Key Insights

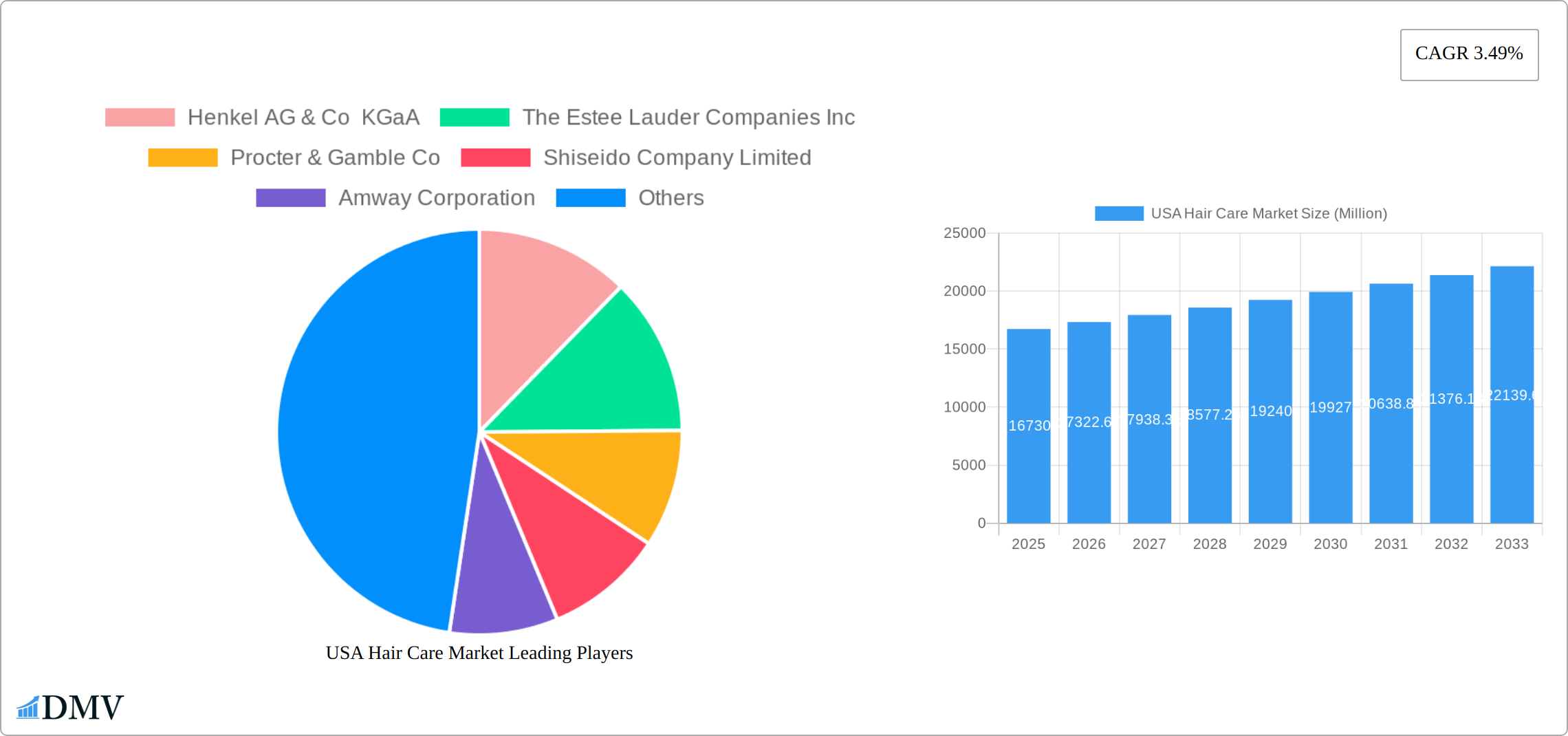

The USA hair care market, valued at approximately $16.73 billion in 2025, exhibits a steady Compound Annual Growth Rate (CAGR) of 3.49%. This growth is fueled by several key factors. Increasing consumer awareness of hair health and the rising demand for premium and specialized hair care products, including those catering to diverse hair types and textures, are major drivers. The strong online retail presence facilitates market expansion, with e-commerce platforms providing convenient access to a wider range of products and brands. Furthermore, the influence of social media and beauty influencers significantly impacts purchasing decisions, driving trends and creating demand for innovative products. The market segmentation, encompassing shampoos, conditioners, styling agents, colorants, and oils, distributed through various channels including supermarkets, specialty stores, and online retailers, reflects the diverse consumer needs and preferences within the sector. Competition is fierce, with major players like L'Oréal, Procter & Gamble, Unilever, and Estee Lauder dominating the market, alongside a growing number of niche brands catering to specific customer segments.

Despite its robust growth, the market faces challenges. Price fluctuations in raw materials, particularly those sourced internationally, could impact profitability. Furthermore, increasing environmental concerns and a growing preference for sustainable and ethically sourced products put pressure on manufacturers to adopt eco-friendly practices. The regulatory landscape, concerning product safety and labeling, also presents a challenge. However, ongoing innovation in product formulations, driven by advancements in technology and scientific understanding of hair health, is expected to propel market growth and overcome these challenges. The focus on personalized hair care solutions and tailored product offerings tailored to specific hair types and concerns will continue to shape the future of the USA hair care market.

USA Hair Care Market Market Composition & Trends

The U.S. hair care market is moderately concentrated, dominated by a few key players. Procter & Gamble holds a leading position, commanding approximately 25% of market share, followed by L'Oréal and Unilever. This dynamic market is fueled by continuous innovation, responding to consumer demand for natural, organic, and sustainable products. The regulatory landscape, particularly FDA oversight of ingredients, has intensified, resulting in substantial investments in research and development to ensure compliance and safety. This regulatory pressure is also driving innovation towards cleaner, more sustainable formulations.

- Market Share Distribution (Estimate): Procter & Gamble (25%), L'Oréal (20%), Unilever (15%), Others (40%)

- Key Innovation Drivers: Growing consumer preference for natural and ethically sourced ingredients; advancements in product formulation technologies (e.g., personalized solutions, improved efficacy); increasing emphasis on sustainability and eco-friendly packaging.

- Regulatory Landscape: Stringent FDA regulations on ingredients and labeling; growing consumer awareness of ingredient safety and environmental impact; increasing pressure for transparency and sustainable practices.

- Substitute Products & Competition: The rise of DIY hair care solutions and smaller niche brands presents some competitive pressure, but branded products continue to hold a significant majority of the market share.

- End-User Demographics: The core consumer base consists of women aged 18-45. However, there's notable growth in the male and children's hair care segments, signifying an expanding market.

- Mergers & Acquisitions (M&A): Recent M&A activity, exceeding $500 million in value, reflects strategic efforts by larger companies to broaden their product portfolios and capture a greater market share.

The significant M&A activity highlights the competitive landscape and the ongoing pursuit of market dominance within the lucrative U.S. hair care sector. Companies are actively seeking opportunities for expansion and diversification.

USA Hair Care Market Industry Evolution

The USA hair care market has experienced significant growth over the past decade, driven by increasing consumer awareness about hair health and the availability of diverse product ranges. From 2019 to 2024, the market grew at a CAGR of approximately 3.5%, with projections for the forecast period (2025-2033) suggesting a steady growth rate of 4.2%. Technological advancements, particularly in the formulation of hair care products, have played a crucial role in this growth. Innovations such as the use of natural ingredients and advanced delivery systems have enhanced product efficacy and consumer satisfaction.

Consumer demands have shifted towards sustainability and personalization, prompting companies to invest in eco-friendly packaging and customized hair care solutions. The adoption of online retail platforms has also surged, with online sales accounting for 25% of total hair care product sales in 2024. This trend is expected to continue, with online retail projected to grow at a CAGR of 5.5% during the forecast period. The integration of AI and machine learning for personalized product recommendations is another area witnessing rapid development, with adoption rates increasing by 10% annually.

Leading Regions, Countries, or Segments in USA Hair Care Market

The USA hair care market is diverse, with different segments and distribution channels showing varying levels of dominance. The shampoo segment remains the largest, accounting for 35% of the market, driven by daily use and the wide variety of products available. Conditioners and hair styling agents follow, with each holding about 20% of the market share.

Shampoo Segment:

Key Driver: Daily use and wide variety of products

Investment Trends: Increased R&D spending on natural and organic formulations

Regulatory Support: Compliance with FDA guidelines on ingredients

Conditioner Segment:

Key Driver: Consumer focus on hair health and repair

Investment Trends: Development of advanced conditioning technologies

Regulatory Support: Emphasis on eco-friendly packaging

Hair Styling Agent Segment:

Key Driver: Growing demand for professional styling products

Investment Trends: Innovations in heat protection and styling longevity

Regulatory Support: Guidelines on safe use of chemicals in styling products

Distribution Channels:

Supermarkets/Hypermarkets: Dominant due to wide product availability and consumer convenience

Online Retail Stores: Fastest-growing channel, driven by e-commerce boom and personalized shopping experiences

Specialty Stores: Catering to niche markets and offering expert advice

The dominance of the shampoo segment can be attributed to its essential role in daily hair care routines and the continuous innovation in this category. Supermarkets and hypermarkets remain the leading distribution channels, offering a wide range of products and convenience to consumers. However, online retail is gaining ground rapidly, fueled by the convenience of shopping from home and the ability to access a broader range of products and brands.

USA Hair Care Market Product Innovations

The USA hair care market is witnessing significant product innovations aimed at meeting consumer demands for natural and effective solutions. Procter & Gamble's launch of the Head & Shoulders dry scalp care range exemplifies this trend, offering shampoos with properties like smoothness and anti-hair fall. L'Oréal's patent on a natural sugar-based curly hair styling formula highlights the shift towards sustainable and plant-based ingredients, providing a lightweight alternative to traditional styling products. These innovations not only enhance product performance but also align with consumer values of sustainability and health.

Propelling Factors for USA Hair Care Market Growth

The U.S. hair care market's growth is driven by a confluence of factors. Technological advancements, particularly AI-powered personalized product recommendations, enhance consumer engagement and brand loyalty. Rising disposable incomes empower consumers to invest in premium and specialized hair care products. Furthermore, stricter regulations are pushing companies toward innovation in sustainable and natural formulations—a trend exemplified by L'Oréal's development of sugar-based formulas. These combined factors contribute to a dynamic and expansive market.

Obstacles in the USA Hair Care Market Market

The USA hair care market faces several challenges that could impede growth. Regulatory hurdles, such as stringent FDA guidelines on ingredients, increase the cost and time required for product development. Supply chain disruptions, particularly during global crises, can lead to product shortages and increased prices. Competitive pressures are intense, with numerous brands vying for market share, which can lead to price wars and reduced profit margins. These obstacles require strategic management to maintain market growth and profitability.

Future Opportunities in USA Hair Care Market

The U.S. hair care market presents substantial future growth potential. Untapped opportunities exist in catering to the diverse needs of various hair types and ethnicities. The continued development of AI-driven personalized solutions promises to further elevate consumer experience and brand engagement. The overarching trend towards sustainability and natural ingredients presents a significant opportunity for brands to differentiate themselves and capture market share with eco-conscious products. This includes exploring innovative packaging solutions and minimizing environmental impact across the entire supply chain.

Major Players in the USA Hair Care Market Ecosystem

- Henkel AG & Co KGaA

- The Estée Lauder Companies Inc

- Procter & Gamble Co

- Shiseido Company Limited

- Amway Corporation

- Garnier

- Moroccanoil

- Unilever PLC

- L'Oréal SA

- Natura & Co

- Kao Corporation

*List Not Exhaustive

Key Developments in USA Hair Care Market Industry

- August 2022: Procter & Gamble's brand, Head & Shoulders, launched a new shampoo range for dry scalp care. The company also introduced shampoos with properties like smooth, silky, and anti-hair fall, impacting market dynamics by catering to specific consumer needs.

- September 2021: L'Oréal filed a patent on its natural sugar-based curly hair styling formula. This development signifies a shift towards natural and sustainable products, influencing market trends and consumer preferences.

- August 2021: Procter & Gamble launched its newest hair care brand, Nou, sold through Walmart and expanded to other stores in the United States. This move increased product availability and brand reach, impacting market competition.

Strategic USA Hair Care Market Market Forecast

The USA hair care market is poised for continued growth, driven by technological advancements and shifting consumer preferences towards sustainability and personalization. The forecast period (2025-2033) is expected to see a CAGR of 4.2%, with significant opportunities in emerging markets and the development of AI-driven personalized hair care solutions. The market's potential is further enhanced by increasing disposable incomes and regulatory pushes for natural and eco-friendly products, ensuring a dynamic and promising future for the industry.

USA Hair Care Market Segmentation

-

1. Product Type

- 1.1. Shampoo

- 1.2. Conditioner

- 1.3. Hair Styling Agent

- 1.4. Hair Colorant

- 1.5. Hair Oil

- 1.6. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialty Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

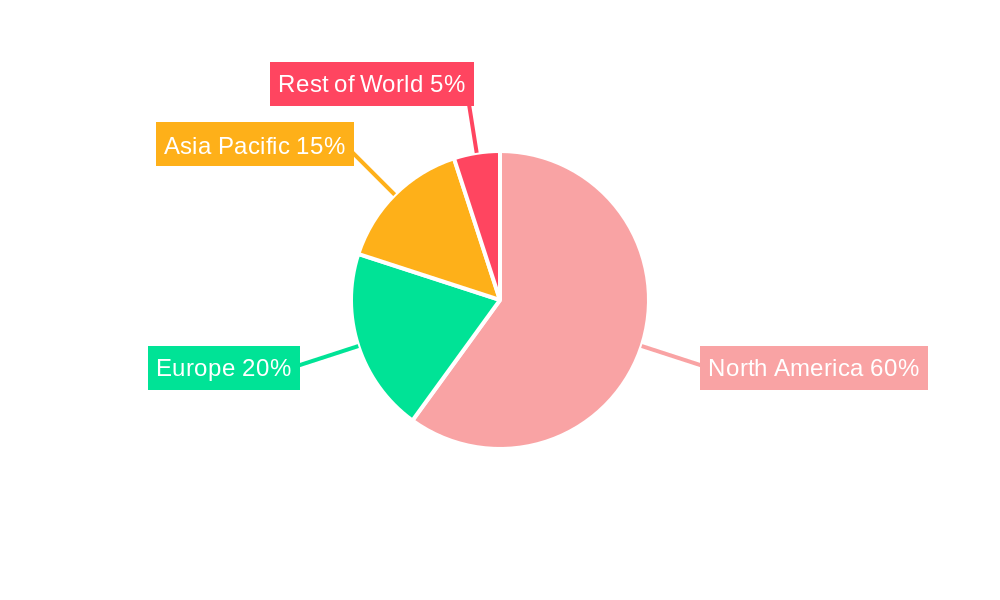

USA Hair Care Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

USA Hair Care Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.49% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Minimalist and Clean Beauty Trend; Popularity of Effective and Smart Skincare

- 3.3. Market Restrains

- 3.3.1. Easy Access to Alternative Options

- 3.4. Market Trends

- 3.4.1. Escalating Expenditure on Hair Care Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global USA Hair Care Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Shampoo

- 5.1.2. Conditioner

- 5.1.3. Hair Styling Agent

- 5.1.4. Hair Colorant

- 5.1.5. Hair Oil

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America USA Hair Care Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Shampoo

- 6.1.2. Conditioner

- 6.1.3. Hair Styling Agent

- 6.1.4. Hair Colorant

- 6.1.5. Hair Oil

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Specialty Stores

- 6.2.4. Online Retail Stores

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America USA Hair Care Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Shampoo

- 7.1.2. Conditioner

- 7.1.3. Hair Styling Agent

- 7.1.4. Hair Colorant

- 7.1.5. Hair Oil

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Specialty Stores

- 7.2.4. Online Retail Stores

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe USA Hair Care Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Shampoo

- 8.1.2. Conditioner

- 8.1.3. Hair Styling Agent

- 8.1.4. Hair Colorant

- 8.1.5. Hair Oil

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Specialty Stores

- 8.2.4. Online Retail Stores

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa USA Hair Care Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Shampoo

- 9.1.2. Conditioner

- 9.1.3. Hair Styling Agent

- 9.1.4. Hair Colorant

- 9.1.5. Hair Oil

- 9.1.6. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Specialty Stores

- 9.2.4. Online Retail Stores

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific USA Hair Care Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Shampoo

- 10.1.2. Conditioner

- 10.1.3. Hair Styling Agent

- 10.1.4. Hair Colorant

- 10.1.5. Hair Oil

- 10.1.6. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Specialty Stores

- 10.2.4. Online Retail Stores

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. United States USA Hair Care Market Analysis, Insights and Forecast, 2019-2031

- 12. Canada USA Hair Care Market Analysis, Insights and Forecast, 2019-2031

- 13. Mexico USA Hair Care Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Henkel AG & Co KGaA

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 The Estee Lauder Companies Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Procter & Gamble Co

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Shiseido Company Limited

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Amway Corporation

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Garnier*List Not Exhaustive

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Moroccanoil

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Unilever PLC

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 L'Oreal SA

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Natura & Co

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Kao Corporation

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Global USA Hair Care Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America USA Hair Care Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America USA Hair Care Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America USA Hair Care Market Revenue (Million), by Product Type 2024 & 2032

- Figure 5: North America USA Hair Care Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 6: North America USA Hair Care Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 7: North America USA Hair Care Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 8: North America USA Hair Care Market Revenue (Million), by Country 2024 & 2032

- Figure 9: North America USA Hair Care Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America USA Hair Care Market Revenue (Million), by Product Type 2024 & 2032

- Figure 11: South America USA Hair Care Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 12: South America USA Hair Care Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 13: South America USA Hair Care Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 14: South America USA Hair Care Market Revenue (Million), by Country 2024 & 2032

- Figure 15: South America USA Hair Care Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe USA Hair Care Market Revenue (Million), by Product Type 2024 & 2032

- Figure 17: Europe USA Hair Care Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 18: Europe USA Hair Care Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 19: Europe USA Hair Care Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 20: Europe USA Hair Care Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe USA Hair Care Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa USA Hair Care Market Revenue (Million), by Product Type 2024 & 2032

- Figure 23: Middle East & Africa USA Hair Care Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 24: Middle East & Africa USA Hair Care Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 25: Middle East & Africa USA Hair Care Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: Middle East & Africa USA Hair Care Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa USA Hair Care Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific USA Hair Care Market Revenue (Million), by Product Type 2024 & 2032

- Figure 29: Asia Pacific USA Hair Care Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Asia Pacific USA Hair Care Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 31: Asia Pacific USA Hair Care Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 32: Asia Pacific USA Hair Care Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific USA Hair Care Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global USA Hair Care Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global USA Hair Care Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global USA Hair Care Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global USA Hair Care Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global USA Hair Care Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global USA Hair Care Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 10: Global USA Hair Care Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 11: Global USA Hair Care Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Canada USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Mexico USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global USA Hair Care Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: Global USA Hair Care Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: Global USA Hair Care Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Brazil USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Argentina USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of South America USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global USA Hair Care Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 22: Global USA Hair Care Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 23: Global USA Hair Care Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United Kingdom USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Germany USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: France USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Italy USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Spain USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Russia USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Benelux USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Nordics USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Europe USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global USA Hair Care Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 34: Global USA Hair Care Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 35: Global USA Hair Care Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Turkey USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Israel USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: GCC USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: North Africa USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: South Africa USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of Middle East & Africa USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global USA Hair Care Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 43: Global USA Hair Care Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 44: Global USA Hair Care Market Revenue Million Forecast, by Country 2019 & 2032

- Table 45: China USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: India USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Japan USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Korea USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: ASEAN USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Oceania USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Asia Pacific USA Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the USA Hair Care Market?

The projected CAGR is approximately 3.49%.

2. Which companies are prominent players in the USA Hair Care Market?

Key companies in the market include Henkel AG & Co KGaA, The Estee Lauder Companies Inc, Procter & Gamble Co, Shiseido Company Limited, Amway Corporation, Garnier*List Not Exhaustive, Moroccanoil, Unilever PLC, L'Oreal SA, Natura & Co, Kao Corporation.

3. What are the main segments of the USA Hair Care Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.73 Million as of 2022.

5. What are some drivers contributing to market growth?

Minimalist and Clean Beauty Trend; Popularity of Effective and Smart Skincare.

6. What are the notable trends driving market growth?

Escalating Expenditure on Hair Care Products.

7. Are there any restraints impacting market growth?

Easy Access to Alternative Options.

8. Can you provide examples of recent developments in the market?

In August 2022: Proctor & Gamble's brand, Head & Shoulders, launched a new shampoo range for dry scalp care. The company launched a few more hair care shampoos with different properties like smooth, silky, and anti-hair fall shampoos.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "USA Hair Care Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the USA Hair Care Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the USA Hair Care Market?

To stay informed about further developments, trends, and reports in the USA Hair Care Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence