Key Insights

The Chinese road freight logistics market is poised for substantial expansion, propelled by escalating e-commerce volumes and heightened industrial output. This vital sector benefits from ongoing infrastructure development, particularly in highway networks, facilitating efficient long-haul distribution. The burgeoning e-commerce landscape mandates swift and dependable delivery services, directly stimulating demand for road freight solutions. Furthermore, the increasing sophistication of supply chains is fostering demand for specialized services, including temperature-controlled transport for perishables and optimized Less-Than-Truckload (LTL) solutions for smaller consignments. Despite challenges such as driver availability and fuel price volatility, sustained market growth is anticipated. Domestic transportation is expected to remain dominant, with international trade contributing through efficient Full-Truckload (FTL) containerized services. Detailed segmentation highlights significant opportunities in temperature-controlled logistics for agricultural and manufactured goods across various route lengths. Leading domestic and international logistics providers are actively pursuing market share through technological integration, enhanced fleet management, and strategic alliances.

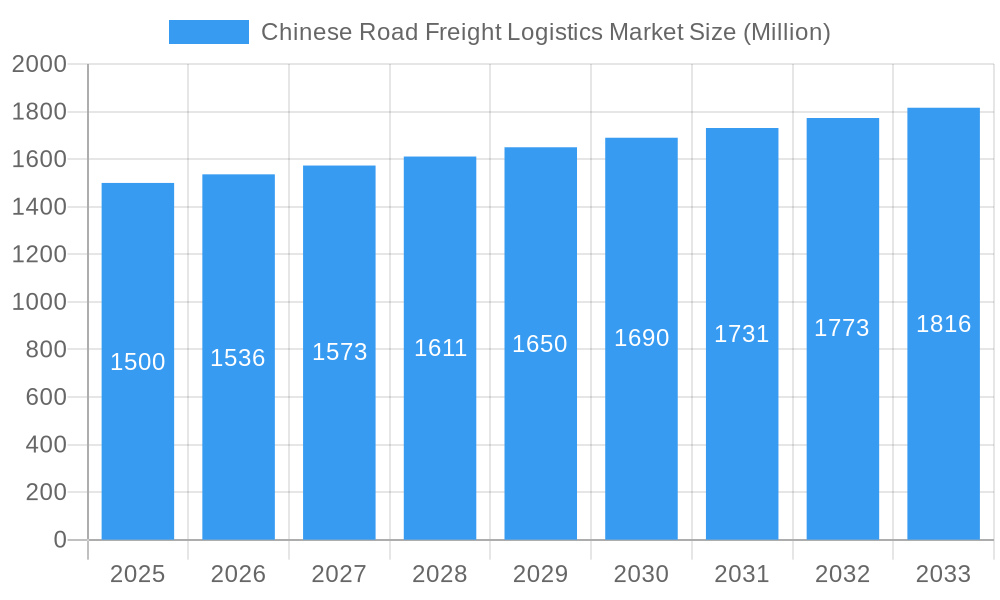

Chinese Road Freight Logistics Market Market Size (In Billion)

Market segmentation reveals key areas of accelerated growth. The FTL segment, particularly for long-haul routes, is projected for robust expansion due to its cost-effectiveness for bulk shipments. The temperature-controlled logistics segment presents considerable promise, driven by rising demand for fresh produce and pharmaceuticals. The manufacturing, e-commerce, and agricultural sectors serve as primary growth engines, with their ongoing development directly influencing road freight requirements. Regional analysis indicates that China's eastern coastal areas, characterized by high population density and industrial concentration, will continue to command the largest market share. However, western and central regions are expected to experience accelerated growth as infrastructure development progresses and economic activity diversifies. The competitive environment is dynamic, with established international players and agile domestic companies competing vigorously through technological innovation and service enhancements. This intense competition fuels continuous operational improvements and efficiency gains within the sector.

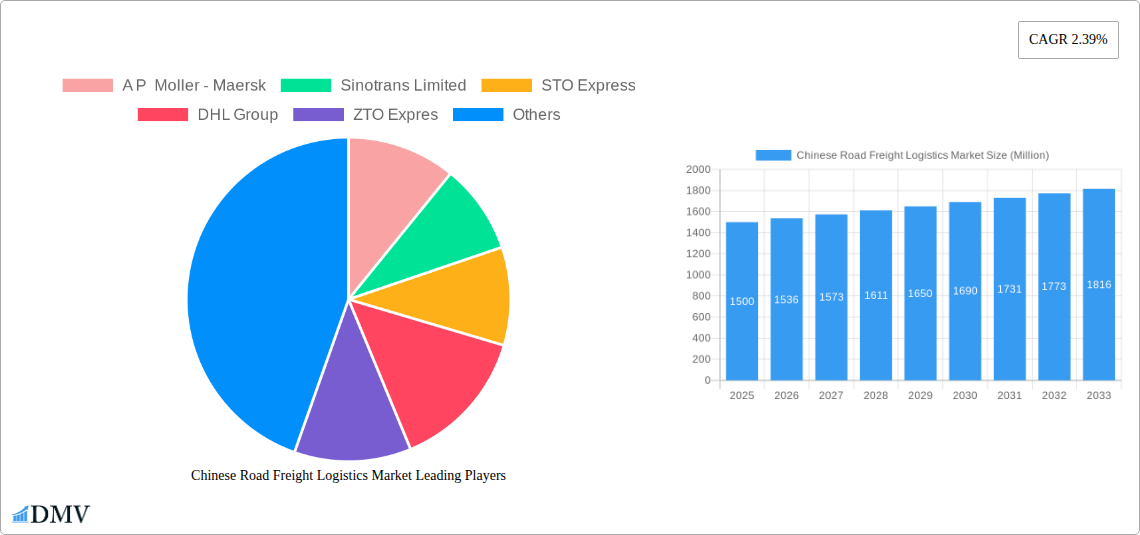

Chinese Road Freight Logistics Market Company Market Share

Chinese Road Freight Logistics Market: A Comprehensive Report (2019-2033)

This insightful report provides a deep dive into the dynamic Chinese road freight logistics market, offering a comprehensive analysis of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this rapidly evolving sector. The market size in 2025 is estimated at xx Million, poised for significant growth in the coming years.

Chinese Road Freight Logistics Market Market Composition & Trends

This section evaluates the market concentration, innovation drivers, regulatory landscape, substitute products, end-user profiles, and M&A activities within the Chinese road freight logistics market. The market is characterized by a mix of large multinational corporations and smaller domestic players, leading to a moderately concentrated market. However, the increasing adoption of technology and the rise of e-commerce are driving increased competition and market fragmentation.

Market Concentration: While precise market share figures for each player are unavailable publicly, it's evident that companies like SF Express (KEX-SF), STO Express, and Sinotrans Limited hold significant market share. Smaller players focus on niche segments or regional dominance.

Innovation Catalysts: Technological advancements such as autonomous trucking, telematics, and improved route optimization software are key innovation drivers. Government initiatives promoting green logistics further stimulate innovation.

Regulatory Landscape: Government regulations, particularly concerning safety standards, environmental regulations, and licensing, significantly impact market operations. Recent regulatory changes aimed at improving road safety and reducing emissions have led to increased operating costs for some companies.

Substitute Products: Rail freight and air freight serve as substitutes for certain road freight segments, though road freight remains dominant due to its flexibility and cost-effectiveness for many applications.

End-User Profiles: The market caters to a diverse range of end-user industries, including manufacturing (representing the largest share), wholesale and retail trade, construction, and agriculture.

M&A Activities: The past few years have witnessed several M&A deals, albeit with undisclosed values in many cases. These deals primarily focused on consolidating market share, enhancing technological capabilities, and expanding service offerings. An example would be strategic partnerships focusing on technology integration for increased efficiency.

Chinese Road Freight Logistics Market Industry Evolution

The Chinese road freight logistics market has experienced substantial growth over the historical period (2019-2024). This growth has been fueled by several factors, including the rapid expansion of e-commerce, increasing industrial output, and robust infrastructure development. The market is expected to continue its expansion, albeit at a potentially moderated pace, during the forecast period (2025-2033). Technological advancements, including the adoption of autonomous vehicles and advanced logistics software, are reshaping the industry landscape. These innovations are aimed at optimizing delivery routes, enhancing efficiency, reducing costs, and improving delivery times. Changing consumer demands, particularly the rise of next-day and same-day delivery expectations, are also shaping market dynamics. The shift towards sustainable logistics practices, driven by both environmental concerns and government regulations, is another major trend. The average annual growth rate during the historical period was xx%, and is projected to be xx% during the forecast period.

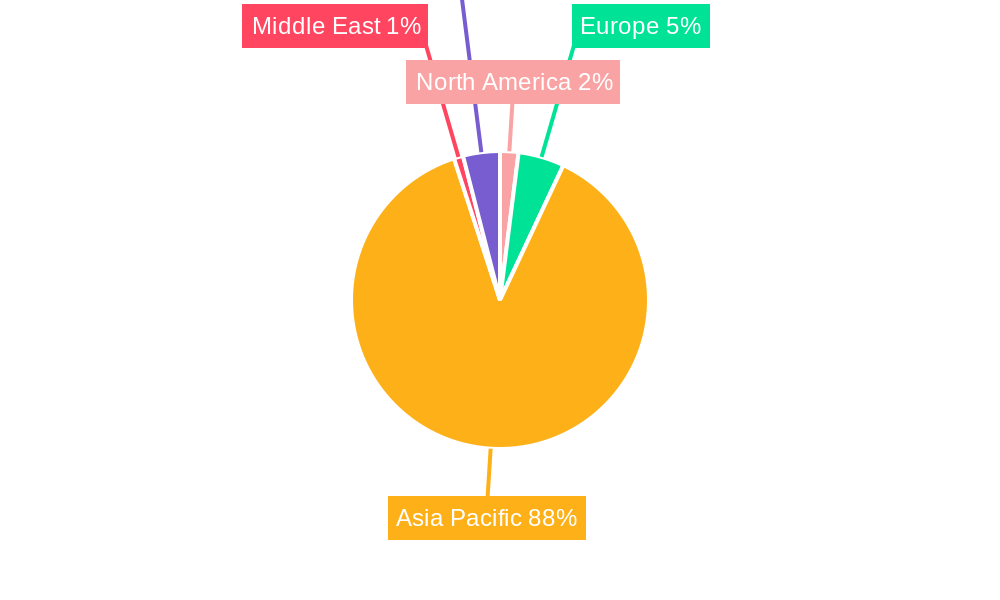

Leading Regions, Countries, or Segments in Chinese Road Freight Logistics Market

The Chinese road freight logistics market exhibits significant regional variations in terms of growth and market size. While precise regional breakdowns require extensive data analysis, coastal regions and major economic hubs like Shanghai, Guangdong, and Jiangsu generally show higher activity. The domestic market continues to dominate in terms of volume, driven by the vast scale of China's internal trade.

- Key Drivers for Domestic Market Dominance:

- High volume of intra-country trade

- Extensive road network

- Strong economic growth in various regions

- Key Drivers for Growth in Specific Segments:

- Manufacturing: High volume of goods transportation.

- E-commerce: Demand for fast and efficient last-mile delivery.

- FTL: Cost-effective for high-volume shipments.

- Containerized: Standardization leading to efficiency gains.

- Long Haul: Connecting major production and consumption centers.

Solid goods, especially those associated with the manufacturing sector and e-commerce, currently represent the largest segment by goods configuration. Non-temperature-controlled transportation comprises the majority of the market.

Chinese Road Freight Logistics Market Product Innovations

Recent innovations in the Chinese road freight logistics market focus on efficiency and sustainability. This includes the introduction of autonomous trucking solutions, improved route optimization software leveraging AI and machine learning, and the expansion of containerization for streamlined handling. These innovations aim to reduce operational costs, improve delivery speeds, and minimize environmental impact. The unique selling propositions often center around enhanced tracking capabilities, optimized routes, and reduced delivery times, appealing to both businesses and consumers.

Propelling Factors for Chinese Road Freight Logistics Market Growth

Several factors fuel the growth of the Chinese road freight logistics market. Firstly, the expansion of e-commerce creates a constant demand for efficient delivery services. Secondly, continuous industrial growth necessitates the transportation of raw materials and finished goods. Thirdly, government investments in infrastructure, particularly road networks, enhance connectivity and facilitate transportation. Finally, technological innovations streamline operations, reducing costs and improving efficiency.

Obstacles in the Chinese Road Freight Logistics Market Market

The market faces challenges such as fluctuating fuel prices, increasing labor costs, and strict government regulations. These regulatory pressures can lead to delays and increased operational expenses. Moreover, the competitive landscape, characterized by many players, creates pricing pressures. Supply chain disruptions, particularly those caused by geopolitical events or natural disasters, can cause significant delays and impact overall market stability.

Future Opportunities in Chinese Road Freight Logistics Market

The future presents opportunities for growth through the adoption of autonomous vehicles, last-mile delivery optimization, and expansion into rural areas. The increasing focus on sustainable logistics, including the adoption of electric and alternative fuel vehicles, creates substantial opportunities for companies that invest in eco-friendly solutions. The market’s ongoing integration with technological advancements opens doors for specialized services catered to evolving customer expectations.

Major Players in the Chinese Road Freight Logistics Market Ecosystem

- A P Moller - Maersk

- Sinotrans Limited

- STO Express

- DHL Group

- ZTO Express

- Shanghai Yunda Freight Co Ltd

- YTO Express

- China Post Group Corporation Ltd

- Changjiu Logistics

- Deppon Express

- Shanghai Aneng Juchuang Supply Chain Management Co Ltd

- SF Express (KEX-SF)

- CMA CGM Group

Key Developments in Chinese Road Freight Logistics Market Industry

- October 2023: Volvo, Renault, and CMA CGM announced a joint venture to develop electric vans for the logistics sector, signifying a push towards decarbonization.

- October 2023: SF Express launched SF Express Container Line (SFBuy), a one-stop cross-border shipping platform catering to the growing e-commerce market.

- September 2023: STO Express ordered 500 autonomous trucks from Inceptio Technology, accelerating the adoption of autonomous driving technology in the industry.

Strategic Chinese Road Freight Logistics Market Market Forecast

The Chinese road freight logistics market is poised for continued growth, driven by e-commerce expansion, industrial development, and technological innovation. The increasing adoption of sustainable practices and automation will reshape the industry, presenting new opportunities for market participants. While challenges remain, the market's vast size and dynamic nature ensure significant future potential. The market is projected to reach xx Million by 2033.

Chinese Road Freight Logistics Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. Truckload Specification

- 3.1. Full-Truck-Load (FTL)

- 3.2. Less than-Truck-Load (LTL)

-

4. Containerization

- 4.1. Containerized

- 4.2. Non-Containerized

-

5. Distance

- 5.1. Long Haul

- 5.2. Short Haul

-

6. Goods Configuration

- 6.1. Fluid Goods

- 6.2. Solid Goods

-

7. Temperature Control

- 7.1. Non-Temperature Controlled

Chinese Road Freight Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Chinese Road Freight Logistics Market Regional Market Share

Geographic Coverage of Chinese Road Freight Logistics Market

Chinese Road Freight Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.86% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing production of chemical and allied products driving the market4.; Rising demand for green warehouses

- 3.3. Market Restrains

- 3.3.1. 4.; Stringent Rules and Regulations4.; Higher Costs

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Chinese Road Freight Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 5.3.1. Full-Truck-Load (FTL)

- 5.3.2. Less than-Truck-Load (LTL)

- 5.4. Market Analysis, Insights and Forecast - by Containerization

- 5.4.1. Containerized

- 5.4.2. Non-Containerized

- 5.5. Market Analysis, Insights and Forecast - by Distance

- 5.5.1. Long Haul

- 5.5.2. Short Haul

- 5.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 5.6.1. Fluid Goods

- 5.6.2. Solid Goods

- 5.7. Market Analysis, Insights and Forecast - by Temperature Control

- 5.7.1. Non-Temperature Controlled

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. North America

- 5.8.2. South America

- 5.8.3. Europe

- 5.8.4. Middle East & Africa

- 5.8.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. North America Chinese Road Freight Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 6.1.1. Agriculture, Fishing, and Forestry

- 6.1.2. Construction

- 6.1.3. Manufacturing

- 6.1.4. Oil and Gas, Mining and Quarrying

- 6.1.5. Wholesale and Retail Trade

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Destination

- 6.2.1. Domestic

- 6.2.2. International

- 6.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 6.3.1. Full-Truck-Load (FTL)

- 6.3.2. Less than-Truck-Load (LTL)

- 6.4. Market Analysis, Insights and Forecast - by Containerization

- 6.4.1. Containerized

- 6.4.2. Non-Containerized

- 6.5. Market Analysis, Insights and Forecast - by Distance

- 6.5.1. Long Haul

- 6.5.2. Short Haul

- 6.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 6.6.1. Fluid Goods

- 6.6.2. Solid Goods

- 6.7. Market Analysis, Insights and Forecast - by Temperature Control

- 6.7.1. Non-Temperature Controlled

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 7. South America Chinese Road Freight Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 7.1.1. Agriculture, Fishing, and Forestry

- 7.1.2. Construction

- 7.1.3. Manufacturing

- 7.1.4. Oil and Gas, Mining and Quarrying

- 7.1.5. Wholesale and Retail Trade

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Destination

- 7.2.1. Domestic

- 7.2.2. International

- 7.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 7.3.1. Full-Truck-Load (FTL)

- 7.3.2. Less than-Truck-Load (LTL)

- 7.4. Market Analysis, Insights and Forecast - by Containerization

- 7.4.1. Containerized

- 7.4.2. Non-Containerized

- 7.5. Market Analysis, Insights and Forecast - by Distance

- 7.5.1. Long Haul

- 7.5.2. Short Haul

- 7.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 7.6.1. Fluid Goods

- 7.6.2. Solid Goods

- 7.7. Market Analysis, Insights and Forecast - by Temperature Control

- 7.7.1. Non-Temperature Controlled

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 8. Europe Chinese Road Freight Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 8.1.1. Agriculture, Fishing, and Forestry

- 8.1.2. Construction

- 8.1.3. Manufacturing

- 8.1.4. Oil and Gas, Mining and Quarrying

- 8.1.5. Wholesale and Retail Trade

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Destination

- 8.2.1. Domestic

- 8.2.2. International

- 8.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 8.3.1. Full-Truck-Load (FTL)

- 8.3.2. Less than-Truck-Load (LTL)

- 8.4. Market Analysis, Insights and Forecast - by Containerization

- 8.4.1. Containerized

- 8.4.2. Non-Containerized

- 8.5. Market Analysis, Insights and Forecast - by Distance

- 8.5.1. Long Haul

- 8.5.2. Short Haul

- 8.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 8.6.1. Fluid Goods

- 8.6.2. Solid Goods

- 8.7. Market Analysis, Insights and Forecast - by Temperature Control

- 8.7.1. Non-Temperature Controlled

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 9. Middle East & Africa Chinese Road Freight Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 9.1.1. Agriculture, Fishing, and Forestry

- 9.1.2. Construction

- 9.1.3. Manufacturing

- 9.1.4. Oil and Gas, Mining and Quarrying

- 9.1.5. Wholesale and Retail Trade

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Destination

- 9.2.1. Domestic

- 9.2.2. International

- 9.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 9.3.1. Full-Truck-Load (FTL)

- 9.3.2. Less than-Truck-Load (LTL)

- 9.4. Market Analysis, Insights and Forecast - by Containerization

- 9.4.1. Containerized

- 9.4.2. Non-Containerized

- 9.5. Market Analysis, Insights and Forecast - by Distance

- 9.5.1. Long Haul

- 9.5.2. Short Haul

- 9.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 9.6.1. Fluid Goods

- 9.6.2. Solid Goods

- 9.7. Market Analysis, Insights and Forecast - by Temperature Control

- 9.7.1. Non-Temperature Controlled

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 10. Asia Pacific Chinese Road Freight Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 10.1.1. Agriculture, Fishing, and Forestry

- 10.1.2. Construction

- 10.1.3. Manufacturing

- 10.1.4. Oil and Gas, Mining and Quarrying

- 10.1.5. Wholesale and Retail Trade

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Destination

- 10.2.1. Domestic

- 10.2.2. International

- 10.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 10.3.1. Full-Truck-Load (FTL)

- 10.3.2. Less than-Truck-Load (LTL)

- 10.4. Market Analysis, Insights and Forecast - by Containerization

- 10.4.1. Containerized

- 10.4.2. Non-Containerized

- 10.5. Market Analysis, Insights and Forecast - by Distance

- 10.5.1. Long Haul

- 10.5.2. Short Haul

- 10.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 10.6.1. Fluid Goods

- 10.6.2. Solid Goods

- 10.7. Market Analysis, Insights and Forecast - by Temperature Control

- 10.7.1. Non-Temperature Controlled

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 A P Moller - Maersk

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sinotrans Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 STO Express

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DHL Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ZTO Expres

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Shanghai Yunda Freight Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 YTO Express

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 China Post Group Corporation Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Changjiu Logistics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Deppon Express

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Shanghai Aneng Juchuang Supply Chain Management Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 SF Express (KEX-SF)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 CMA CGM Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 A P Moller - Maersk

List of Figures

- Figure 1: Global Chinese Road Freight Logistics Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Chinese Road Freight Logistics Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 3: North America Chinese Road Freight Logistics Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 4: North America Chinese Road Freight Logistics Market Revenue (billion), by Destination 2025 & 2033

- Figure 5: North America Chinese Road Freight Logistics Market Revenue Share (%), by Destination 2025 & 2033

- Figure 6: North America Chinese Road Freight Logistics Market Revenue (billion), by Truckload Specification 2025 & 2033

- Figure 7: North America Chinese Road Freight Logistics Market Revenue Share (%), by Truckload Specification 2025 & 2033

- Figure 8: North America Chinese Road Freight Logistics Market Revenue (billion), by Containerization 2025 & 2033

- Figure 9: North America Chinese Road Freight Logistics Market Revenue Share (%), by Containerization 2025 & 2033

- Figure 10: North America Chinese Road Freight Logistics Market Revenue (billion), by Distance 2025 & 2033

- Figure 11: North America Chinese Road Freight Logistics Market Revenue Share (%), by Distance 2025 & 2033

- Figure 12: North America Chinese Road Freight Logistics Market Revenue (billion), by Goods Configuration 2025 & 2033

- Figure 13: North America Chinese Road Freight Logistics Market Revenue Share (%), by Goods Configuration 2025 & 2033

- Figure 14: North America Chinese Road Freight Logistics Market Revenue (billion), by Temperature Control 2025 & 2033

- Figure 15: North America Chinese Road Freight Logistics Market Revenue Share (%), by Temperature Control 2025 & 2033

- Figure 16: North America Chinese Road Freight Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 17: North America Chinese Road Freight Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America Chinese Road Freight Logistics Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 19: South America Chinese Road Freight Logistics Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 20: South America Chinese Road Freight Logistics Market Revenue (billion), by Destination 2025 & 2033

- Figure 21: South America Chinese Road Freight Logistics Market Revenue Share (%), by Destination 2025 & 2033

- Figure 22: South America Chinese Road Freight Logistics Market Revenue (billion), by Truckload Specification 2025 & 2033

- Figure 23: South America Chinese Road Freight Logistics Market Revenue Share (%), by Truckload Specification 2025 & 2033

- Figure 24: South America Chinese Road Freight Logistics Market Revenue (billion), by Containerization 2025 & 2033

- Figure 25: South America Chinese Road Freight Logistics Market Revenue Share (%), by Containerization 2025 & 2033

- Figure 26: South America Chinese Road Freight Logistics Market Revenue (billion), by Distance 2025 & 2033

- Figure 27: South America Chinese Road Freight Logistics Market Revenue Share (%), by Distance 2025 & 2033

- Figure 28: South America Chinese Road Freight Logistics Market Revenue (billion), by Goods Configuration 2025 & 2033

- Figure 29: South America Chinese Road Freight Logistics Market Revenue Share (%), by Goods Configuration 2025 & 2033

- Figure 30: South America Chinese Road Freight Logistics Market Revenue (billion), by Temperature Control 2025 & 2033

- Figure 31: South America Chinese Road Freight Logistics Market Revenue Share (%), by Temperature Control 2025 & 2033

- Figure 32: South America Chinese Road Freight Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 33: South America Chinese Road Freight Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Chinese Road Freight Logistics Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 35: Europe Chinese Road Freight Logistics Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 36: Europe Chinese Road Freight Logistics Market Revenue (billion), by Destination 2025 & 2033

- Figure 37: Europe Chinese Road Freight Logistics Market Revenue Share (%), by Destination 2025 & 2033

- Figure 38: Europe Chinese Road Freight Logistics Market Revenue (billion), by Truckload Specification 2025 & 2033

- Figure 39: Europe Chinese Road Freight Logistics Market Revenue Share (%), by Truckload Specification 2025 & 2033

- Figure 40: Europe Chinese Road Freight Logistics Market Revenue (billion), by Containerization 2025 & 2033

- Figure 41: Europe Chinese Road Freight Logistics Market Revenue Share (%), by Containerization 2025 & 2033

- Figure 42: Europe Chinese Road Freight Logistics Market Revenue (billion), by Distance 2025 & 2033

- Figure 43: Europe Chinese Road Freight Logistics Market Revenue Share (%), by Distance 2025 & 2033

- Figure 44: Europe Chinese Road Freight Logistics Market Revenue (billion), by Goods Configuration 2025 & 2033

- Figure 45: Europe Chinese Road Freight Logistics Market Revenue Share (%), by Goods Configuration 2025 & 2033

- Figure 46: Europe Chinese Road Freight Logistics Market Revenue (billion), by Temperature Control 2025 & 2033

- Figure 47: Europe Chinese Road Freight Logistics Market Revenue Share (%), by Temperature Control 2025 & 2033

- Figure 48: Europe Chinese Road Freight Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 49: Europe Chinese Road Freight Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Chinese Road Freight Logistics Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 51: Middle East & Africa Chinese Road Freight Logistics Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 52: Middle East & Africa Chinese Road Freight Logistics Market Revenue (billion), by Destination 2025 & 2033

- Figure 53: Middle East & Africa Chinese Road Freight Logistics Market Revenue Share (%), by Destination 2025 & 2033

- Figure 54: Middle East & Africa Chinese Road Freight Logistics Market Revenue (billion), by Truckload Specification 2025 & 2033

- Figure 55: Middle East & Africa Chinese Road Freight Logistics Market Revenue Share (%), by Truckload Specification 2025 & 2033

- Figure 56: Middle East & Africa Chinese Road Freight Logistics Market Revenue (billion), by Containerization 2025 & 2033

- Figure 57: Middle East & Africa Chinese Road Freight Logistics Market Revenue Share (%), by Containerization 2025 & 2033

- Figure 58: Middle East & Africa Chinese Road Freight Logistics Market Revenue (billion), by Distance 2025 & 2033

- Figure 59: Middle East & Africa Chinese Road Freight Logistics Market Revenue Share (%), by Distance 2025 & 2033

- Figure 60: Middle East & Africa Chinese Road Freight Logistics Market Revenue (billion), by Goods Configuration 2025 & 2033

- Figure 61: Middle East & Africa Chinese Road Freight Logistics Market Revenue Share (%), by Goods Configuration 2025 & 2033

- Figure 62: Middle East & Africa Chinese Road Freight Logistics Market Revenue (billion), by Temperature Control 2025 & 2033

- Figure 63: Middle East & Africa Chinese Road Freight Logistics Market Revenue Share (%), by Temperature Control 2025 & 2033

- Figure 64: Middle East & Africa Chinese Road Freight Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 65: Middle East & Africa Chinese Road Freight Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Asia Pacific Chinese Road Freight Logistics Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 67: Asia Pacific Chinese Road Freight Logistics Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 68: Asia Pacific Chinese Road Freight Logistics Market Revenue (billion), by Destination 2025 & 2033

- Figure 69: Asia Pacific Chinese Road Freight Logistics Market Revenue Share (%), by Destination 2025 & 2033

- Figure 70: Asia Pacific Chinese Road Freight Logistics Market Revenue (billion), by Truckload Specification 2025 & 2033

- Figure 71: Asia Pacific Chinese Road Freight Logistics Market Revenue Share (%), by Truckload Specification 2025 & 2033

- Figure 72: Asia Pacific Chinese Road Freight Logistics Market Revenue (billion), by Containerization 2025 & 2033

- Figure 73: Asia Pacific Chinese Road Freight Logistics Market Revenue Share (%), by Containerization 2025 & 2033

- Figure 74: Asia Pacific Chinese Road Freight Logistics Market Revenue (billion), by Distance 2025 & 2033

- Figure 75: Asia Pacific Chinese Road Freight Logistics Market Revenue Share (%), by Distance 2025 & 2033

- Figure 76: Asia Pacific Chinese Road Freight Logistics Market Revenue (billion), by Goods Configuration 2025 & 2033

- Figure 77: Asia Pacific Chinese Road Freight Logistics Market Revenue Share (%), by Goods Configuration 2025 & 2033

- Figure 78: Asia Pacific Chinese Road Freight Logistics Market Revenue (billion), by Temperature Control 2025 & 2033

- Figure 79: Asia Pacific Chinese Road Freight Logistics Market Revenue Share (%), by Temperature Control 2025 & 2033

- Figure 80: Asia Pacific Chinese Road Freight Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 81: Asia Pacific Chinese Road Freight Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 2: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 3: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Truckload Specification 2020 & 2033

- Table 4: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Containerization 2020 & 2033

- Table 5: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Distance 2020 & 2033

- Table 6: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Goods Configuration 2020 & 2033

- Table 7: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Temperature Control 2020 & 2033

- Table 8: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 9: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 10: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 11: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Truckload Specification 2020 & 2033

- Table 12: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Containerization 2020 & 2033

- Table 13: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Distance 2020 & 2033

- Table 14: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Goods Configuration 2020 & 2033

- Table 15: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Temperature Control 2020 & 2033

- Table 16: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: United States Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Canada Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Mexico Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 21: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 22: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Truckload Specification 2020 & 2033

- Table 23: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Containerization 2020 & 2033

- Table 24: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Distance 2020 & 2033

- Table 25: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Goods Configuration 2020 & 2033

- Table 26: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Temperature Control 2020 & 2033

- Table 27: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Brazil Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Argentina Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 32: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 33: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Truckload Specification 2020 & 2033

- Table 34: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Containerization 2020 & 2033

- Table 35: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Distance 2020 & 2033

- Table 36: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Goods Configuration 2020 & 2033

- Table 37: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Temperature Control 2020 & 2033

- Table 38: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 39: United Kingdom Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Germany Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: France Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Italy Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: Spain Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Russia Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Benelux Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Nordics Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Rest of Europe Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 49: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 50: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Truckload Specification 2020 & 2033

- Table 51: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Containerization 2020 & 2033

- Table 52: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Distance 2020 & 2033

- Table 53: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Goods Configuration 2020 & 2033

- Table 54: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Temperature Control 2020 & 2033

- Table 55: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 56: Turkey Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Israel Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: GCC Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 59: North Africa Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: South Africa Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 61: Rest of Middle East & Africa Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 63: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 64: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Truckload Specification 2020 & 2033

- Table 65: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Containerization 2020 & 2033

- Table 66: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Distance 2020 & 2033

- Table 67: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Goods Configuration 2020 & 2033

- Table 68: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Temperature Control 2020 & 2033

- Table 69: Global Chinese Road Freight Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 70: China Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 71: India Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: Japan Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 73: South Korea Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: ASEAN Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 75: Oceania Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: Rest of Asia Pacific Chinese Road Freight Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chinese Road Freight Logistics Market?

The projected CAGR is approximately 5.86%.

2. Which companies are prominent players in the Chinese Road Freight Logistics Market?

Key companies in the market include A P Moller - Maersk, Sinotrans Limited, STO Express, DHL Group, ZTO Expres, Shanghai Yunda Freight Co Ltd, YTO Express, China Post Group Corporation Ltd, Changjiu Logistics, Deppon Express, Shanghai Aneng Juchuang Supply Chain Management Co Ltd, SF Express (KEX-SF), CMA CGM Group.

3. What are the main segments of the Chinese Road Freight Logistics Market?

The market segments include End User Industry, Destination, Truckload Specification, Containerization, Distance, Goods Configuration, Temperature Control.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.64 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing production of chemical and allied products driving the market4.; Rising demand for green warehouses.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

4.; Stringent Rules and Regulations4.; Higher Costs.

8. Can you provide examples of recent developments in the market?

October 2023: Truck and industrial equipment maker Volvo, auto maker Renault, and shipping giant CMA CGM unveiled a joint venture that would create a company aimed at developing a new series of electric vans. The partnership would provide electric urban transportation for companies in the logistics and transportation sector seeking to decarbonize their fleets.October 2023: In response to growing demand for cross-border shipping when shopping on mainland e-commerce platforms, SF Express has launched, SF Express Container Line (SFBuy), one-stop cargo transportation platform specially built for global overseas shopping users, providing safe, efficient and convenient cross-border parcel transportation services.September 2023: STO Express has entered into a strategic collaboration with Inceptio Technology, a Chinese developer of autonomous driving technologies for heavy-duty trucks. STO Express has ordered 500 Inceptio autonomous trucks jointly developed with Dongfeng Commercial Vehicle.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chinese Road Freight Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chinese Road Freight Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chinese Road Freight Logistics Market?

To stay informed about further developments, trends, and reports in the Chinese Road Freight Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence