Key Insights

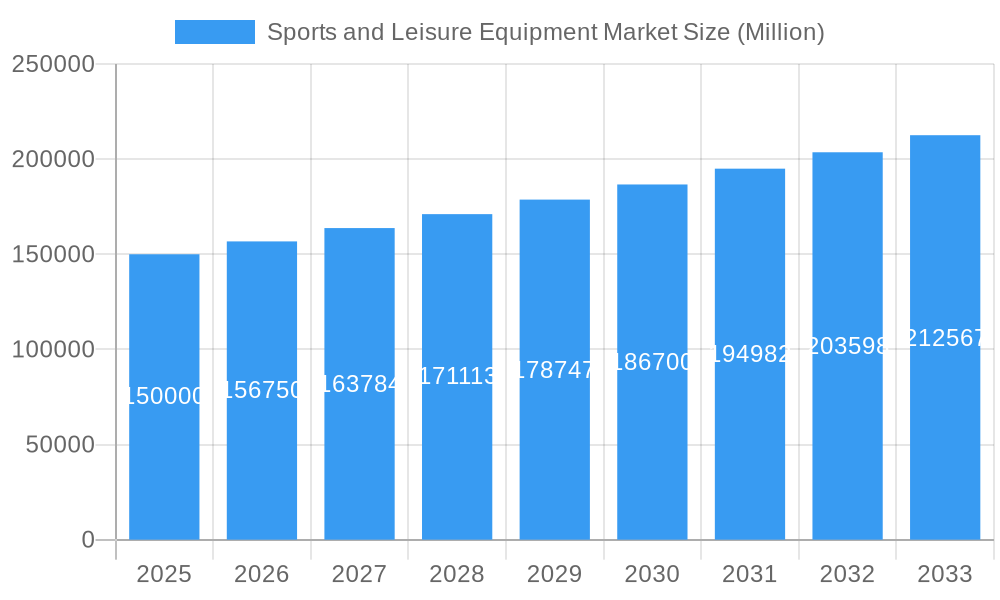

The global Sports and Leisure Equipment Market is projected for substantial growth, anticipated to reach $10 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 1.3% through 2033. This expansion is driven by increased health and wellness focus, rising disposable incomes in emerging economies, and the growing popularity of organized sports, fitness events, and adventure tourism. Technological innovations, such as smart features in wearable devices and performance-enhancing gear, are also boosting market dynamism.

Sports and Leisure Equipment Market Market Size (In Billion)

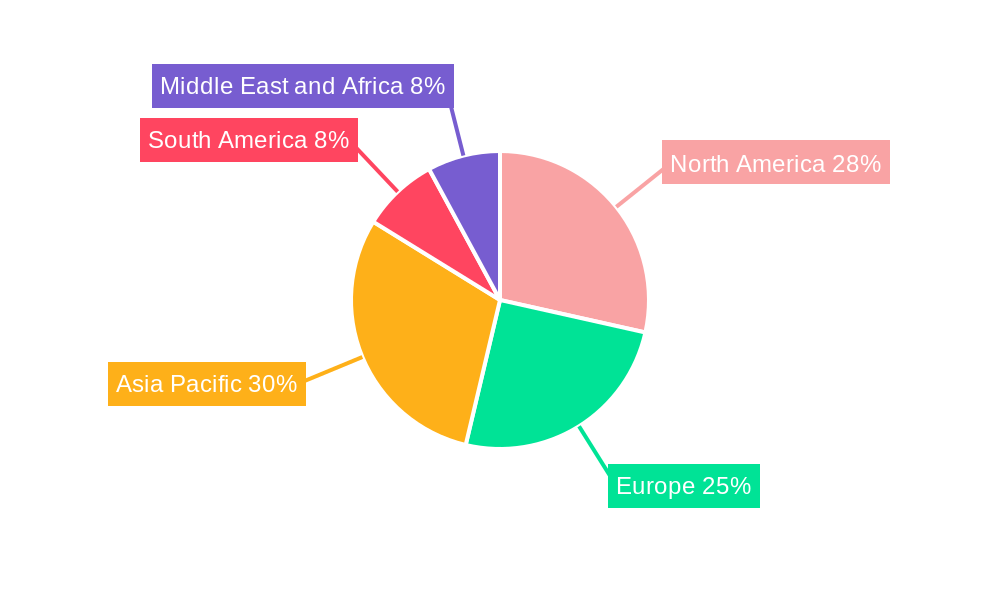

Key growth segments include Ball Sports Equipment, driven by enduring popularity, and Fitness Sports Equipment, fueled by the booming health club and home fitness sectors. Adventure Sports Equipment is also experiencing significant expansion due to the rise in outdoor recreation. Online retail is rapidly emerging as a dominant distribution channel, offering convenience and wide selections, alongside traditional channels like supermarkets and specialty stores. The Asia Pacific region, particularly China and India, is a major growth engine, while North America and Europe remain significant mature markets.

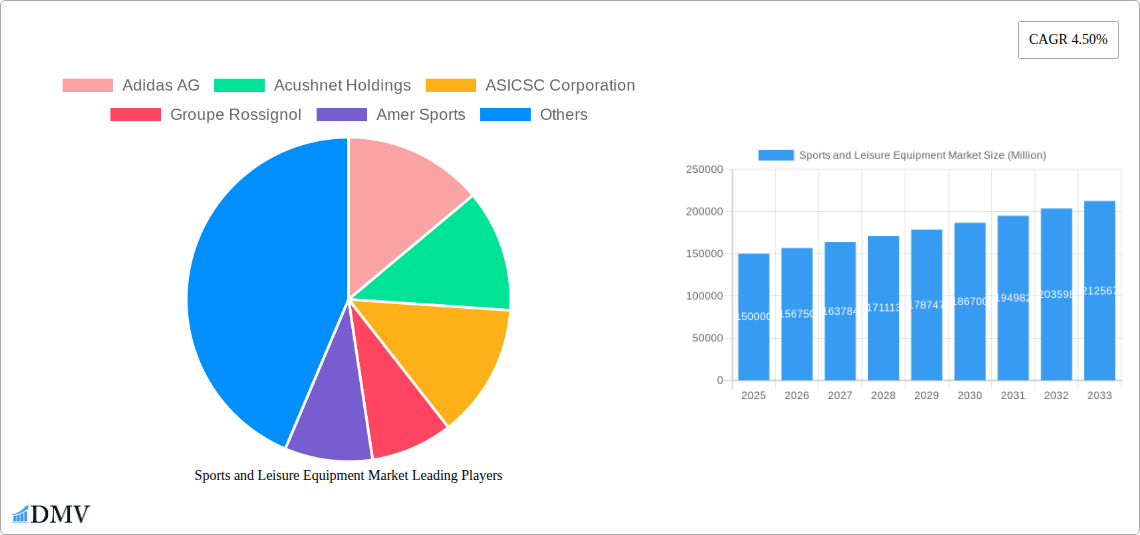

Sports and Leisure Equipment Market Company Market Share

This report provides a strategic overview of the global Sports and Leisure Equipment Market, analyzing trends and future projections from 2019 to 2033. With a base year of 2025, it offers critical insights for stakeholders in sports apparel, fitness equipment, outdoor gear, and golf equipment industries, highlighting key growth segments, regional dominance, and emerging opportunities.

Sports and Leisure Equipment Market Market Composition & Trends

The Sports and Leisure Equipment Market exhibits a moderate to high level of concentration, with key players like Nike Inc., Adidas AG, and Puma SE dominating significant market share. Innovation remains a primary catalyst, driven by advancements in material science, smart technology integration into fitness equipment, and a growing consumer demand for sustainable and performance-enhancing products. Regulatory landscapes, while generally supportive of sports and recreational activities, can vary by region concerning product safety standards and environmental impact. Substitute products, particularly from emerging brands and direct-to-consumer (DTC) models, pose a growing challenge to established players. End-user profiles are increasingly diverse, spanning professional athletes, fitness enthusiasts, outdoor adventurers, and casual participants, each with unique purchasing behaviors and product preferences. Mergers and acquisitions (M&A) activities are strategically aimed at expanding product portfolios, gaining access to new technologies, and consolidating market presence. For instance, M&A deal values are projected to reach billions of US dollars annually, reflecting the strategic importance of consolidation.

- Market Concentration: Dominated by a few major global brands, but with increasing competition from niche players.

- Innovation Catalysts: Advanced materials, smart technology, sustainability, personalized fitness solutions.

- Regulatory Landscapes: Product safety, environmental compliance, import/export regulations.

- Substitute Products: DTC brands, rental services, lower-cost alternatives.

- End-User Profiles: Athletes (professional & amateur), fitness enthusiasts, outdoor adventurers, families, seniors.

- M&A Activities: Strategic acquisitions for market expansion, technology integration, and portfolio diversification.

Sports and Leisure Equipment Market Industry Evolution

The Sports and Leisure Equipment Market has undergone a significant evolution, driven by shifting consumer preferences, technological breakthroughs, and increasing global participation in sports and recreational activities. Over the historical period (2019-2024), the market experienced robust growth, fueled by a heightened awareness of health and wellness, particularly accelerated by the global pandemic. This period saw a surge in demand for home fitness equipment, outdoor adventure gear, and personalized athletic wear. Technological advancements have been pivotal, with the integration of smart sensors, wearable technology, and advanced material composites revolutionizing product performance and user experience. For instance, the adoption of performance-enhancing fabrics in athletic apparel saw a growth rate of approximately 8% annually during this period. Furthermore, the rise of e-commerce platforms has democratized access to sports equipment, enabling brands to reach a wider consumer base and fostering a more competitive market.

The base year (2025) marks a transition where established trends continue, but new dynamics are emerging. The fitness sports equipment segment, in particular, is projected to witness a Compound Annual Growth Rate (CAGR) of around 7.5% during the forecast period (2025-2033). This growth is underpinned by innovations in connected fitness solutions, personalized training apps, and the development of ergonomic and space-saving equipment for home use. The adventure sports equipment segment is also poised for substantial expansion, with a projected CAGR of approximately 6.8%, driven by increased disposable income, a growing interest in eco-tourism, and the accessibility of new adventure destinations. Golf equipment, while a mature segment, continues to see innovation with a CAGR of around 4.5%, particularly in areas like advanced club technology and personalized ball performance.

The industry's evolution is further characterized by a greater emphasis on sustainability and ethical manufacturing practices. Consumers are increasingly scrutinizing the environmental footprint of the products they purchase, pushing manufacturers to adopt eco-friendly materials and production processes. This shift is not just a trend but a fundamental change that will shape product development and brand loyalty in the coming years. The COVID-19 pandemic served as a powerful catalyst for many of these changes, accelerating the adoption of digital solutions and reinforcing the importance of personal well-being. As we move through the forecast period, the market's trajectory will be shaped by continued technological innovation, evolving consumer demands for customization and sustainability, and the ongoing expansion of global sports participation.

Leading Regions, Countries, or Segments in Sports and Leisure Equipment Market

The global Sports and Leisure Equipment Market is characterized by significant regional variations and dominant segments. North America and Europe currently lead in terms of market value and consumer spending, driven by a high disposable income, a well-established sports culture, and a strong emphasis on health and fitness. The United States, in particular, stands out as a dominant country within the North American region, accounting for a substantial portion of global sales in sports and leisure equipment. This dominance is fueled by a large and engaged consumer base, significant investment in sports infrastructure, and the presence of major global sports brands and retailers.

Within the Type segment, Fitness Sports Equipment has emerged as a leading category, exhibiting exceptional growth. This is largely attributable to the increasing health consciousness among consumers, the proliferation of home-based workouts, and technological innovations in smart fitness devices and connected gym equipment. The CAGR for this segment is projected to be around 7.5% during the forecast period. Ball Sports Equipment and Golf Equipment remain significant contributors, with consistent demand from amateur and professional participants. Adventure Sports Equipment is also experiencing rapid expansion, propelled by a growing interest in outdoor activities and eco-tourism.

In terms of Distribution Channels, Online Retail Stores have become a dominant force, transforming how consumers access sports and leisure equipment. The convenience, wider selection, and competitive pricing offered by e-commerce platforms have led to a significant shift in purchasing behavior. This channel is projected to continue its strong growth trajectory throughout the forecast period, with a CAGR estimated at over 9%. Speciality Stores also maintain a crucial role, offering expert advice and a curated selection of high-performance gear, particularly for niche sports. Supermarkets/Hypermarkets cater to a broader, more casual consumer base for basic sporting goods.

Key Drivers for Dominance:

- North America & Europe: High disposable income, robust sports culture, strong health and wellness trends, extensive retail infrastructure.

- United States: Large consumer base, significant investment in sports, presence of major brands.

- Fitness Sports Equipment: Increasing health awareness, home fitness trend, technological advancements in smart equipment.

- Online Retail Stores: Convenience, accessibility, competitive pricing, wider product variety, effective digital marketing.

- Investment Trends: Increased venture capital funding for sports tech startups and e-commerce platforms.

- Regulatory Support: Government initiatives promoting sports participation and healthy lifestyles.

The interplay of these factors—regional economic strength, specific segment demands, and evolving distribution strategies—collectively shapes the leadership positions within the Sports and Leisure Equipment Market. The continued growth of online retail and the persistent demand for fitness-focused products are poised to be major determinants of market leadership in the coming years.

Sports and Leisure Equipment Market Product Innovations

Product innovation in the Sports and Leisure Equipment Market is characterized by a relentless pursuit of enhanced performance, user comfort, and technological integration. Companies are investing heavily in advanced material science, leading to lighter, stronger, and more durable equipment. For instance, the use of graphene-infused composites in tennis rackets and golf clubs is improving power transfer and vibration dampening. Smart technology integration is another significant trend, with connected fitness equipment offering real-time performance tracking, personalized coaching, and gamified workout experiences. The Lululemon Blissfeel running shoe launch exemplifies this, focusing on women's specific biomechanics. Furthermore, sustainability is driving innovation in material sourcing and manufacturing processes, with brands exploring recycled plastics, organic cotton, and biodegradable components.

Propelling Factors for Sports and Leisure Equipment Market Growth

The Sports and Leisure Equipment Market is propelled by several key factors. A significant driver is the escalating global emphasis on health and wellness, encouraging more individuals to engage in physical activities. Technological advancements, such as wearable fitness trackers and smart home gym equipment, further enhance user engagement and performance, contributing to market expansion. The increasing disposable income in emerging economies also fuels demand as more consumers can afford sports and leisure equipment. Furthermore, government initiatives promoting sports participation and outdoor recreation create a favorable environment for market growth. The growing popularity of adventure sports and outdoor activities, coupled with effective marketing strategies by leading brands, also plays a crucial role.

- Health and Wellness Trend: Increased consumer focus on physical and mental well-being.

- Technological Advancements: Smart devices, connected fitness, advanced materials.

- Rising Disposable Income: Particularly in emerging economies, enabling greater purchasing power.

- Government Initiatives: Promotion of sports, outdoor recreation, and healthy lifestyles.

- Growth of Adventure Sports: Increasing participation in activities like hiking, cycling, and water sports.

Obstacles in the Sports and Leisure Equipment Market Market

Despite its robust growth potential, the Sports and Leisure Equipment Market faces several obstacles. Intense competition from both established global players and emerging direct-to-consumer (DTC) brands can lead to price wars and reduced profit margins. Supply chain disruptions, as witnessed in recent years due to geopolitical events and logistical challenges, can impact product availability and increase costs. Regulatory hurdles in different regions, concerning product safety, environmental standards, and import/export policies, can also pose challenges for market expansion. Furthermore, economic downturns or recessions can lead to reduced consumer spending on discretionary items like sports equipment.

- Intense Competition: Price pressures and market saturation.

- Supply Chain Vulnerabilities: Disruptions affecting availability and costs.

- Regulatory Compliance: Navigating diverse international standards and policies.

- Economic Volatility: Impact of recessions on discretionary spending.

Future Opportunities in Sports and Leisure Equipment Market

The Sports and Leisure Equipment Market is ripe with future opportunities. The burgeoning market for personalized and customizable sports equipment presents a significant avenue for growth, catering to individual needs and preferences. The increasing demand for sustainable and eco-friendly products offers a strong niche for brands focusing on ethical manufacturing and materials. Expansion into emerging markets with growing middle classes and increasing interest in sports offers substantial untapped potential. Furthermore, the integration of virtual and augmented reality (VR/AR) into sports training and gaming offers innovative pathways for engagement and product development. Collaborations between sports equipment manufacturers and technology companies will likely lead to groundbreaking advancements.

- Personalization & Customization: Tailored products for individual athletes and enthusiasts.

- Sustainability & Eco-Friendly Products: Growing consumer demand for responsible consumption.

- Emerging Markets: Untapped potential in developing economies with rising incomes.

- VR/AR Integration: Innovative applications in training, gaming, and experience.

Major Players in the Sports and Leisure Equipment Market Ecosystem

- Adidas AG

- Acushnet Holdings

- ASICSC Corporation

- Groupe Rossignol

- Amer Sports

- New Balance

- Puma SE

- Callaway Golf

- Nike Inc

- Under Armour

Key Developments in Sports and Leisure Equipment Market Industry

- March 2022: Lululemon launched the Blissfeel running shoe, the first of four shoes it planned to release in women's sizes that year. The company also announced the summer 2022 launch of Chargefeel, a cross-training shoe, in two styles: low-top and mid-top.

- March 2022: Puma extended its partnership with W Series, the international single-seater motor racing championship for female drivers, signing Finnish driver Emma Kimiläinen for the Puma W Series Team in 2022.

- February 2022: Callaway Golf announced new Chrome Soft X and Chrome Soft X LS Golf balls, incorporating unique precision technology for tightest dispersion, consistent ball speeds, and overall performance.

Strategic Sports and Leisure Equipment Market Market Forecast

The strategic outlook for the Sports and Leisure Equipment Market is highly positive, driven by enduring trends in health and wellness, continuous technological innovation, and expanding global participation in sports. The forecast period (2025-2033) is expected to witness sustained growth, fueled by the increasing demand for smart fitness solutions, sustainable products, and the burgeoning adventure sports segment. The expansion of online retail channels will continue to democratize access and foster market competition, while emerging economies present significant untapped potential. Strategic investments in R&D, coupled with a focus on customer-centric product development and sustainable practices, will be critical for capitalizing on these opportunities and ensuring long-term market leadership.

Sports and Leisure Equipment Market Segmentation

-

1. Type

- 1.1. Ball Sports Equipment

- 1.2. Fitness Sports Equipment

- 1.3. Adventure Sports Equipment

- 1.4. Golf Equipment

- 1.5. Other Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Speciality Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

Sports and Leisure Equipment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Sports and Leisure Equipment Market Regional Market Share

Geographic Coverage of Sports and Leisure Equipment Market

Sports and Leisure Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations Leading to Ban on Smokeless Tobacco

- 3.4. Market Trends

- 3.4.1. Increased Sports Participation Rate Owing to Favorable Government Initiatives

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sports and Leisure Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ball Sports Equipment

- 5.1.2. Fitness Sports Equipment

- 5.1.3. Adventure Sports Equipment

- 5.1.4. Golf Equipment

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Speciality Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Sports and Leisure Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Ball Sports Equipment

- 6.1.2. Fitness Sports Equipment

- 6.1.3. Adventure Sports Equipment

- 6.1.4. Golf Equipment

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Speciality Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Sports and Leisure Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Ball Sports Equipment

- 7.1.2. Fitness Sports Equipment

- 7.1.3. Adventure Sports Equipment

- 7.1.4. Golf Equipment

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Speciality Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Sports and Leisure Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Ball Sports Equipment

- 8.1.2. Fitness Sports Equipment

- 8.1.3. Adventure Sports Equipment

- 8.1.4. Golf Equipment

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Speciality Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Sports and Leisure Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Ball Sports Equipment

- 9.1.2. Fitness Sports Equipment

- 9.1.3. Adventure Sports Equipment

- 9.1.4. Golf Equipment

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Speciality Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Sports and Leisure Equipment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Ball Sports Equipment

- 10.1.2. Fitness Sports Equipment

- 10.1.3. Adventure Sports Equipment

- 10.1.4. Golf Equipment

- 10.1.5. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Speciality Stores

- 10.2.3. Online Retail Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Adidas AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Acushnet Holdings

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ASICSC Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Groupe Rossignol

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Amer Sports

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 New Balance

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Puma SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Callaway Golf*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nike Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Under Armour

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Adidas AG

List of Figures

- Figure 1: Global Sports and Leisure Equipment Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Sports and Leisure Equipment Market Volume Breakdown (K Units , %) by Region 2025 & 2033

- Figure 3: North America Sports and Leisure Equipment Market Revenue (billion), by Type 2025 & 2033

- Figure 4: North America Sports and Leisure Equipment Market Volume (K Units ), by Type 2025 & 2033

- Figure 5: North America Sports and Leisure Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Sports and Leisure Equipment Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Sports and Leisure Equipment Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 8: North America Sports and Leisure Equipment Market Volume (K Units ), by Distribution Channel 2025 & 2033

- Figure 9: North America Sports and Leisure Equipment Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Sports and Leisure Equipment Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America Sports and Leisure Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Sports and Leisure Equipment Market Volume (K Units ), by Country 2025 & 2033

- Figure 13: North America Sports and Leisure Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Sports and Leisure Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Sports and Leisure Equipment Market Revenue (billion), by Type 2025 & 2033

- Figure 16: Europe Sports and Leisure Equipment Market Volume (K Units ), by Type 2025 & 2033

- Figure 17: Europe Sports and Leisure Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Sports and Leisure Equipment Market Volume Share (%), by Type 2025 & 2033

- Figure 19: Europe Sports and Leisure Equipment Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 20: Europe Sports and Leisure Equipment Market Volume (K Units ), by Distribution Channel 2025 & 2033

- Figure 21: Europe Sports and Leisure Equipment Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Europe Sports and Leisure Equipment Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 23: Europe Sports and Leisure Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Sports and Leisure Equipment Market Volume (K Units ), by Country 2025 & 2033

- Figure 25: Europe Sports and Leisure Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Sports and Leisure Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Sports and Leisure Equipment Market Revenue (billion), by Type 2025 & 2033

- Figure 28: Asia Pacific Sports and Leisure Equipment Market Volume (K Units ), by Type 2025 & 2033

- Figure 29: Asia Pacific Sports and Leisure Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Sports and Leisure Equipment Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Asia Pacific Sports and Leisure Equipment Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 32: Asia Pacific Sports and Leisure Equipment Market Volume (K Units ), by Distribution Channel 2025 & 2033

- Figure 33: Asia Pacific Sports and Leisure Equipment Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 34: Asia Pacific Sports and Leisure Equipment Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 35: Asia Pacific Sports and Leisure Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 36: Asia Pacific Sports and Leisure Equipment Market Volume (K Units ), by Country 2025 & 2033

- Figure 37: Asia Pacific Sports and Leisure Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Sports and Leisure Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Sports and Leisure Equipment Market Revenue (billion), by Type 2025 & 2033

- Figure 40: South America Sports and Leisure Equipment Market Volume (K Units ), by Type 2025 & 2033

- Figure 41: South America Sports and Leisure Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: South America Sports and Leisure Equipment Market Volume Share (%), by Type 2025 & 2033

- Figure 43: South America Sports and Leisure Equipment Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 44: South America Sports and Leisure Equipment Market Volume (K Units ), by Distribution Channel 2025 & 2033

- Figure 45: South America Sports and Leisure Equipment Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: South America Sports and Leisure Equipment Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: South America Sports and Leisure Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 48: South America Sports and Leisure Equipment Market Volume (K Units ), by Country 2025 & 2033

- Figure 49: South America Sports and Leisure Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Sports and Leisure Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Sports and Leisure Equipment Market Revenue (billion), by Type 2025 & 2033

- Figure 52: Middle East and Africa Sports and Leisure Equipment Market Volume (K Units ), by Type 2025 & 2033

- Figure 53: Middle East and Africa Sports and Leisure Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East and Africa Sports and Leisure Equipment Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East and Africa Sports and Leisure Equipment Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 56: Middle East and Africa Sports and Leisure Equipment Market Volume (K Units ), by Distribution Channel 2025 & 2033

- Figure 57: Middle East and Africa Sports and Leisure Equipment Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Middle East and Africa Sports and Leisure Equipment Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Middle East and Africa Sports and Leisure Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 60: Middle East and Africa Sports and Leisure Equipment Market Volume (K Units ), by Country 2025 & 2033

- Figure 61: Middle East and Africa Sports and Leisure Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Sports and Leisure Equipment Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Sports and Leisure Equipment Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Sports and Leisure Equipment Market Volume K Units Forecast, by Type 2020 & 2033

- Table 3: Global Sports and Leisure Equipment Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Sports and Leisure Equipment Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Sports and Leisure Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Sports and Leisure Equipment Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Global Sports and Leisure Equipment Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Sports and Leisure Equipment Market Volume K Units Forecast, by Type 2020 & 2033

- Table 9: Global Sports and Leisure Equipment Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Sports and Leisure Equipment Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global Sports and Leisure Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Sports and Leisure Equipment Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: United States Sports and Leisure Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Sports and Leisure Equipment Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 15: Canada Sports and Leisure Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Sports and Leisure Equipment Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 17: Mexico Sports and Leisure Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Sports and Leisure Equipment Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 19: Rest of North America Sports and Leisure Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of North America Sports and Leisure Equipment Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 21: Global Sports and Leisure Equipment Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Global Sports and Leisure Equipment Market Volume K Units Forecast, by Type 2020 & 2033

- Table 23: Global Sports and Leisure Equipment Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 24: Global Sports and Leisure Equipment Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 25: Global Sports and Leisure Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global Sports and Leisure Equipment Market Volume K Units Forecast, by Country 2020 & 2033

- Table 27: Spain Sports and Leisure Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Spain Sports and Leisure Equipment Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 29: United Kingdom Sports and Leisure Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Sports and Leisure Equipment Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 31: Germany Sports and Leisure Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Germany Sports and Leisure Equipment Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 33: France Sports and Leisure Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: France Sports and Leisure Equipment Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 35: Italy Sports and Leisure Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Italy Sports and Leisure Equipment Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 37: Russia Sports and Leisure Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Russia Sports and Leisure Equipment Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Sports and Leisure Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Europe Sports and Leisure Equipment Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 41: Global Sports and Leisure Equipment Market Revenue billion Forecast, by Type 2020 & 2033

- Table 42: Global Sports and Leisure Equipment Market Volume K Units Forecast, by Type 2020 & 2033

- Table 43: Global Sports and Leisure Equipment Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 44: Global Sports and Leisure Equipment Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global Sports and Leisure Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 46: Global Sports and Leisure Equipment Market Volume K Units Forecast, by Country 2020 & 2033

- Table 47: China Sports and Leisure Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: China Sports and Leisure Equipment Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 49: Japan Sports and Leisure Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Japan Sports and Leisure Equipment Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 51: India Sports and Leisure Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: India Sports and Leisure Equipment Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 53: Australia Sports and Leisure Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Australia Sports and Leisure Equipment Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 55: Rest of Asia Pacific Sports and Leisure Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: Rest of Asia Pacific Sports and Leisure Equipment Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 57: Global Sports and Leisure Equipment Market Revenue billion Forecast, by Type 2020 & 2033

- Table 58: Global Sports and Leisure Equipment Market Volume K Units Forecast, by Type 2020 & 2033

- Table 59: Global Sports and Leisure Equipment Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 60: Global Sports and Leisure Equipment Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 61: Global Sports and Leisure Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 62: Global Sports and Leisure Equipment Market Volume K Units Forecast, by Country 2020 & 2033

- Table 63: Brazil Sports and Leisure Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: Brazil Sports and Leisure Equipment Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 65: Argentina Sports and Leisure Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: Argentina Sports and Leisure Equipment Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 67: Rest of South America Sports and Leisure Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: Rest of South America Sports and Leisure Equipment Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 69: Global Sports and Leisure Equipment Market Revenue billion Forecast, by Type 2020 & 2033

- Table 70: Global Sports and Leisure Equipment Market Volume K Units Forecast, by Type 2020 & 2033

- Table 71: Global Sports and Leisure Equipment Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 72: Global Sports and Leisure Equipment Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 73: Global Sports and Leisure Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 74: Global Sports and Leisure Equipment Market Volume K Units Forecast, by Country 2020 & 2033

- Table 75: South Africa Sports and Leisure Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: South Africa Sports and Leisure Equipment Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 77: United Arab Emirates Sports and Leisure Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 78: United Arab Emirates Sports and Leisure Equipment Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 79: Rest of Middle East and Africa Sports and Leisure Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 80: Rest of Middle East and Africa Sports and Leisure Equipment Market Volume (K Units ) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sports and Leisure Equipment Market?

The projected CAGR is approximately 1.3%.

2. Which companies are prominent players in the Sports and Leisure Equipment Market?

Key companies in the market include Adidas AG, Acushnet Holdings, ASICSC Corporation, Groupe Rossignol, Amer Sports, New Balance, Puma SE, Callaway Golf*List Not Exhaustive, Nike Inc, Under Armour.

3. What are the main segments of the Sports and Leisure Equipment Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 10 billion as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco.

6. What are the notable trends driving market growth?

Increased Sports Participation Rate Owing to Favorable Government Initiatives.

7. Are there any restraints impacting market growth?

Stringent Government Regulations Leading to Ban on Smokeless Tobacco.

8. Can you provide examples of recent developments in the market?

March 2022: Lululemon launched the Blissfeel running shoe, the first of four shoes it plans to release in women's sizes that year. Also, during the launch, the company announced that in summer 2022, it will launch Chargefeel, a cross-training shoe, in two styles: low-top and mid-top.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sports and Leisure Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sports and Leisure Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sports and Leisure Equipment Market?

To stay informed about further developments, trends, and reports in the Sports and Leisure Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence