Key Insights

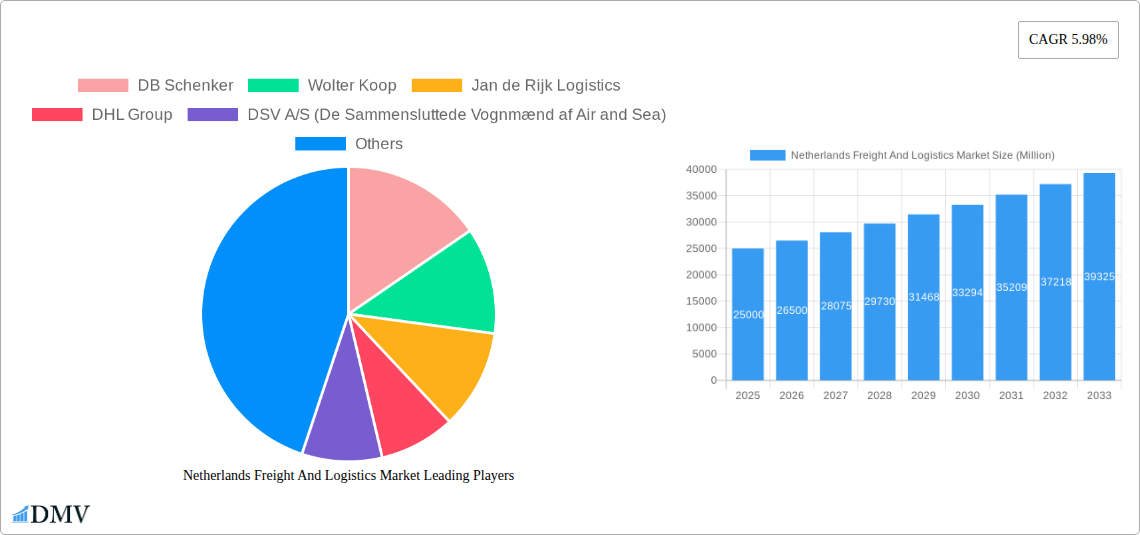

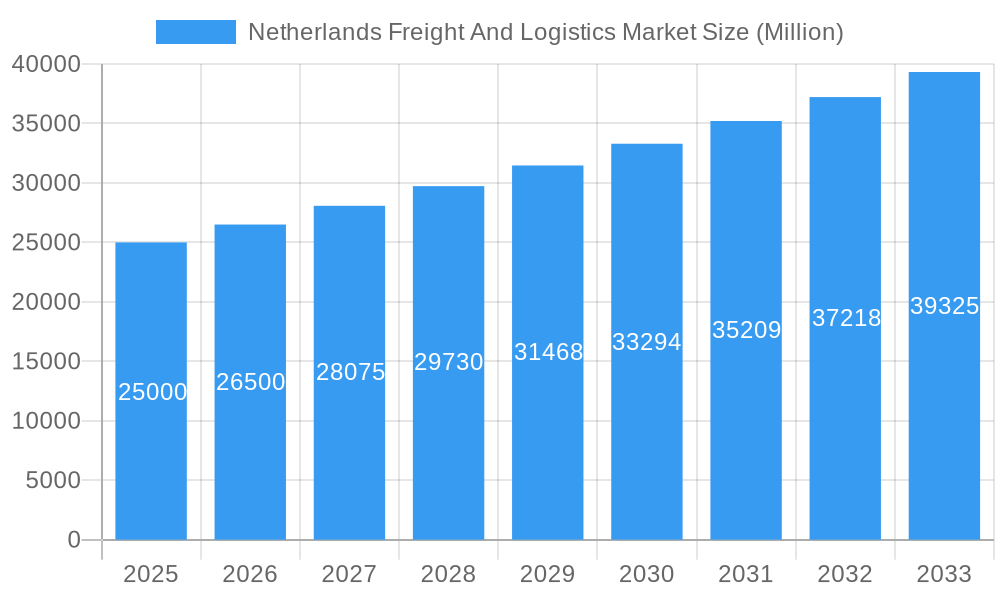

The Netherlands freight and logistics market, valued at approximately $82.11 billion in 2025, is projected to experience significant expansion with a Compound Annual Growth Rate (CAGR) of 5.5% through 2033. Key growth drivers include the burgeoning e-commerce sector, robust EU cross-border trade, and the nation's strategic position as a premier European logistics hub. Increased demand for temperature-controlled logistics, driven by the expanding food and pharmaceutical industries, alongside the need for efficient last-mile delivery solutions from e-commerce, are pivotal. Furthermore, substantial investments in advanced technologies such as automation and data analytics are enhancing operational efficiency and traceability. The market is segmented by end-user industry and logistics function, with manufacturing, e-commerce, and the food and beverage sectors being major contributors. While labor shortages and fuel price volatility present potential challenges, ongoing infrastructure development and government support for sustainable logistics are mitigating these concerns. Prominent players like DHL, FedEx, and DB Schenker are actively influencing the market through their extensive networks and technological innovations.

Netherlands Freight And Logistics Market Market Size (In Billion)

The competitive environment features a mix of global industry leaders and specialized regional providers. The Netherlands' exceptional port infrastructure, notably the Port of Rotterdam, is a significant contributor to the market's success. Future growth will be contingent on adapting to evolving consumer demands for faster, more transparent deliveries, embracing sustainable practices to reduce environmental impact, and leveraging technological advancements like AI and blockchain for enhanced supply chain visibility. The construction and manufacturing sectors are anticipated to drive considerable demand for freight and logistics services. The proliferation of omnichannel retail models will also necessitate more sophisticated logistics solutions, creating new opportunities for innovative companies. The Netherlands freight and logistics market is well-positioned for substantial growth in the foreseeable future.

Netherlands Freight And Logistics Market Company Market Share

Netherlands Freight and Logistics Market: A Comprehensive Report (2019-2033)

This insightful report provides a deep dive into the dynamic Netherlands freight and logistics market, offering a comprehensive analysis of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this thriving sector. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

Netherlands Freight And Logistics Market Market Composition & Trends

This section evaluates the competitive landscape, innovation drivers, regulatory environment, and market dynamics of the Netherlands freight and logistics market. We analyze market concentration, highlighting the market share distribution among key players like DB Schenker, DHL Group, and DSV A/S. The report also explores the impact of mergers and acquisitions (M&A) activities, including deal values and their influence on market consolidation. Furthermore, it examines the influence of substitute products, end-user industry profiles (Agriculture, Fishing & Forestry, Construction, Manufacturing, Oil & Gas, Mining & Quarrying, Wholesale & Retail Trade, Others), and the evolving regulatory landscape. Innovation catalysts, such as technological advancements and sustainability initiatives, are also critically assessed.

- Market Concentration: The Netherlands freight and logistics market exhibits a moderately concentrated structure, with the top five players holding an estimated xx% market share in 2025.

- M&A Activity: Recent M&A activity has been characterized by a focus on strategic partnerships and acquisitions aimed at expanding network reach and service offerings. Total M&A deal value in the past five years is estimated at xx Million.

- Regulatory Landscape: The Netherlands’ robust regulatory framework influences operational efficiency and environmental sustainability within the logistics sector. Compliance requirements and environmental regulations significantly impact operational costs and strategies for logistics providers.

- End-User Profiles: The report provides a detailed analysis of each end-user industry, outlining their specific logistics needs and preferences. Manufacturing and wholesale & retail trade represent the largest segments.

Netherlands Freight And Logistics Market Industry Evolution

This section meticulously analyzes the evolution of the Netherlands freight and logistics market, focusing on key growth trajectories, technological disruptions, and shifting consumer demands over the period 2019-2024 and projecting these trends through 2033. We delve into the adoption of advanced technologies like automation, AI, and blockchain, assessing their impact on efficiency, cost reduction, and service improvement. The report further explores the influence of e-commerce growth and its effect on last-mile delivery solutions. Specific data points, including compound annual growth rates (CAGR) for various segments and adoption rates for new technologies, are provided to support the analysis. The increasing focus on sustainability and its influence on transportation modes and warehousing operations is also examined. The report further analyzes the influence of geopolitical events and economic fluctuations on market growth.

Leading Regions, Countries, or Segments in Netherlands Freight And Logistics Market

This section identifies the dominant regions, countries, or segments within the Netherlands freight and logistics market, based on both end-user industries and logistics functions.

Dominant End-User Industries:

- Manufacturing: High manufacturing output and a strong export-oriented economy drive significant demand for freight and logistics services. Key drivers include high levels of foreign direct investment and a skilled workforce.

- Wholesale and Retail Trade: The thriving e-commerce sector and robust domestic retail market fuel substantial demand for efficient and reliable delivery solutions. Growth is driven by increasing consumer spending and the adoption of omnichannel strategies.

Dominant Logistics Functions:

- Courier, Express, and Parcel (CEP): The rapid growth of e-commerce fuels significant demand for CEP services, driving investments in infrastructure and technology to enhance speed and efficiency.

- Temperature Controlled: The Netherlands’ position as a major hub for perishable goods necessitates sophisticated temperature-controlled logistics solutions for various industries, including agriculture and pharmaceuticals. Stringent regulatory standards further drive investment in specialized facilities and transportation.

Netherlands Freight And Logistics Market Product Innovations

The Netherlands freight and logistics market is witnessing significant product innovation, particularly in areas such as automated warehousing systems, real-time tracking technologies, and sustainable transportation solutions. These innovations aim to improve efficiency, enhance transparency, and reduce environmental impact. Unique selling propositions focus on cost optimization, improved delivery speed, and enhanced supply chain visibility. Examples include the adoption of autonomous vehicles and drone delivery for last-mile solutions and the development of smart logistics platforms leveraging AI and machine learning for optimized route planning and predictive analytics.

Propelling Factors for Netherlands Freight And Logistics Market Growth

Several factors contribute to the growth of the Netherlands freight and logistics market. Technological advancements, particularly in automation and digitalization, significantly enhance efficiency and reduce costs. Economic growth within the Netherlands and the wider European Union provides a robust foundation for sustained market expansion. Government initiatives aimed at improving infrastructure and promoting sustainability within the logistics sector also play a key role. The increasing demand for e-commerce and global trade further contributes to market growth.

Obstacles in the Netherlands Freight And Logistics Market Market

The Netherlands freight and logistics market faces challenges like driver shortages, fluctuating fuel prices and potential disruptions caused by geopolitical events, impacting operational costs and delivery timelines. Strict environmental regulations, while beneficial for sustainability, impose compliance costs on logistics providers. Intense competition among established players and new entrants also adds pressure. Congestion in major ports and transportation networks can cause delays and inefficiencies. Furthermore, cyber security threats and supply chain vulnerabilities add risk and complexity.

Future Opportunities in Netherlands Freight And Logistics Market

Emerging opportunities lie in sustainable logistics solutions, utilizing alternative fuels, optimizing last-mile delivery using technologies like drones and robots, and implementing blockchain technology for enhanced supply chain transparency and security. Growth in e-commerce and cross-border trade presents significant potential. The expansion of cold chain logistics to handle temperature-sensitive goods will continue to drive investment. Developing robust data analytics capabilities to improve decision-making and operational efficiency is another key area for future growth.

Major Players in the Netherlands Freight And Logistics Market Ecosystem

- DB Schenker

- Wolter Koop

- Jan de Rijk Logistics

- DHL Group

- DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- Vos Logistics Beheer B V

- FedEx

- Kuehne + Nagel

- C H Robinson

- Ewals Cargo Care

- Neele-Vat Logistics

- Netlog Logistics (including Bleckmann)

- Broekman Logistics

Key Developments in Netherlands Freight And Logistics Market Industry

- October 2023: Kuehne+Nagel launched three new charter connections between the Americas, Europe, and Asia, expanding its global reach and capacity for key industries like healthcare and perishables.

- January 2024: Kuehne + Nagel announced its Book & Claim insetting solution for electric vehicles, enhancing its decarbonization efforts and offering customers a way to offset carbon emissions from road freight.

- February 2024: Vos Logistics and VRD Logistiek formed an operational partnership, increasing network density and efficiency across the Benelux region.

Strategic Netherlands Freight And Logistics Market Market Forecast

The Netherlands freight and logistics market is poised for continued growth, driven by technological advancements, economic expansion, and the increasing demand for efficient and sustainable solutions. Opportunities in e-commerce, specialized logistics (e.g., cold chain), and sustainable transportation methods will drive significant market expansion. The focus on digitization and automation will lead to improved efficiency and reduced costs, further enhancing the market's attractiveness for both established players and new entrants. The overall market outlook remains optimistic, with substantial potential for growth and innovation in the coming years.

Netherlands Freight And Logistics Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Logistics Function

-

2.1. Courier, Express, and Parcel (CEP)

-

2.1.1. By Destination Type

- 2.1.1.1. Domestic

- 2.1.1.2. International

-

2.1.1. By Destination Type

-

2.2. Freight Forwarding

-

2.2.1. By Mode Of Transport

- 2.2.1.1. Air

- 2.2.1.2. Sea and Inland Waterways

- 2.2.1.3. Others

-

2.2.1. By Mode Of Transport

-

2.3. Freight Transport

- 2.3.1. Pipelines

- 2.3.2. Rail

- 2.3.3. Road

-

2.4. Warehousing and Storage

-

2.4.1. By Temperature Control

- 2.4.1.1. Non-Temperature Controlled

-

2.4.1. By Temperature Control

- 2.5. Other Services

-

2.1. Courier, Express, and Parcel (CEP)

Netherlands Freight And Logistics Market Segmentation By Geography

- 1. Netherlands

Netherlands Freight And Logistics Market Regional Market Share

Geographic Coverage of Netherlands Freight And Logistics Market

Netherlands Freight And Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Freight And Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Logistics Function

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.2.1.1. By Destination Type

- 5.2.1.1.1. Domestic

- 5.2.1.1.2. International

- 5.2.1.1. By Destination Type

- 5.2.2. Freight Forwarding

- 5.2.2.1. By Mode Of Transport

- 5.2.2.1.1. Air

- 5.2.2.1.2. Sea and Inland Waterways

- 5.2.2.1.3. Others

- 5.2.2.1. By Mode Of Transport

- 5.2.3. Freight Transport

- 5.2.3.1. Pipelines

- 5.2.3.2. Rail

- 5.2.3.3. Road

- 5.2.4. Warehousing and Storage

- 5.2.4.1. By Temperature Control

- 5.2.4.1.1. Non-Temperature Controlled

- 5.2.4.1. By Temperature Control

- 5.2.5. Other Services

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wolter Koop

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jan de Rijk Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DHL Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vos Logistics Beheer B V

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 FedEx

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kuehne + Nagel

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 C H Robinson

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ewals Cargo Care

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Neele-Vat Logistics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Netlog Logistics (including Bleckmann)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Broekman Logistics

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Netherlands Freight And Logistics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Netherlands Freight And Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Netherlands Freight And Logistics Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 2: Netherlands Freight And Logistics Market Revenue billion Forecast, by Logistics Function 2020 & 2033

- Table 3: Netherlands Freight And Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Netherlands Freight And Logistics Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 5: Netherlands Freight And Logistics Market Revenue billion Forecast, by Logistics Function 2020 & 2033

- Table 6: Netherlands Freight And Logistics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Freight And Logistics Market?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the Netherlands Freight And Logistics Market?

Key companies in the market include DB Schenker, Wolter Koop, Jan de Rijk Logistics, DHL Group, DSV A/S (De Sammensluttede Vognmænd af Air and Sea), Vos Logistics Beheer B V, FedEx, Kuehne + Nagel, C H Robinson, Ewals Cargo Care, Neele-Vat Logistics, Netlog Logistics (including Bleckmann), Broekman Logistics.

3. What are the main segments of the Netherlands Freight And Logistics Market?

The market segments include End User Industry, Logistics Function.

4. Can you provide details about the market size?

The market size is estimated to be USD 82.11 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

February 2024: Vos Logistics and VRD Logistiek from Belgium combine their distribution networks in an operational partnership. The partnership increases network density and synergy, increasing efficiency. The partners utilize each other’s logistical hubs and national networks. Customers of Vos Logistics and VRD Logistiek through this partenrship can have pick-ups or collections carried out throughout the Benelux area.January 2024: Kuehne + Nagel has announced its Book & Claim insetting solution for electric vehicles, to improve its decarbonization solutions. Developing Book & Claim insetting solutions for road freight was a strategic priority for Kuehne + Nagel. Customers who use Kuehne + Nagel's road transport services can now claim the carbon reductions of electric trucks when it is not possible to physically move their goods on these vehicles.October 2023: Kuehne+Nagel has introduced three new charter connections between the Americas, Europe, and Asia. It has begun its operations with its own freighter, the B747-8 “Inspire”, from October 23, 2023. It has conducted two additional weekly routings from Atlanta and Chicago to Amsterdam and from there to Taipei. This flight will serve key industries such as healthcare, perishables and semiconductors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Freight And Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Freight And Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Freight And Logistics Market?

To stay informed about further developments, trends, and reports in the Netherlands Freight And Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence