Key Insights

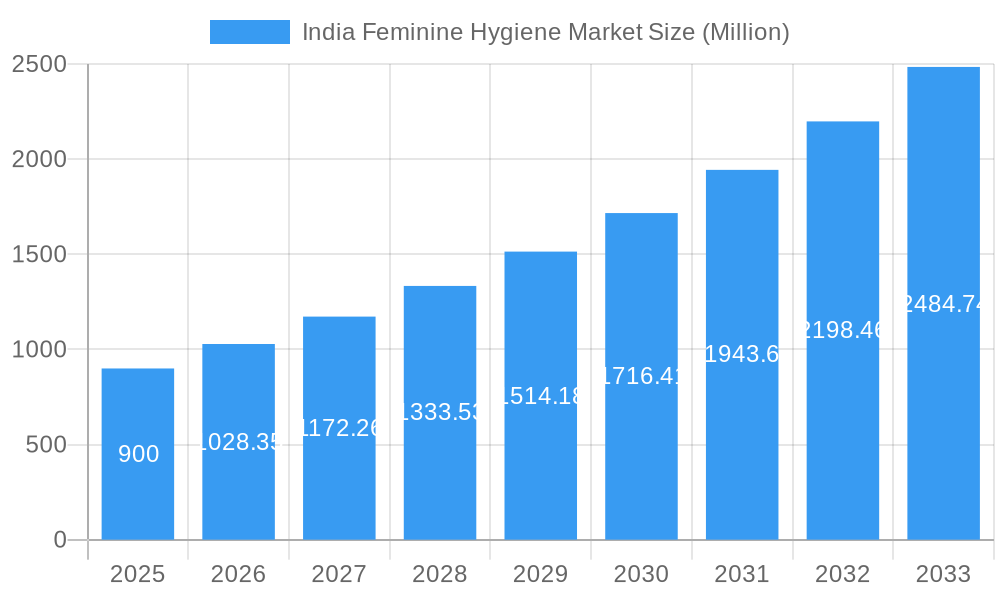

The India Feminine Hygiene Market, valued at $0.90 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 14.85% from 2025 to 2033. This expansion is driven by several key factors. Rising awareness of menstrual hygiene management (MHM), coupled with increasing disposable incomes and improved access to modern feminine hygiene products across both urban and rural areas, significantly fuels market growth. The shift towards premium and eco-friendly products like menstrual cups and organic sanitary napkins reflects changing consumer preferences and a growing focus on sustainability. Furthermore, effective marketing campaigns targeting younger generations and a wider distribution network through online channels and retail outlets are contributing to market penetration. Government initiatives promoting MHM further bolster the market's trajectory.

India Feminine Hygiene Market Market Size (In Million)

However, challenges remain. Price sensitivity, particularly in rural areas, continues to restrict market expansion for premium products. Furthermore, cultural barriers and a lack of awareness in certain regions still hinder widespread adoption of modern hygiene practices. Competition among established players like Procter & Gamble, Johnson & Johnson, and Essity, alongside the emergence of domestic brands like Redcliffe Hygiene, creates a dynamic market landscape. To capitalize on future opportunities, companies are likely to focus on product innovation, targeted marketing campaigns tailored to specific demographics, and strengthening distribution networks to reach underserved populations. The market's segmentation, encompassing various product types (sanitary napkins, tampons, menstrual cups) and distribution channels (supermarkets, pharmacies, online retailers), offers diverse avenues for growth. The Asia-Pacific region, particularly India, is anticipated to be a major growth driver due to its large and expanding female population.

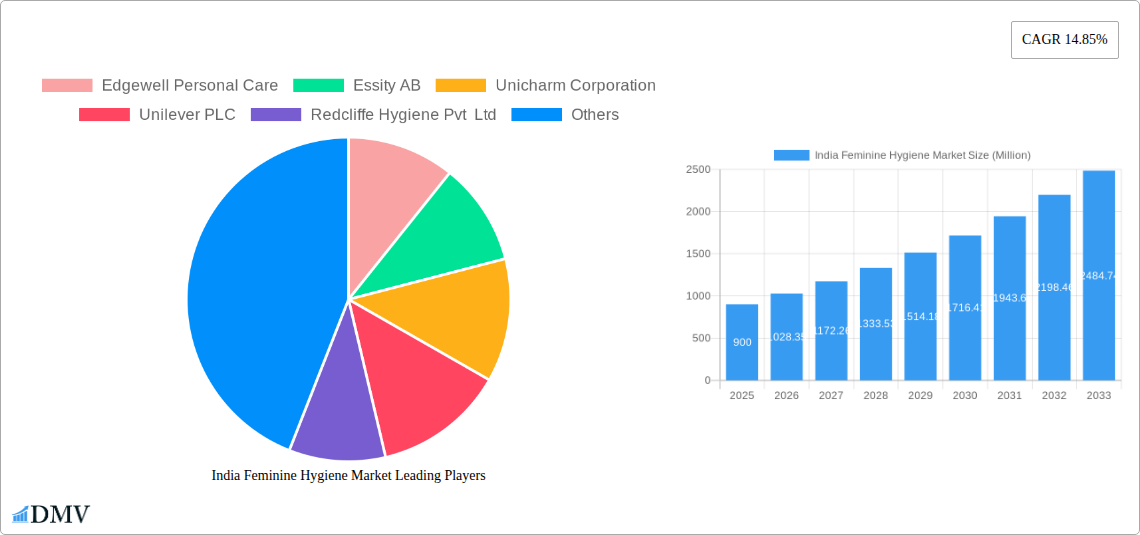

India Feminine Hygiene Market Company Market Share

India Feminine Hygiene Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the India Feminine Hygiene Market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on this dynamic market. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

India Feminine Hygiene Market Composition & Trends

The India Feminine Hygiene Market exhibits a moderately concentrated landscape, with key players like Procter & Gamble, Unilever, and Essity holding significant market share. However, the market is also witnessing a rise of smaller, innovative players focusing on sustainable and affordable solutions. This competitive dynamic is fueled by increasing consumer awareness, rising disposable incomes, and government initiatives promoting menstrual hygiene. The regulatory landscape, while evolving, is increasingly focused on product safety and standardization. Substitute products, such as menstrual cups and reusable cloth pads, are gaining traction, driven by environmental concerns and cost-effectiveness. The primary end-users are women of reproductive age, with a growing focus on addressing the needs of diverse demographics and socioeconomic groups. Mergers and acquisitions (M&A) activity has been moderate, with deal values ranging from xx Million to xx Million in recent years, primarily focused on expanding distribution networks and product portfolios.

- Market Concentration: Moderately concentrated, with a few major players dominating.

- Innovation Catalysts: Rising consumer awareness, increasing disposable incomes, and government initiatives.

- Regulatory Landscape: Evolving, focusing on product safety and standardization.

- Substitute Products: Menstrual cups and reusable cloth pads are gaining popularity.

- End-User Profiles: Women of reproductive age, with a focus on diverse demographics.

- M&A Activity: Moderate activity, with deal values ranging from xx Million to xx Million.

India Feminine Hygiene Market Industry Evolution

The India Feminine Hygiene Market has witnessed significant growth over the past few years, driven by factors such as increasing female literacy, rising urbanization, and greater access to information about menstrual hygiene. The market has transitioned from a predominantly sanitary napkin-centric market to one embracing a wider range of products, including tampons, menstrual cups, and reusable options. This shift is also propelled by technological advancements in product design and manufacturing, leading to improved absorbency, comfort, and convenience. Consumer demands are evolving, with a growing preference for eco-friendly, sustainable products and those offering enhanced hygiene and comfort. The market is experiencing an average annual growth rate (AAGR) of xx% during the historical period (2019-2024) and is projected to grow at an AAGR of xx% during the forecast period (2025-2033). Adoption rates for newer products like menstrual cups are increasing, albeit from a relatively low base. The market shows promising future growth opportunities driven by increasing awareness and improved accessibility.

Leading Regions, Countries, or Segments in India Feminine Hygiene Market

Sanitary napkins/pads remain the dominant product type in the Indian Feminine Hygiene Market, holding approximately xx% of the market share in 2025. This dominance is attributed to factors such as widespread awareness, affordability, and readily available distribution channels. Supermarkets/hypermarkets continue to be the leading distribution channel, owing to their extensive reach and established customer base. However, online retail is rapidly gaining traction, driven by increasing internet penetration and consumer preference for convenient shopping experiences.

- Key Drivers for Sanitary Napkins/Pads: Widely available, affordable, and high awareness.

- Key Drivers for Supermarkets/Hypermarkets: Extensive reach and established customer base.

- Key Drivers for Online Retail: Increasing internet penetration and consumer preference for convenience.

Dominance Factors: High population base, increasing disposable incomes and awareness, strong distribution infrastructure, particularly in urban centers and metro areas.

India Feminine Hygiene Market Product Innovations

Recent innovations in the Indian Feminine Hygiene Market include the launch of biodegradable and eco-friendly sanitary napkins, improved designs for menstrual cups focusing on ease of use, and the development of reusable cloth pads emphasizing cost-effectiveness and sustainability. These innovations are driven by growing consumer demand for sustainable and convenient options and technological advances in material science and manufacturing processes. Unique selling propositions emphasize comfort, hygiene, and environmental friendliness. Adoption rates vary, with sanitary napkins retaining significant market share while menstrual cups and reusable pads show incremental growth.

Propelling Factors for India Feminine Hygiene Market Growth

Technological advancements, such as improved manufacturing processes and material science, are driving product innovation and efficiency. Increasing disposable incomes and rising awareness of menstrual hygiene among women are significantly contributing to market growth. Favorable government policies and initiatives, including promoting menstrual hygiene awareness campaigns and providing subsidized products in rural areas, further bolster market expansion.

Obstacles in the India Feminine Hygiene Market

Regulatory hurdles, such as complex approval processes for new products, pose challenges to market expansion. Supply chain disruptions, exacerbated by factors such as raw material price volatility and transportation issues, can affect product availability and affordability. Intense competition among established players and the entry of new players also increases the pressure on profit margins and market share.

Future Opportunities in India Feminine Hygiene Market

Expansion into untapped rural markets through enhanced distribution networks presents significant potential. Technological innovations, including the use of AI and machine learning, can lead to personalized product development and improved customer experiences. Rising consumer awareness and a growing preference for eco-friendly products offer immense possibilities for sustainable and innovative products.

Major Players in the India Feminine Hygiene Market Ecosystem

- Edgewell Personal Care

- Essity AB

- Unicharm Corporation

- Unilever PLC

- Redcliffe Hygiene Pvt Ltd

- Johnson & Johnson Private Limited

- Procter & Gamble Company

- Wet and Dry Personal Care Pvt Ltd

- Tzmo SA

- Kimberly Clark Corporation

Key Developments in India Feminine Hygiene Market Industry

- MAR 2021: Care Form Labs Private Limited launched the 'Onpery Menstrual Cup,' the first novel menstrual cup designed in India.

- SEP 2021: A collaborative project launched reusable, cost-effective, and eco-friendly cloth-based sanitary napkins.

- OCT 2021: Niine Hygiene and Personal Care launched a period tracking app and WhatsApp Store Locator service.

Strategic India Feminine Hygiene Market Forecast

The India Feminine Hygiene Market is poised for substantial growth over the forecast period, driven by a confluence of factors. Increasing awareness, rising disposable incomes, technological innovations, and supportive government initiatives will collectively fuel market expansion. The market's future is bright, with opportunities for both established players and innovative entrants to thrive.

India Feminine Hygiene Market Segmentation

-

1. Product Type

- 1.1. Sanitary Napkins/Pads

- 1.2. Tampons

- 1.3. Menstrual Cups

- 1.4. Other Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Pharmacies/Drug Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

India Feminine Hygiene Market Segmentation By Geography

- 1. India

India Feminine Hygiene Market Regional Market Share

Geographic Coverage of India Feminine Hygiene Market

India Feminine Hygiene Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Natural Cosmetics; Increasing Demand for Cruelty Free Cosmetics

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Technological Evolutions and Increasing Penetration of Brands in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Feminine Hygiene Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Sanitary Napkins/Pads

- 5.1.2. Tampons

- 5.1.3. Menstrual Cups

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Pharmacies/Drug Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Edgewell Personal Care

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Essity AB

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Unicharm Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Unilever PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Redcliffe Hygiene Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Johnson & Johnson Private Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Procter & Gamble Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wet and Dry Personal Care Pvt Ltd*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tzmo SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kimberly Clark Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Edgewell Personal Care

List of Figures

- Figure 1: India Feminine Hygiene Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Feminine Hygiene Market Share (%) by Company 2025

List of Tables

- Table 1: India Feminine Hygiene Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: India Feminine Hygiene Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: India Feminine Hygiene Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Feminine Hygiene Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: India Feminine Hygiene Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: India Feminine Hygiene Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Feminine Hygiene Market?

The projected CAGR is approximately 14.85%.

2. Which companies are prominent players in the India Feminine Hygiene Market?

Key companies in the market include Edgewell Personal Care, Essity AB, Unicharm Corporation, Unilever PLC, Redcliffe Hygiene Pvt Ltd, Johnson & Johnson Private Limited, Procter & Gamble Company, Wet and Dry Personal Care Pvt Ltd*List Not Exhaustive, Tzmo SA, Kimberly Clark Corporation.

3. What are the main segments of the India Feminine Hygiene Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Natural Cosmetics; Increasing Demand for Cruelty Free Cosmetics.

6. What are the notable trends driving market growth?

Technological Evolutions and Increasing Penetration of Brands in the Market.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

OCT 2021: By ramping up its plan to streamline its promotion and distribution of sanitary napkins, Niine Hygiene and Personal Care became the first company in India to launch a period tracking app developed in consultation with medical professionals. To streamline the process of making Niine Sanitary napkins accessible to its customers, the WhatsApp Store Locator service enables customers to find the closest store where Niine Sanitary Napkins are available.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Feminine Hygiene Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Feminine Hygiene Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Feminine Hygiene Market?

To stay informed about further developments, trends, and reports in the India Feminine Hygiene Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence