Key Insights

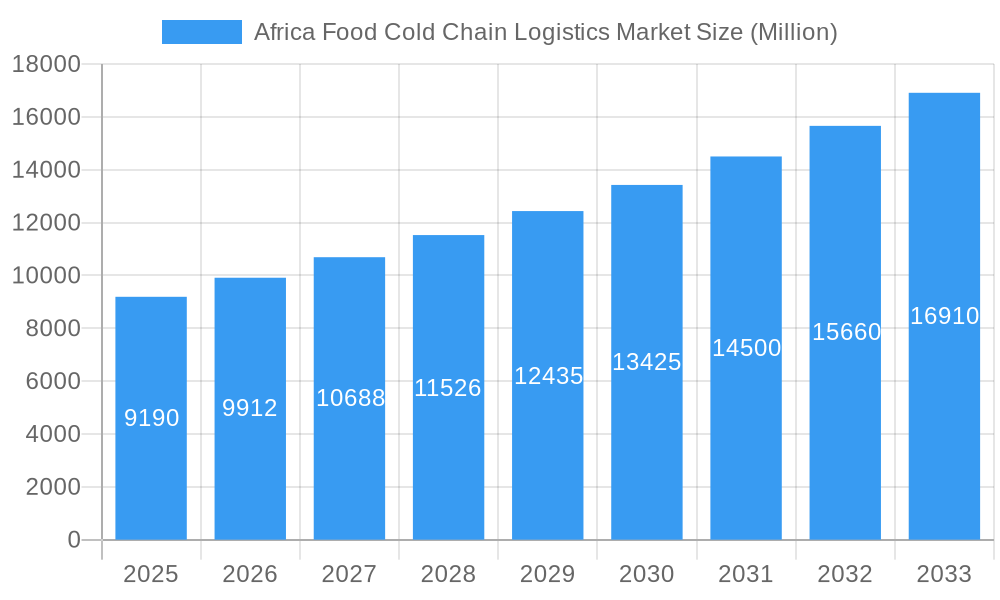

The African food cold chain logistics market, valued at $9.19 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 7.94% from 2025 to 2033. This expansion is driven by several key factors. Increasing urbanization and a burgeoning middle class are fueling demand for fresh and processed food products, requiring efficient cold chain solutions for preservation and timely delivery. The rise of organized retail and e-commerce platforms further necessitates reliable cold chain infrastructure to ensure product quality and minimize waste. Government initiatives promoting food security and agricultural modernization are also contributing to market growth. Furthermore, the increasing adoption of innovative technologies, such as temperature-controlled containers and real-time tracking systems, is enhancing efficiency and transparency across the supply chain. Key segments within the market show strong potential. The frozen segment is likely to dominate, driven by the increasing demand for frozen foods and longer shelf-life products. The horticulture sector, encompassing fresh fruits and vegetables, is expected to show substantial growth due to its high perishability and reliance on efficient cold chain management. South Africa, Nigeria, and Egypt represent the largest national markets, reflecting their advanced infrastructure and substantial food production and consumption. However, challenges remain. Limited cold storage infrastructure in many African countries, inadequate transportation networks, and high energy costs hinder market expansion. Overcoming these constraints will be crucial for unlocking the full potential of the African food cold chain logistics market.

Africa Food Cold Chain Logistics Market Market Size (In Billion)

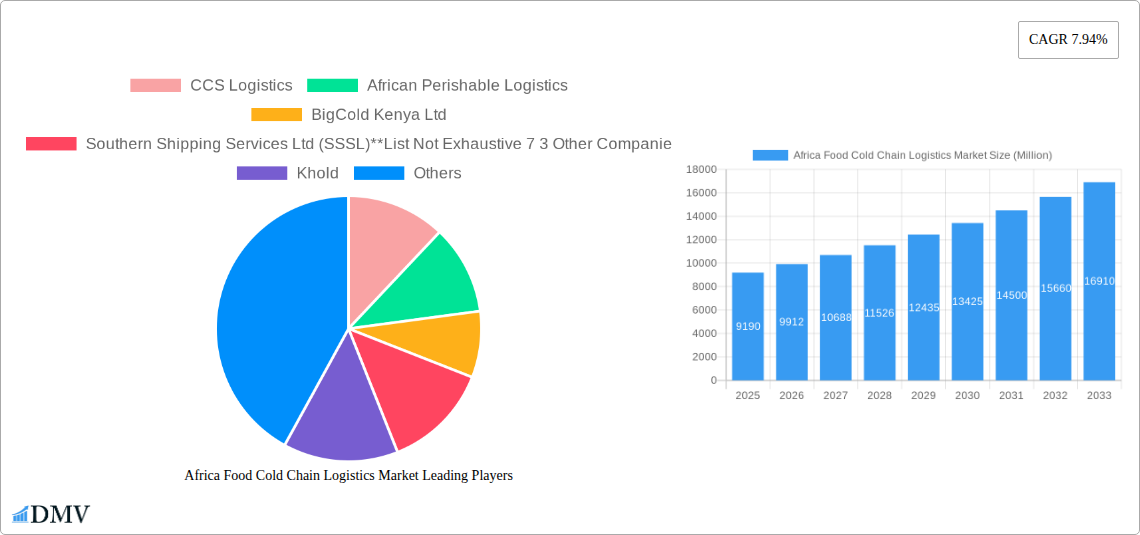

The competitive landscape is characterized by a mix of established multinational logistics providers and local players. Companies like CCS Logistics, African Perishable Logistics, and BigCold Kenya Ltd are at the forefront, focusing on specialized services, technology integration, and strategic partnerships to capture market share. However, market fragmentation and the presence of numerous smaller players suggest opportunities for consolidation and the emergence of larger, more integrated players. The future growth of this market will depend on sustained investments in infrastructure, technological advancements, and policy support to address the infrastructural challenges and build a more resilient and efficient cold chain system across the African continent. Focus on sustainable and environmentally friendly cold chain solutions is also anticipated, aligning with global sustainability goals.

Africa Food Cold Chain Logistics Market Company Market Share

Africa Food Cold Chain Logistics Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Africa Food Cold Chain Logistics Market, offering crucial insights for stakeholders seeking to navigate this dynamic sector. With a comprehensive study period spanning 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report delivers a robust understanding of market trends, growth drivers, and future opportunities. The market is projected to reach xx Million by 2033, showcasing immense potential for investment and expansion.

Africa Food Cold Chain Logistics Market Composition & Trends

This section meticulously examines the competitive landscape of the African food cold chain logistics market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and M&A activities. The market is characterized by a mix of established players and emerging entrants, with a fragmented structure leading to intense competition.

Market Concentration: The market exhibits moderate concentration, with a few major players holding significant market share, while numerous smaller companies cater to niche segments. The top 5 players account for approximately xx% of the market share in 2025.

Innovation Catalysts: Technological advancements, such as IoT-enabled monitoring systems and improved transportation infrastructure, are driving innovation. The rising demand for efficient and reliable cold chain solutions fuels the development of innovative services and technologies.

Regulatory Landscape: Varying regulatory frameworks across different African countries present both opportunities and challenges. Harmonization of regulations would facilitate smoother cross-border operations.

Substitute Products: While direct substitutes are limited, alternative preservation methods and local sourcing strategies impact market dynamics.

End-User Profiles: Key end-users include food processors, retailers, exporters, and importers. Understanding their specific requirements is crucial for market success.

M&A Activities: The market has witnessed several M&A activities in recent years, valued at approximately xx Million. Consolidation is expected to continue, shaping the competitive landscape. Examples include [insert specific M&A deals if available, otherwise state "Data unavailable"].

Africa Food Cold Chain Logistics Market Industry Evolution

This section analyzes the historical and projected growth trajectories of the African food cold chain logistics market, exploring the influence of technological advancements and evolving consumer preferences. Market growth is significantly driven by increasing urbanization, rising disposable incomes, and a growing preference for processed and perishable food products.

The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to witness a CAGR of xx% during the forecast period (2025-2033). This growth is propelled by increasing investment in cold storage facilities, technological advancements such as GPS tracking and temperature monitoring systems, and the growing adoption of value-added services. Furthermore, changing consumer demands for fresh and high-quality food, along with increasing food exports from the continent, are boosting market growth. E-commerce expansion is another crucial driver, requiring improved logistics infrastructure. The adoption rate of temperature-controlled transportation has increased from xx% in 2019 to xx% in 2024 and is projected to reach xx% by 2033. Challenges such as inadequate infrastructure and high transportation costs continue to influence market evolution.

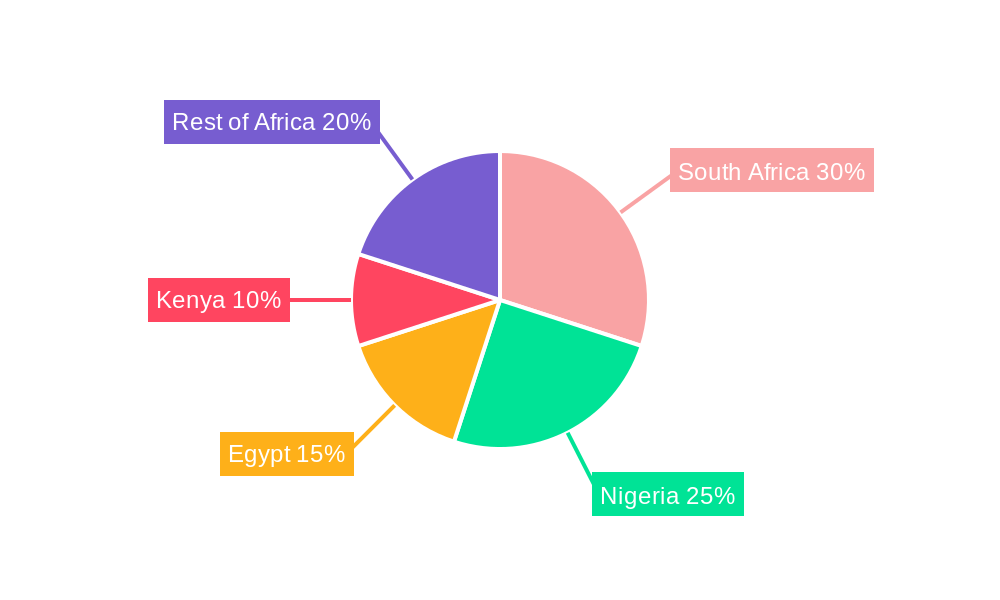

Leading Regions, Countries, or Segments in Africa Food Cold Chain Logistics Market

This section identifies the dominant regions, countries, and segments within the African food cold chain logistics market. Key drivers in each region/segment will be highlighted, accompanied by a detailed analysis of dominance factors.

By Country: South Africa, Nigeria, and Egypt currently dominate the market due to their larger economies, better infrastructure, and higher levels of food processing activity. However, significant growth potential exists in other countries with improving infrastructure.

By Service: Storage currently holds the largest market share, followed by transportation. The demand for value-added services is rising rapidly.

By Temperature: Frozen products account for a significant portion of the market share due to the increasing demand for frozen foods and the need for long-distance transportation.

By Product Category: Horticulture (fresh fruits and vegetables) is the largest segment, followed by meat, poultry, and seafood. The processed food segment is also witnessing robust growth.

Key Drivers:

- Investment Trends: Significant investments in cold storage infrastructure are being made by both private and public sectors.

- Regulatory Support: Governments in several countries are actively promoting the development of cold chain infrastructure through various policies and incentives.

- Economic Growth: Rising disposable incomes and urbanization are fueling demand for higher-quality food products, driving the need for efficient cold chain solutions.

Africa Food Cold Chain Logistics Market Product Innovations

Recent innovations focus on improving temperature control, monitoring, and tracking capabilities. This includes advanced refrigeration technologies, real-time tracking systems, and data analytics platforms to optimize logistics and minimize food spoilage. Unique selling propositions often center on cost efficiency, improved temperature control precision, and enhanced traceability throughout the supply chain. The development of specialized containers and vehicles for specific products such as vaccines adds value to this market segment.

Propelling Factors for Africa Food Cold Chain Logistics Market Growth

The market is propelled by factors including rising disposable incomes, increasing urbanization, growing demand for processed foods, and government initiatives to improve infrastructure. Technological advancements such as IoT-enabled monitoring systems and improved transportation infrastructure also contribute to market growth. The increasing adoption of e-commerce platforms further fuels the demand for efficient cold chain logistics.

Obstacles in the Africa Food Cold Chain Logistics Market

Significant barriers include inadequate infrastructure, particularly in rural areas, leading to higher transportation costs and increased risk of spoilage. Furthermore, inconsistent electricity supply and a shortage of skilled labor present challenges. Competition among logistics providers also influences market dynamics. These factors contribute to higher costs and reduced efficiency within the supply chain.

Future Opportunities in Africa Food Cold Chain Logistics Market

Future opportunities include expansion into underserved markets, particularly in rural areas, and the adoption of innovative technologies such as blockchain for improved traceability and transparency. The growth of e-commerce will further drive demand for efficient cold chain solutions. Specializing in specific temperature-sensitive products like pharmaceuticals and vaccines can offer significant potential.

Major Players in the Africa Food Cold Chain Logistics Market Ecosystem

- CCS Logistics

- African Perishable Logistics

- BigCold Kenya Ltd

- Southern Shipping Services Ltd (SSSL)

- 7 3 Other Companies

- Khold

- Lieben Logistics

- Vector Logistics

- Go Global

- HFR Transport

- Unitrans

- Cold Solutions East Africa

- Africa Global Logistics (AGL)

- Africa Cold Chain Limited

Key Developments in Africa Food Cold Chain Logistics Market Industry

June 2023: Africa Global Logistics (AGL) Côte d'Ivoire tripled its cold room capacity at the Abidjan Aerohub, significantly boosting capacity for pharmaceutical, retail, and catering clients. This expansion highlights the growing demand for cold storage facilities in West Africa.

October 2023: Cold Solutions Kenya launched a 15,000 sq. m cold storage facility in Tatu City, one of the largest in Kenya, emphasizing the ongoing investment in modern cold chain infrastructure.

Strategic Africa Food Cold Chain Logistics Market Forecast

The African food cold chain logistics market is poised for robust growth, driven by increasing investments in infrastructure, technological advancements, and supportive government policies. The expansion into underserved regions and the adoption of innovative technologies present significant opportunities for market players. The forecast indicates a substantial increase in market value over the coming years.

Africa Food Cold Chain Logistics Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature

- 2.1. Chilled

- 2.2. Frozen

- 2.3. Ambient

-

3. Product Category

- 3.1. Horticulture (Fresh Fruits and Vegetables)

- 3.2. Dairy Products (Milk, Ice Cream, Butter, etc.)

- 3.3. Meat, Poultry, and Seafood

- 3.4. Processed Food Products

- 3.5. Other Categories

Africa Food Cold Chain Logistics Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Food Cold Chain Logistics Market Regional Market Share

Geographic Coverage of Africa Food Cold Chain Logistics Market

Africa Food Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Fruit Exports

- 3.3. Market Restrains

- 3.3.1. Electricity Crisis

- 3.4. Market Trends

- 3.4.1. Electricity Crisis is Negatively Affecting the South African Food Cold Chain Logistics Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Food Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.2.3. Ambient

- 5.3. Market Analysis, Insights and Forecast - by Product Category

- 5.3.1. Horticulture (Fresh Fruits and Vegetables)

- 5.3.2. Dairy Products (Milk, Ice Cream, Butter, etc.)

- 5.3.3. Meat, Poultry, and Seafood

- 5.3.4. Processed Food Products

- 5.3.5. Other Categories

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CCS Logistics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 African Perishable Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BigCold Kenya Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Southern Shipping Services Ltd (SSSL)**List Not Exhaustive 7 3 Other Companie

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Khold

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lieben Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vector Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Go Global

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 HFR Transport

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Unitrans

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Cold Solutions East Africa

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Africa Global Logistics (AGL)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Africa Cold Chain Limited

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 CCS Logistics

List of Figures

- Figure 1: Africa Food Cold Chain Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Food Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Food Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Africa Food Cold Chain Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 3: Africa Food Cold Chain Logistics Market Revenue Million Forecast, by Product Category 2020 & 2033

- Table 4: Africa Food Cold Chain Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Africa Food Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 6: Africa Food Cold Chain Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 7: Africa Food Cold Chain Logistics Market Revenue Million Forecast, by Product Category 2020 & 2033

- Table 8: Africa Food Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Nigeria Africa Food Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Africa Africa Food Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Egypt Africa Food Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Kenya Africa Food Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Ethiopia Africa Food Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Morocco Africa Food Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Ghana Africa Food Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Algeria Africa Food Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Tanzania Africa Food Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Ivory Coast Africa Food Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Food Cold Chain Logistics Market?

The projected CAGR is approximately 7.94%.

2. Which companies are prominent players in the Africa Food Cold Chain Logistics Market?

Key companies in the market include CCS Logistics, African Perishable Logistics, BigCold Kenya Ltd, Southern Shipping Services Ltd (SSSL)**List Not Exhaustive 7 3 Other Companie, Khold, Lieben Logistics, Vector Logistics, Go Global, HFR Transport, Unitrans, Cold Solutions East Africa, Africa Global Logistics (AGL), Africa Cold Chain Limited.

3. What are the main segments of the Africa Food Cold Chain Logistics Market?

The market segments include Service, Temperature, Product Category.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.19 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Fruit Exports.

6. What are the notable trends driving market growth?

Electricity Crisis is Negatively Affecting the South African Food Cold Chain Logistics Market.

7. Are there any restraints impacting market growth?

Electricity Crisis.

8. Can you provide examples of recent developments in the market?

June 2023: Africa Global Logistics (AGL) Côte d'Ivoire extended its cold room in the Aerohub, the largest contract logistics base in West Africa located near the Felix Houphouët Boigny International Airport in Abidjan. The company has tripled the capacity of the temperature-controlled area to meet the increasing customer demand and was able to do so by using local companies, including Aric, 2I Ivoire ingénierie, and Instafric. Specifically, the new cold zone will support customers in the pharmaceutical, retail, and catering sectors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Food Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Food Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Food Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the Africa Food Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence