Key Insights

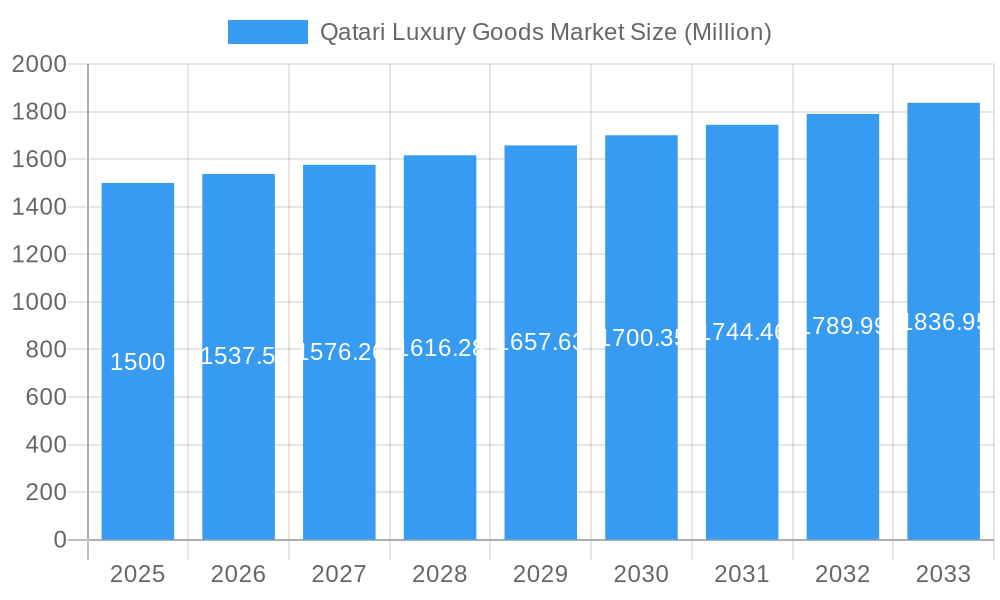

The Qatari luxury goods market, while exhibiting a relatively modest Compound Annual Growth Rate (CAGR) of 2.50% between 2019 and 2033, presents a lucrative opportunity for established players and emerging brands alike. Driven by a high concentration of high-net-worth individuals, a strong tourism sector, and a government focused on diversifying the economy beyond hydrocarbons, the market shows significant potential for expansion. Key growth drivers include the increasing popularity of e-commerce platforms, coupled with a younger generation embracing luxury brands and experiences. While the market is segmented across diverse product categories – including clothing and apparel, footwear, bags, jewelry, watches, and other accessories – the strongest growth is anticipated in the online retail segment, reflecting global trends towards convenient and personalized luxury shopping. The presence of established luxury conglomerates like LVMH, Kering, and Prada, alongside regional players like Qatar Luxury Group, indicates a competitive yet dynamic market landscape. However, economic volatility and global geopolitical events could present potential restraints to growth, requiring brands to adopt agile and diversified strategies. The Middle East and Africa region, with its affluent consumers and expanding tourism, offers significant expansion opportunities for luxury brands seeking a global presence.

Qatari Luxury Goods Market Market Size (In Billion)

The forecast period (2025-2033) will likely see a continuous, albeit gradual, expansion of the Qatari luxury goods market. The segment of online stores is poised to experience above-average growth due to factors such as increased internet penetration and the convenience of online shopping. Luxury brands are expected to respond to shifting consumer preferences by investing in digital marketing and omnichannel strategies, enhancing their online presence, and focusing on personalized customer experiences to sustain growth. Brand loyalty and the appeal of exclusivity will remain crucial differentiators in this competitive market, while innovative product offerings and sustainability initiatives will also play important roles in attracting and retaining affluent customers. Given the high concentration of luxury retailers within the country, the market's concentration may remain relatively high throughout the forecast period.

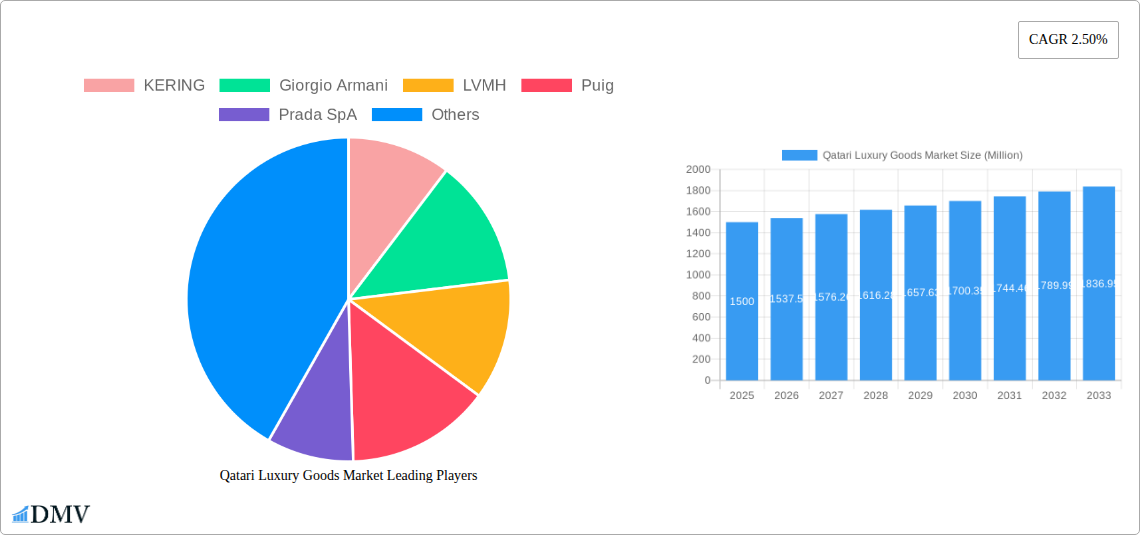

Qatari Luxury Goods Market Company Market Share

Qatari Luxury Goods Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the lucrative Qatari luxury goods market, projecting robust growth from 2025 to 2033. We delve into market dynamics, identifying key trends, challenges, and opportunities for stakeholders. The report covers a comprehensive range of product types, distribution channels, and leading players, offering invaluable insights for strategic decision-making. With a base year of 2025 and a forecast period spanning 2025-2033, this report is an essential resource for understanding the evolution and future potential of this high-value market. The study period covers 2019-2024, providing a solid historical foundation for the projections. The market is expected to reach XX Million by 2033.

Qatari Luxury Goods Market Composition & Trends

This section evaluates the competitive landscape, innovation drivers, regulatory environment, and market dynamics within the Qatari luxury goods market. The market is characterized by a mix of international luxury brands and local players, resulting in a dynamic market share distribution. Key players like KERING, LVMH, Prada SpA, and CHANEL hold significant market share, while regional players like Qatar Luxury Group contribute to market diversification. High net-worth individuals and tourists are the primary end-users. The market witnessed an estimated XX Million in M&A deal values during 2019-2024 with an average deal size of XX Million.

- Market Concentration: Highly concentrated, with a few major players dominating. LVMH and KERING are expected to retain a considerable share.

- Innovation Catalysts: High disposable incomes, tourism, and government initiatives supporting luxury retail.

- Regulatory Landscape: Generally supportive of luxury goods trade but subject to import duties and regulations.

- Substitute Products: Limited, given the exclusivity and prestige associated with luxury brands.

- M&A Activities: Moderate level of activity, driven by expansion strategies and brand portfolio diversification.

Qatari Luxury Goods Market Industry Evolution

The Qatari luxury goods market exhibits a growth trajectory heavily influenced by economic growth, tourism, and infrastructural development. Over the historical period (2019-2024), the market experienced a Compound Annual Growth Rate (CAGR) of approximately XX%, driven by increasing purchasing power and the influx of high-spending tourists. Technological advancements, such as e-commerce and personalized luxury experiences, have further fueled market growth, enhancing customer engagement and accessibility. The market is projected to experience a CAGR of XX% during the forecast period (2025-2033), reaching a projected value of XX Million by 2033. Shifting consumer demands towards sustainable and ethically sourced luxury goods are also influencing brand strategies and product development. The adoption of digital technologies, like AR/VR for virtual try-ons, is accelerating at a rate of XX% annually.

Leading Regions, Countries, or Segments in Qatari Luxury Goods Market

Within Qatar, Doha remains the dominant hub for luxury goods, concentrating high-end retail spaces and attracting significant tourist spending. This concentration is driven by substantial investments in infrastructure, tourism promotion, and the presence of flagship luxury stores.

By Product Type:

- Watches and Jewelry: Strong growth driven by high demand for premium timepieces and exquisite jewelry, fueled by significant tourist spending and affluent locals.

- Clothing and Apparel: Significant market segment with a focus on designer labels and high-end fashion.

- Bags: High demand for luxury handbags from prestigious brands.

By Distribution Channel:

- Single-Branded Stores: Dominate the market, offering a controlled brand experience and personalized customer service.

- Multi-brand Stores: Offer diverse luxury selections, appealing to a broader consumer base.

- Online Stores: Growing rapidly, fueled by increased internet penetration and demand for convenience.

Key Drivers:

- Significant government investments in infrastructure and tourism.

- Strong purchasing power of the local population and influx of high-spending tourists.

- Strategic partnerships between luxury brands and local retailers.

Qatari Luxury Goods Market Product Innovations

The Qatari luxury goods market witnesses continuous product innovation, particularly in materials, design, and technology integration. Brands are incorporating sustainable and ethically sourced materials, while technological advancements like augmented reality (AR) enhance the customer experience, allowing for virtual try-ons and personalized shopping consultations. Unique selling propositions (USPs) often center around limited-edition collections, collaborations with artists, and personalized customization options.

Propelling Factors for Qatari Luxury Goods Market Growth

Several key factors fuel the growth of the Qatari luxury goods market:

- Economic Growth: Qatar's robust economy and high per capita income create a large base of potential consumers.

- Tourism: The increasing number of tourists contributes significantly to luxury goods sales.

- Government Initiatives: Government support for tourism and retail development bolsters the market.

- Infrastructure Development: Investments in infrastructure enhance shopping experiences and attract luxury brands.

Obstacles in the Qatari Luxury Goods Market

Challenges facing the market include:

- Economic Volatility: Global economic fluctuations can impact consumer spending.

- Geopolitical Factors: Regional instability can affect tourism and investment.

- Competition: Intense competition from established international and emerging brands.

- Supply Chain Disruptions: Global supply chain disruptions impact product availability and pricing.

Future Opportunities in Qatari Luxury Goods Market

Future opportunities include:

- E-commerce Expansion: Growing online luxury retail market offers significant potential.

- Experiential Retail: Creating immersive shopping experiences to enhance customer engagement.

- Sustainability Focus: Growing demand for sustainable and ethically sourced luxury goods.

- Personalization: Offering personalized luxury experiences to cater to individual preferences.

Major Players in the Qatari Luxury Goods Market Ecosystem

- KERING

- Giorgio Armani

- LVMH

- Puig

- Prada SpA

- Joyalukkas

- PVH

- Qatar Luxury Group

- HUGO BOSS

- Valentino s p a

- CHANEL

- Rolex

Key Developments in Qatari Luxury Goods Market Industry

- November 2022: The Giantto Group launched a limited-edition timepiece collection in Doha, capitalizing on the FIFA World Cup.

- November 2022: Louis Vuitton launched a limited-edition FIFA World Cup Collection of leather accessories.

- August 2022: CHANEL unveiled two new sneaker styles, reflecting the growing athleisure trend.

- April 2022: Louis Vuitton announced its first store at Qatar Duty-Free in Hamad International Airport.

Strategic Qatari Luxury Goods Market Market Forecast

The Qatari luxury goods market is poised for continued growth, driven by increasing affluence, tourism expansion, and the ongoing development of luxury retail infrastructure. The focus on e-commerce and personalized experiences will further fuel market expansion. The market is expected to maintain a strong growth trajectory throughout the forecast period (2025-2033), exceeding XX Million by 2033. Smart investments in experiential retail and sustainable practices will be crucial for success in this competitive and dynamic market.

Qatari Luxury Goods Market Segmentation

-

1. Product Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Jewelry

- 1.5. Watches

- 1.6. Other Types

-

2. Distribution Channel

- 2.1. Single-branded Stores

- 2.2. Multi-brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

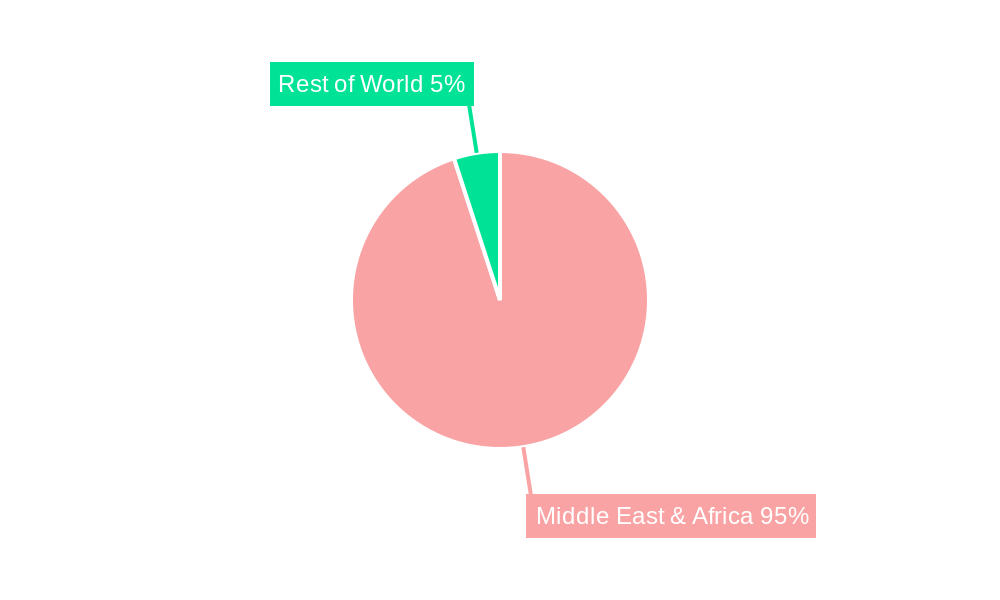

Qatari Luxury Goods Market Segmentation By Geography

- 1. Qatar

Qatari Luxury Goods Market Regional Market Share

Geographic Coverage of Qatari Luxury Goods Market

Qatari Luxury Goods Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.03% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fast Fashion Trend; Inflating Income Level of Individuals

- 3.3. Market Restrains

- 3.3.1. The Presence Of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Qatar is the Regional Luxury Fashion Hub

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatari Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Jewelry

- 5.1.5. Watches

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Single-branded Stores

- 5.2.2. Multi-brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 KERING

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Giorgio Armani

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 LVMH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Puig

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Prada SpA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Joyalukkas

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PVH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Qatar Luxury Group*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 HUGO BOSS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Valentino s p a

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CHANEL

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Rolex

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 KERING

List of Figures

- Figure 1: Qatari Luxury Goods Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Qatari Luxury Goods Market Share (%) by Company 2025

List of Tables

- Table 1: Qatari Luxury Goods Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Qatari Luxury Goods Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Qatari Luxury Goods Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Qatari Luxury Goods Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Qatari Luxury Goods Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Qatari Luxury Goods Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatari Luxury Goods Market?

The projected CAGR is approximately 5.03%.

2. Which companies are prominent players in the Qatari Luxury Goods Market?

Key companies in the market include KERING, Giorgio Armani, LVMH, Puig, Prada SpA, Joyalukkas, PVH, Qatar Luxury Group*List Not Exhaustive, HUGO BOSS, Valentino s p a, CHANEL, Rolex.

3. What are the main segments of the Qatari Luxury Goods Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Fast Fashion Trend; Inflating Income Level of Individuals.

6. What are the notable trends driving market growth?

Qatar is the Regional Luxury Fashion Hub.

7. Are there any restraints impacting market growth?

The Presence Of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

November 2022: The Giantto Group, a prominent LA-based jewelry company, officially launched 300 units of a collector's edition numbered and exclusive timepiece collection, just in time for the World Cup 2022 in Doha, Qatar.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatari Luxury Goods Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatari Luxury Goods Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatari Luxury Goods Market?

To stay informed about further developments, trends, and reports in the Qatari Luxury Goods Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence