Key Insights

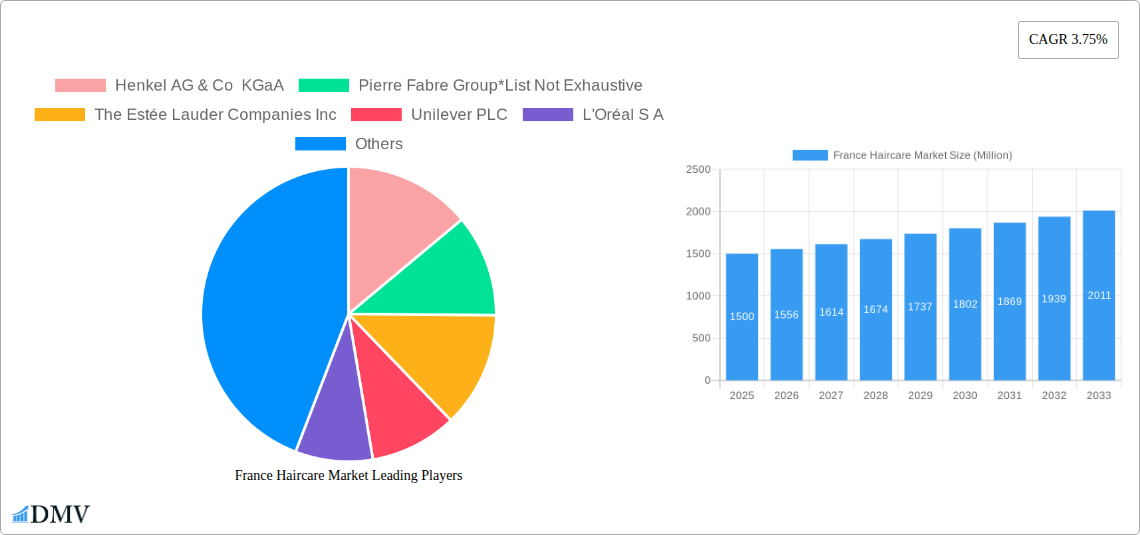

The French haircare market is poised for robust expansion, projected to reach €2.07 billion by 2025, with a compound annual growth rate (CAGR) of 3.73% through 2033. This growth trajectory is propelled by escalating consumer consciousness regarding hair health and the burgeoning demand for natural and organic formulations. Enhanced accessibility through expanding online retail platforms further facilitates market penetration. Social media influence and influencer endorsements are also significant drivers, shaping consumer trends and spurring sector innovation. The market is segmented by product type, including shampoo, conditioner, hair spray, and hair oil, and by distribution channel, encompassing hypermarkets, specialty stores, convenience stores, and online retail.

France Haircare Market Market Size (In Billion)

Key market restraints include the volatility of raw material costs and economic instability, which can affect pricing and profitability. Intense competition, particularly from private-label brands, also exerts pressure on profit margins. Adapting to evolving consumer preferences and sustainability demands presents ongoing challenges. To sustain competitiveness, companies must prioritize product innovation, eco-friendly practices, and targeted marketing strategies tailored to specific French demographics. The French haircare market demonstrates a favorable outlook, driven by established brands and growing consumer interest in premium, natural, and specialized hair solutions.

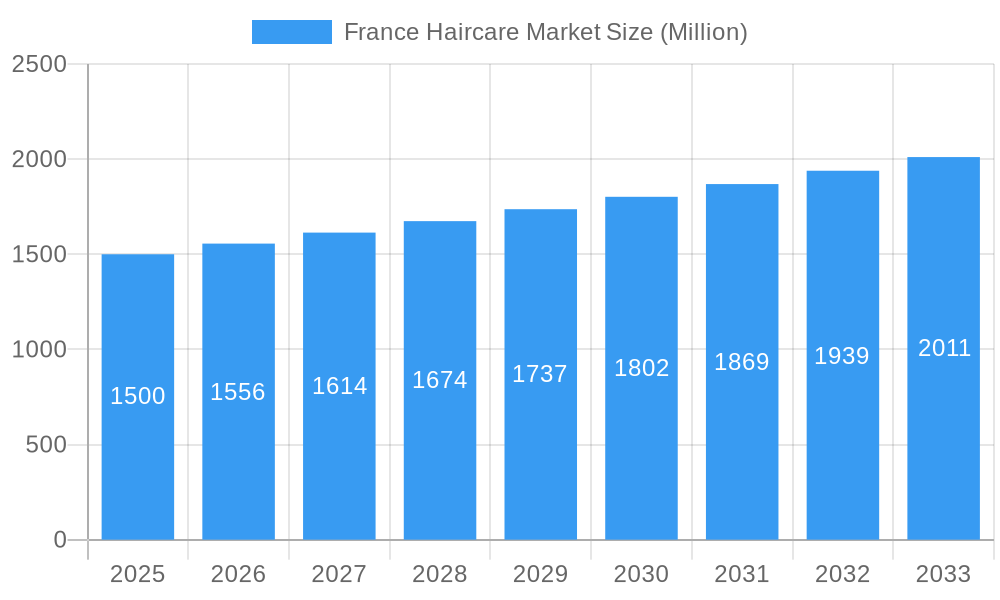

France Haircare Market Company Market Share

France Haircare Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the France haircare market, offering a comprehensive overview of its current state, future trajectory, and key players. With a focus on market size, segmentation, competitive landscape, and future growth opportunities, this report is an essential resource for stakeholders seeking to understand and capitalize on this dynamic market. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, while the historical period encompasses 2019-2024. The market value is projected at xx Million in 2025.

France Haircare Market Composition & Trends

This section delves into the intricate dynamics of the French haircare market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity. The report examines the market share distribution among key players, revealing a moderately concentrated market with L'Oréal S.A., Unilever PLC, and Henkel AG & Co KGaA holding significant shares. However, the presence of numerous smaller brands and niche players indicates a competitive landscape. The market's growth is influenced by several factors, including the increasing demand for natural and organic products, a growing awareness of hair health and scalp care, and the rise of e-commerce.

- Market Concentration: Moderately concentrated, with L'Oréal, Unilever, and Henkel dominating.

- Innovation Catalysts: Demand for natural ingredients, personalized hair care solutions, and sustainable packaging.

- Regulatory Landscape: EU regulations on cosmetics ingredients and labeling influence product formulations.

- Substitute Products: Home remedies and DIY hair care solutions represent a minor competitive threat.

- End-User Profiles: Diverse, encompassing various age groups, genders, and hair types, with specific needs and preferences.

- M&A Activity: The report analyzes completed and potential M&A deals, including deal values (xx Million estimated for the period 2019-2024). This activity reflects strategic moves to expand market share and product portfolios.

France Haircare Market Industry Evolution

This section provides a detailed analysis of the French haircare market's evolution, exploring market growth trajectories, technological advancements, and shifting consumer preferences. From 2019 to 2024, the market experienced a Compound Annual Growth Rate (CAGR) of xx%, driven by factors such as increasing disposable incomes, changing lifestyles, and the growing popularity of premium hair care products. Technological advancements, such as the use of advanced ingredients and innovative packaging, are further driving market growth. Consumer demand for natural and organic products, sustainable and ethical brands, and personalized solutions has significantly influenced product development and marketing strategies. The increasing adoption of online retail channels has also impacted market dynamics.

Leading Regions, Countries, or Segments in France Haircare Market

This section identifies the leading segments within the French haircare market, analyzing their dominant factors, investment trends, and regulatory support. Detailed analysis examines the key drivers of growth for each segment including:

- Product Type: Shampoo remains the largest segment, followed by conditioners, with hair oils and other specialized products showing strong growth potential. Key drivers include innovation in formulations and ingredient sourcing (e.g., sustainable and organic ingredients).

- Distribution Channel: Hypermarkets/supermarkets retain a substantial share, but online retail is experiencing rapid growth, fueled by consumer convenience and targeted marketing. Specialty stores cater to premium and niche products. Convenience stores offer a smaller, but rapidly developing segment.

France Haircare Market Product Innovations

Recent innovations include the introduction of environmentally friendly packaging, such as Garnier's "No Rinse Conditioner" with 75% less plastic and a 92% reduction in carbon footprint. Other innovations focus on incorporating natural and organic ingredients, personalized solutions tailored to specific hair types and concerns, and advanced technologies to enhance product performance (e.g., improved conditioning, volume enhancement, and damage repair). These innovations cater to the growing consumer demand for healthier, more sustainable, and effective hair care solutions.

Propelling Factors for France Haircare Market Growth

Several factors drive the growth of the French haircare market. Technological advancements in formulation and packaging lead to better product quality and sustainability. Economic factors, such as rising disposable incomes, allow consumers to spend more on premium hair care products. Favorable regulatory environments supporting product innovation also contribute.

Obstacles in the France Haircare Market

Challenges include intense competition from established and emerging brands. Supply chain disruptions may lead to higher input costs and reduced product availability. Strict regulatory frameworks can increase the cost and time required for product development and launch.

Future Opportunities in France Haircare Market

Future opportunities lie in expanding into niche segments, such as customized hair care solutions and specialized products for specific hair concerns. Leveraging technological advancements like AI and big data can provide further personalization and precision in formulations and marketing. Growing consumer awareness of sustainability opens opportunities for eco-friendly products and packaging.

Major Players in the France Haircare Market Ecosystem

- Henkel AG & Co KGaA

- Pierre Fabre Group

- The Estée Lauder Companies Inc

- Unilever PLC

- L'Oréal S.A

- Elyssa Cosmetiques

- MOROCCANOIL Inc

- Natura & Co

- Johnson & Johnson

- Procter & Gamble Company

Key Developments in France Haircare Market Industry

- November 2022: Elyssa Cosmetiques launched Lisage Bresilien, a keratin and cocoa-based hair care range.

- March 2022: Klorane (Pierre Fabre Group) launched a volumizing dry shampoo.

- January 2022: Garnier (L'Oréal) launched "No Rinse Conditioner" with eco-friendly packaging.

Strategic France Haircare Market Forecast

The France haircare market is poised for continued growth, driven by factors such as increasing demand for premium and natural products, technological advancements, and the expanding e-commerce sector. This growth is expected to create significant opportunities for both established players and new entrants. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. This forecast accounts for potential economic fluctuations and shifts in consumer preferences.

France Haircare Market Segmentation

-

1. Product Type

- 1.1. Shampoo

- 1.2. Conditioner

- 1.3. Hair Spray

- 1.4. Hair Oil

- 1.5. Other Product Types

-

2. Distribution Channel

- 2.1. Hypermarket/Supermarket

- 2.2. Specialty Store

- 2.3. Convenience Store

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

France Haircare Market Segmentation By Geography

- 1. France

France Haircare Market Regional Market Share

Geographic Coverage of France Haircare Market

France Haircare Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Marketing and Advertising by Brands; Rising Inclination Toward Natural and Organic Formulations

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Growing Demand For Natural Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Haircare Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Shampoo

- 5.1.2. Conditioner

- 5.1.3. Hair Spray

- 5.1.4. Hair Oil

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarket/Supermarket

- 5.2.2. Specialty Store

- 5.2.3. Convenience Store

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Henkel AG & Co KGaA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pierre Fabre Group*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Estée Lauder Companies Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Unilever PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 L'Oréal S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Elyssa Cosmetiques

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MOROCCANOIL Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Natura & Co

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Johnson & Johnson

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Procter & Gamble Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: France Haircare Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: France Haircare Market Share (%) by Company 2025

List of Tables

- Table 1: France Haircare Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: France Haircare Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: France Haircare Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: France Haircare Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: France Haircare Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: France Haircare Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Haircare Market?

The projected CAGR is approximately 3.73%.

2. Which companies are prominent players in the France Haircare Market?

Key companies in the market include Henkel AG & Co KGaA, Pierre Fabre Group*List Not Exhaustive, The Estée Lauder Companies Inc, Unilever PLC, L'Oréal S A, Elyssa Cosmetiques, MOROCCANOIL Inc, Natura & Co, Johnson & Johnson, Procter & Gamble Company.

3. What are the main segments of the France Haircare Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.07 billion as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Marketing and Advertising by Brands; Rising Inclination Toward Natural and Organic Formulations.

6. What are the notable trends driving market growth?

Growing Demand For Natural Products.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In November 2022, Elyssa Cosmetiques, a premium beauty and hair care brand launched Lisage Bresilien, an exclusive hair care product range from Keratine and cocoa. The products can be used for rehydrating purposes and provide shiny and healthy hair.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Haircare Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Haircare Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Haircare Market?

To stay informed about further developments, trends, and reports in the France Haircare Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence