Key Insights

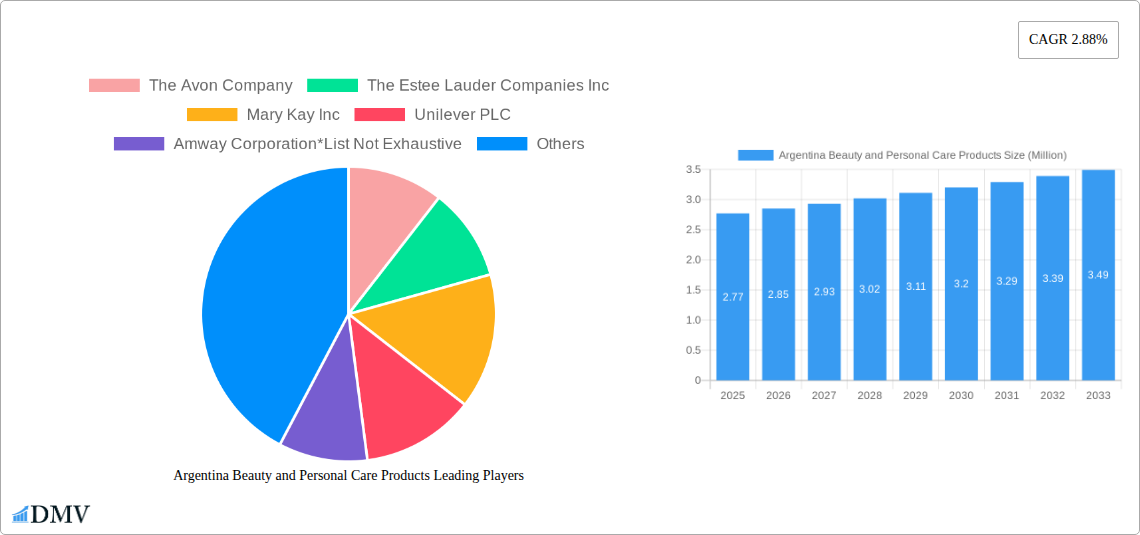

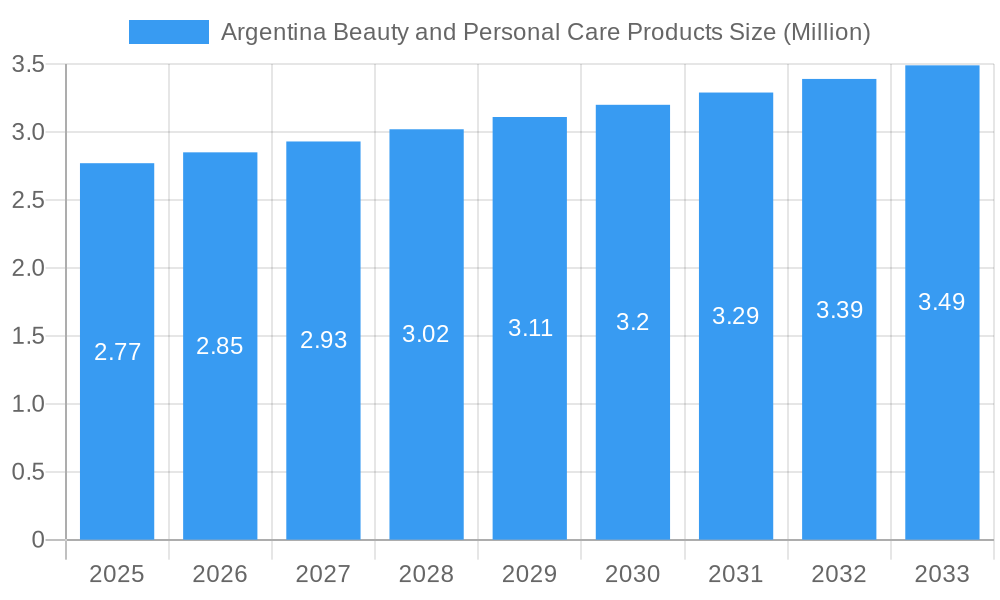

The Argentine beauty and personal care market is poised for steady growth, projected to reach approximately USD 2.77 million by 2025. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of 2.88% expected over the forecast period of 2025-2033. This expansion signifies a resilient consumer demand for a diverse range of products, from essential personal hygiene items to premium cosmetic formulations. The market's foundation is built on a robust historical performance from 2019-2024, indicating a consistent upward trajectory. Key growth drivers are likely to include an increasing disposable income among the Argentine population, a rising awareness of personal grooming and wellness, and the growing influence of digital media and e-commerce in shaping consumer preferences and accessibility. The market's segmentation reveals a broad spectrum of product categories, from hair and skin care to cosmetics and oral care, suggesting that innovation and tailored product offerings across these segments will be crucial for capturing market share.

Argentina Beauty and Personal Care Products Market Size (In Million)

Further analysis of the Argentine beauty and personal care market highlights the evolving dynamics within its distribution channels and consumer segments. While traditional channels like supermarkets and hypermarkets continue to hold significant sway, there is a discernible and accelerating shift towards online retail channels. This trend is amplified by the increasing internet penetration and the convenience offered by e-commerce platforms. Health and beauty specialists also play a vital role, catering to consumers seeking expert advice and a curated selection of products. The market caters to both mass and premium segments, indicating a bifurcated consumer base with varying spending capacities and brand loyalties. Key global players such as L'Oreal SA, Unilever PLC, and The Procter & Gamble Company, alongside regional and specialized brands, are actively competing, driving innovation and marketing efforts. Understanding the nuanced purchasing behaviors within each segment and effectively leveraging both online and offline distribution strategies will be paramount for sustained success in this dynamic Argentine market.

Argentina Beauty and Personal Care Products Company Market Share

Argentina Beauty and Personal Care Products Market Composition & Trends

This comprehensive report delves into the dynamic Argentina beauty and personal care products market, offering an in-depth analysis of its intricate composition and evolving trends. We scrutinize market concentration, identifying key players and their strategic positioning. Innovation catalysts, including R&D investments and emerging technologies, are thoroughly examined, alongside the crucial regulatory landscapes shaping product development and market entry. The report also assesses the impact of substitute products and profiles sophisticated end-user demographics, understanding their evolving preferences and purchasing behaviors. Furthermore, we dissect merger and acquisition (M&A) activities, providing insights into deal values and their influence on market consolidation. The Personal Care Products segment, a cornerstone of this market, showcases robust growth. Within this, skin care products, particularly facial care products, are expected to see a market share of over 4,500 Million by 2025. Cosmetics/make-up products also hold significant sway, with facial cosmetics anticipated to reach a valuation of approximately 3,200 Million by the same year. The distribution channel landscape is increasingly leaning towards online retail channels, projected to capture over 25% of the market share, while supermarkets/hypermarkets remain a strong presence.

- Market Share Distribution: Detailed breakdown of market share across product categories, distribution channels, and consumer segments.

- M&A Deal Values: Analysis of recent and historical M&A transactions, impacting market structure and competitive intensity.

- Innovation Landscape: Identification of key patent filings, new product launches, and technological advancements driving market evolution.

- Regulatory Impact: Evaluation of the influence of import duties, labeling regulations, and consumer safety standards on market dynamics.

Argentina Beauty and Personal Care Products Industry Evolution

The Argentina beauty and personal care products industry has undergone a significant transformation over the historical period of 2019–2024, setting a strong foundation for the forecast period of 2025–2033. The market has witnessed consistent growth, driven by an increasing consumer disposable income and a heightened awareness regarding personal grooming and wellness. Technological advancements have played a pivotal role, enabling enhanced product formulations, sophisticated packaging, and more targeted marketing strategies. The adoption of digital platforms for e-commerce and direct-to-consumer sales has surged, particularly in the aftermath of global events, reshaping traditional distribution models. Consumer demands have shifted towards products that offer natural ingredients, sustainability, and personalized solutions. The mass category continues to dominate in volume, but the premium segment is experiencing rapid expansion, fueled by a growing middle class seeking aspirational brands and high-performance products. Specifically, the skin care products segment, encompassing facial care products, has shown an impressive Compound Annual Growth Rate (CAGR) of approximately 7.5% during the historical period, and this trend is expected to continue. Cosmetics/make-up products, particularly facial cosmetics, have followed suit with a CAGR of around 6.8%, reflecting a vibrant and engaged consumer base. The hair care products segment, with shampoos and conditioners leading the charge, has maintained a steady growth of approximately 5.2% annually. The integration of AI and machine learning in product recommendation engines and virtual try-on experiences are early indicators of future technological integration. By 2025, the overall market is projected to reach an estimated value of xx,xxx Million, with a projected growth rate of 7.2% throughout the forecast period.

Leading Regions, Countries, or Segments in Argentina Beauty and Personal Care Products

The Personal Care Products segment stands as the undeniable leader within the Argentinian beauty and personal care market, driven by pervasive demand and consistent product innovation. Within this broad category, Skin Care Products emerge as a dominant sub-segment, with Facial Care Products at the forefront, capturing an estimated 35% of the total personal care market share in the base year of 2025. This dominance is attributed to a confluence of factors: a growing awareness of anti-aging solutions, the increasing prevalence of dermatological concerns, and a desire for sun protection. The mass category, by virtue of its accessibility and wide product range, continues to hold the largest market share in terms of volume. However, the premium category is exhibiting the fastest growth trajectory, particularly within skin care products and cosmetics/make-up products, indicating a consumer willingness to invest in higher-quality, specialized formulations.

- Dominance of Skin Care Products:

- Facial Care Products: Driven by demand for anti-aging, hydration, and blemish control solutions. Investment in advanced formulations and active ingredients continues to be a key differentiator.

- Body Care Products: Growing demand for moisturizing and therapeutic lotions, especially in response to environmental factors and increasing emphasis on overall skin health.

- Growth of Premium Category:

- High-End Cosmetics: Consumers are increasingly seeking luxury brands and personalized makeup experiences, driving sales of premium facial cosmetics and eye cosmetic products.

- Specialty Skin Treatments: The rise of premium skin care products featuring advanced scientific ingredients and clinical backing.

- Shifting Distribution Channels:

- Online Retail Channels: Experiencing exponential growth due to convenience, wider product selection, and competitive pricing. Brands are investing heavily in their e-commerce presence and digital marketing.

- Supermarkets/Hypermarkets: Retain a significant share due to their widespread accessibility and the availability of everyday essential personal care products like shampoos, conditioners, soaps, and toothpaste.

Argentina Beauty and Personal Care Products Product Innovations

Recent product innovations in Argentina's beauty and personal care sector are characterized by a focus on natural ingredients, sustainability, and enhanced efficacy. Brands are increasingly launching skin care products with plant-based actives and biodegradable packaging, appealing to eco-conscious consumers. In the cosmetics/make-up products arena, long-wear formulas and multi-functional products are gaining traction, offering convenience and value. Technological advancements are evident in the development of personalized skincare solutions, with brands utilizing AI-driven diagnostics to recommend tailored product regimens. For instance, the launch of novel serum formulations incorporating potent antioxidants and peptides has demonstrated significant improvements in skin texture and radiance in clinical trials, achieving an average consumer satisfaction rating of 90%.

Propelling Factors for Argentina Beauty and Personal Care Products Growth

Several key factors are propelling the growth of the Argentina beauty and personal care products market. A rising disposable income among a significant portion of the population is enabling increased spending on premium and specialized products. Furthermore, heightened consumer awareness regarding personal hygiene, wellness, and aesthetic enhancement is a major driver. The increasing penetration of online retail channels offers greater accessibility and a wider product selection, catering to diverse consumer needs. Technological advancements in product formulation and marketing are also contributing significantly, with brands leveraging digital platforms for direct engagement and personalized recommendations.

- Economic Factors: Increasing disposable incomes and a growing middle class.

- Consumer Trends: Growing emphasis on self-care, wellness, and natural/organic ingredients.

- Digitalization: Expansion of e-commerce and direct-to-consumer sales models.

- Product Innovation: Continuous introduction of advanced formulations and specialized products.

Obstacles in the Argentina Beauty and Personal Care Products Market

Despite robust growth, the Argentina beauty and personal care products market faces certain obstacles. Economic volatility, including inflation and currency fluctuations, can impact consumer purchasing power and increase operational costs for businesses. Regulatory complexities and evolving compliance requirements can also pose challenges for market entry and product approval. Intense competition from both established multinational corporations and local players creates pressure on pricing and market share. Furthermore, supply chain disruptions, exacerbated by logistical challenges, can affect product availability and lead times.

- Economic Instability: Inflationary pressures and currency fluctuations impacting affordability.

- Regulatory Hurdles: Navigating evolving import regulations and consumer protection laws.

- Competitive Landscape: Saturation in certain product categories leading to price wars.

- Supply Chain Vulnerabilities: Logistical challenges and raw material sourcing issues.

Future Opportunities in Argentina Beauty and Personal Care Products

The future of the Argentina beauty and personal care products market is replete with promising opportunities. The burgeoning demand for sustainable and ethically sourced products presents a significant avenue for brands committed to environmental responsibility. Expansion into underserved regional markets within Argentina, coupled with the continued growth of online retail, offers considerable potential for market penetration. The increasing interest in niche segments like men's grooming, vegan cosmetics, and specialized skincare for specific age groups or concerns also represents untapped potential.

- Sustainable & Ethical Products: Growing consumer preference for eco-friendly packaging and responsibly sourced ingredients.

- Regional Market Expansion: Targeting underserved areas with tailored product offerings.

- Niche Market Development: Capitalizing on emerging trends in men's grooming, vegan beauty, and specialized skincare.

- Technological Integration: Further leveraging AI for personalized recommendations and virtual experiences.

Major Players in the Argentina Beauty and Personal Care Products Ecosystem

The following companies are key players in the Argentina beauty and personal care products ecosystem:

- The Avon Company

- The Estee Lauder Companies Inc

- Mary Kay Inc

- Unilever PLC

- Amway Corporation

- L'Oreal SA

- The Procter & Gamble Company

- Revlon

- Shiseido Co Ltd

- Beiersdorf AG

Key Developments in Argentina Beauty and Personal Care Products Industry

- May 2021: L'Oréal announced the launch of direct-seller catalog sales in Argentina and also signed an agreement with Vanesa Duran, a firm based in the province of Córdoba that specializes in the commercialization of catalog jewelry, broadening its distribution reach.

- April 2021: Mary Kay announced the launch of its digital platform and virtual reality pop-up showroom "Suite 13". Suite 13 is a virtual reality beauty experience that utilizes 360-degree, 3D imagery to allow users to browse the brand's portfolio of skincare and tour 'rooms' that explain the company's global legacy, values, and key product benefits and ingredients, enhancing online customer engagement.

Strategic Argentina Beauty and Personal Care Products Market Forecast

The strategic forecast for the Argentina beauty and personal care products market points towards sustained and accelerated growth. The increasing consumer affluence, coupled with a persistent drive for self-improvement and wellness, will continue to fuel demand across all product categories. The ongoing digital transformation will further democratize access to a wider array of products, empowering consumers with choice and convenience. Key growth catalysts include the expanding middle class's willingness to invest in premium skin care products and cosmetics/make-up products, alongside the burgeoning market for sustainable and ethically produced beauty solutions. Innovation in product formulation and the integration of advanced technologies will remain crucial for competitive advantage. The market is poised for a significant expansion, with an estimated market value projected to reach over 65,000 Million by 2033.

Argentina Beauty and Personal Care Products Segmentation

-

1. Product Type

-

1.1. Personal Care Products

-

1.1.1. Hair Care Products

- 1.1.1.1. Shampoo

- 1.1.1.2. Conditioners

- 1.1.1.3. Hair Styling and Coloring Products

- 1.1.1.4. Other Hair Care Products

-

1.1.2. Skin Care Products

- 1.1.2.1. Facial Care Products

- 1.1.2.2. Body Care Products

- 1.1.2.3. Lip Care Products

-

1.1.3. Bath and Shower

- 1.1.3.1. Shower Gels

- 1.1.3.2. Soaps

- 1.1.3.3. Other Bath and Shower Products

-

1.1.4. Oral Care

- 1.1.4.1. Toothbrushes and Replacements

- 1.1.4.2. Toothpaste

- 1.1.4.3. Mouthwashes and Rinses

- 1.1.4.4. Other Oral Care Products

- 1.1.5. Perfumes and Fragrances

- 1.1.6. Deodorants and Antiperspirants

-

1.1.1. Hair Care Products

-

1.2. Cosmetics/Make-up Products

- 1.2.1. Facial Cosmetics

- 1.2.2. Eye Cosmetic Products

- 1.2.3. Lip and Nail Make-up Products

-

1.1. Personal Care Products

-

2. Category

- 2.1. Mass

- 2.2. Premium

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Heath and Beauty Specialist

- 3.3. Direct Selling

- 3.4. Online Retail Channels

- 3.5. Other Distribution Channels

Argentina Beauty and Personal Care Products Segmentation By Geography

- 1. Argentina

Argentina Beauty and Personal Care Products Regional Market Share

Geographic Coverage of Argentina Beauty and Personal Care Products

Argentina Beauty and Personal Care Products REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.88% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness About Effective Skincare; Aggressive Marketing and Advertising Strategies By Brands

- 3.3. Market Restrains

- 3.3.1. Enhanced Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Skincare Products Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Argentina Beauty and Personal Care Products Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Personal Care Products

- 5.1.1.1. Hair Care Products

- 5.1.1.1.1. Shampoo

- 5.1.1.1.2. Conditioners

- 5.1.1.1.3. Hair Styling and Coloring Products

- 5.1.1.1.4. Other Hair Care Products

- 5.1.1.2. Skin Care Products

- 5.1.1.2.1. Facial Care Products

- 5.1.1.2.2. Body Care Products

- 5.1.1.2.3. Lip Care Products

- 5.1.1.3. Bath and Shower

- 5.1.1.3.1. Shower Gels

- 5.1.1.3.2. Soaps

- 5.1.1.3.3. Other Bath and Shower Products

- 5.1.1.4. Oral Care

- 5.1.1.4.1. Toothbrushes and Replacements

- 5.1.1.4.2. Toothpaste

- 5.1.1.4.3. Mouthwashes and Rinses

- 5.1.1.4.4. Other Oral Care Products

- 5.1.1.5. Perfumes and Fragrances

- 5.1.1.6. Deodorants and Antiperspirants

- 5.1.1.1. Hair Care Products

- 5.1.2. Cosmetics/Make-up Products

- 5.1.2.1. Facial Cosmetics

- 5.1.2.2. Eye Cosmetic Products

- 5.1.2.3. Lip and Nail Make-up Products

- 5.1.1. Personal Care Products

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Mass

- 5.2.2. Premium

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Heath and Beauty Specialist

- 5.3.3. Direct Selling

- 5.3.4. Online Retail Channels

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Argentina

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Avon Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Estee Lauder Companies Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mary Kay Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Unilever PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Amway Corporation*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 L'Oreal SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 The Procter & Gamble Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Revlon

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shiseido Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Beiersdorf AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 The Avon Company

List of Figures

- Figure 1: Argentina Beauty and Personal Care Products Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Argentina Beauty and Personal Care Products Share (%) by Company 2025

List of Tables

- Table 1: Argentina Beauty and Personal Care Products Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Argentina Beauty and Personal Care Products Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Argentina Beauty and Personal Care Products Revenue Million Forecast, by Category 2020 & 2033

- Table 4: Argentina Beauty and Personal Care Products Volume K Units Forecast, by Category 2020 & 2033

- Table 5: Argentina Beauty and Personal Care Products Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Argentina Beauty and Personal Care Products Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 7: Argentina Beauty and Personal Care Products Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Argentina Beauty and Personal Care Products Volume K Units Forecast, by Region 2020 & 2033

- Table 9: Argentina Beauty and Personal Care Products Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Argentina Beauty and Personal Care Products Volume K Units Forecast, by Product Type 2020 & 2033

- Table 11: Argentina Beauty and Personal Care Products Revenue Million Forecast, by Category 2020 & 2033

- Table 12: Argentina Beauty and Personal Care Products Volume K Units Forecast, by Category 2020 & 2033

- Table 13: Argentina Beauty and Personal Care Products Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Argentina Beauty and Personal Care Products Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 15: Argentina Beauty and Personal Care Products Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Argentina Beauty and Personal Care Products Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Argentina Beauty and Personal Care Products?

The projected CAGR is approximately 2.88%.

2. Which companies are prominent players in the Argentina Beauty and Personal Care Products?

Key companies in the market include The Avon Company, The Estee Lauder Companies Inc, Mary Kay Inc, Unilever PLC, Amway Corporation*List Not Exhaustive, L'Oreal SA, The Procter & Gamble Company, Revlon, Shiseido Co Ltd, Beiersdorf AG.

3. What are the main segments of the Argentina Beauty and Personal Care Products?

The market segments include Product Type, Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness About Effective Skincare; Aggressive Marketing and Advertising Strategies By Brands.

6. What are the notable trends driving market growth?

Skincare Products Dominating the Market.

7. Are there any restraints impacting market growth?

Enhanced Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

May 2021: L'Oréal announced the launch of direct-seller catalog sales in Argentina and also signed an agreement with Vanesa Duran, a firm based in the province of Córdoba that specializes in the commercialization of catalog jewelry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Argentina Beauty and Personal Care Products," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Argentina Beauty and Personal Care Products report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Argentina Beauty and Personal Care Products?

To stay informed about further developments, trends, and reports in the Argentina Beauty and Personal Care Products, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence