Key Insights

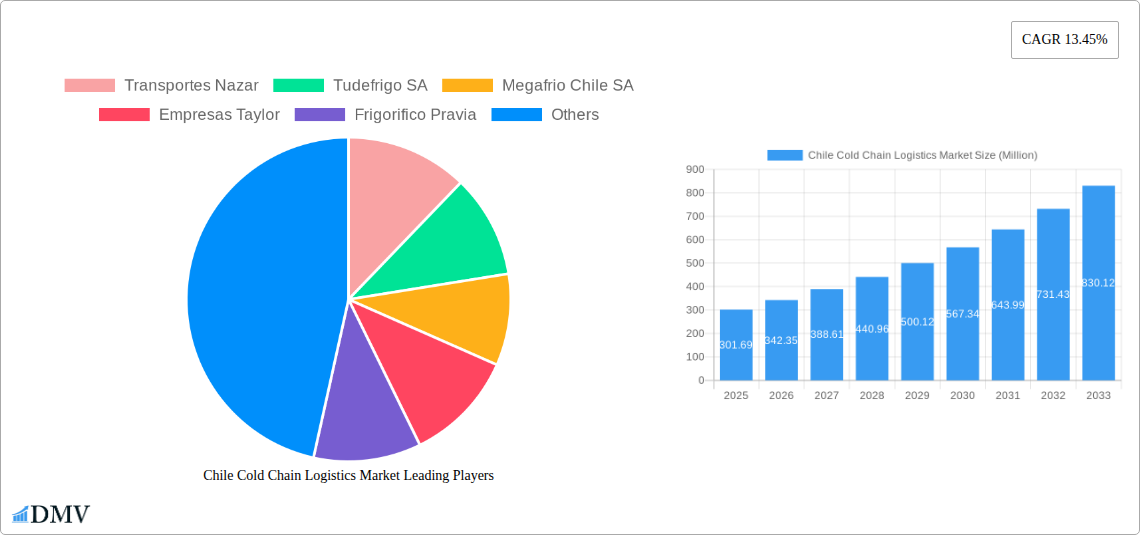

The Chilean cold chain logistics market is poised for robust expansion, projected to reach an estimated USD 301.69 million in 2025, with an impressive Compound Annual Growth Rate (CAGR) of 13.45% anticipated to continue through 2033. This significant growth is primarily fueled by the increasing demand for temperature-sensitive goods, particularly within the horticulture sector, encompassing fresh fruits and vegetables, which form a substantial portion of Chile's export economy. The burgeoning dairy and meat, fish, and poultry segments also contribute significantly to this upward trajectory, driven by evolving consumer preferences for fresh, high-quality products and enhanced food safety standards. Furthermore, the expanding pharmaceutical, life sciences, and chemicals industries, all heavily reliant on precise temperature control, are increasingly leveraging specialized cold chain solutions, acting as a vital catalyst for market growth. The expansion of e-commerce for perishable goods further amplifies the need for efficient and reliable cold chain infrastructure across Chile.

Chile Cold Chain Logistics Market Market Size (In Million)

Several key drivers underpin this dynamic market expansion. The growing sophistication of Chile's agricultural export sector, coupled with stringent international quality and safety regulations for perishable goods, necessitates advanced cold chain capabilities. Investments in modern warehousing facilities equipped with advanced refrigeration technologies, alongside the adoption of sophisticated transportation solutions, are crucial for maintaining product integrity from farm to fork. The increasing adoption of technology, including real-time temperature monitoring and route optimization software, enhances efficiency and reduces spoilage, further supporting market growth. While opportunities abound, challenges remain in the form of initial capital investment for infrastructure development and the need for skilled personnel to manage complex cold chain operations. However, the overwhelming trend towards higher quality, safer, and more readily available temperature-sensitive products across various end-user industries in Chile ensures a highly promising outlook for the cold chain logistics market.

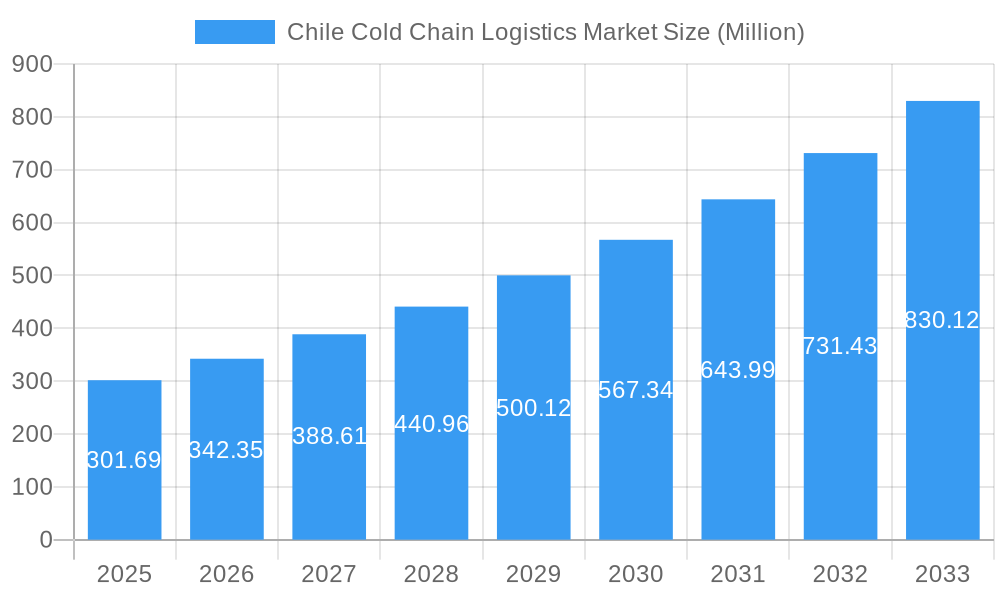

Chile Cold Chain Logistics Market Company Market Share

Chile Cold Chain Logistics Market: Market Analysis & Strategic Forecast 2019-2033

This comprehensive report delves into the dynamic Chile cold chain logistics market, providing deep insights into its current landscape, historical performance, and future trajectory. With a study period spanning 2019 to 2033, a base year of 2025, and a forecast period from 2025 to 2033, this analysis is essential for stakeholders seeking to understand market segmentation, innovation, key players, and growth drivers. We meticulously examine the Chile cold chain logistics market size, Chile cold chain logistics market share, and the impact of critical developments on this vital industry.

Chile Cold Chain Logistics Market Market Composition & Trends

The Chile cold chain logistics market exhibits a moderate to high concentration, with key players vying for market share through strategic investments in infrastructure and technology. Innovation catalysts are primarily driven by the increasing demand for temperature-sensitive goods, stringent quality control mandates, and the growing adoption of advanced tracking and monitoring systems. The regulatory landscape, while evolving, generally supports the expansion of cold chain capabilities, particularly in sectors like pharmaceuticals and fresh produce export. Substitute products are limited within the core cold chain services, but advancements in packaging and preservation techniques offer indirect competition. End-user profiles are diverse, ranging from high-volume agricultural exporters to specialized pharmaceutical distributors, each with distinct logistical requirements. Mergers and acquisitions (M&A) activities are anticipated to increase as companies seek to expand their geographical reach and service portfolios, consolidating the market and enhancing operational efficiencies. M&A deal values are expected to reflect the growing strategic importance of integrated cold chain solutions.

- Market Concentration: Moderate to High.

- Innovation Catalysts: Demand for temperature-sensitive goods, quality control, advanced tracking.

- Regulatory Landscape: Supportive, with increasing focus on specialized sectors.

- Substitute Products: Limited in core services; indirect competition from packaging innovations.

- End-User Profiles: Diverse, including agriculture, pharmaceuticals, and food processing.

- M&A Activities: Expected to rise, focusing on consolidation and service expansion.

Chile Cold Chain Logistics Market Industry Evolution

The Chile cold chain logistics market has witnessed a significant evolutionary path, driven by robust economic growth and Chile's prominent role as an exporter of fresh produce and other temperature-sensitive commodities. Over the historical period (2019-2024), the market demonstrated steady growth, fueled by increased investments in refrigerated warehousing and specialized transportation fleets. Technological advancements have been a key propeller, with the adoption of IoT sensors for real-time temperature monitoring, advanced warehouse management systems (WMS), and streamlined route optimization software becoming standard. Shifting consumer demands for higher quality, longer shelf-life perishable goods, both domestically and internationally, have further amplified the need for sophisticated cold chain solutions. The Chile cold chain logistics market growth rate is projected to accelerate in the forecast period (2025-2033) as these trends intensify. For instance, the adoption of AI-powered predictive analytics for inventory management and demand forecasting is gaining traction, promising to enhance efficiency and reduce waste. The expansion of e-commerce for groceries and pharmaceuticals is also a significant factor, necessitating reliable last-mile cold chain delivery services. The market is moving towards more integrated and technologically advanced solutions, with a strong emphasis on sustainability and energy efficiency in cold storage facilities. The estimated market value for the base year 2025 is projected to reach approximately XX Million USD, with a projected compound annual growth rate (CAGR) of XX% during the forecast period, signifying a robust expansion driven by innovation and demand.

Leading Regions, Countries, or Segments in Chile Cold Chain Logistics Market

Within the Chile cold chain logistics market, several segments and regions stand out due to their significant contribution to market growth and their specific logistical demands. The Transportation segment is consistently a dominant force, driven by Chile's extensive export network and the need for efficient movement of goods across vast distances and to international markets. This includes refrigerated trucking, air cargo, and maritime transport for perishables. Storage is also a critical component, with a growing demand for state-of-the-art cold storage facilities equipped with advanced temperature control and monitoring systems, particularly near key ports and agricultural production hubs. The Horticulture (Fresh Fruits and Vegetables) end-user segment is a primary driver, given Chile's global leadership in exporting fruits like grapes, cherries, and blueberries. The stringent temperature requirements for these products necessitate specialized cold chain infrastructure from farm to port.

- Dominant Service Segment: Transportation, closely followed by Storage.

- Key Drivers for Transportation: Extensive export volumes, intermodal connectivity, demand for timely delivery.

- Key Drivers for Storage: Growing export volumes, need for consolidation and buffer stock, technological upgrades in facilities.

- Dominant End-User Segment: Horticulture (Fresh Fruits and Vegetables).

- Key Drivers for Horticulture: Chile's reputation as a global exporter, high demand for quality produce, strict international quality standards.

- Investment Trends: Significant investment in refrigerated container fleets and port-side cold storage.

- Regulatory Support: Government initiatives to support agricultural exports and food safety standards.

- Temperature Segment Dominance: Chilled logistics often sees higher volumes due to the vast fresh produce export market, but Frozen logistics also plays a crucial role for products like fish and poultry. Ambient temperatures are relevant for certain processed foods and pharmaceuticals requiring controlled environments.

- Geographic Concentration: Regions with significant agricultural production and major port infrastructure, such as the Valparaíso region and regions in the central and southern parts of the country, are leading hubs for cold chain logistics operations.

Chile Cold Chain Logistics Market Product Innovations

The Chile cold chain logistics market is witnessing a surge in product innovations aimed at enhancing efficiency, reducing spoilage, and improving sustainability. Advanced temperature-controlled packaging solutions, utilizing phase-change materials (PCMs) and vacuum insulated panels (VIPs), are enabling longer transit times and greater temperature stability for high-value exports like berries and pharmaceuticals. IoT-enabled sensors and real-time data analytics platforms are offering unprecedented visibility into the cold chain, allowing for proactive issue resolution and optimized inventory management. Furthermore, the development of energy-efficient refrigeration units for both trucks and warehouses, incorporating technologies like variable speed drives and advanced insulation, is reducing operational costs and the environmental footprint of cold chain operations. These innovations contribute to a XX% reduction in product spoilage for participating companies and a XX% improvement in energy efficiency for storage facilities.

Propelling Factors for Chile Cold Chain Logistics Market Growth

Several factors are propelling the growth of the Chile cold chain logistics market. The nation's strong agricultural sector and its position as a leading global exporter of fresh fruits, vegetables, and seafood are fundamental drivers, demanding robust and reliable cold chain infrastructure. Technological advancements, including the adoption of IoT for real-time monitoring, AI for predictive analytics, and automation in warehouses, are enhancing efficiency and reducing operational costs. Favorable government policies and international trade agreements that facilitate agricultural exports also play a significant role. Furthermore, the increasing demand for temperature-sensitive products like pharmaceuticals and vaccines, coupled with a growing middle class and evolving consumer preferences for high-quality perishable goods, are creating substantial market opportunities. The projected market value for 2025 is estimated to be XX Million USD, highlighting this robust growth trajectory.

Obstacles in the Chile Cold Chain Logistics Market Market

Despite its growth potential, the Chile cold chain logistics market faces several obstacles. High initial investment costs for state-of-the-art cold storage facilities and specialized transportation equipment can be a deterrent, especially for smaller players. The geographical dispersion of agricultural production sites across Chile can lead to complex and costly logistics for last-mile delivery. Infrastructure limitations in certain remote areas, including inadequate road networks and limited access to reliable power supply for refrigeration, can also pose challenges. Furthermore, a shortage of skilled labor with expertise in operating and maintaining sophisticated cold chain technologies can impact operational efficiency. Navigating diverse and evolving international regulatory requirements for food safety and pharmaceutical transportation adds another layer of complexity. These challenges can lead to an estimated XX% increase in operational costs if not adequately addressed.

Future Opportunities in Chile Cold Chain Logistics Market

The Chile cold chain logistics market is ripe with future opportunities. The increasing global demand for high-quality Chilean produce, particularly berries, avocados, and cherries, presents a significant opportunity for expanding export-oriented cold chain services. The burgeoning pharmaceutical and biotechnology sectors in Chile are also creating a growing need for specialized, temperature-controlled logistics for medicines and vaccines. E-commerce growth, especially in the grocery and food delivery sectors, necessitates the development of efficient last-mile cold chain solutions. Furthermore, investments in sustainable cold chain technologies, such as renewable energy sources for cold storage and electric or alternative fuel refrigeration vehicles, align with global sustainability goals and offer competitive advantages. The expansion of cold chain infrastructure into less developed regions of Chile could unlock new markets and reduce logistical bottlenecks, potentially increasing market efficiency by XX%.

Major Players in the Chile Cold Chain Logistics Market Ecosystem

- Transportes Nazar

- Tudefrigo SA

- Megafrio Chile SA

- Empresas Taylor

- Frigorifico Pravia

- Friofort SA

- Frigorificos Puerto Montt

- Ceva Logistics

- Emergent Cold LatAm

- TIBA Chile

- 6 3 Other Companies

Key Developments in Chile Cold Chain Logistics Market Industry

- 2023: Expansion of refrigerated warehousing capacity by Emergent Cold LatAm, enhancing cold storage options for agricultural exports.

- 2023: Implementation of advanced IoT tracking solutions by Transportes Nazar to improve real-time visibility and temperature control for frozen goods.

- 2022: Strategic partnership between Megafrio Chile SA and key fruit export cooperatives to optimize the cold chain for berry exports.

- 2022: Introduction of new environmentally friendly refrigeration units by Tudefrigo SA to reduce carbon emissions.

- 2021: Investment in advanced cold chain technology by Empresas Taylor to cater to the growing demand for pharmaceutical logistics.

- 2020: Launch of new chilled transportation routes by TIBA Chile to serve the expanding e-commerce grocery market.

Strategic Chile Cold Chain Logistics Market Market Forecast

The strategic forecast for the Chile cold chain logistics market points towards continued robust growth, driven by the nation's established position in global food supply chains and emerging opportunities in pharmaceuticals and e-commerce. Investments in technology will remain paramount, with a focus on digitalization, automation, and sustainability to enhance efficiency and reduce operational costs. The market is expected to see further consolidation through M&A activities as companies strive to offer integrated end-to-end cold chain solutions. The increasing demand for high-quality, temperature-sensitive products will continue to fuel expansion in both refrigerated storage and transportation, with a particular emphasis on specialized logistics for high-value perishables. The market is projected to reach a value of XX Million USD by 2033, exhibiting a CAGR of XX% during the forecast period, a testament to its strategic importance and ongoing development.

Chile Cold Chain Logistics Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature

- 2.1. Chilled

- 2.2. Frozen

- 2.3. Ambient

-

3. End User

- 3.1. Horticulture (Fresh Fruits and Vegetables)

- 3.2. Dairy Products (Milk, Ice Cream, Butter, etc.)

- 3.3. Meat, Fish, and Poultry

- 3.4. Processed Food Products

- 3.5. Pharma, Life Sciences, and Chemicals

- 3.6. Other End Users

Chile Cold Chain Logistics Market Segmentation By Geography

- 1. Chile

Chile Cold Chain Logistics Market Regional Market Share

Geographic Coverage of Chile Cold Chain Logistics Market

Chile Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Fruit Exports

- 3.3. Market Restrains

- 3.3.1. 4.; Challenges of First Mile Distribution in Chile

- 3.4. Market Trends

- 3.4.1. Growth Of E-commerce Driving The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Chile Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.2.3. Ambient

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Horticulture (Fresh Fruits and Vegetables)

- 5.3.2. Dairy Products (Milk, Ice Cream, Butter, etc.)

- 5.3.3. Meat, Fish, and Poultry

- 5.3.4. Processed Food Products

- 5.3.5. Pharma, Life Sciences, and Chemicals

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Chile

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Transportes Nazar

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tudefrigo SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Megafrio Chile SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Empresas Taylor

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Frigorifico Pravia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Friofort SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Frigorificos Puerto Montt

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ceva Logistics**List Not Exhaustive 6 3 Other Companie

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Emergent Cold LatAm

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TIBA Chile

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Transportes Nazar

List of Figures

- Figure 1: Chile Cold Chain Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Chile Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Chile Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Chile Cold Chain Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 3: Chile Cold Chain Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Chile Cold Chain Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Chile Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 6: Chile Cold Chain Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 7: Chile Cold Chain Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Chile Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chile Cold Chain Logistics Market?

The projected CAGR is approximately 13.45%.

2. Which companies are prominent players in the Chile Cold Chain Logistics Market?

Key companies in the market include Transportes Nazar, Tudefrigo SA, Megafrio Chile SA, Empresas Taylor, Frigorifico Pravia, Friofort SA, Frigorificos Puerto Montt, Ceva Logistics**List Not Exhaustive 6 3 Other Companie, Emergent Cold LatAm, TIBA Chile.

3. What are the main segments of the Chile Cold Chain Logistics Market?

The market segments include Service, Temperature, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 301.69 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Fruit Exports.

6. What are the notable trends driving market growth?

Growth Of E-commerce Driving The Market.

7. Are there any restraints impacting market growth?

4.; Challenges of First Mile Distribution in Chile.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chile Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chile Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chile Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the Chile Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence