Key Insights

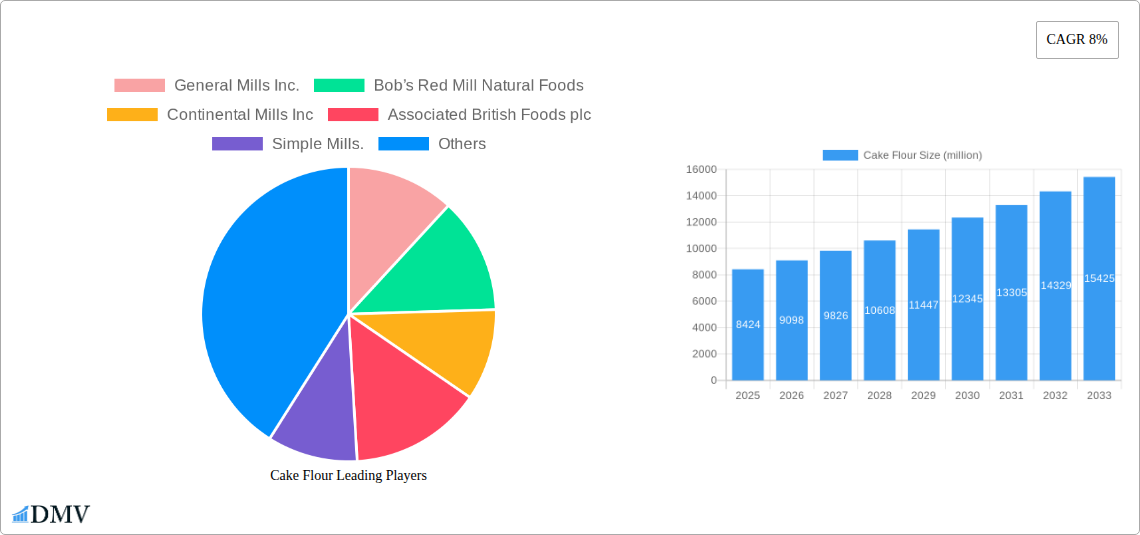

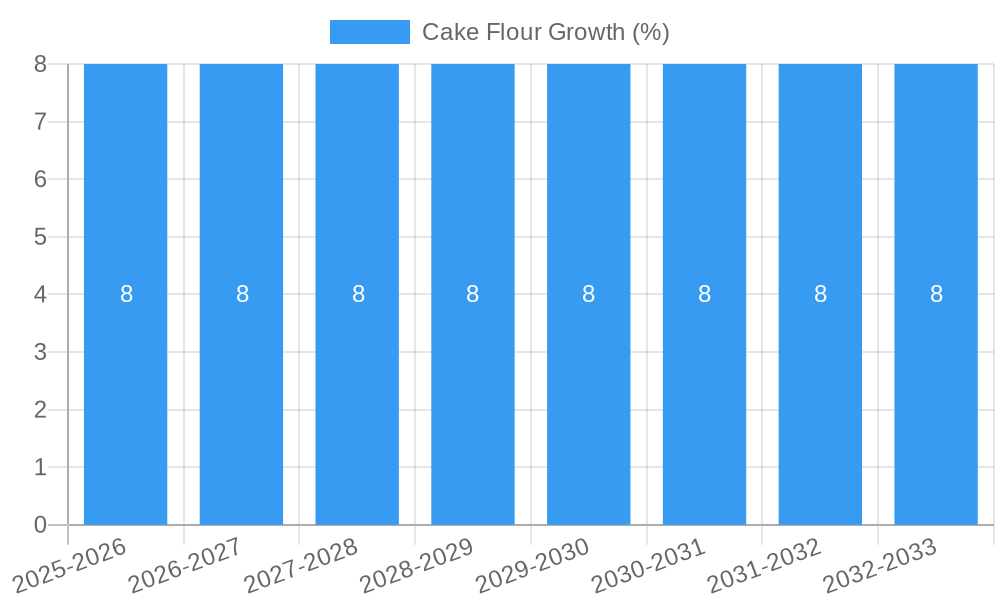

The global Cake Flour market is poised for significant expansion, with an estimated market size of USD 8,424 million and a projected Compound Annual Growth Rate (CAGR) of 8% for the forecast period 2025-2033. This robust growth is fueled by an increasing consumer demand for convenient and high-quality baking ingredients, driven by the burgeoning e-commerce sector and the growing popularity of home baking. The versatility of cake flour, catering to a wide array of applications from indulgent chocolate and vanilla cakes to healthier fruit-infused options, further solidifies its market position. Key market players are actively innovating, introducing specialized flour blends and expanding their distribution networks to capture a larger share of this dynamic market. The rise of artisanal baking and the increasing influence of social media in promoting baking trends are also significant contributors to this upward trajectory.

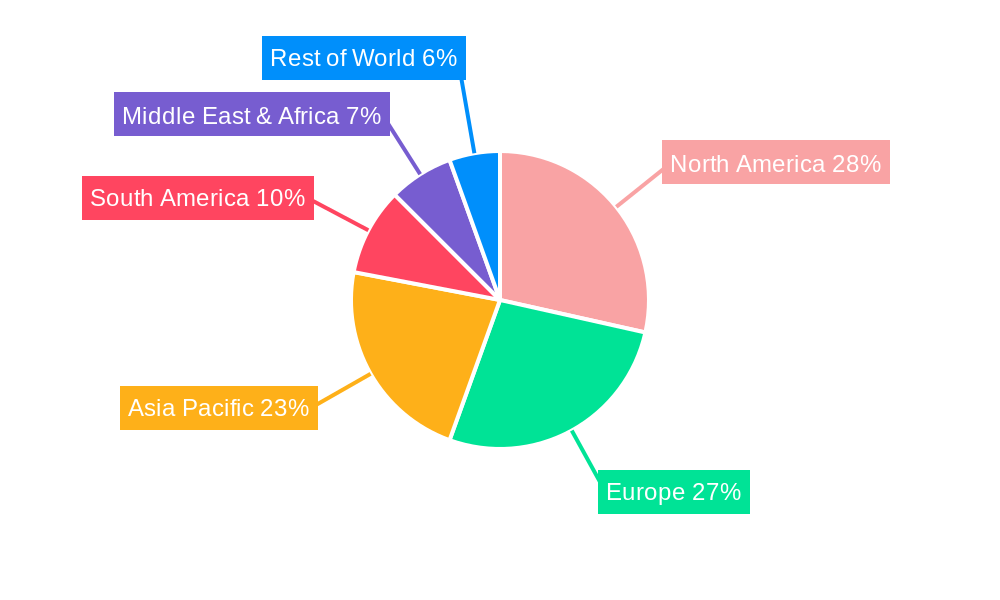

The market's expansion is strategically supported by diverse applications, with e-commerce emerging as a dominant channel, offering unparalleled accessibility and a wide product selection to consumers. While offline retail remains a consistent contributor, the digital marketplace is set to revolutionize how cake flour is purchased and consumed. The product landscape is characterized by a variety of flavor profiles, including original, chocolate, vanilla, and fruit-based options, alongside an "other" category that signifies ongoing innovation and niche product development. North America and Europe are expected to remain leading regions, driven by established baking cultures and strong consumer purchasing power. However, the Asia Pacific region, with its rapidly growing middle class and increasing adoption of Western culinary trends, presents substantial untapped potential for market growth in the coming years. The market's resilience is further underpinned by a growing awareness of the importance of quality ingredients in achieving superior baking results.

Cake Flour Market Composition & Trends

The global cake flour market is characterized by moderate concentration, with key players like General Mills Inc., Bob’s Red Mill Natural Foods, Continental Mills Inc., Associated British Foods plc, and Conagra Brands Inc. holding significant shares. Innovation is a significant catalyst, driven by demand for specialized flours and convenience. Regulatory landscapes are evolving, with a growing emphasis on food safety and ingredient transparency, impacting formulation and labeling. Substitute products, such as all-purpose flour blends and alternative grain flours, present a competitive pressure, necessitating differentiation through specialized properties and branding. End-user profiles are diverse, ranging from professional bakers and food manufacturers to home bakers seeking premium ingredients. Mergers and acquisitions (M&A) are strategically shaping the market, with recent deals valued in the hundreds of millions aimed at expanding product portfolios and market reach. For instance, a recent $500 million acquisition by a major food conglomerate focused on acquiring niche specialty flour brands. The market share distribution within the cake flour sector is estimated at 70% for Original cake flour and 30% for flavored variants as of the base year. The value of M&A deals within the specialty flour segment over the historical period (2019-2024) is estimated to be $1.2 billion. Future M&A activity is projected to focus on companies with strong e-commerce presence and innovative product lines, valued at approximately $750 million in the forecast period.

Cake Flour Industry Evolution

The cake flour industry has undergone a dynamic evolution, marked by consistent growth trajectories and significant technological advancements. The historical period (2019-2024) witnessed a compound annual growth rate (CAGR) of 5.5%, driven by an increasing demand for high-quality baking ingredients. This upward trend is projected to continue into the forecast period (2025-2033), with an estimated CAGR of 6.2%, reaching a market size of $5.3 billion by 2033. Technological advancements have been instrumental in this growth. Innovations in milling techniques have led to finer flour textures, resulting in lighter and more tender cakes. Furthermore, advancements in gluten-free cake flour formulations have opened new avenues for market expansion, catering to a growing segment of health-conscious consumers. The adoption rate of specialized cake flour varieties has seen a substantial increase, with gluten-free cake flour adoption growing by 15% annually over the last three years. Consumer demands have also shifted considerably. There is a heightened preference for natural and organic ingredients, with consumers actively seeking cake flours free from artificial additives and preservatives. This has spurred manufacturers to invest in sustainable sourcing and organic certification. The rise of the e-commerce channel has also played a pivotal role, providing consumers with easy access to a wider range of cake flour products and brands. The online sales channel is projected to account for 45% of total cake flour sales by 2028. Shifting consumer preferences towards premium and artisanal baking experiences further fuel demand for specialized flours like cake flour, contributing to an estimated market growth of $2 billion in the study period. The investment in research and development for novel cake flour formulations is expected to reach $300 million by 2027.

Leading Regions, Countries, or Segments in Cake Flour

North America currently stands as the dominant region in the global cake flour market, driven by deeply ingrained baking traditions and a strong consumer appetite for high-quality baked goods. The United States, in particular, represents a significant market share, estimated at 38% of the global market as of the base year 2025. This dominance is fueled by several key factors. Investment trends in the food processing industry within North America are robust, with manufacturers continuously investing in advanced milling technologies and product development to meet evolving consumer needs. Regulatory support for food safety and labeling standards also instills confidence among consumers, further bolstering the market.

Within the application segments, the Offline segment continues to hold a substantial market share, accounting for approximately 65% of total sales in 2025. This is attributed to the traditional retail infrastructure, including supermarkets, hypermarkets, and specialty baking stores, which remain primary purchasing points for many consumers and professional bakers. However, the e-commerce segment is experiencing rapid growth, projected to capture 35% of the market by 2033, with a CAGR of 8.5% during the forecast period. This surge is driven by convenience, wider product availability, and competitive pricing offered online.

In terms of product types, the Original cake flour segment remains the market leader, representing an estimated 55% of global sales in 2025. Its versatility and widespread use in traditional cake recipes solidify its position. However, the Chocolate and Vanilla cake flour segments are showing accelerated growth, with CAGRs of 7.2% and 6.8% respectively, driven by increasing consumer preference for flavored baked goods and convenience products. The Fruit and Other segments, while smaller, are also poised for expansion due to innovative flavor profiles and niche applications.

Key Drivers for North America's Dominance:

- Strong cultural affinity for baking and confectionery.

- High disposable income enabling premium ingredient purchases.

- Well-established food retail and distribution networks.

- Continuous product innovation by leading companies like General Mills Inc. and Bob’s Red Mill Natural Foods.

Growth in E-commerce:

- Increasing online penetration and digital adoption.

- Targeted marketing and promotions by online retailers.

- The rise of direct-to-consumer (DTC) models from specialized brands like Miss Jones Baking Co.

Segmental Growth Trends:

- Premiumization in baking drives demand for specialized flavors.

- Innovation in ready-to-bake mixes incorporating flavored cake flours.

- Expansion of gluten-free and allergen-free cake flour options within the "Other" category.

Cake Flour Product Innovations

Product innovations in the cake flour market are increasingly focusing on enhancing user experience and catering to specific dietary needs. Advances in milling technology have resulted in ultra-fine cake flours, delivering unparalleled tenderness and a lighter crumb in baked goods. Brands are also introducing pre-mixed cake flour formulations that incorporate leavening agents and stabilizers, simplifying the baking process for home consumers. Furthermore, the development of specialized cake flours, such as gluten-free and protein-fortified variants, is expanding the market's reach. Performance metrics like improved rise, reduced density, and enhanced moisture retention are key selling points for these innovative products. For example, a new line of cake flours boasts 30% better moisture retention compared to conventional flours, and the adoption of these advanced formulations is projected to reach 25% by 2028.

Propelling Factors for Cake Flour Growth

Several factors are propelling the growth of the cake flour market. Technological advancements in milling and formulation, leading to superior texture and specialized options, are key drivers. The growing popularity of home baking, amplified by social media trends and increased leisure time, fuels consistent demand. Economic factors, such as rising disposable incomes in emerging economies, enable consumers to opt for premium baking ingredients. Regulatory support for clean label initiatives and ingredient transparency also encourages manufacturers to develop and market high-quality cake flours. Furthermore, the continuous innovation in product variety, including gluten-free and flavored options, caters to diverse consumer preferences and dietary needs. The global home baking market is projected to grow by $10 billion in the study period.

Obstacles in the Cake Flour Market

Despite robust growth, the cake flour market faces several obstacles. Regulatory challenges, particularly concerning ingredient sourcing and labeling in different regions, can impact market entry and compliance costs. Supply chain disruptions, such as fluctuations in grain availability and transportation issues, can affect production and pricing. Intense competitive pressures from established brands and the introduction of private-label alternatives also pose a threat, potentially leading to price wars. The availability and affordability of substitute products like all-purpose flour also present a restraint, especially for price-sensitive consumers. The impact of supply chain disruptions on raw material costs has been an increase of approximately 12% in the historical period.

Future Opportunities in Cake Flour

Emerging opportunities in the cake flour market lie in further diversification and catering to niche segments. The demand for organic and sustainably sourced cake flours is on the rise, presenting a significant growth avenue. Innovations in functional cake flours, incorporating added health benefits like fiber or probiotics, are poised to capture consumer interest. The expansion of the e-commerce channel, including direct-to-consumer (DTC) sales, offers a direct pathway to reach a broader customer base. Furthermore, exploring untapped markets in developing economies with a growing middle class and increasing interest in Western baking trends presents substantial potential. The global organic food market is projected to grow by $80 billion in the study period.

Major Players in the Cake Flour Ecosystem

- General Mills Inc.

- Bob’s Red Mill Natural Foods

- Continental Mills Inc.

- Associated British Foods plc

- Simple Mills.

- Conagra Brands Inc.

- Hain Celestial Group Inc.

- Chelsea Milling Co.

- Miss Jones Baking Co.

- Kellogg Co.

- Auf Foods Co.,Ltd.

- Binzhou Zhongyu Food Co.,Ltd.

Key Developments in Cake Flour Industry

- January 2024: General Mills Inc. launched a new line of organic cake flours, expanding its sustainable product offerings.

- November 2023: Bob’s Red Mill Natural Foods introduced an innovative gluten-free cake flour blend, enhancing its allergen-friendly range.

- July 2023: Continental Mills Inc. acquired a regional specialty flour producer, strengthening its market presence in the US Northeast.

- April 2023: Associated British Foods plc announced a significant investment in R&D for novel flavor infusions in cake flours.

- February 2023: Simple Mills. expanded its e-commerce reach by partnering with a major online grocery platform.

- December 2022: Conagra Brands Inc. reported a 15% year-over-year increase in sales for its cake flour product line.

- September 2022: Hain Celestial Group Inc. focused on enhancing its supply chain for natural ingredients, impacting its cake flour production.

- May 2022: Chelsea Milling Co. celebrated its centennial, highlighting its legacy in traditional cake flour production.

- March 2022: Miss Jones Baking Co. introduced a subscription service for its premium cake flour, boosting customer loyalty.

- January 2022: Kellogg Co. explored potential acquisitions in the specialty baking ingredients sector.

- October 2021: Auf Foods Co.,Ltd. expanded its production capacity for cake flour to meet rising domestic demand.

- June 2021: Binzhou Zhongyu Food Co.,Ltd. invested in new milling technology to improve flour fineness and consistency.

Strategic Cake Flour Market Forecast

The strategic cake flour market forecast indicates a promising growth trajectory driven by persistent innovation and evolving consumer preferences. The increasing demand for convenient, high-quality baking ingredients, coupled with the expansion of e-commerce platforms, will continue to propel market expansion. Key opportunities lie in catering to niche markets, such as health-conscious consumers seeking organic and functional flours, and in leveraging technological advancements to create superior baking experiences. Strategic investments in R&D and market expansion, particularly in emerging economies, will be crucial for stakeholders to capitalize on the projected CAGR of 6.2% from 2025 to 2033, reaching an estimated $5.3 billion by the end of the forecast period.

Cake Flour Segmentation

-

1. Application

- 1.1. e-commerce

- 1.2. Offline

-

2. Types

- 2.1. Original

- 2.2. Chocolate

- 2.3. Vanilla

- 2.4. Fruit

- 2.5. Othe

Cake Flour Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cake Flour REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cake Flour Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. e-commerce

- 5.1.2. Offline

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Original

- 5.2.2. Chocolate

- 5.2.3. Vanilla

- 5.2.4. Fruit

- 5.2.5. Othe

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Cake Flour Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. e-commerce

- 6.1.2. Offline

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Original

- 6.2.2. Chocolate

- 6.2.3. Vanilla

- 6.2.4. Fruit

- 6.2.5. Othe

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Cake Flour Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. e-commerce

- 7.1.2. Offline

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Original

- 7.2.2. Chocolate

- 7.2.3. Vanilla

- 7.2.4. Fruit

- 7.2.5. Othe

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Cake Flour Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. e-commerce

- 8.1.2. Offline

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Original

- 8.2.2. Chocolate

- 8.2.3. Vanilla

- 8.2.4. Fruit

- 8.2.5. Othe

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Cake Flour Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. e-commerce

- 9.1.2. Offline

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Original

- 9.2.2. Chocolate

- 9.2.3. Vanilla

- 9.2.4. Fruit

- 9.2.5. Othe

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Cake Flour Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. e-commerce

- 10.1.2. Offline

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Original

- 10.2.2. Chocolate

- 10.2.3. Vanilla

- 10.2.4. Fruit

- 10.2.5. Othe

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 General Mills Inc.

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bob’s Red Mill Natural Foods

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Continental Mills Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Associated British Foods plc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Simple Mills.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Conagra Brands Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hain Celestial Group Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Chelsea Milling Co.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Miss Jones Baking Co

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kellogg Co

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Auf Foods Co.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Ltd.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Binzhou Zhongyu Food Co.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Ltd.

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 General Mills Inc.

List of Figures

- Figure 1: Global Cake Flour Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Cake Flour Revenue (million), by Application 2024 & 2032

- Figure 3: North America Cake Flour Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Cake Flour Revenue (million), by Types 2024 & 2032

- Figure 5: North America Cake Flour Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Cake Flour Revenue (million), by Country 2024 & 2032

- Figure 7: North America Cake Flour Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Cake Flour Revenue (million), by Application 2024 & 2032

- Figure 9: South America Cake Flour Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Cake Flour Revenue (million), by Types 2024 & 2032

- Figure 11: South America Cake Flour Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Cake Flour Revenue (million), by Country 2024 & 2032

- Figure 13: South America Cake Flour Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Cake Flour Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Cake Flour Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Cake Flour Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Cake Flour Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Cake Flour Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Cake Flour Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Cake Flour Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Cake Flour Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Cake Flour Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Cake Flour Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Cake Flour Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Cake Flour Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Cake Flour Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Cake Flour Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Cake Flour Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Cake Flour Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Cake Flour Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Cake Flour Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cake Flour Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Cake Flour Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Cake Flour Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Cake Flour Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Cake Flour Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Cake Flour Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Cake Flour Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Cake Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Cake Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Cake Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Cake Flour Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Cake Flour Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Cake Flour Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Cake Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Cake Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Cake Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Cake Flour Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Cake Flour Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Cake Flour Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Cake Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Cake Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Cake Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Cake Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Cake Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Cake Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Cake Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Cake Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Cake Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Cake Flour Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Cake Flour Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Cake Flour Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Cake Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Cake Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Cake Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Cake Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Cake Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Cake Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Cake Flour Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Cake Flour Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Cake Flour Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Cake Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Cake Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Cake Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Cake Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Cake Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Cake Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Cake Flour Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cake Flour?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Cake Flour?

Key companies in the market include General Mills Inc., Bob’s Red Mill Natural Foods, Continental Mills Inc, Associated British Foods plc, Simple Mills., Conagra Brands Inc, Hain Celestial Group Inc, Chelsea Milling Co., Miss Jones Baking Co, Kellogg Co, Auf Foods Co., Ltd., Binzhou Zhongyu Food Co., Ltd..

3. What are the main segments of the Cake Flour?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 84240 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cake Flour," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cake Flour report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cake Flour?

To stay informed about further developments, trends, and reports in the Cake Flour, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence