Key Insights

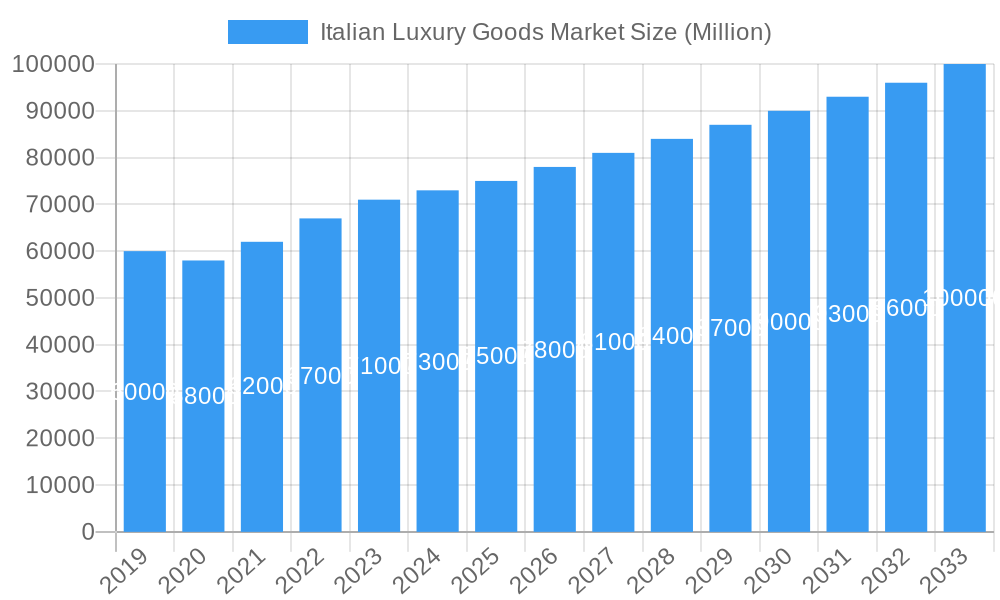

The Italian Luxury Goods Market is projected to reach approximately $5.82 billion by 2032, exhibiting a Compound Annual Growth Rate (CAGR) of 3.18% from a 2024 base year. This growth is driven by the enduring appeal of Italian craftsmanship, increasing global affluent consumer disposable income, and a rising demand for personalized luxury experiences. Digital channels are increasingly vital for market penetration, catering to younger demographics, while innovations in sustainable luxury and the pre-owned market are shaping consumer preferences. Key market segments include high fashion, premium footwear, designer handbags, fine jewelry, and luxury watches.

Italian Luxury Goods Market Market Size (In Billion)

While the market shows strong growth potential, it faces challenges including intense competition, potential economic downturns, geopolitical instability, rising raw material costs, and complex global supply chains. Strategic collaborations, innovative marketing, and experiential retail are expected to mitigate these risks. Leading companies are investing in digital transformation and sustainability. The Italian luxury sector's heritage in fashion and design, combined with technological advancements and a focus on sustainability, positions it for continued global dominance.

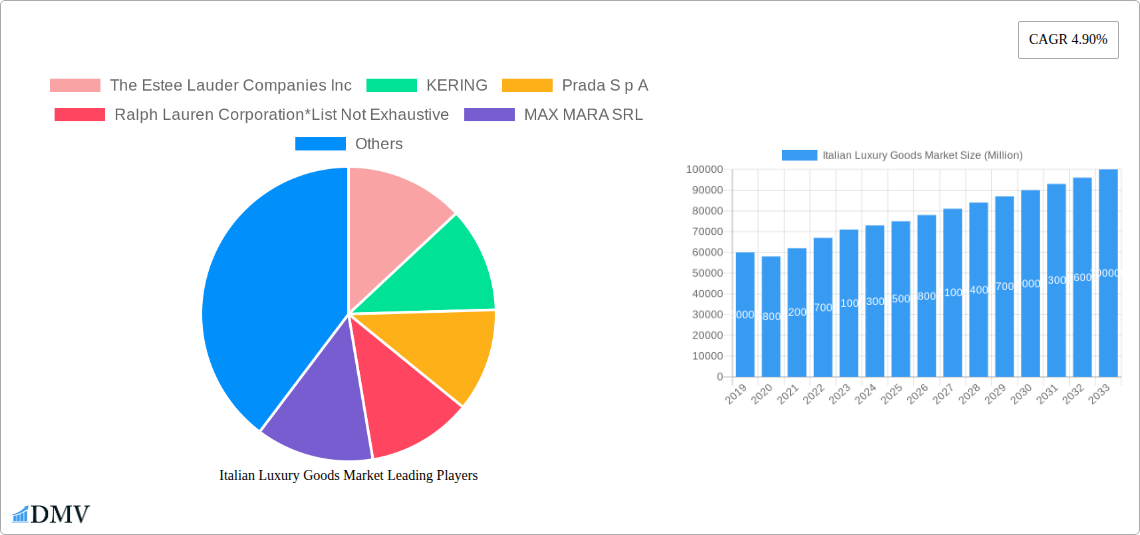

Italian Luxury Goods Market Company Market Share

This report offers a comprehensive analysis of the Italian Luxury Goods Market, a sector recognized for its timeless elegance and global economic significance. Examining the period from 2019 to 2033, with a base year of 2024, this research provides deep insights into market dynamics, growth trends, and future potential. Essential for stakeholders interested in high-end fashion, designer accessories, luxury watches, and premium jewelry, the report meticulously analyzes market composition, industry evolution, regional performance, product innovation, growth drivers, potential challenges, and emerging opportunities within the Italian luxury landscape.

Italian Luxury Goods Market Market Composition & Trends

The Italian luxury goods market is characterized by a moderate to high degree of concentration, with a few dominant players holding significant market share in segments like designer clothing, luxury footwear, and high-end leather goods. The report identifies innovation catalysts such as the increasing integration of sustainable luxury practices and the burgeoning digital transformation impacting omnichannel retail strategies. Regulatory landscapes primarily focus on intellectual property protection and ethical sourcing, influencing brand reputation and consumer trust. Substitute products, while less prevalent in the true luxury segment, can emerge from accessible premium brands or innovative material alternatives. End-user profiles are increasingly segmented, encompassing affluent millennials and Gen Z who prioritize experiential luxury, brand heritage, and personalization. Mergers and acquisitions (M&A) activity, while selective, often targets niche brands with strong heritage or innovative technologies, with deal values reaching several hundred million dollars.

- Market Share Distribution: Dominated by established Italian and international conglomerates in clothing and apparel and bags.

- M&A Deal Values: Estimated to reach $2,500 Million for strategic acquisitions of boutique brands.

- Innovation Focus: Sustainability, digitalization, and personalization.

- Consumer Profiles: Evolving demographics with an emphasis on values and digital engagement.

Italian Luxury Goods Market Industry Evolution

The Italian Luxury Goods Market has undergone a significant transformation, shifting from traditional craftsmanship to a digitally integrated, experience-driven industry. The historical period (2019-2024) witnessed robust growth driven by strong demand in emerging economies and a resurgence of interest in Italian craftsmanship. Technological advancements, particularly in e-commerce platforms and augmented reality (AR) for virtual try-ons, have revolutionized online luxury sales. Shifting consumer demands are evident in the growing preference for personalized products, transparent supply chains, and brands with a strong social and environmental conscience. The base year (2025) is projected to see the market stabilize with a projected growth rate of approximately 7.2%, fueled by continued economic recovery and evolving consumer aspirations. The forecast period (2025-2033) anticipates sustained growth, albeit at a moderated pace of 5.8% CAGR, as the market matures and adapts to new economic realities and technological disruptions. Key industry developments include the increasing adoption of blockchain technology for product authenticity verification and the rise of circular economy models in luxury fashion.

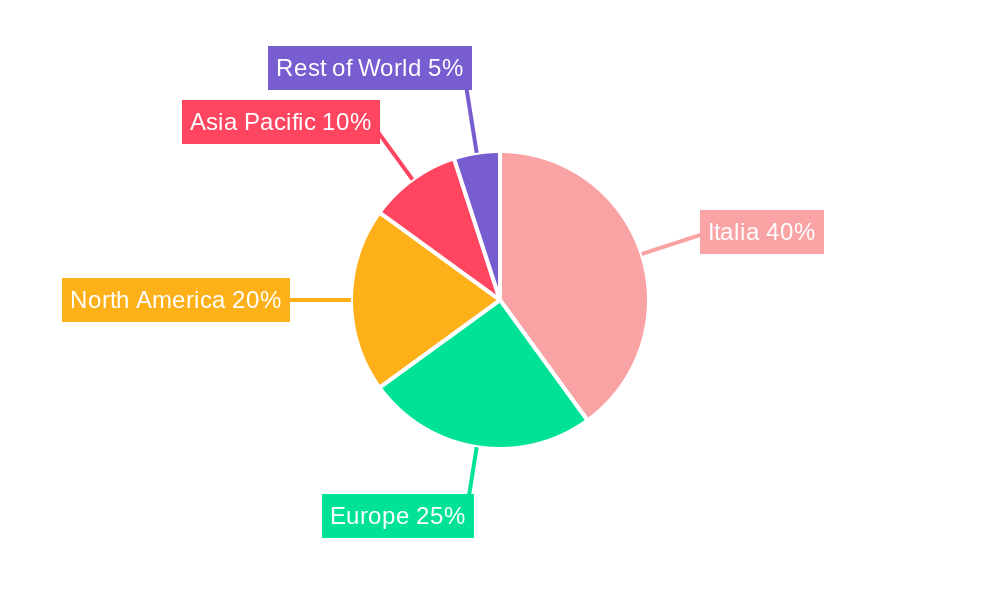

Leading Regions, Countries, or Segments in Italian Luxury Goods Market

The Italian Luxury Goods Market exhibits distinct regional and segmental dominance. Within Italy, Clothing and Apparel and Bags consistently lead in terms of revenue and market share, driven by the strong heritage of Italian fashion houses and their global appeal. The Distribution Channel landscape is increasingly dominated by Online Stores, which have seen exponential growth, particularly post-pandemic, accounting for an estimated 35% of total sales in 2025. However, Single-brand Stores and Multi-brand Stores in prime urban locations remain crucial for brand experience and customer engagement, contributing significantly to brand perception.

Key Drivers of Dominance:

- Clothing and Apparel: Iconic Italian design, brand heritage, and strong global brand recognition of companies like Prada S p A and Kering.

- Bags: Demand for premium leather goods and status symbol appeal.

- Online Stores: Convenience, wider reach, and effective digital marketing strategies, especially for reaching younger demographics.

- Single-brand Stores: Immersive brand experience, personalized customer service, and exclusive product offerings, contributing an estimated 30% to the market value.

- Multi-brand Stores: Curated selections and accessibility to a wider range of luxury brands, contributing approximately 25%.

The report details how investment trends favor digital infrastructure and sustainable material sourcing, while regulatory support for Italian craftsmanship further bolsters the dominance of these segments. The Watches segment, while smaller in volume, commands high revenue due to the premium pricing of brands like TAG Heuer International SA, and the Jewelry segment benefits from high-value individual sales.

Italian Luxury Goods Market Product Innovations

Product innovation within the Italian Luxury Goods Market is a constant differentiator. Companies are increasingly focusing on integrating cutting-edge technologies with traditional artistry. Innovations in sustainable luxury materials, such as recycled textiles and bio-based leathers, are gaining traction, appealing to environmentally conscious consumers. Furthermore, the application of digital technologies like AI-powered personalization and AR for virtual fittings is enhancing the customer experience. Performance metrics show a direct correlation between the adoption of these innovations and increased customer engagement and sales conversions, particularly in the online retail space. The unique selling proposition of many Italian luxury products now lies in their blend of heritage, craftsmanship, and forward-thinking design.

Propelling Factors for Italian Luxury Goods Market Growth

The Italian Luxury Goods Market is propelled by a confluence of technological, economic, and regulatory factors. The enduring appeal of Italian craftsmanship and design is a foundational driver. Economically, rising disposable incomes in key emerging markets and a growing affluent consumer base continue to fuel demand for high-end fashion and accessories. Technologically, the pervasive influence of digital marketing, e-commerce expansion, and the adoption of metaverse experiences are creating new avenues for customer engagement and sales. Regulatory support for Made in Italy certifications and intellectual property protection further solidifies the market's standing.

Obstacles in the Italian Luxury Goods Market Market

Despite its strong performance, the Italian Luxury Goods Market faces several obstacles. Supply chain disruptions, exacerbated by global events, can impact production timelines and raw material availability. Regulatory challenges related to import/export complexities and evolving sustainability standards require constant adaptation. Intense competitive pressures, both from established players and emerging direct-to-consumer brands, necessitate continuous innovation and marketing investment. The increasing cost of raw materials and skilled labor also poses a significant constraint, potentially impacting profit margins. Counterfeiting remains a persistent threat to brand integrity and revenue.

Future Opportunities in Italian Luxury Goods Market

Emerging opportunities in the Italian Luxury Goods Market are diverse and promising. The continued expansion into emerging markets in Asia and the Middle East presents significant untapped potential. The burgeoning experiential luxury trend, encompassing travel, dining, and exclusive events, offers avenues for brand diversification. Furthermore, the integration of Web3 technologies and NFTs opens up new possibilities for digital ownership, virtual collections, and enhanced customer loyalty programs. The growing demand for personalized luxury and vintage luxury items also presents avenues for niche market development and revenue streams.

Major Players in the Italian Luxury Goods Market Ecosystem

- The Estee Lauder Companies Inc

- KERING

- Prada S p A

- Ralph Lauren Corporation

- MAX MARA SRL

- PVH Corp

- TAG Heuer International SA

- L'OREAL

- LVMH Moët Hennessy Louis Vuitton

Key Developments in Italian Luxury Goods Market Industry

- July 2022: Prada SA unveiled its second Timecapsule NFT collection, featuring a shirt made from upcycled fabric from the Prada archives, integrating sustainability and digital innovation.

- May 2022: Fendi announced an investment to establish a new shoe factory in Fermo, Italy, aiming to enhance production capacity and streamline operations.

- February 2022: Hublot, a Swiss luxury watch brand, opened its fourth Italian store in Milan, showcasing a sophisticated retail design and reinforcing its presence in key luxury markets.

Strategic Italian Luxury Goods Market Market Forecast

The Italian Luxury Goods Market is poised for sustained growth, driven by its unparalleled brand equity and continuous adaptation to consumer trends. The strategic forecast highlights a future where digital transformation, sustainable practices, and personalized experiences will be paramount. Growth catalysts include the expanding global middle class, the increasing demand for authentic Italian craftsmanship, and the innovative integration of new technologies. The market's resilience and ability to evolve will ensure its continued prominence on the global luxury stage, with significant potential for value creation across various segments, particularly in designer apparel and luxury accessories.

Italian Luxury Goods Market Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Jewelry

- 1.5. Watches

- 1.6. Other Accessories

-

2. Distibution Channel

- 2.1. Single-brand Stores

- 2.2. Multi-brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

Italian Luxury Goods Market Segmentation By Geography

- 1. Italia

Italian Luxury Goods Market Regional Market Share

Geographic Coverage of Italian Luxury Goods Market

Italian Luxury Goods Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Internet Usage and Effortless Shopping Experience; Growing Consumer Inclination Towards Appearance and Latest Fashion

- 3.3. Market Restrains

- 3.3.1. Robust Offline Retail Channel Penetration

- 3.4. Market Trends

- 3.4.1. Exponentially Growing market of Luxury Leather Goods

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italian Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Jewelry

- 5.1.5. Watches

- 5.1.6. Other Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Single-brand Stores

- 5.2.2. Multi-brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Estee Lauder Companies Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 KERING

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Prada S p A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ralph Lauren Corporation*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MAX MARA SRL

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PVH Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TAG Heuer International SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ralph Lauren Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 L'OREAL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LVMH Moët Hennessy Louis Vuitton

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 The Estee Lauder Companies Inc

List of Figures

- Figure 1: Italian Luxury Goods Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italian Luxury Goods Market Share (%) by Company 2025

List of Tables

- Table 1: Italian Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Italian Luxury Goods Market Volume K Units Forecast, by Type 2020 & 2033

- Table 3: Italian Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 4: Italian Luxury Goods Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 5: Italian Luxury Goods Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Italian Luxury Goods Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Italian Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Italian Luxury Goods Market Volume K Units Forecast, by Type 2020 & 2033

- Table 9: Italian Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 10: Italian Luxury Goods Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 11: Italian Luxury Goods Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Italian Luxury Goods Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italian Luxury Goods Market?

The projected CAGR is approximately 3.18%.

2. Which companies are prominent players in the Italian Luxury Goods Market?

Key companies in the market include The Estee Lauder Companies Inc, KERING, Prada S p A, Ralph Lauren Corporation*List Not Exhaustive, MAX MARA SRL, PVH Corp, TAG Heuer International SA, Ralph Lauren Corporation, L'OREAL, LVMH Moët Hennessy Louis Vuitton.

3. What are the main segments of the Italian Luxury Goods Market?

The market segments include Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.82 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Internet Usage and Effortless Shopping Experience; Growing Consumer Inclination Towards Appearance and Latest Fashion.

6. What are the notable trends driving market growth?

Exponentially Growing market of Luxury Leather Goods.

7. Are there any restraints impacting market growth?

Robust Offline Retail Channel Penetration.

8. Can you provide examples of recent developments in the market?

In July 2022, Prada SA unveiled its second Timecapsule NFT collection, a shirt made from upcycled fabric from the Prada archives. The shirt features a 'Jacquard Animalier' silk brocade and lurex fabric in addition to a Jacquard Thrush (flower), which is silk sourced from an early 20th-century French archive.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italian Luxury Goods Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italian Luxury Goods Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italian Luxury Goods Market?

To stay informed about further developments, trends, and reports in the Italian Luxury Goods Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence