Key Insights

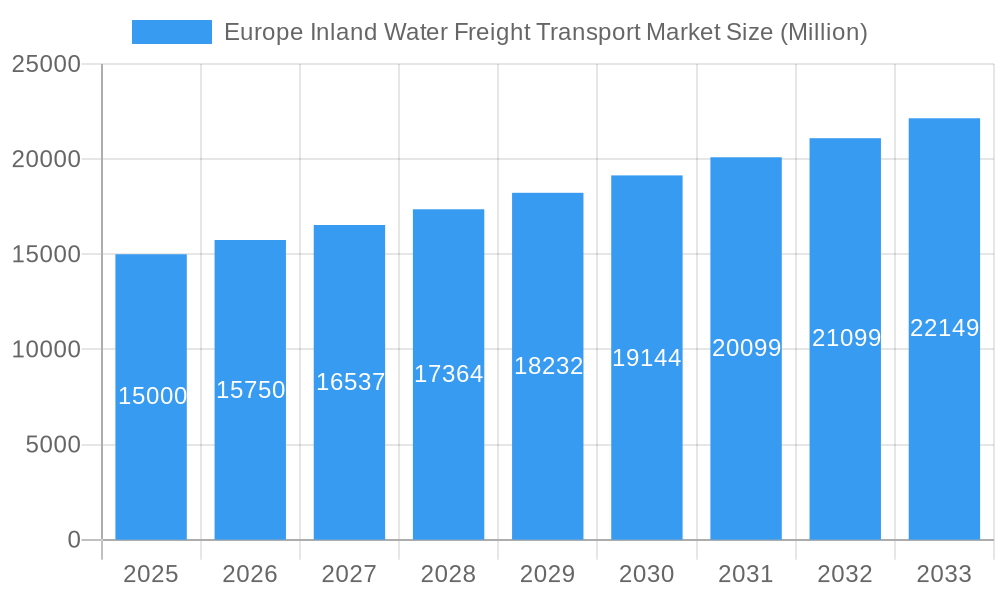

The European Inland Water Freight Transport Market is projected to experience robust growth, reaching a market size of $6.8 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 6.2% from the base year 2025. This expansion is driven by the increasing demand for efficient, cost-effective, and sustainable logistics solutions. Key growth catalysts include the imperative to reduce carbon emissions, the inherent economic advantages of waterway transport over road and rail, and ongoing investments in inland port infrastructure. The capacity of inland waterways to handle substantial volumes of liquid and dry bulk cargo solidifies their importance in the European supply chain. Moreover, the modernization of vessel fleets, encompassing advancements in cargo ships, container vessels, and tankers, is enhancing operational efficiency and safety.

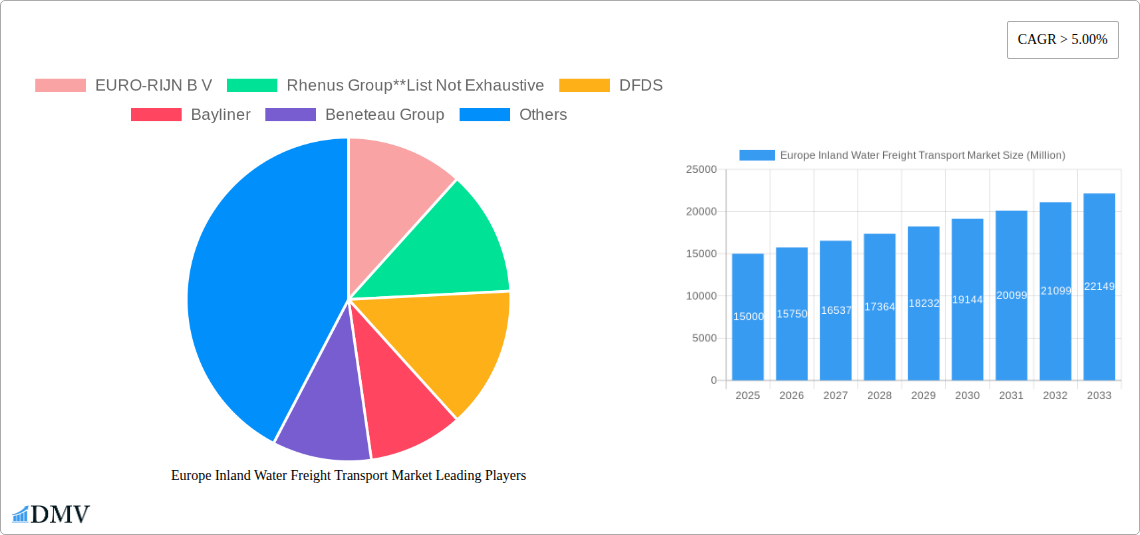

Europe Inland Water Freight Transport Market Market Size (In Billion)

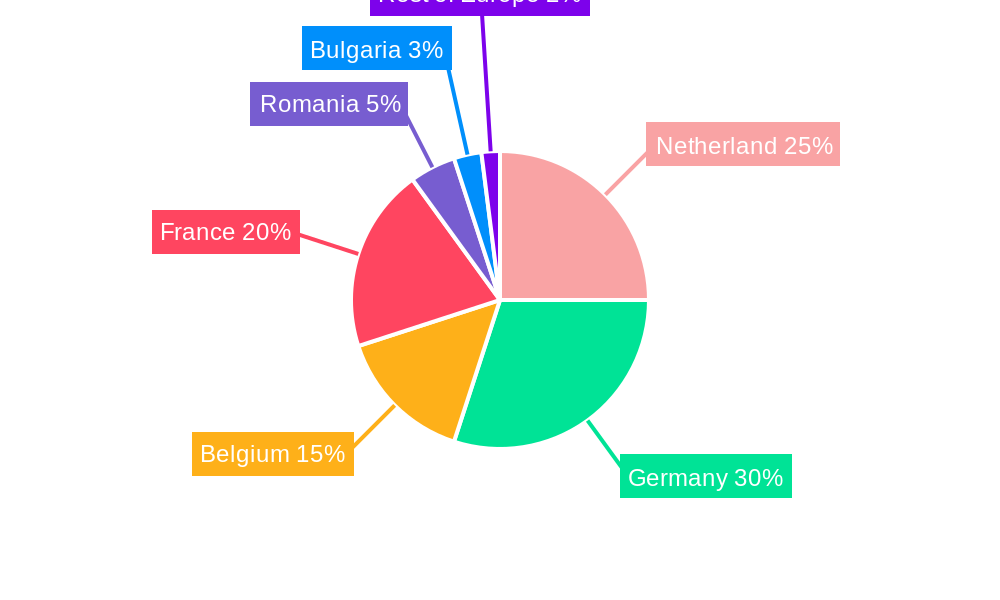

The competitive arena comprises established industry leaders and innovative new entrants. Major players such as Rhenus Group, MSC Mediterranean Shipping Company S.A., and CMA CGM Group are strategically broadening their inland waterway operations through network expansion and capacity investment. The market is segmented by transport type, with liquid bulk and dry bulk transportation as primary categories. Vessel types include versatile cargo ships, specialized container vessels, bulk carriers, and tankers, each designed for specific cargo requirements. Geographically, nations with extensive navigable river systems, including the Netherlands, Germany, Belgium, and France, are anticipated to dominate market activity. Emerging economies like Romania and Bulgaria, with developing inland waterway networks, offer significant growth potential. Challenges such as climate-change-induced water level fluctuations, ongoing infrastructure investment needs, and regional regulatory complexities may pose restraints. Nevertheless, the overarching shift towards sustainable and efficient freight movement is expected to underpin the continued expansion of the European Inland Water Freight Transport Market.

Europe Inland Water Freight Transport Market Company Market Share

Europe Inland Water Freight Transport Market: Navigating Growth & Sustainability

This comprehensive report delves into the dynamic Europe Inland Water Freight Transport Market, a critical component of the continent's logistics infrastructure. As sustainable logistics and green transportation gain paramount importance, inland waterways are witnessing a significant resurgence. This study provides an in-depth analysis of market trends, industry evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities. With a study period of 2019–2033, a base year of 2025, and an estimated year also of 2025, this report leverages a forecast period of 2025–2033 and a historical period of 2019–2024 to offer unparalleled insights for stakeholders. Discover key developments, market composition, and the strategic outlook for this vital sector.

Europe Inland Water Freight Transport Market Market Composition & Trends

The Europe Inland Water Freight Transport Market is characterized by a moderate degree of concentration, with a few key players dominating specific segments. Innovation is largely driven by the imperative for eco-friendly shipping solutions, including the development of low-emission vessels and optimized route planning. The regulatory landscape is increasingly favorable, with initiatives like the European Green Deal actively promoting modal shift towards inland waterways. Substitute products, primarily road and rail freight, face intensifying competition as the cost-effectiveness and environmental benefits of water transport become more pronounced. End-user profiles are diverse, spanning industries such as agriculture, chemicals, manufacturing, and energy. Mergers and acquisitions (M&A) activities are notable, driven by the need for expanded service offerings and enhanced operational efficiencies. For instance, the acquisition of smaller niche operators by larger logistics conglomerates is a recurring trend, consolidating market share and fostering economies of scale. The market share distribution is influenced by established river networks and strategic port locations, with countries boasting extensive waterway systems holding a significant advantage.

Europe Inland Water Freight Transport Market Industry Evolution

The Europe Inland Water Freight Transport Market has undergone a significant transformation over the historical period, driven by a confluence of technological advancements, evolving regulatory frameworks, and shifting consumer and industrial demands. From 2019 to 2024, the industry witnessed a steady increase in freight volume, primarily fueled by a growing awareness of the environmental impact of traditional road transport. The push for decarbonization and reduced carbon footprints has been a pivotal catalyst, encouraging shippers to explore more sustainable alternatives. Technological advancements, including the integration of digitalization and IoT solutions, have revolutionized operational efficiency. Real-time tracking, predictive maintenance, and optimized cargo management are becoming standard, leading to reduced transit times and enhanced reliability.

The market growth trajectory has been largely positive, with average annual growth rates showing an upward trend. For example, the adoption of smart navigation systems and automated vessel operations has contributed to improved safety and reduced operational costs. Furthermore, the development of specialized vessel types, such as multi-purpose cargo ships and advanced container ships designed for inland waterways, has expanded the scope of cargo that can be efficiently transported. Consumer demand for ethically sourced and sustainably transported goods is indirectly influencing the freight industry, compelling businesses to adopt greener logistics solutions. This shift is reflected in the increasing preference for liquid bulk transportation and dry bulk transportation via inland waterways for bulk commodities, as these modes offer a significantly lower per-unit cost and environmental impact compared to road. The industry's evolution is a testament to its adaptability and its crucial role in supporting a more sustainable European economy.

Leading Regions, Countries, or Segments in Europe Inland Water Freight Transport Market

The dominance within the Europe Inland Water Freight Transport Market is multifaceted, with specific segments and regions exhibiting substantial leadership. In terms of Type of Transportation, Dry Bulk Transportation commands a significant share, driven by the continuous demand for raw materials in industries like construction and agriculture. Commodities such as coal, grain, and ores are efficiently moved across the continent via its extensive river networks. Similarly, Liquid Bulk Transportation remains a cornerstone, crucial for the petrochemical, chemical, and energy sectors, with tankers traversing major arteries like the Rhine and Danube.

Regarding Vessel Type, Cargo Ships represent a broad category that includes general cargo vessels and specialized carriers, playing a vital role in diverse freight movements. Container Ships adapted for inland waterways are also gaining prominence, facilitating the intermodal transfer of goods from sea to river ports, thereby streamlining the supply chain and reducing congestion on road networks.

Geographically, countries with extensive and well-maintained inland waterway systems naturally lead. Germany, with the Rhine river, is a powerhouse, facilitating immense volumes of both liquid bulk transportation and dry bulk transportation. The Netherlands, with its strategic port of Rotterdam and its network of canals and rivers, is another pivotal hub, acting as a gateway for goods entering and leaving continental Europe. France, Belgium, and Eastern European countries along the Danube also contribute significantly to the overall market volume.

Key drivers for this dominance include:

- Extensive River Networks: The Rhine, Danube, and Seine rivers, among others, form a natural backbone for efficient freight movement.

- Strategic Port Infrastructure: Major river ports equipped with modern handling facilities and intermodal connections are crucial.

- Regulatory Support: The European Union's strong emphasis on promoting inland waterways as a sustainable and efficient mode of transport, through various funding schemes and policy initiatives, is a major impetus.

- Cost-Effectiveness: For bulk and heavy cargo, inland water transport offers a lower cost per tonne-kilometer compared to road or rail.

- Environmental Benefits: The significantly lower carbon emissions per tonne-mile make it an attractive option for businesses aiming to reduce their environmental impact.

The synergistic interplay of these factors solidifies the leadership of specific regions and segments within the Europe Inland Water Freight Transport Market.

Europe Inland Water Freight Transport Market Product Innovations

Product innovations in the Europe Inland Water Freight Transport Market are increasingly focused on enhancing efficiency, safety, and environmental sustainability. A notable trend is the development of hybrid and electric propulsion systems for inland vessels, drastically reducing emissions and noise pollution. Advanced hull designs and propeller technologies are being implemented to improve fuel efficiency and maneuverability in congested waterways. Furthermore, the integration of sophisticated digital twin technology allows for real-time monitoring of vessel performance and predictive maintenance, minimizing downtime. The application of smart cargo management systems ensures optimized loading and unloading, leading to faster turnaround times and reduced handling costs. These innovations are crucial for meeting stringent environmental regulations and for enhancing the competitive edge of inland water transport.

Propelling Factors for Europe Inland Water Freight Transport Market Growth

Several key factors are propelling the growth of the Europe Inland Water Freight Transport Market. The increasing global focus on sustainability and decarbonization is a primary driver, pushing industries towards greener logistics solutions. Inland waterways offer a significantly lower carbon footprint compared to road and rail, making them an attractive alternative for businesses seeking to reduce their environmental impact. Government initiatives and policies, such as the European Green Deal, are actively promoting modal shift towards inland navigation through subsidies, infrastructure investments, and favorable regulations. Technological advancements, including the development of more efficient and environmentally friendly vessels, as well as the adoption of digitalization for improved logistics management, are further enhancing the attractiveness and competitiveness of this sector. Economic factors, such as the rising costs of fuel for road transport and the need for efficient bulk cargo movement, also contribute to the sustained growth of the market.

Obstacles in the Europe Inland Water Freight Transport Market Market

Despite its growth potential, the Europe Inland Water Freight Transport Market faces several obstacles. Infrastructure limitations, including the need for continuous dredging of waterways and modernization of lock systems, can hinder capacity and efficiency. Regulatory fragmentation across different European countries, while improving, still presents challenges in seamless cross-border operations. Competition from other transport modes, particularly road haulage which offers greater flexibility for last-mile delivery, remains a significant factor. Seasonal variations in water levels due to droughts or heavy rainfall can disrupt operations and impact transit times. Additionally, the aging workforce in the sector and the need for specialized skills for operating modern vessels pose a challenge in terms of labor availability and training. Cybersecurity threats to increasingly digitized logistics systems also represent a growing concern.

Future Opportunities in Europe Inland Water Freight Transport Market

The future of the Europe Inland Water Freight Transport Market is ripe with opportunities. The ongoing push for modal shift by governments and corporations presents a significant avenue for increased freight volumes. The development of digital platforms and AI-driven logistics solutions will further enhance efficiency, transparency, and predictive capabilities, attracting new users. Expansion and modernization of intermodal terminals will improve connectivity with other transport networks, making inland waterways a more integrated part of the supply chain. The growing demand for sustainable and traceable logistics will favor inland water transport, especially for bulk and heavy goods. Furthermore, advancements in alternative fuels and propulsion systems will lead to even cleaner and quieter operations, enhancing public acceptance and environmental credentials. Investing in multipurpose vessels capable of handling diverse cargo types will also open up new market segments.

Major Players in the Europe Inland Water Freight Transport Market Ecosystem

- EURO-RIJN B V

- Rhenus Group

- DFDS

- Bayliner

- Beneteau Group

- EUROPEAN CRUISE SERVICE

- MSC Mediterranean Shipping Company S A

- Construction Navale Bordeaux

- MEYER WERFT GmbH & Co KG

- CMA CGM Group

Key Developments in Europe Inland Water Freight Transport Market Industry

- October 2022: The European Commission (EC) approved a EUR 22.5 million (USD 23.91 million) Dutch scheme to support the shifting of freight transport from road to inland waterways and rail. This initiative, designed to run until January 2026, aims to encourage a greener mode of transport by providing grants to shippers and logistics operators for reducing external costs like pollution and congestion.

- June 2022: Rhenus PartnerShip announced significant investment in sustainable articulated push barge units, the Rhenus Mannheim I+II and Rhenus Wörth I+II. These low-emission flagships, built at the Den Breejen shipyard in the Netherlands, utilize alternative fuels. The construction phase began in June, with completion anticipated in September 2023 and initial trials in October 2023, marking a strong commitment to environmental relief through advanced shipping technology.

Strategic Europe Inland Water Freight Transport Market Market Forecast

The strategic outlook for the Europe Inland Water Freight Transport Market is overwhelmingly positive, driven by a robust combination of sustainability mandates and infrastructure development. Forecasts indicate a steady increase in freight volumes as more industries actively seek to decarbonize their supply chains. The continued investment in green technologies, such as hybrid propulsion and alternative fuels, will further enhance the market's appeal and competitiveness. Expected advancements in digitalization will streamline operations, leading to greater efficiency and reliability. Governmental support through various EU initiatives will remain a crucial growth catalyst, encouraging modal shifts and supporting infrastructure upgrades. This strategic alignment positions the Europe Inland Water Freight Transport Market for sustained expansion and a more significant role in the continent's future logistics landscape.

Europe Inland Water Freight Transport Market Segmentation

-

1. Type of Transportation

- 1.1. Liquid Bulk Transportation

- 1.2. Dry Bulk Transportation

-

2. Vessel Type

- 2.1. Cargo Ships

- 2.2. Container Ships

- 2.3. Tankers

- 2.4. Other Vessel Types

Europe Inland Water Freight Transport Market Segmentation By Geography

- 1. Netherland

- 2. Germany

- 3. Begium

- 4. France

- 5. Romania

- 6. Bulgaria

- 7. Rest of Europe

Europe Inland Water Freight Transport Market Regional Market Share

Geographic Coverage of Europe Inland Water Freight Transport Market

Europe Inland Water Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce Fueling the Growth of 3PL Market

- 3.3. Market Restrains

- 3.3.1. Slow Infrastructure Development

- 3.4. Market Trends

- 3.4.1. Digitization of inland-waterway transport

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 5.1.1. Liquid Bulk Transportation

- 5.1.2. Dry Bulk Transportation

- 5.2. Market Analysis, Insights and Forecast - by Vessel Type

- 5.2.1. Cargo Ships

- 5.2.2. Container Ships

- 5.2.3. Tankers

- 5.2.4. Other Vessel Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Netherland

- 5.3.2. Germany

- 5.3.3. Begium

- 5.3.4. France

- 5.3.5. Romania

- 5.3.6. Bulgaria

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 6. Netherland Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 6.1.1. Liquid Bulk Transportation

- 6.1.2. Dry Bulk Transportation

- 6.2. Market Analysis, Insights and Forecast - by Vessel Type

- 6.2.1. Cargo Ships

- 6.2.2. Container Ships

- 6.2.3. Tankers

- 6.2.4. Other Vessel Types

- 6.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 7. Germany Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 7.1.1. Liquid Bulk Transportation

- 7.1.2. Dry Bulk Transportation

- 7.2. Market Analysis, Insights and Forecast - by Vessel Type

- 7.2.1. Cargo Ships

- 7.2.2. Container Ships

- 7.2.3. Tankers

- 7.2.4. Other Vessel Types

- 7.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 8. Begium Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 8.1.1. Liquid Bulk Transportation

- 8.1.2. Dry Bulk Transportation

- 8.2. Market Analysis, Insights and Forecast - by Vessel Type

- 8.2.1. Cargo Ships

- 8.2.2. Container Ships

- 8.2.3. Tankers

- 8.2.4. Other Vessel Types

- 8.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 9. France Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 9.1.1. Liquid Bulk Transportation

- 9.1.2. Dry Bulk Transportation

- 9.2. Market Analysis, Insights and Forecast - by Vessel Type

- 9.2.1. Cargo Ships

- 9.2.2. Container Ships

- 9.2.3. Tankers

- 9.2.4. Other Vessel Types

- 9.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 10. Romania Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 10.1.1. Liquid Bulk Transportation

- 10.1.2. Dry Bulk Transportation

- 10.2. Market Analysis, Insights and Forecast - by Vessel Type

- 10.2.1. Cargo Ships

- 10.2.2. Container Ships

- 10.2.3. Tankers

- 10.2.4. Other Vessel Types

- 10.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 11. Bulgaria Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 11.1.1. Liquid Bulk Transportation

- 11.1.2. Dry Bulk Transportation

- 11.2. Market Analysis, Insights and Forecast - by Vessel Type

- 11.2.1. Cargo Ships

- 11.2.2. Container Ships

- 11.2.3. Tankers

- 11.2.4. Other Vessel Types

- 11.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 12. Rest of Europe Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 12.1.1. Liquid Bulk Transportation

- 12.1.2. Dry Bulk Transportation

- 12.2. Market Analysis, Insights and Forecast - by Vessel Type

- 12.2.1. Cargo Ships

- 12.2.2. Container Ships

- 12.2.3. Tankers

- 12.2.4. Other Vessel Types

- 12.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 EURO-RIJN B V

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Rhenus Group**List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 DFDS

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Bayliner

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Beneteau Group

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 EUROPEAN CRUISE SERVICE

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 MSC Mediterranean Shipping Company S A

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Construction Navale Bordeaux

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 MEYER WERFT GmbH & Co KG

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 CMA CGM Group

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 EURO-RIJN B V

List of Figures

- Figure 1: Europe Inland Water Freight Transport Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Inland Water Freight Transport Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Inland Water Freight Transport Market Revenue billion Forecast, by Type of Transportation 2020 & 2033

- Table 2: Europe Inland Water Freight Transport Market Revenue billion Forecast, by Vessel Type 2020 & 2033

- Table 3: Europe Inland Water Freight Transport Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Inland Water Freight Transport Market Revenue billion Forecast, by Type of Transportation 2020 & 2033

- Table 5: Europe Inland Water Freight Transport Market Revenue billion Forecast, by Vessel Type 2020 & 2033

- Table 6: Europe Inland Water Freight Transport Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Europe Inland Water Freight Transport Market Revenue billion Forecast, by Type of Transportation 2020 & 2033

- Table 8: Europe Inland Water Freight Transport Market Revenue billion Forecast, by Vessel Type 2020 & 2033

- Table 9: Europe Inland Water Freight Transport Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe Inland Water Freight Transport Market Revenue billion Forecast, by Type of Transportation 2020 & 2033

- Table 11: Europe Inland Water Freight Transport Market Revenue billion Forecast, by Vessel Type 2020 & 2033

- Table 12: Europe Inland Water Freight Transport Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Inland Water Freight Transport Market Revenue billion Forecast, by Type of Transportation 2020 & 2033

- Table 14: Europe Inland Water Freight Transport Market Revenue billion Forecast, by Vessel Type 2020 & 2033

- Table 15: Europe Inland Water Freight Transport Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Inland Water Freight Transport Market Revenue billion Forecast, by Type of Transportation 2020 & 2033

- Table 17: Europe Inland Water Freight Transport Market Revenue billion Forecast, by Vessel Type 2020 & 2033

- Table 18: Europe Inland Water Freight Transport Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Europe Inland Water Freight Transport Market Revenue billion Forecast, by Type of Transportation 2020 & 2033

- Table 20: Europe Inland Water Freight Transport Market Revenue billion Forecast, by Vessel Type 2020 & 2033

- Table 21: Europe Inland Water Freight Transport Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Europe Inland Water Freight Transport Market Revenue billion Forecast, by Type of Transportation 2020 & 2033

- Table 23: Europe Inland Water Freight Transport Market Revenue billion Forecast, by Vessel Type 2020 & 2033

- Table 24: Europe Inland Water Freight Transport Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Inland Water Freight Transport Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Europe Inland Water Freight Transport Market?

Key companies in the market include EURO-RIJN B V, Rhenus Group**List Not Exhaustive, DFDS, Bayliner, Beneteau Group, EUROPEAN CRUISE SERVICE, MSC Mediterranean Shipping Company S A, Construction Navale Bordeaux, MEYER WERFT GmbH & Co KG, CMA CGM Group.

3. What are the main segments of the Europe Inland Water Freight Transport Market?

The market segments include Type of Transportation, Vessel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.8 billion as of 2022.

5. What are some drivers contributing to market growth?

E-commerce Fueling the Growth of 3PL Market.

6. What are the notable trends driving market growth?

Digitization of inland-waterway transport.

7. Are there any restraints impacting market growth?

Slow Infrastructure Development.

8. Can you provide examples of recent developments in the market?

October 2022: The European Commission (EC) has approved a EUR 22.5 million (USD 23.91 million) Dutch scheme to support the shifting of freight transport from road to inland waterways and rail. The new scheme is part of an initiative to encourage a greener mode of transport. Designed to run until the end of January 2026, the scheme will enable shippers and logistics operators to secure non-refundable grants for cutting down external costs, including pollution, noise, congestion, and accidents, using inland waterways and rail.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Inland Water Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Inland Water Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Inland Water Freight Transport Market?

To stay informed about further developments, trends, and reports in the Europe Inland Water Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence