Key Insights

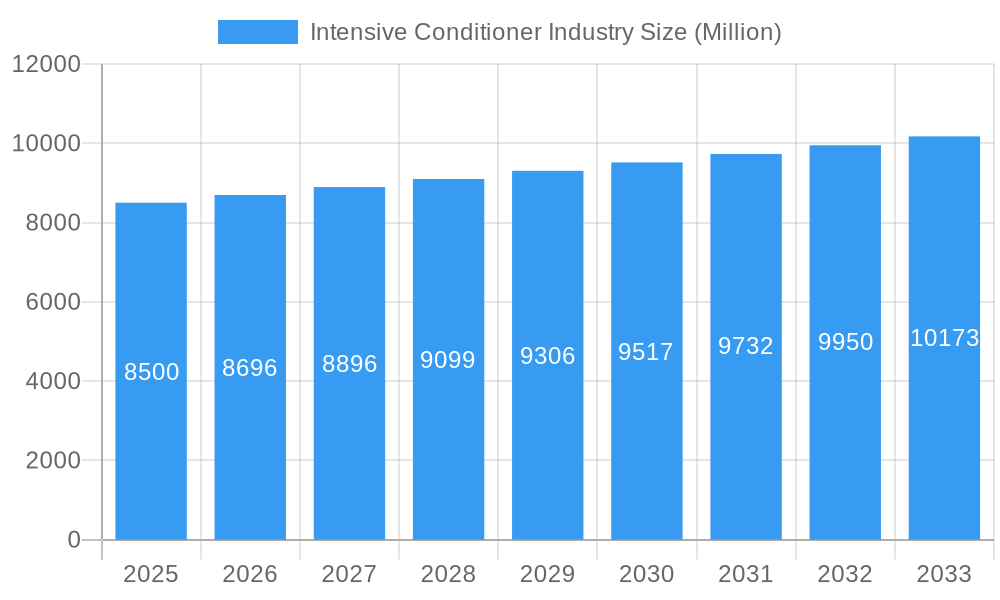

The global Intensive Conditioner market is projected to experience robust growth, reaching a market size of $5.04 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 7.31%. This expansion is driven by escalating consumer demand for advanced hair care solutions targeting damage, dryness, and frizz. Increased awareness of hair health and the pursuit of salon-quality results at home are key motivators. The market also benefits from a rising preference for natural and organic ingredients, with companies actively developing innovative formulations. Growing disposable incomes in emerging economies and the influence of social media beauty trends further contribute to this upward trajectory. Leading companies are investing in R&D to introduce novel products with enhanced benefits like heat protection, color vibrancy, and scalp health.

Intensive Conditioner Industry Market Size (In Billion)

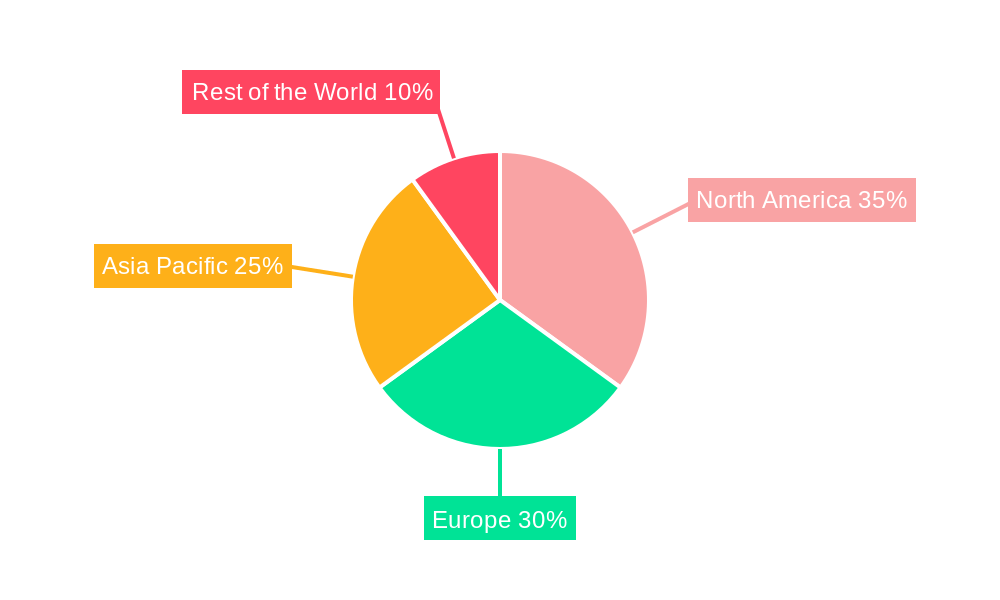

The competitive landscape features established multinational corporations and agile niche brands. Distribution channels are evolving, with online retail showing substantial growth due to convenience and broad product availability. Supermarkets and hypermarkets remain significant, while convenience stores cater to impulse buys. Geographically, North America and Europe are mature markets with high premium hair care spending. However, the Asia Pacific region presents the most substantial growth opportunities, fueled by a growing middle class and increasing adoption of Western beauty standards. Potential restraints include intense price competition and product segment saturation. Nevertheless, the trend towards personalized hair care and continuous innovation are expected to propel the Intensive Conditioner market forward.

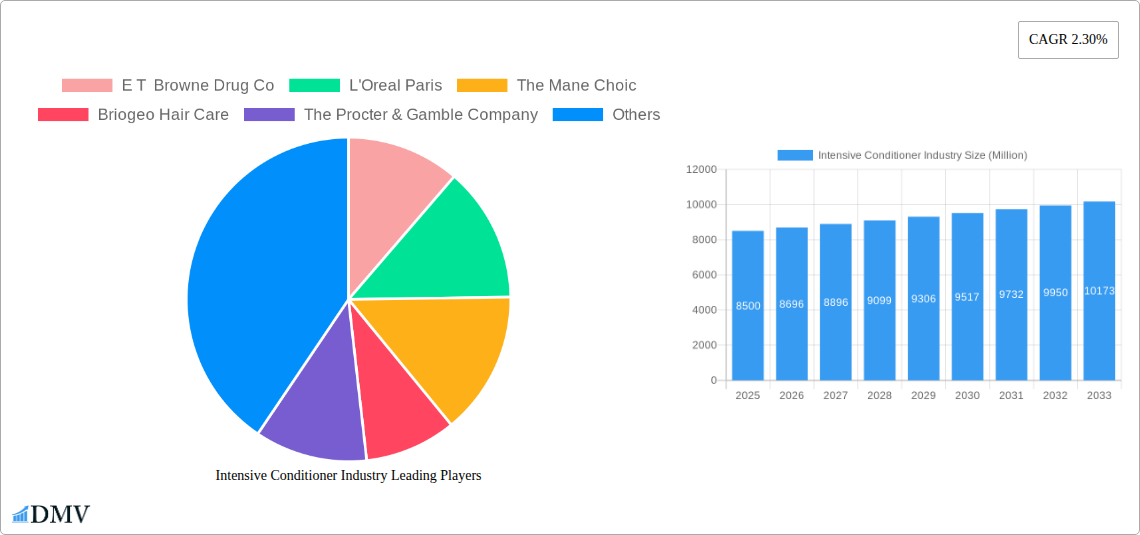

Intensive Conditioner Industry Company Market Share

This report offers an insightful analysis of the Intensive Conditioner industry, detailing market size, growth, and forecasts.

Intensive Conditioner Industry Market Composition & Trends

This comprehensive report delves into the dynamic intensive conditioner market, examining its intricate composition and evolving trends between 2019 and 2033. We meticulously analyze market concentration, identifying key players like L'Oreal Paris, The Procter & Gamble Company, and Kao Corporation who collectively command a significant market share, estimated at XX Million. The report highlights the crucial role of innovation catalysts, such as the increasing consumer demand for natural and sustainable ingredients, driving hair care product development. We evaluate the impact of regulatory landscapes on product formulations and marketing strategies, alongside an assessment of substitute products like leave-in conditioners and hair masks, which collectively shape consumer choices. Understanding end-user profiles, from individuals seeking damage repair to those prioritizing hair health, is central to our analysis. Furthermore, the report scrutinizes mergers and acquisitions (M&A) activities, with recent deals in the beauty and personal care sector valued in the hundreds of Million, indicating strategic consolidation and expansion by major entities such as E T Browne Drug Co and Briogeo Hair Care.

- Market Share Distribution: Analysis of leading companies' market share, with L'Oreal Paris holding an estimated XX Million in the base year.

- M&A Deal Values: Tracking of significant M&A transactions, with the beauty and personal care industry seeing deals exceeding XX Million in the historical period.

- Innovation Drivers: Focus on R&D investments in specialized formulations and sustainable sourcing, contributing XX Million to market growth.

Intensive Conditioner Industry Industry Evolution

The intensive conditioner industry has witnessed remarkable evolution from 2019 to 2033, marked by significant market growth trajectories, groundbreaking technological advancements, and consistently shifting consumer demands. The historical period (2019–2024) saw a compound annual growth rate (CAGR) of approximately XX%, driven by heightened awareness of hair health and the proliferation of specialized hair care solutions. The base year (2025) represents a pivotal point, with the market valued at an estimated XX Million. Looking ahead, the forecast period (2025–2033) is projected to experience a robust CAGR of XX%. Technological advancements have been instrumental, with the introduction of advanced ingredient technologies like hyaluronic acid and keratin treatments, enhancing product efficacy and leading to an adoption rate of XX% for premium formulations. Consumer demands have transitioned from basic conditioning to sophisticated needs such as color protection, heat damage repair, and scalp health. This shift is evidenced by the rising popularity of brands like The Mane Choice, which caters to specific hair types and concerns, contributing an estimated XX Million to the market. The increasing influence of social media and influencer marketing has also played a crucial role in shaping purchasing decisions, leading to a XX% increase in online sales of intensive conditioners. Furthermore, the global expansion of e-commerce platforms has democratized access to a wider array of specialized products, further propelling the industry's growth. The emphasis on clean beauty and natural ingredients has also spurred innovation, with brands increasingly focusing on plant-based formulations and ethical sourcing, creating a market segment valued at XX Million. The continuous pursuit of personalized hair care solutions, driven by advancements in AI and diagnostic tools, is expected to further segment the market and foster niche growth opportunities.

Leading Regions, Countries, or Segments in Intensive Conditioner Industry

The intensive conditioner market landscape is characterized by distinct regional dominance and segment performance, with a particular focus on the Online Retail Stores distribution channel. In the forecast period (2025–2033), Online Retail Stores are poised to emerge as the leading segment, projected to capture a market share of XX%, valued at XX Million. This dominance is fueled by several key drivers including unparalleled convenience, a wider product selection, competitive pricing, and the increasing digital penetration across demographics. The historical period (2019–2024) already indicated a strong upward trend in online sales, with an estimated XX% year-over-year growth. Countries with high internet accessibility and a digitally-savvy population, such as the United States, China, and the United Kingdom, are at the forefront of this trend, contributing significantly to the global online sales figures, estimated at XX Million in 2025. Regulatory support for e-commerce and the growing adoption of direct-to-consumer (DTC) models by brands like Briogeo Hair Care further amplify this growth trajectory. Investment trends are heavily skewed towards enhancing online infrastructure, optimizing digital marketing campaigns, and leveraging data analytics to personalize customer experiences. While Supermarkets/Hypermarkets and Convenience Stores will continue to hold a substantial presence, their market share is expected to gradually decline as consumers increasingly opt for the digital shopping experience for specialized hair care products. The ease of comparing products, reading reviews, and accessing exclusive online deals makes Online Retail Stores the preferred channel for informed purchasing decisions in the intensive conditioner industry.

- Dominant Distribution Channel: Online Retail Stores, projected to capture XX% of the market share by 2033.

- Key Regional Contributors: North America and Europe, with their high e-commerce adoption rates, expected to drive XX Million in online sales.

- Investment Trends: Significant capital allocation towards e-commerce platforms, digital marketing, and supply chain optimization for online delivery.

- Growth Drivers: Increasing internet penetration, consumer preference for convenience, and wider product availability online.

Intensive Conditioner Industry Product Innovations

Product innovation in the intensive conditioner industry is rapidly transforming hair care. The market is witnessing a surge in formulations featuring advanced ingredients like ceramides, biotin, and peptides, designed to offer deep repair and rejuvenation for damaged hair. These innovations are not merely cosmetic; they are backed by scientific research, with performance metrics demonstrating significant improvements in hair strength, shine, and manageability. Unique selling propositions often revolve around targeted solutions for specific hair concerns such as color-treated hair, heat-damaged hair, and thinning hair. Technological advancements are evident in the development of micro-encapsulation technology for sustained release of active ingredients and the incorporation of natural, ethically sourced extracts that appeal to the growing conscious consumer base. This focus on efficacy and naturalism, exemplified by brands like E T Browne Drug Co and Briogeo Hair Care, is driving market value by an estimated XX Million.

Propelling Factors for Intensive Conditioner Industry Growth

Several key factors are propelling the intensive conditioner industry forward. Technological advancements in hair care science, including the development of potent active ingredients and advanced delivery systems, are enhancing product efficacy and appeal. Growing consumer awareness regarding hair health, coupled with an increasing prevalence of hair damage due to styling and environmental factors, fuels demand for specialized treatments. The expanding middle class in emerging economies and rising disposable incomes translate to increased spending on premium beauty products. Furthermore, supportive government initiatives promoting the beauty and personal care sector and favorable trade policies contribute to market expansion. The estimated growth contribution from these factors is XX Million.

Obstacles in the Intensive Conditioner Industry Market

Despite robust growth, the intensive conditioner industry faces several obstacles. Stringent regulations regarding ingredient sourcing and product claims in certain regions can pose compliance challenges and increase development costs. Intense competition from both established brands and emerging indie labels necessitates continuous innovation and significant marketing investment, creating price pressures. Supply chain disruptions, exacerbated by global events, can impact raw material availability and distribution efficiency. Furthermore, the threat of counterfeit products and the growing consumer preference for DIY remedies can also restrain market growth, with an estimated impact of XX Million.

Future Opportunities in Intensive Conditioner Industry

The intensive conditioner industry is ripe with future opportunities. The burgeoning demand for personalized hair care solutions, leveraging AI and genetic profiling, presents a significant untapped market, potentially worth XX Million. The increasing focus on sustainability and clean beauty opens avenues for eco-friendly formulations and packaging, aligning with evolving consumer values. Expansion into untapped geographical markets, particularly in Asia-Pacific and Latin America, offers substantial growth potential. Furthermore, the integration of at-home salon-like treatments and the development of innovative delivery mechanisms, such as smart hair care devices, will redefine consumer experiences and market dynamics, projected to add XX Million.

Major Players in the Intensive Conditioner Industry Ecosystem

- E T Browne Drug Co

- L'Oreal Paris

- The Mane Choic

- Briogeo Hair Care

- The Procter & Gamble Company

- Kao Corporation

Key Developments in Intensive Conditioner Industry Industry

- 2023/08: L'Oreal Paris launches its new "Elvive Hyaluron Plump" range, featuring hyaluronic acid for intense hydration, contributing an estimated XX Million to its market share.

- 2023/05: Briogeo Hair Care introduces a vegan and cruelty-free intensive mask with algae extract, targeting a growing segment of environmentally conscious consumers, valued at XX Million.

- 2023/02: The Procter & Gamble Company announces its acquisition of a niche sustainable hair care brand for an undisclosed sum, bolstering its portfolio in the premium segment.

- 2022/11: Kao Corporation invests XX Million in R&D for advanced keratin-based hair repair technologies, aiming to enhance product efficacy.

- 2022/07: E T Browne Drug Co expands its "Palmer's" intensive treatment line with new formulations catering to specific hair textures, projecting XX Million in additional revenue.

- 2022/03: The Mane Choice launches a direct-to-consumer e-commerce platform, enhancing customer accessibility and brand engagement.

Strategic Intensive Conditioner Industry Market Forecast

The strategic intensive conditioner market forecast highlights a promising future driven by sustained innovation and evolving consumer preferences. The anticipated growth in the Online Retail Stores segment, coupled with the increasing demand for personalized and sustainable hair care solutions, presents significant opportunities. Investments in advanced ingredient technologies and ethical sourcing will further solidify market positions. The ability of major players like L'Oreal Paris and The Procter & Gamble Company to adapt to these trends and capitalize on emerging markets will be crucial for sustained success. The market is projected to reach XX Million by 2033, demonstrating a robust CAGR of XX%.

Intensive Conditioner Industry Segmentation

-

1. Distribution Channel

- 1.1. Supermarkets/Hypermarkets

- 1.2. Convenience Stores

- 1.3. Online Retail Stores

- 1.4. Other Distribution Channels

Intensive Conditioner Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. Russia

- 2.4. France

- 2.5. Spain

- 2.6. Italy

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. Australia

- 3.4. India

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Intensive Conditioner Industry Regional Market Share

Geographic Coverage of Intensive Conditioner Industry

Intensive Conditioner Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness About the Importance of Skin Care & Personal Care; Growing Influence of Social Media and Digital Technology

- 3.3. Market Restrains

- 3.3.1. Penetration of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Supermarkets/Hypermarkets to Dominate the Global Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Intensive Conditioner Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Supermarkets/Hypermarkets

- 5.1.2. Convenience Stores

- 5.1.3. Online Retail Stores

- 5.1.4. Other Distribution Channels

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. North America Intensive Conditioner Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.1.1. Supermarkets/Hypermarkets

- 6.1.2. Convenience Stores

- 6.1.3. Online Retail Stores

- 6.1.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7. Europe Intensive Conditioner Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.1.1. Supermarkets/Hypermarkets

- 7.1.2. Convenience Stores

- 7.1.3. Online Retail Stores

- 7.1.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8. Asia Pacific Intensive Conditioner Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.1.1. Supermarkets/Hypermarkets

- 8.1.2. Convenience Stores

- 8.1.3. Online Retail Stores

- 8.1.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9. Rest of the World Intensive Conditioner Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.1.1. Supermarkets/Hypermarkets

- 9.1.2. Convenience Stores

- 9.1.3. Online Retail Stores

- 9.1.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 E T Browne Drug Co

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 L'Oreal Paris

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 The Mane Choic

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Briogeo Hair Care

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 The Procter & Gamble Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Kao Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 E T Browne Drug Co

List of Figures

- Figure 1: Global Intensive Conditioner Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Intensive Conditioner Industry Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: North America Intensive Conditioner Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 4: North America Intensive Conditioner Industry Volume (K Tons), by Distribution Channel 2025 & 2033

- Figure 5: North America Intensive Conditioner Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Intensive Conditioner Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 7: North America Intensive Conditioner Industry Revenue (billion), by Country 2025 & 2033

- Figure 8: North America Intensive Conditioner Industry Volume (K Tons), by Country 2025 & 2033

- Figure 9: North America Intensive Conditioner Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Intensive Conditioner Industry Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Intensive Conditioner Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 12: Europe Intensive Conditioner Industry Volume (K Tons), by Distribution Channel 2025 & 2033

- Figure 13: Europe Intensive Conditioner Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: Europe Intensive Conditioner Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 15: Europe Intensive Conditioner Industry Revenue (billion), by Country 2025 & 2033

- Figure 16: Europe Intensive Conditioner Industry Volume (K Tons), by Country 2025 & 2033

- Figure 17: Europe Intensive Conditioner Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Intensive Conditioner Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Intensive Conditioner Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 20: Asia Pacific Intensive Conditioner Industry Volume (K Tons), by Distribution Channel 2025 & 2033

- Figure 21: Asia Pacific Intensive Conditioner Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Asia Pacific Intensive Conditioner Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 23: Asia Pacific Intensive Conditioner Industry Revenue (billion), by Country 2025 & 2033

- Figure 24: Asia Pacific Intensive Conditioner Industry Volume (K Tons), by Country 2025 & 2033

- Figure 25: Asia Pacific Intensive Conditioner Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Intensive Conditioner Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Rest of the World Intensive Conditioner Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 28: Rest of the World Intensive Conditioner Industry Volume (K Tons), by Distribution Channel 2025 & 2033

- Figure 29: Rest of the World Intensive Conditioner Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Rest of the World Intensive Conditioner Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 31: Rest of the World Intensive Conditioner Industry Revenue (billion), by Country 2025 & 2033

- Figure 32: Rest of the World Intensive Conditioner Industry Volume (K Tons), by Country 2025 & 2033

- Figure 33: Rest of the World Intensive Conditioner Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of the World Intensive Conditioner Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Intensive Conditioner Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 2: Global Intensive Conditioner Industry Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Intensive Conditioner Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Intensive Conditioner Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 5: Global Intensive Conditioner Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Intensive Conditioner Industry Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Intensive Conditioner Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Global Intensive Conditioner Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 9: United States Intensive Conditioner Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United States Intensive Conditioner Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 11: Canada Intensive Conditioner Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada Intensive Conditioner Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 13: Mexico Intensive Conditioner Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Mexico Intensive Conditioner Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Rest of North America Intensive Conditioner Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Rest of North America Intensive Conditioner Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Global Intensive Conditioner Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global Intensive Conditioner Industry Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 19: Global Intensive Conditioner Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Global Intensive Conditioner Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 21: Germany Intensive Conditioner Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Germany Intensive Conditioner Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: United Kingdom Intensive Conditioner Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: United Kingdom Intensive Conditioner Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Russia Intensive Conditioner Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Russia Intensive Conditioner Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: France Intensive Conditioner Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: France Intensive Conditioner Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Spain Intensive Conditioner Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Spain Intensive Conditioner Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Italy Intensive Conditioner Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Italy Intensive Conditioner Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Rest of Europe Intensive Conditioner Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of Europe Intensive Conditioner Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: Global Intensive Conditioner Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 36: Global Intensive Conditioner Industry Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Intensive Conditioner Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 38: Global Intensive Conditioner Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 39: China Intensive Conditioner Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: China Intensive Conditioner Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 41: Japan Intensive Conditioner Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Intensive Conditioner Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 43: Australia Intensive Conditioner Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Australia Intensive Conditioner Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 45: India Intensive Conditioner Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: India Intensive Conditioner Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific Intensive Conditioner Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Rest of Asia Pacific Intensive Conditioner Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: Global Intensive Conditioner Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 50: Global Intensive Conditioner Industry Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 51: Global Intensive Conditioner Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 52: Global Intensive Conditioner Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 53: South America Intensive Conditioner Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: South America Intensive Conditioner Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 55: Middle East and Africa Intensive Conditioner Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: Middle East and Africa Intensive Conditioner Industry Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Intensive Conditioner Industry?

The projected CAGR is approximately 7.31%.

2. Which companies are prominent players in the Intensive Conditioner Industry?

Key companies in the market include E T Browne Drug Co, L'Oreal Paris, The Mane Choic, Briogeo Hair Care, The Procter & Gamble Company, Kao Corporation.

3. What are the main segments of the Intensive Conditioner Industry?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.04 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness About the Importance of Skin Care & Personal Care; Growing Influence of Social Media and Digital Technology.

6. What are the notable trends driving market growth?

Supermarkets/Hypermarkets to Dominate the Global Market.

7. Are there any restraints impacting market growth?

Penetration of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Intensive Conditioner Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Intensive Conditioner Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Intensive Conditioner Industry?

To stay informed about further developments, trends, and reports in the Intensive Conditioner Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence