Key Insights

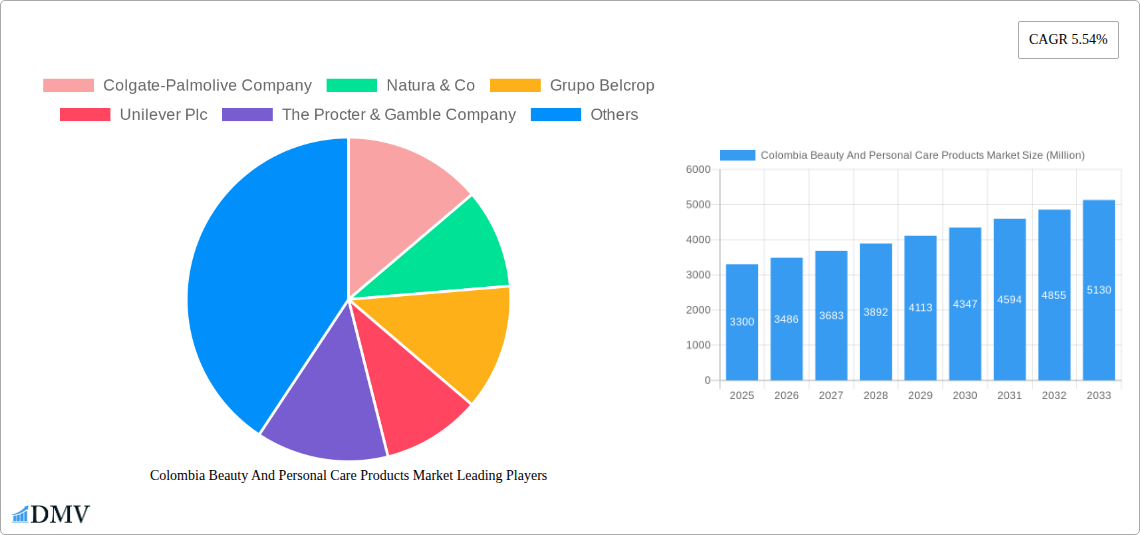

The Colombian beauty and personal care products market, valued at $3.30 billion in 2025, is projected to experience robust growth, driven by rising disposable incomes, increasing urbanization, and a growing preference for premium and natural products. The market's Compound Annual Growth Rate (CAGR) of 5.54% from 2019 to 2024 suggests a continued upward trajectory, fueled by a young and increasingly fashion-conscious population. Key drivers include the expanding e-commerce sector, providing broader access to diverse product offerings, and the rising influence of social media, impacting consumer purchasing decisions. The market segmentation likely includes categories such as skincare, hair care, makeup, fragrances, and personal hygiene products, with a diverse range of price points catering to different consumer segments. Competition is fierce, with both international giants like Colgate-Palmolive, Unilever, and L'Oreal, and strong domestic players like Yanbal and Grupo Familia vying for market share. Challenges could include economic volatility impacting consumer spending, and the need for brands to adapt to changing consumer preferences towards sustainable and ethically sourced products.

Colombia Beauty And Personal Care Products Market Market Size (In Billion)

The forecast period of 2025-2033 promises continued expansion, with projected growth stemming from factors such as increased product innovation, particularly within natural and organic segments, and the growing adoption of personalized beauty routines. Success in this market will require a deep understanding of Colombian consumer preferences and a strategic approach to marketing and distribution. The ongoing development of the country's infrastructure and improving logistics should support the expansion of the market, further bolstering growth projections. Market entrants should consider localization strategies to effectively target the specific demographics and cultural nuances within the Colombian market. Focus on building strong brand loyalty and leveraging digital channels will be crucial for maintaining a competitive edge.

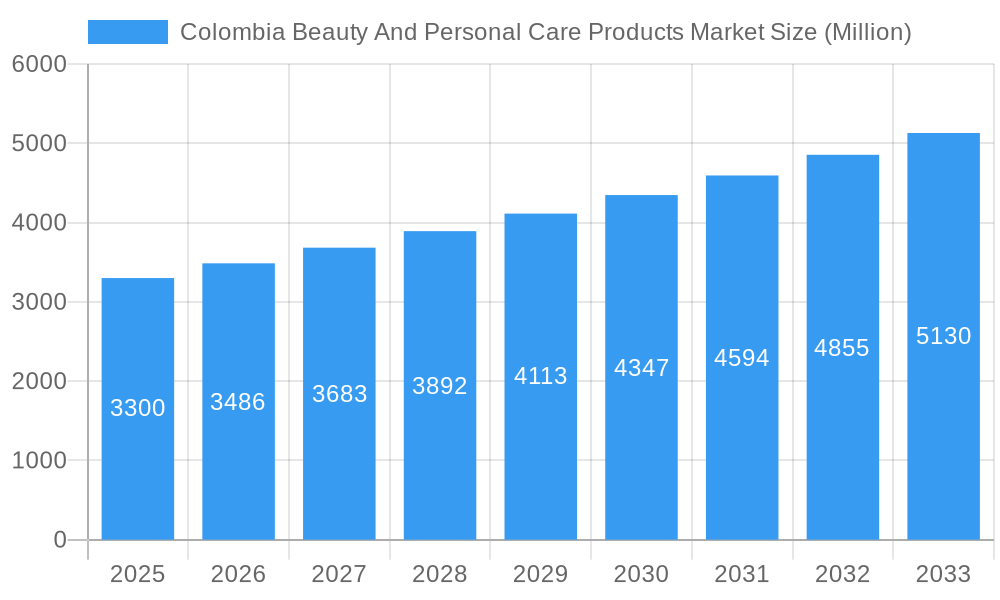

Colombia Beauty And Personal Care Products Market Company Market Share

Colombia Beauty And Personal Care Products Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Colombia beauty and personal care products market, offering a comprehensive overview of its current state, future trends, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The market value in 2025 is estimated at XXX Million, providing crucial insights for strategic decision-making.

Colombia Beauty And Personal Care Products Market Market Composition & Trends

The Colombian beauty and personal care market is characterized by a mix of multinational giants and local players, resulting in a moderately concentrated market. Market share distribution is influenced by brand recognition, pricing strategies, and distribution networks. While exact figures for market share are not publicly available for every company, we estimate that the top 5 players (Colgate-Palmolive Company, Unilever Plc, The Procter & Gamble Company, Natura & Co, and L'Oreal SA) hold approximately xx% of the market in 2025. Innovation is a key driver, with companies constantly introducing new products and formulations to cater to evolving consumer preferences. The regulatory landscape is increasingly focused on sustainability and transparency, impacting product formulations and marketing claims. Substitute products, such as homemade remedies and natural alternatives, also exert pressure on the market. The end-user profile is diverse, spanning various age groups, income levels, and lifestyles, highlighting the need for targeted marketing strategies. Mergers and acquisitions (M&A) activity has been significant, particularly involving acquisitions of smaller local brands by larger international players. While precise M&A deal values vary greatly, recent acquisitions suggest a trend towards deals valued between xx Million and xx Million.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2025 estimate).

- Innovation Catalysts: Consumer demand for natural, organic, and ethically sourced products; technological advancements in formulation and delivery systems.

- Regulatory Landscape: Increasing focus on ingredient transparency, sustainability, and ethical sourcing.

- Substitute Products: Homemade remedies, natural and organic alternatives.

- End-User Profiles: Diverse, encompassing various demographics and lifestyle preferences.

- M&A Activity: Significant activity, particularly acquisitions of local brands by international players.

Colombia Beauty And Personal Care Products Market Industry Evolution

The Colombian beauty and personal care market has demonstrated steady growth throughout the historical period (2019-2024), with an average annual growth rate (AAGR) of approximately xx%. This growth is attributed to a number of factors including rising disposable incomes, increasing urbanization, and a growing awareness of personal grooming and beauty among the population. Technological advancements, particularly in e-commerce and digital marketing, have significantly influenced the market's evolution, enabling more efficient product distribution and targeted advertising campaigns. Consumer demands are shifting towards natural, sustainable, and ethically produced products, driving innovation in product formulation and packaging. The market is witnessing a growing adoption of personalized beauty products and services as well as increasing demand for skincare products addressing specific skin conditions. This demand shift necessitates adaptation by brands, including investments in research and development, customized offerings and targeted marketing strategies. Furthermore, an expanding middle class and rising disposable incomes fuel significant growth across segments such as skincare, haircare, and cosmetics. The overall market growth is projected to continue, with an estimated AAGR of xx% during the forecast period (2025-2033).

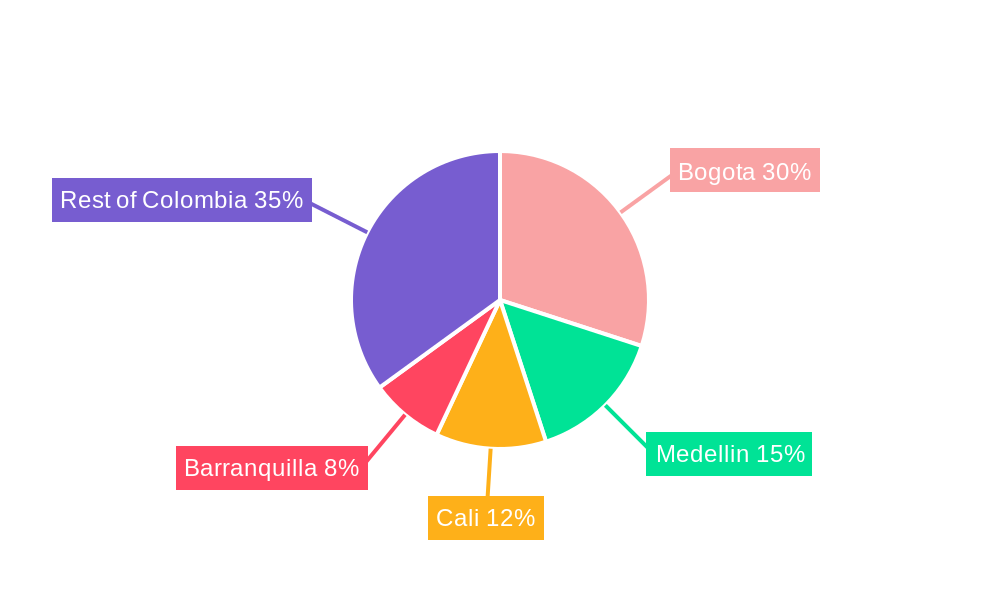

Leading Regions, Countries, or Segments in Colombia Beauty And Personal Care Products Market

While precise data segmentation by region within Colombia is unavailable, major cities like Bogotá, Medellín, and Cali are expected to dominate the market due to higher population density, greater disposable incomes, and increased access to modern retail channels. The significant growth within urban areas is driven primarily by higher spending power amongst the residents.

- Key Drivers for Dominant Regions:

- Higher population density

- Increased disposable incomes

- Well-developed retail infrastructure

- Greater access to online shopping

- Strong marketing and advertising campaigns targeted towards urban consumers

- In-depth Analysis: The concentration of consumers in major urban areas, coupled with higher purchasing power and extensive marketing efforts by major players, results in a disproportionately high market share for these regions. The availability of diverse product offerings in urban centers compared to rural areas further solidifies this dominance.

Colombia Beauty And Personal Care Products Market Product Innovations

Recent innovations encompass sustainable packaging, personalized skincare solutions based on genetic analysis, and advanced haircare formulas addressing specific scalp conditions. Companies are increasingly incorporating natural and organic ingredients, responding to consumer demand for eco-friendly and ethically sourced products. These advancements reflect a broader industry trend towards personalized and sustainable beauty solutions. Unique selling propositions often highlight natural ingredients, scientifically proven efficacy, and ethically responsible production processes.

Propelling Factors for Colombia Beauty And Personal Care Products Market Growth

Several factors contribute to the market's growth trajectory. Rising disposable incomes, particularly within the growing middle class, are driving increased spending on beauty and personal care products. The increasing penetration of e-commerce platforms provides enhanced access to a wider range of products, further fueling market expansion. Government initiatives promoting local businesses and entrepreneurship within the beauty and personal care sector also contribute. Lastly, the influence of social media and beauty influencers plays a crucial role in shaping consumer preferences and driving product demand.

Obstacles in the Colombia Beauty And Personal Care Products Market Market

Significant challenges exist, including fluctuating currency exchange rates affecting import costs and price stability. Supply chain disruptions due to global events or regional infrastructure limitations impact the availability of raw materials and finished goods. Intense competition from both domestic and international players creates pricing pressures and necessitates continuous innovation and differentiation. Counterfeit products represent a significant concern affecting brand reputation and market integrity.

Future Opportunities in Colombia Beauty And Personal Care Products Market

Opportunities abound in the niche markets of men's grooming, personalized beauty solutions leveraging digital technologies, and sustainable and ethical products. Expanding into rural markets through targeted distribution strategies and tailored product offerings presents further potential. The integration of advanced technologies, such as augmented reality for virtual try-ons, presents exciting prospects for enhanced customer experiences.

Major Players in the Colombia Beauty And Personal Care Products Market Ecosystem

- Colgate-Palmolive Company

- Natura & Co

- Grupo Belcrop

- Unilever Plc

- The Procter & Gamble Company

- Yanbal de Colombia SAS

- L'Oreal SA

- The Estee Lauder Companies Inc

- Grupo Familia

- Johnson & Johnson Services Inc

- List Not Exhaustive

Key Developments in Colombia Beauty And Personal Care Products Market Industry

- August 2023: Ésika (Belcorp) partners with Proximity BBDO Colombia to focus on fragrances, aiming to revitalize its brand presence in Colombia and Latin America.

- August 2023: L'Oréal Professionnel Paris launches Scalp Advanced hair care product, claiming up to 83% relief from scalp discomfort and 100% dandruff elimination.

- July 2022: Puig Group acquires Loto del Sur, a Colombian natural cosmetics brand, to strengthen its Latin American leadership and international growth.

Strategic Colombia Beauty And Personal Care Products Market Market Forecast

The Colombian beauty and personal care market is poised for sustained growth, driven by a confluence of factors including rising disposable incomes, evolving consumer preferences, and technological advancements. The increasing adoption of e-commerce, coupled with the growing demand for personalized and sustainable products, will shape future market dynamics. This presents significant opportunities for both established players and new entrants to capture market share by catering to specific consumer needs and preferences. The market's future trajectory is promising, with considerable potential for continued expansion and innovation.

Colombia Beauty And Personal Care Products Market Segmentation

-

1. Product Type

-

1.1. Personal Care Products

-

1.1.1. Hair Care Products

- 1.1.1.1. Shampoo

- 1.1.1.2. Conditioner

- 1.1.1.3. Other Hair Care Products

-

1.1.2. Skincare Products

- 1.1.2.1. Facial Care Products

- 1.1.2.2. Body Care Products

- 1.1.2.3. Lip Care Products

-

1.1.3. Bath and Shower

- 1.1.3.1. Shower Gels

- 1.1.3.2. Soaps

- 1.1.3.3. Other Bath and Shower Products

-

1.1.4. Oral Care

- 1.1.4.1. Toothbrush and Replacements

- 1.1.4.2. Toothpaste

- 1.1.4.3. Other Oral Care Products

- 1.1.5. Men's Grooming Products

- 1.1.6. Deodorants and Antiperspirants

-

1.1.1. Hair Care Products

-

1.2. Cosmetics/Make-up Products

- 1.2.1. Facial Cosmetics

- 1.2.2. Eye Cosmetics

- 1.2.3. Lip and Nail Make-up Products

- 1.2.4. Hair Styling and Coloring Products

- 1.3. Fragrances

-

1.1. Personal Care Products

-

2. Category

- 2.1. Mass Products

- 2.2. Premium Products

-

3. Distribution Channel

- 3.1. Specialty Stores

- 3.2. Supermarkets/Hypermarkets

- 3.3. Convenience Stores

- 3.4. Pharmacies/Drug Stores

- 3.5. Online Retail Stores

- 3.6. Direct Selling

- 3.7. Other Distribution Channels

Colombia Beauty And Personal Care Products Market Segmentation By Geography

- 1. Colombia

Colombia Beauty And Personal Care Products Market Regional Market Share

Geographic Coverage of Colombia Beauty And Personal Care Products Market

Colombia Beauty And Personal Care Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strong Focus on Personal Health and Hygiene; Aggressive Marketing and Advertising Strategies by Brands

- 3.3. Market Restrains

- 3.3.1. Strong Focus on Personal Health and Hygiene; Aggressive Marketing and Advertising Strategies by Brands

- 3.4. Market Trends

- 3.4.1. The Bath and Shower Products Segment is the Fastest-growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Colombia Beauty And Personal Care Products Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Personal Care Products

- 5.1.1.1. Hair Care Products

- 5.1.1.1.1. Shampoo

- 5.1.1.1.2. Conditioner

- 5.1.1.1.3. Other Hair Care Products

- 5.1.1.2. Skincare Products

- 5.1.1.2.1. Facial Care Products

- 5.1.1.2.2. Body Care Products

- 5.1.1.2.3. Lip Care Products

- 5.1.1.3. Bath and Shower

- 5.1.1.3.1. Shower Gels

- 5.1.1.3.2. Soaps

- 5.1.1.3.3. Other Bath and Shower Products

- 5.1.1.4. Oral Care

- 5.1.1.4.1. Toothbrush and Replacements

- 5.1.1.4.2. Toothpaste

- 5.1.1.4.3. Other Oral Care Products

- 5.1.1.5. Men's Grooming Products

- 5.1.1.6. Deodorants and Antiperspirants

- 5.1.1.1. Hair Care Products

- 5.1.2. Cosmetics/Make-up Products

- 5.1.2.1. Facial Cosmetics

- 5.1.2.2. Eye Cosmetics

- 5.1.2.3. Lip and Nail Make-up Products

- 5.1.2.4. Hair Styling and Coloring Products

- 5.1.3. Fragrances

- 5.1.1. Personal Care Products

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Mass Products

- 5.2.2. Premium Products

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Specialty Stores

- 5.3.2. Supermarkets/Hypermarkets

- 5.3.3. Convenience Stores

- 5.3.4. Pharmacies/Drug Stores

- 5.3.5. Online Retail Stores

- 5.3.6. Direct Selling

- 5.3.7. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Colombia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Colgate-Palmolive Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Natura & Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Grupo Belcrop

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Unilever Plc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The Procter & Gamble Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Yanbal de Colombia SAS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 L'Oreal SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Estee Lauder Companies Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Grupo Familia

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Johnson & Johnson Services Inc *List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Colgate-Palmolive Company

List of Figures

- Figure 1: Colombia Beauty And Personal Care Products Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Colombia Beauty And Personal Care Products Market Share (%) by Company 2025

List of Tables

- Table 1: Colombia Beauty And Personal Care Products Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Colombia Beauty And Personal Care Products Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: Colombia Beauty And Personal Care Products Market Revenue Million Forecast, by Category 2020 & 2033

- Table 4: Colombia Beauty And Personal Care Products Market Volume Billion Forecast, by Category 2020 & 2033

- Table 5: Colombia Beauty And Personal Care Products Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Colombia Beauty And Personal Care Products Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Colombia Beauty And Personal Care Products Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Colombia Beauty And Personal Care Products Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Colombia Beauty And Personal Care Products Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Colombia Beauty And Personal Care Products Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 11: Colombia Beauty And Personal Care Products Market Revenue Million Forecast, by Category 2020 & 2033

- Table 12: Colombia Beauty And Personal Care Products Market Volume Billion Forecast, by Category 2020 & 2033

- Table 13: Colombia Beauty And Personal Care Products Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Colombia Beauty And Personal Care Products Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Colombia Beauty And Personal Care Products Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Colombia Beauty And Personal Care Products Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Colombia Beauty And Personal Care Products Market?

The projected CAGR is approximately 5.54%.

2. Which companies are prominent players in the Colombia Beauty And Personal Care Products Market?

Key companies in the market include Colgate-Palmolive Company, Natura & Co, Grupo Belcrop, Unilever Plc, The Procter & Gamble Company, Yanbal de Colombia SAS, L'Oreal SA, The Estee Lauder Companies Inc, Grupo Familia, Johnson & Johnson Services Inc *List Not Exhaustive.

3. What are the main segments of the Colombia Beauty And Personal Care Products Market?

The market segments include Product Type, Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Strong Focus on Personal Health and Hygiene; Aggressive Marketing and Advertising Strategies by Brands.

6. What are the notable trends driving market growth?

The Bath and Shower Products Segment is the Fastest-growing Segment.

7. Are there any restraints impacting market growth?

Strong Focus on Personal Health and Hygiene; Aggressive Marketing and Advertising Strategies by Brands.

8. Can you provide examples of recent developments in the market?

August 2023: Ésika, the beauty brand owned by Belcorp, partnered with Proximity BBDO Colombia. The partnership was intended to concentrate the brand's initial efforts on the fragrances segment of the market. The strategic step sought to inject vitality into the brand's presence in Colombia and Latin America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Colombia Beauty And Personal Care Products Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Colombia Beauty And Personal Care Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Colombia Beauty And Personal Care Products Market?

To stay informed about further developments, trends, and reports in the Colombia Beauty And Personal Care Products Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence