Key Insights

The Indonesian e-commerce logistics market is projected for significant expansion, driven by the nation's burgeoning digital commerce sector. Forecasted to achieve a Compound Annual Growth Rate (CAGR) of 14.8%, the market is anticipated to reach approximately $848.87 billion by the base year 2025. Key growth catalysts include widespread internet and smartphone adoption, an expanding middle class with increased purchasing power, and government-backed digitalization efforts. The market's segmentation across service types (transportation, warehousing, value-added services), business models (B2B, B2C), destinations (domestic, international), and product categories (fashion, electronics, home goods) offers diverse strategic opportunities. Leading market participants, including DHL Express, UPS, and J&T Express, alongside numerous domestic logistics providers, are expected to focus on service excellence, technological innovation, and cost efficiency to maintain a competitive edge. The growing demand for effective last-mile delivery and optimized warehousing solutions will be pivotal in shaping market dynamics.

Indonesia eCommerce Logistics Market Market Size (In Billion)

Despite the promising outlook, the market faces hurdles such as regional infrastructure limitations, volatile fuel costs affecting operational expenses, and the necessity for enhanced supply chain management to support e-commerce growth. Successful navigation of these challenges, alongside localized strategies, will be crucial for market penetration and sustained growth. Future expansion will depend on overcoming logistical complexities, adopting advanced tracking and delivery technologies, and cultivating consumer confidence through reliable service. The varied product segments within the market present avenues for specialization and tailored service development, catering to specific e-commerce industry needs.

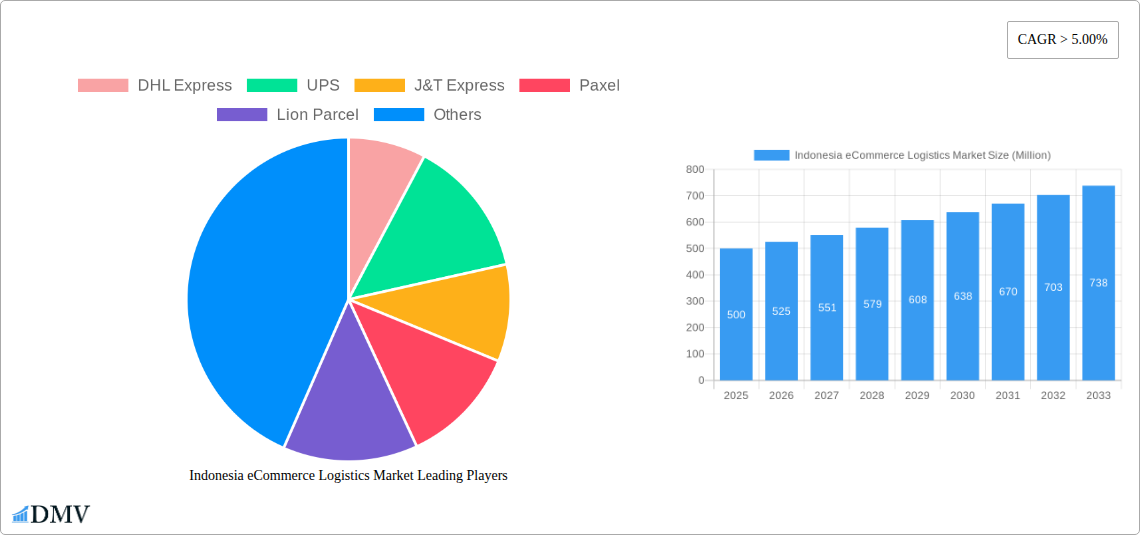

Indonesia eCommerce Logistics Market Company Market Share

Indonesia eCommerce Logistics Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Indonesia eCommerce logistics market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the immense opportunities within this dynamic market. The market is projected to reach xx Million by 2033, demonstrating substantial growth potential.

Indonesia eCommerce Logistics Market Composition & Trends

This section delves into the competitive landscape of the Indonesian eCommerce logistics market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The report analyzes the market share distribution among key players, including DHL Express, UPS, J&T Express, Paxel, Lion Parcel, Ninja Xpress, POS Indonesia, JNE Express, SiCepat Ekspres Indonesia, and Wahana Express (list not exhaustive). We evaluate the impact of regulatory changes on market dynamics and identify emerging trends that are shaping the industry's future. The analysis includes an assessment of M&A deal values and their influence on market consolidation. The report also explores the diverse end-user profiles within the B2B and B2C segments, providing a granular understanding of consumer behavior and preferences.

- Market Concentration: The Indonesian eCommerce logistics market exhibits a [Describe level of concentration - e.g., moderately concentrated] market structure with [Number] major players holding approximately [Percentage]% of the market share in 2024. Further analysis of market share distribution is included in the report.

- Innovation Catalysts: Technological advancements, such as AI-powered route optimization and automated warehousing systems, are driving innovation.

- Regulatory Landscape: Government regulations concerning data privacy, cross-border shipping, and environmental sustainability significantly impact market operations.

- Substitute Products: The presence of alternative delivery methods (e.g., same-day delivery options) influences consumer choice and market dynamics.

- M&A Activity: [Number] significant M&A deals were recorded between [Start Year] and [End Year], with a total estimated value of xx Million.

Indonesia eCommerce Logistics Market Industry Evolution

This section meticulously traces the evolution of the Indonesian eCommerce logistics market, analyzing its growth trajectories, technological advancements, and evolving consumer demands throughout the historical period (2019-2024) and into the forecast period (2025-2033). We delve into the market's Compound Annual Growth Rate (CAGR) during the historical period, providing a detailed analysis of the factors contributing to this growth. The report assesses the adoption of key technologies, highlighting their impact on operational efficiency and service quality. Furthermore, it examines shifts in consumer expectations and their implications for logistics providers. This comprehensive analysis provides valuable insights into the market's past performance and future potential.

Leading Regions, Countries, or Segments in Indonesia eCommerce Logistics Market

This section identifies the leading regions, countries, and segments within the Indonesian eCommerce logistics market across various categories. We analyze the dominance factors for each segment, providing a comprehensive understanding of their market share, growth drivers, and potential for future growth.

- By Service: Transportation (dominance analysis); Warehousing and Inventory Management (dominance analysis); Value-added services (labeling, packaging) (dominance analysis).

- By Business: B2B (dominance analysis); B2C (dominance analysis).

- By Destination: Domestic (dominance analysis); International/Cross-border (dominance analysis).

- By Product: Fashion and Apparel (dominance analysis); Consumer Electronics (dominance analysis); Home Appliances (dominance analysis); Furniture (dominance analysis); Beauty and Personal Care Products (dominance analysis); Other products (Toys, Food Products, etc.) (dominance analysis).

Key drivers, including investment trends and regulatory support, are highlighted using bullet points for each segment.

Indonesia eCommerce Logistics Market Product Innovations

Recent innovations in the Indonesian eCommerce logistics market encompass the adoption of automated sorting systems, drone delivery trials in specific regions, and the integration of real-time tracking and delivery optimization software. These advancements enhance efficiency, improve delivery times, and offer enhanced customer experiences. Unique selling propositions include same-day delivery options in urban areas and specialized handling for fragile or temperature-sensitive goods.

Propelling Factors for Indonesia eCommerce Logistics Market Growth

Several factors propel the growth of the Indonesian eCommerce logistics market. Firstly, the rapid expansion of e-commerce in Indonesia, driven by increasing internet and smartphone penetration, fuels the demand for efficient and reliable delivery services. Secondly, government initiatives promoting digitalization and infrastructure development, such as the construction of new roads and logistics hubs, significantly enhance market potential. Finally, technological advancements, including the use of AI and IoT in logistics operations, create further opportunities for market expansion.

Obstacles in the Indonesia eCommerce Logistics Market

The Indonesian eCommerce logistics market faces several challenges. These include the country's vast geographical expanse and diverse infrastructure, leading to higher transportation costs and longer delivery times. Furthermore, regulatory complexities and a lack of standardized procedures can create operational bottlenecks. The intense competition among logistics providers also contributes to downward pressure on pricing and profit margins. These factors collectively impact the overall market growth rate, although the increasing digitization is gradually mitigating some of these challenges.

Future Opportunities in Indonesia eCommerce Logistics Market

The future of the Indonesian eCommerce logistics market holds significant potential. The growth of e-commerce in less-developed regions presents a substantial opportunity for expansion. The adoption of innovative technologies, including autonomous vehicles and AI-powered route optimization, promises to increase efficiency and reduce costs. Finally, the emergence of new business models, such as last-mile delivery partnerships with local businesses, offers opportunities for diversification and improved service reach.

Major Players in the Indonesia eCommerce Logistics Market Ecosystem

- DHL Express

- UPS

- J&T Express

- Paxel

- Lion Parcel

- Ninja Xpress

- POS Indonesia

- JNE Express

- SiCepat Ekspres Indonesia

- Wahana Express

Key Developments in Indonesia eCommerce Logistics Market Industry

- August 2022: J&T Express expanded two sorting centers in Madiun and Banjarmasin (20,000 sq m each, >12,000 sq m building area), launched a free shipping campaign. This signifies investment in infrastructure to meet growing demand and enhance operational capacity.

- December 2022: Ninja Van partnered with Trigana Air to use a Boeing 737-300 for package delivery from Jakarta to Sulawesi, Kalimantan, and Sumatra, enhancing its reach and capacity within the archipelago. The launch of Logistics+ demonstrates a move toward comprehensive supply chain solutions for SMEs.

Strategic Indonesia eCommerce Logistics Market Forecast

The Indonesian eCommerce logistics market is poised for significant growth, driven by continued e-commerce expansion, infrastructure development, and technological advancements. The rising middle class, increasing internet penetration, and government support for digitalization are key growth catalysts. The market is expected to experience substantial growth in the forecast period, with opportunities for both established players and new entrants to participate in this dynamic and expanding sector. Specific forecast figures and growth projections are detailed within the complete report.

Indonesia eCommerce Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing and Inventory Management

- 1.3. Value added services (Labeling, Packaging)

-

2. Business

- 2.1. B2B

- 2.2. B2C

-

3. Destination

- 3.1. Domestic

- 3.2. International/Cross-border

-

4. Product

- 4.1. Fashion and Apparel

- 4.2. Consumer Electronics

- 4.3. Home Appliances

- 4.4. Furniture

- 4.5. Beauty and Personal care products

- 4.6. Other products (Toys, Food Products, etc.)

Indonesia eCommerce Logistics Market Segmentation By Geography

- 1. Indonesia

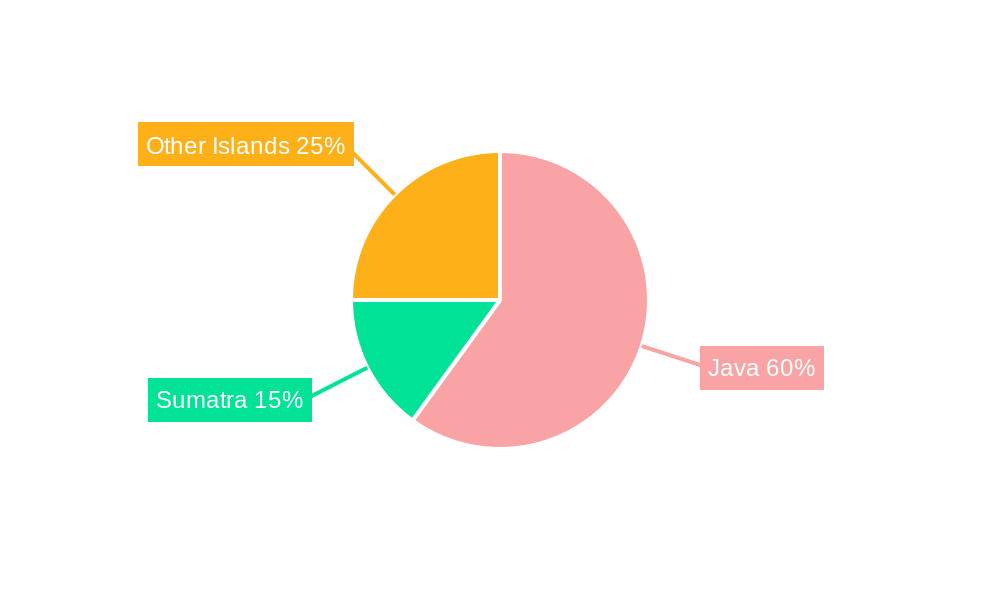

Indonesia eCommerce Logistics Market Regional Market Share

Geographic Coverage of Indonesia eCommerce Logistics Market

Indonesia eCommerce Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in global trade activites; Increase in infrastrustrure and construction

- 3.3. Market Restrains

- 3.3.1. Long distances and sometimes difficult terrain can contribute to increased transportation costs

- 3.4. Market Trends

- 3.4.1. Live Commerce Contributing in Market Expansion

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia eCommerce Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing and Inventory Management

- 5.1.3. Value added services (Labeling, Packaging)

- 5.2. Market Analysis, Insights and Forecast - by Business

- 5.2.1. B2B

- 5.2.2. B2C

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International/Cross-border

- 5.4. Market Analysis, Insights and Forecast - by Product

- 5.4.1. Fashion and Apparel

- 5.4.2. Consumer Electronics

- 5.4.3. Home Appliances

- 5.4.4. Furniture

- 5.4.5. Beauty and Personal care products

- 5.4.6. Other products (Toys, Food Products, etc.)

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DHL Express

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 UPS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 J&T Express

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Paxel

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lion Parcel

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ninja Xpress

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 POS Indonesia**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 JNE Express

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SiCepat Ekspres Indonesia

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Wahana Express

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DHL Express

List of Figures

- Figure 1: Indonesia eCommerce Logistics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Indonesia eCommerce Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia eCommerce Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Indonesia eCommerce Logistics Market Revenue billion Forecast, by Business 2020 & 2033

- Table 3: Indonesia eCommerce Logistics Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 4: Indonesia eCommerce Logistics Market Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Indonesia eCommerce Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Indonesia eCommerce Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 7: Indonesia eCommerce Logistics Market Revenue billion Forecast, by Business 2020 & 2033

- Table 8: Indonesia eCommerce Logistics Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 9: Indonesia eCommerce Logistics Market Revenue billion Forecast, by Product 2020 & 2033

- Table 10: Indonesia eCommerce Logistics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia eCommerce Logistics Market?

The projected CAGR is approximately 14.8%.

2. Which companies are prominent players in the Indonesia eCommerce Logistics Market?

Key companies in the market include DHL Express, UPS, J&T Express, Paxel, Lion Parcel, Ninja Xpress, POS Indonesia**List Not Exhaustive, JNE Express, SiCepat Ekspres Indonesia, Wahana Express.

3. What are the main segments of the Indonesia eCommerce Logistics Market?

The market segments include Service, Business, Destination, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 848.87 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in global trade activites; Increase in infrastrustrure and construction.

6. What are the notable trends driving market growth?

Live Commerce Contributing in Market Expansion.

7. Are there any restraints impacting market growth?

Long distances and sometimes difficult terrain can contribute to increased transportation costs.

8. Can you provide examples of recent developments in the market?

August 2022: Global logistics service provider J&T Express announced the expansion of two sorting centers in Indonesia to meet growing local business demand and upgrade the work environment for employees, along with a free shipping campaign for customers, in celebration of the company's seventh anniversary in the country. To meet the rising demand for delivery services, the two upgraded sorting warehouses in the cities of Madiun and Banjarmasin each cover an area of about 20,000 square meters, with a building area of more than 12,000 square meters.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia eCommerce Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia eCommerce Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia eCommerce Logistics Market?

To stay informed about further developments, trends, and reports in the Indonesia eCommerce Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence