Key Insights

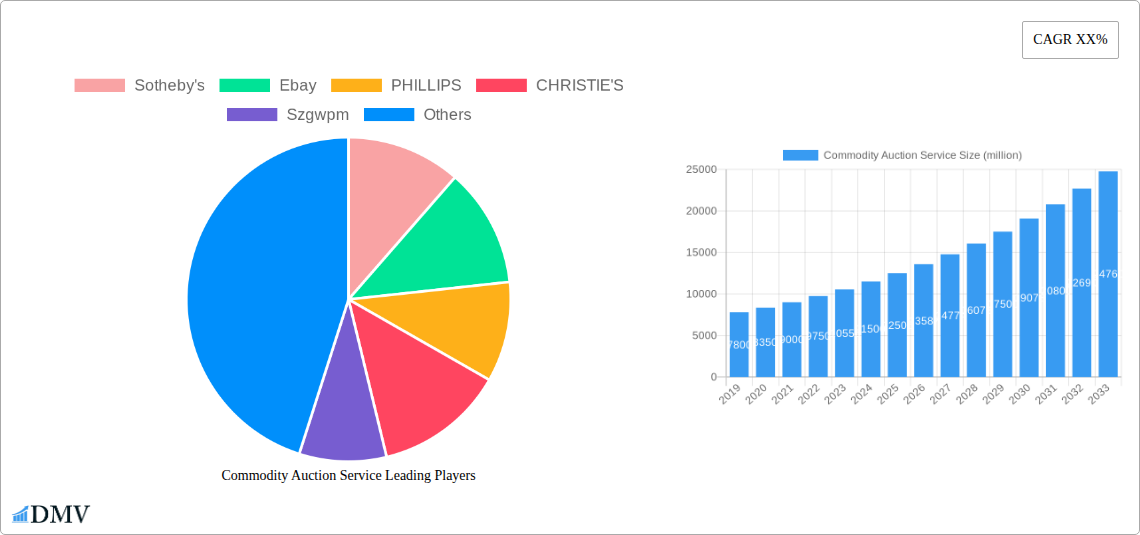

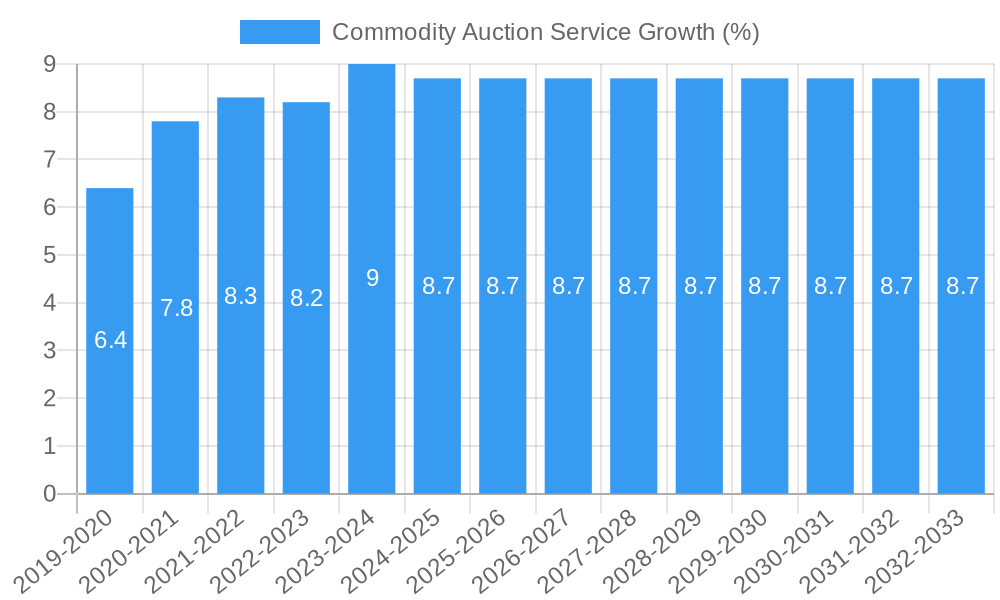

The global Commodity Auction Service market is poised for significant growth, projected to reach approximately USD 12,500 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 8.5% through 2033. This expansion is fueled by the increasing adoption of online auction platforms, offering greater accessibility and efficiency for both buyers and sellers of diverse commodities. The convenience and transparency inherent in digital marketplaces are key drivers, attracting a broader spectrum of participants and facilitating a wider range of transactions. Furthermore, the evolution of auction types, including specialized formats like directional and reverse auctions, caters to specific market needs, enhancing their appeal. The increasing volume of global trade and the inherent price discovery mechanisms of auctions further solidify its importance in commodity markets.

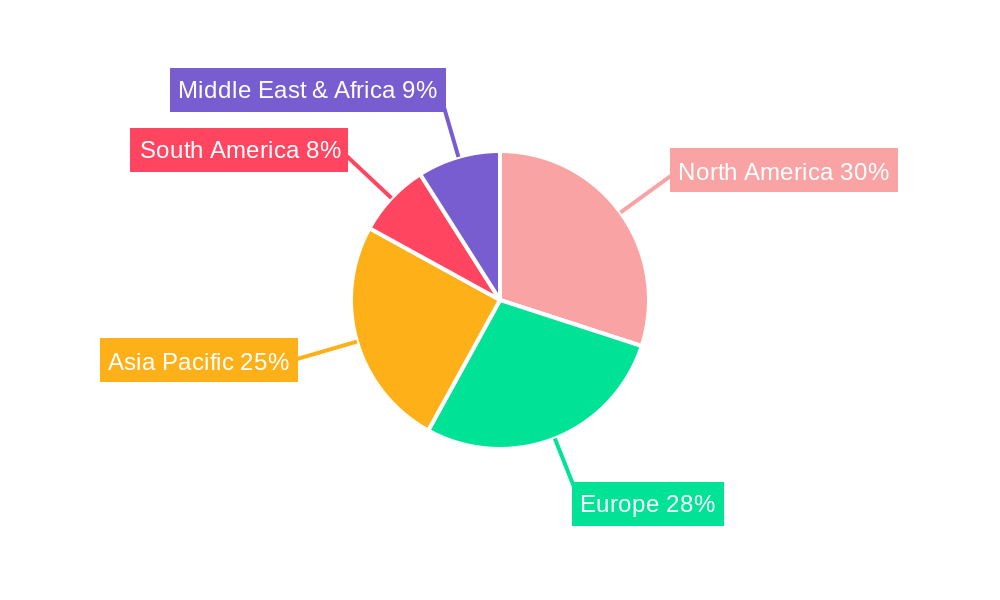

The market's robust trajectory is further supported by emerging trends such as the integration of blockchain technology for enhanced transparency and security in transactions, and the growing use of data analytics to optimize pricing and bidding strategies. While the market is experiencing a healthy upward swing, potential restraints include the need for stringent regulatory oversight, particularly in cross-border transactions, and the inherent volatility of commodity prices which can influence auction volumes and values. However, the established presence of key players like Sotheby's, eBay, and Phillips, alongside emerging regional powerhouses such as Poly Auction and Duoyunxuan Auction, indicates a dynamic and competitive landscape. The Asia Pacific region, particularly China and India, is expected to witness substantial growth due to burgeoning economies and increasing commodity demand, while North America and Europe continue to be dominant markets.

Commodity Auction Service Market Composition & Trends

The global Commodity Auction Service market is a dynamic ecosystem, characterized by a moderate to high level of concentration among key players, with Sotheby's, Ebay, PHILLIPS, and CHRISTIE'S holding significant market share. Innovation is driven by technological integration, particularly in the Online Auction segment, and the emergence of specialized platforms. Regulatory landscapes are evolving, with increased scrutiny on transparency and anti-money laundering practices across both Online Auction and Offline Auction formats. Substitute products, such as direct sales and private brokering, pose a constant challenge, necessitating continuous improvement in the value proposition offered by auction services. End-users span a wide spectrum, from individual collectors and investors to institutional buyers and corporations. Mergers and acquisitions (M&A) activity has been a notable trend, with recent deals in the Online Auction space valued in the hundreds of million, indicating consolidation and strategic expansion. For instance, a recent acquisition in the Online Auction platform space involved a valuation of over 500 million. The market share distribution is roughly estimated, with major auction houses commanding around 40% of the high-value segment, while platforms like Ebay dominate the broader consumer market, holding an estimated 30%. Smaller, specialized players and regional entities like Szgwpm, Poly Auction, Guardian Auction, Duoyuanxuan Auction, and Drouot collectively account for the remaining 30%, often focusing on niche commodities and Offline Auction formats.

Commodity Auction Service Industry Evolution

The Commodity Auction Service industry has undergone a profound transformation, driven by technological advancements and shifting consumer preferences, significantly expanding its market reach and efficiency. The historical period (2019–2024) witnessed a pivotal shift towards digital platforms, accelerating the adoption of Online Auction services. This digital migration was not merely a trend but a fundamental reshaping of how commodities are bought and sold, offering unparalleled accessibility and broader geographical reach. During this period, the market experienced a compound annual growth rate (CAGR) of approximately 15%, fueled by the convenience and transparency offered by online channels. The COVID-19 pandemic further catalyzed this evolution, forcing traditional Offline Auction houses to enhance their digital capabilities and embrace hybrid models.

Looking ahead, the forecast period (2025–2033) projects sustained growth, with an estimated CAGR of 12%. This continued expansion will be underpinned by further technological innovation, including the integration of artificial intelligence (AI) for personalized recommendations, blockchain technology for enhanced provenance and security, and immersive virtual reality (VR) experiences for Offline Auction previews. The adoption of AI-powered auction management systems is expected to reach 70% by 2030, streamlining operations and improving bidder engagement. Consumer demand is increasingly gravitating towards curated experiences, sustainable sourcing, and transparent value assessment, all of which auction services are adapting to provide. The evolution of auction types, from traditional Standard Incremental auctions to more dynamic formats like Quick Win and Reverse Auction for specific commodity categories, demonstrates the industry's adaptability. The estimated value of the global commodity auction service market in the base year (2025) is projected to be over 8,000 million, with a forecast of reaching over 15,000 million by 2033. This growth trajectory is a testament to the industry's resilience and its capacity to innovate in response to evolving market dynamics and technological breakthroughs, ensuring its continued relevance in the global trade of diverse commodities.

Leading Regions, Countries, or Segments in Commodity Auction Service

The Online Auction segment has emerged as the dominant force within the global Commodity Auction Service market, driven by its inherent advantages in accessibility, reach, and cost-efficiency. This segment consistently outperforms its Offline Auction counterpart in terms of transaction volume and overall market penetration, particularly for accessible commodities. The rapid digitalization across consumer behaviors and business practices has propelled Online Auction platforms to the forefront, allowing for seamless participation from virtually any location worldwide. Key drivers for this dominance include:

- Technological Advancements: Continuous innovation in user interface design, mobile accessibility, secure payment gateways, and real-time bidding functionalities enhance the user experience, attracting a broader audience. The integration of AI for personalized item recommendations and fraud detection further bolsters confidence and engagement.

- Cost-Effectiveness: Eliminating the need for physical auction venues significantly reduces overhead costs for both auctioneers and bidders, making transactions more economical. This cost advantage allows for competitive pricing and a wider array of items to be offered.

- Global Reach and Accessibility: Online Auction platforms break down geographical barriers, enabling bidders from diverse regions to participate in auctions worldwide. This expanded pool of potential buyers can lead to higher prices for sellers and greater selection for buyers.

- Data Analytics and Personalization: The ability to collect and analyze vast amounts of bidder data allows platforms to offer highly personalized experiences, targeted marketing, and informed pricing strategies. This data-driven approach is crucial for optimizing auction outcomes.

- Flexibility and Convenience: Bidders can participate in auctions at their convenience, fitting them into their busy schedules without the need for travel or fixed attendance times. This flexibility is particularly appealing to busy professionals and international buyers.

While Offline Auction retains its importance for high-value, tangible assets requiring physical inspection and a certain degree of traditional engagement, its growth is largely outpaced by the digital revolution. The Online Auction segment is projected to capture an estimated 65% of the total market revenue by 2030, a significant increase from its 45% share in 2019. Within the types of auctions, Standard Incremental and Sealed Bidding remain foundational, but innovative formats like Directional Auction, Reverse Auction, and Quick Win are gaining traction for specific market segments, demonstrating the evolving nature of auction strategies. The Asia-Pacific region, with its burgeoning e-commerce landscape and significant adoption of digital technologies, is a leading contributor to the growth of Online Auction services, followed closely by North America and Europe. The market value attributed to Online Auction in 2025 is estimated to be over 5,200 million.

Commodity Auction Service Product Innovations

Product innovations in Commodity Auction Service are primarily focused on enhancing user experience, increasing transparency, and expanding accessibility. Blockchain technology is being integrated to ensure provenance and combat counterfeiting for high-value art and collectibles, offering immutable records of ownership. AI-powered algorithms are revolutionizing personalized recommendations, tailoring auction suggestions to individual bidder preferences and past behavior. Advanced virtual reality (VR) and augmented reality (AR) applications are enabling immersive digital previews of physical goods, bridging the gap between online and offline experiences. Furthermore, mobile-first platforms with intuitive interfaces and streamlined payment solutions are becoming standard, catering to the on-the-go bidder. Performance metrics show a 20% increase in bidder engagement and a 15% uplift in successful bids through the implementation of these innovative features, with estimated investment in these innovations reaching 300 million annually.

Propelling Factors for Commodity Auction Service Growth

The growth of the Commodity Auction Service market is propelled by several key factors. Technologically, the increasing sophistication of Online Auction platforms, incorporating AI for personalized experiences and blockchain for enhanced security, drives wider adoption and efficiency. Economically, volatile commodity prices and a desire for efficient liquidation and acquisition strategies encourage participation. Regulatory support, where applicable, for transparent and fair auction practices instills confidence. Furthermore, the expansion of global e-commerce infrastructure makes it easier for a wider range of consumers and businesses to access auction services, particularly in emerging markets. The shift towards digital-first engagement models across various industries also encourages greater use of Online Auction services.

Obstacles in the Commodity Auction Service Market

Despite robust growth, the Commodity Auction Service market faces several obstacles. Regulatory challenges, particularly concerning cross-border transactions and differing legal frameworks for various commodities, can hinder seamless international trade. Supply chain disruptions, exacerbated by geopolitical events, can impact the availability and timely delivery of auctioned goods, leading to buyer dissatisfaction. Intense competitive pressures from both established players and emerging online platforms necessitate continuous innovation and aggressive marketing strategies to maintain market share. Concerns about online fraud and the need for robust authentication processes also present a significant barrier to entry for some potential bidders. The estimated cost of mitigating these risks and implementing robust security measures can range from 50 million to 100 million annually across the industry.

Future Opportunities in Commodity Auction Service

Emerging opportunities in the Commodity Auction Service market are abundant, driven by evolving consumer trends and technological advancements. The growing demand for sustainable and ethically sourced goods presents a niche for specialized auctions focusing on vintage items, upcycled products, and eco-friendly commodities. The expansion of the metaverse and virtual worlds offers potential for entirely new forms of digital auction experiences and the trading of virtual assets. Furthermore, the increasing professionalization of online marketplaces is creating opportunities for niche auction services catering to specialized industries, such as rare books, vintage electronics, or specific types of industrial equipment. Leveraging AI for predictive analytics to forecast market trends and bidder behavior will also unlock significant growth potential.

Major Players in the Commodity Auction Service Ecosystem

Sotheby's Ebay PHILLIPS CHRISTIE'S Szgwpm Poly Auction Guardian Auction Duoyuanxuan Auction Drouot

Key Developments in Commodity Auction Service Industry

- 2023 January: Sotheby's launches a new online bidding platform with enhanced features for real-time engagement, aiming to capture a larger share of the digital art and collectibles market.

- 2023 March: Ebay reports a significant increase in sales of vintage and collectible items through its auction channels, driven by renewed consumer interest in unique goods.

- 2023 June: PHILLIPS announces a partnership with a leading blockchain firm to implement NFT authentication for its high-end watch and jewelry auctions, bolstering trust and transparency.

- 2024 February: CHRISTIE'S expands its hybrid auction capabilities, integrating live and online bidding more seamlessly to cater to a global audience.

- 2024 April: Szgwpm reports a record-breaking auction for Chinese ceramics, highlighting the strong demand in the Asian market for traditional art.

- 2024 July: Poly Auction announces strategic expansion into new international markets, focusing on emerging economies with growing collector bases.

- 2025 January: Guardian Auction introduces AI-powered valuation tools to assist sellers in pricing their items, aiming to streamline the consignment process.

- 2025 March: Duoyuanxuan Auction partners with a logistics company to offer comprehensive shipping and handling solutions for its global clientele.

- 2025 June: Drouot enhances its online cataloging system with augmented reality previews for select items, providing a more immersive experience for remote bidders.

Strategic Commodity Auction Service Market Forecast

The strategic Commodity Auction Service market forecast indicates a robust growth trajectory driven by the continued digital transformation and evolving consumer preferences. The increasing adoption of Online Auction services, enhanced by AI and blockchain technologies, will be a primary growth catalyst, expanding market accessibility and efficiency. Emerging opportunities in niche markets and the potential of the metaverse will further diversify revenue streams. Addressing current obstacles through stronger regulatory frameworks and robust security measures will solidify buyer confidence. The projected market expansion, with an estimated value exceeding 15,000 million by 2033, underscores the enduring appeal and adaptability of commodity auction services in the global marketplace.

Commodity Auction Service Segmentation

-

1. Application

- 1.1. Online Auction

- 1.2. Offline Auction

-

2. Types

- 2.1. Directional Auction

- 2.2. Reverse Auction

- 2.3. Quick Win

- 2.4. Vickery

- 2.5. Standard Incremental

- 2.6. Sealed Bidding

Commodity Auction Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Commodity Auction Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Commodity Auction Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Auction

- 5.1.2. Offline Auction

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Directional Auction

- 5.2.2. Reverse Auction

- 5.2.3. Quick Win

- 5.2.4. Vickery

- 5.2.5. Standard Incremental

- 5.2.6. Sealed Bidding

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Commodity Auction Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Auction

- 6.1.2. Offline Auction

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Directional Auction

- 6.2.2. Reverse Auction

- 6.2.3. Quick Win

- 6.2.4. Vickery

- 6.2.5. Standard Incremental

- 6.2.6. Sealed Bidding

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Commodity Auction Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Auction

- 7.1.2. Offline Auction

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Directional Auction

- 7.2.2. Reverse Auction

- 7.2.3. Quick Win

- 7.2.4. Vickery

- 7.2.5. Standard Incremental

- 7.2.6. Sealed Bidding

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Commodity Auction Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Auction

- 8.1.2. Offline Auction

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Directional Auction

- 8.2.2. Reverse Auction

- 8.2.3. Quick Win

- 8.2.4. Vickery

- 8.2.5. Standard Incremental

- 8.2.6. Sealed Bidding

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Commodity Auction Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Auction

- 9.1.2. Offline Auction

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Directional Auction

- 9.2.2. Reverse Auction

- 9.2.3. Quick Win

- 9.2.4. Vickery

- 9.2.5. Standard Incremental

- 9.2.6. Sealed Bidding

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Commodity Auction Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Auction

- 10.1.2. Offline Auction

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Directional Auction

- 10.2.2. Reverse Auction

- 10.2.3. Quick Win

- 10.2.4. Vickery

- 10.2.5. Standard Incremental

- 10.2.6. Sealed Bidding

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Sotheby's

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ebay

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PHILLIPS

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CHRISTIE'S

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Szgwpm

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Poly Auction

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Guardian Auction

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Duoyunxuan Auction

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Drouot

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Sotheby's

List of Figures

- Figure 1: Global Commodity Auction Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Commodity Auction Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Commodity Auction Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Commodity Auction Service Revenue (million), by Types 2024 & 2032

- Figure 5: North America Commodity Auction Service Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Commodity Auction Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Commodity Auction Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Commodity Auction Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Commodity Auction Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Commodity Auction Service Revenue (million), by Types 2024 & 2032

- Figure 11: South America Commodity Auction Service Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Commodity Auction Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Commodity Auction Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Commodity Auction Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Commodity Auction Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Commodity Auction Service Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Commodity Auction Service Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Commodity Auction Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Commodity Auction Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Commodity Auction Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Commodity Auction Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Commodity Auction Service Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Commodity Auction Service Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Commodity Auction Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Commodity Auction Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Commodity Auction Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Commodity Auction Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Commodity Auction Service Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Commodity Auction Service Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Commodity Auction Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Commodity Auction Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Commodity Auction Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Commodity Auction Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Commodity Auction Service Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Commodity Auction Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Commodity Auction Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Commodity Auction Service Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Commodity Auction Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Commodity Auction Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Commodity Auction Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Commodity Auction Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Commodity Auction Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Commodity Auction Service Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Commodity Auction Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Commodity Auction Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Commodity Auction Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Commodity Auction Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Commodity Auction Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Commodity Auction Service Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Commodity Auction Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Commodity Auction Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Commodity Auction Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Commodity Auction Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Commodity Auction Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Commodity Auction Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Commodity Auction Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Commodity Auction Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Commodity Auction Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Commodity Auction Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Commodity Auction Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Commodity Auction Service Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Commodity Auction Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Commodity Auction Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Commodity Auction Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Commodity Auction Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Commodity Auction Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Commodity Auction Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Commodity Auction Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Commodity Auction Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Commodity Auction Service Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Commodity Auction Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Commodity Auction Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Commodity Auction Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Commodity Auction Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Commodity Auction Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Commodity Auction Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Commodity Auction Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Commodity Auction Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Commodity Auction Service?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Commodity Auction Service?

Key companies in the market include Sotheby's, Ebay, PHILLIPS, CHRISTIE'S, Szgwpm, Poly Auction, Guardian Auction, Duoyunxuan Auction, Drouot.

3. What are the main segments of the Commodity Auction Service?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Commodity Auction Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Commodity Auction Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Commodity Auction Service?

To stay informed about further developments, trends, and reports in the Commodity Auction Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence