Key Insights

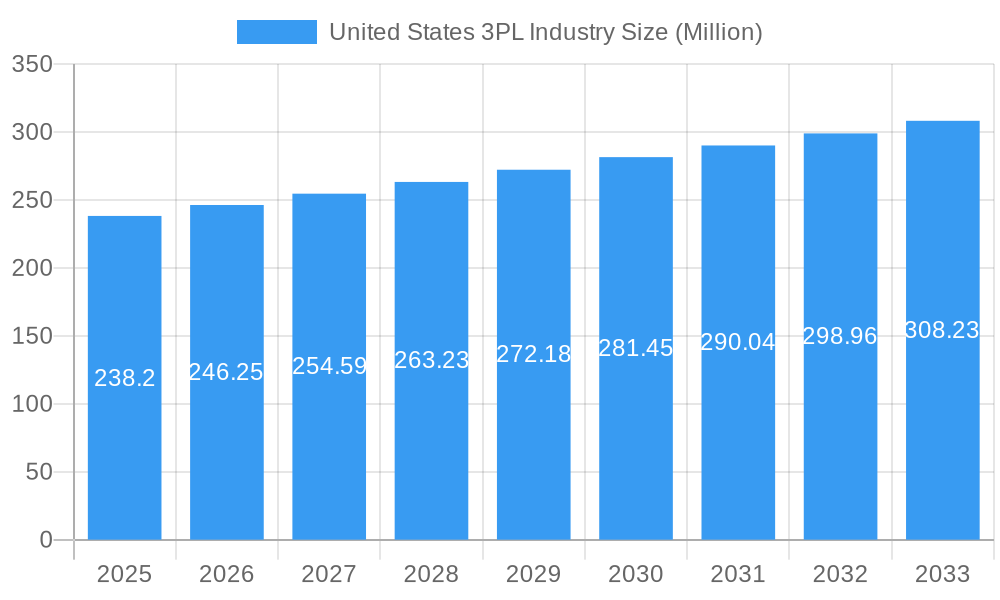

The United States Third-Party Logistics (3PL) market is poised for robust expansion, projected to reach a substantial $238.20 million by 2025. This growth trajectory is underpinned by a consistent Compound Annual Growth Rate (CAGR) of 3.38% over the forecast period, indicating sustained demand and increasing reliance on outsourced logistics solutions. Key drivers fueling this expansion include the relentless pursuit of operational efficiency and cost optimization by businesses across diverse sectors. Companies are increasingly leveraging 3PL providers to manage complex supply chains, streamline transportation, and enhance warehousing capabilities, thereby freeing up internal resources to focus on core competencies. The burgeoning e-commerce landscape, with its ever-increasing volume and demand for faster delivery, is a significant catalyst. Furthermore, advancements in technology, such as real-time tracking, warehouse automation, and sophisticated supply chain analytics, are enhancing the value proposition of 3PL services, making them indispensable for businesses looking to maintain a competitive edge.

United States 3PL Industry Market Size (In Million)

The market's segmentation highlights a strong emphasis on Domestic Transportation Management and International Transportation Management, reflecting the globalized nature of modern commerce and the critical need for efficient movement of goods. The Value-added Warehousing and Distribution segment also plays a pivotal role, offering essential services like inventory management, order fulfillment, and reverse logistics. A broad spectrum of end-users, including Aerospace, Automotive, Consumer and Retail, Energy, Healthcare, Manufacturing, and Technology, are actively participating in this market, each with unique logistical challenges and requirements. Major industry players like J.B. Hunt, Hub Group, DHL Supply Chain Logistics, United Parcel Service, and Kuehne + Nagel are at the forefront, continuously innovating and expanding their service offerings to meet evolving market demands. Emerging trends such as the adoption of sustainable logistics practices, the integration of AI and machine learning for predictive analytics, and the rise of micro-fulfillment centers are further shaping the future of the U.S. 3PL industry, promising greater agility, transparency, and efficiency.

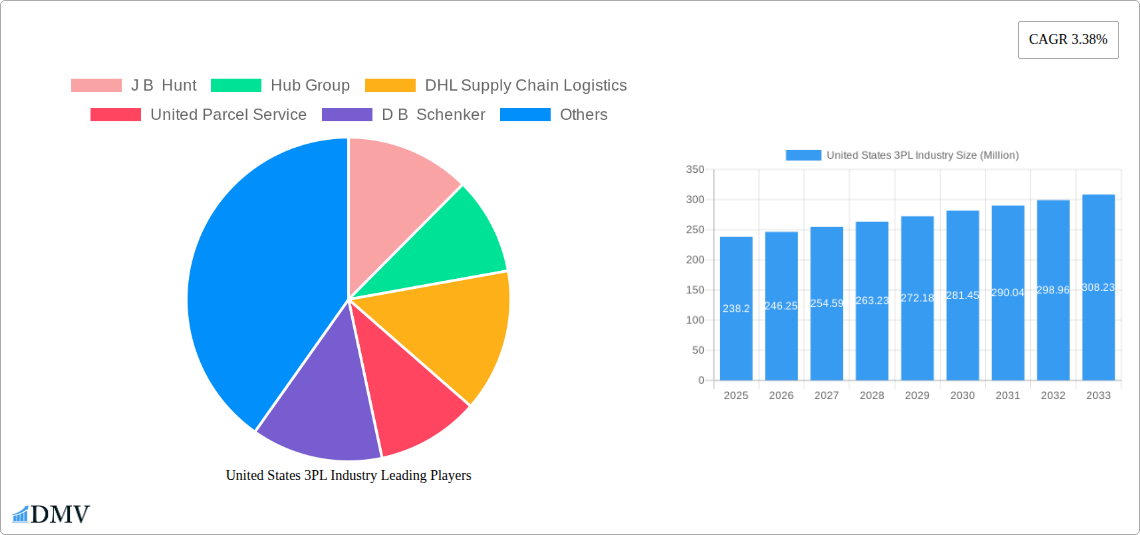

United States 3PL Industry Company Market Share

United States 3PL Industry Market Composition & Trends

The United States Third-Party Logistics (3PL) industry is characterized by a dynamic and evolving market concentration, driven by innovation, stringent regulatory landscapes, and a complex web of substitute products. Innovation catalysts, such as the adoption of advanced analytics and automation, are reshaping operational efficiencies and service offerings. The regulatory environment, while providing structure, also presents compliance challenges for 3PL providers. Substitute products, including in-house logistics operations and emerging digital freight platforms, continually influence market positioning. End-user profiles span diverse sectors, from the high-stakes Aerospace and Automotive industries to the high-volume Consumer and Retail and critical Healthcare sectors, each with unique logistical demands. Mergers and acquisitions (M&A) activities are pivotal in consolidating market share and expanding capabilities.

- Market Share Distribution: Dominated by a few key players with significant market share, alongside a fragmented landscape of smaller, specialized providers.

- M&A Deal Values: Significant M&A transactions in the past year, with deal values ranging from tens of millions to over one billion USD, indicating strategic consolidation and growth ambitions.

- Innovation Focus: Increased investment in technology, particularly in areas like AI-powered route optimization, warehouse automation, and real-time visibility solutions.

- End-User Demand: Growing demand for integrated supply chain solutions, sustainability initiatives, and resilient logistics networks across all end-user segments.

United States 3PL Industry Industry Evolution

The United States 3PL industry has undergone a profound transformation, evolving from basic warehousing and transportation services to comprehensive, integrated supply chain solutions. This evolution has been fueled by a confluence of factors including rapid technological advancements, shifting consumer expectations, and an increasingly complex global trade environment. The historical period from 2019–2024 witnessed a steady growth trajectory, punctuated by the unprecedented disruptions of the COVID-19 pandemic, which exposed vulnerabilities and accelerated the adoption of digital technologies. During this time, companies like J.B. Hunt, Hub Group, and UPS invested heavily in expanding their domestic transportation management capabilities to meet surging e-commerce demand and address port congestion. The base year of 2025 marks a pivotal point, with the industry poised for continued robust expansion throughout the forecast period of 2025–2033.

Technological advancements have been a primary driver of this evolution. The widespread adoption of Warehouse Management Systems (WMS), Transportation Management Systems (TMS), and advanced analytics has enabled 3PLs to optimize inventory, streamline routes, and provide greater visibility into supply chains. Artificial intelligence (AI) and machine learning (ML) are now integral to predictive analytics, enabling proactive problem-solving and enhanced operational efficiency. Furthermore, the rise of automation in warehousing, including robotics and automated guided vehicles (AGVs), is revolutionizing fulfillment processes, leading to faster order processing and reduced labor costs.

Shifting consumer demands, particularly the "Amazon effect," have placed immense pressure on retailers and, consequently, their 3PL partners. Consumers now expect faster delivery times, greater flexibility in shipping options, and seamless returns processes. This has necessitated a move towards more agile and responsive supply chains, with 3PLs playing a crucial role in managing the complexities of direct-to-consumer (DTC) fulfillment and omnichannel retail strategies. The focus has shifted from simply moving goods to providing end-to-end supply chain management, including value-added warehousing and distribution services like kitting, assembly, and customization.

The forecast period of 2025–2033 anticipates continued strong growth for the U.S. 3PL market. The industry is projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 6-8%, driven by ongoing e-commerce expansion, the reshoring of manufacturing, and the increasing complexity of global supply chains. Companies are increasingly recognizing the strategic advantage of outsourcing logistics to specialized 3PL providers, allowing them to focus on core competencies while leveraging the expertise and infrastructure of their partners. The integration of new technologies, such as the Internet of Things (IoT) for real-time tracking and autonomous vehicles for long-haul and last-mile delivery, will further shape the industry's future, creating more efficient, resilient, and sustainable supply chains. The market's trajectory clearly indicates a move towards more sophisticated, technology-driven, and customer-centric logistics solutions.

Leading Regions, Countries, or Segments in United States 3PL Industry

Within the vast landscape of the United States 3PL industry, certain segments and regions exhibit pronounced dominance, driven by strategic investments, robust infrastructure, and specialized demand. Among the services offered, Domestic Transportation Management consistently emerges as the most significant segment. This dominance is directly attributable to the sheer scale of the U.S. domestic market, the continuous growth of e-commerce, and the imperative for efficient, timely movement of goods across the continent. The sheer volume of freight, coupled with the increasing need for last-mile delivery solutions, makes domestic transportation the bedrock of the 3PL sector.

Furthermore, the Consumer and Retail end-user segment stands out as a primary driver of 3PL activity. The insatiable demand for consumer goods, amplified by online retail, necessitates sophisticated logistics networks capable of handling high volumes, rapid inventory turnover, and complex return processes. 3PLs supporting the consumer and retail sector are instrumental in managing everything from warehousing and inventory management to direct-to-consumer fulfillment and returns logistics.

The dominance of these segments is underpinned by several key drivers:

- Investment Trends: Significant capital investment is channeled into expanding domestic transportation networks, including fleet modernization, warehouse automation, and the development of regional distribution hubs. Companies like FedEx and UPS, along with dedicated LTL carriers, are continuously investing in their infrastructure to enhance capacity and efficiency.

- Regulatory Support: While regulations exist, government initiatives aimed at improving infrastructure and facilitating trade indirectly support the growth of domestic transportation. The focus on supply chain resilience also encourages investment in robust domestic logistics capabilities.

- Technological Adoption: The rapid integration of advanced technologies in Domestic Transportation Management, such as AI-powered route optimization, real-time tracking through IoT, and the exploration of autonomous trucking, further solidifies its leading position. Similarly, the Consumer and Retail segment benefits immensely from technologies that enable efficient inventory management, personalized delivery options, and streamlined returns.

- E-commerce Growth: The relentless expansion of e-commerce is arguably the single most significant factor propelling the Consumer and Retail sector and, by extension, Domestic Transportation Management. The ability of 3PLs to facilitate seamless online shopping experiences, from order placement to final delivery, is paramount.

While other segments and end-users like Automotive, Manufacturing, and Healthcare are substantial and growing, the sheer volume and pervasive nature of consumer goods movement, combined with the necessity of efficient domestic transit, place Domestic Transportation Management and the Consumer and Retail end-user segment at the forefront of the U.S. 3PL industry's current and projected future landscape. The interconnectedness of these two facets – how the demand from consumers drives the need for domestic transport solutions – underscores their symbiotic and leading role.

United States 3PL Industry Product Innovations

The United States 3PL industry is a hotbed of product innovation, driven by the relentless pursuit of efficiency, visibility, and sustainability. Leading 3PLs are not just moving goods; they are developing sophisticated technology platforms and service enhancements. Innovations range from AI-powered predictive analytics for demand forecasting and inventory optimization to advanced warehouse automation solutions, including robotic picking and sorting systems. Real-time visibility platforms leveraging IoT sensors and blockchain technology are transforming supply chain transparency, enabling stakeholders to track goods with unprecedented accuracy. Furthermore, the development of specialized services, such as cold chain logistics for pharmaceuticals and perishables, and tailored solutions for e-commerce returns management, represent significant product advancements that cater to niche yet growing market demands. These innovations are geared towards reducing lead times, minimizing errors, and enhancing overall customer satisfaction.

Propelling Factors for United States 3PL Industry Growth

Several interconnected factors are propelling the growth of the United States 3PL industry. The relentless expansion of e-commerce, characterized by increasing online sales and consumer expectations for rapid delivery, is a primary driver, necessitating more sophisticated and agile logistics solutions. Technological advancements, including the widespread adoption of automation in warehouses, AI for route optimization, and real-time visibility platforms, are enhancing operational efficiency and reducing costs, making 3PL services more attractive. Additionally, companies are increasingly focusing on their core competencies, leading them to outsource complex supply chain management to specialized 3PL providers. Government initiatives promoting supply chain resilience and infrastructure development also contribute to market expansion. The reshoring of manufacturing also presents significant opportunities for 3PLs to manage domestic supply chains more effectively.

Obstacles in the United States 3PL Industry Market

Despite its robust growth, the United States 3PL industry faces several significant obstacles. Ongoing supply chain disruptions, stemming from geopolitical events, natural disasters, and labor shortages, continue to pose challenges to operational continuity and cost management. The stringent and evolving regulatory landscape, particularly concerning transportation, emissions, and labor, requires constant adaptation and compliance, which can be costly. Intense competitive pressure among a large number of 3PL providers can lead to price wars and squeezed profit margins. Furthermore, the significant capital investment required for technological upgrades and infrastructure development can be a barrier, especially for smaller players. The persistent shortage of skilled labor, particularly for truck drivers and warehouse personnel, also presents a significant constraint on capacity expansion and service delivery.

Future Opportunities in United States 3PL Industry

The future of the United States 3PL industry is brimming with opportunities. The continued growth of e-commerce, especially in niche markets and for specialized products, will drive demand for tailored fulfillment solutions. The increasing focus on sustainability and Environmental, Social, and Governance (ESG) principles presents opportunities for 3PLs to develop and offer green logistics solutions, including electric vehicle fleets and optimized routing for reduced emissions. The advancement of autonomous vehicle technology promises to revolutionize long-haul and last-mile delivery, leading to increased efficiency and reduced labor costs. The ongoing trend of supply chain diversification and nearshoring offers 3PLs the chance to build and manage more resilient, regionalized supply networks. Furthermore, the integration of advanced data analytics and AI will enable proactive supply chain management, predictive maintenance, and personalized customer experiences, creating new service categories and revenue streams.

Major Players in the United States 3PL Industry Ecosystem

- J B Hunt

- Hub Group

- DHL Supply Chain Logistics

- United Parcel Service

- D B Schenker

- Ryder Supply Chain Solutions

- XPO Logistics

- Kuehne + Nagel

- C H Robinson

- Fedex

Key Developments in United States 3PL Industry Industry

- January 2022: J.B. Hunt announced the acquisition of Zenith Freight Lines' assets from Bassett Furniture Industries for USD 87 Million, enhancing its furniture delivery capabilities nationwide.

- January 2022: XPO Logistics opened two new LTL terminals, bolstering customer service capacity following the launch of a 264-door terminal in Chicago Heights, Illinois, in October 2021, to manage increased freight flows.

- December 2021: DHL Supply Chain collaborated with TuSimple to implement autonomous trucking operations, making a reservation for 100 autonomous trucks designed by TuSimple and Navistar in the United States.

Strategic United States 3PL Industry Market Forecast

The strategic outlook for the United States 3PL industry remains exceptionally strong, driven by foundational growth catalysts and emerging opportunities. The continuous expansion of e-commerce, coupled with the increasing need for agile and resilient supply chains, ensures sustained demand for comprehensive logistics solutions. Advancements in automation and artificial intelligence are poised to unlock new levels of efficiency and cost-effectiveness, transforming operational paradigms. The growing emphasis on sustainability and the potential of autonomous transportation further present avenues for innovation and market differentiation. As businesses continue to prioritize core competencies and leverage external expertise for their logistics needs, the market potential for 3PL providers offering integrated, technology-driven, and customer-centric services is projected to be substantial, indicating a future characterized by significant growth and strategic evolution.

United States 3PL Industry Segmentation

-

1. Services

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. End User

- 2.1. Aerospace

- 2.2. Automotive

- 2.3. Consumer and Retail

- 2.4. Energy

- 2.5. Healthcare

- 2.6. Manufacturing

- 2.7. Technology

- 2.8. Other End Users

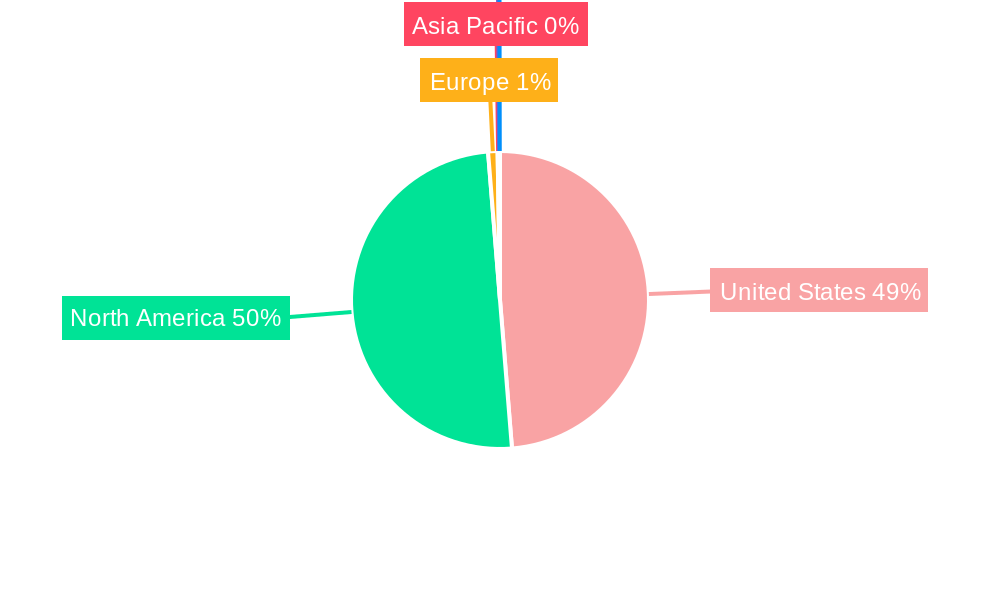

United States 3PL Industry Segmentation By Geography

- 1. United States

United States 3PL Industry Regional Market Share

Geographic Coverage of United States 3PL Industry

United States 3PL Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing production of chemical and allied products driving the market4.; Rising demand for green warehouses

- 3.3. Market Restrains

- 3.3.1. 4.; Stringent Rules and Regulations4.; Higher Costs

- 3.4. Market Trends

- 3.4.1. E-commerce Driving the 3PL Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States 3PL Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Aerospace

- 5.2.2. Automotive

- 5.2.3. Consumer and Retail

- 5.2.4. Energy

- 5.2.5. Healthcare

- 5.2.6. Manufacturing

- 5.2.7. Technology

- 5.2.8. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 J B Hunt

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hub Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL Supply Chain Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 United Parcel Service

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 D B Schenker

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ryder Supply Chain Solutions*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 XPO Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kuehne + Nagel

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 C H Robinson

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fedex

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 J B Hunt

List of Figures

- Figure 1: United States 3PL Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States 3PL Industry Share (%) by Company 2025

List of Tables

- Table 1: United States 3PL Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 2: United States 3PL Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: United States 3PL Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United States 3PL Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 5: United States 3PL Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: United States 3PL Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States 3PL Industry?

The projected CAGR is approximately 3.38%.

2. Which companies are prominent players in the United States 3PL Industry?

Key companies in the market include J B Hunt, Hub Group, DHL Supply Chain Logistics, United Parcel Service, D B Schenker, Ryder Supply Chain Solutions*List Not Exhaustive, XPO Logistics, Kuehne + Nagel, C H Robinson, Fedex.

3. What are the main segments of the United States 3PL Industry?

The market segments include Services, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 238.20 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing production of chemical and allied products driving the market4.; Rising demand for green warehouses.

6. What are the notable trends driving market growth?

E-commerce Driving the 3PL Market.

7. Are there any restraints impacting market growth?

4.; Stringent Rules and Regulations4.; Higher Costs.

8. Can you provide examples of recent developments in the market?

In January 2022, J.B. Hunt announced that it was acquiring the assets of Zenith Freight Lines from Bassett Furniture Industries, a leading manufacturer of quality furniture. The acquisition is worth USD 87 million. From now on, J.B. Hunt will continue to provide the services for Bassett. This investment helps J.B. Hunt to enhance its furniture delivery capabilities by expanding nationwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States 3PL Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States 3PL Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States 3PL Industry?

To stay informed about further developments, trends, and reports in the United States 3PL Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence