Key Insights

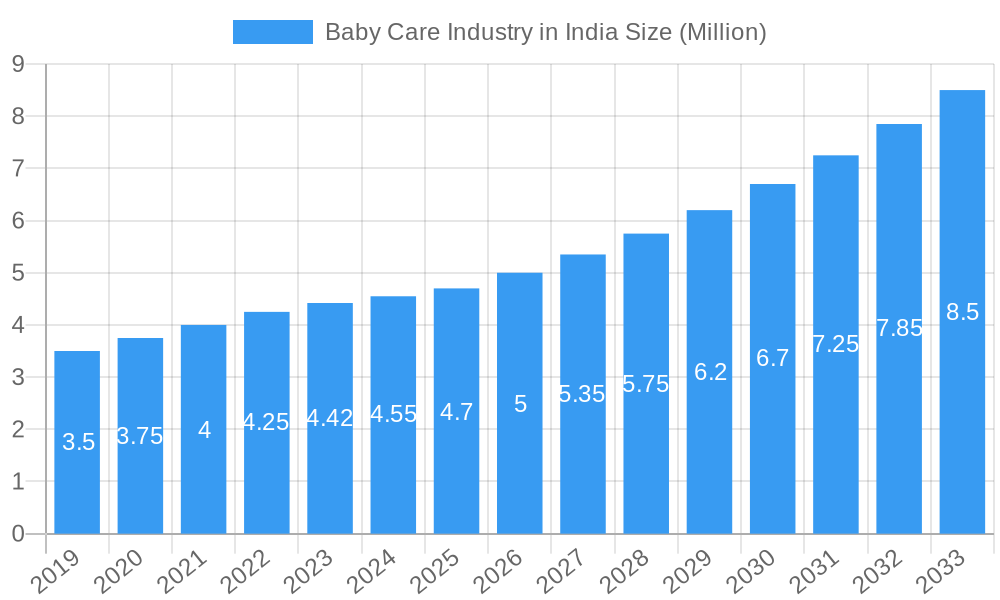

The Indian Baby Care Industry is poised for robust growth, driven by a confluence of demographic shifts and evolving consumer preferences. With a current market size estimated at a significant $4.42 million, the industry is projected to witness an impressive Compound Annual Growth Rate (CAGR) of 11.76% over the forecast period. This rapid expansion is fueled by increasing disposable incomes, a rising awareness among parents regarding specialized baby hygiene and nutrition products, and a growing preference for premium and organic offerings. The "New Parent" demographic, actively seeking safer and more effective solutions for their infants, is a primary catalyst. Furthermore, the increasing penetration of organized retail and the explosive growth of e-commerce platforms are democratizing access to a wider array of baby care products across Tier 1, Tier 2, and even Tier 3 cities, further accelerating market penetration and value.

Baby Care Industry in India Market Size (In Million)

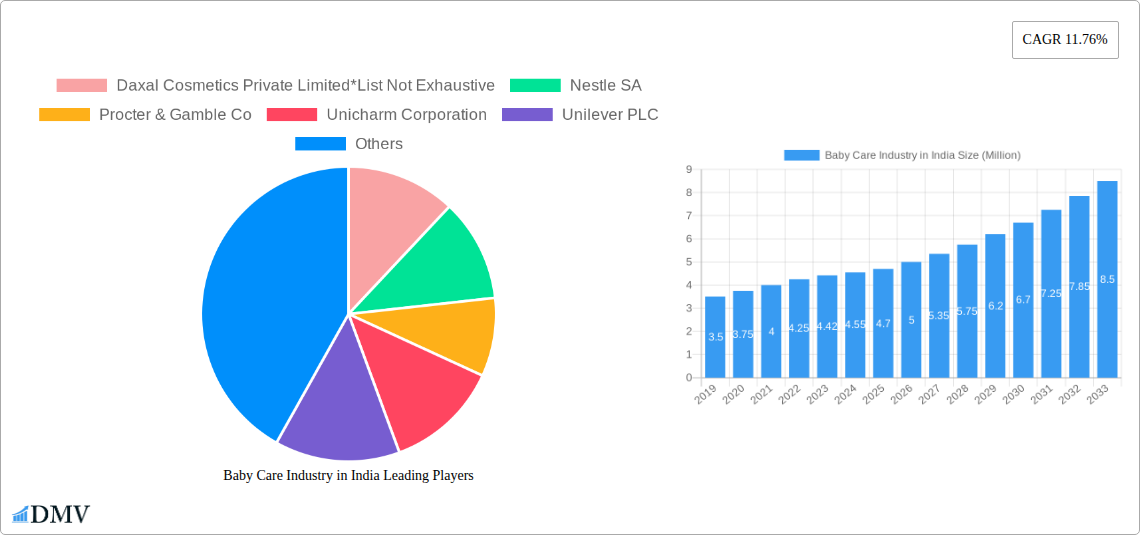

The market's dynamism is further underscored by the diverse segments within it. Baby Skin Care and Baby Hair Care are experiencing sustained demand due to an emphasis on gentle and natural formulations. The Baby Toiletries segment, encompassing bath products, fragrances, and importantly, diapers and wipes, represents a substantial and growing share, with a clear shift towards superabsorbent and eco-friendly diaper options. The Baby Food and Beverages sector is also a key contributor, with a rising demand for nutritious and convenient meal solutions. While supermarkets and hypermarkets remain strong distribution channels, online retailing has emerged as a dominant force, offering unparalleled convenience and choice. However, challenges such as the availability of counterfeit products and the need for greater consumer education in rural areas present opportunities for established players to build trust and expand their reach. The competitive landscape features both global giants like Procter & Gamble and Nestle, and burgeoning domestic players like Daxal Cosmetics and Honasa Consumer, all vying for a larger share in this lucrative and rapidly expanding market.

Baby Care Industry in India Company Market Share

Unveiling India's Booming Baby Care Market: A Comprehensive Report (2019-2033)

This in-depth report provides an exhaustive analysis of the Indian baby care industry, offering critical insights into its dynamic growth, emerging trends, and future trajectory. Designed for stakeholders, investors, manufacturers, and market strategists, this report leverages advanced data analytics and extensive research to deliver actionable intelligence. Discover the market size valued at xx Million (Base Year 2025), projected to reach xx Million by 2033, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Explore the competitive landscape, product innovations, and key drivers shaping this rapidly expanding sector.

Baby Care Industry in India Market Composition & Trends

The Indian baby care market is characterized by a growing concentration of key players, driven by rising disposable incomes and increasing parental awareness regarding specialized baby products. Innovation remains a critical catalyst, with a strong emphasis on natural, organic, and toxin-free formulations addressing evolving consumer preferences. The regulatory landscape, while still developing, is gradually aligning with global standards, influencing product safety and labeling. Substitute products, primarily traditional home remedies, are steadily losing ground to scientifically formulated and convenience-driven baby care solutions. End-user profiles are diversifying, encompassing affluent urban families seeking premium offerings and a burgeoning middle class prioritizing value and efficacy. Mergers and acquisitions (M&A) are becoming more prevalent as established players seek to expand their portfolios and gain market share, with recent M&A deal values estimated at xx Million.

Key market composition elements include:

- Dominant Segments: Baby Diapers and Wipes, Baby Food and Beverages.

- Key Influences: Increasing female workforce participation, a growing nuclear family structure, and heightened awareness of infant health and hygiene.

- Market Share Distribution: The top 5 players are estimated to hold xx% of the market share.

Baby Care Industry in India Industry Evolution

The Indian baby care industry has witnessed a remarkable evolutionary journey, transforming from a nascent market catering to basic needs to a sophisticated ecosystem driven by innovation and evolving consumer demands. During the historical period (2019-2024), the market experienced robust growth, fueled by increasing birth rates, rising disposable incomes, and a growing emphasis on infant well-being. Technological advancements have played a pivotal role, enabling the development of safer, more effective, and user-friendly products. For instance, the adoption of advanced materials in diapers has led to enhanced absorbency and comfort, while new formulations in skincare have addressed specific infant dermatological concerns.

Shifting consumer demands are a significant driver of this evolution. Parents, particularly in urban centers, are increasingly discerning, actively seeking products that are not only safe and effective but also environmentally conscious and free from harmful chemicals. This has led to a surge in demand for organic baby care products, natural baby products, and hypoallergenic baby skincare. The rise of e-commerce has democratized access to a wider range of brands and product categories, empowering consumers with information and choice. The baby food and beverage segment, in particular, has seen significant innovation, moving beyond traditional offerings to incorporate specialized nutritional blends, organic ingredients, and allergy-friendly options. The baby toiletries market, including baby bath products, baby shampoo, and baby wipes, has also seen a shift towards gentle, plant-based formulations.

Growth rates during the historical period averaged xx% annually, with specific segments like baby diapers and wipes exhibiting growth rates of xx%. The adoption of premium and specialized baby care products has seen a significant increase, estimated at xx% among urban households. This evolution underscores a market moving towards higher value, greater specialization, and a stronger alignment with global trends in infant care and wellness. The foundation laid during this period has set the stage for continued expansion and innovation in the coming years.

Leading Regions, Countries, or Segments in Baby Care Industry in India

The Indian baby care market exhibits distinct regional dominance and segment leadership, driven by a confluence of socio-economic factors, urbanization, and purchasing power. Online retailing has emerged as a dominant distribution channel across the nation, providing unparalleled reach and convenience, especially in Tier 2 and Tier 3 cities where traditional retail infrastructure might be less developed. This channel's growth is further propelled by increasing internet penetration and smartphone usage.

Within product segments, Baby Diapers and Wipes consistently hold a leading position due to their essential nature and recurring purchase cycle. The sheer volume of demand, coupled with ongoing innovation in absorbency, comfort, and skin-friendliness, solidifies its market dominance. Following closely is the Baby Food and Beverages segment, witnessing robust growth fueled by rising awareness about infant nutrition and the increasing preference for convenient, ready-to-feed options. The Baby Toiletries segment, encompassing Baby Bath Products and Fragrances, also commands significant market share, driven by the demand for gentle, specialized cleansing and grooming products.

Key Drivers for Segment Dominance:

- Baby Diapers and Wipes:

- High Birth Rates: Contributing to a consistent and substantial consumer base.

- Increasing Disposable Income: Enabling greater affordability of branded and premium diapers.

- Product Innovation: Continuous advancements in absorbency, leak protection, and skin comfort.

- Baby Food and Beverages:

- Nutritional Awareness: Growing parental understanding of the critical role of early nutrition.

- Busy Lifestyles: Driving demand for convenient and ready-to-feed baby food options.

- Availability of Organic & Natural Options: Catering to a segment of parents seeking healthier choices.

- Online Retailing:

- Digital Penetration: Widespread internet and smartphone usage across demographics.

- Convenience & Accessibility: Doorstep delivery and wider product selection.

- Competitive Pricing & Discounts: Attracting price-sensitive consumers.

Geographically, metropolitan cities and Tier 1 cities, such as Delhi NCR, Mumbai, Bengaluru, and Chennai, represent the largest markets due to higher disposable incomes, greater awareness of specialized products, and a strong presence of modern retail formats and online platforms. However, Tier 2 and Tier 3 cities are exhibiting faster growth rates as improved distribution networks and increasing digital literacy expand the market's reach.

Baby Care Industry in India Product Innovations

Product innovations in the Indian baby care industry are predominantly focused on safety, efficacy, and natural ingredients. There's a significant trend towards organic baby skincare and hypoallergenic baby products, addressing parental concerns about harsh chemicals. Brands are increasingly formulating products with plant-derived ingredients like shea butter, chamomile, and calendula for gentle cleansing and moisturizing. The baby diaper segment sees continuous innovation in materials for enhanced absorbency, breathability, and skin protection, including the introduction of plant-based and biodegradable options. In baby food, innovations include fortified formulas, allergen-free options, and single-ingredient purees for easier digestion. These innovations are crucial for differentiating brands and capturing market share.

Propelling Factors for Baby Care Industry in India Growth

Several key factors are propelling the Indian baby care industry forward. Rising disposable incomes and a growing middle class are significantly increasing the purchasing power for premium baby products. Increased parental awareness about infant health, hygiene, and developmental needs drives demand for specialized and scientifically formulated products. The rapid expansion of online retailing provides unparalleled accessibility to a wider range of brands and product categories, especially in Tier 2 and Tier 3 cities. Furthermore, government initiatives promoting maternal and child health, coupled with a favorable demographic profile characterized by a large young population, provide a sustained growth impetus.

Obstacles in the Baby Care Industry in India Market

Despite robust growth, the Indian baby care market faces certain obstacles. Regulatory complexities and evolving standards can pose challenges for manufacturers, particularly for smaller players. Supply chain disruptions, exacerbated by logistical issues and the reliance on imported raw materials, can impact product availability and costs. Intense competition, both from established multinational corporations and agile domestic brands, pressures profit margins. Price sensitivity among a significant portion of the consumer base also remains a barrier, especially for premium or niche products, hindering faster market penetration in certain segments.

Future Opportunities in Baby Care Industry in India

The Indian baby care industry is ripe with future opportunities. The burgeoning demand for organic and natural baby products presents a significant avenue for brands focusing on sustainable and eco-friendly offerings. The increasing penetration of online retailing into smaller towns and villages offers immense potential for market expansion. Innovation in the baby food segment, particularly in specialized nutrition for infants with allergies or specific health needs, is a promising frontier. Furthermore, the growing trend of personalized baby care solutions and the integration of smart technologies in baby monitoring and feeding systems represent untapped market segments with substantial growth potential.

Major Players in the Baby Care Industry in India Ecosystem

- Daxal Cosmetics Private Limited

- Nestle SA

- Procter & Gamble Co

- Unicharm Corporation

- Unilever PLC

- Danone SA

- Himalaya Global Holdings Ltd

- Kimberly-Clark Corporation

- Johnson & Johnson

- Honasa Consumer Pvt Ltd

Key Developments in Baby Care Industry in India Industry

- August 2023: Mamaearth launched its Exclusive Brand Outlet (EBO) in Bengaluru, showcasing a comprehensive range of toxin-free baby care, beauty, and personal care solutions.

- December 2022: Mother Nurture launched its parent-tested, baby-approved range of nutritious, preservative-free baby food products in the Indian market, with ingredients sourced from high-quality farms.

- October 2022: R for Rabbit introduced its new baby care product range, Pure & Beyond, formulated with natural and soothing ingredients for delicate baby skin.

- July 2022: BabyChakra launched its first range of 100% natural and certified organic baby care products, developed with input from doctors and mothers, including moisturizing body wash and baby massage oil.

- April 2022: Sanosan, a German premium baby skincare brand, partnered with Glowderma to introduce a baby cleansing range in India, including bath & shampoo, care soap, and wash foam.

Strategic Baby Care Industry in India Market Forecast

The Indian baby care market forecast indicates sustained and robust growth, driven by a confluence of increasing disposable incomes, a rising awareness of child health and nutrition, and the expanding reach of e-commerce. Opportunities abound in the segments of organic baby products, natural baby skincare, and specialized baby food. The continuous innovation in product development, focusing on safety and sustainability, will be crucial for market players. Strategic expansion into Tier 2 and Tier 3 cities, coupled with effective digital marketing strategies, will unlock significant potential. The market is projected to continue its upward trajectory, presenting lucrative investment and growth prospects for stakeholders.

Baby Care Industry in India Segmentation

-

1. Type

- 1.1. Baby Skin Care

- 1.2. Baby Hair Care

-

1.3. Baby Toiletries

- 1.3.1. Baby Bath Products and Fragrances

- 1.3.2. Baby Diapers and wipes

- 1.4. Baby Food and Beverages

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Pharmacies/Drug Stores

- 2.4. Online Retailing

- 2.5. Other Distribution Channels

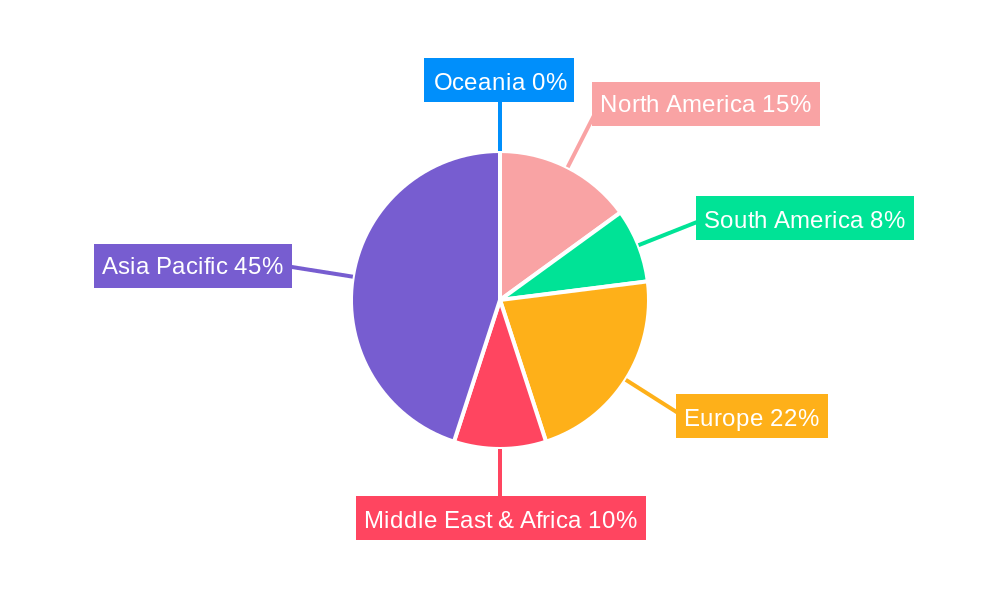

Baby Care Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Baby Care Industry in India Regional Market Share

Geographic Coverage of Baby Care Industry in India

Baby Care Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Organic Baby Care Products; Increasing Demand for Herbal Baby Skincare Products

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Organic and Herbal Baby Care Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Baby Care Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Baby Skin Care

- 5.1.2. Baby Hair Care

- 5.1.3. Baby Toiletries

- 5.1.3.1. Baby Bath Products and Fragrances

- 5.1.3.2. Baby Diapers and wipes

- 5.1.4. Baby Food and Beverages

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Pharmacies/Drug Stores

- 5.2.4. Online Retailing

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Baby Care Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Baby Skin Care

- 6.1.2. Baby Hair Care

- 6.1.3. Baby Toiletries

- 6.1.3.1. Baby Bath Products and Fragrances

- 6.1.3.2. Baby Diapers and wipes

- 6.1.4. Baby Food and Beverages

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Pharmacies/Drug Stores

- 6.2.4. Online Retailing

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Baby Care Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Baby Skin Care

- 7.1.2. Baby Hair Care

- 7.1.3. Baby Toiletries

- 7.1.3.1. Baby Bath Products and Fragrances

- 7.1.3.2. Baby Diapers and wipes

- 7.1.4. Baby Food and Beverages

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Pharmacies/Drug Stores

- 7.2.4. Online Retailing

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Baby Care Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Baby Skin Care

- 8.1.2. Baby Hair Care

- 8.1.3. Baby Toiletries

- 8.1.3.1. Baby Bath Products and Fragrances

- 8.1.3.2. Baby Diapers and wipes

- 8.1.4. Baby Food and Beverages

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Pharmacies/Drug Stores

- 8.2.4. Online Retailing

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Baby Care Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Baby Skin Care

- 9.1.2. Baby Hair Care

- 9.1.3. Baby Toiletries

- 9.1.3.1. Baby Bath Products and Fragrances

- 9.1.3.2. Baby Diapers and wipes

- 9.1.4. Baby Food and Beverages

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Pharmacies/Drug Stores

- 9.2.4. Online Retailing

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Baby Care Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Baby Skin Care

- 10.1.2. Baby Hair Care

- 10.1.3. Baby Toiletries

- 10.1.3.1. Baby Bath Products and Fragrances

- 10.1.3.2. Baby Diapers and wipes

- 10.1.4. Baby Food and Beverages

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Pharmacies/Drug Stores

- 10.2.4. Online Retailing

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Daxal Cosmetics Private Limited*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nestle SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Procter & Gamble Co

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Unicharm Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Unilever PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Danone SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Himalaya Global Holdings Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kimberly-Clark Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Johnson & Johnson

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Honasa Consumer Pvt Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Daxal Cosmetics Private Limited*List Not Exhaustive

List of Figures

- Figure 1: Global Baby Care Industry in India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Baby Care Industry in India Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America Baby Care Industry in India Revenue (Million), by Type 2025 & 2033

- Figure 4: North America Baby Care Industry in India Volume (K Units), by Type 2025 & 2033

- Figure 5: North America Baby Care Industry in India Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Baby Care Industry in India Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Baby Care Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 8: North America Baby Care Industry in India Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 9: North America Baby Care Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Baby Care Industry in India Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America Baby Care Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Baby Care Industry in India Volume (K Units), by Country 2025 & 2033

- Figure 13: North America Baby Care Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Baby Care Industry in India Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Baby Care Industry in India Revenue (Million), by Type 2025 & 2033

- Figure 16: South America Baby Care Industry in India Volume (K Units), by Type 2025 & 2033

- Figure 17: South America Baby Care Industry in India Revenue Share (%), by Type 2025 & 2033

- Figure 18: South America Baby Care Industry in India Volume Share (%), by Type 2025 & 2033

- Figure 19: South America Baby Care Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 20: South America Baby Care Industry in India Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 21: South America Baby Care Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: South America Baby Care Industry in India Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 23: South America Baby Care Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 24: South America Baby Care Industry in India Volume (K Units), by Country 2025 & 2033

- Figure 25: South America Baby Care Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Baby Care Industry in India Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Baby Care Industry in India Revenue (Million), by Type 2025 & 2033

- Figure 28: Europe Baby Care Industry in India Volume (K Units), by Type 2025 & 2033

- Figure 29: Europe Baby Care Industry in India Revenue Share (%), by Type 2025 & 2033

- Figure 30: Europe Baby Care Industry in India Volume Share (%), by Type 2025 & 2033

- Figure 31: Europe Baby Care Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 32: Europe Baby Care Industry in India Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 33: Europe Baby Care Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 34: Europe Baby Care Industry in India Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 35: Europe Baby Care Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Baby Care Industry in India Volume (K Units), by Country 2025 & 2033

- Figure 37: Europe Baby Care Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Baby Care Industry in India Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Baby Care Industry in India Revenue (Million), by Type 2025 & 2033

- Figure 40: Middle East & Africa Baby Care Industry in India Volume (K Units), by Type 2025 & 2033

- Figure 41: Middle East & Africa Baby Care Industry in India Revenue Share (%), by Type 2025 & 2033

- Figure 42: Middle East & Africa Baby Care Industry in India Volume Share (%), by Type 2025 & 2033

- Figure 43: Middle East & Africa Baby Care Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 44: Middle East & Africa Baby Care Industry in India Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 45: Middle East & Africa Baby Care Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Middle East & Africa Baby Care Industry in India Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Middle East & Africa Baby Care Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East & Africa Baby Care Industry in India Volume (K Units), by Country 2025 & 2033

- Figure 49: Middle East & Africa Baby Care Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Baby Care Industry in India Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Baby Care Industry in India Revenue (Million), by Type 2025 & 2033

- Figure 52: Asia Pacific Baby Care Industry in India Volume (K Units), by Type 2025 & 2033

- Figure 53: Asia Pacific Baby Care Industry in India Revenue Share (%), by Type 2025 & 2033

- Figure 54: Asia Pacific Baby Care Industry in India Volume Share (%), by Type 2025 & 2033

- Figure 55: Asia Pacific Baby Care Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 56: Asia Pacific Baby Care Industry in India Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 57: Asia Pacific Baby Care Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Asia Pacific Baby Care Industry in India Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Asia Pacific Baby Care Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific Baby Care Industry in India Volume (K Units), by Country 2025 & 2033

- Figure 61: Asia Pacific Baby Care Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Baby Care Industry in India Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Baby Care Industry in India Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Baby Care Industry in India Volume K Units Forecast, by Type 2020 & 2033

- Table 3: Global Baby Care Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Baby Care Industry in India Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Baby Care Industry in India Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Baby Care Industry in India Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Global Baby Care Industry in India Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Baby Care Industry in India Volume K Units Forecast, by Type 2020 & 2033

- Table 9: Global Baby Care Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Baby Care Industry in India Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global Baby Care Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Baby Care Industry in India Volume K Units Forecast, by Country 2020 & 2033

- Table 13: United States Baby Care Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Baby Care Industry in India Volume (K Units) Forecast, by Application 2020 & 2033

- Table 15: Canada Baby Care Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Baby Care Industry in India Volume (K Units) Forecast, by Application 2020 & 2033

- Table 17: Mexico Baby Care Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Baby Care Industry in India Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Global Baby Care Industry in India Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Baby Care Industry in India Volume K Units Forecast, by Type 2020 & 2033

- Table 21: Global Baby Care Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Baby Care Industry in India Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Baby Care Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Baby Care Industry in India Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Brazil Baby Care Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Brazil Baby Care Industry in India Volume (K Units) Forecast, by Application 2020 & 2033

- Table 27: Argentina Baby Care Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina Baby Care Industry in India Volume (K Units) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Baby Care Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Baby Care Industry in India Volume (K Units) Forecast, by Application 2020 & 2033

- Table 31: Global Baby Care Industry in India Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Baby Care Industry in India Volume K Units Forecast, by Type 2020 & 2033

- Table 33: Global Baby Care Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global Baby Care Industry in India Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Baby Care Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Baby Care Industry in India Volume K Units Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Baby Care Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Baby Care Industry in India Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: Germany Baby Care Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany Baby Care Industry in India Volume (K Units) Forecast, by Application 2020 & 2033

- Table 41: France Baby Care Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France Baby Care Industry in India Volume (K Units) Forecast, by Application 2020 & 2033

- Table 43: Italy Baby Care Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy Baby Care Industry in India Volume (K Units) Forecast, by Application 2020 & 2033

- Table 45: Spain Baby Care Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain Baby Care Industry in India Volume (K Units) Forecast, by Application 2020 & 2033

- Table 47: Russia Baby Care Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Russia Baby Care Industry in India Volume (K Units) Forecast, by Application 2020 & 2033

- Table 49: Benelux Baby Care Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Benelux Baby Care Industry in India Volume (K Units) Forecast, by Application 2020 & 2033

- Table 51: Nordics Baby Care Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Nordics Baby Care Industry in India Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Baby Care Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Baby Care Industry in India Volume (K Units) Forecast, by Application 2020 & 2033

- Table 55: Global Baby Care Industry in India Revenue Million Forecast, by Type 2020 & 2033

- Table 56: Global Baby Care Industry in India Volume K Units Forecast, by Type 2020 & 2033

- Table 57: Global Baby Care Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 58: Global Baby Care Industry in India Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 59: Global Baby Care Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Baby Care Industry in India Volume K Units Forecast, by Country 2020 & 2033

- Table 61: Turkey Baby Care Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Turkey Baby Care Industry in India Volume (K Units) Forecast, by Application 2020 & 2033

- Table 63: Israel Baby Care Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Israel Baby Care Industry in India Volume (K Units) Forecast, by Application 2020 & 2033

- Table 65: GCC Baby Care Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: GCC Baby Care Industry in India Volume (K Units) Forecast, by Application 2020 & 2033

- Table 67: North Africa Baby Care Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: North Africa Baby Care Industry in India Volume (K Units) Forecast, by Application 2020 & 2033

- Table 69: South Africa Baby Care Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Africa Baby Care Industry in India Volume (K Units) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Baby Care Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Baby Care Industry in India Volume (K Units) Forecast, by Application 2020 & 2033

- Table 73: Global Baby Care Industry in India Revenue Million Forecast, by Type 2020 & 2033

- Table 74: Global Baby Care Industry in India Volume K Units Forecast, by Type 2020 & 2033

- Table 75: Global Baby Care Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 76: Global Baby Care Industry in India Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 77: Global Baby Care Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global Baby Care Industry in India Volume K Units Forecast, by Country 2020 & 2033

- Table 79: China Baby Care Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: China Baby Care Industry in India Volume (K Units) Forecast, by Application 2020 & 2033

- Table 81: India Baby Care Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: India Baby Care Industry in India Volume (K Units) Forecast, by Application 2020 & 2033

- Table 83: Japan Baby Care Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Japan Baby Care Industry in India Volume (K Units) Forecast, by Application 2020 & 2033

- Table 85: South Korea Baby Care Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Korea Baby Care Industry in India Volume (K Units) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Baby Care Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Baby Care Industry in India Volume (K Units) Forecast, by Application 2020 & 2033

- Table 89: Oceania Baby Care Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oceania Baby Care Industry in India Volume (K Units) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Baby Care Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Baby Care Industry in India Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Baby Care Industry in India?

The projected CAGR is approximately 11.76%.

2. Which companies are prominent players in the Baby Care Industry in India?

Key companies in the market include Daxal Cosmetics Private Limited*List Not Exhaustive, Nestle SA, Procter & Gamble Co, Unicharm Corporation, Unilever PLC, Danone SA, Himalaya Global Holdings Ltd, Kimberly-Clark Corporation, Johnson & Johnson, Honasa Consumer Pvt Ltd.

3. What are the main segments of the Baby Care Industry in India?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.42 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Organic Baby Care Products; Increasing Demand for Herbal Baby Skincare Products.

6. What are the notable trends driving market growth?

Increasing Demand for Organic and Herbal Baby Care Products.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

August 2023: Mamaearth launched its Exclusive Brand Outlet (EBO) in Bengaluru. Strategically positioned at the renowned Mantri Square Mall, Malleshwaram, this opening marks a significant stride in Mamaearth's journey. The Bengaluru EBO is set to provide a comprehensive assortment of toxin-free personal care items, encompassing baby care, beauty, and personal care solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Baby Care Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Baby Care Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Baby Care Industry in India?

To stay informed about further developments, trends, and reports in the Baby Care Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence