Key Insights

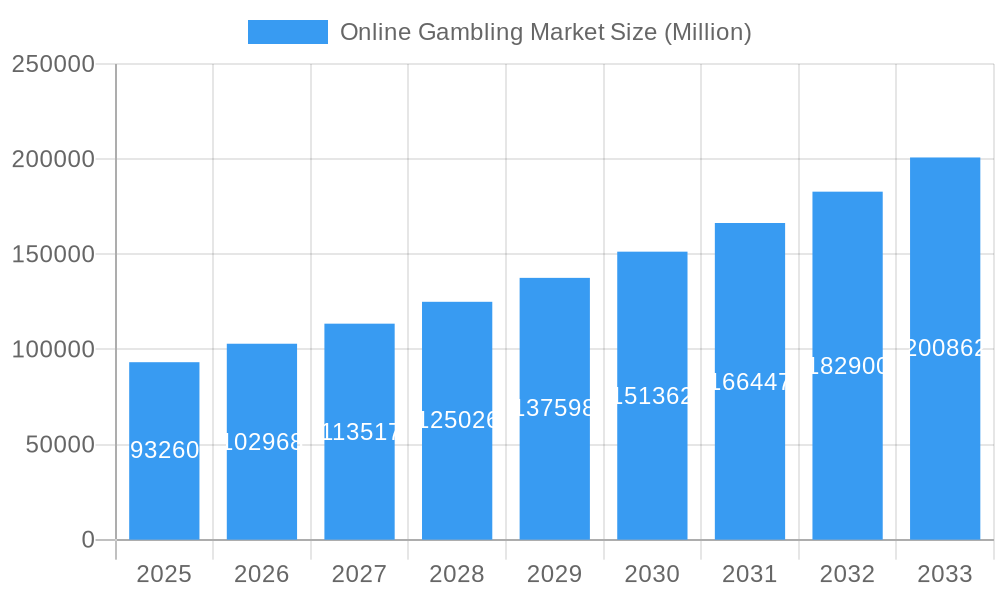

The online gambling market is experiencing robust growth, projected to reach a market size of $93.26 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 10.44% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing accessibility of high-speed internet and mobile devices has significantly broadened the market's reach, enabling participation from a wider demographic. Furthermore, the continuous innovation in gaming technology, including the development of immersive and engaging virtual reality experiences and the integration of cryptocurrency payment options, are attracting new players and increasing engagement. The legalization and regulation of online gambling in several key markets are also contributing significantly to the market's growth, fostering a more secure and trustworthy environment for both operators and users. However, challenges remain, including concerns around responsible gaming and the need for robust regulatory frameworks to mitigate potential risks such as addiction and fraud. The competitive landscape is also intense, with established players and new entrants vying for market share.

Online Gambling Market Market Size (In Billion)

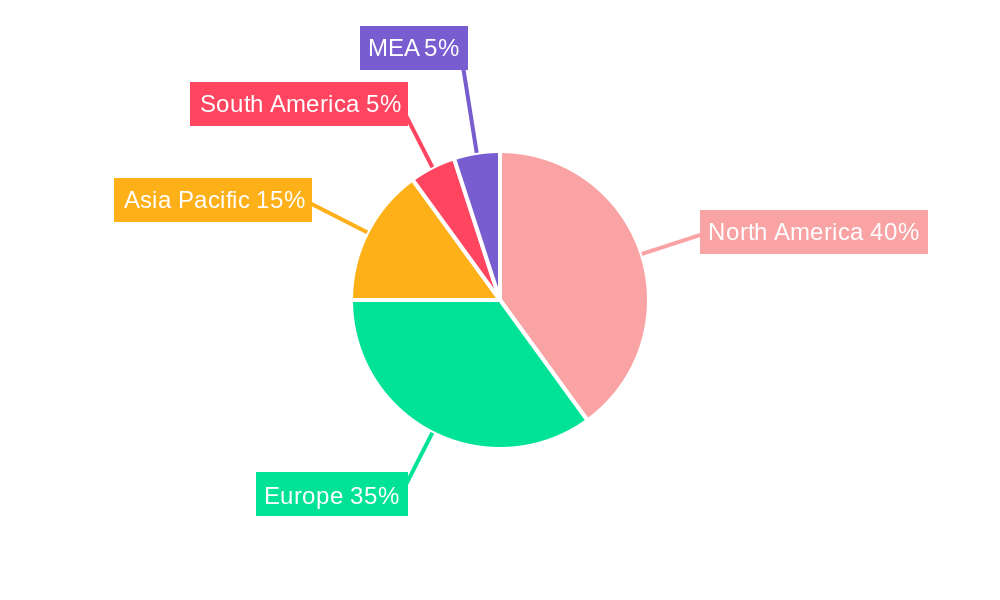

Segment-wise, sports betting and casino games (including slots, table games, and live dealer options) are currently the most dominant segments, but the "Other Casino Games" segment, encompassing lottery and bingo, holds significant growth potential, driven by increasing popularity and the accessibility offered by online platforms. From a geographical perspective, North America and Europe currently dominate the market, but the Asia-Pacific region exhibits particularly high growth potential owing to increasing internet penetration and the rising disposable incomes in emerging economies. The mobile segment is experiencing the fastest growth rate, surpassing desktop usage as the preferred platform for online gambling, reflecting the widespread adoption of smartphones and tablets. This trend is expected to continue, further fueling the expansion of the overall market. Companies like MGM Resorts International, DraftKings Inc., Flutter Entertainment PLC, and others are strategically investing in technological advancements and marketing efforts to capitalize on these trends.

Online Gambling Market Company Market Share

Online Gambling Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global online gambling market, encompassing historical performance (2019-2024), current estimations (2025), and future projections (2025-2033). Valued at xx Million in 2025, the market is poised for significant growth, driven by technological advancements, evolving consumer preferences, and strategic market expansions. This report is invaluable for stakeholders seeking to understand market dynamics, identify key players, and capitalize on emerging opportunities within this rapidly evolving industry.

Online Gambling Market Composition & Trends

This section delves into the intricate structure of the online gambling market, analyzing its concentration, innovative drivers, regulatory landscape, and competitive dynamics. We examine the market share distribution amongst key players like MGM Resorts International, DraftKings Inc, Flutter Entertainment PLC, Betsson AB, Super Group (SGHC Limited), 888 Holdings PLC, Entain PLC, Bet, Kindred Group PLC, and 22bet (list not exhaustive), assessing their strategic moves and market influence. The report also meticulously details mergers and acquisitions (M&A) activities, providing insights into deal values and their impact on market consolidation. The analysis covers various segments based on game type (Sports Betting, Casino, Lottery, Bingo), end-user devices (Desktop, Mobile), and regional variations, revealing significant trends and market concentrations. We identify key innovation catalysts, including the integration of advanced technologies such as VR/AR and the evolution of mobile gaming, and evaluate the regulatory landscape's impact on market growth and competition. Analysis of substitute products and their market impact is also included.

- Market Concentration: xx% held by top 5 players in 2025.

- M&A Activity (2019-2024): Total deal value estimated at xx Million.

- Regulatory Landscape: Analysis of key regional regulations and their impact on market access.

Online Gambling Market Industry Evolution

This section provides a detailed examination of the online gambling market's trajectory, analyzing growth rates, technological advancements, and evolving consumer preferences from 2019 to 2033. We explore the impact of technological innovations, such as improved mobile interfaces, enhanced user experience, and the rise of esports betting, on market expansion. Furthermore, the report investigates shifting consumer demands, including preferences for specific game types, payment methods, and platform features. Data points such as year-on-year growth rates, adoption rates of new technologies, and consumer behavior patterns are meticulously analyzed to provide a comprehensive understanding of the market's dynamic evolution. We project a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). The analysis will also explore the evolving landscape of responsible gambling initiatives and their impact on the industry.

Leading Regions, Countries, or Segments in Online Gambling Market

This section identifies and analyzes the leading regions, countries, and segments within the online gambling market. We pinpoint the dominant segment(s), whether it be Sports Betting, Casino games, Lottery, Bingo, or a combination thereof, and provide a detailed analysis of the factors contributing to their dominance. The analysis considers various aspects, including:

- Sports Betting: High growth potential driven by increasing popularity of esports and live betting.

- Casino Games: Strong market presence due to diverse game offerings and high engagement rates.

- Lottery & Bingo: Steady growth fueled by accessible platforms and loyal customer bases.

- Mobile vs. Desktop: Analysis of market share distribution between mobile and desktop platforms, and the factors influencing this split.

For each leading segment, we detail key drivers such as investment trends, regulatory support, and consumer preferences. Regional variations and country-specific market analysis is also included, highlighting factors influencing market leadership in specific geographic areas.

Online Gambling Market Product Innovations

The online gambling industry is characterized by constant innovation. Recent developments include the integration of advanced technologies such as virtual and augmented reality (VR/AR) to create immersive gaming experiences, and the personalization of gaming platforms through AI-powered recommendations. New game formats, enhanced payment systems, and improved mobile applications are continually being introduced to enhance user experience and engagement. These innovations are directly reflected in improved key performance indicators (KPIs) like customer retention rates, average revenue per user (ARPU), and overall market growth.

Propelling Factors for Online Gambling Market Growth

Several key factors fuel the growth of the online gambling market. Technological advancements, like the proliferation of smartphones and high-speed internet, have made online gaming more accessible and convenient. Favorable regulatory environments in some regions have also opened up new markets and increased participation. Furthermore, economic factors such as rising disposable incomes in certain regions contribute to increased spending on entertainment and gaming activities. The increasing popularity of esports betting is also significantly driving market expansion.

Obstacles in the Online Gambling Market

The online gambling market faces several challenges. Stringent regulations and licensing requirements in many jurisdictions create barriers to entry and limit market expansion. Concerns about problem gambling and responsible gaming initiatives may also impose additional compliance costs and operational limitations. Intense competition among established and emerging players puts pressure on pricing and profitability. Furthermore, potential supply chain disruptions, such as those caused by geopolitical instability, could impact the delivery of services.

Future Opportunities in Online Gambling Market

Future opportunities abound in the online gambling sector. Expansion into new and emerging markets presents significant growth potential, especially in regions with developing digital infrastructures. The adoption of new technologies, such as blockchain for enhanced security and transparency, offers exciting possibilities. Finally, catering to the evolving preferences of a younger, more tech-savvy generation of gamblers will unlock significant market growth opportunities.

Major Players in the Online Gambling Market Ecosystem

- MGM Resorts International

- DraftKings Inc

- Flutter Entertainment PLC

- Betsson AB

- Super Group (SGHC Limited)

- 888 Holdings PLC

- Entain PLC

- Bet

- Kindred Group PLC

- 22bet

Key Developments in Online Gambling Market Industry

- September 2023: Bet365 partnered with Gaming Realms, expanding its online gaming content.

- June 2023: Groupe Partouche and Betsson AB launched online casino services in Belgium.

- June 2023: Bet365 officially launched in Iowa, USA.

Strategic Online Gambling Market Forecast

The online gambling market is projected to experience robust growth over the forecast period (2025-2033), driven by continuous technological innovation, expansion into new markets, and the increasing popularity of various gaming formats. The market’s potential is significant, with opportunities for both established players and new entrants. Strategic partnerships, acquisitions, and the development of innovative products will play crucial roles in shaping the market’s future. The integration of emerging technologies and a focus on responsible gambling practices will be key to sustainable and responsible growth.

Online Gambling Market Segmentation

-

1. Game Type

-

1.1. Sports Betting

- 1.1.1. Football

- 1.1.2. Horse Racing

- 1.1.3. Tennis

- 1.1.4. Other Sports

-

1.2. Casino

- 1.2.1. Live Casino

- 1.2.2. Baccarat

- 1.2.3. Blackjack

- 1.2.4. Poker

- 1.2.5. Slots

- 1.2.6. Others Casino Games

- 1.3. Lottery

- 1.4. Bingo

-

1.1. Sports Betting

-

2. End User

- 2.1. Desktop

- 2.2. Mobile

Online Gambling Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Sweden

- 2.5. Spain

- 2.6. Italy

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. Oceanic Countries

- 3.2. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Online Gambling Market Regional Market Share

Geographic Coverage of Online Gambling Market

Online Gambling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.44% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Aggressive Advertisement And Promotional Activities; Advancement In Security

- 3.2.2 Encryption

- 3.2.3 And Streaming Technology

- 3.3. Market Restrains

- 3.3.1. Regulatory and Legal Challenges

- 3.4. Market Trends

- 3.4.1. Various Sponsorships and Convenient Payment Options are Driving the Online Gambling Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Game Type

- 5.1.1. Sports Betting

- 5.1.1.1. Football

- 5.1.1.2. Horse Racing

- 5.1.1.3. Tennis

- 5.1.1.4. Other Sports

- 5.1.2. Casino

- 5.1.2.1. Live Casino

- 5.1.2.2. Baccarat

- 5.1.2.3. Blackjack

- 5.1.2.4. Poker

- 5.1.2.5. Slots

- 5.1.2.6. Others Casino Games

- 5.1.3. Lottery

- 5.1.4. Bingo

- 5.1.1. Sports Betting

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Desktop

- 5.2.2. Mobile

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Game Type

- 6. North America Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Game Type

- 6.1.1. Sports Betting

- 6.1.1.1. Football

- 6.1.1.2. Horse Racing

- 6.1.1.3. Tennis

- 6.1.1.4. Other Sports

- 6.1.2. Casino

- 6.1.2.1. Live Casino

- 6.1.2.2. Baccarat

- 6.1.2.3. Blackjack

- 6.1.2.4. Poker

- 6.1.2.5. Slots

- 6.1.2.6. Others Casino Games

- 6.1.3. Lottery

- 6.1.4. Bingo

- 6.1.1. Sports Betting

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Desktop

- 6.2.2. Mobile

- 6.1. Market Analysis, Insights and Forecast - by Game Type

- 7. Europe Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Game Type

- 7.1.1. Sports Betting

- 7.1.1.1. Football

- 7.1.1.2. Horse Racing

- 7.1.1.3. Tennis

- 7.1.1.4. Other Sports

- 7.1.2. Casino

- 7.1.2.1. Live Casino

- 7.1.2.2. Baccarat

- 7.1.2.3. Blackjack

- 7.1.2.4. Poker

- 7.1.2.5. Slots

- 7.1.2.6. Others Casino Games

- 7.1.3. Lottery

- 7.1.4. Bingo

- 7.1.1. Sports Betting

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Desktop

- 7.2.2. Mobile

- 7.1. Market Analysis, Insights and Forecast - by Game Type

- 8. Asia Pacific Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Game Type

- 8.1.1. Sports Betting

- 8.1.1.1. Football

- 8.1.1.2. Horse Racing

- 8.1.1.3. Tennis

- 8.1.1.4. Other Sports

- 8.1.2. Casino

- 8.1.2.1. Live Casino

- 8.1.2.2. Baccarat

- 8.1.2.3. Blackjack

- 8.1.2.4. Poker

- 8.1.2.5. Slots

- 8.1.2.6. Others Casino Games

- 8.1.3. Lottery

- 8.1.4. Bingo

- 8.1.1. Sports Betting

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Desktop

- 8.2.2. Mobile

- 8.1. Market Analysis, Insights and Forecast - by Game Type

- 9. Rest of the World Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Game Type

- 9.1.1. Sports Betting

- 9.1.1.1. Football

- 9.1.1.2. Horse Racing

- 9.1.1.3. Tennis

- 9.1.1.4. Other Sports

- 9.1.2. Casino

- 9.1.2.1. Live Casino

- 9.1.2.2. Baccarat

- 9.1.2.3. Blackjack

- 9.1.2.4. Poker

- 9.1.2.5. Slots

- 9.1.2.6. Others Casino Games

- 9.1.3. Lottery

- 9.1.4. Bingo

- 9.1.1. Sports Betting

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Desktop

- 9.2.2. Mobile

- 9.1. Market Analysis, Insights and Forecast - by Game Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Mgm Resorts International

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Draftkings Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Flutter Entertainment PLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Betsson AB

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Super Group (sghc Limited) *List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 888 Holdings PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Entain PLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Bet

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Kindred Group PLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 22bet

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Mgm Resorts International

List of Figures

- Figure 1: Global Online Gambling Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Online Gambling Market Revenue (Million), by Game Type 2025 & 2033

- Figure 3: North America Online Gambling Market Revenue Share (%), by Game Type 2025 & 2033

- Figure 4: North America Online Gambling Market Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Online Gambling Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Online Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Online Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Online Gambling Market Revenue (Million), by Game Type 2025 & 2033

- Figure 9: Europe Online Gambling Market Revenue Share (%), by Game Type 2025 & 2033

- Figure 10: Europe Online Gambling Market Revenue (Million), by End User 2025 & 2033

- Figure 11: Europe Online Gambling Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Online Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Online Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Online Gambling Market Revenue (Million), by Game Type 2025 & 2033

- Figure 15: Asia Pacific Online Gambling Market Revenue Share (%), by Game Type 2025 & 2033

- Figure 16: Asia Pacific Online Gambling Market Revenue (Million), by End User 2025 & 2033

- Figure 17: Asia Pacific Online Gambling Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Online Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Online Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Online Gambling Market Revenue (Million), by Game Type 2025 & 2033

- Figure 21: Rest of the World Online Gambling Market Revenue Share (%), by Game Type 2025 & 2033

- Figure 22: Rest of the World Online Gambling Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Rest of the World Online Gambling Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Rest of the World Online Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Online Gambling Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 2: Global Online Gambling Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Online Gambling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 5: Global Online Gambling Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 12: Global Online Gambling Market Revenue Million Forecast, by End User 2020 & 2033

- Table 13: Global Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Germany Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Sweden Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 22: Global Online Gambling Market Revenue Million Forecast, by End User 2020 & 2033

- Table 23: Global Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Oceanic Countries Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 27: Global Online Gambling Market Revenue Million Forecast, by End User 2020 & 2033

- Table 28: Global Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: South America Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Middle East and Africa Online Gambling Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Gambling Market?

The projected CAGR is approximately 10.44%.

2. Which companies are prominent players in the Online Gambling Market?

Key companies in the market include Mgm Resorts International, Draftkings Inc, Flutter Entertainment PLC, Betsson AB, Super Group (sghc Limited) *List Not Exhaustive, 888 Holdings PLC, Entain PLC, Bet, Kindred Group PLC, 22bet.

3. What are the main segments of the Online Gambling Market?

The market segments include Game Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 93.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Advertisement And Promotional Activities; Advancement In Security. Encryption. And Streaming Technology.

6. What are the notable trends driving market growth?

Various Sponsorships and Convenient Payment Options are Driving the Online Gambling Industry.

7. Are there any restraints impacting market growth?

Regulatory and Legal Challenges.

8. Can you provide examples of recent developments in the market?

In September 2023, Bet365 partnered with mobile-focused gaming content provider Gaming Realms. Following the agreement, Gaming Realms provides Bet365 with its online gaming content selection. Slingo Rainbow Riches and Slingo Lobstermania are included in the provider's collection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Online Gambling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Online Gambling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Online Gambling Market?

To stay informed about further developments, trends, and reports in the Online Gambling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence