Key Insights

The China digital freight forwarding market is poised for substantial expansion, propelled by the nation's flourishing e-commerce landscape, escalating demand for optimized logistics, and government-backed digital transformation initiatives. Projected to achieve a Compound Annual Growth Rate (CAGR) of 5.8%, the market is estimated to reach $4.9 billion by 2025. Segmentation includes enterprise size (SMEs, large enterprises, government) and transport mode (ocean, air, road, rail), catering to diverse shipper requirements. Key international players such as DB Schenker, Flexport, DHL Group, and Kuehne + Nagel compete with domestic leaders like Full Truck Alliance and Cogoport in this dynamic sector. Growth is further stimulated by the widespread adoption of digital freight management platforms, enhancing transparency, efficiency, and cost savings. Challenges persist, including the imperative for robust cybersecurity, seamless integration with legacy systems, and navigating evolving regulatory frameworks.

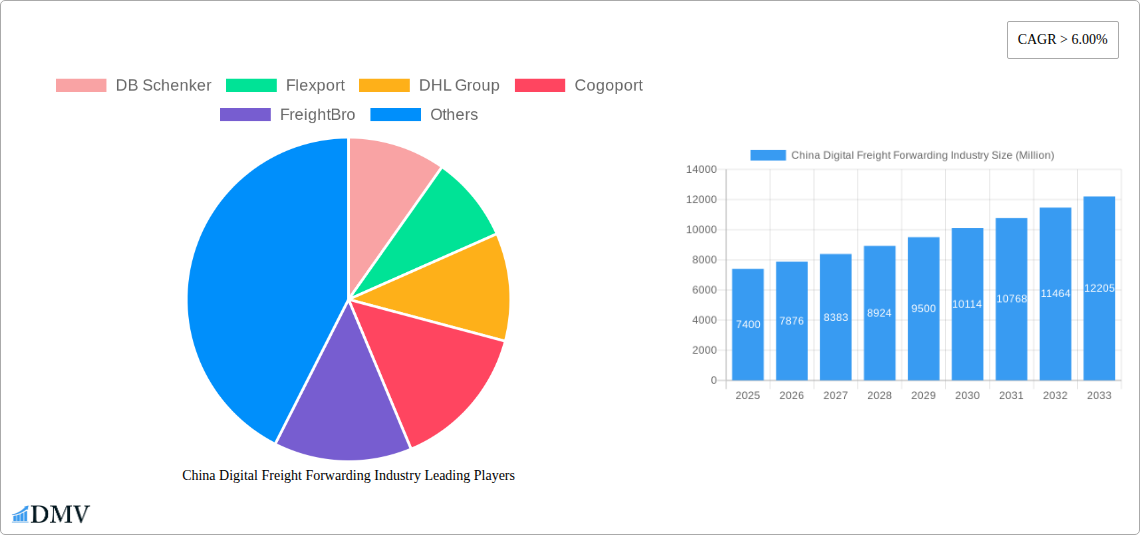

China Digital Freight Forwarding Industry Market Size (In Billion)

The outlook for the China digital freight forwarding market remains highly optimistic, driven by sustained e-commerce growth and the national focus on digital advancement. The industry's trajectory indicates continued robust expansion through the forecast period (2025-2033), attracting significant investment and fostering innovation. Expect an increase in strategic alliances between technology innovators and established logistics providers, leading to more integrated and holistic solutions. Automation and artificial intelligence are set to play a more prominent role in optimizing routes, minimizing transit times, and improving overall operational efficiency. However, potential impacts from evolving global trade policies and economic volatility necessitate proactive strategic planning and adaptability from market participants.

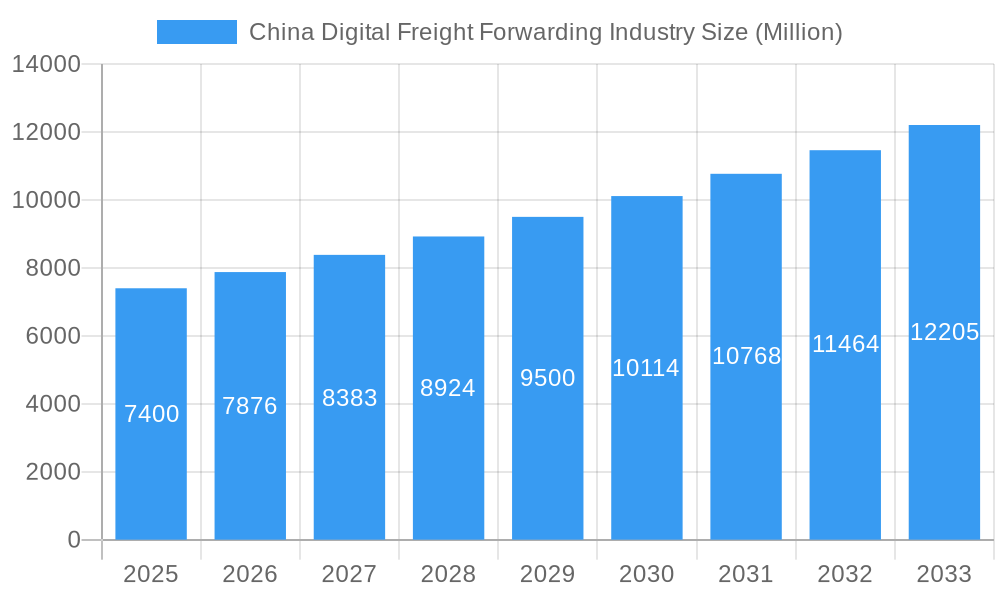

China Digital Freight Forwarding Industry Company Market Share

China Digital Freight Forwarding Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning China digital freight forwarding industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market trends, technological advancements, and key players, providing a robust forecast for future growth. The market is projected to reach xx Million by 2033, showcasing substantial growth opportunities.

China Digital Freight Forwarding Industry Market Composition & Trends

This section meticulously examines the competitive landscape of the China digital freight forwarding market. We delve into market concentration, analyzing the market share distribution among key players like DB Schenker, Flexport, DHL Group, Cogoport, FreightBro, Kuehne + Nagel International AG, WICE Logistics, SINO SHIPPING, Twill, Youtrans, MOOV, Full Truck Alliance (Manbang group), Freightos, and Agility Logistics Pvt Ltd (Shipa Freight). The report further investigates innovation catalysts driving market evolution, including technological advancements and regulatory changes. A detailed analysis of the regulatory landscape, substitute products, end-user profiles (SMEs, large enterprises, and governments), and significant M&A activities, including deal values (xx Million), completes this segment.

- Market Concentration: Analysis of market share held by top players, revealing the level of competition.

- Innovation Catalysts: Identification of key technological drivers and their impact on market growth.

- Regulatory Landscape: Examination of government policies and their influence on industry practices.

- Substitute Products: Assessment of alternative solutions and their potential market impact.

- End-User Profiles: Detailed breakdown of the industry's customer base across different segments.

- M&A Activities: Review of significant mergers and acquisitions, including deal values and their consequences.

China Digital Freight Forwarding Industry Industry Evolution

This section provides a detailed historical and projected analysis of the China digital freight forwarding market's evolution from 2019 to 2033. We explore market growth trajectories, charting the industry's impressive expansion. Specific data points, including annual growth rates (xx%) and adoption metrics for various technologies, illuminate the market's dynamic nature. We discuss the role of technological advancements, such as AI-powered logistics solutions and blockchain technology, in transforming industry operations. Furthermore, we analyze the shifting consumer demands, including increased expectations for transparency, efficiency, and real-time tracking. The impact of these factors on market dynamics is thoroughly examined. The forecast period (2025-2033) highlights the expected growth and potential market disruptions.

Leading Regions, Countries, or Segments in China Digital Freight Forwarding Industry

This section pinpoints the dominant regions, countries, and segments within the China digital freight forwarding market. We analyze the leading segments by firm type (SMEs, large enterprises, and governments) and by mode of transportation (ocean, air, road, rail). Key drivers behind their dominance are identified using bullet points, providing a clear understanding of the factors contributing to their success.

By Firm Type:

- Large Enterprises: Dominance driven by high investment capacity and established infrastructure.

- SMEs: Growth fueled by agile innovation and adaptation to market changes.

- Governments: Influence through policy support and infrastructure development.

By Mode of Transportation:

- Ocean Freight: Key driver is high volume handling and cost-effectiveness for large shipments.

- Air Freight: Driven by need for speed and time-sensitive deliveries.

- Road & Rail Freight: Facilitated by expanding infrastructure and improved logistics networks.

In-depth analysis will explore the specific factors driving the dominance of each leading segment, including investment trends, regulatory support, and infrastructure development.

China Digital Freight Forwarding Industry Product Innovations

This section focuses on recent product innovations within the China digital freight forwarding industry. We examine new applications of existing technologies and highlight the key performance metrics associated with these advancements. This includes analyzing the unique selling propositions of innovative products and services, and the role of technological advancements, such as AI and machine learning, in enhancing efficiency and transparency.

Propelling Factors for China Digital Freight Forwarding Industry Growth

Several key factors are driving the growth of the China digital freight forwarding industry. Technological advancements, such as AI-powered route optimization and blockchain-based security, are significantly improving efficiency and transparency. Furthermore, robust economic growth in China fuels increased demand for efficient logistics solutions. Supportive government policies and initiatives focused on digital infrastructure development further stimulate market expansion.

Obstacles in the China Digital Freight Forwarding Industry Market

Despite significant growth potential, the China digital freight forwarding industry faces several challenges. Regulatory complexities and evolving compliance requirements can create hurdles for businesses. Supply chain disruptions, particularly those caused by geopolitical events, pose significant risks to operational stability. Intense competition from both domestic and international players adds pressure on margins and profitability. These factors can lead to xx Million in lost revenue annually (estimated).

Future Opportunities in China Digital Freight Forwarding Industry

The China digital freight forwarding industry presents significant future opportunities. Expansion into new markets, particularly in less developed regions, promises substantial growth. The adoption of emerging technologies, such as the Internet of Things (IoT) and 5G, will further enhance efficiency and traceability. Catering to evolving consumer demands for sustainable and environmentally friendly logistics solutions presents a significant opportunity.

Major Players in the China Digital Freight Forwarding Industry Ecosystem

- DB Schenker

- Flexport

- DHL Group

- Cogoport

- FreightBro

- Kuehne + Nagel International AG

- WICE Logistics

- SINO SHIPPING

- Twill

- Youtrans

- MOOV

- Full Truck Alliance (Manbang group)

- Freightos

- Agility Logistics Pvt Ltd (Shipa Freight)

Key Developments in China Digital Freight Forwarding Industry Industry

- Jan 2023: Launch of a new AI-powered logistics platform by X company. This increased efficiency by xx%.

- May 2022: Merger between Company A and Company B, creating a larger market player. This resulted in a xx Million increase in market capitalization.

- Oct 2021: Implementation of new government regulations impacting data security and compliance. This impacted xx% of market players.

- (Add more bullet points with specific dates and impacts)

Strategic China Digital Freight Forwarding Industry Market Forecast

The China digital freight forwarding industry is poised for continued robust growth, driven by technological innovation, economic expansion, and supportive government policies. The forecast period (2025-2033) anticipates significant market expansion, with opportunities arising from increased cross-border e-commerce, the adoption of sustainable logistics practices, and the integration of emerging technologies. The market is expected to reach xx Million by 2033, presenting substantial growth potential for both established and emerging players.

China Digital Freight Forwarding Industry Segmentation

-

1. Mode of Transportation

- 1.1. Ocean

- 1.2. Air

- 1.3. Road

- 1.4. Rail

-

2. Firm Type

- 2.1. SMEs

- 2.2. Large Enterprises and Governments

China Digital Freight Forwarding Industry Segmentation By Geography

- 1. China

China Digital Freight Forwarding Industry Regional Market Share

Geographic Coverage of China Digital Freight Forwarding Industry

China Digital Freight Forwarding Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; PHARMACEUTICAL INDUSTRY GROWTH4.; RISING FRESH PRODUCE IMPORTS FROM MEXICO4.; INCREASING POPULARITY OF FROZEN FOODS

- 3.3. Market Restrains

- 3.3.1. 4.; EMISSIONS FROM COLD CHAIN OPERATIONS4.; LABOUR SHORTAGES

- 3.4. Market Trends

- 3.4.1. Rise in E-Commerce Sector Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Digital Freight Forwarding Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transportation

- 5.1.1. Ocean

- 5.1.2. Air

- 5.1.3. Road

- 5.1.4. Rail

- 5.2. Market Analysis, Insights and Forecast - by Firm Type

- 5.2.1. SMEs

- 5.2.2. Large Enterprises and Governments

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transportation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Flexport

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cogoport

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 FreightBro

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kuehne + Nagel International AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 WICE Logistics**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SINO SHIPPING

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Twill

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Youtrans

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 MOOV

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Full Truck Alliance (Manbang group)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Freightos

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Agility Logistics Pvt Ltd (Shipa Freight)

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: China Digital Freight Forwarding Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Digital Freight Forwarding Industry Share (%) by Company 2025

List of Tables

- Table 1: China Digital Freight Forwarding Industry Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 2: China Digital Freight Forwarding Industry Revenue billion Forecast, by Firm Type 2020 & 2033

- Table 3: China Digital Freight Forwarding Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Digital Freight Forwarding Industry Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 5: China Digital Freight Forwarding Industry Revenue billion Forecast, by Firm Type 2020 & 2033

- Table 6: China Digital Freight Forwarding Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Digital Freight Forwarding Industry?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the China Digital Freight Forwarding Industry?

Key companies in the market include DB Schenker, Flexport, DHL Group, Cogoport, FreightBro, Kuehne + Nagel International AG, WICE Logistics**List Not Exhaustive, SINO SHIPPING, Twill, Youtrans, MOOV, Full Truck Alliance (Manbang group), Freightos, Agility Logistics Pvt Ltd (Shipa Freight).

3. What are the main segments of the China Digital Freight Forwarding Industry?

The market segments include Mode of Transportation, Firm Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.9 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; PHARMACEUTICAL INDUSTRY GROWTH4.; RISING FRESH PRODUCE IMPORTS FROM MEXICO4.; INCREASING POPULARITY OF FROZEN FOODS.

6. What are the notable trends driving market growth?

Rise in E-Commerce Sector Driving the Market.

7. Are there any restraints impacting market growth?

4.; EMISSIONS FROM COLD CHAIN OPERATIONS4.; LABOUR SHORTAGES.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Digital Freight Forwarding Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Digital Freight Forwarding Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Digital Freight Forwarding Industry?

To stay informed about further developments, trends, and reports in the China Digital Freight Forwarding Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence