Key Insights

The North American online gambling market is experiencing robust growth, driven by increasing smartphone penetration, evolving consumer preferences towards convenient digital entertainment, and the gradual legalization and regulation of online gambling across various states and provinces. The market's Compound Annual Growth Rate (CAGR) of 11.78% from 2019 to 2024 indicates a significant upward trajectory. This growth is fueled by the popularity of various game types, with sports betting and casino games, including slots and table games, leading the charge. The convenience of mobile platforms significantly contributes to market expansion, as players readily access games from their smartphones and tablets. However, regulatory hurdles and concerns regarding responsible gambling remain key restraints. While some states have fully embraced online gambling, others maintain restrictions, creating a fragmented market landscape. Despite these challenges, the market's substantial growth potential is undeniable, with projections indicating continued expansion throughout the forecast period (2025-2033). The segmentation by device (desktop and mobile) and game type (sports betting, casino, other casino games) provides crucial insights into consumer preferences and market dynamics. Major players like Caesars Entertainment, DraftKings, and Flutter Entertainment are aggressively competing to capture market share through technological innovation, strategic acquisitions, and targeted marketing campaigns. The North American market's dominance within the global online gambling sector reflects the region's technological advancement, high disposable income levels, and significant interest in various forms of gaming entertainment.

North America Online Gambling Market Market Size (In Billion)

The future of the North American online gambling market hinges on several factors. Continued regulatory changes will play a pivotal role, with the potential for broader legalization across states unlocking substantial market growth. Technological advancements, particularly in areas such as virtual reality and augmented reality gaming, are poised to enhance the player experience and attract new demographics. Furthermore, the ongoing emphasis on responsible gambling initiatives will shape the industry's sustainability and public perception. Competition among established players and emerging entrants will continue to intensify, driving innovation and potentially leading to mergers and acquisitions. Analyzing market trends and player behavior will be critical for companies seeking long-term success in this dynamic and evolving market. A data-driven approach to marketing and product development will be essential for effective strategy.

North America Online Gambling Market Company Market Share

North America Online Gambling Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the North America online gambling market, encompassing its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable data-driven insights for stakeholders seeking to understand and capitalize on this rapidly evolving market. The market size in 2025 is estimated at xx Million.

North America Online Gambling Market Composition & Trends

The North American online gambling market is characterized by a dynamic interplay of factors influencing its growth and evolution. Market concentration is moderate, with a few dominant players alongside numerous smaller operators. Innovation is driven by technological advancements in game development, payment processing, and user experience. The regulatory landscape varies significantly across states and provinces, creating both opportunities and challenges. Substitute products, such as traditional casinos and other forms of entertainment, exert competitive pressure. End-user profiles are diversifying, with increasing participation from younger demographics and varied socioeconomic groups. Mergers and acquisitions (M&A) are frequent, reflecting industry consolidation and strategic expansion.

- Market Share Distribution (2025): DraftKings holds an estimated xx% market share, followed by Flutter Entertainment PLC at xx%, and Caesars Entertainment Corporation at xx%. The remaining market share is distributed among numerous smaller operators.

- M&A Activity (2019-2024): Total M&A deal value exceeded xx Million, with notable transactions including DraftKings’ acquisition of Golden Nugget Online Gaming and 888 Holdings’ acquisition of William Hill's non-US business.

North America Online Gambling Market Industry Evolution

The North American online gambling market has experienced significant growth over the past few years, driven by factors such as increased internet penetration, relaxation of regulatory restrictions in several jurisdictions, and the rising popularity of mobile gaming. Technological advancements such as improved user interfaces, virtual reality integration, and enhanced security features have further propelled market expansion. Consumer demand is shifting towards more immersive and personalized gaming experiences.

- Growth Rate (2019-2024): The market experienced a Compound Annual Growth Rate (CAGR) of xx%, and is projected to grow at a CAGR of xx% during the forecast period (2025-2033).

- Mobile Gaming Adoption: Mobile devices now account for over xx% of total online gambling activity, signifying a significant shift towards mobile-first gaming.

Leading Regions, Countries, or Segments in North America Online Gambling Market

The market is experiencing diverse growth across regions, segments, and device types.

- Dominant Region: New Jersey and Pennsylvania currently lead in terms of revenue generation and regulatory maturity for online gambling, owing to their relatively progressive regulatory frameworks. Other states with legalized online gambling continue to gain traction.

- Dominant Segment (Game Type): Sports betting currently holds the largest market share, followed by online casino games and other casino games, such as poker and bingo. This is due to the significant popularity of sports betting, especially amongst the younger population.

- Dominant Segment (Device): Mobile is the dominant segment, with a significant growth driven by user convenience and accessibility.

Key Drivers:

- Investment Trends: Significant capital investment in technology, marketing, and expansion has fueled market growth, particularly in regions with favorable regulatory environments.

- Regulatory Support: Progressive legislation in several states has fostered legal and regulated online gambling, driving market expansion while ensuring responsible gaming practices.

North America Online Gambling Market Product Innovations

Recent product innovations focus on enhanced user experience, personalized gaming features, and integration of advanced technologies such as artificial intelligence and blockchain. Many operators are implementing features like live dealer games, virtual reality gaming experiences, and loyalty programs to enhance customer engagement and retention. The focus is on developing unique selling propositions and offering a wider array of game types to attract and retain players.

Propelling Factors for North America Online Gambling Market Growth

Several factors are driving the growth of the North American online gambling market. These include the increasing accessibility and affordability of internet and mobile devices, expanding regulatory acceptance in multiple states, and the continuous innovation in game design, leading to a more engaging user experience. The rising popularity of sports betting is also a substantial growth driver. Furthermore, targeted marketing campaigns and strategic partnerships are enhancing the industry’s reach and appeal to wider demographics.

Obstacles in the North America Online Gambling Market

Significant obstacles remain. The complex and fragmented regulatory landscape across different states presents challenges for operators seeking nationwide expansion. Stringent regulatory compliance requirements, including KYC (Know Your Customer) protocols and anti-money laundering measures, add to operational complexity and costs. Competition among established and emerging operators is intense, leading to price wars and pressure on profitability. The potential for illegal offshore gambling continues to affect market growth in some regions.

Future Opportunities in North America Online Gambling Market

Expansion into new states legalizing online gambling represents significant future opportunities. Technological advancements such as virtual reality and augmented reality offer potential for creating highly immersive gaming experiences, enhancing player engagement and market share. Increasing integration with other forms of entertainment and social media platforms, including esports and interactive streaming, holds significant potential for further growth. Also, data-driven personalized marketing can significantly improve player acquisition and retention.

Major Players in the North America Online Gambling Market Ecosystem

- Caesars Entertainment Corporation

- Flutter Entertainment PLC

- 888 Holding PLC

- DraftKings (Golden Nugget)

- Slots Empire Casino

- El Royale Casino

- The Stars Group Inc

- BoVegas

- Cherry Gold Casino

- MGM Resorts International (Borgata Hotel Casino & Spa)

- Wild Casino

Key Developments in North America Online Gambling Market Industry

- July 2022: 888 Holdings acquired William Hill's non-US business from Caesars Entertainment. This acquisition significantly expanded 888 Holdings' global presence and market share.

- May 2022: DraftKings acquired Golden Nugget Online Gaming (GNOG), strengthening its market position and enhancing its product offerings.

- July 2021: FanDuel Group, a Flutter Entertainment subsidiary, expanded its FanDuel Casino offerings in New Jersey and Michigan, further solidifying its presence in the growing online casino market.

Strategic North America Online Gambling Market Forecast

The North American online gambling market is poised for sustained growth, driven by continuous technological innovation, expanding legal frameworks, and increasing consumer adoption. The market's future potential is significant, especially in states yet to legalize online gambling, creating immense opportunities for market expansion and revenue generation for established and new operators alike. Strategic partnerships and investments in technological advancements will be crucial for operators looking to secure a leading position in this dynamic and rapidly evolving market.

North America Online Gambling Market Segmentation

-

1. Game Type

- 1.1. Sports Betting

-

1.2. Casino

- 1.2.1. Live Casino

- 1.2.2. Slots

- 1.2.3. Baccarat

- 1.2.4. Blackjack

- 1.2.5. Poker

- 1.2.6. Other Casino Games

- 1.3. Other Game Types

-

2. Device

- 2.1. Desktop

- 2.2. Mobile

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of the North America

North America Online Gambling Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of the North America

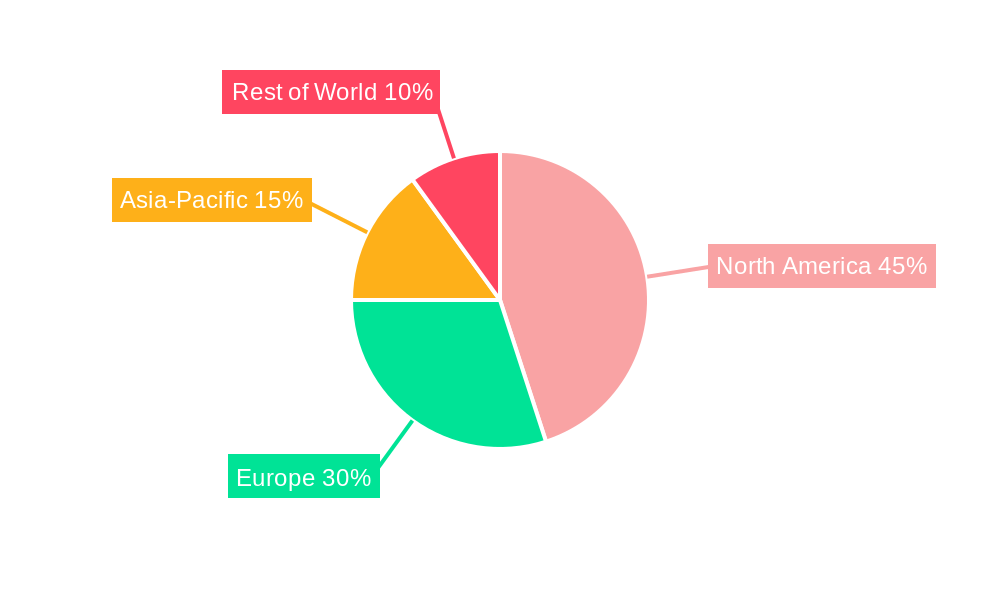

North America Online Gambling Market Regional Market Share

Geographic Coverage of North America Online Gambling Market

North America Online Gambling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shift in Shopping Mode Preferences of the people; Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-priced products and additional delivery charges; Inconsistency in product quality

- 3.4. Market Trends

- 3.4.1. The Increasing Adoption of Internet and Internet-based Devices Supports Market Growth.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Game Type

- 5.1.1. Sports Betting

- 5.1.2. Casino

- 5.1.2.1. Live Casino

- 5.1.2.2. Slots

- 5.1.2.3. Baccarat

- 5.1.2.4. Blackjack

- 5.1.2.5. Poker

- 5.1.2.6. Other Casino Games

- 5.1.3. Other Game Types

- 5.2. Market Analysis, Insights and Forecast - by Device

- 5.2.1. Desktop

- 5.2.2. Mobile

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of the North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of the North America

- 5.1. Market Analysis, Insights and Forecast - by Game Type

- 6. United States North America Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Game Type

- 6.1.1. Sports Betting

- 6.1.2. Casino

- 6.1.2.1. Live Casino

- 6.1.2.2. Slots

- 6.1.2.3. Baccarat

- 6.1.2.4. Blackjack

- 6.1.2.5. Poker

- 6.1.2.6. Other Casino Games

- 6.1.3. Other Game Types

- 6.2. Market Analysis, Insights and Forecast - by Device

- 6.2.1. Desktop

- 6.2.2. Mobile

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of the North America

- 6.1. Market Analysis, Insights and Forecast - by Game Type

- 7. Canada North America Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Game Type

- 7.1.1. Sports Betting

- 7.1.2. Casino

- 7.1.2.1. Live Casino

- 7.1.2.2. Slots

- 7.1.2.3. Baccarat

- 7.1.2.4. Blackjack

- 7.1.2.5. Poker

- 7.1.2.6. Other Casino Games

- 7.1.3. Other Game Types

- 7.2. Market Analysis, Insights and Forecast - by Device

- 7.2.1. Desktop

- 7.2.2. Mobile

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of the North America

- 7.1. Market Analysis, Insights and Forecast - by Game Type

- 8. Mexico North America Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Game Type

- 8.1.1. Sports Betting

- 8.1.2. Casino

- 8.1.2.1. Live Casino

- 8.1.2.2. Slots

- 8.1.2.3. Baccarat

- 8.1.2.4. Blackjack

- 8.1.2.5. Poker

- 8.1.2.6. Other Casino Games

- 8.1.3. Other Game Types

- 8.2. Market Analysis, Insights and Forecast - by Device

- 8.2.1. Desktop

- 8.2.2. Mobile

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of the North America

- 8.1. Market Analysis, Insights and Forecast - by Game Type

- 9. Rest of the North America North America Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Game Type

- 9.1.1. Sports Betting

- 9.1.2. Casino

- 9.1.2.1. Live Casino

- 9.1.2.2. Slots

- 9.1.2.3. Baccarat

- 9.1.2.4. Blackjack

- 9.1.2.5. Poker

- 9.1.2.6. Other Casino Games

- 9.1.3. Other Game Types

- 9.2. Market Analysis, Insights and Forecast - by Device

- 9.2.1. Desktop

- 9.2.2. Mobile

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of the North America

- 9.1. Market Analysis, Insights and Forecast - by Game Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Slots Empire Casino

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 El Royale Casino

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Caesars Entertainment Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Flutter Entertainment PLC

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 The Stars Group Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 BoVegas

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 888 Holding PLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Cherry Gold Casino*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 MGM Resorts International (Borgata Hotel Casino & Spa)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Wild Casino

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 DraftKings (Golden Nugget

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Slots Empire Casino

List of Figures

- Figure 1: North America Online Gambling Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Online Gambling Market Share (%) by Company 2025

List of Tables

- Table 1: North America Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 2: North America Online Gambling Market Revenue Million Forecast, by Device 2020 & 2033

- Table 3: North America Online Gambling Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: North America Online Gambling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 6: North America Online Gambling Market Revenue Million Forecast, by Device 2020 & 2033

- Table 7: North America Online Gambling Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: North America Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 10: North America Online Gambling Market Revenue Million Forecast, by Device 2020 & 2033

- Table 11: North America Online Gambling Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: North America Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 14: North America Online Gambling Market Revenue Million Forecast, by Device 2020 & 2033

- Table 15: North America Online Gambling Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: North America Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: North America Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 18: North America Online Gambling Market Revenue Million Forecast, by Device 2020 & 2033

- Table 19: North America Online Gambling Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: North America Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Online Gambling Market?

The projected CAGR is approximately 11.78%.

2. Which companies are prominent players in the North America Online Gambling Market?

Key companies in the market include Slots Empire Casino, El Royale Casino, Caesars Entertainment Corporation, Flutter Entertainment PLC, The Stars Group Inc, BoVegas, 888 Holding PLC, Cherry Gold Casino*List Not Exhaustive, MGM Resorts International (Borgata Hotel Casino & Spa), Wild Casino, DraftKings (Golden Nugget.

3. What are the main segments of the North America Online Gambling Market?

The market segments include Game Type, Device, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Shift in Shopping Mode Preferences of the people; Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

The Increasing Adoption of Internet and Internet-based Devices Supports Market Growth..

7. Are there any restraints impacting market growth?

High-priced products and additional delivery charges; Inconsistency in product quality.

8. Can you provide examples of recent developments in the market?

July 2022: 888 Holdings acquired William Hill's non-US business from Caesars Entertainment. William Hill is a popular online gambling platform brand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Online Gambling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Online Gambling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Online Gambling Market?

To stay informed about further developments, trends, and reports in the North America Online Gambling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence