Key Insights

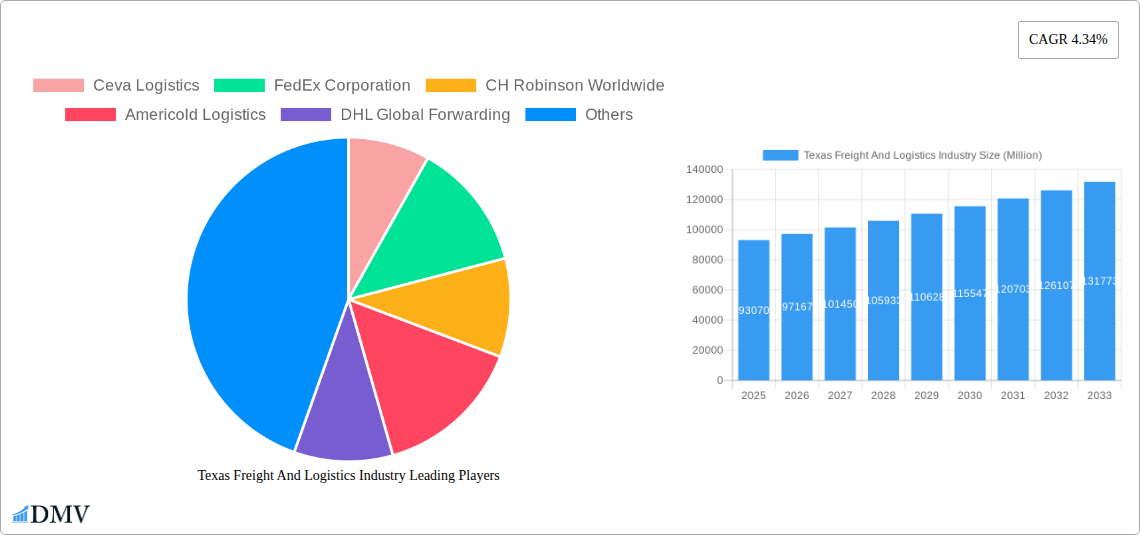

The Texas freight and logistics industry is poised for robust expansion, with an estimated market size of USD 93.07 billion in 2025. This growth is projected to continue at a Compound Annual Growth Rate (CAGR) of 4.34% over the forecast period of 2025-2033, indicating a sustained upward trajectory. Key drivers fueling this expansion include Texas's strategic geographic location as a major transportation hub, its booming economy with strong contributions from sectors like Oil & Gas, Construction, and Manufacturing, and the increasing demand for efficient supply chain solutions. The state's extensive network of ports, highways, and rail lines facilitates seamless movement of goods, both domestically and internationally, further bolstering its position as a critical node in global trade.

Texas Freight And Logistics Industry Market Size (In Billion)

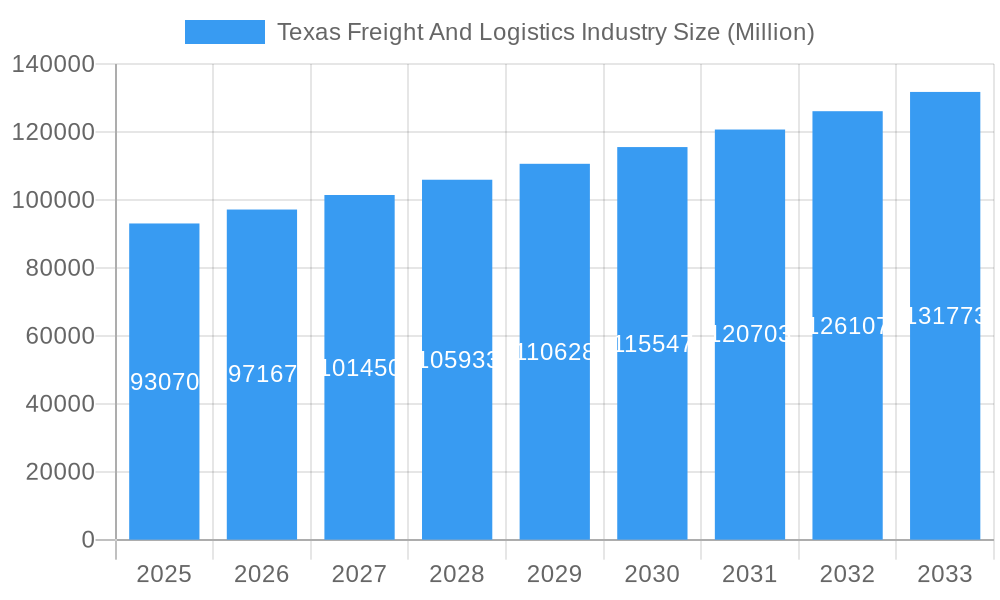

The industry's segmentation reveals diverse areas of opportunity. Freight transport, encompassing road, rail, sea, and air, will remain the largest segment, benefiting from increased trade volumes. Freight forwarding and warehousing services are also expected to witness significant growth as businesses seek optimized inventory management and distribution strategies. Value-added services, such as cross-docking and customized packaging, are becoming increasingly crucial for maintaining a competitive edge. End-user industries like Construction, driven by ongoing infrastructure development and urban expansion, and Oil & Gas, a cornerstone of the Texan economy, will continue to be major contributors to logistics demand. The Manufacturing and Automotive sectors, alongside Distributive Trade, will also fuel demand for sophisticated logistics solutions. Leading companies such as Ceva Logistics, FedEx Corporation, CH Robinson Worldwide, Americold Logistics, and DHL Global Forwarding are actively investing in expanding their presence and capabilities within Texas to capitalize on these growth prospects.

Texas Freight And Logistics Industry Company Market Share

Texas Freight And Logistics Industry Market Analysis Report

This comprehensive report delves into the dynamic Texas freight and logistics industry, providing an in-depth analysis of its market composition, evolution, leading segments, and future trajectory. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this research is invaluable for stakeholders seeking to understand the intricacies of this vital sector.

Texas Freight And Logistics Industry Market Composition & Trends

The Texas freight and logistics industry is characterized by a moderately concentrated market, with key players driving innovation and service expansion. Market share distribution is influenced by the scale of operations and specialization within segments like freight transport, forwarding, warehousing, and value-added services. Mergers and acquisitions (M&A) are pivotal in shaping this landscape, with estimated deal values in the hundreds of millions of dollars fueling consolidation and strategic growth. Major M&A activities include acquisitions aimed at expanding fleet capacity and service reach, particularly along the Gulf Coast. Regulatory frameworks, while essential for operational integrity, also present a dynamic environment that companies must navigate. The emergence of substitute products, such as advanced logistics software solutions, is continually pushing the industry towards greater efficiency. Understanding the diverse end-user profiles, from the robust demands of the Oil and Gas sector to the evolving needs of Manufacturing and Automotive, is critical for identifying market opportunities and developing targeted strategies.

Texas Freight And Logistics Industry Industry Evolution

The Texas freight and logistics industry has experienced a significant evolution, driven by a confluence of technological advancements, shifting consumer demands, and robust economic growth within the state. Over the historical period (2019–2024), the industry has witnessed a steady upward trajectory in market growth, with an estimated annual growth rate hovering around XX%. This expansion has been fueled by Texas's strategic position as a major hub for trade and commerce, its extensive infrastructure network, and the burgeoning energy and manufacturing sectors. Technological integration has been a transformative force, with the adoption of advanced Transportation Management Systems (TMS), real-time tracking solutions, and warehouse automation technologies becoming increasingly prevalent. For instance, the expansion of partnerships like E2open's with Uber Freight in October 2022 signifies a move towards greater digitalization and efficiency, offering shippers instant comparisons of real-time transportation rates. This evolution is also marked by a growing emphasis on sustainable logistics practices and the integration of AI and machine learning for predictive analytics and route optimization. Shifting consumer demands, particularly the rise of e-commerce, have placed greater pressure on last-mile delivery services and warehousing capabilities, leading to increased investment in these areas. The industry's ability to adapt to these changes, including the adoption of electric vehicles and more efficient supply chain models, will dictate its continued success.

Leading Regions, Countries, or Segments in Texas Freight And Logistics Industry

Within the vast and multifaceted Texas freight and logistics industry, Freight Transport, particularly Road Freight, consistently emerges as the dominant segment. This is underpinned by the state's extensive highway network and its critical role in national and international supply chains. Key drivers for this dominance include:

- Massive Infrastructure Investment: Continuous investment in expanding and maintaining Texas's road infrastructure, including major arteries like I-10, I-35, and I-45, directly supports efficient road freight movement. Government initiatives and private sector investments in road construction and maintenance create a conducive environment for trucking operations.

- Economic Powerhouse: Texas's thriving economy, driven by sectors like Oil and Gas and Quarrying, Manufacturing and Automotive, and Distributive Trade, generates immense freight volumes that are predominantly moved by road. The sheer scale of resource extraction and production in Texas necessitates robust trucking solutions.

- Intermodal Connectivity: While road freight leads, its dominance is amplified by its seamless integration with other transport modes. Major seaports, rail terminals, and airports are strategically located to facilitate intermodal transfers, with road transport serving as the crucial first and last mile.

- Technological Adoption in Road Freight: The road freight sector has been a key adopter of advanced technologies, including fleet management software, telematics, and real-time tracking. Innovations that enhance visibility, optimize routes, and improve driver safety directly contribute to its efficiency and appeal.

The Oil and Gas and Quarrying end-user sector also plays a pivotal role in bolstering road freight demand, with the transportation of raw materials, equipment, and finished products heavily reliant on trucking. Similarly, the Manufacturing and Automotive sector's complex supply chains depend on timely and flexible road transport for inbound components and outbound finished goods. The Distributive Trade segment, encompassing the movement of goods to retail and consumer points, further solidifies the importance of road freight. While other segments like Warehousing and Freight Forwarding are critical components of the overall logistics ecosystem, the sheer volume and frequency of goods movement, particularly for intrastate and regional distribution, firmly place Freight Transport (Road) at the forefront of Texas's logistics landscape.

Texas Freight And Logistics Industry Product Innovations

Innovation in the Texas freight and logistics industry is rapidly transforming operational efficiencies and service offerings. Companies are increasingly deploying AI-powered route optimization software, predictive maintenance solutions for fleets, and advanced warehouse automation technologies like robotic picking systems. The integration of IoT sensors provides real-time cargo visibility, enhancing security and reducing loss. Furthermore, the development of specialized logistics platforms, such as E2open's expanded partnership with Uber Freight for real-time rating, showcases a commitment to digital solutions that streamline operations and provide instant data-driven insights. These innovations are not merely incremental; they represent a paradigm shift towards a more intelligent, agile, and responsive logistics ecosystem.

Propelling Factors for Texas Freight And Logistics Industry Growth

The Texas freight and logistics industry's growth is propelled by several key factors. Texas's status as a major energy producer and its substantial manufacturing base create consistent high demand for freight services. Significant state and federal investments in infrastructure, including the expansion of ports and highways, enhance connectivity and efficiency. Furthermore, technological advancements in supply chain management, automation, and data analytics are driving operational improvements and cost reductions. The state's favorable business climate and strategic geographic location also attract significant trade and distribution activities.

Obstacles in the Texas Freight And Logistics Industry Market

Despite its robust growth, the Texas freight and logistics industry faces several obstacles. A persistent shortage of skilled labor, particularly truck drivers, poses a significant challenge to operational capacity. Supply chain disruptions, stemming from global events, extreme weather, or port congestion, can lead to delays and increased costs. Additionally, evolving environmental regulations and the need for investment in greener technologies present both challenges and opportunities. Intense competition among logistics providers can also exert downward pressure on pricing and profit margins.

Future Opportunities in Texas Freight And Logistics Industry

The future of the Texas freight and logistics industry is ripe with opportunities. The burgeoning e-commerce market will continue to drive demand for efficient last-mile delivery and warehousing solutions. Expansion into specialized logistics services, such as cold chain logistics and hazardous materials transportation, offers avenues for growth. Furthermore, the increasing adoption of autonomous vehicles and drone technology holds the potential to revolutionize freight movement. Investing in sustainable logistics practices and leveraging big data analytics for optimized operations will be crucial for capitalizing on these emerging trends.

Major Players in the Texas Freight And Logistics Industry Ecosystem

- Ceva Logistics

- FedEx Corporation

- CH Robinson Worldwide

- Americold Logistics

- DHL Global Forwarding

- Expeditors International of Washington

- XPO Logistics Inc

- DSV Air & Sea Inc

- Bollore Logistics

- Kintetsu World Express

Key Developments in Texas Freight And Logistics Industry Industry

- November 2022: Quantix, a portfolio company of Wind Point Partners, acquired Dobbins Enterprises, C&S Express, Chancelor Transportation, T&K Chancelor Enterprises, and Templet Transit, significantly expanding its operational footprint and service offerings. Quantix also added L.D. McCloud Transportation to its liquid and plastics transportation division, enhancing its capacity with over 140 new trucks and ancillary equipment, primarily serving the Gulf Coast region including Houston, Baton Rouge, Port Allen, and Meridian, Mississippi. This development indicates a strong consolidation trend and a focus on expanding regional coverage and specialized transport capabilities.

- October 2022: E2open Parent Holdings, Inc. enhanced its partnership with Uber Freight, integrating a real-time rating solution into its Transportation Management System (TMS) application. This Carrier Highlight innovation empowers shippers with instant comparisons of transportation rate options against both contract and spot rates within their network, demonstrating a move towards greater transparency, efficiency, and data-driven decision-making in freight procurement.

Strategic Texas Freight And Logistics Industry Market Forecast

The strategic forecast for the Texas freight and logistics industry points towards sustained and robust growth, driven by ongoing economic expansion and evolving market dynamics. Key growth catalysts include the continued rise of e-commerce, demanding more agile and responsive delivery networks, and the persistent strength of the energy and manufacturing sectors, which ensure a steady flow of goods. The industry's embrace of advanced technologies, such as AI for route optimization and automation in warehousing, will significantly enhance efficiency and reduce operational costs, thereby improving profitability. Furthermore, strategic investments in infrastructure and a growing emphasis on sustainable logistics practices are poised to unlock new market opportunities and attract further investment, solidifying Texas's position as a preeminent logistics hub in North America. The market potential is vast, with ongoing innovation and adaptation to new trends promising a dynamic and prosperous future for the Texas freight and logistics sector.

Texas Freight And Logistics Industry Segmentation

-

1. Function

-

1.1. Freight Transport

- 1.1.1. Road

- 1.1.2. Rail

- 1.1.3. Sea and Inland

- 1.1.4. Air

- 1.2. Freight Forwarding

- 1.3. Warehousing

- 1.4. Value-added Services

-

1.1. Freight Transport

-

2. End-User

- 2.1. Construction

- 2.2. Oil and Gas and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Manufacturing and Automotive

- 2.5. Distributive Trade

- 2.6. Other End Users

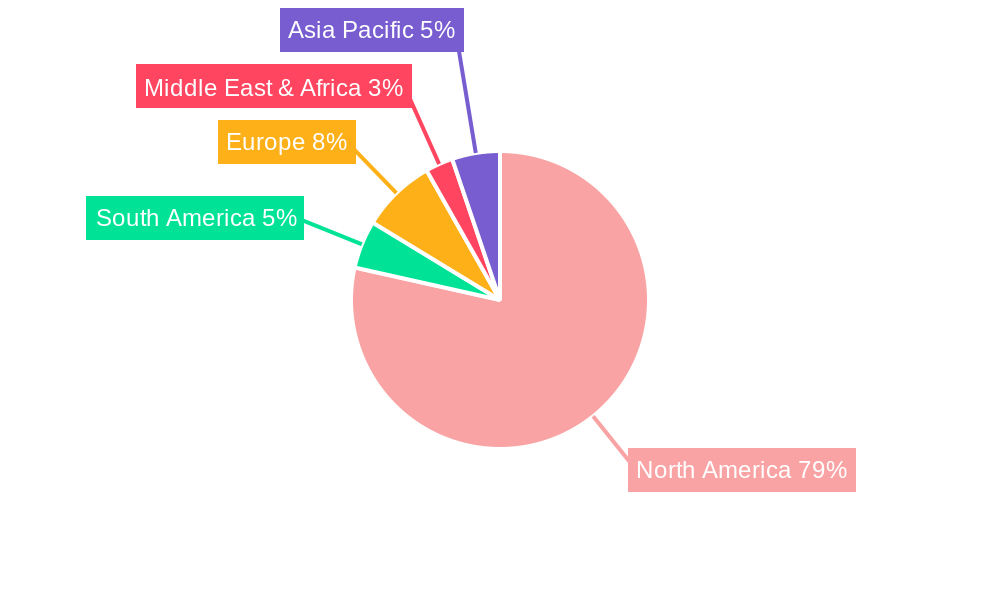

Texas Freight And Logistics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Texas Freight And Logistics Industry Regional Market Share

Geographic Coverage of Texas Freight And Logistics Industry

Texas Freight And Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expansion of online apparel sales; The demand for faster delivery and quicker time to market

- 3.3. Market Restrains

- 3.3.1. Highly perishable fashion trends; High cost of technology and infrastructure

- 3.4. Market Trends

- 3.4.1. Increase in value-added services in the country driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Texas Freight And Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Freight Transport

- 5.1.1.1. Road

- 5.1.1.2. Rail

- 5.1.1.3. Sea and Inland

- 5.1.1.4. Air

- 5.1.2. Freight Forwarding

- 5.1.3. Warehousing

- 5.1.4. Value-added Services

- 5.1.1. Freight Transport

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Construction

- 5.2.2. Oil and Gas and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Manufacturing and Automotive

- 5.2.5. Distributive Trade

- 5.2.6. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. North America Texas Freight And Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Function

- 6.1.1. Freight Transport

- 6.1.1.1. Road

- 6.1.1.2. Rail

- 6.1.1.3. Sea and Inland

- 6.1.1.4. Air

- 6.1.2. Freight Forwarding

- 6.1.3. Warehousing

- 6.1.4. Value-added Services

- 6.1.1. Freight Transport

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Construction

- 6.2.2. Oil and Gas and Quarrying

- 6.2.3. Agriculture, Fishing, and Forestry

- 6.2.4. Manufacturing and Automotive

- 6.2.5. Distributive Trade

- 6.2.6. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Function

- 7. South America Texas Freight And Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Function

- 7.1.1. Freight Transport

- 7.1.1.1. Road

- 7.1.1.2. Rail

- 7.1.1.3. Sea and Inland

- 7.1.1.4. Air

- 7.1.2. Freight Forwarding

- 7.1.3. Warehousing

- 7.1.4. Value-added Services

- 7.1.1. Freight Transport

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Construction

- 7.2.2. Oil and Gas and Quarrying

- 7.2.3. Agriculture, Fishing, and Forestry

- 7.2.4. Manufacturing and Automotive

- 7.2.5. Distributive Trade

- 7.2.6. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Function

- 8. Europe Texas Freight And Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Function

- 8.1.1. Freight Transport

- 8.1.1.1. Road

- 8.1.1.2. Rail

- 8.1.1.3. Sea and Inland

- 8.1.1.4. Air

- 8.1.2. Freight Forwarding

- 8.1.3. Warehousing

- 8.1.4. Value-added Services

- 8.1.1. Freight Transport

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Construction

- 8.2.2. Oil and Gas and Quarrying

- 8.2.3. Agriculture, Fishing, and Forestry

- 8.2.4. Manufacturing and Automotive

- 8.2.5. Distributive Trade

- 8.2.6. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Function

- 9. Middle East & Africa Texas Freight And Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Function

- 9.1.1. Freight Transport

- 9.1.1.1. Road

- 9.1.1.2. Rail

- 9.1.1.3. Sea and Inland

- 9.1.1.4. Air

- 9.1.2. Freight Forwarding

- 9.1.3. Warehousing

- 9.1.4. Value-added Services

- 9.1.1. Freight Transport

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Construction

- 9.2.2. Oil and Gas and Quarrying

- 9.2.3. Agriculture, Fishing, and Forestry

- 9.2.4. Manufacturing and Automotive

- 9.2.5. Distributive Trade

- 9.2.6. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Function

- 10. Asia Pacific Texas Freight And Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Function

- 10.1.1. Freight Transport

- 10.1.1.1. Road

- 10.1.1.2. Rail

- 10.1.1.3. Sea and Inland

- 10.1.1.4. Air

- 10.1.2. Freight Forwarding

- 10.1.3. Warehousing

- 10.1.4. Value-added Services

- 10.1.1. Freight Transport

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Construction

- 10.2.2. Oil and Gas and Quarrying

- 10.2.3. Agriculture, Fishing, and Forestry

- 10.2.4. Manufacturing and Automotive

- 10.2.5. Distributive Trade

- 10.2.6. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Function

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ceva Logistics

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 FedEx Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CH Robinson Worldwide

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Americold Logistics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DHL Global Forwarding

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Expeditors International of Washington**List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 XPO Logistics Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DSV Air & Sea Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bollore Logistics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kintetsu World Express

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Ceva Logistics

List of Figures

- Figure 1: Global Texas Freight And Logistics Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Texas Freight And Logistics Industry Revenue (Million), by Function 2025 & 2033

- Figure 3: North America Texas Freight And Logistics Industry Revenue Share (%), by Function 2025 & 2033

- Figure 4: North America Texas Freight And Logistics Industry Revenue (Million), by End-User 2025 & 2033

- Figure 5: North America Texas Freight And Logistics Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 6: North America Texas Freight And Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Texas Freight And Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Texas Freight And Logistics Industry Revenue (Million), by Function 2025 & 2033

- Figure 9: South America Texas Freight And Logistics Industry Revenue Share (%), by Function 2025 & 2033

- Figure 10: South America Texas Freight And Logistics Industry Revenue (Million), by End-User 2025 & 2033

- Figure 11: South America Texas Freight And Logistics Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 12: South America Texas Freight And Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Texas Freight And Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Texas Freight And Logistics Industry Revenue (Million), by Function 2025 & 2033

- Figure 15: Europe Texas Freight And Logistics Industry Revenue Share (%), by Function 2025 & 2033

- Figure 16: Europe Texas Freight And Logistics Industry Revenue (Million), by End-User 2025 & 2033

- Figure 17: Europe Texas Freight And Logistics Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 18: Europe Texas Freight And Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Texas Freight And Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Texas Freight And Logistics Industry Revenue (Million), by Function 2025 & 2033

- Figure 21: Middle East & Africa Texas Freight And Logistics Industry Revenue Share (%), by Function 2025 & 2033

- Figure 22: Middle East & Africa Texas Freight And Logistics Industry Revenue (Million), by End-User 2025 & 2033

- Figure 23: Middle East & Africa Texas Freight And Logistics Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Middle East & Africa Texas Freight And Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Texas Freight And Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Texas Freight And Logistics Industry Revenue (Million), by Function 2025 & 2033

- Figure 27: Asia Pacific Texas Freight And Logistics Industry Revenue Share (%), by Function 2025 & 2033

- Figure 28: Asia Pacific Texas Freight And Logistics Industry Revenue (Million), by End-User 2025 & 2033

- Figure 29: Asia Pacific Texas Freight And Logistics Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Asia Pacific Texas Freight And Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Texas Freight And Logistics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Function 2020 & 2033

- Table 2: Global Texas Freight And Logistics Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Function 2020 & 2033

- Table 5: Global Texas Freight And Logistics Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Function 2020 & 2033

- Table 11: Global Texas Freight And Logistics Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 12: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Function 2020 & 2033

- Table 17: Global Texas Freight And Logistics Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 18: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Function 2020 & 2033

- Table 29: Global Texas Freight And Logistics Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 30: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Function 2020 & 2033

- Table 38: Global Texas Freight And Logistics Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 39: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Texas Freight And Logistics Industry?

The projected CAGR is approximately 4.34%.

2. Which companies are prominent players in the Texas Freight And Logistics Industry?

Key companies in the market include Ceva Logistics, FedEx Corporation, CH Robinson Worldwide, Americold Logistics, DHL Global Forwarding, Expeditors International of Washington**List Not Exhaustive, XPO Logistics Inc, DSV Air & Sea Inc, Bollore Logistics, Kintetsu World Express.

3. What are the main segments of the Texas Freight And Logistics Industry?

The market segments include Function, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 93.07 Million as of 2022.

5. What are some drivers contributing to market growth?

Expansion of online apparel sales; The demand for faster delivery and quicker time to market.

6. What are the notable trends driving market growth?

Increase in value-added services in the country driving the market.

7. Are there any restraints impacting market growth?

Highly perishable fashion trends; High cost of technology and infrastructure.

8. Can you provide examples of recent developments in the market?

November 2022- Quantix, a portfolio company of Wind Point Partners in Chicago, has acquired five companies: Dobbins Enterprises, C&S Express, Chancelor Transportation, T&K Chancelor Enterprises, and Templet Transit. Quantix also announced the addition of a new agent, L.D. McCloud Transportation, to its liquid and plastics transportation division, added more than 140 trucks and ancillary equipment. Customers will be served by the new trucks all along the Gulf Coast, including Houston, Baton Rouge and Port Allen, Louisiana, and Meridian, Mississippi.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Texas Freight And Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Texas Freight And Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Texas Freight And Logistics Industry?

To stay informed about further developments, trends, and reports in the Texas Freight And Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence