Key Insights

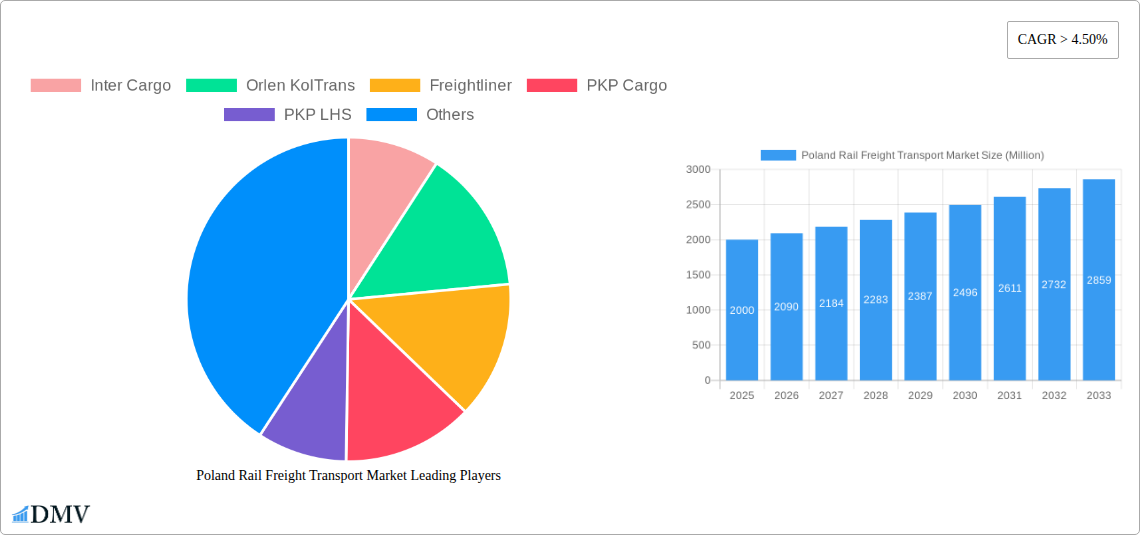

Poland's Rail Freight Transport Market is anticipated to reach 33.4 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 2.64% from 2025 to 2033. This growth is propelled by strategic government investments in rail infrastructure modernization, enhancing efficiency and capacity. A growing emphasis on sustainable logistics and stringent road freight emission regulations are further shifting cargo to rail. The expanding e-commerce sector also boosts demand for reliable rail freight. Key challenges include competition from flexible and potentially lower short-term cost road transport, and the necessity for ongoing technological advancements to optimize operations and reduce transit times. The market is segmented by cargo type (containerized, non-containerized, liquid bulk), destination (domestic, international), and service type (transportation, allied services). Prominent players include Inter Cargo, Orlen KolTrans, and PKP Cargo.

Poland Rail Freight Transport Market Market Size (In Billion)

Containerized freight, bolstered by international trade, significantly contributes to market share. Domestic freight remains a strong segment due to robust economic activity. Allied services, such as railcar maintenance and storage, are also expanding, underscoring the need for comprehensive logistics support. Poland's strategic EU location offers advantages, though cross-border logistics coordination and network interoperability with neighboring countries require continued development. The Poland Rail Freight Transport Market is set for sustained expansion, driven by investment, sustainability policies, and evolving logistics demands. Addressing existing challenges and maintaining a competitive edge against alternative modes will be crucial for continued success.

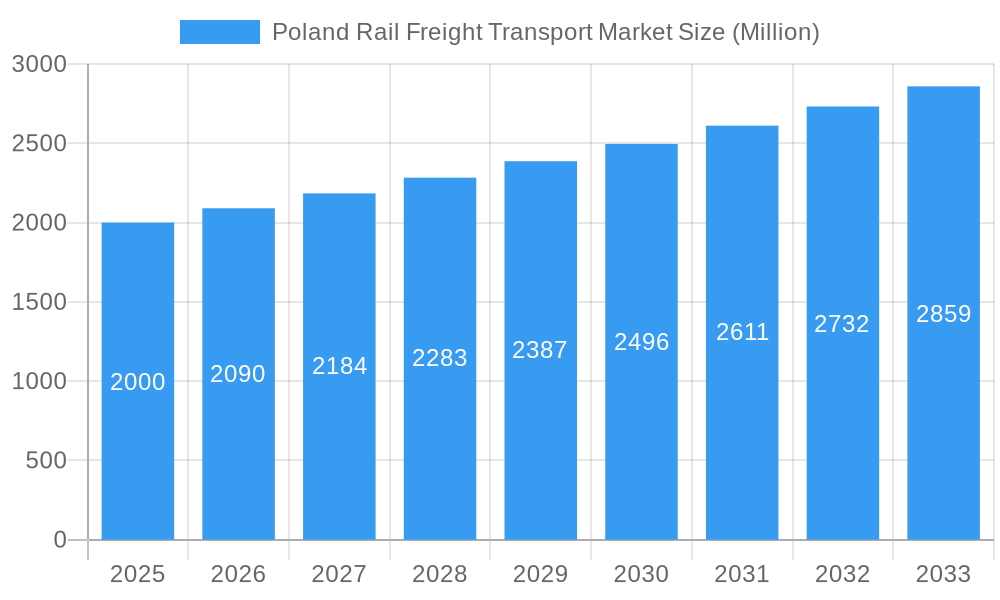

Poland Rail Freight Transport Market Company Market Share

Poland Rail Freight Transport Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Poland Rail Freight Transport Market, offering a comprehensive overview of its current state and future projections. The study period covers 2019-2033, with 2025 serving as the base and estimated year. This in-depth analysis is crucial for stakeholders seeking to understand market dynamics, identify growth opportunities, and make informed business decisions within this dynamic sector. The market is valued at XX Million in 2025 and is projected to reach XX Million by 2033.

Poland Rail Freight Transport Market Composition & Trends

This section dives deep into the competitive landscape of the Polish rail freight market, examining market concentration, innovation drivers, regulatory influences, substitute modes of transport, end-user behavior, and merger & acquisition (M&A) activity.

Market Concentration & Share: The market exhibits a moderately concentrated structure, with key players such as PKP Cargo, Orlen KolTrans, and Inter Cargo holding significant market share. Precise market share distribution is detailed within the report, along with an analysis of competitive intensity and strategic positioning. Smaller players like DB Cargo Polska, CTL Logistics, and others contribute to the overall market vibrancy.

Innovation Catalysts: Technological advancements, such as the adoption of advanced train control systems and the integration of digital technologies for efficient logistics management, are key catalysts for innovation. Furthermore, government initiatives promoting rail freight transport are fostering a climate of innovation within the sector.

Regulatory Landscape: The regulatory framework governing rail freight in Poland plays a crucial role in shaping market dynamics. The report provides a detailed assessment of the current regulations, their impact on market players, and potential future changes.

Substitute Products: Road and waterway transport represent the main substitute modes of transport. The report analyzes their competitive pressures and the relative strengths and weaknesses of each mode.

End-User Profiles: The report segments end-users based on industry, analyzing their specific freight transportation needs and preferences. This includes industries heavily reliant on rail freight, such as manufacturing, mining, and agriculture.

M&A Activities: The report analyzes recent M&A activities in the Polish rail freight sector, providing insights into deal values and their impact on market consolidation. For example, the acquisition of locomotives by LTG Cargo Polska (January 2022) exemplifies this dynamic. The total value of M&A deals within the specified period is estimated at XX Million.

Poland Rail Freight Transport Market Industry Evolution

This section details the evolution of the Poland Rail Freight Transport Market, examining growth trajectories, technological advancements, and shifts in consumer demand from 2019 to 2024 and forecasting trends until 2033. The report analyzes historical growth rates and projects future expansion based on various market factors. Key trends, including increasing adoption of intermodal transport, focus on efficiency improvements and sustainability initiatives are explored. Specific data points on growth rates and technological adoption metrics are presented, providing a granular understanding of market evolution. The report also analyzes the impact of external factors, such as economic fluctuations and geopolitical events, on market growth.

Leading Regions, Countries, or Segments in Poland Rail Freight Transport Market

This section identifies the dominant regions, countries, and segments within the Polish rail freight market, analyzing key factors driving their leadership positions.

By Cargo Type:

- Containerized (Includes Intermodal): This segment experiences strong growth due to increased efficiency and cost-effectiveness. Key drivers include investments in intermodal terminals and improvements to rail infrastructure supporting containerized transport.

- Non-containerized: This segment remains significant, reflecting the diverse nature of goods transported by rail.

- Liquid Bulk: This segment shows steady growth, driven by the transportation of petroleum products and chemicals.

By Destination:

- Domestic: The domestic segment represents the largest share, driven by robust internal demand. Growth is fostered by investments in domestic rail infrastructure and efficient logistics networks.

- International: The international segment exhibits considerable growth potential, facilitated by improvements in cross-border rail connections and increased trade activity.

By Service:

- Transportation: This segment forms the core of the market, encompassing the primary rail freight services.

- Services Allied to Transportation: This burgeoning segment includes railcar maintenance, track maintenance, cargo switching, and storage services. Growing demand is fueled by the need for efficient and reliable rail infrastructure and related services.

The report delves deeper into the dominance factors for each segment, providing detailed analysis and insights.

Poland Rail Freight Transport Market Product Innovations

Recent product innovations include the introduction of more fuel-efficient locomotives and the use of advanced technologies such as GPS tracking and predictive maintenance to enhance operational efficiency and reduce downtime. These innovations improve performance metrics such as fuel consumption, delivery times, and overall cost-effectiveness. The unique selling propositions of these new technologies focus on improved reliability, safety, and environmental sustainability.

Propelling Factors for Poland Rail Freight Transport Market Growth

Several factors fuel the growth of the Polish rail freight market. Government investments in rail infrastructure modernization contribute significantly to increased capacity and operational efficiency. Rising e-commerce activity drives demand for efficient and reliable freight transport solutions, and increased focus on sustainability leads to preference for rail over road transport due to its lower carbon footprint.

Obstacles in the Poland Rail Freight Transport Market

Challenges include the need for continued investment in aging rail infrastructure. Competition from road transport poses a significant challenge, particularly for short-haul freight. Furthermore, potential disruptions to the global supply chain can impact the availability of necessary equipment and materials. These factors may impact the overall market growth trajectory.

Future Opportunities in Poland Rail Freight Transport Market

Opportunities arise from the expansion of intermodal transport networks connecting Poland to other European countries and beyond. Investment in high-speed rail lines will open new markets and enhance connectivity. The increasing demand for sustainable transportation solutions presents a significant opportunity for growth within the rail freight sector.

Major Players in the Poland Rail Freight Transport Market Ecosystem

- Inter Cargo

- Orlen KolTrans

- Freightliner

- PKP Cargo

- PKP LHS

- Rail Polska

- DB Cargo Polska

- CTL Logistics

- Lotos Kolej

- PCC Intermodal

- CD Cargo Poland

Key Developments in Poland Rail Freight Transport Market Industry

- September 2022: PKP CARGO, the Industrial Development Agency, and Polski Tabor Szynowy signed a letter of intent to cooperate on rolling stock, including the Gniewczyn railcar factory restoration, impacting rolling stock availability and maintenance services.

- January 2022: LTG Cargo Polska acquired four new Gama 111Ed locomotives, enhancing its operational capacity and competitiveness.

Strategic Poland Rail Freight Transport Market Forecast

The Polish rail freight market is poised for continued growth driven by ongoing infrastructure investments, increasing demand for efficient and sustainable transportation, and favorable government policies. The forecast period (2025-2033) anticipates significant market expansion, underpinned by these positive trends and the potential for technological advancements.

Poland Rail Freight Transport Market Segmentation

-

1. Cargo Type

- 1.1. Containerized (Includes Intermodal)

- 1.2. Non-containerized

- 1.3. Liquid Bulk

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. Service

- 3.1. Transportation

- 3.2. Services

Poland Rail Freight Transport Market Segmentation By Geography

- 1. Poland

Poland Rail Freight Transport Market Regional Market Share

Geographic Coverage of Poland Rail Freight Transport Market

Poland Rail Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid E-commerce Growth4.; Development Of Logistics Infrastructure And Connectivity

- 3.3. Market Restrains

- 3.3.1. 4.; Logistics Integration In Last-mile Delivery

- 3.4. Market Trends

- 3.4.1. PKP Cargo holds the Largest Share of Rail Cargo transported

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Rail Freight Transport Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Cargo Type

- 5.1.1. Containerized (Includes Intermodal)

- 5.1.2. Non-containerized

- 5.1.3. Liquid Bulk

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Service

- 5.3.1. Transportation

- 5.3.2. Services

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Cargo Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Inter Cargo

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Orlen KolTrans

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Freightliner

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PKP Cargo

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PKP LHS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rail Polska**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DB Cargo Polska

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CTL Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lotos Kolej

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PCC Intermodal

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CD Cargo Poland

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Inter Cargo

List of Figures

- Figure 1: Poland Rail Freight Transport Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Poland Rail Freight Transport Market Share (%) by Company 2025

List of Tables

- Table 1: Poland Rail Freight Transport Market Revenue billion Forecast, by Cargo Type 2020 & 2033

- Table 2: Poland Rail Freight Transport Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 3: Poland Rail Freight Transport Market Revenue billion Forecast, by Service 2020 & 2033

- Table 4: Poland Rail Freight Transport Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Poland Rail Freight Transport Market Revenue billion Forecast, by Cargo Type 2020 & 2033

- Table 6: Poland Rail Freight Transport Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 7: Poland Rail Freight Transport Market Revenue billion Forecast, by Service 2020 & 2033

- Table 8: Poland Rail Freight Transport Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Rail Freight Transport Market?

The projected CAGR is approximately 2.64%.

2. Which companies are prominent players in the Poland Rail Freight Transport Market?

Key companies in the market include Inter Cargo, Orlen KolTrans, Freightliner, PKP Cargo, PKP LHS, Rail Polska**List Not Exhaustive, DB Cargo Polska, CTL Logistics, Lotos Kolej, PCC Intermodal, CD Cargo Poland.

3. What are the main segments of the Poland Rail Freight Transport Market?

The market segments include Cargo Type, Destination, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 33.4 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid E-commerce Growth4.; Development Of Logistics Infrastructure And Connectivity.

6. What are the notable trends driving market growth?

PKP Cargo holds the Largest Share of Rail Cargo transported.

7. Are there any restraints impacting market growth?

4.; Logistics Integration In Last-mile Delivery.

8. Can you provide examples of recent developments in the market?

September 2022- PKP CARGO, the Industrial Development Agency, and Polski Tabor Szynowy signed a letter of intent to cooperate in the rolling stock area, including the Gniewczyn railcar factory restoration. The parties announced that they would take into account two primary considerations in the cooperation model being developed. The first concerns the consolidation of rolling stock potential in the Industrial Development Agency Group, through the acquisition by PTS from PKP CARGO S.A. of assets, including real estate and movable property, located on the site of the former factory in Gniewczyn Lańcucka. The second premise of the proposed cooperation is to take place in the field of ordering maintenance services for rolling stock owned by PKP CARGO, as well as the acquisition of new rolling stock.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Rail Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Rail Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Rail Freight Transport Market?

To stay informed about further developments, trends, and reports in the Poland Rail Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence