Key Insights

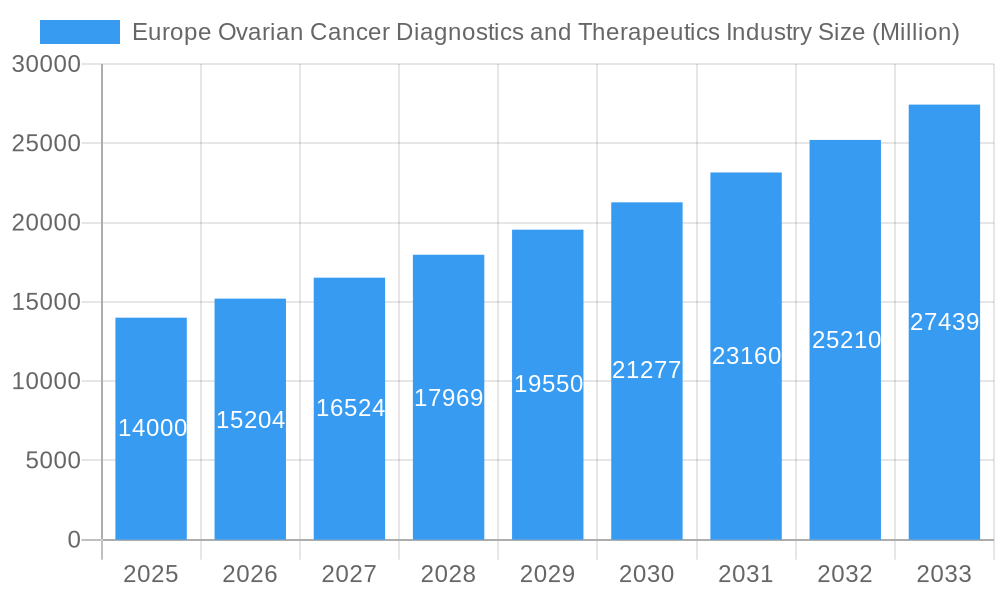

The European Ovarian Cancer Diagnostics and Therapeutics Market is projected to reach a market size of $7.62 billion by 2025, exhibiting a strong CAGR of 14.99%. This expansion is driven by technological advancements in early detection, a deeper understanding of ovarian cancer subtypes, and the development of novel targeted and immunotherapeutic treatments. Increased public health campaigns and rising healthcare investments across Europe are also fueling market growth. The accessibility of advanced diagnostic tools, including imaging techniques (PET, CT scans), sensitive biomarkers, and minimally invasive biopsy procedures, is enabling earlier disease intervention. Therapeutically, the market is shifting towards personalized medicine, featuring advanced immunotherapies and targeted agents that offer enhanced efficacy and reduced adverse effects. The increasing incidence of ovarian cancer and an aging demographic susceptible to the disease further support this market growth.

Europe Ovarian Cancer Diagnostics and Therapeutics Industry Market Size (In Billion)

Market segmentation highlights distinct opportunities within diagnostics and therapeutics. Epithelial ovarian tumors constitute the largest segment due to their prevalence, with ongoing research into germ cell and rarer ovarian tumor types. A multimodal diagnostic approach, integrating biopsy, serological tests, and advanced imaging (ultrasound, PET, CT scans), is vital for accurate and timely diagnosis. Therapeutic strategies encompass chemotherapy, radiation, immunotherapy, and hormonal therapy, with immunotherapy and targeted therapies demonstrating significant growth potential. Key industry players, including AstraZeneca, Roche, Pfizer, and Johnson & Johnson, are actively investing in R&D and strategic partnerships to innovate and expand their presence in major European markets such as Germany, the UK, France, Italy, and Spain. Market challenges, including the high cost of advanced treatments and diagnostics, alongside potential access and regulatory issues, are being addressed through strategies focused on improving affordability and reimbursement.

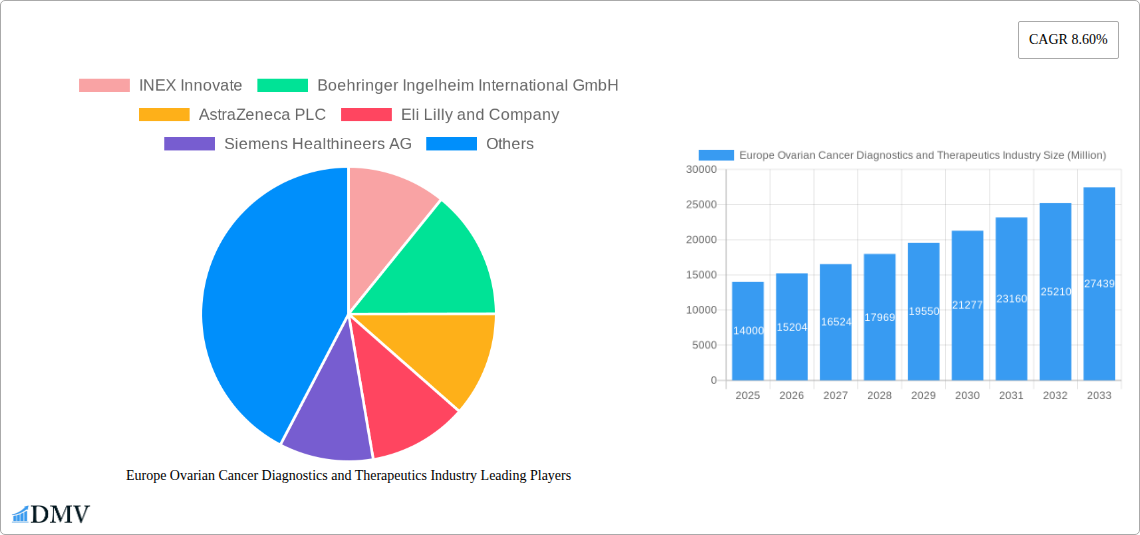

Europe Ovarian Cancer Diagnostics and Therapeutics Industry Company Market Share

Europe Ovarian Cancer Diagnostics and Therapeutics Industry Market Composition & Trends

This comprehensive report delves into the dynamic Europe ovarian cancer diagnostics and therapeutics market, providing an in-depth analysis of its composition, prevailing trends, and future trajectory from 2019 to 2033. We meticulously evaluate market concentration, identifying key players and their ovarian cancer market share within the European landscape. Innovation catalysts, including advancements in ovarian cancer diagnosis and novel ovarian cancer treatment modalities, are thoroughly examined. The report scrutinizes the influence of regulatory landscapes and the availability of substitute products, offering insights into ovarian cancer drug development and ovarian cancer screening efficacy. End-user profiles, encompassing patient demographics and healthcare provider needs, are presented to understand market segmentation. Furthermore, strategic M&A activities are analyzed, with estimated deal values of over XXX Million shaping the competitive environment. The report highlights the increasing investment in ovarian cancer research and the growing adoption of precision oncology approaches.

- Market Concentration: Analysis of dominant players and emerging entities.

- Innovation Catalysts: Focus on breakthroughs in ovarian cancer biomarkers and targeted ovarian cancer therapy.

- Regulatory Landscapes: Impact of EMA approvals and national guidelines on market access.

- Substitute Products: Evaluation of alternative treatment pathways and diagnostic methods.

- End-User Profiles: Segmentation based on patient needs and healthcare provider preferences.

- M&A Activities: Overview of strategic consolidations and their market impact, with estimated values exceeding XXX Million.

Europe Ovarian Cancer Diagnostics and Therapeutics Industry Industry Evolution

The Europe ovarian cancer diagnostics and therapeutics industry has witnessed a remarkable evolution driven by a confluence of scientific breakthroughs, unmet clinical needs, and increasing healthcare expenditure. From 2019 to 2033, the market is projected to exhibit robust growth, fueled by escalating cancer incidence rates and a heightened awareness of early detection strategies. The historical period of 2019–2024 has laid the groundwork for this expansion, characterized by significant advancements in ovarian cancer detection methods, including the refinement of liquid biopsy for ovarian cancer and the integration of AI in diagnostic imaging. Technological advancements are at the forefront of this evolution, with the development of more sophisticated ovarian cancer imaging techniques such as PET and advanced CT scans, enhancing diagnostic accuracy and enabling earlier intervention. The therapeutic landscape has been equally transformative, with a notable shift towards immunotherapy for ovarian cancer and the development of novel hormonal therapy for ovarian cancer agents. Shifting consumer demands, influenced by increased patient education and a desire for personalized treatment approaches, are also playing a pivotal role. The base year of 2025 serves as a crucial benchmark for assessing current market penetration and adoption metrics, with an estimated growth rate of XX% anticipated for the forecast period of 2025–2033. This sustained growth trajectory underscores the increasing investment in ovarian cancer research and development and the growing efficacy of newly introduced ovarian cancer drugs. The widespread adoption of personalized medicine, where treatment is tailored to the specific genetic profile of a patient's tumor, is a significant trend that will continue to shape the market. Furthermore, the growing emphasis on proactive screening programs, particularly for high-risk populations, is contributing to an increased demand for advanced diagnostic tools. The clinical validation of new ovarian cancer drug candidates and the expansion of indications for existing therapies are expected to further accelerate market growth. The integration of digital health solutions for patient monitoring and treatment adherence also presents a promising avenue for market expansion. The collaborative efforts between pharmaceutical companies, diagnostic firms, and academic institutions are instrumental in translating scientific discoveries into tangible clinical benefits for patients, ensuring a positive outlook for the Europe ovarian cancer diagnostics and therapeutics market.

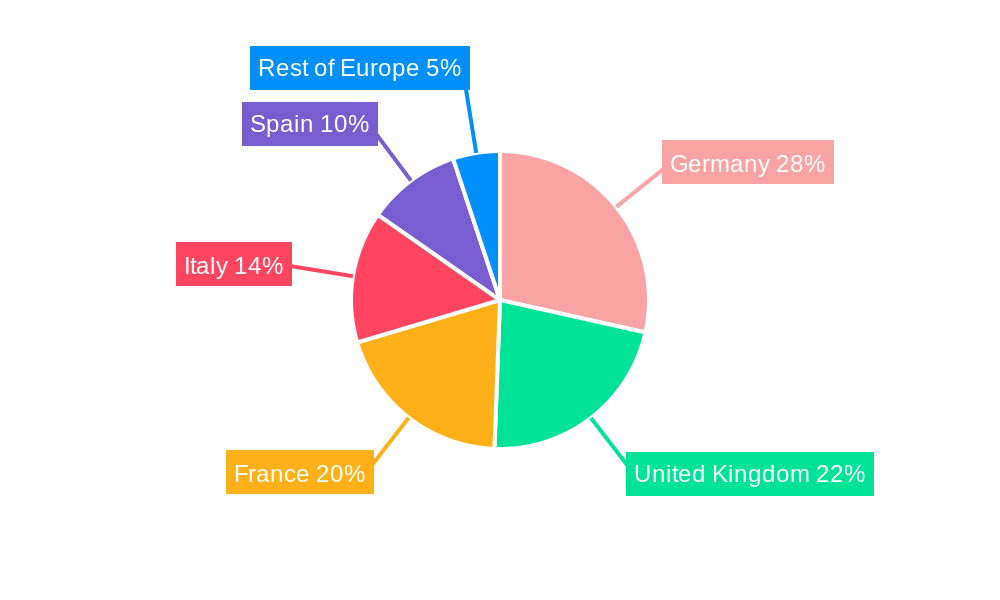

Leading Regions, Countries, or Segments in Europe Ovarian Cancer Diagnostics and Therapeutics Industry

Within the competitive Europe ovarian cancer diagnostics and therapeutics industry, Epithelial Ovarian Tumors consistently emerge as the dominant cancer type, accounting for a significant majority of diagnosed cases and, consequently, driving substantial market demand for both diagnostic and therapeutic solutions. This dominance is directly attributable to the higher incidence rates of epithelial ovarian cancers compared to Ovarian Germ Cell Tumors and Other Cancer Types.

- Dominant Cancer Type: Epithelial Ovarian Tumors

- Incidence Rates: Epithelial ovarian cancers represent approximately 90% of all ovarian cancer diagnoses in Europe, making them the primary focus for research, development, and clinical application.

- Diagnostic Modalities: The demand for advanced diagnostic tools such as blood tests (e.g., CA-125 monitoring), ultrasound, PET scans, and CT scans is exceptionally high for early detection and staging of epithelial ovarian cancers.

- Therapeutic Modalities: Chemotherapy remains a cornerstone treatment, with significant investment in developing new platinum-based regimens and targeted therapies. Immunotherapy and hormonal therapy are also gaining traction as adjuncts or alternative treatment options.

- Research & Development Focus: A disproportionate amount of research funding and drug development efforts are directed towards understanding and combating epithelial ovarian cancers, leading to a richer pipeline of innovative treatments.

Geographically, countries like Germany and the United Kingdom exhibit a leading position due to their robust healthcare infrastructure, higher healthcare spending, and substantial investment in ovarian cancer research. These nations benefit from:

- Strong Research Ecosystems: Presence of leading research institutions and pharmaceutical companies actively involved in ovarian cancer drug discovery.

- Advanced Healthcare Infrastructure: Well-established hospital networks and specialized cancer centers capable of administering complex diagnostic and therapeutic interventions.

- Favorable Regulatory Environment: Efficient pathways for drug approval and adoption of new diagnostic technologies, facilitating market penetration.

- High Patient Awareness and Access: Public health campaigns and government initiatives promote early screening and access to advanced treatments.

In terms of modalities, Diagnosis through Blood Tests (including biomarker testing like CA-125) and Ultrasound represent the most frequently utilized and accessible diagnostic tools, driving significant market volume. However, the increasing sophistication and availability of PET scans and CT Scans are crucial for accurate staging and treatment planning, particularly for epithelial ovarian tumors. On the therapeutic front, Chemotherapy continues to be the most prevalent treatment, but Immunotherapy is rapidly gaining prominence as a significant growth segment, offering new hope for patients with relapsed or platinum-resistant disease. The market share distribution across these segments reflects the current standard of care and the pace of technological adoption.

Europe Ovarian Cancer Diagnostics and Therapeutics Industry Product Innovations

Product innovations in the Europe ovarian cancer diagnostics and therapeutics industry are significantly impacting patient outcomes. Advancements in ovarian cancer diagnosis include highly sensitive blood tests utilizing novel ovarian cancer biomarkers for early detection and monitoring of recurrence. In therapeutics, the development of new immunotherapies and targeted therapies is revolutionizing treatment paradigms for epithelial ovarian tumors. These innovations offer improved efficacy, reduced toxicity, and greater precision in ovarian cancer treatment, with unique selling propositions focusing on enhanced patient survival rates and improved quality of life. Technological advancements are enabling more personalized approaches to ovarian cancer management.

Propelling Factors for Europe Ovarian Cancer Diagnostics and Therapeutics Industry Growth

Several key factors are propelling the growth of the Europe ovarian cancer diagnostics and therapeutics industry. Increased funding for ovarian cancer research and development by both public and private entities is a significant driver, leading to a robust pipeline of novel therapies and diagnostic tools. The rising incidence of ovarian cancer in Europe, coupled with growing awareness among healthcare professionals and the public about early detection, is further fueling market expansion. Advancements in precision oncology and the development of targeted ovarian cancer therapies are enhancing treatment efficacy. Furthermore, favorable reimbursement policies and the expanding accessibility of innovative ovarian cancer treatment options across European nations are critical economic influences. The regulatory bodies are also playing a supportive role by streamlining approval processes for effective ovarian cancer drugs.

Obstacles in the Europe Ovarian Cancer Diagnostics and Therapeutics Industry Market

Despite its growth, the Europe ovarian cancer diagnostics and therapeutics industry faces several obstacles. High development costs and lengthy approval timelines for novel ovarian cancer drugs pose significant financial challenges for pharmaceutical companies. The complexity of ovarian cancer, with its diverse subtypes and propensity for recurrence, makes treatment challenging and can lead to resistance. Stringent regulatory hurdles and variations in reimbursement policies across European countries can impede market access and adoption of new ovarian cancer therapies. Supply chain disruptions for critical ovarian cancer diagnostic reagents and therapeutic agents can also impact availability.

Future Opportunities in Europe Ovarian Cancer Diagnostics and Therapeutics Industry

Emerging opportunities within the Europe ovarian cancer diagnostics and therapeutics industry are abundant. The increasing focus on ovarian cancer prevention and early screening programs presents a significant market for advanced diagnostic technologies, including sophisticated blood tests and imaging modalities. The growing adoption of personalized medicine and targeted ovarian cancer therapies based on genetic profiling of tumors offers substantial growth potential. Furthermore, the exploration of novel therapeutic combinations, including immunotherapy and hormonal therapy, for recurrent or platinum-resistant ovarian cancer will create new market segments. Expansion into less developed European markets with growing healthcare infrastructure also represents a promising avenue.

Major Players in the Europe Ovarian Cancer Diagnostics and Therapeutics Industry Ecosystem

- INEX Innovate

- Boehringer Ingelheim International GmbH

- AstraZeneca PLC

- Eli Lilly and Company

- Siemens Healthineers AG

- Johnson and Johnson (Janssen Pharmaceuticals)

- Ovation Diagnostics

- Bristol Myers Squibb Company

- F Hoffman-La Roche Ltd

- Amneal Pharmaceuticals LLC

- GlaxoSmithKline PLC

- Pfizer Inc

Key Developments in Europe Ovarian Cancer Diagnostics and Therapeutics Industry Industry

- August 2022: Inceptua Group commercially launched Apealea in Germany for the treatment of adult patients with the first relapse of platinum-sensitive epithelial ovarian cancer.

- May 2022: BioMoti Ltd partnered with a global pharmaceutical company to collaborate on the development of its lead ovarian cancer candidate, BMT101, to clinical phase 2a proof-of-concept.

Strategic Europe Ovarian Cancer Diagnostics and Therapeutics Industry Market Forecast

The Europe ovarian cancer diagnostics and therapeutics industry is poised for significant growth, driven by continuous innovation in ovarian cancer diagnosis and the development of novel ovarian cancer treatment modalities. The increasing prevalence of epithelial ovarian tumors, coupled with advancements in precision oncology and immunotherapy, will fuel demand for advanced solutions. Strategic investments in ovarian cancer research and the expanding adoption of early detection strategies will further bolster the market. Favorable regulatory environments and evolving reimbursement landscapes across European nations are expected to accelerate market penetration, creating substantial opportunities for stakeholders.

Europe Ovarian Cancer Diagnostics and Therapeutics Industry Segmentation

-

1. Cancer Type

- 1.1. Epithelial Ovarian Tumors

- 1.2. Ovarian Germ Cell Tumors

- 1.3. Other Cancer Types

-

2. Modality

-

2.1. Diagnosis

- 2.1.1. Biopsy

- 2.1.2. Blood Tests

- 2.1.3. Ultrasound

- 2.1.4. PET

- 2.1.5. CT Scan

- 2.1.6. Other Diagnosis

-

2.2. Therapeutics

- 2.2.1. Chemotherapy

- 2.2.2. Radiation Therapy

- 2.2.3. Immunotherapy

- 2.2.4. Hormonal Therapy

- 2.2.5. Other Therapeutics

-

2.1. Diagnosis

Europe Ovarian Cancer Diagnostics and Therapeutics Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Europe Ovarian Cancer Diagnostics and Therapeutics Industry Regional Market Share

Geographic Coverage of Europe Ovarian Cancer Diagnostics and Therapeutics Industry

Europe Ovarian Cancer Diagnostics and Therapeutics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.99% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Burden of Ovarian Cancer; Greater Use of Combination Therapies for the Treatment of Ovarian Cancer; Rising Geriatric Population

- 3.3. Market Restrains

- 3.3.1. Lack of Accurate Diagnosis of Ovarian Cancer

- 3.4. Market Trends

- 3.4.1. Immunotherapy is Expected to Hold Significant Share of the European Ovarian Cancer Diagnostics and Therapeutics Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Ovarian Cancer Diagnostics and Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Cancer Type

- 5.1.1. Epithelial Ovarian Tumors

- 5.1.2. Ovarian Germ Cell Tumors

- 5.1.3. Other Cancer Types

- 5.2. Market Analysis, Insights and Forecast - by Modality

- 5.2.1. Diagnosis

- 5.2.1.1. Biopsy

- 5.2.1.2. Blood Tests

- 5.2.1.3. Ultrasound

- 5.2.1.4. PET

- 5.2.1.5. CT Scan

- 5.2.1.6. Other Diagnosis

- 5.2.2. Therapeutics

- 5.2.2.1. Chemotherapy

- 5.2.2.2. Radiation Therapy

- 5.2.2.3. Immunotherapy

- 5.2.2.4. Hormonal Therapy

- 5.2.2.5. Other Therapeutics

- 5.2.1. Diagnosis

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Spain

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Cancer Type

- 6. Germany Europe Ovarian Cancer Diagnostics and Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Cancer Type

- 6.1.1. Epithelial Ovarian Tumors

- 6.1.2. Ovarian Germ Cell Tumors

- 6.1.3. Other Cancer Types

- 6.2. Market Analysis, Insights and Forecast - by Modality

- 6.2.1. Diagnosis

- 6.2.1.1. Biopsy

- 6.2.1.2. Blood Tests

- 6.2.1.3. Ultrasound

- 6.2.1.4. PET

- 6.2.1.5. CT Scan

- 6.2.1.6. Other Diagnosis

- 6.2.2. Therapeutics

- 6.2.2.1. Chemotherapy

- 6.2.2.2. Radiation Therapy

- 6.2.2.3. Immunotherapy

- 6.2.2.4. Hormonal Therapy

- 6.2.2.5. Other Therapeutics

- 6.2.1. Diagnosis

- 6.1. Market Analysis, Insights and Forecast - by Cancer Type

- 7. United Kingdom Europe Ovarian Cancer Diagnostics and Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Cancer Type

- 7.1.1. Epithelial Ovarian Tumors

- 7.1.2. Ovarian Germ Cell Tumors

- 7.1.3. Other Cancer Types

- 7.2. Market Analysis, Insights and Forecast - by Modality

- 7.2.1. Diagnosis

- 7.2.1.1. Biopsy

- 7.2.1.2. Blood Tests

- 7.2.1.3. Ultrasound

- 7.2.1.4. PET

- 7.2.1.5. CT Scan

- 7.2.1.6. Other Diagnosis

- 7.2.2. Therapeutics

- 7.2.2.1. Chemotherapy

- 7.2.2.2. Radiation Therapy

- 7.2.2.3. Immunotherapy

- 7.2.2.4. Hormonal Therapy

- 7.2.2.5. Other Therapeutics

- 7.2.1. Diagnosis

- 7.1. Market Analysis, Insights and Forecast - by Cancer Type

- 8. France Europe Ovarian Cancer Diagnostics and Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Cancer Type

- 8.1.1. Epithelial Ovarian Tumors

- 8.1.2. Ovarian Germ Cell Tumors

- 8.1.3. Other Cancer Types

- 8.2. Market Analysis, Insights and Forecast - by Modality

- 8.2.1. Diagnosis

- 8.2.1.1. Biopsy

- 8.2.1.2. Blood Tests

- 8.2.1.3. Ultrasound

- 8.2.1.4. PET

- 8.2.1.5. CT Scan

- 8.2.1.6. Other Diagnosis

- 8.2.2. Therapeutics

- 8.2.2.1. Chemotherapy

- 8.2.2.2. Radiation Therapy

- 8.2.2.3. Immunotherapy

- 8.2.2.4. Hormonal Therapy

- 8.2.2.5. Other Therapeutics

- 8.2.1. Diagnosis

- 8.1. Market Analysis, Insights and Forecast - by Cancer Type

- 9. Italy Europe Ovarian Cancer Diagnostics and Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Cancer Type

- 9.1.1. Epithelial Ovarian Tumors

- 9.1.2. Ovarian Germ Cell Tumors

- 9.1.3. Other Cancer Types

- 9.2. Market Analysis, Insights and Forecast - by Modality

- 9.2.1. Diagnosis

- 9.2.1.1. Biopsy

- 9.2.1.2. Blood Tests

- 9.2.1.3. Ultrasound

- 9.2.1.4. PET

- 9.2.1.5. CT Scan

- 9.2.1.6. Other Diagnosis

- 9.2.2. Therapeutics

- 9.2.2.1. Chemotherapy

- 9.2.2.2. Radiation Therapy

- 9.2.2.3. Immunotherapy

- 9.2.2.4. Hormonal Therapy

- 9.2.2.5. Other Therapeutics

- 9.2.1. Diagnosis

- 9.1. Market Analysis, Insights and Forecast - by Cancer Type

- 10. Spain Europe Ovarian Cancer Diagnostics and Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Cancer Type

- 10.1.1. Epithelial Ovarian Tumors

- 10.1.2. Ovarian Germ Cell Tumors

- 10.1.3. Other Cancer Types

- 10.2. Market Analysis, Insights and Forecast - by Modality

- 10.2.1. Diagnosis

- 10.2.1.1. Biopsy

- 10.2.1.2. Blood Tests

- 10.2.1.3. Ultrasound

- 10.2.1.4. PET

- 10.2.1.5. CT Scan

- 10.2.1.6. Other Diagnosis

- 10.2.2. Therapeutics

- 10.2.2.1. Chemotherapy

- 10.2.2.2. Radiation Therapy

- 10.2.2.3. Immunotherapy

- 10.2.2.4. Hormonal Therapy

- 10.2.2.5. Other Therapeutics

- 10.2.1. Diagnosis

- 10.1. Market Analysis, Insights and Forecast - by Cancer Type

- 11. Rest of Europe Europe Ovarian Cancer Diagnostics and Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Cancer Type

- 11.1.1. Epithelial Ovarian Tumors

- 11.1.2. Ovarian Germ Cell Tumors

- 11.1.3. Other Cancer Types

- 11.2. Market Analysis, Insights and Forecast - by Modality

- 11.2.1. Diagnosis

- 11.2.1.1. Biopsy

- 11.2.1.2. Blood Tests

- 11.2.1.3. Ultrasound

- 11.2.1.4. PET

- 11.2.1.5. CT Scan

- 11.2.1.6. Other Diagnosis

- 11.2.2. Therapeutics

- 11.2.2.1. Chemotherapy

- 11.2.2.2. Radiation Therapy

- 11.2.2.3. Immunotherapy

- 11.2.2.4. Hormonal Therapy

- 11.2.2.5. Other Therapeutics

- 11.2.1. Diagnosis

- 11.1. Market Analysis, Insights and Forecast - by Cancer Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 INEX Innovate

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Boehringer Ingelheim International GmbH

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 AstraZeneca PLC

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Eli Lilly and Company

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Siemens Healthineers AG

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Johnson and Johnson (Janssen Pharmaceuticals)

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Ovation Diagnostics

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Bristol Myers Squibb Company

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 F Hoffman-La Roche Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Amneal Pharmaceuticals LLC

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 GlaxoSmithKline PLC

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Pfizer Inc

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 INEX Innovate

List of Figures

- Figure 1: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue billion Forecast, by Cancer Type 2020 & 2033

- Table 2: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Cancer Type 2020 & 2033

- Table 3: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue billion Forecast, by Modality 2020 & 2033

- Table 4: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Modality 2020 & 2033

- Table 5: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue billion Forecast, by Cancer Type 2020 & 2033

- Table 8: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Cancer Type 2020 & 2033

- Table 9: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue billion Forecast, by Modality 2020 & 2033

- Table 10: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Modality 2020 & 2033

- Table 11: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue billion Forecast, by Cancer Type 2020 & 2033

- Table 14: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Cancer Type 2020 & 2033

- Table 15: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue billion Forecast, by Modality 2020 & 2033

- Table 16: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Modality 2020 & 2033

- Table 17: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue billion Forecast, by Cancer Type 2020 & 2033

- Table 20: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Cancer Type 2020 & 2033

- Table 21: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue billion Forecast, by Modality 2020 & 2033

- Table 22: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Modality 2020 & 2033

- Table 23: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue billion Forecast, by Cancer Type 2020 & 2033

- Table 26: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Cancer Type 2020 & 2033

- Table 27: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue billion Forecast, by Modality 2020 & 2033

- Table 28: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Modality 2020 & 2033

- Table 29: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue billion Forecast, by Cancer Type 2020 & 2033

- Table 32: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Cancer Type 2020 & 2033

- Table 33: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue billion Forecast, by Modality 2020 & 2033

- Table 34: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Modality 2020 & 2033

- Table 35: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue billion Forecast, by Cancer Type 2020 & 2033

- Table 38: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Cancer Type 2020 & 2033

- Table 39: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue billion Forecast, by Modality 2020 & 2033

- Table 40: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Modality 2020 & 2033

- Table 41: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Europe Ovarian Cancer Diagnostics and Therapeutics Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Ovarian Cancer Diagnostics and Therapeutics Industry?

The projected CAGR is approximately 14.99%.

2. Which companies are prominent players in the Europe Ovarian Cancer Diagnostics and Therapeutics Industry?

Key companies in the market include INEX Innovate, Boehringer Ingelheim International GmbH, AstraZeneca PLC, Eli Lilly and Company, Siemens Healthineers AG, Johnson and Johnson (Janssen Pharmaceuticals), Ovation Diagnostics, Bristol Myers Squibb Company, F Hoffman-La Roche Ltd, Amneal Pharmaceuticals LLC, GlaxoSmithKline PLC, Pfizer Inc.

3. What are the main segments of the Europe Ovarian Cancer Diagnostics and Therapeutics Industry?

The market segments include Cancer Type, Modality.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.62 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Burden of Ovarian Cancer; Greater Use of Combination Therapies for the Treatment of Ovarian Cancer; Rising Geriatric Population.

6. What are the notable trends driving market growth?

Immunotherapy is Expected to Hold Significant Share of the European Ovarian Cancer Diagnostics and Therapeutics Market During the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Accurate Diagnosis of Ovarian Cancer.

8. Can you provide examples of recent developments in the market?

August 2022: Inceptua Group commercially launched Apealea in Germany for the treatment of adult patients with the first relapse of platinum-sensitive epithelial ovarian cancer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Ovarian Cancer Diagnostics and Therapeutics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Ovarian Cancer Diagnostics and Therapeutics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Ovarian Cancer Diagnostics and Therapeutics Industry?

To stay informed about further developments, trends, and reports in the Europe Ovarian Cancer Diagnostics and Therapeutics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence