container Depot and Dry Port Market Volume (Billion), by Type of Container 2025 & 2033

- Figure 45: South America Inland Container Depot and Dry Port Market Revenue Share (%), by Type of Container 2025 & 2033

- Figure 46: South America Inland Container Depot and Dry Port Market Volume Share (%), by Type of Container 2025 & 2033

- Figure 47: South America Inland Container Depot and Dry Port Market Revenue (Million), by Country 2025 & 2033

- Figure 48: South America Inland Container Depot and Dry Port Market Volume (Billion), by Country 2025 & 2033

- Figure 49: South America Inland Container Depot and Dry Port Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Inland Container Depot and Dry Port Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East Inland Container Depot and Dry Port Market Revenue (Million), by Service 2025 & 2033

- Figure 52: Middle East Inland Container Depot and Dry Port Market Volume (Billion), by Service 2025 & 2033

- Figure 53: Middle East Inland Container Depot and Dry Port Market Revenue Share (%), by Service 2025 & 2033

- Figure 54: Middle East Inland Container Depot and Dry Port Market Volume Share (%), by Service 2025 & 2033

- Figure 55: Middle East Inland Container Depot and Dry Port Market Revenue (Million), by Type of Container 2025 & 2033

- Figure 56: Middle East Inland Container Depot and Dry Port Market Volume (Billion), by Type of Container 2025 & 2033

- Figure 57: Middle East Inland Container Depot and Dry Port Market Revenue Share (%), by Type of Container 2025 & 2033

- Figure 58: Middle East Inland Container Depot and Dry Port Market Volume Share (%), by Type of Container 2025 & 2033

- Figure 59: Middle East Inland Container Depot and Dry Port Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East Inland Container Depot and Dry Port Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Middle East Inland Container Depot and Dry Port Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East Inland Container Depot and Dry Port Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Service 2020 & 2033

- Table 3: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Type of Container 2020 & 2033

- Table 4: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Type of Container 2020 & 2033

- Table 5: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Service 2020 & 2033

- Table 8: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Service 2020 & 2033

- Table 9: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Type of Container 2020 & 2033

- Table 10: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Type of Container 2020 & 2033

- Table 11: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Service 2020 & 2033

- Table 18: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Service 2020 & 2033

- Table 19: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Type of Container 2020 & 2033

- Table 20: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Type of Container 2020 & 2033

- Table 21: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Country 2020 & 2033

- Table 23: Germany Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: UK Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: UK Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: France Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: France Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Russia Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Russia Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Spain Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Spain Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of Europe Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Europe Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Service 2020 & 2033

- Table 36: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Service 2020 & 2033

- Table 37: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Type of Container 2020 & 2033

- Table 38: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Type of Container 2020 & 2033

- Table 39: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Country 2020 & 2033

- Table 41: India Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: India Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: China Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: China Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Japan Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Japan Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Asia Pacific Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Service 2020 & 2033

- Table 50: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Service 2020 & 2033

- Table 51: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Type of Container 2020 & 2033

- Table 52: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Type of Container 2020 & 2033

- Table 53: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Country 2020 & 2033

- Table 55: Brazil Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Brazil Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Chile Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Chile Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Service 2020 & 2033

- Table 60: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Service 2020 & 2033

- Table 61: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Type of Container 2020 & 2033

- Table 62: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Type of Container 2020 & 2033

- Table 63: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Country 2020 & 2033

- Table 64: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Country 2020 & 2033

- Table 65: United Arab Emirates Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: United Arab Emirates Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: Saudi Arabia Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Saudi Arabia Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: Rest of Middle East Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Rest of Middle East Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Inland Container Depot and Dry Port Market?

The projected CAGR is approximately > 5.45%.

2. Which companies are prominent players in the Inland Container Depot and Dry Port Market?

Key companies in the market include Boasso Global, Maersk, Container Corporation of India (CONCOR), APM Terminals, Hapag Llyod, Hutchison Ports, GAC, DP World, Abu Dhabi Terminals, Freightliner Group Ltd**List Not Exhaustive 7 3 Other Companie.

3. What are the main segments of the Inland Container Depot and Dry Port Market?

The market segments include Service, Type of Container.

4. Can you provide details about the market size?

The market size is estimated to be USD 29.44 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Multimodal Connectivity Boosts Demand for Inland Container Depots.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2024: Quala and Boasso Global, key players in the tank trailer and ISO tank container industry specializing in cleaning, maintenance, storage, and transportation services, completed the acquisition of Mainport Tank Cleaning BV, Mainport Tank Container Services Botlek BV, and Mainport Tank Container Services Moerdijk BV – collectively referred to as "MTC" – from Matrans Holding BV, headquartered in Rotterdam, Netherlands. MTC is renowned for its excellence in tank cleaning and ISO tank container depot services.January 2024: Maersk established a 'center of excellence' at the East Midlands Gateway campus. The campus, featuring a 695,000 sq ft warehouse, a rail terminal managed by Maritime, and a 14-acre container depot, all situated within a freeport, is well-positioned to champion this streamlined approach. Moreover, its strategic location, near major UK ports like Felixstowe, Liverpool, and Southampton, alongside easy access to the nation's rail, road network, and key airports, enhances its allure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Inland Container Depot and Dry Port Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Inland Container Depot and Dry Port Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Inland Container Depot and Dry Port Market?

To stay informed about further developments, trends, and reports in the Inland Container Depot and Dry Port Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence