Key Insights

The Nigerian logistics market, projected to reach $10.95 billion by 2025, is poised for significant expansion. The market is forecasted to grow at a compound annual growth rate (CAGR) of 6.57% from 2025 to 2033. This robust growth is propelled by key factors including the burgeoning e-commerce sector, which is driving demand for efficient courier, express, and parcel (CEP) services. Growth in manufacturing, construction, and the oil and gas industries also necessitates reliable logistics solutions. Improvements in transportation infrastructure are alleviating logistical bottlenecks, while the rise of temperature-controlled logistics is catering to the increasing demand for transporting perishable goods and pharmaceuticals. However, persistent challenges such as inadequate infrastructure in specific regions, security concerns, and regulatory complexities require strategic attention to facilitate smoother market operations and unlock the sector's full potential.

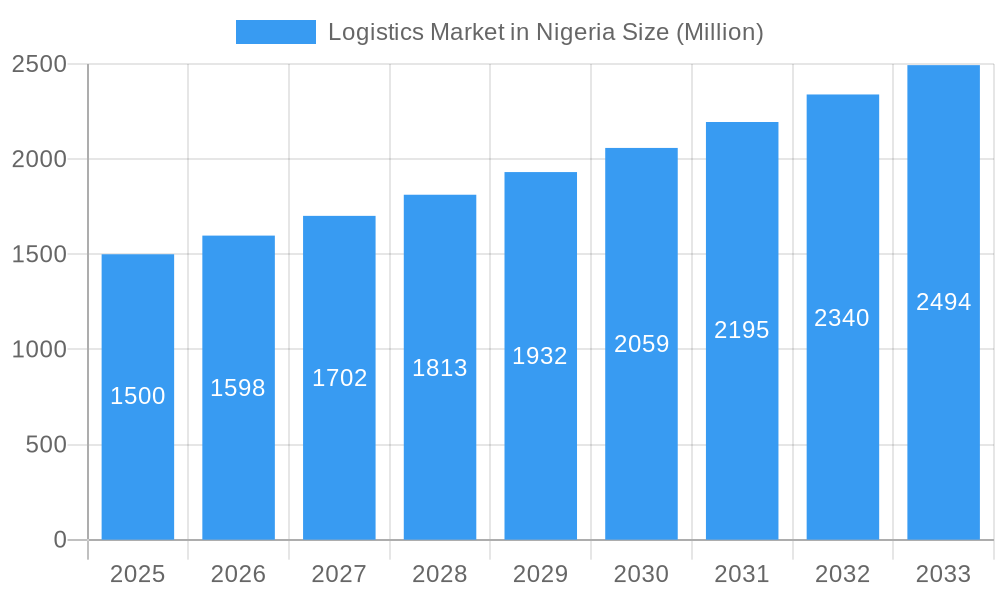

Logistics Market in Nigeria Market Size (In Billion)

The competitive arena features both international giants like A.P. Moller-Maersk and CMA CGM Group, alongside prominent domestic players such as Red Star Express PL and GIG Logistics. The market's adaptability is evident in its diverse service offerings, spanning CEP to specialized temperature-controlled solutions, catering to varied industry requirements. Future success hinges on continued technological investment in tracking and management systems to enhance operational efficiency and competitiveness. Addressing infrastructural gaps, bolstering security measures, and streamlining regulations are critical for sustainable growth. Strategic specialization in areas like cold chain logistics and bespoke solutions for niche industries will be instrumental for market leaders in this evolving landscape.

Logistics Market in Nigeria Company Market Share

Logistics Market in Nigeria: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Nigerian logistics market, offering valuable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, growth drivers, challenges, and future opportunities. The Nigerian logistics market, valued at xx Million in 2025, is poised for significant expansion, driven by factors such as e-commerce growth and infrastructure development. This report unravels the intricacies of this dynamic sector, providing crucial data and analysis to inform strategic decision-making.

Logistics Market in Nigeria Market Composition & Trends

The Nigerian logistics market exhibits a moderately concentrated landscape, with key players like A P Moller - Maersk, Fortune Global Shipping and Logistics Limited, JOF Nigeria Limited, and Red Star Express PL commanding significant market share. However, a growing number of smaller, specialized logistics providers are emerging, creating a more competitive environment. Market share distribution is estimated as follows: A P Moller - Maersk (xx%), Fortune Global Shipping (xx%), JOF Nigeria (xx%), and others (xx%). Innovation is driven by the need for improved efficiency and technological advancements, particularly in areas like tracking and delivery optimization. The regulatory landscape, while evolving, presents both opportunities and challenges. Substitute products, such as informal transportation networks, continue to compete, impacting market penetration. M&A activity remains moderate, with recent deals valued at approximately xx Million collectively.

- Market Concentration: Moderately concentrated, with a few major players and numerous smaller players.

- Innovation Catalysts: Technological advancements in tracking, delivery optimization, and supply chain management.

- Regulatory Landscape: Evolving, presenting opportunities and challenges for market players.

- Substitute Products: Informal transportation networks and other alternatives.

- End-User Profiles: Diverse range of industries, including manufacturing, agriculture, and oil & gas.

- M&A Activities: Moderate level of activity, with xx Million in deal value in recent years.

Logistics Market in Nigeria Industry Evolution

The Nigerian logistics market has experienced significant growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth trajectory is projected to continue during the forecast period (2025-2033), driven primarily by the expansion of e-commerce, the growing need for efficient supply chain management across diverse sectors, and increasing foreign direct investment. Technological advancements, such as the adoption of sophisticated tracking systems, route optimization software, and automated warehousing solutions, are transforming operational efficiency and customer experience. Shifting consumer demands, particularly the preference for faster and more reliable delivery services, are further pushing industry evolution. The adoption rate of advanced technology varies across companies, with larger players leading the way, while smaller firms focus on cost-effective solutions. The integration of technology is expected to increase efficiency by xx% by 2033.

Leading Regions, Countries, or Segments in Logistics Market in Nigeria

The Nigerian logistics market demonstrates strong regional variations in growth and development. Lagos, as the commercial hub, remains the dominant region, followed by Abuja and Port Harcourt. This dominance is attributed to factors including high population density, economic activity, and port infrastructure. The dominant end-user industries are:

- Wholesale and Retail Trade: This sector benefits from strong consumer demand and the growth of e-commerce, driving high volume logistics needs. Investment in warehouse and distribution infrastructure further fuels its dominance.

- Manufacturing: Increased local manufacturing activities contribute significantly to the demand for logistics services, with a focus on efficient supply chain management to meet production targets.

- Oil and Gas: This remains a key sector, although recent trends indicate a shift towards diversification. Specialized logistics services catering to the sector's specific requirements remain significant.

Key Drivers:

- Significant investments in infrastructure development, including roads, railways, and ports.

- Government initiatives aimed at improving the business environment and promoting private sector investment.

- Regulatory reforms to streamline procedures and reduce bureaucratic hurdles.

Logistics Market in Nigeria Product Innovations

Recent product innovations include the implementation of advanced tracking systems using GPS technology, the development of specialized temperature-controlled logistics solutions for pharmaceuticals and perishable goods, and the integration of Artificial Intelligence (AI) for route optimization and predictive analytics. These innovations offer unique selling propositions like increased transparency, reduced delivery times, and improved cost-efficiency. Furthermore, the adoption of blockchain technology holds promise for greater security and trust in supply chain processes.

Propelling Factors for Logistics Market in Nigeria Growth

The growth of the Nigerian logistics market is fueled by several factors: the rapid expansion of e-commerce, creating a surge in demand for last-mile delivery services; increasing foreign direct investment, stimulating industrial growth and the need for reliable supply chain management; and government initiatives aimed at improving infrastructure and reducing bureaucratic hurdles. Technological advancements such as the adoption of AI and IoT solutions further propel market expansion.

Obstacles in the Logistics Market in Nigeria Market

Challenges hindering market growth include inadequate infrastructure (poor road networks), high operational costs (fuel, security), and regulatory complexities which increase operational inefficiencies. Security concerns, particularly road transport insecurity, cause delays and damage goods. These factors increase overall logistics costs and decrease efficiency, potentially reducing market growth by xx% annually.

Future Opportunities in Logistics Market in Nigeria

Emerging opportunities lie in the expansion of e-commerce logistics, the growth of cold chain logistics to cater for the expanding agricultural sector, and the increasing demand for specialized logistics solutions in sectors such as healthcare and pharmaceuticals. The adoption of innovative technologies like blockchain and AI will further unlock growth opportunities. Investment in logistics infrastructure will be crucial for unlocking the full market potential.

Major Players in the Logistics Market in Nigeria Ecosystem

- A P Moller - Maersk

- Fortune Global Shipping and Logistics Limited

- JOF Nigeria Limited

- MDS Logistics

- Gulf Agency Company (GAC)

- AfriGlobal logistics

- Africa Access 3PL Limited

- GWX Logistics

- Bolloré Group

- GIG Logistics

- Hapag-Lloyd

- Red Star Express PL

- CMA CGM Group

Key Developments in Logistics Market in Nigeria Industry

- September 2022: CEVA Logistics expanded its SKYCAPACITY Program, adding five air freight locations certified under the CEIV Lithium Battery Program, enhancing its capabilities in handling specialized cargo.

- November 2022: GIG Logistics purchased two ATR 72-500 freighters to meet growing e-commerce demand and expand its air freight capacity across Africa. This signals a significant investment in air freight infrastructure to cater to the growing demand for faster delivery.

- March 2023: Maersk's divestment of Maersk Supply Service (MSS) signifies a strategic shift towards focusing on integrated logistics, aligning with global trends in sustainability and green transition in the offshore sector.

Strategic Logistics Market in Nigeria Market Forecast

The Nigerian logistics market is poised for robust growth over the forecast period (2025-2033), driven by increased investment in infrastructure, the expanding e-commerce sector, and the growing adoption of innovative technologies. The market's potential is significant, with opportunities in specialized logistics segments and the continued modernization of the sector promising substantial returns on investment. The market is expected to reach xx Million by 2033.

Logistics Market in Nigeria Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Logistics Function

-

2.1. Courier, Express, and Parcel (CEP)

-

2.1.1. By Destination Type

- 2.1.1.1. Domestic

- 2.1.1.2. International

-

2.1.1. By Destination Type

-

2.2. Freight Forwarding

-

2.2.1. By Mode Of Transport

- 2.2.1.1. Air

- 2.2.1.2. Sea and Inland Waterways

- 2.2.1.3. Others

-

2.2.1. By Mode Of Transport

-

2.3. Freight Transport

- 2.3.1. Pipelines

- 2.3.2. Rail

- 2.3.3. Road

-

2.4. Warehousing and Storage

-

2.4.1. By Temperature Control

- 2.4.1.1. Non-Temperature Controlled

-

2.4.1. By Temperature Control

- 2.5. Other Services

-

2.1. Courier, Express, and Parcel (CEP)

Logistics Market in Nigeria Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Logistics Market in Nigeria Regional Market Share

Geographic Coverage of Logistics Market in Nigeria

Logistics Market in Nigeria REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Logistics Market in Nigeria Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Logistics Function

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.2.1.1. By Destination Type

- 5.2.1.1.1. Domestic

- 5.2.1.1.2. International

- 5.2.1.1. By Destination Type

- 5.2.2. Freight Forwarding

- 5.2.2.1. By Mode Of Transport

- 5.2.2.1.1. Air

- 5.2.2.1.2. Sea and Inland Waterways

- 5.2.2.1.3. Others

- 5.2.2.1. By Mode Of Transport

- 5.2.3. Freight Transport

- 5.2.3.1. Pipelines

- 5.2.3.2. Rail

- 5.2.3.3. Road

- 5.2.4. Warehousing and Storage

- 5.2.4.1. By Temperature Control

- 5.2.4.1.1. Non-Temperature Controlled

- 5.2.4.1. By Temperature Control

- 5.2.5. Other Services

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. North America Logistics Market in Nigeria Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 6.1.1. Agriculture, Fishing, and Forestry

- 6.1.2. Construction

- 6.1.3. Manufacturing

- 6.1.4. Oil and Gas, Mining and Quarrying

- 6.1.5. Wholesale and Retail Trade

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Logistics Function

- 6.2.1. Courier, Express, and Parcel (CEP)

- 6.2.1.1. By Destination Type

- 6.2.1.1.1. Domestic

- 6.2.1.1.2. International

- 6.2.1.1. By Destination Type

- 6.2.2. Freight Forwarding

- 6.2.2.1. By Mode Of Transport

- 6.2.2.1.1. Air

- 6.2.2.1.2. Sea and Inland Waterways

- 6.2.2.1.3. Others

- 6.2.2.1. By Mode Of Transport

- 6.2.3. Freight Transport

- 6.2.3.1. Pipelines

- 6.2.3.2. Rail

- 6.2.3.3. Road

- 6.2.4. Warehousing and Storage

- 6.2.4.1. By Temperature Control

- 6.2.4.1.1. Non-Temperature Controlled

- 6.2.4.1. By Temperature Control

- 6.2.5. Other Services

- 6.2.1. Courier, Express, and Parcel (CEP)

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 7. South America Logistics Market in Nigeria Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 7.1.1. Agriculture, Fishing, and Forestry

- 7.1.2. Construction

- 7.1.3. Manufacturing

- 7.1.4. Oil and Gas, Mining and Quarrying

- 7.1.5. Wholesale and Retail Trade

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Logistics Function

- 7.2.1. Courier, Express, and Parcel (CEP)

- 7.2.1.1. By Destination Type

- 7.2.1.1.1. Domestic

- 7.2.1.1.2. International

- 7.2.1.1. By Destination Type

- 7.2.2. Freight Forwarding

- 7.2.2.1. By Mode Of Transport

- 7.2.2.1.1. Air

- 7.2.2.1.2. Sea and Inland Waterways

- 7.2.2.1.3. Others

- 7.2.2.1. By Mode Of Transport

- 7.2.3. Freight Transport

- 7.2.3.1. Pipelines

- 7.2.3.2. Rail

- 7.2.3.3. Road

- 7.2.4. Warehousing and Storage

- 7.2.4.1. By Temperature Control

- 7.2.4.1.1. Non-Temperature Controlled

- 7.2.4.1. By Temperature Control

- 7.2.5. Other Services

- 7.2.1. Courier, Express, and Parcel (CEP)

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 8. Europe Logistics Market in Nigeria Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 8.1.1. Agriculture, Fishing, and Forestry

- 8.1.2. Construction

- 8.1.3. Manufacturing

- 8.1.4. Oil and Gas, Mining and Quarrying

- 8.1.5. Wholesale and Retail Trade

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Logistics Function

- 8.2.1. Courier, Express, and Parcel (CEP)

- 8.2.1.1. By Destination Type

- 8.2.1.1.1. Domestic

- 8.2.1.1.2. International

- 8.2.1.1. By Destination Type

- 8.2.2. Freight Forwarding

- 8.2.2.1. By Mode Of Transport

- 8.2.2.1.1. Air

- 8.2.2.1.2. Sea and Inland Waterways

- 8.2.2.1.3. Others

- 8.2.2.1. By Mode Of Transport

- 8.2.3. Freight Transport

- 8.2.3.1. Pipelines

- 8.2.3.2. Rail

- 8.2.3.3. Road

- 8.2.4. Warehousing and Storage

- 8.2.4.1. By Temperature Control

- 8.2.4.1.1. Non-Temperature Controlled

- 8.2.4.1. By Temperature Control

- 8.2.5. Other Services

- 8.2.1. Courier, Express, and Parcel (CEP)

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 9. Middle East & Africa Logistics Market in Nigeria Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 9.1.1. Agriculture, Fishing, and Forestry

- 9.1.2. Construction

- 9.1.3. Manufacturing

- 9.1.4. Oil and Gas, Mining and Quarrying

- 9.1.5. Wholesale and Retail Trade

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Logistics Function

- 9.2.1. Courier, Express, and Parcel (CEP)

- 9.2.1.1. By Destination Type

- 9.2.1.1.1. Domestic

- 9.2.1.1.2. International

- 9.2.1.1. By Destination Type

- 9.2.2. Freight Forwarding

- 9.2.2.1. By Mode Of Transport

- 9.2.2.1.1. Air

- 9.2.2.1.2. Sea and Inland Waterways

- 9.2.2.1.3. Others

- 9.2.2.1. By Mode Of Transport

- 9.2.3. Freight Transport

- 9.2.3.1. Pipelines

- 9.2.3.2. Rail

- 9.2.3.3. Road

- 9.2.4. Warehousing and Storage

- 9.2.4.1. By Temperature Control

- 9.2.4.1.1. Non-Temperature Controlled

- 9.2.4.1. By Temperature Control

- 9.2.5. Other Services

- 9.2.1. Courier, Express, and Parcel (CEP)

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 10. Asia Pacific Logistics Market in Nigeria Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 10.1.1. Agriculture, Fishing, and Forestry

- 10.1.2. Construction

- 10.1.3. Manufacturing

- 10.1.4. Oil and Gas, Mining and Quarrying

- 10.1.5. Wholesale and Retail Trade

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Logistics Function

- 10.2.1. Courier, Express, and Parcel (CEP)

- 10.2.1.1. By Destination Type

- 10.2.1.1.1. Domestic

- 10.2.1.1.2. International

- 10.2.1.1. By Destination Type

- 10.2.2. Freight Forwarding

- 10.2.2.1. By Mode Of Transport

- 10.2.2.1.1. Air

- 10.2.2.1.2. Sea and Inland Waterways

- 10.2.2.1.3. Others

- 10.2.2.1. By Mode Of Transport

- 10.2.3. Freight Transport

- 10.2.3.1. Pipelines

- 10.2.3.2. Rail

- 10.2.3.3. Road

- 10.2.4. Warehousing and Storage

- 10.2.4.1. By Temperature Control

- 10.2.4.1.1. Non-Temperature Controlled

- 10.2.4.1. By Temperature Control

- 10.2.5. Other Services

- 10.2.1. Courier, Express, and Parcel (CEP)

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 A P Moller - Maersk

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Fortune Global Shipping and Logistics Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 JOF Nigeria Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 MDS Logistics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Gulf Agency Company (GAC)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AfriGlobal logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Africa Access 3PL Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GWX Logistics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bolloré Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 GIG Logistics

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Hapag-Lloyd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Red Star Express PL

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 CMA CGM Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 A P Moller - Maersk

List of Figures

- Figure 1: Global Logistics Market in Nigeria Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Logistics Market in Nigeria Revenue (billion), by End User Industry 2025 & 2033

- Figure 3: North America Logistics Market in Nigeria Revenue Share (%), by End User Industry 2025 & 2033

- Figure 4: North America Logistics Market in Nigeria Revenue (billion), by Logistics Function 2025 & 2033

- Figure 5: North America Logistics Market in Nigeria Revenue Share (%), by Logistics Function 2025 & 2033

- Figure 6: North America Logistics Market in Nigeria Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Logistics Market in Nigeria Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Logistics Market in Nigeria Revenue (billion), by End User Industry 2025 & 2033

- Figure 9: South America Logistics Market in Nigeria Revenue Share (%), by End User Industry 2025 & 2033

- Figure 10: South America Logistics Market in Nigeria Revenue (billion), by Logistics Function 2025 & 2033

- Figure 11: South America Logistics Market in Nigeria Revenue Share (%), by Logistics Function 2025 & 2033

- Figure 12: South America Logistics Market in Nigeria Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Logistics Market in Nigeria Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Logistics Market in Nigeria Revenue (billion), by End User Industry 2025 & 2033

- Figure 15: Europe Logistics Market in Nigeria Revenue Share (%), by End User Industry 2025 & 2033

- Figure 16: Europe Logistics Market in Nigeria Revenue (billion), by Logistics Function 2025 & 2033

- Figure 17: Europe Logistics Market in Nigeria Revenue Share (%), by Logistics Function 2025 & 2033

- Figure 18: Europe Logistics Market in Nigeria Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Logistics Market in Nigeria Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Logistics Market in Nigeria Revenue (billion), by End User Industry 2025 & 2033

- Figure 21: Middle East & Africa Logistics Market in Nigeria Revenue Share (%), by End User Industry 2025 & 2033

- Figure 22: Middle East & Africa Logistics Market in Nigeria Revenue (billion), by Logistics Function 2025 & 2033

- Figure 23: Middle East & Africa Logistics Market in Nigeria Revenue Share (%), by Logistics Function 2025 & 2033

- Figure 24: Middle East & Africa Logistics Market in Nigeria Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Logistics Market in Nigeria Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Logistics Market in Nigeria Revenue (billion), by End User Industry 2025 & 2033

- Figure 27: Asia Pacific Logistics Market in Nigeria Revenue Share (%), by End User Industry 2025 & 2033

- Figure 28: Asia Pacific Logistics Market in Nigeria Revenue (billion), by Logistics Function 2025 & 2033

- Figure 29: Asia Pacific Logistics Market in Nigeria Revenue Share (%), by Logistics Function 2025 & 2033

- Figure 30: Asia Pacific Logistics Market in Nigeria Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Logistics Market in Nigeria Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Logistics Market in Nigeria Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 2: Global Logistics Market in Nigeria Revenue billion Forecast, by Logistics Function 2020 & 2033

- Table 3: Global Logistics Market in Nigeria Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Logistics Market in Nigeria Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 5: Global Logistics Market in Nigeria Revenue billion Forecast, by Logistics Function 2020 & 2033

- Table 6: Global Logistics Market in Nigeria Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Logistics Market in Nigeria Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Logistics Market in Nigeria Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Logistics Market in Nigeria Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Logistics Market in Nigeria Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 11: Global Logistics Market in Nigeria Revenue billion Forecast, by Logistics Function 2020 & 2033

- Table 12: Global Logistics Market in Nigeria Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Logistics Market in Nigeria Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Logistics Market in Nigeria Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Logistics Market in Nigeria Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Logistics Market in Nigeria Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 17: Global Logistics Market in Nigeria Revenue billion Forecast, by Logistics Function 2020 & 2033

- Table 18: Global Logistics Market in Nigeria Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Logistics Market in Nigeria Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Logistics Market in Nigeria Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Logistics Market in Nigeria Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Logistics Market in Nigeria Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Logistics Market in Nigeria Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Logistics Market in Nigeria Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Logistics Market in Nigeria Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Logistics Market in Nigeria Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Logistics Market in Nigeria Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Logistics Market in Nigeria Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 29: Global Logistics Market in Nigeria Revenue billion Forecast, by Logistics Function 2020 & 2033

- Table 30: Global Logistics Market in Nigeria Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Logistics Market in Nigeria Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Logistics Market in Nigeria Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Logistics Market in Nigeria Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Logistics Market in Nigeria Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Logistics Market in Nigeria Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Logistics Market in Nigeria Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Logistics Market in Nigeria Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 38: Global Logistics Market in Nigeria Revenue billion Forecast, by Logistics Function 2020 & 2033

- Table 39: Global Logistics Market in Nigeria Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Logistics Market in Nigeria Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Logistics Market in Nigeria Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Logistics Market in Nigeria Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Logistics Market in Nigeria Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Logistics Market in Nigeria Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Logistics Market in Nigeria Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Logistics Market in Nigeria Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Logistics Market in Nigeria?

The projected CAGR is approximately 6.57%.

2. Which companies are prominent players in the Logistics Market in Nigeria?

Key companies in the market include A P Moller - Maersk, Fortune Global Shipping and Logistics Limited, JOF Nigeria Limited, MDS Logistics, Gulf Agency Company (GAC), AfriGlobal logistics, Africa Access 3PL Limited, GWX Logistics, Bolloré Group, GIG Logistics, Hapag-Lloyd, Red Star Express PL, CMA CGM Group.

3. What are the main segments of the Logistics Market in Nigeria?

The market segments include End User Industry, Logistics Function.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.95 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

March 2023: Maersk announced an intended divestment of Maersk Supply Service (MSS), a provider of global offshore marine services and project solutions for the energy sector. It took this step to help Maersk Supply Service continue further development of new solutions for the green transition of the offshore sector under new long-term ownership. It also marks the completion of its decision to divest all energy-related activities and focus on truly integrated logistics.November 2022: GIG signed up to purchase two ATR 72-500 freighters as it looks to meet growing e-commerce demand and expand its air freight services in Africa.September 2022: CEVA Logistics expanded its owned and controlled SKYCAPACITY Program and added five more stations to its network of air freight locations certified under the CEIV Lithium Battery Program.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Logistics Market in Nigeria," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Logistics Market in Nigeria report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Logistics Market in Nigeria?

To stay informed about further developments, trends, and reports in the Logistics Market in Nigeria, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence