Key Insights

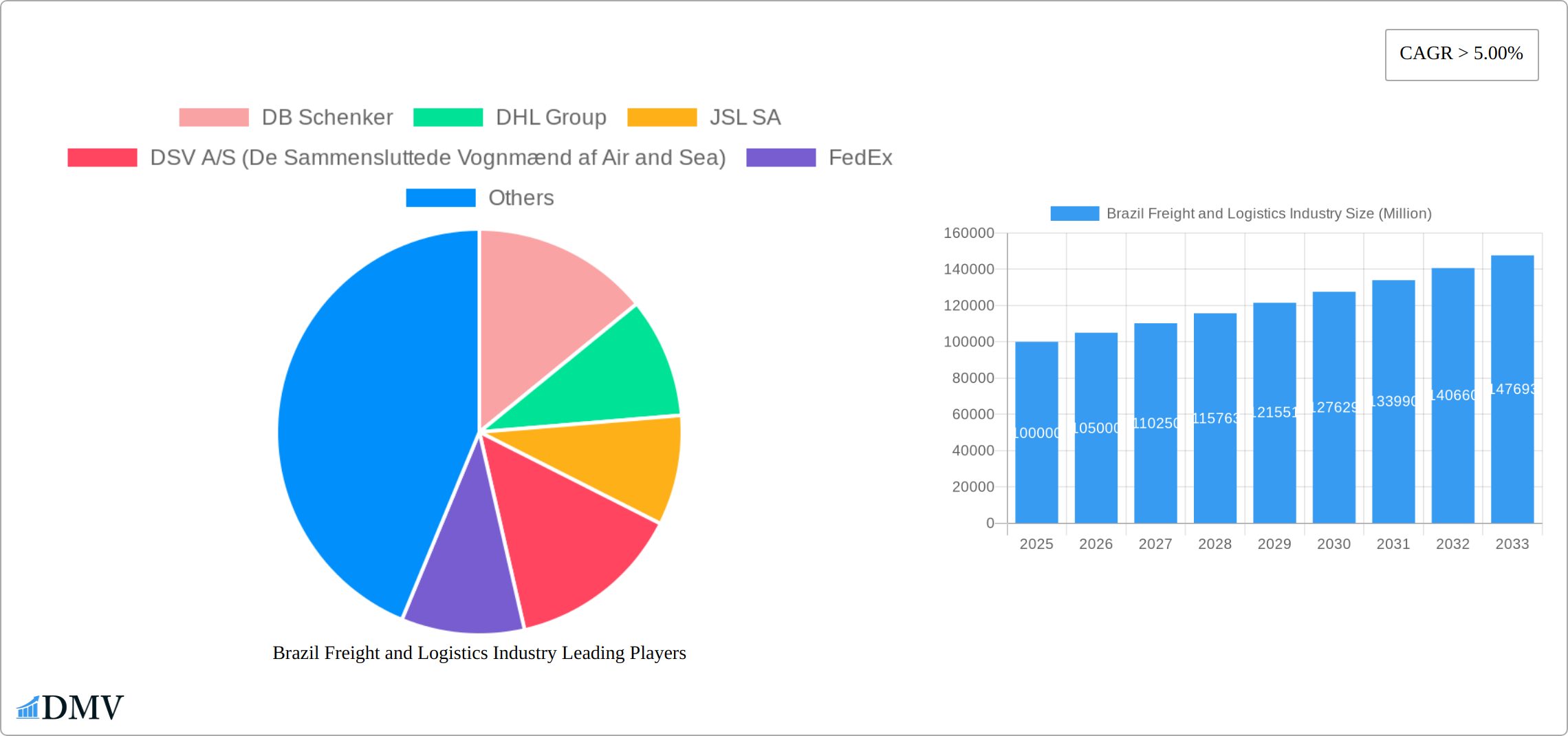

The Brazilian freight and logistics industry is experiencing robust growth, fueled by a burgeoning e-commerce sector, increasing industrial activity, and expanding infrastructure projects. The market, valued at approximately $X billion in 2025 (assuming a logical market size based on global trends and a 5%+ CAGR), is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 5% through 2033. Key drivers include the expansion of Brazil's agricultural exports, particularly in commodities like soybeans and beef, the growth of the manufacturing sector, and a rising demand for efficient supply chain solutions. The industry is segmented by end-user industry (agriculture, construction, manufacturing, oil & gas, mining, retail, etc.) and logistics function (courier, express, parcel, temperature-controlled, and other services). The significant presence of major players like DHL, FedEx, and DB Schenker highlights the industry's maturity and international connectivity.

Growth is further propelled by ongoing investments in infrastructure, including improved roadways, port facilities, and railway networks. However, challenges remain, including infrastructure limitations in certain regions, bureaucratic complexities, and the need for improved technological integration across the supply chain. Despite these constraints, the positive economic outlook for Brazil, coupled with a growing focus on logistics optimization and e-commerce fulfillment, ensures the continued expansion of this vital sector. The increasing adoption of technology like route optimization software and real-time tracking systems also promises to enhance efficiency and drive further growth. Competition remains intense among both established multinational corporations and domestic logistics providers, with strategic partnerships and acquisitions becoming increasingly common.

Brazil Freight and Logistics Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Brazilian freight and logistics industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. From market composition and leading players to future growth opportunities and challenges, this report covers all key aspects of this multi-billion-dollar sector. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033.

Brazil Freight and Logistics Industry Market Composition & Trends

The Brazilian freight and logistics industry presents a dynamic and complex landscape shaped by diverse players, innovative technologies, evolving regulations, and robust market dynamics. While the market exhibits a degree of concentration among major players, the competitive environment remains fiercely contested. Significant mergers and acquisitions (M&A) activity, involving deals valued in the hundreds of millions of USD in recent years, underscore the ongoing consolidation and strategic repositioning within the sector. Innovation is a key driver, fueled by the increasing adoption of technologies such as electric vehicles, autonomous delivery systems, Internet of Things (IoT) devices, artificial intelligence (AI)-powered optimization software, and blockchain solutions for enhanced supply chain transparency. Simultaneously, the regulatory environment is undergoing transformation, with a focus on sustainability initiatives, infrastructure development, and streamlined processes. While substitute products exist, they currently pose a limited threat to the core market. The industry serves a broad range of end-user industries, including agriculture, fishing, and forestry; construction; manufacturing; oil and gas; mining and quarrying; wholesale and retail trade; and others, each with unique logistical needs and challenges.

- Market Concentration: The top 5 players hold approximately [Insert Updated Percentage]% of the market share (2024). [Optional: Add a brief explanation of the market share calculation methodology.]

- M&A Activity: Total M&A deal value exceeded USD [Insert Updated Value] Million in the period 2019-2024. [Optional: Briefly mention the types of M&A activity, e.g., horizontal, vertical integration.]

- Innovation Catalysts: Increased adoption of IoT, AI, blockchain, and automation technologies is driving efficiency gains and improved supply chain visibility. [Optional: Provide specific examples of innovative applications in the Brazilian context.]

- Regulatory Landscape: Government initiatives focused on infrastructure improvements (e.g., [mention specific projects or initiatives]), regulatory streamlining, and the promotion of sustainable practices are shaping the industry's future. [Optional: Briefly discuss the impact of any relevant legislation.]

Brazil Freight and Logistics Industry Industry Evolution

The Brazilian freight and logistics market has demonstrated robust growth over the past five years (2019-2024), achieving a Compound Annual Growth Rate (CAGR) of [Insert Updated CAGR]%. This expansion is attributed to several converging factors, including the surge in e-commerce activity, increased industrial production across various sectors, and significant investments in infrastructure development. Technological advancements, encompassing the implementation of blockchain for enhanced supply chain transparency, the burgeoning use of autonomous vehicles for last-mile delivery, and the broader adoption of digital solutions for logistics management, are fundamentally transforming the sector's operational efficiency and capabilities. Simultaneously, evolving consumer demands, particularly a strong preference for faster, more reliable, and more transparent delivery services, are influencing industry practices and driving innovation. Continued market growth is projected throughout the forecast period (2025-2033), albeit at a slightly moderated CAGR of [Insert Updated CAGR]%, with technological innovation and ongoing infrastructure improvements serving as key growth drivers. [Optional: Add a sentence or two about potential challenges to growth, such as economic fluctuations or geopolitical factors.]

Leading Regions, Countries, or Segments in Brazil Freight and Logistics Industry

The Brazilian freight and logistics industry exhibits significant regional disparities in market concentration and growth, with the Southeastern region establishing itself as the dominant hub. This leadership is primarily driven by its high concentration of manufacturing, industrial, and population centers, resulting in substantial demand for logistical services. Within the end-user segments, Wholesale and Retail Trade, and Manufacturing stand out as particularly significant contributors to industry growth, demanding sophisticated and efficient logistical solutions. Furthermore, Courier, Express, and Parcel (CEP) services are experiencing remarkable growth potential, largely fueled by the explosive expansion of the e-commerce sector.

Key Drivers for Southeastern Region Dominance:

- High concentration of industrial and manufacturing activities.

- Extensive and well-developed transportation infrastructure, including major ports and airports.

- Significant population density and high levels of consumption.

- [Optional: Add another specific point, e.g., proximity to major consumer markets.]

Key Drivers for Wholesale and Retail Trade Dominance:

- Rapid growth of e-commerce sector, demanding efficient last-mile delivery solutions.

- Increased demand for efficient and reliable supply chains to meet consumer expectations.

- Government initiatives designed to enhance the efficiency and competitiveness of retail logistics.

Key Drivers for CEP Services Growth:

- Exponential growth of e-commerce, driving the need for faster and more frequent deliveries.

- Heightened consumer expectations for faster delivery times and enhanced tracking capabilities.

- Technological advancements in logistics and delivery technologies, such as route optimization software and automated sorting systems.

Brazil Freight and Logistics Industry Product Innovations

Recent innovations include the implementation of sophisticated route optimization software, the adoption of electric and alternative fuel vehicles to reduce carbon footprints, and the integration of AI-powered predictive analytics for enhanced supply chain efficiency. These advancements aim to improve delivery speed, reduce costs, and enhance sustainability. A notable example is Kuehne + Nagel's "Book & Claim" insetting solution for electric vehicles, allowing customers to offset carbon emissions.

Propelling Factors for Brazil Freight and Logistics Industry Growth

Several factors are driving the growth of Brazil's freight and logistics industry. The expanding e-commerce market demands efficient delivery solutions. Government investments in infrastructure improvements, such as highway expansions and port modernization, are facilitating smoother transportation. Technological innovations, like AI-powered route optimization and autonomous vehicles, are enhancing operational efficiency and reducing costs. Furthermore, the growth of Brazil's manufacturing and industrial sectors fuels the demand for reliable logistics services.

Obstacles in the Brazil Freight and Logistics Industry Market

Despite strong growth potential, the industry faces significant hurdles. Bureaucratic regulations and infrastructure deficiencies in certain regions create operational challenges and increased costs. Supply chain disruptions, including port congestion and driver shortages, can impact delivery timelines and reliability. Intense competition among numerous players necessitates efficiency and adaptability to maintain market share. These factors contribute to a complex operating environment.

Future Opportunities in Brazil Freight and Logistics Industry

The Brazilian freight and logistics industry is poised for continued expansion and transformation, presenting a wealth of opportunities for businesses and investors. Expansion into currently underserved rural regions offers significant potential for market penetration and growth. The increasing demand for sustainable logistics solutions, such as electric vehicle fleets, alternative fuels, and eco-friendly packaging, presents a lucrative avenue for innovation and differentiation. Strategic investments in advanced technologies like artificial intelligence (AI) for predictive analytics and route optimization, and blockchain for improved supply chain traceability and security, will further enhance efficiency and transparency. The integration of smart logistics solutions, including real-time tracking and data-driven decision-making, will unlock new levels of operational optimization and customer satisfaction. [Optional: Mention specific government policies or incentives that support these opportunities.]

Major Players in the Brazil Freight and Logistics Industry Ecosystem

- DB Schenker

- DHL Group

- JSL SA

- DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- FedEx

- DC Logistics Brasil

- Kuehne + Nagel

- Braspress Transportes Urgentes

- AMTrans Logistics

- TBL - Transportes Bertolini Ltda

- Tegma Gestao Logistica S

- Gafor SA [Optional: Add other relevant players, consider adding a brief description for each company if space allows.]

Key Developments in Brazil Freight and Logistics Industry Industry

January 2024: Polar (DHL Group) invested over R$ 5 Million in five multi-temperature trucks, expanding its capacity for temperature-sensitive goods. This addresses a significant gap in the Brazilian healthcare logistics market.

January 2024: Kuehne + Nagel launched its Book & Claim insetting solution for electric vehicles, enabling customers to reduce their carbon footprint even when not directly utilizing electric transport.

February 2024: DHL Supply Chain and Adidas inaugurated a state-of-the-art USD 14 Million distribution center, integrating innovative technologies and sustainable practices. This signifies a significant investment in modern logistics infrastructure and underscores the growing focus on efficiency and sustainability.

Strategic Brazil Freight and Logistics Industry Market Forecast

The Brazilian freight and logistics market is poised for sustained growth driven by infrastructure development, technological advancements, and the expansion of e-commerce. Opportunities abound in expanding into underserved regions, adopting sustainable practices, and investing in cutting-edge technologies. The market's size is projected to reach USD xx Million by 2033, presenting substantial potential for both established and new entrants.

Brazil Freight and Logistics Industry Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Logistics Function

-

2.1. Courier, Express, and Parcel (CEP)

-

2.1.1. By Destination Type

- 2.1.1.1. Domestic

- 2.1.1.2. International

-

2.1.1. By Destination Type

-

2.2. Freight Forwarding

-

2.2.1. By Mode Of Transport

- 2.2.1.1. Air

- 2.2.1.2. Sea and Inland Waterways

- 2.2.1.3. Others

-

2.2.1. By Mode Of Transport

-

2.3. Freight Transport

- 2.3.1. Pipelines

- 2.3.2. Rail

- 2.3.3. Road

-

2.4. Warehousing and Storage

-

2.4.1. By Temperature Control

- 2.4.1.1. Non-Temperature Controlled

-

2.4.1. By Temperature Control

- 2.5. Other Services

-

2.1. Courier, Express, and Parcel (CEP)

Brazil Freight and Logistics Industry Segmentation By Geography

- 1. Brazil

Brazil Freight and Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increase demand of Petrochemical is driving the market4.; Increase in Investments is driving the market

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost of Operations

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Freight and Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Logistics Function

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.2.1.1. By Destination Type

- 5.2.1.1.1. Domestic

- 5.2.1.1.2. International

- 5.2.1.1. By Destination Type

- 5.2.2. Freight Forwarding

- 5.2.2.1. By Mode Of Transport

- 5.2.2.1.1. Air

- 5.2.2.1.2. Sea and Inland Waterways

- 5.2.2.1.3. Others

- 5.2.2.1. By Mode Of Transport

- 5.2.3. Freight Transport

- 5.2.3.1. Pipelines

- 5.2.3.2. Rail

- 5.2.3.3. Road

- 5.2.4. Warehousing and Storage

- 5.2.4.1. By Temperature Control

- 5.2.4.1.1. Non-Temperature Controlled

- 5.2.4.1. By Temperature Control

- 5.2.5. Other Services

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 JSL SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 FedEx

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DC Logistics Brasil

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kuehne + Nagel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Braspress Transportes Urgentes

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AMTrans Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TBL - Transportes Bertolini Ltda

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Tegma Gestao Logistica S

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Gafor SA

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Brazil Freight and Logistics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Freight and Logistics Industry Share (%) by Company 2024

List of Tables

- Table 1: Brazil Freight and Logistics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Freight and Logistics Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Brazil Freight and Logistics Industry Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 4: Brazil Freight and Logistics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Brazil Freight and Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Freight and Logistics Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 7: Brazil Freight and Logistics Industry Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 8: Brazil Freight and Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Freight and Logistics Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Brazil Freight and Logistics Industry?

Key companies in the market include DB Schenker, DHL Group, JSL SA, DSV A/S (De Sammensluttede Vognmænd af Air and Sea), FedEx, DC Logistics Brasil, Kuehne + Nagel, Braspress Transportes Urgentes, AMTrans Logistics, TBL - Transportes Bertolini Ltda, Tegma Gestao Logistica S, Gafor SA.

3. What are the main segments of the Brazil Freight and Logistics Industry?

The market segments include End User Industry, Logistics Function.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increase demand of Petrochemical is driving the market4.; Increase in Investments is driving the market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

4.; High Cost of Operations.

8. Can you provide examples of recent developments in the market?

February 2024: DHL Supply Chain and ADIDAS, inaugurated one of the most modern Distribution Centers (DCs) in Brazil. With an investment of more than USD 14M (R$ 70 million), the facilities were built from scratch especially for this project and add innovative technologies and sustainable practices. The new CD, with nearly 40,000 m², will be adidas' main logistics operations center in Brazil, serving the three areas (e-commerce, retail and own stores) in a synergistic way in a more agile, efficient and technological logistics design.January 2024: Polar, a DHL Group company specialized in the transportation of medicines, vaccines and other medical and hospital supplies, has included in its fleet currently composed of more than 350 vehicles, 5 multi-temperature trucks, in an investment of more than R$ 5 million. The new vehicle profile makes it possible to deliver products that require different temperature ranges, something that is still uncommon in the health logistics market in Brazil.January 2024: Kuehne + Nagel has announced its Book & Claim insetting solution for electric vehicles, to improve its decarbonization solutions. Developing Book & Claim insetting solutions for road freight was a strategic priority for Kuehne + Nagel. Customers who use Kuehne + Nagel's road transport services can now claim the carbon reductions of electric trucks when it is not possible to physically move their goods on these vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Freight and Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Freight and Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Freight and Logistics Industry?

To stay informed about further developments, trends, and reports in the Brazil Freight and Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence