Key Insights

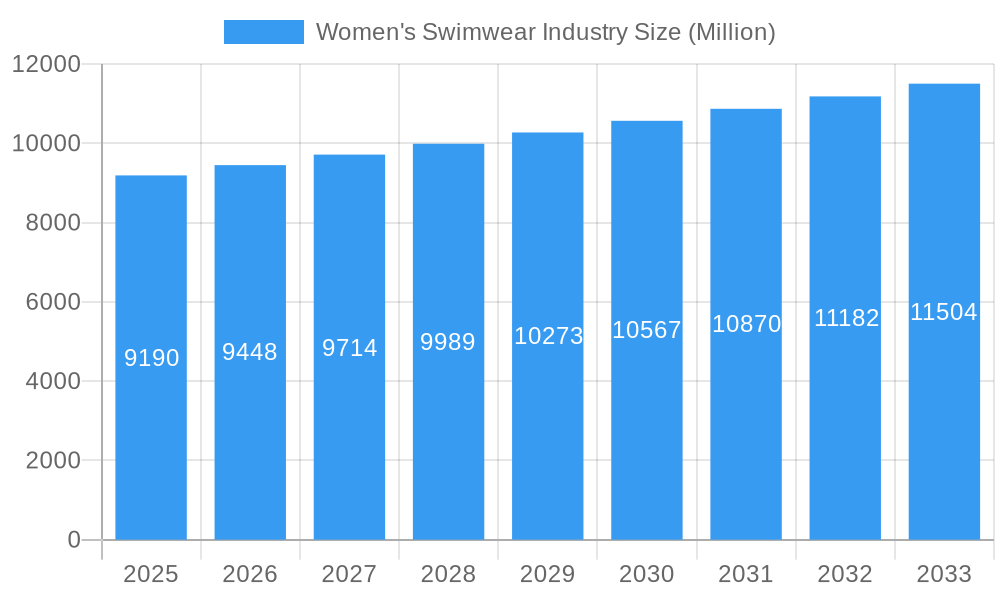

The global Women's Swimwear Industry is poised for steady growth, projected to reach approximately $9.19 billion in 2025, with an estimated Compound Annual Growth Rate (CAGR) of 2.84% extending through 2033. This sustained expansion is fueled by a confluence of factors, including evolving fashion trends, increasing participation in water-based recreational activities, and a growing emphasis on health and wellness. The market is segmented into Sports Swimwear and Regular/Leisure Swimwear, with the latter likely holding a larger share due to broader consumer appeal and diverse usage occasions. Within product types, bikinis continue to dominate, yet one-piece swimsuits are experiencing a resurgence driven by designs offering both style and comfort. The "Mass" category is expected to capture a significant portion of the market, while the "Premium" segment offers substantial growth opportunities, particularly for brands focusing on innovative designs, sustainable materials, and luxury appeal. E-commerce has emerged as a dominant force in distribution, providing unparalleled convenience and a wider selection, although traditional offline retail channels, especially in emerging markets, will continue to play a vital role.

Women's Swimwear Industry Market Size (In Billion)

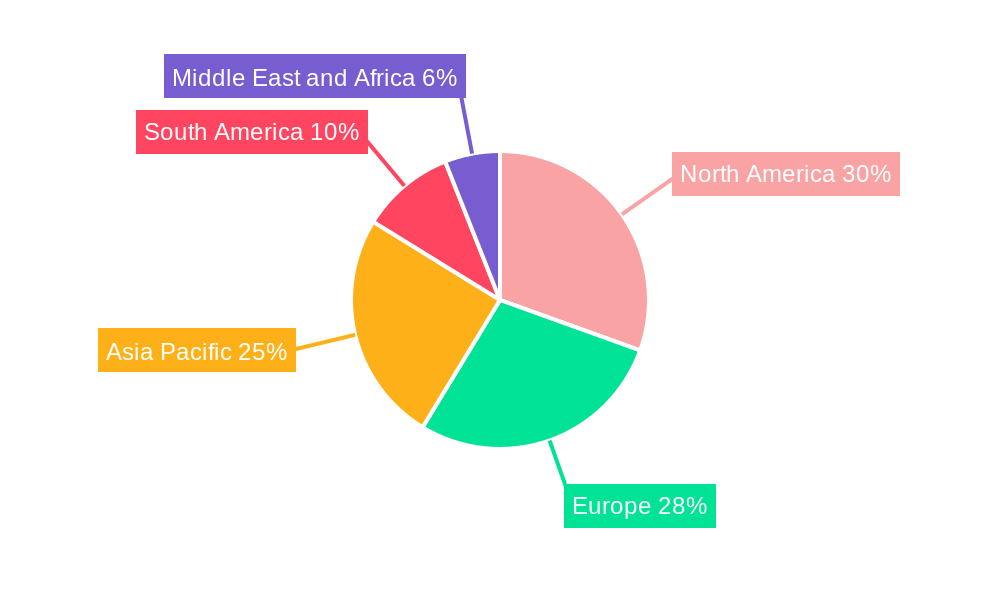

Key drivers propelling this market include the persistent influence of social media in showcasing swimwear trends and promoting active lifestyles, a rising disposable income in developing economies, and an increased focus on body positivity, encouraging a wider demographic to engage in swimwear-related activities. Emerging trends are leaning towards sustainable and eco-friendly swimwear made from recycled materials, sophisticated and versatile designs that can transition from beach to resort wear, and the integration of smart technologies in activewear. However, the industry faces certain restraints, such as intense competition leading to price pressures, the cyclical nature of fashion impacting demand, and potential supply chain disruptions. Geographically, North America and Europe are expected to remain the largest markets, driven by established fashion markets and high consumer spending. The Asia Pacific region presents the most significant growth potential, with rising incomes and a burgeoning middle class increasingly embracing leisure and fitness activities.

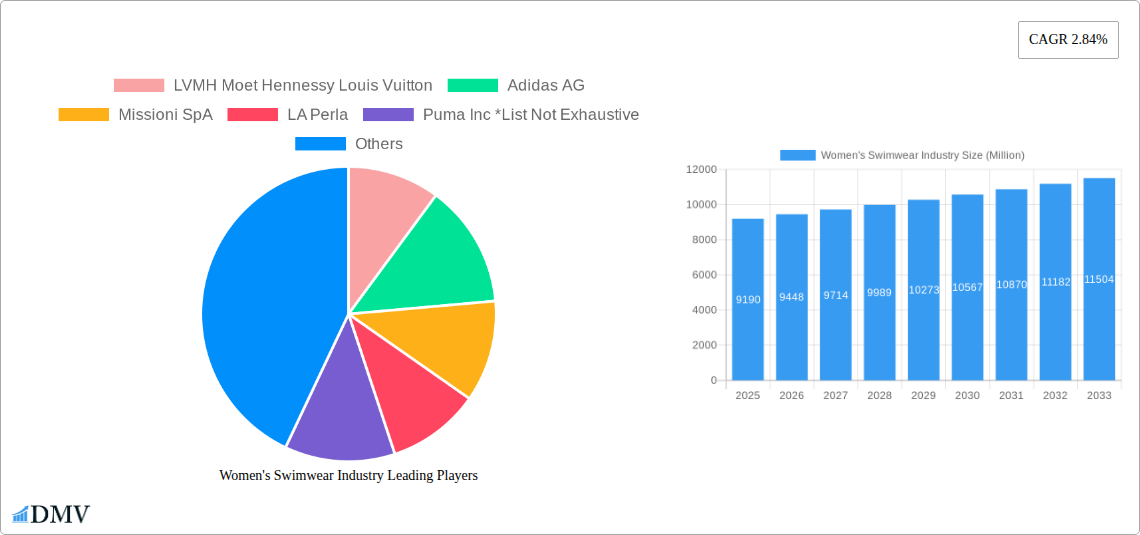

Women's Swimwear Industry Company Market Share

Women's Swimwear Industry Market Composition & Trends

The women's swimwear industry is a dynamic and evolving market characterized by a moderate to high level of competition and a steady influx of innovation. Market concentration varies across segments, with premium and luxury brands often exhibiting higher consolidation due to brand equity and exclusive designs. The industry is propelled by catalysts such as the growing emphasis on fitness and active lifestyles, the increasing popularity of destination travel and water-based recreational activities, and a continuous demand for fashionable and functional swimwear. Regulatory landscapes, while generally less stringent than in highly regulated sectors, focus on material safety, labor practices, and sustainability standards. Substitute products, including athletic apparel suitable for water activities and cover-ups, present a mild competitive threat, particularly in the sports swimwear segment. End-user profiles are diverse, ranging from performance-driven athletes to fashion-conscious consumers seeking stylish beachwear. Mergers and acquisitions (M&A) activities are present, though often strategic, involving established brands acquiring niche players or technology innovators to expand their product portfolios or market reach. For instance, an acquisition valuing xx Million USD in the historical period demonstrates strategic consolidation. Market share distribution is influenced by brand reputation, product differentiation, and effective marketing campaigns, with the top 5 companies holding approximately 45% of the global market share.

Women's Swimwear Industry Industry Evolution

The women's swimwear industry has undergone a significant transformation over the study period of 2019–2033, driven by a confluence of economic, social, and technological factors. From 2019 to 2024, the historical period witnessed steady growth, with an average annual growth rate of 5.8%. This upward trajectory was primarily fueled by rising disposable incomes, a burgeoning global tourism sector, and a heightened awareness of health and wellness, leading more women to engage in water-based fitness and leisure activities. The COVID-19 pandemic introduced a temporary disruption, with a 3% contraction in 2020, but subsequent recovery was robust, demonstrating the industry's resilience and the enduring appeal of swimwear for both domestic and international travel.

Technological advancements have played a pivotal role in shaping the industry's evolution. The incorporation of innovative fabrics, such as those offering enhanced UV protection, chlorine resistance, and quick-drying properties, has become a standard expectation for consumers. Furthermore, the development of sustainable materials, including recycled polyester and nylon derived from ocean plastics, has gained significant traction, aligning with growing environmental consciousness. Brands like Zoggs, with their April 2022 launch of a new thermal range of silver-lined sustainable swimsuits, exemplify this trend, highlighting features like maintaining body heat 60% longer than standard swimwear. The integration of smart textiles, though still in its nascent stages, presents a future frontier, potentially offering features like body temperature regulation or integrated fitness tracking.

Shifting consumer demands have also been instrumental in driving market evolution. There's a discernible trend towards more inclusive sizing and a greater demand for diverse styles that cater to different body types and preferences. The rise of body positivity movements has influenced design aesthetics, with brands increasingly offering a wider range of fits and styles that promote confidence and comfort. Full-coverage swimwear, once a niche segment, has seen a notable surge in popularity, as evidenced by Adidas' December 2021 launch of its first line of women's full-coverage swimwear, complete with functional features like thumb holes and press studs. The proliferation of social media platforms has further amplified the influence of fashion trends, making consumers more aware of emerging styles and brand offerings, and encouraging brands to adopt more engaging and interactive marketing strategies. The base year of 2025 is projected to see a growth rate of 6.5%, with the forecast period (2025–2033) anticipating an average annual growth rate of 7.2%, driven by continued innovation, expanding markets, and evolving consumer preferences.

Leading Regions, Countries, or Segments in Women's Swimwear Industry

The women's swimwear industry is segmented by product type, category, and distribution channel, with significant variations in regional dominance. Among the Segments by Type, Regular/Leisure Swimwear commands a substantial market share, estimated at 60% of the total market value in the base year of 2025. This dominance is attributed to its broad appeal, encompassing vacation wear, casual beach activities, and general aesthetic preferences. Sports Swimwear, while smaller in market share at approximately 40%, is experiencing robust growth, driven by the increasing participation in water sports and fitness activities. Key drivers for this segment include a growing health-conscious population, advancements in performance-enhancing materials, and the proliferation of specialized athletic events.

In terms of Segments by Product Type, Bikinis remain the most popular choice, accounting for an estimated 55% of the market value in 2025, due to their fashion-forward designs and versatility. One-piece swimsuits follow, holding around 35% of the market, appealing to a wider range of body types and offering greater coverage and support, with a notable resurgence in recent years. Other Product Types, including tankinis and swim dresses, constitute the remaining 10%, catering to niche preferences and specific design requirements.

The Segments by Category are bifurcated into Mass and Premium. The Mass category currently holds a larger market share, estimated at 70%, driven by affordability and wide availability. However, the Premium segment is exhibiting a higher growth rate, projected at 8.5% annually from 2025–2033, fueled by increasing disposable incomes, brand loyalty, and a growing consumer desire for high-quality, designer swimwear. Luxury brands like LVMH Moet Hennessy Louis Vuitton and Chanel Group are significant players in this segment, leveraging brand prestige and innovative designs.

Considering the Segments by Distribution Channel, Online Stores are rapidly gaining dominance, projected to capture over 65% of the market share by 2033. This surge is attributed to the convenience of online shopping, a wider selection of products, competitive pricing, and the increasing penetration of e-commerce globally. Brands are investing heavily in their online presence, offering personalized shopping experiences and efficient delivery services. Offline Stores (brick-and-mortar retail) still hold a significant portion of the market, particularly for the premium segment, where customers value the tactile experience of trying on garments and receiving personalized advice. Key drivers for the dominance of online channels include ease of access, detailed product descriptions and reviews, and the ability to compare prices effortlessly. Investment trends in digital marketing and e-commerce infrastructure are pivotal for online channel growth, while strategic location and enhanced in-store experiences are crucial for offline success.

Women's Swimwear Industry Product Innovations

Product innovation in the women's swimwear industry is primarily focused on material science, design functionality, and sustainability. Advances in fabric technology have led to the development of lightweight, quick-drying, and highly durable materials that offer superior comfort and performance. Innovations like the thermal silver lining in Zoggs' sustainable swimsuits (April 2022) that maintains body heat 60% longer, and the full-coverage designs with integrated features like thumb holes and secure fastenings from Adidas (December 2021), showcase a trend towards performance-driven and practical swimwear. Furthermore, brands are increasingly incorporating eco-friendly materials, such as recycled plastics and organic cotton, to meet the growing consumer demand for sustainable fashion. The integration of UV-protective properties and seamless construction are other key innovations enhancing both functionality and aesthetic appeal, leading to unique selling propositions such as enhanced comfort, extended wearability, and reduced environmental impact.

Propelling Factors for Women's Swimwear Industry Growth

Several key factors are propelling the growth of the women's swimwear industry. Technological advancements in fabric innovation, such as moisture-wicking, UV-resistant, and sustainable materials, are enhancing product performance and appeal. Growing consumer emphasis on health and wellness drives demand for activewear, including specialized swimwear for sports and fitness. The resurgence of travel and tourism, post-pandemic, is a significant economic driver, boosting demand for vacation wear. Furthermore, increasing disposable incomes in emerging economies allow more consumers to invest in premium and fashion-forward swimwear. Social media influence and the demand for aesthetically pleasing content also encourage the purchase of trendy swimwear. Regulatory support for sustainable manufacturing practices is fostering innovation in eco-friendly product development.

Obstacles in the Women's Swimwear Industry Market

Despite robust growth, the women's swimwear industry faces several obstacles. Intense competition from both established brands and emerging players leads to price pressures and necessitates continuous innovation, potentially impacting profit margins. Supply chain disruptions, as evidenced by global events, can lead to increased raw material costs and delayed production cycles, affecting product availability and pricing. Fluctuating raw material prices, particularly for synthetic fibers derived from petrochemicals, pose a significant challenge. Economic downturns can lead to reduced consumer spending on discretionary items like fashion swimwear. Changing fashion trends require brands to be agile and responsive, making it challenging to predict and adapt to rapid shifts in consumer preferences. The cost of implementing sustainable manufacturing processes can also be a barrier for smaller businesses.

Future Opportunities in Women's Swimwear Industry

The women's swimwear industry is poised for significant future opportunities. The expansion of e-commerce platforms offers access to a global customer base and facilitates personalized marketing strategies. Growing demand for sustainable and ethically produced swimwear presents a substantial opportunity for brands focusing on eco-friendly materials and transparent supply chains. The increasing participation in water-based fitness and adventure tourism will continue to drive demand for specialized and high-performance swimwear. Emerging markets in Asia and Latin America offer significant untapped potential for growth. Furthermore, technological integration, such as smart fabrics with enhanced functionalities, represents a frontier for innovation and product differentiation. The trend towards inclusive sizing and adaptive swimwear also creates new market segments.

Major Players in the Women's Swimwear Industry Ecosystem

- LVMH Moet Hennessy Louis Vuitton

- Adidas AG

- Missioni SpA

- LA Perla

- Puma Inc

- Chanel Group

- La Jolla Group

- Swimwear Anywhere Inc

- Pentland Group PLC

- Marysia LLC

Key Developments in Women's Swimwear Industry Industry

- March 2023: Penney IP LLC launched sports swimwear for men and women, offering trendy styles with graphic prints, vibrant colors, and bold silhouettes in sizes S-XL.

- April 2022: Zoggs launched a new thermal range of silver-lined sustainable swimsuits, designed to maintain body heat 60% longer than standard swimwear, providing warmth in all conditions, particularly for winter skin divers.

- December 2021: Adidas launched its first line of women's full-coverage swimwear, featuring innovative additions like thumb holes and press studs on the hips to keep shirts securely in place over leggings and shorts.

Strategic Women's Swimwear Industry Market Forecast

The strategic forecast for the women's swimwear industry indicates a continued robust growth trajectory, driven by an confluence of evolving consumer demands and innovative product development. The market is expected to expand significantly as individuals increasingly prioritize health, wellness, and active lifestyles, fueling the demand for both performance-oriented sports swimwear and fashionable leisure wear. The persistent growth of e-commerce will further democratize access to a wider array of styles and brands, while the escalating consumer consciousness towards sustainability will propel the adoption of eco-friendly materials and ethical production practices. Emerging markets, coupled with the ongoing popularity of travel and water-based recreational activities, present substantial opportunities for market penetration and brand expansion, solidifying the industry's positive outlook through 2033 with an estimated market size of xx Million.

Women's Swimwear Industry Segmentation

-

1. Type

- 1.1. Sports Swimwear

- 1.2. Regular/Leisure Swimwear

-

2. Product Type

- 2.1. One-piece

- 2.2. Bikinis

- 2.3. Other Product Types

-

3. Category

- 3.1. Mass

- 3.2. Premium

-

4. Distribution Channel

- 4.1. Online Stores

- 4.2. Offline Stores

Women's Swimwear Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. Italy

- 2.5. France

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. Australia

- 3.4. India

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Women's Swimwear Industry Regional Market Share

Geographic Coverage of Women's Swimwear Industry

Women's Swimwear Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Product Innovations to Drive Demand for Watches; Rising Demand for Premium Fashion Items

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Popularity of Swimming as a Hobby and Sport

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Women's Swimwear Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Sports Swimwear

- 5.1.2. Regular/Leisure Swimwear

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. One-piece

- 5.2.2. Bikinis

- 5.2.3. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Category

- 5.3.1. Mass

- 5.3.2. Premium

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Online Stores

- 5.4.2. Offline Stores

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. South America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Women's Swimwear Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Sports Swimwear

- 6.1.2. Regular/Leisure Swimwear

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. One-piece

- 6.2.2. Bikinis

- 6.2.3. Other Product Types

- 6.3. Market Analysis, Insights and Forecast - by Category

- 6.3.1. Mass

- 6.3.2. Premium

- 6.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.4.1. Online Stores

- 6.4.2. Offline Stores

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Women's Swimwear Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Sports Swimwear

- 7.1.2. Regular/Leisure Swimwear

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. One-piece

- 7.2.2. Bikinis

- 7.2.3. Other Product Types

- 7.3. Market Analysis, Insights and Forecast - by Category

- 7.3.1. Mass

- 7.3.2. Premium

- 7.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.4.1. Online Stores

- 7.4.2. Offline Stores

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Women's Swimwear Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Sports Swimwear

- 8.1.2. Regular/Leisure Swimwear

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. One-piece

- 8.2.2. Bikinis

- 8.2.3. Other Product Types

- 8.3. Market Analysis, Insights and Forecast - by Category

- 8.3.1. Mass

- 8.3.2. Premium

- 8.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.4.1. Online Stores

- 8.4.2. Offline Stores

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Women's Swimwear Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Sports Swimwear

- 9.1.2. Regular/Leisure Swimwear

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. One-piece

- 9.2.2. Bikinis

- 9.2.3. Other Product Types

- 9.3. Market Analysis, Insights and Forecast - by Category

- 9.3.1. Mass

- 9.3.2. Premium

- 9.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.4.1. Online Stores

- 9.4.2. Offline Stores

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Women's Swimwear Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Sports Swimwear

- 10.1.2. Regular/Leisure Swimwear

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. One-piece

- 10.2.2. Bikinis

- 10.2.3. Other Product Types

- 10.3. Market Analysis, Insights and Forecast - by Category

- 10.3.1. Mass

- 10.3.2. Premium

- 10.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.4.1. Online Stores

- 10.4.2. Offline Stores

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 LVMH Moet Hennessy Louis Vuitton

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Adidas AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Missioni SpA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 LA Perla

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Puma Inc *List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Chanel Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 La Jolla Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Swimwear Anywhere Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pentland Group PLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Marysia LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 LVMH Moet Hennessy Louis Vuitton

List of Figures

- Figure 1: Global Women's Swimwear Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Women's Swimwear Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Women's Swimwear Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Women's Swimwear Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 5: North America Women's Swimwear Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Women's Swimwear Industry Revenue (Million), by Category 2025 & 2033

- Figure 7: North America Women's Swimwear Industry Revenue Share (%), by Category 2025 & 2033

- Figure 8: North America Women's Swimwear Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 9: North America Women's Swimwear Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Women's Swimwear Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Women's Swimwear Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Women's Swimwear Industry Revenue (Million), by Type 2025 & 2033

- Figure 13: Europe Women's Swimwear Industry Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Women's Swimwear Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Europe Women's Swimwear Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Women's Swimwear Industry Revenue (Million), by Category 2025 & 2033

- Figure 17: Europe Women's Swimwear Industry Revenue Share (%), by Category 2025 & 2033

- Figure 18: Europe Women's Swimwear Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 19: Europe Women's Swimwear Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 20: Europe Women's Swimwear Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Women's Swimwear Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Women's Swimwear Industry Revenue (Million), by Type 2025 & 2033

- Figure 23: Asia Pacific Women's Swimwear Industry Revenue Share (%), by Type 2025 & 2033

- Figure 24: Asia Pacific Women's Swimwear Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 25: Asia Pacific Women's Swimwear Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 26: Asia Pacific Women's Swimwear Industry Revenue (Million), by Category 2025 & 2033

- Figure 27: Asia Pacific Women's Swimwear Industry Revenue Share (%), by Category 2025 & 2033

- Figure 28: Asia Pacific Women's Swimwear Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific Women's Swimwear Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific Women's Swimwear Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Women's Swimwear Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: South America Women's Swimwear Industry Revenue (Million), by Type 2025 & 2033

- Figure 33: South America Women's Swimwear Industry Revenue Share (%), by Type 2025 & 2033

- Figure 34: South America Women's Swimwear Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 35: South America Women's Swimwear Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: South America Women's Swimwear Industry Revenue (Million), by Category 2025 & 2033

- Figure 37: South America Women's Swimwear Industry Revenue Share (%), by Category 2025 & 2033

- Figure 38: South America Women's Swimwear Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: South America Women's Swimwear Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: South America Women's Swimwear Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: South America Women's Swimwear Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Women's Swimwear Industry Revenue (Million), by Type 2025 & 2033

- Figure 43: Middle East and Africa Women's Swimwear Industry Revenue Share (%), by Type 2025 & 2033

- Figure 44: Middle East and Africa Women's Swimwear Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 45: Middle East and Africa Women's Swimwear Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 46: Middle East and Africa Women's Swimwear Industry Revenue (Million), by Category 2025 & 2033

- Figure 47: Middle East and Africa Women's Swimwear Industry Revenue Share (%), by Category 2025 & 2033

- Figure 48: Middle East and Africa Women's Swimwear Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 49: Middle East and Africa Women's Swimwear Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 50: Middle East and Africa Women's Swimwear Industry Revenue (Million), by Country 2025 & 2033

- Figure 51: Middle East and Africa Women's Swimwear Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Women's Swimwear Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Women's Swimwear Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Global Women's Swimwear Industry Revenue Million Forecast, by Category 2020 & 2033

- Table 4: Global Women's Swimwear Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Women's Swimwear Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Women's Swimwear Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Women's Swimwear Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Global Women's Swimwear Industry Revenue Million Forecast, by Category 2020 & 2033

- Table 9: Global Women's Swimwear Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Women's Swimwear Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Women's Swimwear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Women's Swimwear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico Women's Swimwear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of North America Women's Swimwear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global Women's Swimwear Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 16: Global Women's Swimwear Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Global Women's Swimwear Industry Revenue Million Forecast, by Category 2020 & 2033

- Table 18: Global Women's Swimwear Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 19: Global Women's Swimwear Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: United Kingdom Women's Swimwear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Germany Women's Swimwear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Women's Swimwear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Italy Women's Swimwear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Women's Swimwear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Women's Swimwear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Women's Swimwear Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Global Women's Swimwear Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 28: Global Women's Swimwear Industry Revenue Million Forecast, by Category 2020 & 2033

- Table 29: Global Women's Swimwear Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Women's Swimwear Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: China Women's Swimwear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Japan Women's Swimwear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Australia Women's Swimwear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: India Women's Swimwear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Asia Pacific Women's Swimwear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global Women's Swimwear Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 37: Global Women's Swimwear Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 38: Global Women's Swimwear Industry Revenue Million Forecast, by Category 2020 & 2033

- Table 39: Global Women's Swimwear Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 40: Global Women's Swimwear Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Brazil Women's Swimwear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Argentina Women's Swimwear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Rest of South America Women's Swimwear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Global Women's Swimwear Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 45: Global Women's Swimwear Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 46: Global Women's Swimwear Industry Revenue Million Forecast, by Category 2020 & 2033

- Table 47: Global Women's Swimwear Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 48: Global Women's Swimwear Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 49: South Africa Women's Swimwear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Saudi Arabia Women's Swimwear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East and Africa Women's Swimwear Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Women's Swimwear Industry?

The projected CAGR is approximately 2.84%.

2. Which companies are prominent players in the Women's Swimwear Industry?

Key companies in the market include LVMH Moet Hennessy Louis Vuitton, Adidas AG, Missioni SpA, LA Perla, Puma Inc *List Not Exhaustive, Chanel Group, La Jolla Group, Swimwear Anywhere Inc, Pentland Group PLC, Marysia LLC.

3. What are the main segments of the Women's Swimwear Industry?

The market segments include Type, Product Type, Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.19 Million as of 2022.

5. What are some drivers contributing to market growth?

Product Innovations to Drive Demand for Watches; Rising Demand for Premium Fashion Items.

6. What are the notable trends driving market growth?

Increasing Popularity of Swimming as a Hobby and Sport.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

March 2023: Penney IP LLC launched sports swimwear for men and women. The brand offers trendy styles with graphic print, vibrant colors, and bold silhouettes. The products are available in sizes from S-XL.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Women's Swimwear Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Women's Swimwear Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Women's Swimwear Industry?

To stay informed about further developments, trends, and reports in the Women's Swimwear Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence