Key Insights

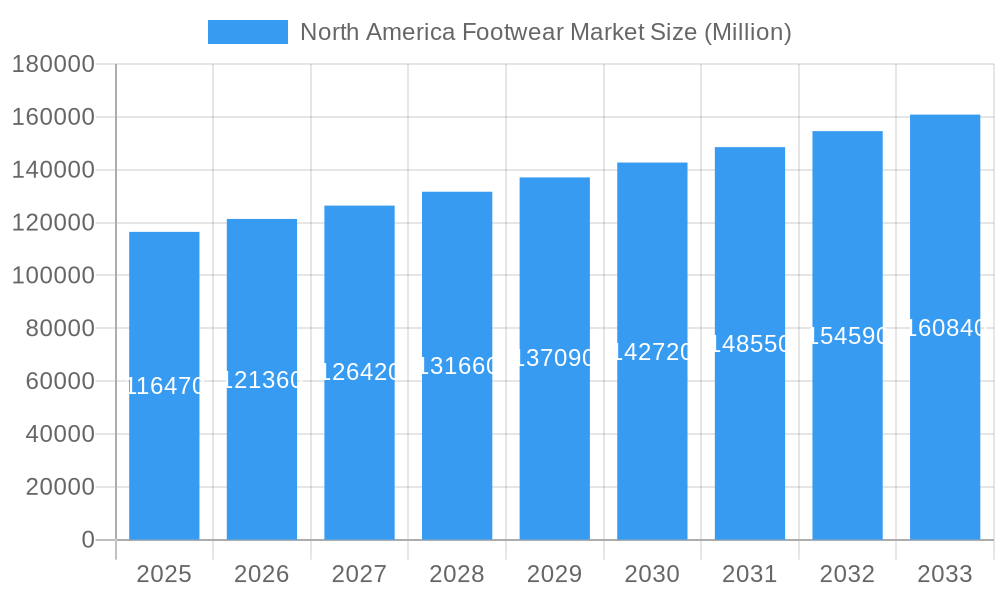

The North American footwear market, valued at $116.47 billion in 2025, is projected to experience steady growth, driven by several key factors. The increasing popularity of athletic and outdoor activities, coupled with a rising disposable income among consumers, fuels demand across all footwear segments. The market is segmented by end-user (men, women, kids), distribution channel (specialty stores, supermarkets/hypermarkets, online retail stores), product type (athletic, non-athletic), and category (mass, premium/luxury). The strong presence of established brands like Nike, Adidas, and Under Armour, along with emerging players, contributes to market dynamism. Growth in the online retail channel is a significant trend, impacting traditional brick-and-mortar stores. While potential economic downturns could act as a restraint, the consistent demand for comfortable and stylish footwear across demographics ensures market resilience. The premium/luxury segment is expected to show robust growth due to increased consumer spending on high-quality products. The increasing awareness of sustainable and ethically sourced materials is driving innovation and influencing consumer purchasing decisions within the market.

North America Footwear Market Market Size (In Billion)

Growth in the North American footwear market is anticipated to continue through 2033, fueled by factors such as technological advancements in footwear design (e.g., enhanced comfort, performance features), and the rising popularity of fitness and wellness trends among consumers. The market’s diverse product offerings cater to varied lifestyles and preferences, contributing to its broad appeal. Competition among established and emerging brands is intense, leading to continuous product innovation and marketing strategies. Regional variations in growth may occur, with specific areas demonstrating higher growth based on factors such as population density, income levels, and consumer preferences. Strategic partnerships and mergers & acquisitions will likely continue shaping the market landscape. Analyzing specific segments (like athletic footwear within the online retail channel) will offer more granular insights into growth potential and market opportunities.

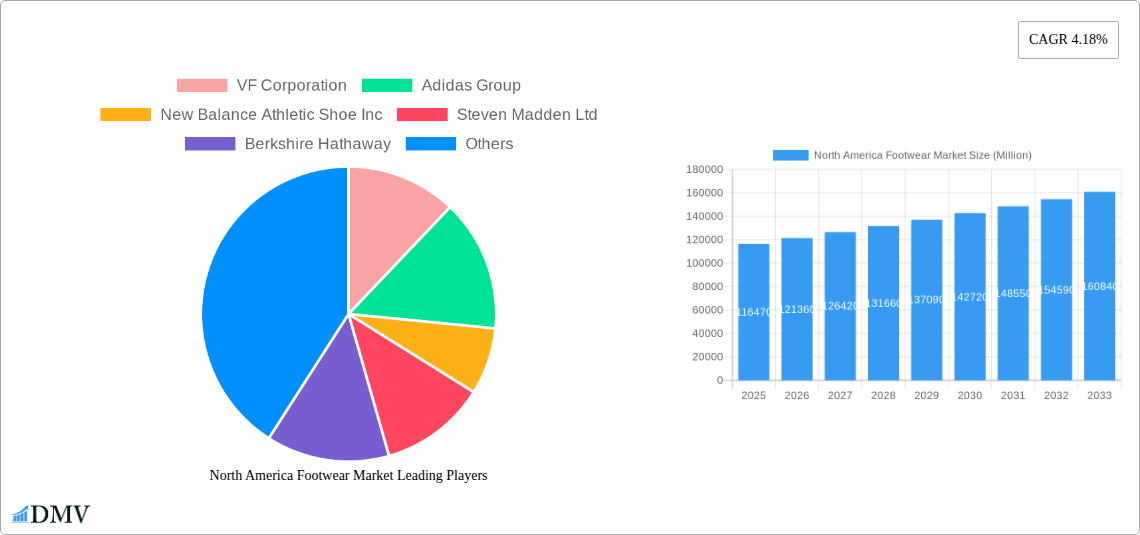

North America Footwear Market Company Market Share

North America Footwear Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the North America footwear market, covering the period from 2019 to 2033. With a base year of 2025 and an estimated year of 2025, this comprehensive study forecasts market trends and growth opportunities until 2033. The report delves into market segmentation, competitive landscapes, key players, and emerging technological advancements, offering invaluable insights for stakeholders across the footwear industry. Expect detailed analysis of market size (in Millions), growth rates, and crucial trends shaping the future of footwear in North America.

North America Footwear Market Composition & Trends

This section meticulously examines the North American footwear market's structure and dynamics. We analyze market concentration, revealing the market share distribution among key players like Nike Inc, Adidas Group, VF Corporation, and others. We explore the innovative forces driving market growth, including technological advancements in materials and manufacturing processes. The regulatory landscape, including trade policies and environmental regulations, is also assessed. Furthermore, we analyze substitute products and their impact on market share, considering factors influencing consumer choices. We provide a detailed overview of end-user demographics (Men, Women, Kids), their purchasing habits, and market preferences. Finally, this section includes an analysis of recent mergers and acquisitions (M&A) activities within the industry, highlighting deal values and their strategic implications. Expect a detailed breakdown of market share percentages for each major player and an overview of significant M&A deals valued at xx Million during the historical period (2019-2024).

- Market Concentration: Analysis of market share held by top players (Nike, Adidas, etc.).

- Innovation Catalysts: Detailed examination of technological advancements in materials, design, and manufacturing.

- Regulatory Landscape: Assessment of relevant regulations impacting the industry.

- Substitute Products: Analysis of competing product categories and their market impact.

- End-User Profiles: Demographic breakdown of consumer segments and their footwear preferences.

- M&A Activities: Overview of significant mergers and acquisitions, including deal values.

North America Footwear Market Industry Evolution

This section traces the evolution of the North American footwear market, examining historical growth trajectories from 2019 to 2024. We project future growth rates through 2033, considering market size and volume. We analyze the impact of technological advancements, including 3D printing, sustainable materials, and personalized designs, on market growth. This section also explores the evolving consumer preferences, including shifts towards comfort, sustainability, and specialized footwear for specific activities (running, hiking, etc.). We present data points such as compound annual growth rates (CAGR) for different segments during the historical and forecast periods. Specific examples of technological advancements and their impact on market growth are highlighted. The analysis of evolving consumer demands considers factors such as fashion trends, health consciousness, and increasing disposable incomes.

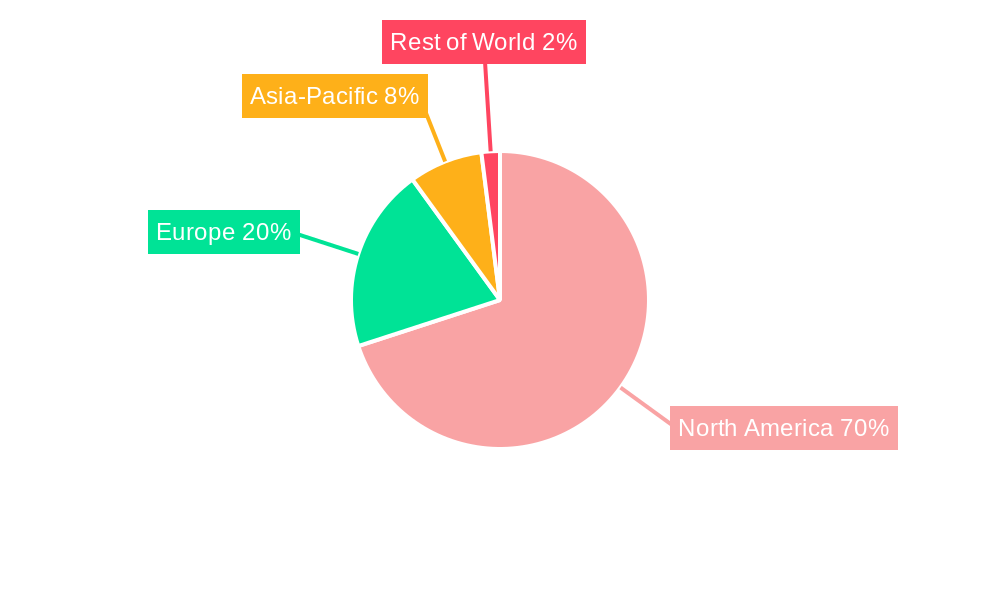

Leading Regions, Countries, or Segments in North America Footwear Market

This section identifies the leading regions, countries, and market segments within the North American footwear market. We analyze dominant segments across end-user (Men, Women, Kids), distribution channels (Specialty Stores, Supermarkets/Hypermarkets, Online Retail Stores, Other Distribution Channels), product types (Athletic Footwear, Non-athletic Footwear), and categories (Mass, Premium/Luxury). We delve into the key drivers behind the dominance of each leading segment, including investment trends, government support, and consumer behavior patterns.

- End-User: Analysis of market share and growth for Men's, Women's, and Kids' footwear.

- Distribution Channel: Comparison of sales and growth across different distribution channels.

- Product Type: Assessment of market share for athletic vs. non-athletic footwear.

- Category: Analysis of market share and growth trends for mass and premium/luxury footwear.

North America Footwear Market Product Innovations

This section highlights recent and significant product innovations within the North American footwear market. We showcase examples of new materials, designs, and technologies that enhance performance, comfort, and sustainability. This includes discussing unique selling propositions (USPs) of newly launched products and analyzing the impact of these innovations on market competition and consumer preferences. For instance, the report will analyze the advancements in materials science leading to lighter, more durable, and environmentally friendly footwear.

Propelling Factors for North America Footwear Market Growth

This section identifies and analyzes the key growth drivers for the North American footwear market. We discuss technological advancements, economic factors such as rising disposable incomes, and supportive government regulations that stimulate market expansion. Specific examples of these drivers, including increasing adoption of e-commerce and the rising popularity of fitness activities, will be provided.

Obstacles in the North America Footwear Market

This section identifies and discusses the major barriers and restraints to growth in the North American footwear market. We consider regulatory challenges, supply chain disruptions (including material shortages and manufacturing bottlenecks), and intense competitive pressure as key obstacles, quantifying their impact on market growth where possible, including potential impacts on production costs and market share.

Future Opportunities in North America Footwear Market

This section highlights promising opportunities for growth and expansion within the North American footwear market. We identify emerging markets, innovative technologies such as personalized footwear manufacturing, and evolving consumer trends (e.g., increasing demand for sustainable and ethically produced footwear) that present significant potential for future growth.

Major Players in the North America Footwear Market Ecosystem

- VF Corporation (VF Corporation)

- Adidas Group (Adidas Group)

- New Balance Athletic Shoe Inc (New Balance Athletic Shoe Inc)

- Steven Madden Ltd (Steven Madden Ltd)

- Berkshire Hathaway (Berkshire Hathaway)

- Deckers Outdoor Corporation (Deckers Outdoor Corporation)

- Puma SE (Puma SE)

- Under Armour Inc (Under Armour Inc)

- Sketchers USA Inc (Sketchers USA Inc)

- Nike Inc (Nike Inc)

Key Developments in North America Footwear Market Industry

- April 2024: Adidas launched a new product line featuring seven footwear styles (six sneakers, one slide set), including new iterations of the Gazelle, Handball Pro, Moston Super, Wensley Low, and Whitworth. This expansion strengthens Adidas' position in the market.

- April 2024: Adidas Basketball announced Anthony Edwards as a signature athlete, signaling a strategic move to capture a larger share of the basketball footwear market.

- April 2024: Hoka expanded its product line for spring 2024, including new road, trail, and hiking shoes like the CLIFTON 9 and ROCKET X2, broadening its appeal to diverse consumer segments.

Strategic North America Footwear Market Forecast

The North American footwear market is poised for continued growth over the forecast period (2025-2033), driven by factors including increasing disposable incomes, technological innovations in design and materials, and the growing popularity of fitness and athletic activities. The market’s expansion will be influenced by evolving consumer preferences towards sustainable and personalized footwear options. The increasing adoption of e-commerce channels will also contribute to market growth. This report offers valuable insights into these trends, enabling stakeholders to make informed decisions and capitalize on emerging opportunities within the dynamic North American footwear market.

North America Footwear Market Segmentation

-

1. Product Type

-

1.1. Athletic Footwear

- 1.1.1. Running/Cycling Shoes

- 1.1.2. Sports Shoes

- 1.1.3. Trekking/Hiking Shoes

- 1.1.4. Other Athletic Footwear

-

1.2. Non-athletic Footwear

- 1.2.1. Boots

- 1.2.2. Flip-flops/Slippers

- 1.2.3. Sneakers

- 1.2.4. Other Non-athletic Footwear

-

1.1. Athletic Footwear

-

2. Category

- 2.1. Mass

- 2.2. Premium/Luxury

-

3. End User

- 3.1. Men

- 3.2. Women

- 3.3. Kids

-

4. Distribution Channel

- 4.1. Specialty Stores

- 4.2. Supermarkets/Hypermarkets

- 4.3. Online Retail Stores

- 4.4. Other Distribution Channels

-

5. Geography

- 5.1. United States

- 5.2. Canada

- 5.3. Mexico

- 5.4. Rest of North America

North America Footwear Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Footwear Market Regional Market Share

Geographic Coverage of North America Footwear Market

North America Footwear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Participation In Recreational And Outdoor Activities; Aggressive Marketing Through Social Media And Celebrity Endorsement

- 3.3. Market Restrains

- 3.3.1. Unorganized Footwear Sector And Availability Of Counterfeit Goods

- 3.4. Market Trends

- 3.4.1. Increased Participation In Recreational And Outdoor Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Footwear Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Athletic Footwear

- 5.1.1.1. Running/Cycling Shoes

- 5.1.1.2. Sports Shoes

- 5.1.1.3. Trekking/Hiking Shoes

- 5.1.1.4. Other Athletic Footwear

- 5.1.2. Non-athletic Footwear

- 5.1.2.1. Boots

- 5.1.2.2. Flip-flops/Slippers

- 5.1.2.3. Sneakers

- 5.1.2.4. Other Non-athletic Footwear

- 5.1.1. Athletic Footwear

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Mass

- 5.2.2. Premium/Luxury

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Men

- 5.3.2. Women

- 5.3.3. Kids

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Specialty Stores

- 5.4.2. Supermarkets/Hypermarkets

- 5.4.3. Online Retail Stores

- 5.4.4. Other Distribution Channels

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.5.4. Rest of North America

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.6.2. Canada

- 5.6.3. Mexico

- 5.6.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Footwear Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Athletic Footwear

- 6.1.1.1. Running/Cycling Shoes

- 6.1.1.2. Sports Shoes

- 6.1.1.3. Trekking/Hiking Shoes

- 6.1.1.4. Other Athletic Footwear

- 6.1.2. Non-athletic Footwear

- 6.1.2.1. Boots

- 6.1.2.2. Flip-flops/Slippers

- 6.1.2.3. Sneakers

- 6.1.2.4. Other Non-athletic Footwear

- 6.1.1. Athletic Footwear

- 6.2. Market Analysis, Insights and Forecast - by Category

- 6.2.1. Mass

- 6.2.2. Premium/Luxury

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Men

- 6.3.2. Women

- 6.3.3. Kids

- 6.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.4.1. Specialty Stores

- 6.4.2. Supermarkets/Hypermarkets

- 6.4.3. Online Retail Stores

- 6.4.4. Other Distribution Channels

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. United States

- 6.5.2. Canada

- 6.5.3. Mexico

- 6.5.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Footwear Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Athletic Footwear

- 7.1.1.1. Running/Cycling Shoes

- 7.1.1.2. Sports Shoes

- 7.1.1.3. Trekking/Hiking Shoes

- 7.1.1.4. Other Athletic Footwear

- 7.1.2. Non-athletic Footwear

- 7.1.2.1. Boots

- 7.1.2.2. Flip-flops/Slippers

- 7.1.2.3. Sneakers

- 7.1.2.4. Other Non-athletic Footwear

- 7.1.1. Athletic Footwear

- 7.2. Market Analysis, Insights and Forecast - by Category

- 7.2.1. Mass

- 7.2.2. Premium/Luxury

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Men

- 7.3.2. Women

- 7.3.3. Kids

- 7.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.4.1. Specialty Stores

- 7.4.2. Supermarkets/Hypermarkets

- 7.4.3. Online Retail Stores

- 7.4.4. Other Distribution Channels

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. United States

- 7.5.2. Canada

- 7.5.3. Mexico

- 7.5.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Footwear Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Athletic Footwear

- 8.1.1.1. Running/Cycling Shoes

- 8.1.1.2. Sports Shoes

- 8.1.1.3. Trekking/Hiking Shoes

- 8.1.1.4. Other Athletic Footwear

- 8.1.2. Non-athletic Footwear

- 8.1.2.1. Boots

- 8.1.2.2. Flip-flops/Slippers

- 8.1.2.3. Sneakers

- 8.1.2.4. Other Non-athletic Footwear

- 8.1.1. Athletic Footwear

- 8.2. Market Analysis, Insights and Forecast - by Category

- 8.2.1. Mass

- 8.2.2. Premium/Luxury

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Men

- 8.3.2. Women

- 8.3.3. Kids

- 8.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.4.1. Specialty Stores

- 8.4.2. Supermarkets/Hypermarkets

- 8.4.3. Online Retail Stores

- 8.4.4. Other Distribution Channels

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. United States

- 8.5.2. Canada

- 8.5.3. Mexico

- 8.5.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America Footwear Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Athletic Footwear

- 9.1.1.1. Running/Cycling Shoes

- 9.1.1.2. Sports Shoes

- 9.1.1.3. Trekking/Hiking Shoes

- 9.1.1.4. Other Athletic Footwear

- 9.1.2. Non-athletic Footwear

- 9.1.2.1. Boots

- 9.1.2.2. Flip-flops/Slippers

- 9.1.2.3. Sneakers

- 9.1.2.4. Other Non-athletic Footwear

- 9.1.1. Athletic Footwear

- 9.2. Market Analysis, Insights and Forecast - by Category

- 9.2.1. Mass

- 9.2.2. Premium/Luxury

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Men

- 9.3.2. Women

- 9.3.3. Kids

- 9.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.4.1. Specialty Stores

- 9.4.2. Supermarkets/Hypermarkets

- 9.4.3. Online Retail Stores

- 9.4.4. Other Distribution Channels

- 9.5. Market Analysis, Insights and Forecast - by Geography

- 9.5.1. United States

- 9.5.2. Canada

- 9.5.3. Mexico

- 9.5.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 VF Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Adidas Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 New Balance Athletic Shoe Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Steven Madden Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Berkshire Hathaway

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Deckers Outdoor Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Puma SE

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Under Armour Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Sketchers USA Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Nike Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 VF Corporation

List of Figures

- Figure 1: North America Footwear Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Footwear Market Share (%) by Company 2025

List of Tables

- Table 1: North America Footwear Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: North America Footwear Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: North America Footwear Market Revenue Million Forecast, by Category 2020 & 2033

- Table 4: North America Footwear Market Volume K Units Forecast, by Category 2020 & 2033

- Table 5: North America Footwear Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: North America Footwear Market Volume K Units Forecast, by End User 2020 & 2033

- Table 7: North America Footwear Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: North America Footwear Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 9: North America Footwear Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: North America Footwear Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 11: North America Footwear Market Revenue Million Forecast, by Region 2020 & 2033

- Table 12: North America Footwear Market Volume K Units Forecast, by Region 2020 & 2033

- Table 13: North America Footwear Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: North America Footwear Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 15: North America Footwear Market Revenue Million Forecast, by Category 2020 & 2033

- Table 16: North America Footwear Market Volume K Units Forecast, by Category 2020 & 2033

- Table 17: North America Footwear Market Revenue Million Forecast, by End User 2020 & 2033

- Table 18: North America Footwear Market Volume K Units Forecast, by End User 2020 & 2033

- Table 19: North America Footwear Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 20: North America Footwear Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 21: North America Footwear Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: North America Footwear Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 23: North America Footwear Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: North America Footwear Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: North America Footwear Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 26: North America Footwear Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 27: North America Footwear Market Revenue Million Forecast, by Category 2020 & 2033

- Table 28: North America Footwear Market Volume K Units Forecast, by Category 2020 & 2033

- Table 29: North America Footwear Market Revenue Million Forecast, by End User 2020 & 2033

- Table 30: North America Footwear Market Volume K Units Forecast, by End User 2020 & 2033

- Table 31: North America Footwear Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 32: North America Footwear Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 33: North America Footwear Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 34: North America Footwear Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 35: North America Footwear Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: North America Footwear Market Volume K Units Forecast, by Country 2020 & 2033

- Table 37: North America Footwear Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 38: North America Footwear Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 39: North America Footwear Market Revenue Million Forecast, by Category 2020 & 2033

- Table 40: North America Footwear Market Volume K Units Forecast, by Category 2020 & 2033

- Table 41: North America Footwear Market Revenue Million Forecast, by End User 2020 & 2033

- Table 42: North America Footwear Market Volume K Units Forecast, by End User 2020 & 2033

- Table 43: North America Footwear Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 44: North America Footwear Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 45: North America Footwear Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 46: North America Footwear Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 47: North America Footwear Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: North America Footwear Market Volume K Units Forecast, by Country 2020 & 2033

- Table 49: North America Footwear Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 50: North America Footwear Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 51: North America Footwear Market Revenue Million Forecast, by Category 2020 & 2033

- Table 52: North America Footwear Market Volume K Units Forecast, by Category 2020 & 2033

- Table 53: North America Footwear Market Revenue Million Forecast, by End User 2020 & 2033

- Table 54: North America Footwear Market Volume K Units Forecast, by End User 2020 & 2033

- Table 55: North America Footwear Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 56: North America Footwear Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 57: North America Footwear Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 58: North America Footwear Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 59: North America Footwear Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: North America Footwear Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Footwear Market?

The projected CAGR is approximately 4.18%.

2. Which companies are prominent players in the North America Footwear Market?

Key companies in the market include VF Corporation, Adidas Group, New Balance Athletic Shoe Inc, Steven Madden Ltd, Berkshire Hathaway, Deckers Outdoor Corporation, Puma SE, Under Armour Inc, Sketchers USA Inc, Nike Inc.

3. What are the main segments of the North America Footwear Market?

The market segments include Product Type, Category, End User, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 116.47 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Participation In Recreational And Outdoor Activities; Aggressive Marketing Through Social Media And Celebrity Endorsement.

6. What are the notable trends driving market growth?

Increased Participation In Recreational And Outdoor Activities.

7. Are there any restraints impacting market growth?

Unorganized Footwear Sector And Availability Of Counterfeit Goods.

8. Can you provide examples of recent developments in the market?

April 2024: Adidas announced the launch of a new product line, which includes seven footwear styles, six pairs of sneakers, and one set of slides. Two Gazelles in all-white and all-black lead the charge, with the rest of the sneaker lineup consisting of one-offs of the Handball Pro, Moston Super, Wensley Low, and Whitworth.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Footwear Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Footwear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Footwear Market?

To stay informed about further developments, trends, and reports in the North America Footwear Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence