Key Insights

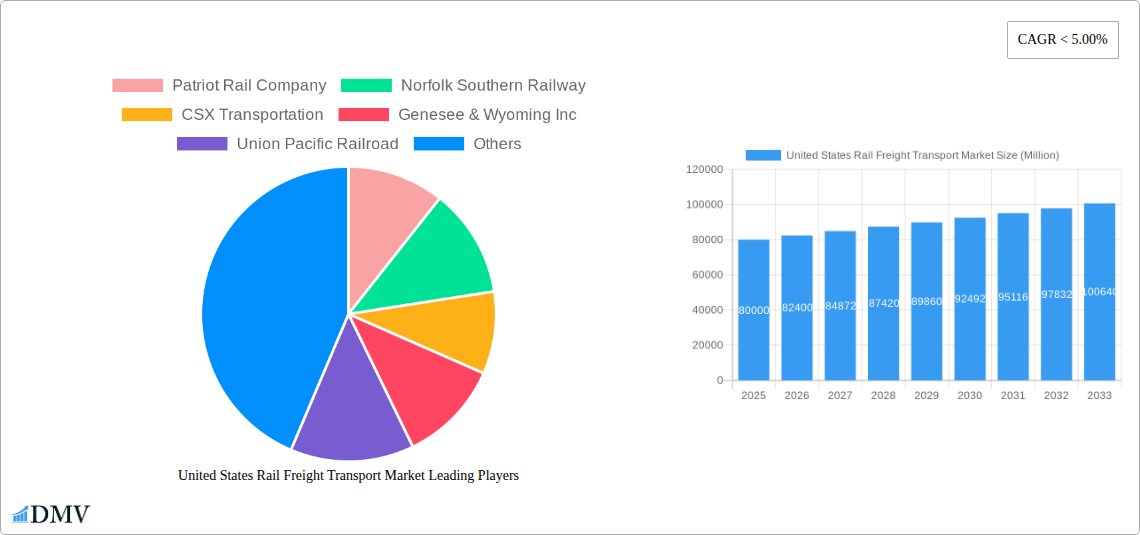

The United States rail freight transport market is a vital component of national logistics, poised for sustained expansion. This growth is propelled by rising industrial output, the e-commerce boom, and the cost and environmental advantages of rail over road transport. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5%, reaching a market size of $103 billion by 2033, from a base year market size of $103 billion in 2025. Key drivers include the demand for efficient long-haul solutions, ongoing infrastructure modernization, and the increasing preference for sustainable logistics. The market is segmented by commodity type, rail type, and geographic region. Future expansion will be shaped by emission regulations and the adoption of technologies like automation and data analytics.

United States Rail Freight Transport Market Market Size (In Billion)

This upward market trend is expected to persist throughout the forecast period (2025-2033), subject to macroeconomic conditions, fuel prices, and policy shifts. Leading market participants are actively pursuing strategic alliances, acquisitions, and technological enhancements to bolster operational efficiency and service portfolios. The industry's focus will be on delivering dependable, effective, and economical rail freight services to address evolving industry needs and support US economic growth. Detailed segmentation analysis will highlight opportunities within specialized market niches.

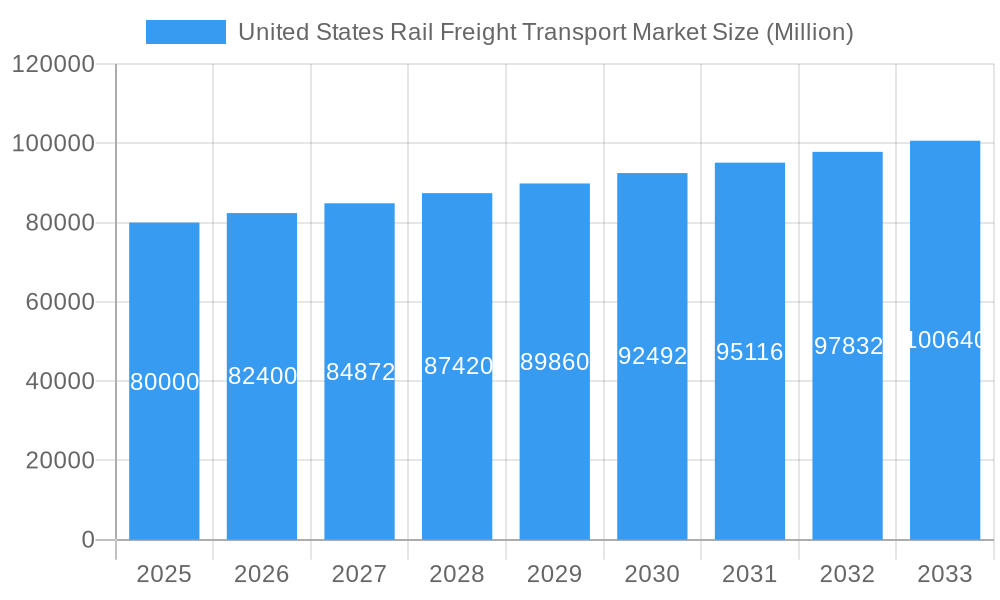

United States Rail Freight Transport Market Company Market Share

United States Rail Freight Transport Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the United States Rail Freight Transport Market, offering a comprehensive overview of market trends, key players, and future growth prospects. Covering the period from 2019 to 2033, with a focus on 2025, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market is projected to reach USD xx Million by 2033, demonstrating significant growth potential.

United States Rail Freight Transport Market Market Composition & Trends

The US rail freight transport market is characterized by a moderately concentrated landscape, with major players like Union Pacific Railroad, BNSF Railway Company, CSX Transportation, and Norfolk Southern Railway holding significant market share. The exact distribution varies yearly but generally demonstrates a slight oligopolistic tendency. Innovation is driven by increasing demand for efficiency, sustainability, and improved intermodal capabilities. Stringent regulations concerning safety, environmental impact, and operational standards significantly influence market dynamics. Substitute modes of transport, such as trucking and pipelines, pose competitive challenges, particularly for specific cargo types. The end-user profile is diverse, encompassing manufacturing, agriculture, energy, and retail sectors. M&A activity has been moderate, with deal values fluctuating depending on market conditions. Recent deals have primarily focused on expanding service offerings and optimizing operational efficiency. For example, in 2024, the total value of M&A transactions within the sector was estimated at USD xx Million.

- Market Concentration: Moderately concentrated, with top players controlling a significant share.

- Innovation Catalysts: Demand for efficiency, sustainability, and intermodal solutions.

- Regulatory Landscape: Stringent safety, environmental, and operational standards.

- Substitute Products: Trucking, pipelines, and maritime transport pose competition.

- End-User Profile: Diverse, including manufacturing, agriculture, energy, and retail.

- M&A Activity: Moderate, primarily focused on service expansion and operational optimization.

United States Rail Freight Transport Market Industry Evolution

The US rail freight transport market has experienced consistent growth over the historical period (2019-2024), driven by factors such as economic expansion, increasing industrial production, and the growing demand for efficient long-haul transportation. Technological advancements, particularly in areas like digitalization, automation, and the adoption of alternative fuel technologies, are reshaping the industry. The market is witnessing a shift towards more sustainable and environmentally friendly operations. This includes investments in electric locomotives, improved fuel efficiency measures, and the development of advanced rail infrastructure. Consumer demand for faster and more reliable delivery services is also influencing industry practices. The annual growth rate (AGR) during the historical period averaged approximately x%, with expectations for similar growth in the coming years. The market is poised to witness increased adoption of advanced technologies like predictive maintenance and real-time tracking systems, improving operational efficiency and reducing downtime. The adoption rate of these technologies is anticipated to reach xx% by 2033.

Leading Regions, Countries, or Segments in United States Rail Freight Transport Market

The leading segments and regions in the US rail freight transport market showcase diverse dynamics:

By Type of Cargo: Containerized cargo (including intermodal) dominates due to its efficiency and suitability for diverse goods. However, the Non-containerized segment is substantial, particularly in bulk commodity transportation. The Liquid Bulk segment sees steady growth, driven by the energy and chemical industries.

By Destination: Domestic freight transport commands the largest share, reflecting the extensive intra-US rail network. International transportation, while a smaller segment, is experiencing gradual growth, particularly in cross-border trade.

By Service Type: Transportation services account for the largest segment of the market, followed by services allied to transportation, including railcar maintenance, track maintenance, cargo switching, and storage. This reflects the multifaceted nature of the rail freight ecosystem.

Key Drivers:

- Investment Trends: Significant capital expenditures are directed towards infrastructure upgrades, equipment modernization, and technological improvements.

- Regulatory Support: Government policies promoting efficient freight transport and sustainable practices support industry growth.

The dominance of specific segments is driven by factors such as economic activity in various sectors, government infrastructure investment, and technological advancements that enhance efficiency and reduce costs.

United States Rail Freight Transport Market Product Innovations

Recent innovations focus on enhancing operational efficiency, sustainability, and safety. This includes the introduction of battery-electric locomotives (as seen with Wabtec's FLXdrive), advanced signaling systems for improved train control, and the development of lighter, more durable railcars to maximize payload capacity. These innovations contribute to increased efficiency, reduced environmental impact, and improved safety for both personnel and infrastructure. The unique selling propositions center on lowering operational costs, reducing emissions, and enhancing overall operational reliability and safety.

Propelling Factors for United States Rail Freight Transport Market Growth

The US rail freight transport market's growth is propelled by several key factors:

- Technological advancements: Automation, improved signaling, and electric locomotives contribute to increased efficiency and sustainability.

- Economic growth: Expansion in key sectors like manufacturing and agriculture increases demand for rail freight services.

- Government regulations: Policies supporting infrastructure improvements and sustainable transportation fuel market expansion. For example, the emphasis on reducing carbon emissions creates incentives for the adoption of electric locomotives and other green technologies.

Obstacles in the United States Rail Freight Transport Market Market

Several factors hinder market growth:

- Regulatory challenges: Complex permitting processes and stringent environmental regulations can delay projects and increase costs.

- Supply chain disruptions: Labor shortages and unforeseen events (e.g., extreme weather) can impact operational efficiency and reliability.

- Competitive pressures: Competition from other modes of transport, particularly trucking, necessitates continuous optimization of cost and service offerings.

Future Opportunities in United States Rail Freight Transport Market

Future opportunities lie in:

- Expansion into new markets: Growth in e-commerce and the need for efficient last-mile delivery solutions can unlock new market segments.

- Technological innovation: Further advancements in automation, AI, and data analytics can optimize operations and improve service quality.

- Sustainable solutions: Increased demand for environmentally friendly transportation will drive investment in electric and alternative fuel technologies.

Major Players in the United States Rail Freight Transport Market Ecosystem

Key Developments in United States Rail Freight Transport Market Industry

January 2022: Wabtec Corporation receives an order for 10 FLXdrive battery-electric locomotives from Union Pacific Railroad, promoting GHG emission reduction efforts and infrastructure upgrades. This signifies a major step towards sustainable rail operations.

February 2022: BNSF Railway Company announces a USD 580 Million investment in efficiency and expansion initiatives, including double- and triple-track additions, bridge projects, and intermodal facility expansions. This investment significantly enhances capacity and supports traffic growth.

Strategic United States Rail Freight Transport Market Market Forecast

The US rail freight transport market is poised for continued growth driven by technological advancements, increasing e-commerce activity, and a focus on sustainability. Opportunities exist in expanding intermodal services, implementing advanced technologies for improved efficiency and safety, and capitalizing on growing demand in key sectors. The market is expected to see robust growth throughout the forecast period (2025-2033), driven by these factors and further bolstered by supportive government regulations. The combined effect of these trends positions the market for substantial expansion and continued dominance in the US freight transportation landscape.

United States Rail Freight Transport Market Segmentation

-

1. Type of Cargo

- 1.1. Containerized (Includes Intermodal)

- 1.2. Non-containerized

- 1.3. Liquid Bulk

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. Service Type

- 3.1. Transportation

- 3.2. Services

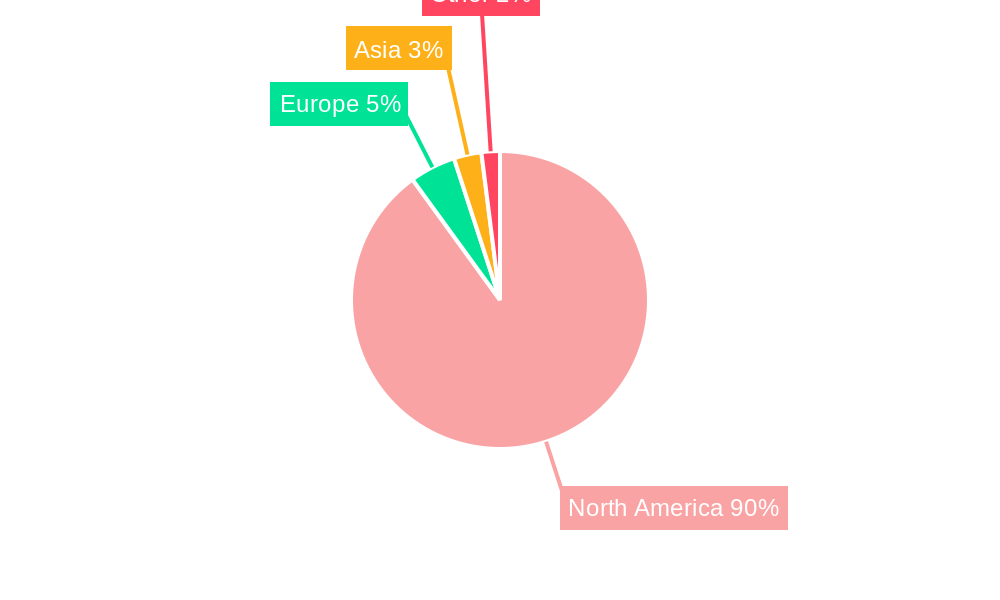

United States Rail Freight Transport Market Segmentation By Geography

- 1. United States

United States Rail Freight Transport Market Regional Market Share

Geographic Coverage of United States Rail Freight Transport Market

United States Rail Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Need for Reliable Connections between Carriers and Shippers; Demand for Real-time Visibility of Shipments

- 3.3. Market Restrains

- 3.3.1. High Fragmentation of the Logistics Industry; Data Security Concerns

- 3.4. Market Trends

- 3.4.1. Demand on The US Freight Rail Network Increase

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Rail Freight Transport Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Cargo

- 5.1.1. Containerized (Includes Intermodal)

- 5.1.2. Non-containerized

- 5.1.3. Liquid Bulk

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Service Type

- 5.3.1. Transportation

- 5.3.2. Services

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type of Cargo

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Patriot Rail Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Norfolk Southern Railway

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CSX Transportation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Genesee & Wyoming Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Union Pacific Railroad

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BNSF Railway Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Canadian National Railway

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kansas City Southern**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Patriot Rail Company

List of Figures

- Figure 1: United States Rail Freight Transport Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Rail Freight Transport Market Share (%) by Company 2025

List of Tables

- Table 1: United States Rail Freight Transport Market Revenue billion Forecast, by Type of Cargo 2020 & 2033

- Table 2: United States Rail Freight Transport Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 3: United States Rail Freight Transport Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 4: United States Rail Freight Transport Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United States Rail Freight Transport Market Revenue billion Forecast, by Type of Cargo 2020 & 2033

- Table 6: United States Rail Freight Transport Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 7: United States Rail Freight Transport Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 8: United States Rail Freight Transport Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Rail Freight Transport Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the United States Rail Freight Transport Market?

Key companies in the market include Patriot Rail Company, Norfolk Southern Railway, CSX Transportation, Genesee & Wyoming Inc, Union Pacific Railroad, BNSF Railway Company, Canadian National Railway, Kansas City Southern**List Not Exhaustive.

3. What are the main segments of the United States Rail Freight Transport Market?

The market segments include Type of Cargo, Destination, Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 103 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Need for Reliable Connections between Carriers and Shippers; Demand for Real-time Visibility of Shipments.

6. What are the notable trends driving market growth?

Demand on The US Freight Rail Network Increase.

7. Are there any restraints impacting market growth?

High Fragmentation of the Logistics Industry; Data Security Concerns.

8. Can you provide examples of recent developments in the market?

January 2022 - Wabtec Corporation has received an order for 10 FLXdrive battery-electric locomotives from Union Pacific Railroad, a freight-hauling railroad in the US. The action will promote Union Pacific's efforts to lower greenhouse gas (GHG) emissions from operations while also upgrading the infrastructure of its train yards. Seven thousand battery cells will be used in each FLXdrive battery-electric locomotive. The US will be the exclusive producer of all the vehicles. The 10 battery-powered locomotives will be able to offset 4,000t of carbon emissions from Union Pacific's train yards each year when used together. Union Pacific is expected to receive the first units from Wabtec in late 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Rail Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Rail Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Rail Freight Transport Market?

To stay informed about further developments, trends, and reports in the United States Rail Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence