Key Insights

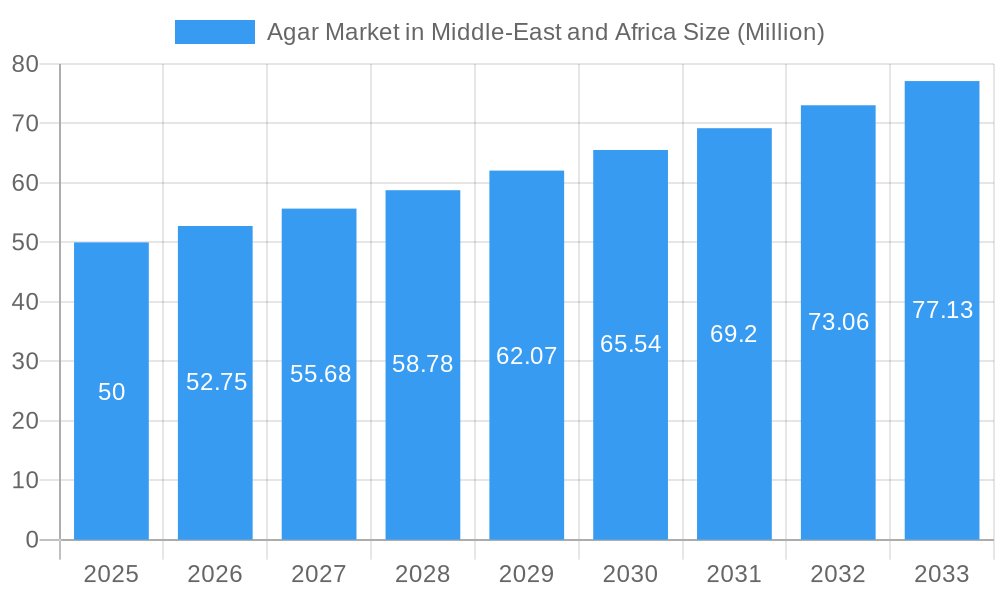

The Agar market in the Middle East and Africa (MEA) presents a compelling investment opportunity, projected to experience steady growth driven by rising demand across diverse sectors. While precise market size figures for MEA are unavailable, extrapolating from the global CAGR of 5.50% and considering the region's growing food and beverage industry, pharmaceutical sector expansion, and increasing adoption in other applications like cosmetics and biotechnology, a conservative estimate for the 2025 MEA Agar market size could be placed around $50 million. This figure accounts for the region's unique characteristics, including varying levels of economic development and infrastructural limitations across different countries. Key drivers include the expanding food and beverage sector, particularly in processed foods and confectionery, where agar is used as a gelling agent and stabilizer. The pharmaceutical industry's growth, coupled with increasing awareness of natural and sustainable ingredients, further fuels market expansion. However, price volatility of raw materials and potential supply chain challenges, particularly in some African nations, pose significant restraints. The market segmentation by form (strip, powder, others) and application (food and beverage, pharmaceuticals, other applications) offers opportunities for targeted product development and market penetration. The prevalence of traditional food practices in certain areas may also present both a challenge and an opportunity, as the market develops strategies for blending traditional applications with modern uses of agar. Companies operating in this space should focus on establishing robust supply chains, fostering collaborations with local stakeholders, and highlighting the versatility and benefits of agar across different applications.

Agar Market in Middle-East and Africa Market Size (In Million)

The MEA Agar market is poised for significant growth in the forecast period (2025-2033). Several factors will contribute to this expansion. The increasing middle class across many MEA countries is driving demand for processed foods and beverages containing agar as a key ingredient. Furthermore, the rising adoption of agar in pharmaceutical formulations (tablets, capsules) and other applications (cosmetics, biotechnology) offers further avenues for growth. The relatively low penetration of agar compared to other gelling agents within certain sectors suggests substantial untapped potential. However, regional variations in economic development, regulatory landscapes, and consumer preferences need careful consideration. Stronger partnerships with regional distributors, tailored marketing strategies, and potentially developing locally sourced agar to address supply chain challenges would be vital to capitalizing on the full potential of the market. Companies should prioritize investment in research and development to discover innovative applications for agar within the region, particularly within the health and wellness space.

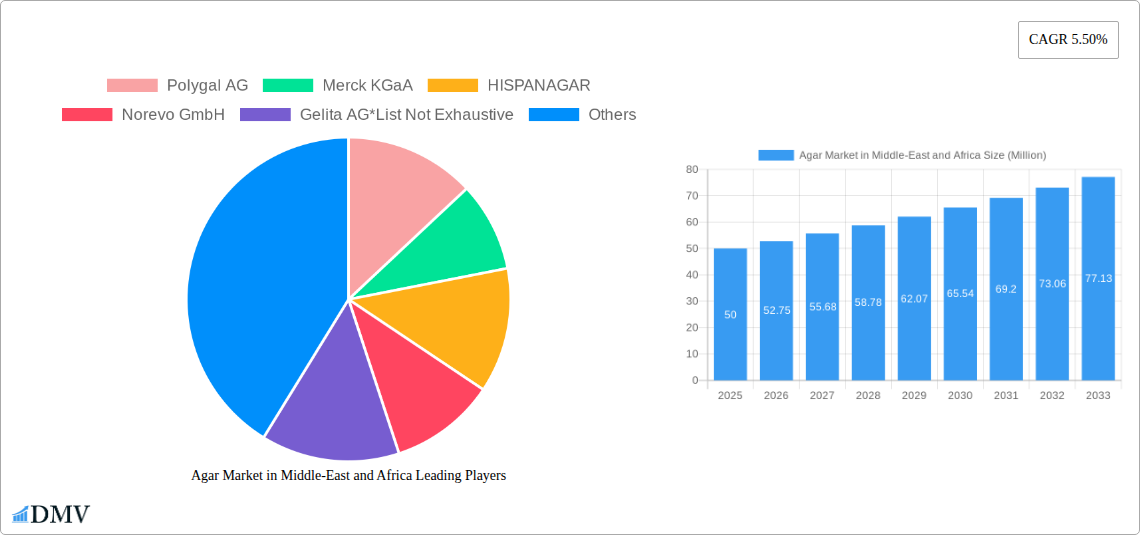

Agar Market in Middle-East and Africa Company Market Share

Agar Market in Middle-East and Africa: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Agar market in the Middle East and Africa, offering a comprehensive overview of market dynamics, trends, and future prospects. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The report values are expressed in Millions.

Agar Market in Middle-East and Africa Market Composition & Trends

This section delves into the competitive landscape of the Agar market in the Middle East and Africa, examining market concentration, innovation drivers, regulatory frameworks, substitute products, and end-user profiles. We analyze mergers and acquisitions (M&A) activities, providing insights into deal values and their impact on market share distribution.

Market Concentration: The MEA Agar market exhibits a moderately concentrated structure, with key players holding significant market share. However, the presence of several smaller, regional players indicates opportunities for both consolidation and niche market penetration. xx% of the market is controlled by the top 5 players in 2025.

Innovation Catalysts: Growing demand for natural and clean-label ingredients is driving innovation in Agar extraction and processing techniques. Companies are focusing on developing novel Agar products with enhanced functionalities and improved shelf life.

Regulatory Landscape: Regulatory compliance concerning food safety and labeling is crucial for Agar manufacturers operating within the MEA region. Variations in regulations across different countries necessitate a thorough understanding of local compliance requirements.

Substitute Products: Carrageenan and pectin are primary substitutes for Agar, posing competitive pressures. However, Agar's unique gelling properties and health benefits create a differentiated market position.

End-User Profiles: The Food and Beverage industry is the dominant end-user segment, followed by the Pharmaceutical and other applications sectors. Growing consumer awareness of Agar’s health benefits is further expanding the market.

M&A Activities: The MEA Agar market has witnessed xx M&A deals in the historical period (2019-2024), with a total deal value of approximately $xx Million. These transactions reflect ongoing industry consolidation and efforts to expand market reach.

Agar Market in Middle-East and Africa Industry Evolution

This section analyzes the evolution of the Agar market in the MEA region, focusing on growth trajectories, technological advancements, and shifting consumer preferences. We explore historical growth trends (2019-2024) and project future growth (2025-2033) based on current market dynamics and anticipated developments.

The MEA Agar market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), driven primarily by rising demand from the food and beverage sector. This growth is expected to continue at a CAGR of xx% during the forecast period (2025-2033), propelled by increasing health consciousness among consumers, growing adoption of Agar in various applications, and technological advancements improving Agar extraction and processing. The rising demand for vegan and vegetarian products also contributes significantly to the growth. Specific examples include the adoption of advanced extraction methods that yield higher purity Agar and improved techniques in modifying Agar properties to enhance its functional versatility in different applications. Consumer preference for natural food additives over synthetic counterparts is a notable factor, fueling demand for Agar across different product categories. The market is also witnessing the rise of innovative product formulations incorporating Agar, such as novel food textures and improved drug delivery systems in the pharmaceutical industry. The changing dietary habits and the rise of health-conscious consumers are pushing the demand for Agar to increase substantially over the next decade.

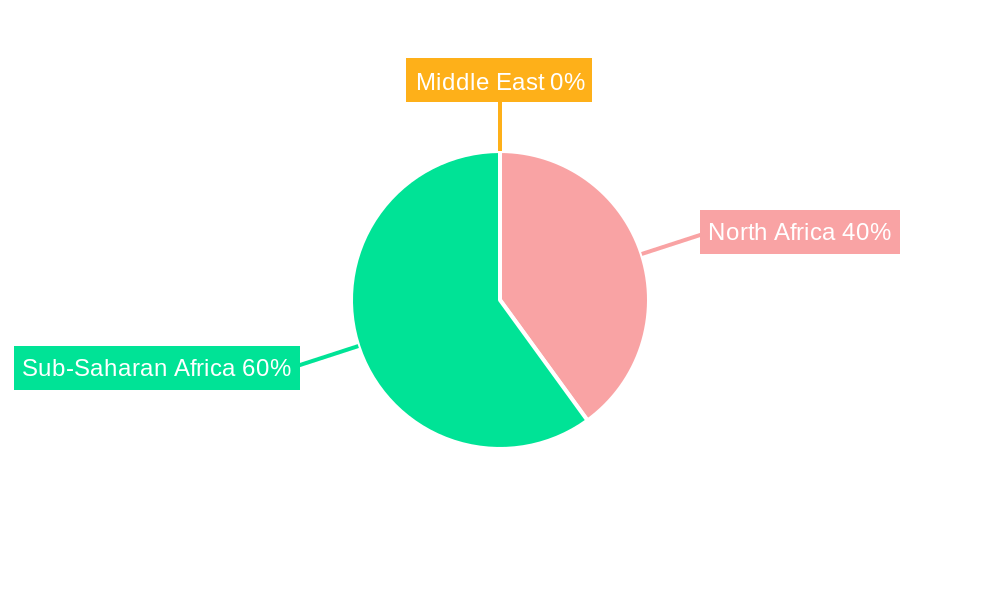

Leading Regions, Countries, or Segments in Agar Market in Middle-East and Africa

This section identifies the dominant regions, countries, and segments within the MEA Agar market.

Dominant Region: [Specific Region - e.g., North Africa] is currently the leading region for Agar consumption in the MEA market due to [Reasons - e.g., established food processing industry, favorable regulatory environment].

Dominant Country: [Specific Country - e.g., Egypt] holds the largest market share within [Region], driven by [Factors - e.g., high population density, strong food and beverage industry].

Dominant Segment (By Form): Powdered Agar dominates the market due to its ease of use and cost-effectiveness in various applications.

Dominant Segment (By Application): The food and beverage sector is the dominant application segment, fueled by Agar's use as a gelling, stabilizing, and thickening agent. Pharmaceutical applications represent a significant growth opportunity.

Key Drivers:

- Investment Trends: Increased investment in food processing and pharmaceutical industries across the MEA region is boosting the demand for Agar.

- Regulatory Support: Supportive government regulations promoting the use of natural food additives are fostering Agar market growth.

- Consumer Preferences: The rising popularity of vegan and vegetarian diets is driving up the demand for Agar as a natural alternative.

Agar Market in Middle-East and Africa Product Innovations

Recent innovations in Agar include the development of modified Agar products with tailored properties, such as enhanced gelling strength, improved clarity, and improved stability at various temperatures. These innovations cater to the specific requirements of different applications, expanding Agar's market reach and versatility. The development of novel Agar-based ingredients and the exploration of its applications in emerging sectors such as cosmetics and nutraceuticals are notable examples. Companies are focusing on developing sustainable and cost-effective methods of Agar extraction and production, along with exploring new functionalities such as improved texture and mouthfeel, further enhancing Agar's attractiveness to manufacturers.

Propelling Factors for Agar Market in Middle-East and Africa Growth

Several factors are driving the growth of the Agar market in the MEA region, including:

- Technological advancements: Improved extraction and processing techniques are leading to higher-quality Agar at competitive prices.

- Economic growth: Rising disposable incomes in some MEA countries are increasing consumer spending on food and beverages, driving up the demand for Agar as an ingredient in processed foods.

- Favorable regulatory environment: Government regulations supporting the use of natural ingredients are benefiting the Agar market.

Obstacles in the Agar Market in Middle-East and Africa Market

Challenges impacting the MEA Agar market include:

- Price volatility: Fluctuations in Agar prices due to variations in supply and demand can affect market stability.

- Supply chain disruptions: Political instability and logistical challenges in some regions can disrupt the supply chain.

- Competition from substitutes: Other gelling agents like carrageenan and pectin pose competition to Agar.

Future Opportunities in Agar Market in Middle-East and Africa

Future opportunities for Agar in the MEA market include:

- Expanding into new applications: Exploring Agar's potential in emerging areas like cosmetics and nutraceuticals can unlock new growth avenues.

- Developing innovative products: Creating Agar-based products with enhanced functionality and improved consumer appeal can further boost market demand.

- Focusing on sustainability: Adopting environmentally friendly Agar production practices will appeal to increasingly eco-conscious consumers.

Major Players in the Agar Market in Middle-East and Africa Ecosystem

- Polygal AG

- Merck KGaA

- HISPANAGAR

- Norevo GmbH

- Gelita AG

- Ingredion Incorporated (TIC Gums)

- Agramex S A

Key Developments in Agar Market in Middle-East and Africa Industry

- [Month, Year]: [Company Name] launched a new line of modified Agar products with improved gelling properties.

- [Month, Year]: [Company Name] announced a strategic partnership to expand its Agar production capacity in the MEA region.

- [Month, Year]: A new regulatory guideline concerning the use of Agar in food products was implemented in [Country]. (Add more bullet points as needed).

Strategic Agar Market in Middle-East and Africa Market Forecast

The Agar market in the MEA region is poised for significant growth over the next decade, driven by factors such as rising consumer demand for natural food ingredients, the growing popularity of vegan and vegetarian diets, and technological advancements enhancing Agar production and functionality. Emerging applications and a focus on sustainability are expected to further fuel market expansion, presenting substantial opportunities for stakeholders. The continued growth in the food and beverage and pharmaceutical industries will significantly impact the overall Agar market growth, creating a promising future for market players.

Agar Market in Middle-East and Africa Segmentation

-

1. Form

- 1.1. Strip

- 1.2. Powder

- 1.3. Others

-

2. Application

-

2.1. Food and Beverage

- 2.1.1. Bakery & Confectionary

- 2.1.2. Meat Products

- 2.1.3. Dairy Products

- 2.1.4. Others

- 2.2. Pharmaceuticals

- 2.3. Other Applications

-

2.1. Food and Beverage

-

3. Geography

- 3.1. South Africa

- 3.2. Saudi Arabia

- 3.3. Rest of Middle East and Africa

Agar Market in Middle-East and Africa Segmentation By Geography

- 1. South Africa

- 2. Saudi Arabia

- 3. Rest of Middle East and Africa

Agar Market in Middle-East and Africa Regional Market Share

Geographic Coverage of Agar Market in Middle-East and Africa

Agar Market in Middle-East and Africa REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The numerous benefits offered by collagen in the food and beverage industry

- 3.3. Market Restrains

- 3.3.1. Increasing vegan population in the region

- 3.4. Market Trends

- 3.4.1. Nutritional Atrritube of Agar Leading to Increased Application in Food and Beverage Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Agar Market in Middle-East and Africa Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Strip

- 5.1.2. Powder

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverage

- 5.2.1.1. Bakery & Confectionary

- 5.2.1.2. Meat Products

- 5.2.1.3. Dairy Products

- 5.2.1.4. Others

- 5.2.2. Pharmaceuticals

- 5.2.3. Other Applications

- 5.2.1. Food and Beverage

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Saudi Arabia

- 5.3.3. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Saudi Arabia

- 5.4.3. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. South Africa Agar Market in Middle-East and Africa Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Form

- 6.1.1. Strip

- 6.1.2. Powder

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food and Beverage

- 6.2.1.1. Bakery & Confectionary

- 6.2.1.2. Meat Products

- 6.2.1.3. Dairy Products

- 6.2.1.4. Others

- 6.2.2. Pharmaceuticals

- 6.2.3. Other Applications

- 6.2.1. Food and Beverage

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Saudi Arabia

- 6.3.3. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Form

- 7. Saudi Arabia Agar Market in Middle-East and Africa Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Form

- 7.1.1. Strip

- 7.1.2. Powder

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food and Beverage

- 7.2.1.1. Bakery & Confectionary

- 7.2.1.2. Meat Products

- 7.2.1.3. Dairy Products

- 7.2.1.4. Others

- 7.2.2. Pharmaceuticals

- 7.2.3. Other Applications

- 7.2.1. Food and Beverage

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Saudi Arabia

- 7.3.3. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Form

- 8. Rest of Middle East and Africa Agar Market in Middle-East and Africa Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Form

- 8.1.1. Strip

- 8.1.2. Powder

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food and Beverage

- 8.2.1.1. Bakery & Confectionary

- 8.2.1.2. Meat Products

- 8.2.1.3. Dairy Products

- 8.2.1.4. Others

- 8.2.2. Pharmaceuticals

- 8.2.3. Other Applications

- 8.2.1. Food and Beverage

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Saudi Arabia

- 8.3.3. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Form

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Polygal AG

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Merck KGaA

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 HISPANAGAR

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Norevo GmbH

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Gelita AG*List Not Exhaustive

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Ingredion Incorporated (TIC Gums)

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Agramex S A

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.1 Polygal AG

List of Figures

- Figure 1: Agar Market in Middle-East and Africa Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Agar Market in Middle-East and Africa Share (%) by Company 2025

List of Tables

- Table 1: Agar Market in Middle-East and Africa Revenue Million Forecast, by Form 2020 & 2033

- Table 2: Agar Market in Middle-East and Africa Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Agar Market in Middle-East and Africa Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Agar Market in Middle-East and Africa Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Agar Market in Middle-East and Africa Revenue Million Forecast, by Form 2020 & 2033

- Table 6: Agar Market in Middle-East and Africa Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Agar Market in Middle-East and Africa Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Agar Market in Middle-East and Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Agar Market in Middle-East and Africa Revenue Million Forecast, by Form 2020 & 2033

- Table 10: Agar Market in Middle-East and Africa Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Agar Market in Middle-East and Africa Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Agar Market in Middle-East and Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Agar Market in Middle-East and Africa Revenue Million Forecast, by Form 2020 & 2033

- Table 14: Agar Market in Middle-East and Africa Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Agar Market in Middle-East and Africa Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Agar Market in Middle-East and Africa Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Agar Market in Middle-East and Africa?

The projected CAGR is approximately 5.50%.

2. Which companies are prominent players in the Agar Market in Middle-East and Africa?

Key companies in the market include Polygal AG, Merck KGaA, HISPANAGAR, Norevo GmbH, Gelita AG*List Not Exhaustive, Ingredion Incorporated (TIC Gums), Agramex S A.

3. What are the main segments of the Agar Market in Middle-East and Africa?

The market segments include Form, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The numerous benefits offered by collagen in the food and beverage industry.

6. What are the notable trends driving market growth?

Nutritional Atrritube of Agar Leading to Increased Application in Food and Beverage Sector.

7. Are there any restraints impacting market growth?

Increasing vegan population in the region.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Agar Market in Middle-East and Africa," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Agar Market in Middle-East and Africa report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Agar Market in Middle-East and Africa?

To stay informed about further developments, trends, and reports in the Agar Market in Middle-East and Africa, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence