Key Insights

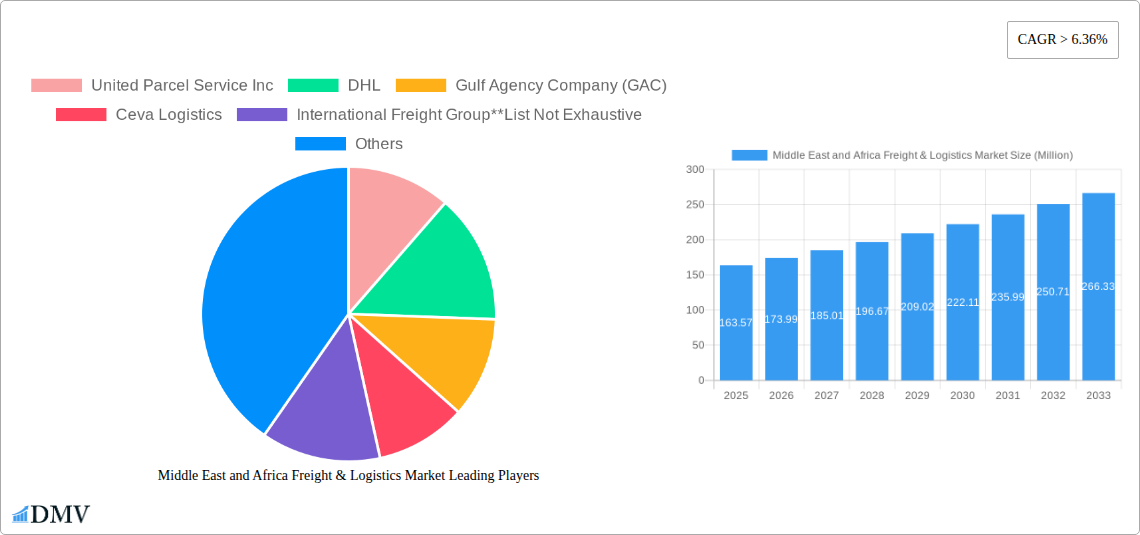

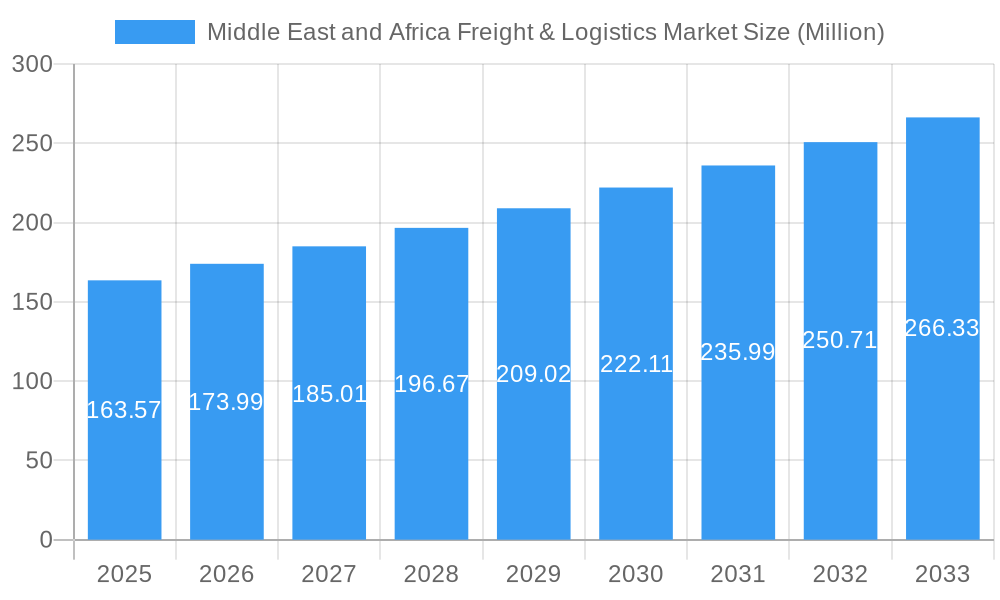

The Middle East and Africa (MEA) Freight & Logistics Market is poised for robust expansion, with a projected market size of USD 163.57 million in 2025, indicating a significant economic driver for the region. The market is anticipated to experience a Compound Annual Growth Rate (CAGR) exceeding 6.36% throughout the forecast period of 2025-2033. This growth is propelled by several key factors, including escalating trade volumes, increasing foreign direct investment, and the continuous development of e-commerce infrastructure across both the Middle East and African continents. The burgeoning manufacturing and automotive sectors, coupled with the vital oil and gas, mining, and quarrying industries, are substantial contributors, demanding efficient and reliable freight and logistics services for raw material procurement and finished goods distribution. Furthermore, evolving consumer demands for faster deliveries and the expansion of global supply chains necessitate advanced warehousing solutions and value-added services, including last-mile delivery optimization and specialized handling.

Middle East and Africa Freight & Logistics Market Market Size (In Million)

The dynamic MEA freight and logistics landscape is characterized by significant opportunities and strategic investments by major global and regional players such as United Parcel Service Inc., DHL, FedEx, and Agility Logistics. The market’s segmentation reveals a strong reliance on road freight, followed by water, air, and rail transport, reflecting the diverse geographical terrains and trade routes within the region. Freight forwarding and warehousing services are also critical components, facilitating seamless cross-border and domestic movements of goods. Emerging trends like the adoption of digital technologies for supply chain visibility, automation in warehouses, and the growing focus on sustainable logistics practices are shaping the market’s trajectory. Despite these positive indicators, certain restraints such as underdeveloped infrastructure in some African nations, regulatory complexities, and geopolitical instability in specific sub-regions present challenges that stakeholders must strategically navigate to fully capitalize on the market’s immense potential. The study period of 2019-2033, with a base year of 2025, provides a comprehensive outlook on this evolving sector.

Middle East and Africa Freight & Logistics Market Company Market Share

Here is an SEO-optimized, insightful report description for the Middle East and Africa Freight & Logistics Market, incorporating all your requirements:

This in-depth report provides a thorough examination of the Middle East and Africa (MEA) Freight & Logistics Market, encompassing a detailed analysis of market dynamics, growth trajectories, and future opportunities. Covering the study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this research delves into the critical factors shaping this rapidly evolving sector. We offer unparalleled insights for stakeholders seeking to understand the intricate landscape of freight transport, warehousing, freight forwarding, and value-added services across diverse end-user industries.

Middle East and Africa Freight & Logistics Market Market Composition & Trends

The MEA Freight & Logistics Market exhibits a dynamic composition, characterized by a moderate to high degree of concentration among key players, with leading companies like DHL, United Parcel Service Inc., FedEx, and Kuehne + Nagel holding significant market share. Innovation is driven by the increasing adoption of digital technologies, including AI-powered route optimization and blockchain for enhanced supply chain transparency. Regulatory landscapes are progressively evolving, with governments investing in infrastructure development and implementing policies to streamline customs procedures and promote trade facilitation, though regional disparities persist. Substitute products are limited in the core logistics functions, but advancements in e-commerce and last-mile delivery solutions are creating new service paradigms. End-user profiles range from the robust Manufacturing and Automotive sectors to the crucial Oil and Gas industries, with emerging demand from Agriculture and Construction. Mergers and acquisitions (M&A) are a key strategy for expansion and market consolidation, with estimated M&A deal values in the hundreds of millions to billions of dollars, as companies aim to enhance their service portfolios and geographical reach. The market size is projected to reach XX Billion USD by 2033, with a Compound Annual Growth Rate (CAGR) of XX% during the forecast period.

Middle East and Africa Freight & Logistics Market Industry Evolution

The evolution of the Middle East and Africa Freight & Logistics Market is a compelling narrative of transformation, driven by rapid economic diversification, burgeoning e-commerce, and significant infrastructure investments. Over the historical period (2019–2024), the market has witnessed a substantial growth trajectory, spurred by increased trade volumes and a growing demand for efficient and reliable logistics solutions. Technological advancements have been pivotal in this evolution. The adoption of advanced tracking systems, warehouse automation, and data analytics has significantly improved operational efficiency and visibility. For instance, the implementation of IoT devices for real-time cargo monitoring has become a standard practice for many providers, leading to a reduction in transit times by an average of XX% for key routes. Furthermore, the burgeoning digital economy has fundamentally reshaped consumer expectations, demanding faster delivery times and more flexible logistics options, which in turn has pushed logistics providers to innovate and expand their service offerings. The increasing emphasis on sustainability is also influencing industry evolution, with a growing focus on optimizing routes to reduce carbon emissions and exploring greener transportation alternatives. The market size for freight transport alone is estimated to be XX Billion USD in 2024, with a projected CAGR of XX% from 2019 to 2024. Key segments like Freight Forwarding and Warehousing have seen considerable growth, with the latter experiencing a XX% increase in demand for specialized temperature-controlled facilities.

Leading Regions, Countries, or Segments in Middle East and Africa Freight & Logistics Market

Within the dynamic MEA Freight & Logistics Market, the United Arab Emirates (UAE) consistently emerges as a dominant force, driven by its strategic geographical location, robust infrastructure, and pro-business policies. Its advanced ports, including Jebel Ali Port, and its status as a global trade hub make it a critical nexus for both regional and international logistics operations. The country's investment in smart logistics solutions and its commitment to digital transformation further solidify its leadership. The Freight Transport segment, particularly Road Freight, accounts for a significant portion of the market share, estimated at XX%, due to the extensive road networks connecting major economic centers and facilitating intra-regional trade. However, Air Freight is also witnessing substantial growth, driven by the booming e-commerce sector and the demand for express cargo services, projected to grow at a CAGR of XX% during the forecast period.

Dominant Region (UAE):

- Investment Trends: Continuous government investment in port modernization, airport expansion, and free zone development, exceeding XX Billion USD annually.

- Regulatory Support: Streamlined customs procedures, trade agreements, and supportive policies for foreign direct investment in the logistics sector.

- Infrastructure: World-class seaports, airports, and advanced road networks enabling efficient multimodal transport.

- E-commerce Boom: The exponential growth of online retail fuels demand for sophisticated last-mile delivery and warehousing solutions.

Key Segments Driving Growth:

- Freight Forwarding: The expansion of global supply chains and the increasing complexity of international trade necessitate efficient freight forwarding services. Key players like Gulf Agency Company (GAC) and Ceva Logistics are instrumental in facilitating these movements.

- Warehousing: The rise of e-commerce and the need for efficient inventory management are driving significant demand for modern warehousing facilities, including cold chain storage and fulfillment centers. The warehousing segment is expected to grow at a CAGR of XX% during the forecast period.

- Manufacturing and Automotive End User: These sectors rely heavily on timely and cost-effective logistics for raw material sourcing and finished goods distribution, contributing XX% to the overall market revenue. The Oil and Gas sector remains a substantial contributor, especially in regions like Saudi Arabia and other GCC countries, with specialized logistics requirements.

Middle East and Africa Freight & Logistics Market Product Innovations

Innovation in the MEA Freight & Logistics Market is increasingly centered on digital transformation and enhanced efficiency. Companies are investing in AI-driven route optimization software, leading to a projected XX% reduction in fuel consumption and delivery times. Blockchain technology is being deployed for enhanced supply chain visibility and security, reducing paperwork and fraud. Advanced warehouse management systems (WMS) with robotics and automation are improving inventory accuracy and order fulfillment speed. Furthermore, the development of specialized logistics solutions for temperature-sensitive goods and hazardous materials is a key product innovation, catering to the growing demands of the pharmaceutical and food & beverage industries. The integration of IoT devices for real-time tracking and condition monitoring is becoming a standard offering, providing unparalleled transparency to clients.

Propelling Factors for Middle East and Africa Freight & Logistics Market Growth

Several key factors are propelling the growth of the MEA Freight & Logistics Market. Foremost is the increasing government focus on economic diversification and infrastructure development, exemplified by Saudi Arabia's Vision 2030 initiatives, which include significant investments in logistics. The burgeoning e-commerce sector across the region is a major demand driver, necessitating efficient and rapid delivery networks. Technological advancements, such as the adoption of AI, IoT, and automation, are enhancing operational efficiency and reducing costs. Furthermore, growing foreign direct investment and the expansion of international trade routes are creating new opportunities. The XX% projected growth in intra-regional trade is also a significant catalyst.

Obstacles in the Middle East and Africa Freight & Logistics Market Market

Despite the robust growth, the MEA Freight & Logistics Market faces several obstacles. Regulatory fragmentation across different countries can lead to complex customs procedures and trade barriers. Inadequate infrastructure in certain remote areas and a lack of skilled labor can also hinder efficient operations. Supply chain disruptions, including geopolitical instability and natural disasters, pose significant risks. Fierce competition among numerous players, particularly in pricing, can impact profit margins, with smaller players often struggling to compete with the scale of larger, established entities. The high cost of technology adoption for smaller logistics providers also presents a challenge, potentially widening the gap between technologically advanced and less advanced companies.

Future Opportunities in Middle East and Africa Freight & Logistics Market

The MEA Freight & Logistics Market is poised for significant future opportunities. The continued expansion of e-commerce, particularly in emerging markets within Africa, presents a vast untapped potential for last-mile delivery solutions. The development of specialized logistics services for sectors like healthcare (cold chain for pharmaceuticals) and renewable energy (components for solar and wind farms) will offer new revenue streams. Increased investment in intermodal transportation, particularly rail connectivity, can unlock new efficiencies. Furthermore, the drive towards sustainable logistics and the adoption of green technologies will create opportunities for innovative service providers. The increasing focus on developing regional logistics hubs can also foster growth.

Major Players in the Middle East and Africa Freight & Logistics Market Ecosystem

- United Parcel Service Inc.

- DHL

- Gulf Agency Company (GAC)

- Ceva Logistics

- International Freight Group

- FedEx

- Agility Logistics

- Al-Futtaim Logistics

- Kuehne + Nagel

- Saudi Transport & Investment Co (Mubarrad)

- RAK Logistics

- Almajdouie Group

Key Developments in Middle East and Africa Freight & Logistics Market Industry

- May 2023: Saudi Logistics Services (SAL) and Lufthansa Technik Logistik Services (LTLS) signed an initial Memorandum of Understanding (MoU) to collaborate on the logistics activities of LTLS within Saudi Arabia. Under this MoU, SAL will provide freight forwarding, transportation, and customs brokerage services to support LTLS' maintenance logistics operations for their key customers around Saudi Arabia. As a result, LTLS would subsequently strengthen its logistics services coverage within Saudi Arabia.

- April 2023: Saudi Arabia's Almajdouie Logistics expanded its fleet size by adding 30 new Hyundai Xcient trucks. The engine produces 440 horsepower, making the Hyundai Xcient one of the most powerful heavy-duty trucks globally.

Strategic Middle East and Africa Freight & Logistics Market Market Forecast

The strategic outlook for the MEA Freight & Logistics Market is exceptionally promising. Growth will be sustained by ongoing infrastructure development, particularly in Saudi Arabia and the UAE, and the unabated rise of e-commerce across the continent. Technological adoption, including AI, automation, and digitalization, will be critical for enhancing efficiency and competitiveness. Emerging opportunities lie in specialized logistics segments, such as cold chain and pharmaceutical logistics, driven by evolving consumer needs and healthcare advancements. The market is expected to witness continued consolidation through strategic M&A activities as larger players seek to expand their service portfolios and geographical reach, solidifying the forecast of significant market expansion and value creation in the coming years.

Middle East and Africa Freight & Logistics Market Segmentation

-

1. Function

-

1.1. Freight Transport

- 1.1.1. Road

- 1.1.2. Water

- 1.1.3. Air

- 1.1.4. Rail

- 1.2. Freight Forwarding

- 1.3. Warehousing

- 1.4. Value-added Services and Other Functions

-

1.1. Freight Transport

-

2. End User

- 2.1. Manufacturing and Automotive

- 2.2. Oil and Gas, Mining, and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Construction

- 2.5. Distribu

- 2.6. Other En

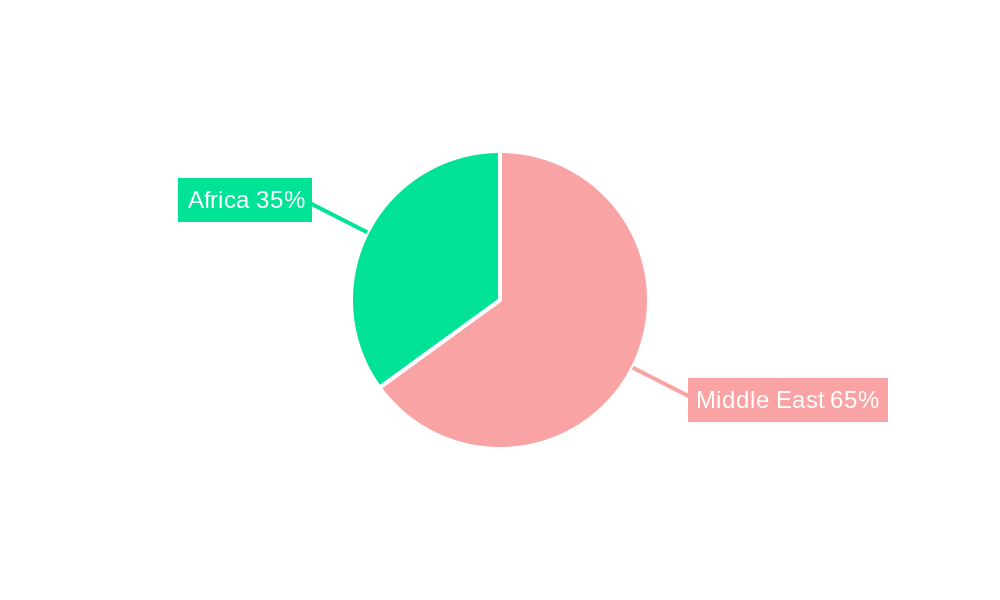

Middle East and Africa Freight & Logistics Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Freight & Logistics Market Regional Market Share

Geographic Coverage of Middle East and Africa Freight & Logistics Market

Middle East and Africa Freight & Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise In E-commerce Growth in The Region; Development of Logistic Infrastructure

- 3.3. Market Restrains

- 3.3.1. Poor Infrastruture

- 3.4. Market Trends

- 3.4.1. Development of freight transport segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Freight & Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Freight Transport

- 5.1.1.1. Road

- 5.1.1.2. Water

- 5.1.1.3. Air

- 5.1.1.4. Rail

- 5.1.2. Freight Forwarding

- 5.1.3. Warehousing

- 5.1.4. Value-added Services and Other Functions

- 5.1.1. Freight Transport

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Oil and Gas, Mining, and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Construction

- 5.2.5. Distribu

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 United Parcel Service Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gulf Agency Company (GAC)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ceva Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 International Freight Group**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FedEx

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Agility Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Al-Futtaim Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kuehne + Nagel

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Saudi Transport & Investment Co (Mubarrad)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 RAK Logistics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Almajdouie Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 United Parcel Service Inc

List of Figures

- Figure 1: Middle East and Africa Freight & Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Freight & Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Freight & Logistics Market Revenue Million Forecast, by Function 2020 & 2033

- Table 2: Middle East and Africa Freight & Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Middle East and Africa Freight & Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Middle East and Africa Freight & Logistics Market Revenue Million Forecast, by Function 2020 & 2033

- Table 5: Middle East and Africa Freight & Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Middle East and Africa Freight & Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Saudi Arabia Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: United Arab Emirates Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Israel Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Qatar Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Kuwait Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Oman Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Bahrain Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Jordan Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Lebanon Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Freight & Logistics Market?

The projected CAGR is approximately > 6.36%.

2. Which companies are prominent players in the Middle East and Africa Freight & Logistics Market?

Key companies in the market include United Parcel Service Inc, DHL, Gulf Agency Company (GAC), Ceva Logistics, International Freight Group**List Not Exhaustive, FedEx, Agility Logistics, Al-Futtaim Logistics, Kuehne + Nagel, Saudi Transport & Investment Co (Mubarrad), RAK Logistics, Almajdouie Group.

3. What are the main segments of the Middle East and Africa Freight & Logistics Market?

The market segments include Function, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 163.57 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise In E-commerce Growth in The Region; Development of Logistic Infrastructure.

6. What are the notable trends driving market growth?

Development of freight transport segment.

7. Are there any restraints impacting market growth?

Poor Infrastruture.

8. Can you provide examples of recent developments in the market?

May 2023: Saudi Logistics Services (SAL) and Lufthansa Technik Logistik Services (LTLS) have signed an initial Memorandum of Understanding (MoU) to collaborate on the logistics activities of LTLS within Saudi Arabia. Under this MoU, SAL will provide freight forwarding, transportation, and customs brokerage services to support LTLS' maintenance logistics operations for their key customers around Saudi Arabia. As a result, LTLS would subsequently strengthen its logistics services coverage within Saudi Arabia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Freight & Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Freight & Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Freight & Logistics Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Freight & Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence