Key Insights

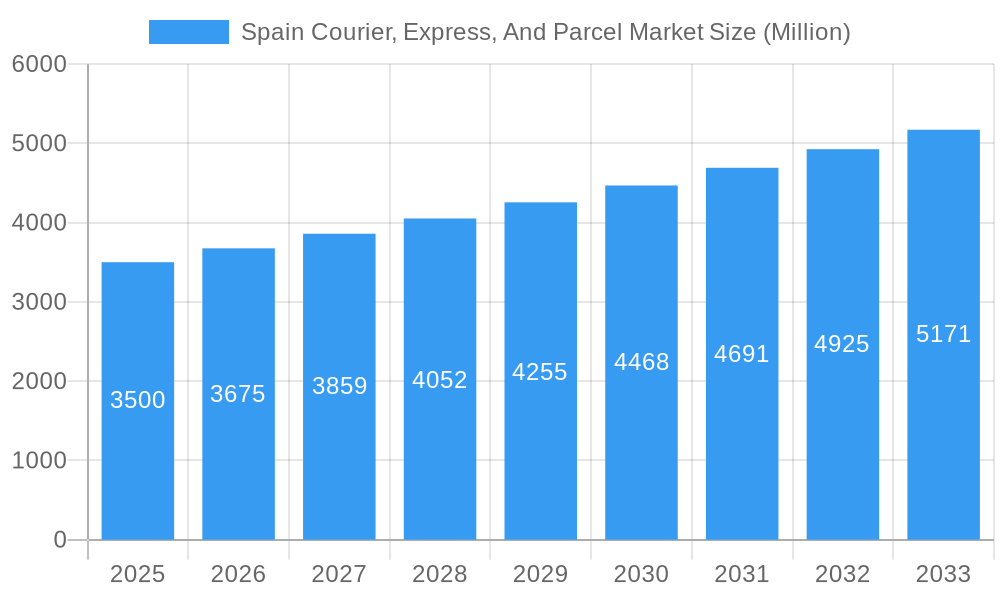

The Spanish Courier, Express, and Parcel (CEP) market is projected for substantial growth, with an estimated market size of $6.47 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 3.9% through the forecast period (2025-2033). This expansion is primarily driven by the flourishing e-commerce sector, which fuels demand for efficient B2C and B2B delivery solutions. Increased online shopping adoption by Spanish consumers and the growth of online retail businesses are key accelerators. The healthcare industry's need for rapid, secure medical supply and pharmaceutical delivery, alongside the manufacturing sector's logistical requirements for components and finished goods, further bolsters market performance. Emerging trends, including the demand for same-day and express delivery services to meet evolving consumer expectations and competitive pressures, are also shaping market dynamics.

Spain Courier, Express, And Parcel Market Market Size (In Billion)

The market features a broad spectrum of services across various shipment weights and transport modes, with air and road transport being predominant. The "Others" segment, likely encompassing multimodal and specialized delivery, is also experiencing growth. Leading companies such as MRW, La Poste Group (including SEUR), UPS, DHL Group, and FedEx are driving innovation through investments in technology, network expansion, and diverse service offerings. However, market growth faces challenges from rising operational costs, including fuel price volatility and labor shortages, and the necessity for significant infrastructure and technology investments. Sustainability and the adoption of eco-friendly delivery practices are increasingly critical factors influencing market strategies and consumer preferences. The Spanish CEP market is characterized by dynamic evolution, with a clear trend towards increased volume and service sophistication.

Spain Courier, Express, And Parcel Market Company Market Share

Spain Courier, Express, and Parcel Market Report: Growth, Trends, and Future Outlook (2019-2033)

This comprehensive report delves into the dynamic Spain Courier, Express, and Parcel (CEP) market, offering an in-depth analysis of its current landscape and projecting future growth trajectories. With a study period spanning from 2019 to 2033, and a base year of 2025, this report provides crucial insights for stakeholders seeking to understand market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, and future opportunities. Leveraging advanced analytics and expert research, we forecast a robust expansion for the Spanish CEP sector, driven by burgeoning e-commerce, technological advancements, and evolving consumer expectations for swift and reliable delivery services.

Spain Courier, Express, And Parcel Market Market Composition & Trends

The Spain Courier, Express, and Parcel (CEP) market is characterized by a competitive landscape featuring major global and domestic players. MRW, La Poste Group (including SEUR), United Parcel Service of America Inc (UPS), Paack SPV Investments SL, DHL Group, Correos Express, GEODIS, FedEx, Logista, and Szendex are prominent entities shaping market dynamics. Market concentration is moderate, with leading players holding significant shares, but the continuous rise of agile, digitally-native providers is fostering healthy competition. Innovation catalysts are primarily driven by technological integration, including automation, AI-powered route optimization, and advanced tracking systems. Regulatory landscapes, while generally supportive of logistics operations, can present compliance challenges, particularly concerning cross-border shipments and environmental sustainability initiatives. Substitute products, such as traditional postal services or customer pick-up points, offer alternatives but often lack the speed and convenience demanded by modern consumers. End-user profiles are increasingly dominated by the E-Commerce sector, with a growing reliance on CEP services for last-mile delivery. Wholesale and Retail Trade (Offline) also represents a significant segment, albeit with shifting dynamics. M&A activities, though not extensively publicized, are expected to play a role in consolidating market positions and acquiring innovative technologies. For instance, a hypothetical M&A deal value in the range of 100-500 Million could be observed for strategic acquisitions aimed at expanding service portfolios or geographical reach. The market share distribution is dynamic, with e-commerce dominating parcel volumes and express delivery services gaining prominence.

Spain Courier, Express, And Parcel Market Industry Evolution

The Spain Courier, Express, and Parcel (CEP) market has witnessed a remarkable evolution, driven by a confluence of technological innovation, shifting consumer behaviors, and economic development. Over the historical period of 2019-2024, the market has experienced consistent growth, with an estimated CAGR of approximately 8-10% during this timeframe, primarily fueled by the exponential rise of e-commerce. The base year of 2025 is projected to continue this upward trend, with the forecast period of 2025-2033 anticipating sustained expansion, albeit at a slightly moderated but still robust pace of 6-8% annually. Technological advancements have been pivotal in this evolution. The adoption of advanced tracking and tracing systems, utilizing GPS and real-time data analytics, has become standard, enhancing transparency and customer satisfaction. Automation in sorting facilities, with robotic arms and automated guided vehicles (AGVs), has significantly boosted operational efficiency and reduced delivery times. Furthermore, the integration of Artificial Intelligence (AI) is revolutionizing route optimization, predictive maintenance of fleets, and even customer service through chatbots.

Shifting consumer demands have also reshaped the CEP landscape. Consumers now expect faster delivery times, often same-day or next-day, and demand greater flexibility in delivery options, including precise time slots and convenient pick-up points. This has led to an increased emphasis on Express delivery services, even for non-urgent shipments, and a proliferation of B2C services. The traditional Business-to-Business (B2B) segment remains crucial, but the growth in B2C has outpaced it in recent years, accounting for over 60% of total parcel volumes in 2025. The Consumer-to-Consumer (C2C) segment, while smaller, also contributes to the overall volume, especially through online marketplaces. The increasing focus on sustainability has also influenced industry evolution. Logistics providers are investing in electric vehicles (EVs), optimizing routes to minimize carbon emissions, and exploring eco-friendly packaging solutions. This growing environmental consciousness among consumers and regulatory pressures are pushing the industry towards greener logistics. The proliferation of mobile applications and integrated e-commerce platforms has further streamlined the ordering and tracking process, making it more seamless for end-users. The impact of these factors collectively has transformed the Spain CEP market from a purely functional service to a critical component of the overall consumer experience and business operations.

Leading Regions, Countries, or Segments in Spain Courier, Express, And Parcel Market

Within the Spain Courier, Express, and Parcel (CEP) market, several segments and end-user industries exhibit dominant growth and influence. The E-Commerce end-user industry stands out as the primary growth engine, consistently driving significant volume for Light Weight Shipments and Medium Weight Shipments. This dominance is fueled by an increasing online shopper base and the convenience of doorstep delivery. Consequently, Business-to-Consumer (B2C) model shipments represent the largest share, with a strong preference for Express delivery speeds, reflecting consumer expectations for rapid fulfillment.

Key drivers for the dominance of these segments include:

- Investment Trends: Significant investments are being channeled into developing last-mile delivery infrastructure, including urban logistics hubs and micro-fulfillment centers, specifically to cater to the surge in e-commerce orders. For example, investment in smart warehousing solutions is projected to reach over 300 Million in the next five years.

- Regulatory Support: Government initiatives aimed at supporting digital transformation and e-commerce growth indirectly benefit the CEP market by creating a favorable environment for online retail and its associated logistics needs. Streamlined customs procedures for international shipments also contribute to this.

- Technological Adoption: The widespread adoption of mobile technology and online payment gateways facilitates seamless transactions and delivery management for e-commerce. This also enables the efficient tracking and delivery of Domestic shipments, which constitute the majority of e-commerce volumes.

The Domestic destination segment accounts for the lion's share of shipments due to the robust internal market and the convenience of intra-country delivery. While International shipments are growing, driven by cross-border e-commerce, domestic logistics remain the bedrock of the market. In terms of shipment weight, Light Weight Shipments (under 5 kg) dominate, aligning with the typical product categories sold online. However, the growing popularity of larger electronics and furniture purchases is contributing to an increase in Medium Weight Shipments (5-20 kg).

The Road mode of transport remains the most prevalent due to its cost-effectiveness and flexibility for last-mile delivery across Spain's well-developed road network. Air transport is crucial for express and international shipments, ensuring speed and reach. The Wholesale and Retail Trade (Offline) end-user industry, while experiencing a shift towards online channels, still contributes significantly, particularly for B2B logistics and the movement of bulk goods. However, its growth trajectory is less pronounced compared to e-commerce. The Financial Services (BFSI) and Healthcare sectors also utilize CEP services for document delivery and medical supplies, representing niche but important segments.

Spain Courier, Express, And Parcel Market Product Innovations

Innovation in the Spain CEP market centers on enhancing speed, efficiency, and customer experience. Leading companies are investing in smart packaging solutions that integrate RFID technology for real-time tracking and inventory management, reducing loss and improving supply chain visibility. Autonomous delivery robots and drones are being piloted for last-mile delivery in urban areas, promising reduced delivery times and operational costs, particularly for Light Weight Shipments. Furthermore, advancements in route optimization software, powered by AI and machine learning, are enabling dynamic adjustments to delivery schedules, factoring in traffic, weather, and customer availability, thereby improving fuel efficiency and delivery success rates for all shipment weights. The development of customer-centric platforms offering personalized delivery options, including precise time slot selection and alternative delivery locations, is also a key innovation.

Propelling Factors for Spain Courier, Express, And Parcel Market Growth

Several key factors are propelling the growth of the Spain Courier, Express, and Parcel (CEP) market. The relentless expansion of the E-Commerce sector is arguably the most significant driver, with consumers increasingly opting for online shopping, thereby increasing the demand for delivery services. Technological advancements, such as AI-powered route optimization, automation in warehouses, and real-time tracking, are enhancing operational efficiency and reducing costs, making services more attractive. Economic stability and rising disposable incomes in Spain also contribute to higher consumer spending, which translates into more online purchases and greater demand for CEP services. Furthermore, evolving consumer expectations for faster, more flexible, and reliable delivery options are pushing providers to innovate and offer premium services like express and same-day delivery. Regulatory support for e-commerce and logistics infrastructure development also plays a crucial role in fostering market expansion.

Obstacles in the Spain Courier, Express, And Parcel Market Market

Despite robust growth, the Spain Courier, Express, and Parcel (CEP) market faces several obstacles. Intense competition among established players and emerging disruptors leads to price wars and pressure on profit margins, particularly for standard delivery services. Rising operational costs, including fuel prices, labor expenses, and vehicle maintenance, pose a continuous challenge to profitability, especially for Road-based transportation. Regulatory hurdles, such as evolving labor laws and environmental regulations, can increase compliance costs and operational complexities. Supply chain disruptions, whether due to geopolitical events, natural disasters, or labor strikes, can significantly impact delivery timelines and customer satisfaction. The increasing demand for sustainable logistics also requires substantial investment in green technologies and infrastructure, which can be a barrier for smaller players. Furthermore, the last-mile delivery in densely populated urban areas presents logistical challenges, including traffic congestion and parking restrictions, impacting efficiency and delivery times.

Future Opportunities in Spain Courier, Express, And Parcel Market

The Spain Courier, Express, and Parcel (CEP) market is ripe with future opportunities. The continued growth of e-commerce, particularly in niche markets and cross-border trade, presents a significant avenue for expansion. The increasing demand for same-day and next-day delivery services will drive innovation in hyper-local logistics and urban fulfillment centers. The burgeoning adoption of sustainable logistics practices, including the use of electric vehicles and optimized delivery routes, offers opportunities for companies that prioritize environmental responsibility. The development and integration of advanced technologies like AI, IoT, and blockchain can further enhance operational efficiency, transparency, and security, creating new service offerings. The expansion of services into less saturated regions and the catering to specific industry needs, such as healthcare logistics with temperature-controlled shipments, also represent untapped potential. Furthermore, the integration of physical and digital retail through omnichannel strategies will continue to drive demand for sophisticated CEP solutions.

Major Players in the Spain Courier, Express, And Parcel Market Ecosystem

- MRW

- La Poste Group

- United Parcel Service of America Inc (UPS)

- Paack SPV Investments SL

- DHL Group

- Correos Express

- GEODIS

- FedEx

- Logista

- Szendex

Key Developments in Spain Courier, Express, And Parcel Market Industry

- September 2023: Logista Libros, a part of the Logista Group, announced the opening of a new facility dedicated to e-commerce in Spain, aiming to boost storage capacity and order fulfillment productivity. This expansion of their Cabanillas del Campo distribution center signifies a strategic move to capitalize on the growing e-commerce logistics demand.

- April 2023: GEODIS announced an expansion of its direct-to-customer cross-border delivery service by inaugurating two new airport gateway facilities in the United States and Italy, along with other European nations. This initiative enhances their global reach and strengthens their capacity for international express shipments.

- March 2023: UPS entered a strategic partnership with Google Cloud. This collaboration involves Google Cloud's assistance in deploying radio-frequency identification (RFID) chips on UPS packages, significantly improving the efficiency and accuracy of package tracking throughout the logistics network.

Strategic Spain Courier, Express, And Parcel Market Market Forecast

The strategic forecast for the Spain Courier, Express, and Parcel (CEP) market indicates a trajectory of sustained and robust growth, driven by the escalating digital economy and evolving consumer expectations. The increasing penetration of e-commerce, coupled with a growing demand for faster and more convenient delivery options, will continue to be the primary catalysts. Investments in technological advancements, such as automation, AI-powered analytics, and sustainable logistics solutions, will not only enhance operational efficiency but also create new service differentiation opportunities. The forecast suggests a significant rise in the adoption of Express delivery services and an expansion of B2C and C2C segments. Companies that successfully integrate innovative technologies, optimize their last-mile delivery networks, and prioritize sustainability are poised to capture substantial market share. The market is expected to witness continued consolidation and strategic partnerships to enhance competitive capabilities, leading to a more dynamic and customer-centric CEP ecosystem in Spain.

Spain Courier, Express, And Parcel Market Segmentation

-

1. Destination

- 1.1. Domestic

- 1.2. International

-

2. Speed Of Delivery

- 2.1. Express

- 2.2. Non-Express

-

3. Model

- 3.1. Business-to-Business (B2B)

- 3.2. Business-to-Consumer (B2C)

- 3.3. Consumer-to-Consumer (C2C)

-

4. Shipment Weight

- 4.1. Heavy Weight Shipments

- 4.2. Light Weight Shipments

- 4.3. Medium Weight Shipments

-

5. Mode Of Transport

- 5.1. Air

- 5.2. Road

- 5.3. Others

-

6. End User Industry

- 6.1. E-Commerce

- 6.2. Financial Services (BFSI)

- 6.3. Healthcare

- 6.4. Manufacturing

- 6.5. Primary Industry

- 6.6. Wholesale and Retail Trade (Offline)

- 6.7. Others

Spain Courier, Express, And Parcel Market Segmentation By Geography

- 1. Spain

Spain Courier, Express, And Parcel Market Regional Market Share

Geographic Coverage of Spain Courier, Express, And Parcel Market

Spain Courier, Express, And Parcel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising E-commerce Sector to Boost the International CEP Market in China; Increasing Volume of Parcel Shipments in China

- 3.3. Market Restrains

- 3.3.1. Poor infrastructure and higher logistics costs; Lack of control of manufacturers on logistics services

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Courier, Express, And Parcel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 5.1.1. Domestic

- 5.1.2. International

- 5.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 5.2.1. Express

- 5.2.2. Non-Express

- 5.3. Market Analysis, Insights and Forecast - by Model

- 5.3.1. Business-to-Business (B2B)

- 5.3.2. Business-to-Consumer (B2C)

- 5.3.3. Consumer-to-Consumer (C2C)

- 5.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 5.4.1. Heavy Weight Shipments

- 5.4.2. Light Weight Shipments

- 5.4.3. Medium Weight Shipments

- 5.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.5.1. Air

- 5.5.2. Road

- 5.5.3. Others

- 5.6. Market Analysis, Insights and Forecast - by End User Industry

- 5.6.1. E-Commerce

- 5.6.2. Financial Services (BFSI)

- 5.6.3. Healthcare

- 5.6.4. Manufacturing

- 5.6.5. Primary Industry

- 5.6.6. Wholesale and Retail Trade (Offline)

- 5.6.7. Others

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 MRW

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 La Poste Group (including SEUR)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 United Parcel Service of America Inc (UPS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Paack SPV Investments SL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DHL Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Correos Express

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 GEODIS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FedEx

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Logista

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Szendex

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 MRW

List of Figures

- Figure 1: Spain Courier, Express, And Parcel Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Spain Courier, Express, And Parcel Market Share (%) by Company 2025

List of Tables

- Table 1: Spain Courier, Express, And Parcel Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 2: Spain Courier, Express, And Parcel Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 3: Spain Courier, Express, And Parcel Market Revenue billion Forecast, by Model 2020 & 2033

- Table 4: Spain Courier, Express, And Parcel Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 5: Spain Courier, Express, And Parcel Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 6: Spain Courier, Express, And Parcel Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 7: Spain Courier, Express, And Parcel Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Spain Courier, Express, And Parcel Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 9: Spain Courier, Express, And Parcel Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 10: Spain Courier, Express, And Parcel Market Revenue billion Forecast, by Model 2020 & 2033

- Table 11: Spain Courier, Express, And Parcel Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 12: Spain Courier, Express, And Parcel Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 13: Spain Courier, Express, And Parcel Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 14: Spain Courier, Express, And Parcel Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Courier, Express, And Parcel Market?

The projected CAGR is approximately 3.9%.

2. Which companies are prominent players in the Spain Courier, Express, And Parcel Market?

Key companies in the market include MRW, La Poste Group (including SEUR), United Parcel Service of America Inc (UPS, Paack SPV Investments SL, DHL Group, Correos Express, GEODIS, FedEx, Logista, Szendex.

3. What are the main segments of the Spain Courier, Express, And Parcel Market?

The market segments include Destination, Speed Of Delivery, Model, Shipment Weight, Mode Of Transport, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.47 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising E-commerce Sector to Boost the International CEP Market in China; Increasing Volume of Parcel Shipments in China.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Poor infrastructure and higher logistics costs; Lack of control of manufacturers on logistics services.

8. Can you provide examples of recent developments in the market?

September 2023: Logista Libros, a part of the Logista Group, announced that it had opened a new facility specifically for e-commerce in Spain to increase storage capacity and productivity in the preparation of e-commerce orders. This new facility is an extension of the company’s distribution center in Cabanillas del Campo.April 2023: GEODIS announced it expanded its direct-to-customer cross-border delivery service offering by opening two new airport gateway facilities in the United States, Italy, and other European nations.March 2023: UPS entered a partnership with Google Cloud, where Google will help UPS by putting radio-frequency identification chips on packages to track them efficiently.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Courier, Express, And Parcel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Courier, Express, And Parcel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Courier, Express, And Parcel Market?

To stay informed about further developments, trends, and reports in the Spain Courier, Express, And Parcel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence