Key Insights

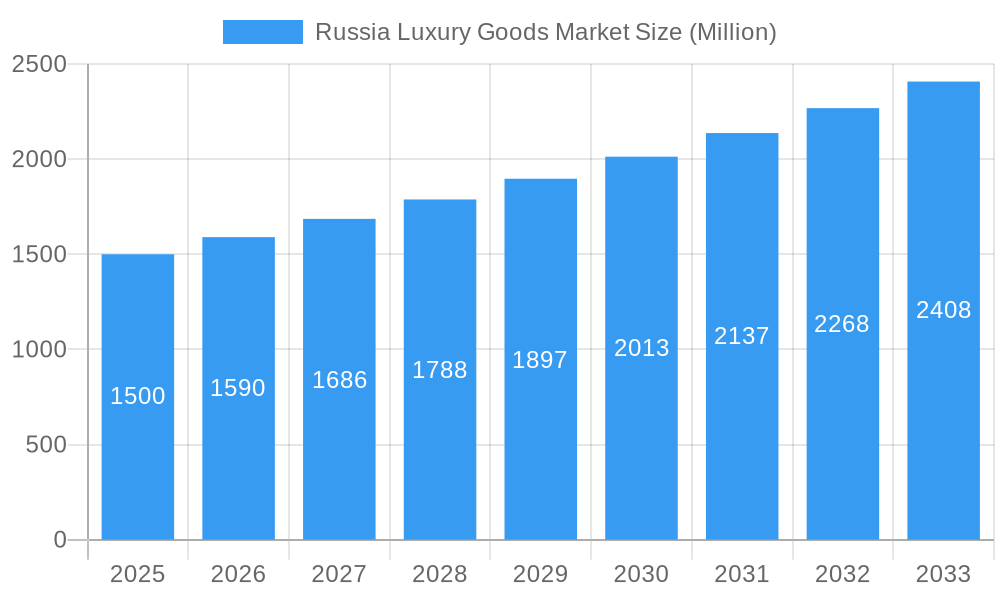

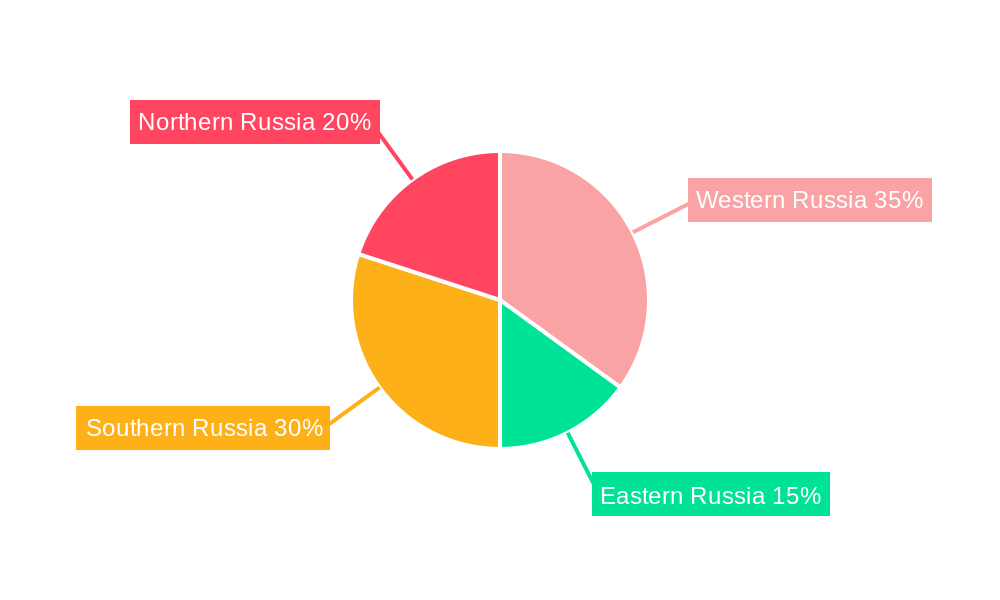

The Russia luxury goods market, valued at $2.59 billion in the base year of 2025, is projected to achieve a robust Compound Annual Growth Rate (CAGR) of 2.81% from 2025 to 2033. This expansion is propelled by increasing disposable incomes among Russia's affluent demographic and a growing preference for premium brands. Enhanced tourism, particularly from international high-spenders, also contributes significantly. Government initiatives aimed at economic diversification and foreign investment in the luxury sector provide additional impetus. Potential restraints include geopolitical uncertainties and currency exchange rate fluctuations, affecting purchasing power and import costs. The market is segmented by product category, with apparel and accessories, followed by jewelry and watches, demonstrating substantial potential. Online sales are trending upwards, complementing the established presence of single-brand retail outlets. Key global and domestic brands are actively shaping the competitive environment, with regional consumption varying, notably higher in Western and Southern Russia. This dynamic market offers considerable opportunities and challenges for luxury brands.

Russia Luxury Goods Market Market Size (In Billion)

The forecast period (2025-2033) indicates significant growth potential across market segments. Sustained consumer interest in luxury goods, influenced by evolving preferences and heightened brand awareness, will drive demand. Leading luxury brands will strategically integrate digital engagement with exceptional in-store experiences to cater to changing consumer behaviors. Tailored marketing campaigns and superior customer service will be crucial for cultivating brand loyalty in this competitive landscape. Addressing regional disparities through optimized distribution and product strategies will be essential for market penetration.

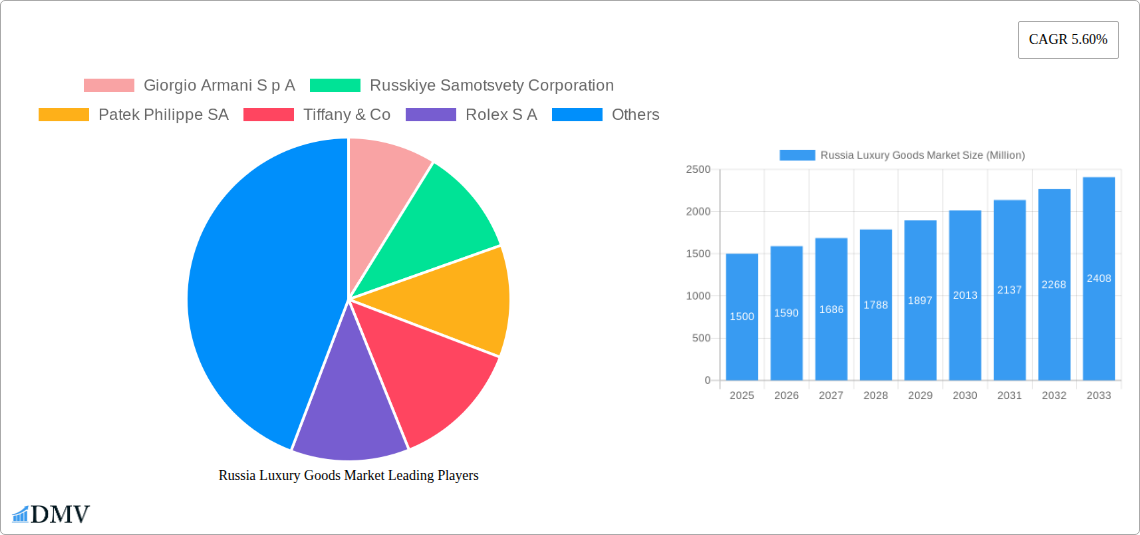

Russia Luxury Goods Market Company Market Share

Russia Luxury Goods Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Russia luxury goods market, encompassing historical data (2019-2024), the base year (2025), and a comprehensive forecast (2025-2033). The study offers a deep dive into market size, growth drivers, challenges, and future opportunities, empowering stakeholders with actionable intelligence for strategic decision-making. With a focus on key segments (clothing & apparel, footwear, jewelry, watches, bags, and other luxury goods) and distribution channels (single-brand stores, multi-brand stores, online stores, and others), this report unveils the intricacies of this dynamic market, valued at XX Million in 2025 and projected to reach XX Million by 2033.

Russia Luxury Goods Market Composition & Trends

This section evaluates the competitive landscape of the Russia luxury goods market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, consumer profiles, and mergers & acquisitions (M&A) activities. The report analyzes market share distribution among key players and provides insights into the value of significant M&A deals.

Market Concentration: The Russian luxury goods market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. However, the presence of numerous smaller, niche players ensures considerable competition. Precise market share data for 2025 will be detailed within the full report.

Innovation Catalysts: Technological advancements, particularly in e-commerce and personalized experiences, are driving innovation. The increasing use of data analytics for targeted marketing and product development significantly impacts the market.

Regulatory Landscape: The Russian government's policies regarding luxury goods imports, taxes, and intellectual property protection shape the market environment. Specific regulations and their implications are analyzed in the comprehensive report.

Substitute Products: The availability of high-quality, yet more affordable alternatives impacts demand for luxury goods. This report quantifies the impact of substitution on various luxury goods segments.

End-User Profiles: The report identifies key consumer segments based on demographics, income levels, and purchasing behavior. Specific details regarding consumer preferences and spending patterns are provided within the full report.

M&A Activities: The report tracks significant mergers and acquisitions in the Russian luxury goods market, including deal values and their strategic implications. Examples of recent M&A activities are detailed with their financial impact.

Russia Luxury Goods Market Industry Evolution

This section meticulously charts the evolution of the Russia luxury goods market, dissecting growth trajectories, technological breakthroughs, and the shifting preferences of discerning consumers. Growth rates, adoption metrics, and other crucial data points are presented to provide a comprehensive view. The impact of geopolitical events and economic fluctuations on market growth is also considered. The analysis will show how the market has adapted to changing consumer demands from the historical period to the projected future, including a deeper look at the impact of the 2020 and 2022 events on the market and its recovery.

Leading Regions, Countries, or Segments in Russia Luxury Goods Market

This section pinpoints the dominant regions, countries, and segments within the Russia luxury goods market. A detailed breakdown is provided by product type (clothing & apparel, footwear, jewelry, watches, bags, other types) and distribution channel (single-brand stores, multi-brand stores, online stores, other channels).

Key Drivers (by segment and channel):

- Jewelry: Strong domestic demand for high-quality precious stones and handcrafted pieces, fueled by both local and international brands, drives significant growth.

- Watches: A growing affluent population seeking high-end timepieces supports the market. Specific brand performance and trends will be included.

- Online Stores: Rapid e-commerce adoption, particularly among younger consumers, is driving significant growth in online sales. This section will include information about the challenges faced and solutions adopted by businesses.

- Single-Brand Stores: These stores provide a premium brand experience and drive significant sales in major cities. The report will cover the expansion plans of luxury brands in this sector.

Dominance Factors: In-depth analysis within the report will highlight the factors that contribute to the dominance of specific segments and regions, incorporating specific market data and case studies. This includes market data analysis, trends, and forecasts for individual segments and channels.

Russia Luxury Goods Market Product Innovations

This section details groundbreaking product innovations, applications, and performance metrics within the Russia luxury goods market. The report highlights unique selling propositions (USPs), innovative designs, technological advancements, and the adoption of sustainable practices within the luxury goods sector. This section also explores the emergence of new luxury product categories and their impact on the overall market.

Propelling Factors for Russia Luxury Goods Market Growth

Several factors fuel the growth of the Russia luxury goods market. These include rising disposable incomes, increasing consumer preference for luxury goods, and the expansion of e-commerce platforms and online retail. Government initiatives supporting the luxury goods industry further contribute to growth.

Obstacles in the Russia Luxury Goods Market

Challenges facing the Russia luxury goods market include economic instability, sanctions imposed on Russia, supply chain disruptions, and intense competition from both domestic and international brands. These factors can hinder market growth and affect business profitability.

Future Opportunities in Russia Luxury Goods Market

The Russia luxury goods market presents promising opportunities for growth. Expanding into new regional markets, capitalizing on technological advancements, and adapting to evolving consumer preferences are key strategies for success. The emergence of new luxury goods markets and the growth of existing ones are discussed in detail.

Major Players in the Russia Luxury Goods Market Ecosystem

- Giorgio Armani S p A

- Russkiye Samotsvety Corporation

- Patek Philippe SA

- Tiffany & Co

- Rolex S A

- Estee Lauder

- EssilorLuxottica SA

- Fossile Group

- Nika Watches Jewelry

- Sokolov Jewelry

Key Developments in Russia Luxury Goods Market Industry

- 2021 (July): Alrosa consolidates jewelry production and launches its first online store, aiming to combat fraud and promote origin-guaranteed Russian diamonds.

- 2021 (October): Sokolov, a Russian jeweler, announces plans for a dual listing in New York and Moscow in 2023, focusing on revenue growth and retail network expansion.

- 2020: & Other Stories opens its first store in Russia, offering a range of luxury goods including bags and jewelry.

Strategic Russia Luxury Goods Market Forecast

The Russia luxury goods market is poised for substantial growth driven by several factors, including the increasing affluence of the population, a burgeoning middle class, and the adoption of innovative technologies. Continued investment in infrastructure and e-commerce will further propel market expansion. The report’s forecast accurately predicts the market’s future trajectory and potential, providing invaluable insights for businesses and stakeholders.

Russia Luxury Goods Market Segmentation

-

1. Product Type

- 1.1. Clothing & Apparel

- 1.2. Footwear

- 1.3. Jewelry

- 1.4. Watches

- 1.5. Bags

- 1.6. Other Types

-

2. Distibution Channel

- 2.1. Single Brand Stores

- 2.2. Multi-Brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

Russia Luxury Goods Market Segmentation By Geography

- 1. Russia

Russia Luxury Goods Market Regional Market Share

Geographic Coverage of Russia Luxury Goods Market

Russia Luxury Goods Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Interest in Adventure Tourism; Growing Focus on Health and Wellness

- 3.3. Market Restrains

- 3.3.1. High Risk and Safety Concerns; Fluctuating Weather Patterns

- 3.4. Market Trends

- 3.4.1. Consumer's Willingness to Spend on Luxury Grooming

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Clothing & Apparel

- 5.1.2. Footwear

- 5.1.3. Jewelry

- 5.1.4. Watches

- 5.1.5. Bags

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Single Brand Stores

- 5.2.2. Multi-Brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Giorgio Armani S p A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Russkiye Samotsvety Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Patek Philippe SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tiffany & Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rolex S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Estee Lauder

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 EssilorLuxottica SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Fossile Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nika Watches Jewelry

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sokolov Jewelry*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Giorgio Armani S p A

List of Figures

- Figure 1: Russia Luxury Goods Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Russia Luxury Goods Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Luxury Goods Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Russia Luxury Goods Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Russia Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 4: Russia Luxury Goods Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 5: Russia Luxury Goods Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Russia Luxury Goods Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Russia Luxury Goods Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Russia Luxury Goods Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 9: Russia Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 10: Russia Luxury Goods Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 11: Russia Luxury Goods Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Russia Luxury Goods Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Luxury Goods Market?

The projected CAGR is approximately 2.81%.

2. Which companies are prominent players in the Russia Luxury Goods Market?

Key companies in the market include Giorgio Armani S p A, Russkiye Samotsvety Corporation, Patek Philippe SA, Tiffany & Co, Rolex S A, Estee Lauder, EssilorLuxottica SA, Fossile Group, Nika Watches Jewelry, Sokolov Jewelry*List Not Exhaustive.

3. What are the main segments of the Russia Luxury Goods Market?

The market segments include Product Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.59 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Interest in Adventure Tourism; Growing Focus on Health and Wellness.

6. What are the notable trends driving market growth?

Consumer's Willingness to Spend on Luxury Grooming.

7. Are there any restraints impacting market growth?

High Risk and Safety Concerns; Fluctuating Weather Patterns.

8. Can you provide examples of recent developments in the market?

In 2021, The Russian company Alrosa completed the consolidation of its jewelry production and launched its first online jewelry store. The company's goal is to promote origin-guaranteed Russian diamonds, improve the user's experience, and combat fraud in the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Luxury Goods Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Luxury Goods Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Luxury Goods Market?

To stay informed about further developments, trends, and reports in the Russia Luxury Goods Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence