Key Insights

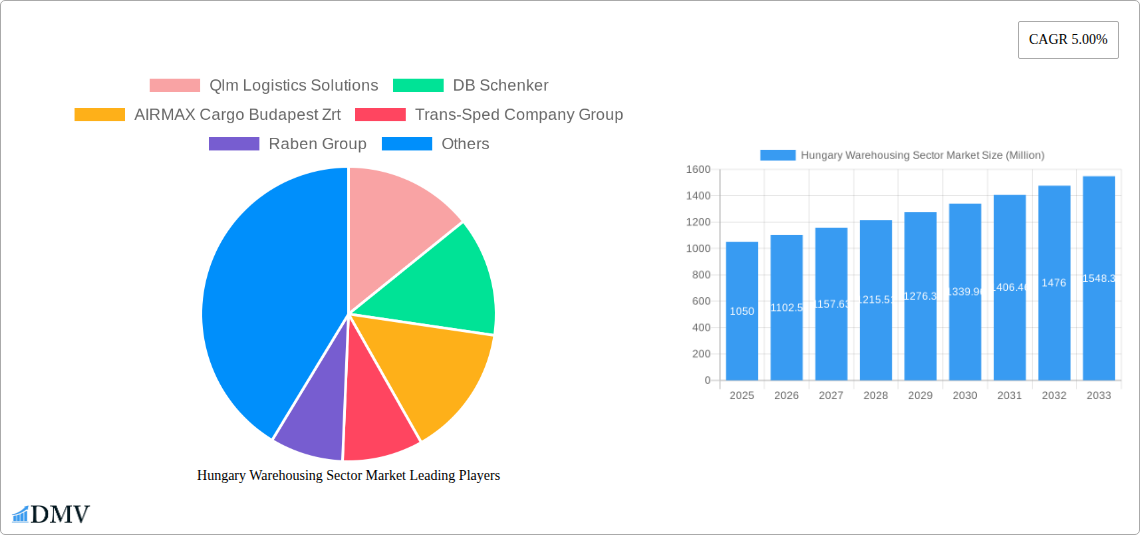

The Hungarian warehousing sector, valued at €1.05 billion in 2025, is projected to experience robust growth, fueled by a Compound Annual Growth Rate (CAGR) of 5% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the burgeoning e-commerce sector in Hungary demands efficient storage and distribution solutions, boosting demand for warehousing services across all segments. Secondly, growth in manufacturing and consumer goods sectors contributes significantly, necessitating increased warehousing capacity for raw materials, finished goods, and inventory management. The rise of temperature-sensitive goods within the food and beverage industry further fuels the demand for specialized refrigerated warehousing. Finally, government initiatives aimed at improving logistics infrastructure and attracting foreign investment positively impact market expansion. The market is segmented by end-user industry (manufacturing, consumer goods, food and beverage, retail, healthcare, and others), warehousing type (general, refrigerated, and farm product warehousing), and ownership (private, public, and bonded warehouses). Competition is relatively fragmented, with both large multinational players like DB Schenker and CEVA Logistics, and smaller regional operators vying for market share.

Hungary Warehousing Sector Market Market Size (In Billion)

While the overall growth trajectory is positive, the market faces certain challenges. Fluctuations in the global economy and potential disruptions to supply chains could impact demand. Furthermore, rising land costs and labor shortages may pose constraints on expansion for some warehouse operators. However, technological advancements in warehouse automation and management systems, along with a growing focus on sustainability within the logistics sector, are expected to mitigate these challenges and contribute to the continued growth of the Hungarian warehousing market. The strategic location of Hungary within Central Europe, acting as a crucial transit point between East and West, further strengthens its position within the regional logistics network. This favorable geographical position is a significant long-term driver for sustained growth in the sector.

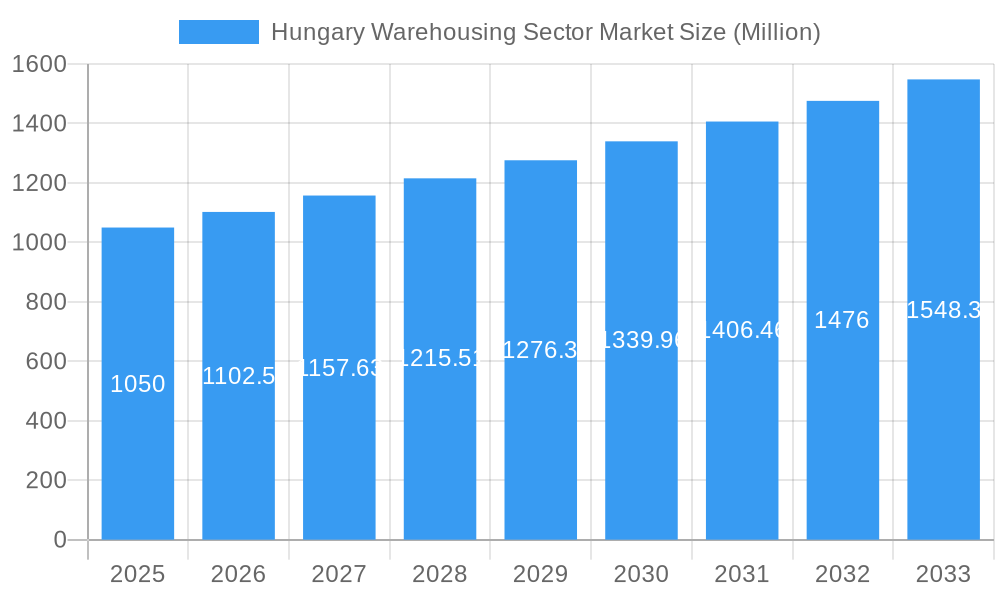

Hungary Warehousing Sector Market Company Market Share

This comprehensive report provides a detailed analysis of the Hungary Warehousing Sector Market, offering invaluable insights for stakeholders seeking to understand market dynamics, growth trajectories, and future opportunities. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033.

Hungary Warehousing Sector Market Composition & Trends

This section delves into the intricate landscape of the Hungarian warehousing sector, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and M&A activities. The report analyzes market share distribution among key players, including Qlm Logistics Solutions, DB Schenker, AIRMAX Cargo Budapest Zrt, Trans-Sped Company Group, Raben Group, CEVA Logistics, ADR Logistics Kft, Eurasia Logistics Ltd, Webshippy Magyarország Kft, and Rhenus Logistics (list not exhaustive). We quantify the market size in Millions and project growth rates, highlighting the impact of mergers and acquisitions (M&A) with deal values (in Millions) where available. The analysis includes a thorough evaluation of the competitive environment and identifies key trends shaping the sector's future.

- Market Size (2025): XX Million

- Market Growth Rate (2025-2033): XX% CAGR

- Market Concentration (2025): XX% (Top 5 players)

- Average M&A Deal Value (2019-2024): XX Million

Hungary Warehousing Sector Market Industry Evolution

This section meticulously charts the evolution of the Hungarian warehousing market from 2019 to 2033, examining growth trajectories, technological advancements, and evolving consumer demands. We analyze the impact of factors like automation, digitalization, and sustainability on market dynamics. The report provides detailed data points on growth rates, adoption metrics for new technologies, and shifts in end-user preferences across various segments – Manufacturing, Consumer Goods, Food and Beverages, Retail, Healthcare, and Other End-User Industries. We analyze the impact of changing supply chains and consumer preferences on warehousing demand, supported by quantifiable data and trends.

Leading Regions, Countries, or Segments in Hungary Warehousing Sector Market

This section identifies the leading segments within the Hungarian warehousing market, analyzing dominance across end-user industries (Manufacturing, Consumer Goods, Food & Beverages, Retail, Healthcare, Others), warehousing types (General, Refrigerated, Farm Product), and ownership structures (Private, Public, Bonded). The analysis pinpoints the key drivers of growth within these dominant segments.

- Dominant End-User Industry: Manufacturing (due to strong automotive and industrial sectors)

- Fastest-Growing Segment: Refrigerated Warehousing (driven by the expanding food and beverage sector)

- Key Drivers:

- Investment in Modernization: Significant investments in advanced warehousing technologies and infrastructure.

- Government Support: Favorable regulatory environment and incentives for logistics infrastructure development.

- Strategic Location: Hungary's central location in Europe fosters robust cross-border trade and warehousing demand.

Hungary Warehousing Sector Market Product Innovations

This section showcases the latest innovations in warehousing technology, encompassing automation solutions, warehouse management systems (WMS), and other cutting-edge technologies that enhance efficiency and productivity. The report will detail the unique selling propositions (USPs) of these innovations, emphasizing their impact on overall operational performance and cost optimization. Specific examples of innovative products and their performance metrics (e.g., increased throughput, reduced error rates) will be presented.

Propelling Factors for Hungary Warehousing Sector Market Growth

Several factors are fueling the growth of the Hungarian warehousing sector. Strong economic growth, increased e-commerce activity, and rising foreign direct investment (FDI) are driving demand for warehousing space. Technological advancements, such as automation and robotics, are improving efficiency and reducing costs. Favorable government policies and infrastructure development further contribute to the market's expansion.

Obstacles in the Hungary Warehousing Sector Market

Despite significant growth potential, the Hungarian warehousing sector faces challenges. These include potential labor shortages, rising land costs, and competition from neighboring countries. Supply chain disruptions and regulatory complexities can also impact market growth. The report quantifies the impact of these factors on market dynamics.

Future Opportunities in Hungary Warehousing Sector Market

The future of the Hungarian warehousing sector presents exciting opportunities. The rising popularity of e-commerce and the growth of specialized warehousing (e.g., cold chain logistics) offer significant potential. Investments in sustainable warehousing practices and the adoption of advanced technologies will shape the sector's future.

Major Players in the Hungary Warehousing Sector Market Ecosystem

- Qlm Logistics Solutions

- DB Schenker

- AIRMAX Cargo Budapest Zrt

- Trans-Sped Company Group

- Raben Group

- CEVA Logistics

- ADR Logistics Kft

- Eurasia Logistics Ltd

- Webshippy Magyarország Kft

- Rhenus Logistics

Key Developments in Hungary Warehousing Sector Market Industry

- September 2023: Sennebogen GmbH opened a new manufacturing facility in Litér, boosting the production of material handling equipment.

- September 2023: Rhenus acquired ITS Logistics Hungary KFT, strengthening its position in Central-Eastern Europe.

Strategic Hungary Warehousing Sector Market Forecast

The Hungarian warehousing sector is poised for continued growth, driven by strong economic fundamentals, technological advancements, and favorable government policies. The sector's expansion will be shaped by the increasing adoption of automation, digitalization, and sustainable practices. The forecast period (2025-2033) projects significant market expansion, presenting attractive investment opportunities.

Hungary Warehousing Sector Market Segmentation

-

1. Type

- 1.1. General Warehousing and Storage

- 1.2. Refrigerated warehousing and storage

- 1.3. Farm Product warehousing and storage

-

2. Ownership

- 2.1. Private Warehouses

- 2.2. Public Warehouses

- 2.3. Bonded Warehouse

-

3. End-User Industry

- 3.1. Manufacturing

- 3.2. Consumer Goods

- 3.3. Food and Beverages

- 3.4. Retail

- 3.5. Helathcare

- 3.6. Other End-User Industries

Hungary Warehousing Sector Market Segmentation By Geography

- 1. Hungary

Hungary Warehousing Sector Market Regional Market Share

Geographic Coverage of Hungary Warehousing Sector Market

Hungary Warehousing Sector Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Popularity of Omnichannel Distribution

- 3.3. Market Restrains

- 3.3.1. High Investment and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Increase in logistics space construction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Hungary Warehousing Sector Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. General Warehousing and Storage

- 5.1.2. Refrigerated warehousing and storage

- 5.1.3. Farm Product warehousing and storage

- 5.2. Market Analysis, Insights and Forecast - by Ownership

- 5.2.1. Private Warehouses

- 5.2.2. Public Warehouses

- 5.2.3. Bonded Warehouse

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Manufacturing

- 5.3.2. Consumer Goods

- 5.3.3. Food and Beverages

- 5.3.4. Retail

- 5.3.5. Helathcare

- 5.3.6. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Hungary

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Qlm Logistics Solutions

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DB Schenker

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AIRMAX Cargo Budapest Zrt

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Trans-Sped Company Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Raben Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CEVA Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ADR Logistics Kft **List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eurasia Logistics Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Webshippy Magyarország Kft

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rhenus Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Qlm Logistics Solutions

List of Figures

- Figure 1: Hungary Warehousing Sector Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Hungary Warehousing Sector Market Share (%) by Company 2025

List of Tables

- Table 1: Hungary Warehousing Sector Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Hungary Warehousing Sector Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 3: Hungary Warehousing Sector Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: Hungary Warehousing Sector Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Hungary Warehousing Sector Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Hungary Warehousing Sector Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 7: Hungary Warehousing Sector Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 8: Hungary Warehousing Sector Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hungary Warehousing Sector Market?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Hungary Warehousing Sector Market?

Key companies in the market include Qlm Logistics Solutions, DB Schenker, AIRMAX Cargo Budapest Zrt, Trans-Sped Company Group, Raben Group, CEVA Logistics, ADR Logistics Kft **List Not Exhaustive, Eurasia Logistics Ltd, Webshippy Magyarország Kft, Rhenus Logistics.

3. What are the main segments of the Hungary Warehousing Sector Market?

The market segments include Type, Ownership, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.05 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Popularity of Omnichannel Distribution.

6. What are the notable trends driving market growth?

Increase in logistics space construction.

7. Are there any restraints impacting market growth?

High Investment and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

September 2023: Germany-based material handling equipment manufacturer Sennebogen GmbH inaugurated its new manufacturing facility, Termelés-Logistic-Centrum GmbH, in Litér, Hungary. Covering an expansive area of 315,000 square feet, the state-of-the-art plant is strategically designed to enhance Sennebogen's capacity for the production of steel and welded assemblies. In addition to the advanced manufacturing capabilities, the facility also includes office space. Situated on a sprawling 32-acre site, the new plant is located approximately a half-hour drive from Sennebogen's initial manufacturing site in Balatonfüred, Hungary.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hungary Warehousing Sector Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hungary Warehousing Sector Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hungary Warehousing Sector Market?

To stay informed about further developments, trends, and reports in the Hungary Warehousing Sector Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence